Best Pay-As-You-Go Auto Insurance in Pennsylvania for 2025 (Top 10 Companies Ranked)

Progressive, Allstate, and State Farm sell the best pay-as-you-go auto insurance in Pennsylvania. Progressive and State Farm are the cheapest pay-per-mile auto insurance companies in PA, with minimum rates starting at $50/mo. Compare the top 10 pay-as-you-go full coverage insurance companies for the best rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

PAYG Full Coverage in PA

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 11,638 reviews

11,638 reviewsCompany Facts

PAYG Full Coverage in PA

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 18,154 reviews

18,154 reviewsCompany Facts

PAYG Full Coverage in PA

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsProgressive, Allstate, and State Farm offer the best pay-as-you-go auto insurance in Pennsylvania. Progressive has the lowest rates and flexible coverage for low-mileage drivers.

Allstate is second on our list, with its solid pay-per-mile options, while State Farm ranks third for its reliable customer service. These top pay-as-you-drive options help drivers save money by only paying for the miles they drive.

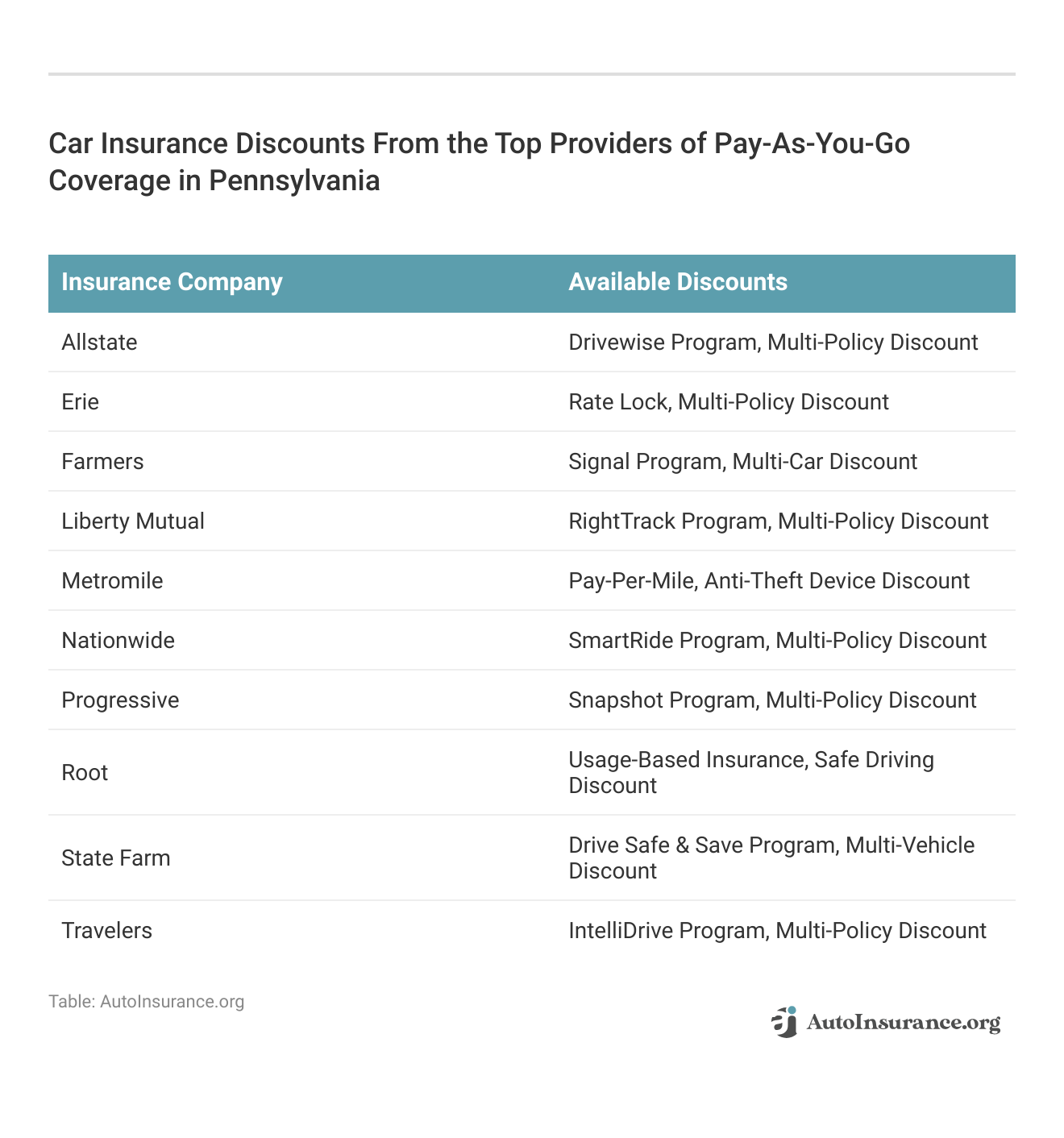

Our Top 10 Picks: Best Pay-As-You-Go Auto Insurance in Pennsylvania

| Company | Rank | Low-Mileage Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 30% | A+ | Usage Based | Progressive | |

| #2 | 30% | A+ | Personalized Rates | Allstate | |

| #3 | 30% | B | Telematics Technology | State Farm | |

| #4 | 20% | A+ | Flexibility Options | Nationwide |

| #5 | 30% | A | Comprehensive Coverage | Liberty Mutual |

| #6 | 10% | A | Customizable Plans | Farmers | |

| #7 | 30% | A+ | Competitive Pricing | Erie |

| #8 | 20% | A++ | Safety Features | Travelers | |

| #9 | 13% | NR | Mileage Rates | Metromile | |

| #10 | 6% | NR | Behavioral Analysis | Root |

This guide breaks down coverage, costs, and benefits to help you find the best fit. When you’re ready, enter your ZIP code into our free comparison tool to find the lowest rates possible.

- Pay-as-you-go insurance plans charge you by the mile instead of a flat monthly fee

- Low-mileage drivers can get substantial savings with pay-per-mile insurance

- Progressive, Allstate, and State Farm have the best pay-per-mile insurance in PA

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Pick Overall

Pros

- Snapshot Program: Save up to 30% on your policy by enrolling in Snapshot, Progressive’s usage-based insurance (UBI) program.

- Name Your Price Tool: Looking to stick to a monthly budget? Progressive’s Name Your Price tool generates a list of insurance options that match your budget.

- Loyalty Discounts: Progressive offers savings for being a customer for a year or longer, which automatically applies to your account.

Cons

- Low Customer Loyalty: Despite being one of the cheapest pay-per-mile car insurance companies, Progressive struggles to keep its customers.

- Unexpected Rate Increases: Progressive rates can increase unexpectedly, even when nothing about your situation has changed. Learn more about its rates in our Progressive auto insurance review.

#2 – Allstate: Best Full Coverage Policies

Pros

- UBI Programs: Allstate offers two UBI options: Milewise and Drivewise. Drivewise offers a discount of up to 40% for safe driving, while Milewise is a pay-per-mile program.

- Daily Mileage Cap: Allstate is one of the best pay-per-mile auto insurance companies because it offers a generous daily cap of 250 miles.

- Coverage Options: Get the best coverage with Allstate’s add-ons, like roadside assistance and extended vehicle care coverage. See all your coverage options in our Allstate auto insurance review.

Cons

- Higher Rates: No matter which ZIP code you live in or what your driving record looks like, Allstate is almost always one of the most expensive insurance options.

- Mixed Reviews: Some customers are loyal drivers, but others report feeling deeply unsatisfied with their Allstate experience.

#3 – State Farm: Best for Personalized Service

Pros

- Drive Safe & Save: State Farm offers low-mileage drivers savings of up to 30% for practicing safe habits on the road.

- Solid Discounts: State Farm offers 13 discounts to help drivers save.

- Wide Network of Agents: You can always get personalized help, as it has one of the largest networks of agents in the country.

Cons

- Limited Availability: Drive Safe & Save is not available everywhere. To see if you can sign up, check out our State Farm auto insurance review.

- Fewer Coverage Options: State Farm is one of the largest companies in the country, so drivers are often surprised by the company’s small selection of insurance add-ons.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best UBI Savings

Pros

- SmartRide: For drivers who regularly practice safe driving habits, Nationwide SmartRide offers up to 40% off.

- SmartMiles: Nationwide is one of the cheapest pay-per-mile auto insurance companies with its SmartMiles tracking program.

- Low Rates for Teens: Nationwide is one of the most affordable options for teen auto insurance.

Cons

- Rates Can be High: High-risk drivers typically see much higher rates. If you have a speeding ticket, at-fault accident, or DUI, Nationwide pay-per-mile insurance is not the cheapest choice.

- Coverage Options Lacking: Nationwide doesn’t offer the longest list of coverage options, e.g., rideshare insurance. Find more details in our Nationwide auto insurance review.

#5 – Liberty Mutual: Best for Diverse Coverage Options

Pros

- RightTrack: Save up to 30% with Liberty Mutual’s UBI option, RightTrack. Learn more in our Liberty Mutual RightTrack review.

- Teacher Discounts: Liberty Mutual helps educators find affordable coverage through teacher discounts.

- Unique Coverage Options: It gives you plenty of customization options, including add-ons like original parts replacement and gap insurance.

Cons

- ByMile Discontinued: Liberty Mutual was once one of the best pay-per-mile car insurance companies, but it discontinued its ByMile program in favor of RightTrack.

- High Level of Complaints: Liberty Mutual auto insurance reviews reveal that the company receives more customer complaints than expected for a company of its size.

#6 – Farmers: Best Discount Selection

Pros

- Long List of Discounts: Farmers sets itself apart by offering 23 discounts. See which discounts you might qualify for in our Farmers auto insurance review.

- Signal App: While it’s not one of the actual pay-as-you-go insurance companies in Pennsylvania, you can get a discount for being a low-mileage driver by signing up for the Signal app.

- Variety of Coverage Options: Add options like roadside assistance and customized equipment coverage to increase the value of your Farmers’ policy.

Cons

- Signal App Can Increase Rates. Most UBI programs don’t increase your rates if your driving habits aren’t good enough, but some customers have seen their rates rise.

- Higher Rates: Farmers has higher-than-average rates for almost every type of driver.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Erie: Best for Affordable Rates

Pros

- YourTurn: Although it doesn’t track mileage, YourTurn is an excellent telematics option to help safe drivers save up to 30%.

- Low Mileage Quotes: When you request a quote from Erie, one of the factors it carefully considers is your annual mileage. Drivers who put fewer miles on their car than the national average will pay less.

- Excellent Customer Service: Erie has a top-rated customer service experience. See what customers have to say in our Erie auto insurance review.

Cons

- Rates Less Competitive: Some drivers see affordable rates from Erie, but drivers with bad credit scores should look elsewhere.

- No Online Quotes: It may offer some of the best full coverage auto insurance in Pennsylvania, but you’ll need to speak to a representative to purchase it.

#8 – Travelers: Best Customer Service

Pros

- Customer Service: Most customers report feeling satisfied with the customer service experience provided by Travelers.

- IntelliDrive: Save up to 30% on your insurance with IntelliDrive, which tracks driving habits like your daily mileage to help you save. See if IntelliDrive is right for you in our Travelers auto insurance review.

- Responsible Driver Plan: Travelers’ Responsible Driver Plan conveniently bundles accident and minor violation forgiveness coverage into one package.

Cons

- Some Drivers Pay More. If you have a low credit score, Travelers may not be the cheapest car insurance option.

- Limited Online Options: It doesn’t offer as many digital tools as some of its competitors. Instead, it prefers to have agents help their customers directly.

#9 – Metromile: Best for Pay-Per-Mile Quotes

Pros

- True Pay-Per-Mile Coverage: Metromile only sells pay-per-mile policies, making it an expert on pay-as-you-go full coverage insurance.

- Transparent Pricing: Metromile’s pay-per-mile rates are easy to understand. See how much you might pay in our Metromile auto insurance review.

- Highly Rated App: Most customers agree that Metromile’s mobile app is easy to use and offers excellent policy management tools.

Cons

- Limited Coverage Options: Metromile doesn’t have as many coverage options compared with more traditional insurance providers.

- High Number of Complaints: Metromile receives almost four times as many complaints as the national average.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Root: Best for Rates Based on Driving Habits

Pros

- Customized Rates: As one of the best non-standard insurance companies, Root offers quotes based almost exclusively on how you drive. Learn more about Root’s driving test in our Root auto insurance review.

- User-Friendly App: Root’s app is easy to use to track driving habits and manage your policy.

- Low Rates: Since Root doesn’t cover people with bad driving habits, it’s able to provide highly affordable Pennsylvania auto insurance quotes.

Cons

- Lack of Traditional Support: Getting personalized help from a Root agent can be difficult as the company does not have a large network of representatives.

- Often Declines Coverage: Root has one of the highest rates of declining insurance applications.

Pay-As-You-Go Auto Insurance in Pennsylvania Explained

Pay-as-you-go auto insurance in Pennsylvania offers the same coverage as a regular policy but bases your cost on how much you drive. With pay-per-mile car insurance, you pay a flat fee plus a per-mile charge, making it ideal for low-mileage drivers.

Drivers who put 10,000 or more miles on their vehicle every year should steer clear of low-mileage insurance plans.Michelle Robbins Licensed Insurance Agent

Your flat fee depends on factors like age, location, and driving history. When you get a GoAuto insurance quote, the company calculates this rate. Then, you pay a pay-per-mile car insurance fee, usually just a few cents per mile.

If you don’t drive much, the best pay-per-mile auto insurance can help you save money. If you own multiple cars, the best pay-by-mile insurance for a second vehicle is another way to cut costs. Some insurers offer programs like the Progressive Snapshot app, which rewards safe driving.

Since this is auto insurance based on miles, it’s great for remote workers, retirees, or occasional drivers. But if you drive often, a standard plan might be better. Pay-per-mile companies are a great place to find cheap auto insurance for occasional drivers. However, not all drivers can benefit from it.

Pros and Cons of Pay-As-You-Go Auto Insurance in PA

The main benefit of pay-as-you-go auto insurance is that it can save you a lot of money. The best pay-as-you-go auto insurance companies offer rates as low as $30 per month. Your annual mileage affects how much you pay, but insurance companies also consider factors like age and gender.

Take a look at the prices below to see how annual mileage affects your auto insurance rates.

Pennsylvania Auto Insurance Monthly Rates by Age, Gender, & Annual Mileage

| Age & Gender | 6,000 Miles | 10,000 Miles | 12,000 Miles | 15,000 Miles |

|---|---|---|---|---|

| 16-Year-Old Female | $76 | $138 | $171 | $203 |

| 16-Year-Old Male | $90 | $155 | $184 | $232 |

| 20-Year-Old Female | $100 | $161 | $184 | $218 |

| 20-Year-Old Male | $106 | $183 | $205 | $256 |

| 30-Year-Old Female | $102 | $159 | $181 | $228 |

| 30-Year-Old Male | $119 | $185 | $197 | $248 |

| 40-Year-Old Female | $102 | $164 | $176 | $218 |

| 40-Year-Old Male | $106 | $185 | $192 | $234 |

| 50-Year-Old Female | $100 | $164 | $173 | $216 |

| 50-Year-Old Male | $104 | $170 | $184 | $224 |

| 60-Year-Old Female | $61 | $109 | $136 | $175 |

| 60-Year-Old Male | $83 | $142 | $171 | $214 |

| 70-Year-Old Female | $57 | $98 | $109 | $164 |

| 70-Year-Old Male | $73 | $138 | $162 | $202 |

Finding affordable insurance for a young driver can be tough, but companies like Good to Go Insurance offer pay-per-mile options that help keep costs low. While this type of insurance has great benefits, it also has some downsides.

Looking at the pros and cons of Allstate Milewise can help you decide if it’s the right fit. Also, since pay-per-mile insurance tracks your driving, make sure you’re okay with sharing your data before signing up.

Pennsylvania Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $346 | $1,010 |

| 16-Year-Old Male | $335 | $629 |

| 20-Year-Old Female | $277 | $746 |

| 20-Year-Old Male | $288 | $762 |

| 30-Year-Old Female | $71 | $212 |

| 30-Year-Old Male | $71 | $215 |

| 40-Year-Old Female | $41 | $122 |

| 40-Year-Old Male | $41 | $126 |

| 50-Year-Old Female | 60.18 | $181 |

| 50-Year-Old Male | $60 | $179 |

| 60-Year-Old Female | $56 | $163 |

| 60-Year-Old Male | $56 | $80 |

| 70-Year-Old Female | $60 | $186 |

| 70-Year-Old Male | $59 | $185 |

If you prefer traditional payments, State Farm car insurance payment plans and the State Farm pay-by-phone option offer simple ways to manage your policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Drivers Who Benefit from Pay-As-You-Go Auto Insurance in Pennsylvania

If you don’t drive often, pay-as-you-go car insurance can help you save money in Pennsylvania. It’s a great choice for retirees, remote workers, students, or anyone who mostly uses public transportation.

Since Pennsylvania law requires all drivers to have insurance, the cheapest pay-per-mile car insurance can be a more affordable option for low-mileage drivers.

There are many pay-per-mile auto insurance options, so it’s important to compare them. Geico’s pay-per-mile car insurance adjusts your costs based on how much you drive, while Allstate Drivewise rewards safe driving.

When comparing pay-per-mile auto insurance plans, pick one that works best for your budget and driving habits. If you want more flexibility, go-to-go auto insurance has plans you can adjust to fit your needs.

With pay-as-you-go car insurance, you only pay for the miles you drive, making it an easy and affordable choice for people who don’t use their cars often.

Read more: Cheap Full Coverage Auto Insurance

Understanding Pennsylvania Auto Insurance Laws

Pennsylvania is a no-fault state, which means your own insurance covers your medical bills after an accident, no matter who was at fault. This is called Personal Injury Protection (PIP) and is required by law. If you don’t drive often, mileage-based insurance could be a smart way to save money since you only pay for the miles you drive.

— Metromile (@Metromile) July 22, 2022

Another choice is pay-as-you-drive insurance, which varies your price according to how much you drive. Metromile insurance in Pennsylvania provides these flexible policies, allowing low-mileage drivers to remain covered without paying too much.

Finding cheap no-fault insurance is usually simple. However, you should understand Pennsylvania auto insurance laws before you find coverage.

Pennsylvania Auto Insurance Requirements

Pennsylvania is one of the many states that require auto insurance. Unless you meet the minimum requirements, you can’t legally drive. That applies to business vehicles, too – you have to meet Pennsylvania commercial auto insurance requirements the same as you do for personal coverage.

Pennsylvania requires a 25/50/25 liability plan and $5,000 in first-party medical benefits, more than most states.Kristen Gryglik Licensed Insurance Agent

Pennsylvania’s auto insurance requirements play a huge role in the state’s average rates. To see how that translates, check the average price of insurance in some of Pennsylvania’s biggest cities below.

Pennsylvania Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Allentown | Erie | Philadelphia | Pittsburgh | Scranton |

|---|---|---|---|---|---|

| 16-Year-Old Female | $189 | $180 | $344 | $183 | $184 |

| 16-Year-Old Male | $183 | $174 | $333 | $177 | $178 |

| 20-Year-Old Female | $96 | $92 | $175 | $93 | $94 |

| 20-Year-Old Male | $94 | $89 | $170 | $91 | $91 |

| 30-Year-Old Female | $38 | $37 | $70 | $37 | $38 |

| 30-Year-Old Male | $38 | $37 | $70 | $37 | $38 |

| 40-Year-Old Female | $36 | $34 | $65 | $35 | $35 |

| 40-Year-Old Male | $36 | $34 | $65 | $35 | $35 |

| 50-Year-Old Female | $31 | $30 | $57 | $30 | $31 |

| 50-Year-Old Male | $32 | $31 | $59 | $31 | $32 |

| 60-Year-Old Female | $31 | $29 | $56 | $30 | $30 |

| 60-Year-Old Male | $31 | $29 | $56 | $30 | $30 |

| 70-Year-Old Female | $38 | $37 | $70 | $37 | $38 |

| 70-Year-Old Male | $38 | $37 | $70 | $37 | $38 |

Although rates can be high, the best pay-as-you-go auto insurance companies can help low-mileage drivers save.

Limited Tort vs. Full Tort Auto Insurance

Pennsylvania offers two insurance options – limited tort and full tort.

Pennsylvania auto insurance tort options decide who pays for injuries in an accident.David Reischer Licensed Attorney

Pennsylvania auto insurance claims laws give people the right to choose how to file an auto insurance claim if they’re injured. These options are:

- Full Tort: If you’re injured in an accident, you can sue the responsible driver for medical costs.

- Limited Tort: If you’re injured in an accident, your insurance will cover your medical bills regardless of who was at fault.

There are some exceptions to a limited tort policy that allow you to sue the other driver. You can file a lawsuit if you lose a limb, suffer a serious injury that prevents you from working, have a permanent disfigurement, or experience a major impairment.

You can also sue if the other driver was under the influence of drugs or alcohol, had no insurance, had an out-of-state vehicle, or intentionally tried to harm you. Choosing the best auto insurance in PA can help ensure you’re covered in these situations.

If you want the best Pennsylvania auto insurance, look for a policy that offers strong protection for serious accidents. Some providers even offer cheap car insurance in Pennsylvania while still providing reliable coverage.

Getting Cheaper Pennsylvania Auto Insurance Rates

If you are interested in reducing your insurance rates, exploring Pennsylvania auto insurance discounts is a good place to begin. Many companies offer special deals, especially for car insurance for low-mileage drivers, making it easier to find the best insurance rates in PA.

A common question is, “Is Allstate cheaper than Progressive?” The answer depends on factors like driving history, mileage, and coverage choices. Comparing Metromile vs. Geico can also help determine which company offers the best fit for your needs.

Reading reviews of the cheapest auto insurance companies in Pennsylvania can help you find a good deal on reliable coverage. Since car insurance is cheaper in Pennsylvania than in many other states, taking the time to compare options is essential.

In addition to discounts, you can save money by increasing your deductible, maintaining a good driving record, and choosing only the coverage you really need.

Reading Pennsylvania car insurance reviews can lead you to a trustworthy provider. Providers such as GoAuto insurance provide affordable plans, allowing you to receive good coverage without breaking the bank.

Read more: Low-Mileage Auto Insurance Discounts

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Buying the Best Pay-As-You-Go Auto Insurance in PA

If you don’t drive much, finding the best pay-as-you-go insurance in Pennsylvania can help you save money. The state’s auto insurance laws may seem complicated, but there are affordable options for low-mileage drivers.

Progressive pay-as-you-go insurance through its Snapshot program is a popular choice, but comparing State Farm vs. Progressive auto insurance can help you see which one better fits your needs.

Another option is Metromile auto insurance, which bases your rates on how many miles you drive. To get the best deal, it’s a good idea to check multiple auto insurance quotes and read GoAuto insurance reviews.

By comparing rates and looking at different options, you can find cheap auto insurance in Pennsylvania that follows state laws while keeping your premiums low.

Enter your ZIP code into our free comparison tool to find the best pay-as-you-go insurance for your needs.

Frequently Asked Questions

What is the average cost of auto insurance per month in Pennsylvania?

The average driver pays $45 monthly for minimum insurance and $88 monthly for a full coverage auto insurance policy. However, you should always compare rates because insurance quotes vary by driver.

How to lower your Pennsylvania insurance costs?

There are several ways to lower your auto insurance costs in Pennsylvania. You can do things like compare quotes, find discounts, sign up for a UBI program, lower your coverage, and raise your deductible.

One of the most important steps to consider when looking for affordable coverage is comparing quotes. Enter your ZIP code into our free tool to find the lowest rates in your area.

What is the minimum auto insurance in Pennsylvania?

Pennsylvania minimum auto insurance requirements include the following:

- Bodily Injury Liability: $15,00 per person, $30,000 per accident

- Property Damage Liability: $5,000

- Uninsured Motorist: $15,000 per person, $30,000 per accident

- Underinsured Motorist: $15,000 per person, $30,000 per accident

- First Party Benefits: $5,000

However, you can request to skip purchasing uninsured and underinsured motorist coverage.

Who typically has the cheapest Pennsylvania auto insurance?

Although rates can vary significantly, our research shows that Root has the cheapest Pennsylvania auto insurance rates for low-mileage drivers. Compare rates in our Root auto insurance review.

What is the best pay-per-mile auto insurance in Pennsylvania?

Progressive has the best pay-per-mile auto insurance in Pennsylvania.

What is the best auto insurance for seniors in Pennsylvania?

AARP, Geico, and State Farm have the best auto insurance for seniors in Pennsylvania.

Which auto insurance company has the highest customer satisfaction in Pennsylvania?

The company with the fewest negative Pennsylvania pay-per-mile auto insurance reviews is Travelers.

Who is cheaper for pay-as-you-go auto insurance in PA, Allstate or Progressive?

Progressive’s average pay-as-you-go auto insurance rates in Pennsylvania are $5 cheaper than Allstate’s. Progressive drivers pay an average of $50 per month, while Allstate customers pay $55.

Is Geico auto insurance in Pennsylvania cheaper than Progressive?

Geico doesn’t top our list of the best pay-per-mile insurance in Pennsylvania, so low-mileage drivers will be better off with Progressive. However, standard auto insurance policies are slightly cheaper at Geico.

Read our Geico auto insurance review to learn more.

What is the difference between Allstate Drivewise and Milewise?

Allstate Drivewise is a telematic program that tracks driving behavior to give drivers a discount. Milewise is Allstate’s pay-per-mile program that charges drivers for each mile they drive.

What is the maximum miles per day for Allstate Milewise?

Milewise caps your daily miles at 250, so you won’t have to pay outrageous fees if you go on a road trip.

Does Allstate Milewise track your speed?

Yes, Milewise tracks a variety of driving behaviors to generate personalized driving advice. However, it doesn’t affect your Milewise rates.

Read more: Cheap Auto Insurance for High-Risk Drivers in Pennsylvania

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.