Best Pay-As-You-Go Auto Insurance in Tennessee for 2025 (Top 10 Companies Ranked)

Progressive, AAA, and Root offer the best pay-as-you-go auto insurance in Tennessee. Metromile has the cheapest usage-based auto insurance rates at $29/month, but Progressive, AAA, and Root have more comprehensive Tennessee insurance policies that include features like roadside assistance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

PAYG Full Coverage in TN

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 3,027 reviews

3,027 reviewsCompany Facts

PAYG Full Coverage in TN

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 791 reviews

791 reviewsCompany Facts

PAYG Full Coverage in TN

A.M. Best Rating

Complaint Level

Pros & Cons

791 reviews

791 reviewsProgressive, AAA, and Root Insurance are the top companies offering the best pay-as-you-go auto insurance in Tennessee. These providers have the cheapest rates in Tennessee.

Our Top 10 Company Picks: Best Pay-As-You-Go Auto Insurance in Tennessee

Company Rank Safe Driver Discount A.M. Best Best For Jump to Pros/Cons

#1 30% A+ Policy Perks Progressive

#2 20% A Roadside Assistance AAA

#3 10% NR Customer Service Root

#4 10% A- Tech-Savvy Drivers Metromile

#5 10% A+ Infrequent Drivers Allstate

#6 40% A+ Accident Forgiveness Nationwide

#7 30% B Personalized Policies State Farm

#8 20% A Local Agents American Family

#9 30% A++ Multi-Policy Discount Geico

#10 10% A Usage-Based Discount Liberty Mutual

They deliver strong roadside assistance and reliable support, making them the top choice for usage-based auto insurance in Tennessee.

Safe drivers can also get additional discounts. Keep reading to compare the pros and cons of pay-as-you-go car insurance companies.

- Progressive offers the best pay-as-you-go auto insurance in Tennessee

- Metromile has the cheapest pay-as-you-go insurance for $29 monthly

- Pay-as-you-go car insurance works best for low-mileage TN drivers

Enter your ZIP code into our free auto insurance quote comparison tool to protect your vehicle at the best rates.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Snapshot Program: Progressive Snapshot lowers TN auto insurance rates by tracking and rewarding safe driving habits with discounts of up to 30%. Learn more in our Progressive Snapshot review.

- Comprehensive Policy Perks: Progressive pay-as-you-go auto insurance in Tennessee features flexible coverage and extra benefits.

- User-Friendly Mobile App: The intuitive mobile app simplifies managing pay-as-you-go auto insurance in Tennessee, providing easy access to policy details and claims.

Cons

- Mixed Reviews on Claims Processing: Tennessee pay-as-you-go auto insurance Reddit reviews report inconsistencies in the claims processing experience.

- Telematics Data Concerns: The Snapshot program’s use of telematics data might raise privacy concerns for some drivers considering switching to pay-as-you-go insurance in Tennessee.

#2 – AAA: Best for Roadside Assistance

Pros

- Top-Tier Roadside Assistance: AAA pay-as-you-go auto insurance in Tennessee includes exceptional roadside assistance, providing peace of mind for drivers on the go.

- Trusted Brand: AAA’s long-standing reputation adds reliability to their pay-as-you-go auto insurance offerings in Tennessee. Read our AAA review for more details.

- Membership Discounts: AAA members enjoy discounts on travel and vacations while saving money on Tennessee car insurance.

Cons

- Membership Fee: AAA roadside assistance in Tennessee and discounts require a membership fee.

- Expensive Rates: On top of an annual fee, AAA pay-as-you-go insurance rates in Tennessee are the most expensive on this list at $65 per month.

#3 – Root: Best Customer Service

Pros

- Excellent Customer Support: Root is known for its outstanding customer service, making pay-as-you-go auto insurance in TN easier to manage. Find out more in our Root auto insurance review.

- User-Friendly App: The Root app provides seamless customer interactions, enhancing the experience for those opting for pay-as-you-go auto insurance in Tennessee.

- Safe Driving Rewards: Only safe drivers qualify for Root insurance, reducing overall Tennessee insurance rates for all drivers.

Cons

- Limited Physical Presence: Root’s strong online focus means fewer in-person service options for pay-as-you-go auto insurance in Tennessee.

- No High-Risk Coverage: Drivers with accidents or those who drive at night may not be eligible for Root car insurance in Tennessee.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Metromile: Best for Tech-Savvy Drivers

Pros

- Advanced Technology Integration: Metromile’s tech-driven approach provides detailed tracking for pay-as-you-go insurance in Tennessee, which you can learn about in our Metromile review.

- Real-Time Monitoring: Tech-savvy drivers benefit from Metromile’s real-time monitoring, optimizing their pay-as-you-go auto insurance in Tennessee based on actual usage.

- Innovative App Features: Metromile’s app offers trip tracking and expense reports. It also allows you to get a Metromile insurance quote.

Cons

- Learning Curve: Advanced technology may present a learning curve for some users, complicating pay-as-you-go auto insurance in Tennessee.

- Potential Privacy Concerns: Continuous monitoring might raise privacy concerns among some drivers opting for TN pay-as-you-go auto insurance.

#5 – Allstate: Best for Low-Mileage Drivers

Pros

- Low-Mileage Discounts: Save up to 30% on Tennessee car insurance if you drive less than 10,000 miles per year.

- Multi-Vehicle Discounts: Insure more than one vehicle with Allstate and get 25% off Tennessee pay-as-you-go auto insurance.

- Flexible UBI: TN drivers can choose between Allstate Milewise, which only tracks mileage, or go for bigger discounts with Allstate Drivewise. See how much you can save in our Allstate Drivewise review.

Cons

- Expensive Rates: Allstate pay-as-you-go auto insurance in Tennessee will be more expensive for high-mileage drivers or those who drive at night.

- Poor Customer Service: Tennessee auto insurance reviews of Allstate rank it below average for customer satisfaction in the region.

#6 – Nationwide: Best for Safe Drivers

Pros

- Accident Forgiveness: Tennessee drivers who remain claim-free won’t see their base rates go up after their first accident.

- Vanishing Deductibles: Safe drivers enjoy $50 off their deductible every year they avoid filing a TN auto insurance claim.

- Flexible UBI: In TN, choose between Nationwide SmartRide, which monitors driving habits, and SmartMiles, which tracks mileage only. Learn more in our Nationwide SmartMiles review.

Cons

- Poor Customer Service: Nationwide ranks lower in customer and claims satisfaction than its competitors for usage-based auto insurance in Tennessee.

- Expensive Rates: Tennessee drivers will get cheaper pay-as-you-go insurance rates with other companies on this list.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – State Farm: Best for Personalized Policies

Pros

- Customizable Coverage: State Farm offers highly personalized policies, making pay-as-you-go auto insurance in Tennessee adaptable to individual needs.

- Dedicated Agents: The availability of dedicated agents helps tailor pay-as-you-go auto insurance in Tennessee to specific driver profiles. Find out more in our State Farm review.

- Flexible Payment Options: State Farm’s flexible payment plans allow for better management of pay-as-you-go auto insurance in Tennessee, suiting different financial situations.

Cons

- Higher Premiums: Personalized policies can sometimes result in higher premiums for pay-as-you-go auto insurance in Tennessee.

- Complex Policy Choices: The wide range of options may overwhelm some customers seeking straightforward pay-as-you-go auto insurance in Tennessee.

#8 – American Family: Best for Local Agents

Pros

- Local Agents: American Family has local agents who provide personalized service for pay-as-you-go auto insurance in Tennessee.

- Tailored Policies: Local agents in Tennessee offer customized pay-as-you-go auto insurance plans designed to fit individual requirements. For a complete list, read our American Family review.

- KnowYourDrive Discount: Avoid using your phone while driving to get a 10% discount on AmFam auto insurance in Tennessee.

Cons

- Higher Rates: The presence of local agents may contribute to higher operating costs, which can increase pay-as-you-go auto insurance rates in Tennessee.

- Inconsistent Service: Experiences vary by location, with drivers in some cities having complaints about Tennessee auto insurance customer service.

#9 – Geico: Best for Multi-Policy Discount

Pros

- Generous Multi-Policy Discount: Geico offers substantial discounts of up to 25% for bundling multiple policies with TN pay-as-you-go auto insurance.

- Affordable Rates: Known for competitive pricing, Geico provides affordable pay-as-you-go auto insurance in Tennessee, averaging $48 monthly. Compare free quotes in our Geico review.

- Easy to Use: Geico’s website and mobile app make managing pay-as-you-go auto insurance in Tennessee and multiple policies straightforward.

Cons

- Poor Customer Service: Geico ranks below average for customer service and claims for pay-as-you-go auto insurance in Tennessee.

- Discount Restrictions: Not all customers may qualify for a multi-policy discount, limiting potential savings on pay-as-you-go insurance in Tennessee.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best Usage-Based Discount

Pros

- Significant Savings Potential: Liberty Mutual offers substantial discounts for usage-based or pay-as-you-go auto insurance in Tennessee, rewarding low-mileage drivers.

- Driving Behavior Insights: Their program provides insights into driving behavior, which can help lower rates for pay-as-you-go auto insurance in Tennessee.

- Customizable Discounts: Discounts tailored to driving habits make pay-as-you-go auto insurance in Tennessee more affordable. Discover additional details in our Liberty Mutual review.

Cons

- Strict Monitoring Requirements: Some who seek pay-as-you-go auto insurance in Tennessee may find the need for consistent monitoring to qualify for discounts intrusive.

- Variable Savings: Savings from usage-based discounts can vary, potentially leading to less predictable costs for pay-as-you-go auto insurance in Tennessee.

Comparing Monthly Rates for TN Pay-As-You-Go Auto Insurance

This table compares monthly rates for auto insurance in Tennessee, showing minimum and full coverage pay-as-you-go auto insurance costs.

TN Pay-As-You-Go Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $129 |

| $57 | $130 | |

| $54 | $116 | |

| $48 | $85 | |

| $62 | $112 |

| $29 | $70 | |

| $60 | $110 |

| $55 | $120 | |

| $52 | $92 |

| $50 | $88 |

Rates vary significantly, with Metromile offering the lowest minimum coverage rate at $29 per month and the cheapest full coverage at $70 per month.

In Tennessee, pay-as-you-go auto insurance offers a modern and flexible approach to vehicle coverage. Pay-as-you-go car insurance isn’t like traditional Tennessee insurance.

Pay-as-you-go rates are based on driving habits or mileage, which is monitored by a mobile app or telematics device you install in your vehicle.Kristen Gryglik Licensed Insurance Agent

This type of insurance allows you to pay for coverage based on how much you drive, making it an ideal choice for those who drive infrequently or want to match their insurance costs closely with their driving habits.

Learn More: Cheap Usage-Based Auto Insurance

How to Get Lower Pay-As-You-Go Auto Insurance Rates

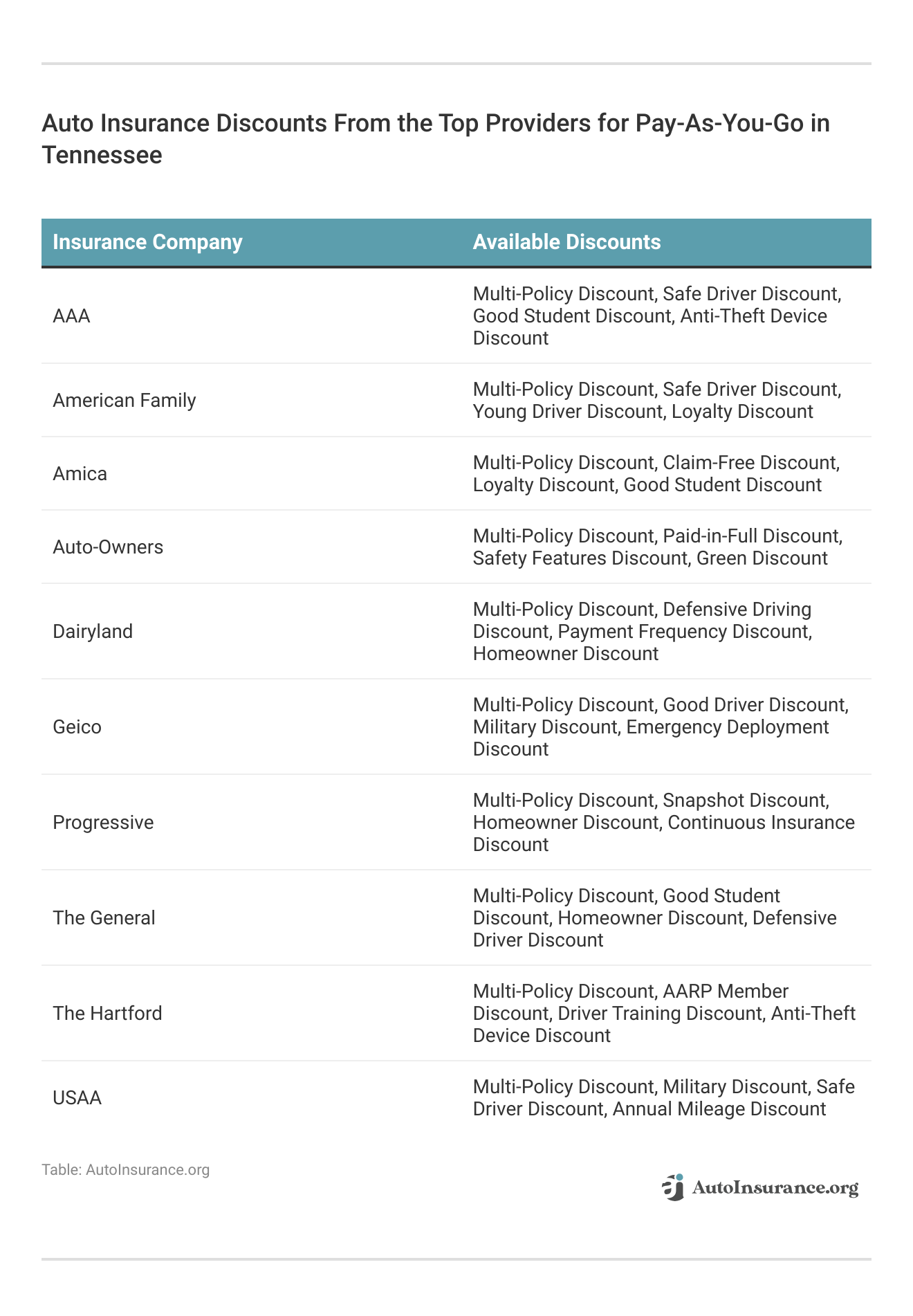

Understanding your discount options for pay-as-you-go auto insurance in Tennessee is the first step toward securing the best deal. By comparing auto insurance discounts across different providers, you can make an informed choice that aligns with your budget and coverage needs.

Explore top auto insurance discounts for pay-as-you-go plans from leading pay-as-you-go auto insurance companies in Tennessee. Save with options like low mileage, safe driver, or good student. Learn how to save money by bundling insurance policies and get a discount.

Several other key factors can significantly impact your rates and coverage options. Understanding how vehicle type, location, coverage choices, and personal factors influence pay-as-you-go insurance rates will enable you to select a policy that fits your specific driving behavior and usage and aligns with your financial situation.

- Vehicle Make and Model: You can get lower car insurance rates by driving an older vehicle with a high safety rating.

- Location: Where you park your vehicle (e.g., in a garage, on the street, or in a driveway) can influence your insurance costs. (Read More: Best Garaging Auto Insurance Discounts)

- Coverage Options: Choosing minimum coverage can lower your premiums, but opting for full coverage provides greater protection.

- Personal Factors: Age and gender impact Tennessee auto insurance costs, with younger drivers, particularly males, often facing higher premiums due to statistically higher risk factors.

If you choose pay-as-you-go auto insurance in TN, remember to monitor and improve your credit score and maintain your safe driving habits to keep costs low.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pay-Per-Mile Car Insurance May Not Be as Good as It Sounds

Pay-per-mile car insurance, or pay-as-you-go car insurance, is designed for drivers who log fewer miles and want to save on premiums. This type of policy includes a base rate plus a per-mile charge, making it ideal for remote workers, retirees, or those who drive occasionally.

While it can lower costs for some, it may not be the best option for frequent drivers, who could end up paying more than with traditional insurance.

For Tennessee residents, comparing options from the best auto insurance providers in Tennessee is essential. Companies like GoAuto offer budget-friendly policies, and checking GoAuto Insurance reviews can help determine customer satisfaction with pricing and claims handling. Additionally, flexible GoAuto Insurance payment options may appeal to drivers looking for affordable coverage.

Is pay per mile car insurance as good as it sounds?

byu/tmarmstr inInsurance

Those needing low-income car insurance in Tennessee might find pay-per-mile insurance useful, but it’s important to ensure that base rates and mileage fees fit within their budget. Some insurers, like Metromile, offer additional perks, such as Metromile accident forgiveness, which prevents premium increases after minor accidents.

However, Tennessee’s best auto insurance rates depend on individual driving habits and coverage needs. While pay-per-mile insurance can be cost-effective for some, it is important to compare quotes, coverage options, and policy restrictions before committing. Additionally, looking into the best auto insurance companies that don’t raise rates after a claim can help ensure affordable and reliable coverage over time.

Case Studies: Pay-As-You-Go Coverage in Tennessee

Whether you’re an infrequent driver, managing multiple vehicles, or seeking discounts for safe driving, this flexible usage-based insurance model can be a game-changer:

- Case Study #1 – Infrequent Driver Saves Big With Progressive: John, a retired teacher who rarely drives, saved on insurance by choosing the Progressive Snapshot pay-as-you-go plan, which matched his low mileage with cost-effective coverage.

- Case Study #2 – Family with Multiple Vehicles Saves with Geico: The Smith family reduced their insurance costs by 15% and streamlined policy management by using Geico’s multi-policy discount and pay-as-you-go option to save on auto insurance for three vehicles.

- Case Study #3 – Young Professional Gets Low Rates With AAA: Sarah in Nashville chose AAA’s pay-as-you-go insurance for its safe-driving discounts and membership perks she can use while traveling for work.

You can make a more informed decision by examining how different insurance providers cater to a range of needs and utilizing available discounts, including multi-policy discounts.

This approach ensures that you select a policy that matches your unique driving habits and financial goals.

Top Pay-As-You-Go Auto Insurance Providers in Tennessee

Pay-as-you-go options offer an ideal solution for Tennessee drivers seeking flexible and cost-effective auto insurance. The leading providers include Progressive, AAA, and Root Insurance for comprehensive coverage with competitive rates.

Progressive is our top pick for pay-as-you-go auto insurance in Tennessee, offering competitive rates and strong policy benefits.Justin Wright Licensed Insurance Agent

Progressive excels in overall affordability and policy perks. AAA is known for superior roadside assistance coverage.

Root shines for safe drivers without accidents or claims. Metromile has the cheapest pay-as-you-go car insurance rates, starting at $29 monthly.

To find the best coverage, compare quotes from multiple companies and consider factors like driving habits and vehicle type. Start saving on your auto insurance by entering your ZIP code and comparing quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What should I look for when choosing the best pay-as-you-go auto insurance in Tennessee?

When choosing a pay-as-you-go auto insurance provider, consider factors such as the provider’s reputation, coverage options, customer service, and available discounts. Evaluate the rates based on your driving habits, review the provider’s claims process, and ensure they offer the necessary coverage for your needs.

How do I install Progressive Snapshot in my vehicle?

To install Progressive Snapshot, plug the device into your car’s OBD-II port or download the mobile app if using the smartphone-based version. Follow Progressive’s instructions for activation.

Who has the cheapest auto insurance rates in Tennessee?

Metromile offers cheap pay-as-you-go car insurance in Tennessee starting at $29 per month. Read our Metromile auto insurance review to compare quotes.

Can I switch from traditional to pay-as-you-go auto insurance in Tennessee?

Yes, you can switch from traditional auto insurance to a pay-as-you-go plan. Reviewing your driving habits and coverage needs before making the switch is important.

Contact your current insurer to cancel your existing policy and get quotes from providers that offer pay-as-you-go insurance to find the best fit for you.

What is the process for canceling GoAuto Insurance?

To cancel GoAuto Insurance, contact customer service directly, request a cancellation in writing if needed, and check for any outstanding balances or fees. You may also want to review GoAuto Insurance quotes for alternative coverage options.

At what age is auto insurance cheapest in Tennessee?

Auto insurance rates are the cheapest for drivers in their 30s and 40s. Younger drivers, particularly those under 25, generally face higher premiums due to their higher risk profile. However, if drivers maintain a clean driving record, their rates may decrease as they age. Compare auto insurance rates by age to learn more.

Which Tennessee auto insurance companies offer the best coverage options?

Some of Tennessee’s best auto insurance companies include State Farm, Geico, Progressive, and Farm Bureau. These companies offer competitive rates, customizable coverage, and good customer service.

How can drivers qualify for Tennessee auto insurance discounts?

Drivers can qualify for discounts by maintaining a clean driving record, bundling policies, enrolling in usage-based programs, and taking defensive driving courses. Insurers may also offer discounts for good students and military members.

What are the benefits of pay-as-you-go auto insurance?

Pay-as-you-go auto insurance offers flexibility by allowing you to pay for coverage based on your driving habits. This can be ideal for infrequent drivers or those looking to match their insurance costs closely with their driving patterns. It often provides cost savings for those who drive less frequently.

Enter your ZIP code to find out if you can get a better deal.

What type of auto insurance is required in Tennessee?

Tennessee minimum requirements are $25,000 for bodily injury per person, $50,000 for total bodily injury per accident, and $15,000 for property damage. Additional coverage, such as uninsured motorist coverage and medical payments, is optional but recommended.

How can I save on pay-as-you-go auto insurance in Tennessee?

To save on pay-as-you-go auto insurance, compare quotes, adjust coverage, and increase your deductible. Using the GoAuto Insurance app to make a GoAuto Insurance payment online can help manage costs.

Explore discounts and usage-based options to find the cheapest auto insurance in Tennessee.

What factors influence pay-as-you-go auto insurance rates in Tennessee?

Pay-as-you-go auto insurance rates in Tennessee are influenced by factors such as your driving habits, the amount of mileage you drive, your vehicle type, your location, and your driving record. Providers assess these factors to tailor your premium to your actual usage.

Learn More: How Auto Insurance Companies Check Driving Records.

Can you sue an uninsured driver in Tennessee?

Yes, you can sue an uninsured driver in Tennessee if you are involved in an accident with one. However, pursuing a lawsuit can be complex and may not guarantee compensation, especially if the uninsured driver has limited financial resources.

To protect yourself financially, it’s important to explore the cheapest car insurance in Tennessee and consider drive-as-you-go insurance to find a policy that offers adequate coverage.

What do users say about Allstate Milewise Reddit reviews?

Users on Reddit have mixed opinions about Allstate Milewise. Some praise its affordability for low-mileage drivers, while others complain about high per-mile rates, billing issues, and unexpected charges.

Is Tennessee a no-fault insurance state?

No, Tennessee is not a no-fault insurance state. Tennessee follows a traditional fault-based system where the driver found at fault for an accident is responsible for covering damages. This means you can file a claim with the at-fault driver’s insurance or your own insurance if you have coverage for such incidents.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

Where can I find the best Tennessee auto insurance quotes?

Comparing rates on websites from Geico, Progressive, State Farm, and local Tennessee insurers can yield the best quotes. Using online comparison tools can also help you find the most competitive rates.

What programs are available for Tennessee auto insurance reduction?

Tennessee offers programs like low-mileage discounts, good driver discounts, and telematics-based insurance options such as Progressive Snapshot and Allstate Milewise.

How does Metromile vs. Root car insurance compare in terms of pricing and features?

Metromile is ideal for low-mileage drivers with a pay-per-mile structure, making it a great option for those seeking pay-as-you-go auto insurance. On the other hand, Root-based rates on driving behavior through app tracking may offer lower premiums for safe drivers.

For those looking for the cheapest SR-22 insurance in Tennessee, comparing auto insurance companies in Tennessee can help identify the best options. Metromile and Root also impact auto insurance rates in Tennessee, depending on individual driving habits and coverage needs.

Where can I find cheap full coverage car insurance in Tennessee?

Cheap full coverage car insurance can be found through companies like Geico, State Farm, and Farm Bureau. Comparing multiple quotes and looking for discounts can help lower costs.

What are the coverage options at Direct Auto Insurance in Crossville, Tennessee?

Direct Auto Insurance in Crossville offers liability, comprehensive, and collision coverage, along with roadside assistance and SR-22 insurance for high-risk drivers.

What services does Direct Auto Insurance in Maryville, Tennessee, provide?

Direct Auto Insurance in Maryville offers Tennessee auto insurance, flexible payment plans, and SR-22 filings for drivers who need proof of coverage.

The company provides budget-friendly options for those looking for cheap auto insurance in Tennessee. Additionally, drivers can compare TN auto insurance quotes to find the best coverage that fits their needs.

Find out more about the best Maryville, Tennessee auto insurance.

How can I explore great car warranty quotes near Tennessee?

You can compare car warranty quotes from providers like Endurance, CarShield, and CARCHEX through online comparison sites or by contacting dealerships.

What insurance options are available at Farm Bureau in Woodbury, TN?

The Farm Bureau in Woodbury offers auto, home, life, and farm insurance and customized coverage options for Tennessee residents.

What is the Progressive Insurance phone number for customer support?

The general customer service number for Progressive Insurance is 1-800-776-4737. Customers can ask about the best Progressive auto insurance discounts, explore the best Tennessee auto insurance options, and find cheap car insurance in Tennessee that fits their budget.

How can I contact the Root Car Insurance customer service number?

Root Car Insurance customer support can be reached at 1-866-980-9431 for policy assistance and claims. When evaluating car insurance rates in Tennessee, comparing different providers can help you find the best coverage for your needs.

Direct Auto Insurance in Crossville, TN, also offers flexible policy options and payment plans for Tennessee drivers seeking affordable coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.