Best Pay-As-You-Go Auto Insurance in Texas (Top 10 Providers in 2025)

Safeco, Progressive, and Allstate have the best pay-as-you-go auto insurance in Texas. Allstate pay-as-you-go charges just $1.50 per day, but costs can add up for high-mileage drivers. Safeco and Progressive have more competitive rates for auto insurance by the mile in Texas, starting at $27 monthly.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,277 reviews

1,277 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

1,277 reviews

1,277 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Pay-As-You-Go in Texas

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviewsSafeco, Progressive, and Allstate have the best pay-as-you-go auto insurance in Texas, offering comprehensive coverage at affordable rates for infrequent drivers.

What is pay-as-you-go insurance? You’ll benefit most from pay-as-you-go car insurance if you drive less than 10,000 miles a year since it only charges by the mile. Whether you’re seeking affordable coverage or top-notch customer service, these providers have the best pay-as-you-go insurance:

Our Top 10 Company Picks: Best Pay-As-You-Go Auto Insurance in Texas

| Company | Rank | Safe Driving Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 24% | A | Tailored Policies | Safeco | |

| #2 | 20% | A+ | Local Agents | Progressive | |

| #3 | 23% | A+ | High-Mileage | Allstate | |

| #4 | 18% | A- | Simplified Pricing | Metromile | |

| #5 | 19% | A++ | Military Drivers | USAA | |

| #6 | 22% | A+ | Safe Drivers | Nationwide |

| #7 | 18% | A | No Tracking | MileAuto | |

| #8 | 17% | A | Costco Members | American Family | |

| #9 | 16% | X | Tech-Savvy Users | GoAuto | |

| #10 | 12% | A | Personalized Discounts | Farmers |

Not every insurer offers pay-and-go insurance, so use this guide to compare the best Texas auto insurance companies with pay-per-mile policies.

With options tailored to fit your driving habits, finding the best pay-as-you-go car insurance has never been easier. If you want to find the cheapest Texas auto insurance online, compare rates with our free quote tool.

- Safeco has the best auto insurance for Texans looking to pay as they go

- Progressive and Allstate have cheap pay-as-you-go insurance for $32 monthly

- Make sure to read pay-per-mile car insurance reviews before choosing a company

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Safeco: Top Pick Overall

Pros

- Sign-Up Bonus: Drivers get 10% discounts just for signing up. Get the details in our Safeco RightTrack review.

- Long-Term Discount: Usage-based discount of up to 30% lasts for the life of your auto policy.

- Accident-Free Rewards: Qualifying drivers with clean records will avoid rate increases after their first accident.

Cons

- Customer Satisfaction: Safeco has some below-average customer ratings.

- Can’t Purchase Online: While you can get an online quote, purchases must be completed through an agent.

#2 – Progressive: Best for Local Agents

Pros

- Local Agents: Progressive has local agents for pay-as-you-go drivers in Texas. Call the local Progressive insurance phone number on your insurance card for convenient access.

- Loyalty Discount: Sticking with Progressive can result in even lower pay-as-you-go auto insurance rates in Texas.

- Short Monitoring Period: Progressive doesn’t continuously track your driving habits. Learn more in our Progressive Snapshot review.

Cons

- Rate Increases: Low-mileage drivers may see pay-as-you-go rate increases after participating in Progressive Snapshot if they speed or drive at night.

- Customer Satisfaction: The company has below-average ratings from J.D. Power.

#3 – Allstate: Best for High-Mileage Drivers

Pros

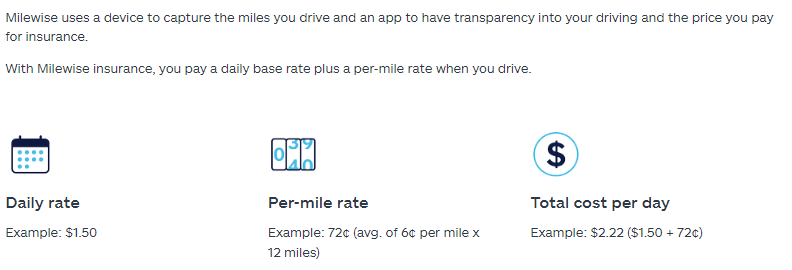

- Two Pay-Per-Mile Programs: Allstate Milewise and Milewise Unlimited provide more ways for Texas drivers to save on pay-as-you-go insurance, even if they drive more than average.

- Doesn’t Track Driving Habits: Allstate Milewise does not track driving habits like speeding and braking. Read about it in our Allstate Milewise review.

- Mobile Convenience: Manage your pay-as-you-go policy from anywhere in Texas and track mileage, discounts, and vehicle diagnostics.

Cons

- Customer Satisfaction: The company has just average ratings from J.D. Power compared to other Texas car insurance companies.

- Higher Rates: Allstate pay-per-mile auto insurance is more expensive than other Texas providers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Metromile: Best for Simplified Pricing

Pros

- Simplified Pricing: Metromile’s monthly pay-as-you-go insurance pricing is straightforward. Compare quotes in our review of Metromile auto insurance.

- Online Convenience: Metromile’s pay-as-you-go insurance app allows drivers to check rates and troubleshoot check engine lights.

- Pet Injury Coverage: Metromile includes pet injury insurance with full coverage pay-as-you-go insurance in Texas.

Cons

- Not For Frequent Drivers: Metromile is only economical for drivers who drive less than 10,000 miles per year.

- High Number of Complaints: Metromile receives six times more complaints from customers than other Texas pay-as-you-go car insurance companies.

#5 – USAA: Best for Military Drivers

Pros

- Military Perks: Military drivers get the cheapest pay-as-you-go auto insurance in Texas, starting at $22 per month.

- Customer Service: USAA has excellent customer service reviews and few customer complaints, which you can read more about in our USAA auto insurance review.

- Accident Forgiveness: USAA customers won’t see their pay-per-mile auto insurance rates go up after an accident.

Cons

- Military-Only: USAA only sells Texas pay-per-mile insurance to military and veterans.

- Doesn’t Underwriter Pay-Per-Mile: USAA partners with Noblr because it doesn’t have its own pay-as-you-insurance program. Learn more in our Noblr auto insurance review.

#6 – Nationwide: Best for Safe Drivers

Pros

- No Rate Increases: Nationwide SmartMiles only tracks driving habits for the first policy term and rewards safe driving with an additional 10% discount.

- Coverage Options: Nationwide has gap insurance, vanishing deductibles, classic auto coverage, and more. Our Nationwide SmartMiles review goes over pay-as-you-go coverages in Texas.

- Customer Satisfaction: Nationwide pay-per-mile and usage-based auto insurance is #1 in J.D. Power satisfaction surveys.

Cons

- Older Vehicles: SmartMiles pay-as-you-go auto insurance is not compatible with vehicles manufactured before 1996.

- Not For Frequent Drivers: You will have higher pay-as-you-go car insurance rates with Nationwide if you drive more than 10,000 miles annually.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Mile Auto: Best For No Tracking Devices

Pros

- No Tracking Devices: Mile Auto only requires a picture of your odometer to calculate monthly pay-as-you-go auto insurance rates in Texas. Read Mile Auto insurance reviews to learn how it works.

- Cheap Rates: Cheap pay-as-you-go car insurance in Texas starts at $30 a month with Mile Auto.

- Good Claims Processing: Mile Auto reviews on Reddit report helpful agents and quick payouts when filing pay-as-you-go auto insurance claims in Texas.

Cons

- No Discounts: MileAuto does not offer any discounts on pay-as-you-go car insurance in Texas.

- Basic Coverage: MileAuto pay-as-you-go insurance policies in Texas are basic without any common add-ons like roadside assistance or rental reimbursement.

#8 – American Family: Best for Costco Members

Pros

- Costco Discounts: Costo members get exclusive policy discounts on Texas pay-as-you-go auto insurance.

- No Tracking Devices: AmFam MilesMyWay doesn’t use an app or plug-in device to monitor mileage but asks for a picture of the odometer instead.

- Customer Service: Read our American Family auto insurance review to see how the company ranks compared to other Texas insurers.

Cons

- Not For Frequent Drivers: Texas drivers must drive less than 8,000 miles per year to benefit from American Family pay-per-mile insurance.

- Average Rates: You can get better pay-as-you-go auto insurance quotes with other companies in Texas.

#9 – GoAuto: Best for Tech-Savvy Drivers

Pros

- Online Convenience: GoAuto doesn’t use agents and streamlines Texas auto insurance with its self-service website and mobile app.

- Cheap Rates: Minimum GoAuto quotes start at $29 monthly, and GoAuto insurance full coverage is among the cheapest in Texas, starting at $72 per month.

- Low Down Payments: GoAuto insurance in Texas has affordable down payments so drivers can get coverage quickly. Compare cheap auto insurance with no down payment.

Cons

- Traditional Policies: Insurance with GoAuto doesn’t track mileage, but the company provides a variety of payment plans tailored for infrequent drivers.

- Poor Customer Service: GoAuto insurance reviews in Texas are mostly negative when it comes to filing claims, and it receives twice the number of complaints.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Personalized Discounts

Pros

- Personalized Discounts: Farmers has plenty of discounts for low-mileage drivers, more than any other Texas car insurance company.

- Safe-Driving Rewards: Pay-as-you-go drivers who score 80% or higher in the Signal app are entered into a monthly drawing for up to $100 in rewards. Learn more in our Farmers Signal review.

- CrashAssist Add-On: Farmers Signal automatically comes with CrashAssist, which helps drivers involved in an accident by contacting emergency services.

Cons

- Small Sign-Up Discount: Farmers only gives Texas drivers 5% off for signing up for pay-as-you-go auto insurance.

- Low Customer Satisfaction: Texas drivers prefer to use Nationwide or Allstate pay-as-you-go insurance over Farmers Signal.

How to Save Money With Texas Pay-As-You-Go-Auto Insurance

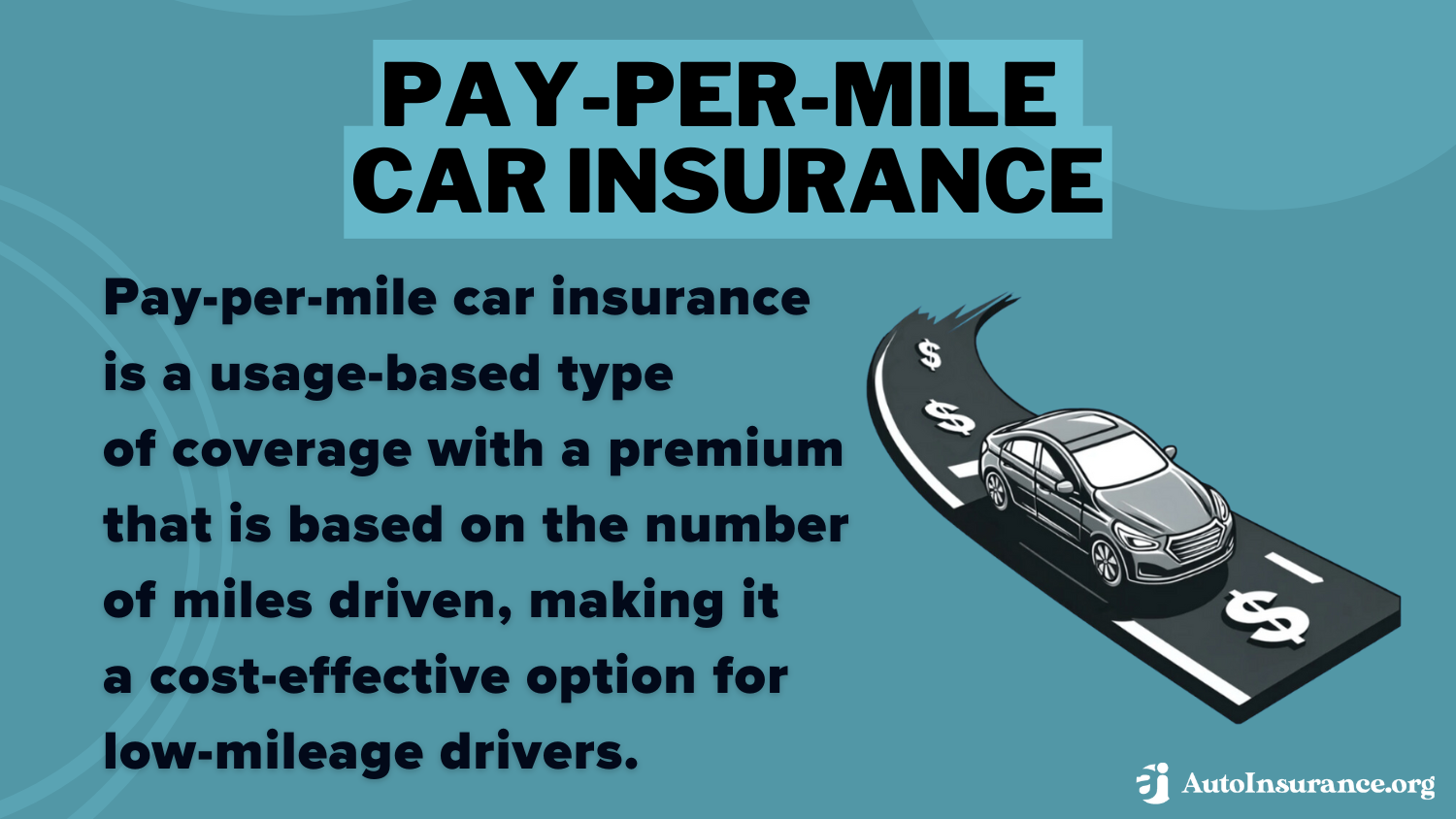

What is pay-as-you-go car insurance? In Texas, pay-as-you-go auto insurance (also known as pay-per-mile insurance) operates on a simple premise: drivers pay a daily base rate and a per-mile charge, offering flexibility and potential savings for those who are retired or work from home.

Pay-As-You-Go Auto Insurance in Texas: Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $116 | $313 | |

| $101 | $274 | |

| $79 | $214 | |

| $50 | $150 | |

| $50 | $160 | |

| $55 | $165 | |

| $89 | $240 |

| $70 | $188 | |

| $95 | $270 | |

| $36 | $97 |

USAA and Safeco have the cheapest pay-as-you-go car insurance. USAA is only for military members and their families, but Safeco and GoAuto auto insurance are available to all Texans who drive less than the national average.

Most will drive around 12,000 miles per year, but those who drive less get cheaper rates with low-mileage discounts and pay-as-you-go policies. Explore Texas insurance costs to see how annual mileage affects auto insurance rates:

Texas Auto Insurance Monthly Rates by Age, Gender, & Annual Mileage

| Age & Gender | 6,000 Miles | 10,000 Miles | 12,000 Miles | 15,000 Miles |

|---|---|---|---|---|

| 16-Year-Old Female | $60 | $107 | $132 | $155 |

| 16-Year-Old Male | $70 | $119 | $141 | $177 |

| 20-Year-Old Female | $79 | $124 | $141 | $167 |

| 20-Year-Old Male | $85 | $140 | $157 | $196 |

| 30-Year-Old Female | $82 | $122 | $138 | $174 |

| 30-Year-Old Male | $91 | $142 | $151 | $189 |

| 40-Year-Old Female | $82 | $126 | $134 | $167 |

| 40-Year-Old Male | $85 | $142 | $147 | $179 |

| 50-Year-Old Female | $79 | $125 | $132 | $165 |

| 50-Year-Old Male | $83 | $130 | $141 | $171 |

| 60-Year-Old Female | $48 | $83 | $104 | $133 |

| 60-Year-Old Male | $67 | $109 | $131 | $163 |

| 70-Year-Old Female | $45 | $75 | $83 | $125 |

| 70-Year-Old Male | $58 | $106 | $124 | $154 |

Compared to standard auto insurance, with fixed monthly rates, Texas pay-as-you-go is much cheaper. This table shows how standard full coverage costs twice as much as full coverage pay-as-you-go:

Texas Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $217 | $614 |

| 16-Year-Old Male | $249 | $674 |

| 20-Year-Old Female | $59 | $161 |

| 20-Year-Old Male | $64 | $94 |

| 30-Year-Old Female | $55 | $81 |

| 30-Year-Old Male | $59 | $87 |

| 40-Year-Old Female | $48 | $130 |

| 40-Year-Old Male | $49 | $217 |

| 50-Year-Old Female | $45 | $130 |

| 50-Year-Old Male | $46 | $133 |

| 60-Year-Old Female | $44 | $116 |

| 60-Year-Old Male | $47 | $123 |

| 70-Year-Old Female | $47 | $134 |

| 70-Year-Old Male | $48 | $137 |

Pay-per-mile car insurance meets Texas minimum auto insurance requirements and includes essential coverage options like full coverage and roadside assistance. It just comes at a lower overall cost based on the miles you drive.

Understanding How Pay-As-You-Go Auto Insurance Works in Texas

Unlike cheap usage-based auto insurance, not all pay-as-you-go car insurance companies track your driving habits. Allstate, MileAuto, Metromile, and Nationwide will only track mileage, so things like speeding and hard braking won’t raise your rates or shrink your discount.

Cheap low-mileage auto insurance companies are only recommended for those who drive fewer than 10,000 miles annually. If you want some pay-per-mile auto insurance examples, see how Allstate’s Milewise works.

It’s important to note that while cheap low-mileage auto insurance can be advantageous for those driving under 10,000 miles yearly, it may not suit high-mileage drivers seeking comprehensive coverage.

Read More: Best Low-Mileage Auto Insurance Discounts

Allstate Milewise Unlimited can accommodate drivers on the road more than 10,000 miles annually but still less than 12,000 miles per year. GoAuto is the best option in Texas for low-mileage drivers who don’t qualify for pay-as-you-go policies.

GoAuto insurance quotes are available online with low down payments and a variety of payment plans that don’t track driving behavior or mileage. However, GoAuto customer service is below average, and many drivers have issues when filing GoAuto claims.

GoAuto should not be confused with Go Insurance in Texas, which is a separate company strictly serving the El Paso area. You can only get Go auto insurance in El Paso, while GoAuto is available throughout Texas and other states. Enter your ZIP code to compare auto insurance in El Paso and other parts of Texas.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Texans Who Need Pay-As-You-Go Auto Insurance

If you want cheap car insurance, pay-as-you-go is ideal for Texas drivers who log fewer miles and want to save on coverage. It’s the best auto insurance for retirees, remote and hybrid workers, and stay-at-home parents since they drive less than daily commuters.

Infrequent drivers get the cheapest pay-as-you-go insurance rates, and low-mileage auto insurance for seniors is often cheaper than for young drivers.Dani Best Licensed Insurance Producer

College students who leave their cars parked for long periods or only drive on the weekends and city residents who rely on public transit can also find cheap car insurance in Texas with pay-per-mile policies.

Texas Pay-As-You-Go Insurance by City

Auto insurance for low-mileage drivers may be cheaper in some parts of Texas than others. These are the most expensive cities in Texas for car insurance. Signing up for coverage from the best pay-as-you-go auto insurance companies can help you get lower rates.

Texas Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Austin | Dallas | El Paso | Houston | San Antonio |

|---|---|---|---|---|---|

| 16-Year-Old Female | $1,050 | $1,040 | $1,020 | $1,030 | $1,035 |

| 16-Year-Old Male | $680 | $690 | $670 | $675 | $685 |

| 20-Year-Old Female | $240 | $245 | $250 | $260 | $255 |

| 20-Year-Old Male | $275 | $280 | $260 | $265 | $270 |

| 30-Year-Old Female | $150 | $140 | $130 | $135 | $145 |

| 30-Year-Old Male | $155 | $160 | $145 | $150 | $160 |

| 40-Year-Old Female | $210 | $205 | $195 | $200 | $202 |

| 40-Year-Old Male | $212 | $210 | $200 | $205 | $207 |

| 50-Year-Old Female | $208 | $205 | $195 | $200 | $202 |

| 50-Year-Old Male | $213 | $210 | $200 | $205 | $207 |

| 60-Year-Old Female | $125 | $120 | $115 | $118 | $123 |

| 60-Year-Old Male | $125 | $122 | $118 | $120 | $123 |

| 70-Year-Old Female | $215 | $210 | $205 | $207 | $209 |

| 70-Year-Old Male | $218 | $215 | $210 | $213 | $214 |

Texas pay-as-you-go provides full protection at a fraction of the cost. It’s especially beneficial for drivers in Houston or Austin who take public transit or work remotely. For example, a driver who commutes occasionally or works remotely could pay far less than someone with a long daily commute.

Finding The Best Pay-As-You-Go Auto Insurance Companies in Texas

Safeco, Progressive, and Allstate sell the best pay-as-you-go auto insurance in Texas. Whether you are looking for the best auto insurance companies for telecommuters or retired drivers, these providers have cheap auto insurance for Texans.

However, Safeco and Progressive track driving habits along with mileage, which can actually increase rates if you speed or drive at night, even if you drive less. Many complain about improper tracking and unfair rate increases when using pay-as-you-go. Insurance companies like Allstate and MileAuto are some of the few that strictly track mileage.

There are additional strategies for low-mileage drivers to cut costs on auto insurance premiums. The first step is to compare rates and check reviews. Exploring discounts offered by top insurance providers can further enhance savings.

You can also use a pay-per-mile car insurance calculator to determine which company offers the best auto insurance in Texas. Leverage these pay-per-mile car insurance calculators to pinpoint the most favorable rates tailored to your driving habits and needs.

Enter your ZIP code below to compare cheap auto insurance quotes near you. By utilizing these tools, you’ll swiftly identify affordable options and ensure comprehensive protection for your vehicle in the Lone Star State.

Frequently Asked Questions

How much does the average Texan pay for auto insurance?

It depends on what company is chosen. For example, minimum coverage at USAA averages 27/mo, but minimum coverage at Liberty Mutual averages $68/mo.

Who is the cheapest auto insurance in Texas?

USAA has the cheapest Texas auto insurance rates, followed by Safeco and GoAuto car insurance, with its low down payment policies to help reduce costs. Enter your ZIP code below to find cheap quotes in your Texas area.

Is pay-per-mile insurance available in Texas?

Pay-per-mile auto insurance coverage is available at several companies. If you are looking for the best insurance for your rarely used vehicle, make sure to read our article on the best auto insurance for limited-use vehicles.

What is the best pay-per-mile auto insurance in Texas?

Safeco has the best pay-per-mile car insurance, although you should always read multiple pay-per-mile auto insurance reviews and get quotes before making a decision.

What is the best auto insurance for Texas seniors?

The best low-mileage car insurance for seniors is at companies like Safeco and Allstate. Check out our list of the best auto insurance companies for seniors in Texas.

Who is State Farm’s biggest auto insurance competitor in Texas?

The biggest competitor of State Farm’s low-mileage auto insurance is Progressive. You can learn more about State Farm low-mileage car insurance in our State Farm auto insurance review.

Who is cheaper than Geico in Texas?

USAA has the cheapest pay-per-mile car insurance that meets Texas auto insurance requirements.

Did Geico raise its auto insurance rates in Texas?

Yes, Geico recently raised rates, so it may not be the best choice for the cheapest pay-per-mile auto insurance.

Is Allstate Milewise a good option for Texas drivers?

Yes, Allstate Milewise can provide affordable auto insurance for Texans who drive less than the average driver. Read our article on cheap auto insurance for infrequent drivers to help you find the best deal.

What is the difference between Allstate Milewise and Drivewise?

Allstate Drivewise is a UBI program that tracks driving behaviors and may issue a low-mileage auto insurance discount on a regular policy, while Allstate Milewise is coverage that charges per mile after a base fee.

Does Allstate handle auto insurance claims well?

Allstate has good ratings from J.D. Power for claims handling.

Is Allstate auto insurance cheaper than Geico in Texas?

Allstate Milewise insurance may be cheaper than Geico low-mileage auto insurance. The only way to tell is to get Texas auto insurance quotes for both Allstate and Geico low-mileage car insurance (learn more: Allstate vs. Geico Auto Insurance).

Does GoAuto offer full coverage in Texas?

Yes, GoAuto full coverage policies are the cheapest in Texas, starting at $72 per month. Compare cheap full coverage auto insurance here.

Who owns GoAuto Insurance?

Everberg Capital finances GoAuto. GoAuto is not the same company as Go Car Insurance or Good to Go Auto Insurance (also known as Good2Go), which sell insurance in Texas but are owned by different investment firms.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.