Best Pay-As-You-Go Auto Insurance in Washington (Top 9 Companies Ranked for 2025)

Geico, Allstate, and Progressive have the best pay-as-you-go auto insurance in Washington, with safe drivers paying as little as $30 per month. Most insurance companies don’t offer true pay-as-you-go plans, but low-mileage drivers can enroll in the many Washington usage-based insurance programs for lower rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage PAYG in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for PAYG in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for PAYG in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsThe best pay-as-you-go auto insurance in Washington comes from Geico, Allstate, and Progressive. Drivers automatically save up to 10% when they enroll in Geico DriveEasy usage-based insurance (UBI).

Despite not having a pay-as-you-go car insurance plan, Geico is a good choice for a low-mileage auto insurance discount. If you want a genuine pay-per-mile car insurance policy, Allstate is your best bet.

Our Top 10 Company Picks: Best Pay-As-You-Go Auto Insurance in Washington

| Company | Rank | UBI Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A++ | Cheap Rates | Geico | |

| #2 | 40% | A+ | Infrequent Drivers | Allstate | |

| #3 | 30% | A+ | Digital Tools | Progressive | |

| #4 | 30% | B | Personalized Service | State Farm | |

| #5 | 30% | A | Customizable Policies | Liberty Mutual |

| #7 | 30% | A | Safe Drivers | Safeco | |

| #8 | 40% | A+ | Vanishing Deductible | Nationwide |

| #9 | 30% | A++ | Industry Experience | Travelers | |

| #10 | 30% | A | Insurance Discounts | Farmers |

Read on to find the best Washington auto insurance for low-mileage drivers.

Then, enter your ZIP code into our free comparison tool to find the best companies for pay-as-you-go auto insurance to fit your needs.

- Geico and Allstate offer the best pay-as-you-go car insurance in Washington

- Companies like Allstate and Nationwide offer specific pay-as-you-go policies

- Other companies offer low-mileage discounts to help drivers save money

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Pick Overall

Pros

- Usage-Based Discounts: Get cheap pay-as-you-go auto insurance in Washington with Geico DriveEasy UBI and low-mileage discounts. Find more ways to save in our Geico review.

- Low Rates: Geico offers competitive pay-as-you-go auto insurance rates, making it a cost-effective choice for Washington drivers.

- Strong Digital Presence: A user-friendly website and mobile auto insurance app make it easy for drivers to manage their Washington auto insurance policies.

Cons

- Average Claims Service: Geico’s auto insurance claims handling process is often reported as less personalized and slow by Washington customers.

- Basic Coverage Options: Despite being one of the best pay-as-you-go auto insurance companies in Washington, Geico has a limited number of policy customization options.

#2 – Allstate: Best for Low-Mileage Drivers

Pros

- Milewise Program: Allstate is one of the best auto insurance companies in Washington because it offers true pay-per-mile insurance. Learn more in our Allstate Milewise review.

- Drivewise UBI: Allstate’s UBI program provides significant savings for low-mileage and safe drivers in Washington. Learn how you can save up to 40% in our Allstate Drivewise review.

- Comprehensive Coverage Options: It’s easy to craft a policy that fits your specific pay-per-mile auto insurance needs in Washington with Allstate’s wide range of add-ons.

Cons

- Higher Premiums: Allstate is almost always one of the more expensive options for Washington pay-as-you-go car insurance no matter how many miles you drive.

- Potential Privacy Concerns: Participation in Allstate Drivewise or Milewise auto insurance programs requires digital tracking, which makes some Washington drivers uncomfortable.

#3 – Progressive: Best Modern Auto Insurance Experience

Pros

- Snapshot Program: Progressive Snapshot UBI rewards safe driving, ideal for Washington drivers who prioritize safety and insurance savings. Compare savings in our Snapshot review.

- Advanced Digital Tools: Progressive has digital options like the Name Your Price tool that makes finding cheap low-mileage auto insurance in Washington easy.

- Flexible Payment Options: With various payment plans to suit different budgets in Washington, Progressive makes it easy to manage your auto insurance budget.

Cons

- Mixed Customer Service: Many Progressive customers in Washington report varying experiences with customer support, and the company struggles with its loyalty ratings for auto insurance.

- Complex Pricing Structure: Progressive Snapshot will reduce pay-as-you-go insurance discounts for poor driving habits even if you are a low-mileage driver.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Personalized Washington Service

Pros

- Drive Safe & Save Program: Save up to 30% on your insurance by enrolling in Drive Safe & Save. This UBI program offers significant discounts for safe and low-mileage Washington drivers.

- Personalized Service: With an extensive network of agents for face-to-face assistance, State Farm promises personalized auto insurance service to every Washington driver.

- User-Friendly App: State Farm’s digital presence isn’t the best in Washington, but it does offer a convenient mobile app for policy management. Explore the app in our State Farm insurance review.

Cons

- Higher Rates for High-Mileage Drivers: State Farm doesn’t offer a pay-per-mile discount, and you will see higher auto insurance rates in Washington the more you drive.

- Slower Claims Process: State Farm’s claims handling can be slower compared to other Washington pay-as-you-go auto insurance providers.

#5 – Liberty Mutual: Best List of Unique Washington Coverage Options

Pros

- Diverse Coverage Options: Liberty Mutual offers excellent customization options that can be hard to find at other Washington pay-as-you-go insurance companies.

- RightTrack Program: Liberty Mutual rewards safe Washington drivers who sign up for RightTrack with pay-as-you-go auto insurance discounts.

- Good Driver Discounts: Liberty Mutual offers other ways to get cheap pay-as-you-go auto insurance in Washington through its safe driving discounts. Get a full list in our Liberty Mutual review.

Cons

- Higher Rates: While Liberty Mutual sometimes offers cheap auto insurance quotes for low-mileage drivers, it’s usually a little more expensive than many of its Washington competitors.

- Inconsistent Customer Service: Washington drivers report that Liberty Mutual representatives can be slow to communicate and resolve pay-as-you-go insurance issues.

#6 – Safeco: Best for Safe Washington Drivers

Pros

- RightTrack Program: Read our RightTrack review to learn how Safeco UBI for Washington drivers can help you save up to 30% on your pay-as-you-go insurance if you practice good habits.

- Cash-Back Rewards: Earn cash-back rewards on pay-as-you-go insurance from Safeco by maintaining a safe driving record and avoiding Washington auto insurance claims.

- Bundling Discounts: Safeco sells a variety of policies besides pay-as-you-go auto insurance. If you buy more than one in Washington, you’ll likely receive a bundling discount.

Cons

- Mixed Customer Service: With reports of varying experiences with customer support, Safeco doesn’t have the best auto insurance ratings in Washington.

- Confusing Discounts: Safeco doesn’t post much information about its discounts, making it difficult to compare plans with other Washington pay-as-you-go companies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Deductible Savings in Washington

Pros

- SmartRide Program: Get cheaper pay-per-mile auto insurance rates in Washington by signing up for SmartRide. See how much you can save in our Nationwide SmartRide review.

- Vanishing Deductible: Nationwide’s vanishing auto insurance deductible add-on reduces your deductible by up to $100 for every year you spend claims-free in Washington, up to $500.

- Good Customer Service: With high ratings for customer support and claims handling, most drivers recommend Nationwide auto insurance in Washington.

Cons

- Limited Availability: Despite its name, Nationwide is not available in all states. While it sells pay-as-you-go car insurance in Washington, you may need to find a different provider if you move.

- Fewer Discounts: Compared with other major insurance providers in Washington, Nationwide’s 11 total discounts can make it hard to find the cheapest pay-as-you-go auto insurance.

#8 – Travelers: Best Reliable Washington Insurance Company

Pros

- IntelliDrive Program: Travelers takes its spot as one of the best pay-per-mile auto insurance companies in Washington with its UBI program. Read more in our IntelliDrive review.

- Financial Stability: With an A++ from A.M. Best, Travelers’ strong financial ratings in Washington ensure the reliability of its pay-as-you-go auto insurance policies.

- Industry Experience: Travelers is one of the most reliable WA pay-as-you-go auto insurance companies with over a century of experience and very few customer complaints.

Cons

- Higher Average Rates: It may be one of the best pay-as-you-go auto insurance companies in Washington, but it can be more expensive if you drive a lot.

- Limited Local Agents: There are fewer physical Travelers locations for in-person pay-as-you-go assistance in Washington. Learn how to get in touch with our Travelers insurance review.

#9 – Farmers: Best Washington Auto Insurance Discounts

Pros

- Signal Program: Enroll in the Signal app for pay-as-you-go auto insurance rewards for your safe driving, making it a great option for low-mileage Washington drivers.

- Personalized Service: Famers has a host of knowledgeable local agents throughout Washington to help you with pay-as-you-go coverage and questions.

- Generous Discounts: Farmers offers 23 discount options on Washington pay-as-you-go insurance to help you save, which you can explore in our Farmers auto insurance review.

Cons

- Limited Local Presence: Farmers doesn’t maintain as many local offices for pay-as-you-go car insurance in Washington.

- No 24/7 Supports: Although Farmers offers personalized pay-as-you-go insurance service, it’s not available 24/7. Instead, you’ll have to call during Washington business hours.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Washington Pay-As-You-Go Auto Insurance Rates

Compared to the rest of the country, Washington auto insurance rates are generally low. Low-mileage drivers can find even lower rates by taking advantage of pay-per-mile insurance programs in Washington. Check below to see how much you might pay for low-mileage insurance at our top Washington companies.

Washington Pay-As-You-Go Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $35 | $90 |

| Farmers | $31 | $83 |

| Geico | $30 | $85 |

| Liberty Mutual | $34 | $87 |

| Nationwide | $29 | $82 |

| Progressive | $32 | $83 |

| Safeco | $33 | $88 |

| State Farm | $28 | $80 |

| Travelers | $32 | $86 |

As you can see, low-mileage drivers can find excellent savings by signing up for pay-as-you-go insurance. Even the best Washington auto insurance companies will likely be more expensive than a pay-per-mile plan.

How Washington Pay-As-You-Go Auto Insurance Works

Finding a pay-as-you-go program is a great way for infrequent drivers to find cheap auto insurance, but how do these programs work? Washington pay-as-you-go auto insurance plans are usually easy to understand, but they are a bit different than traditional coverage.

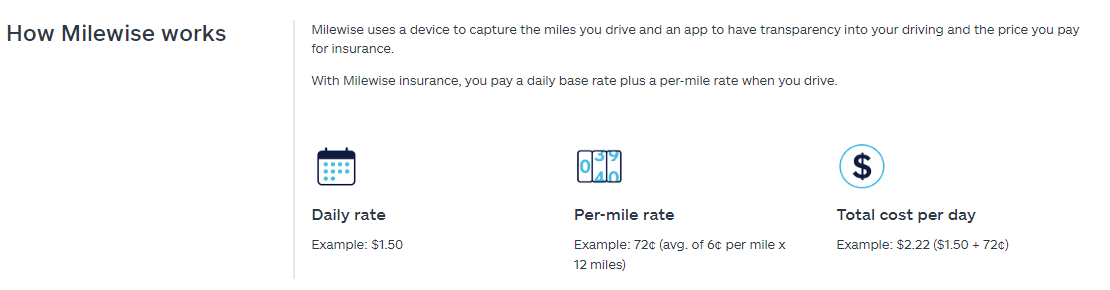

Rates for a pay-as-you-go plan have two parts. The first is a base rate that you’ll pay every month, no matter how much you drive. Then, you’ll have a small rate you’ll pay for each mile you drive, usually just a few cents. Your insurance company will combine your flat fee and your per-mile rate into a monthly premium.

As long as you’re a low-mileage driver, you’ll probably save significantly on Washington auto insurance by choosing a pay-per-mile plan over traditional coverage.

Factors Affecting Washington Auto Insurance Rates

Aside from your annual mileage, there are many factors that affect auto insurance rates. You should be aware of the most common factors that affect car insurance in Washington.

Insurance companies use a set of factors like your age, the car you drive, and your driving record to determine how much to charge you. Unless you’re an extremely high-mileage driver, how much you drive doesn’t have a huge impact on traditional insurance rates.Michelle Robbins Licensed Insurance Agent

Insurance companies look at the same factors when determining your rates, but they have unique formulas. That’s why it’s so crucial to compare rates with multiple companies — you may find one Washington insurance company has much better rates for your unique circumstance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

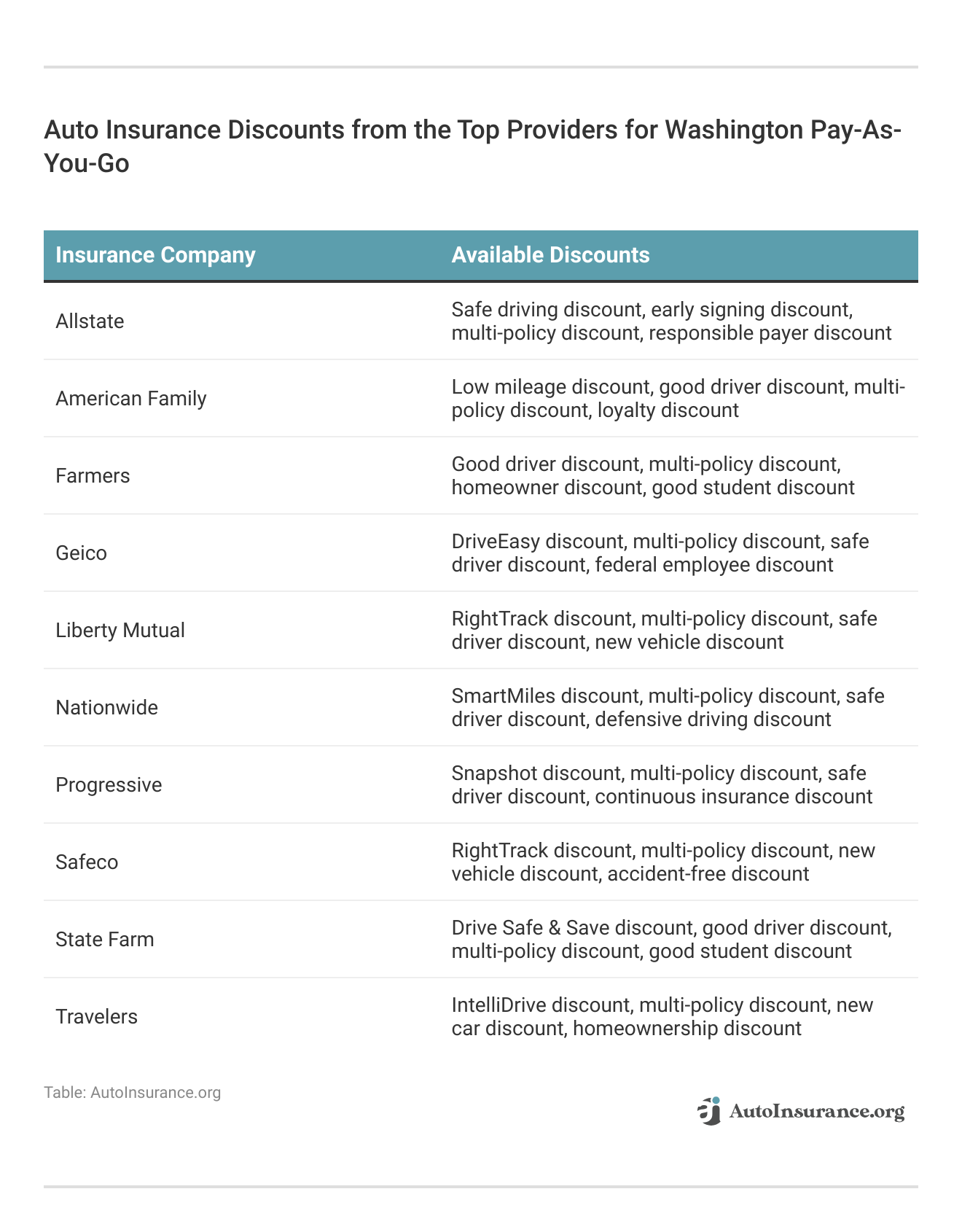

How to Save on Washington Pay-As-You-Go Auto Insurance

Aside from signing up for a pay-per-mile, there are multiple ways of lowering your car insurance even further. For starters, you should look at auto insurance discounts. Check below to see a list of discounts provided by our top pay-as-you-go auto insurance companies.

You can also save on your insurance by lowering your coverage limits, raising your deductible, and picking the right coverage types.

Of all the ways to find low car insurance rates, the most important is to compare multiple quotes. Most insurance companies provide a quote request form on their home page. You can get personalized quotes using these forms in about 10 minutes.

If you don’t want to spend the time to get quotes using multiple forms, online quote generators make it easy to look at rates from several companies at once. Learn how to compare auto insurance quotes in our helpful guide.

Get the Best Pay-As-You-Go Auto Insurance in Washington Today

Finding affordable pay-as-you-go Washington auto insurance rates is usually a simple task, so long as you don’t drive more than 10,000 miles per year. You’ll have to give up a bit of privacy while driving, but the car insurance savings are usually worth it.

On their way to saving on their 🚗 insurance with flexible programs like SmartRide and SmartMiles. pic.twitter.com/cfp4uwVBBq

— Nationwide (@Nationwide) August 17, 2020

Although low-mileage drivers find it easier to get affordable car insurance rates compared to other drivers, they still need to compare rates with multiple companies. Enter your ZIP code in your free comparison tool below to see pay-as-you-go rates in your area.

Frequently Asked Questions

What is the average cost of auto insurance in Washington?

For low-mileage drivers, the average cost of a minimum insurance policy is $31 per month. If you want a full coverage policy, the average driver will pay $85. However, the rates you’ll pay depend on the types of auto insurance you want to purchase.

How does pay-as-you-go auto insurance work in Washington?

Pay-as-you-go insurance in Washington combines a flat monthly rate with a per-mile fee. Your insurance company will combine these two prices to create your monthly premium.

Who has the cheapest pay-as-you-go auto insurance in Washington?

The cheapest pay-as-you-go auto insurance in Washington comes from State Farm, with rates starting as low as $30 per month. However, the cheapest company for you depends on the types of auto insurance coverage you want to purchase.

Is Root auto insurance available in Washington?

Unfortunately, Root is not currently available in Washington.

Is Geico pay-as-you-go auto insurance cheaper than Progressive?

Although Geico is often a cheaper insurance option than Progressive, that’s not necessarily the case for pay-per-mile insurance in Washington. Progressive is a little cheaper on average than Geico for low-mileage insurance in Washington. You should still compare quotes, however, as annual mileage affects car insurance rates differently.

Is Allstate pay-as-you-go auto insurance cheaper than Geico?

No matter what type of car insurance policy you want to buy, Allstate is almost always a more expensive option than Geico. To see how Allstate compares to other companies, enter your ZIP code into our free comparison tool.

Is Allstate or USAA better for Washington pay-as-you-go insurance?

USAA is always a cheaper option for car insurance than Allstate. To see how much you might pay for insurance as a low-mileage driver with Allstate, check out our Milewise auto insurance review.

What are the state minimum auto insurance requirements in Washington?

Washington minimum auto insurance requirements include a 25/50/10 liability policy, 25/50/10 uninsured/underinsured motorist coverage, and $10,000 worth of personal injury protection insurance.

What is full coverage auto insurance in Washington?

Full coverage in Washington is a policy that includes liability, comprehensive, collision, uninsured/underinsured motorist, and personal injury protection insurance.

Can you drive without insurance in Washington?

Washington state laws require that you have insurance before you drive on a public street. The penalty for driving without insurance in Washington includes a fine of at least $550 and license suspension.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.