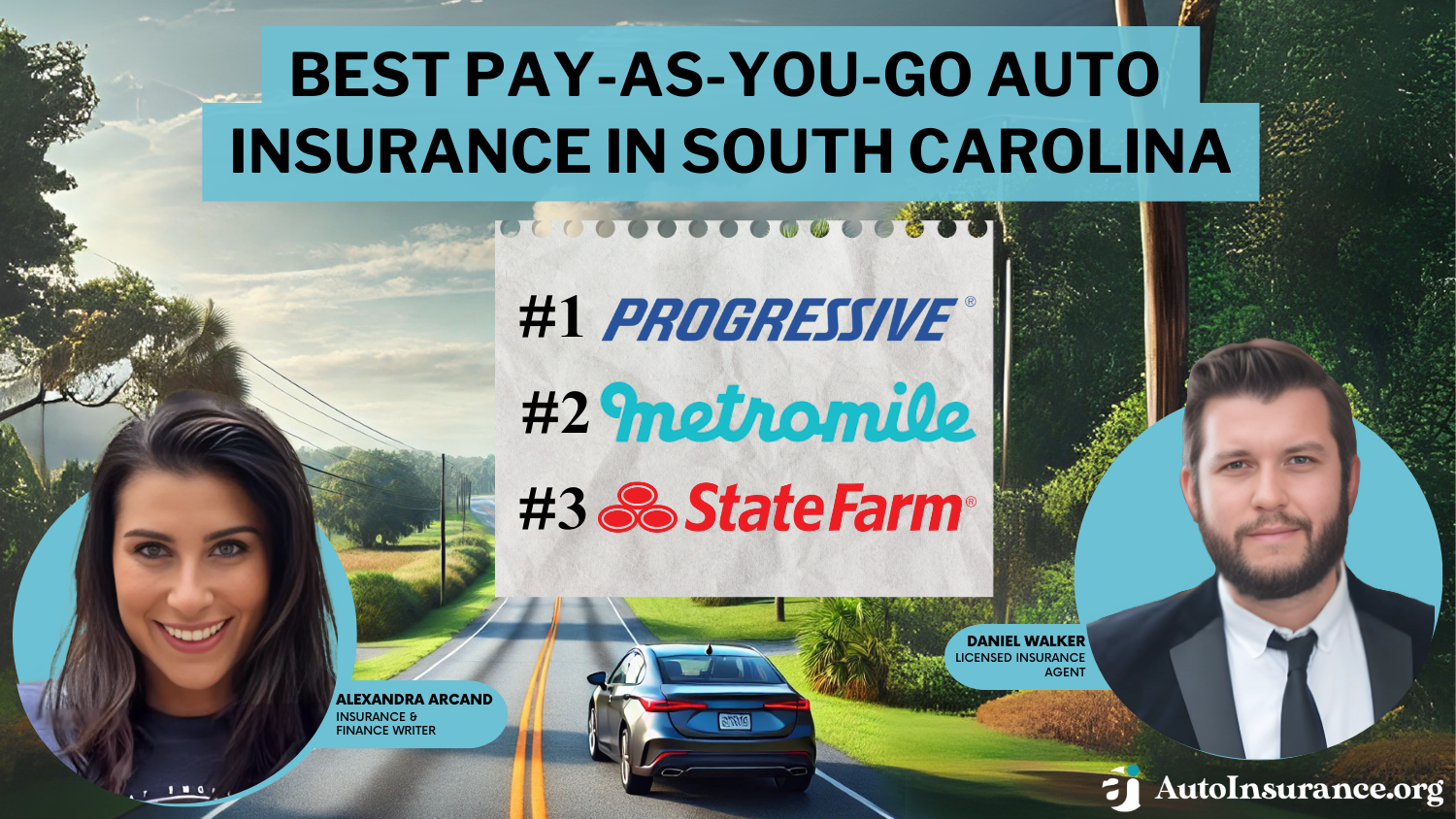

Best Pay-As-You-Go Auto Insurance in South Carolina for 2025 (Top 10 Companies Ranked)

Progressive, Metromile, and State Farm offer the best pay-as-you-go auto insurance in South Carolina, averaging $45/month. Take advantage of South Carolina safe driver discounts and compare specific car insurance rates in SC to secure the best deal for comprehensive coverage and claims service.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Pay-As-You-Go Coverage in South Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 150 reviews

150 reviewsCompany Facts

Pay-As-You-Go Coverage in South Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

150 reviews

150 reviews 18,154 reviews

18,154 reviewsCompany Facts

Pay-As-You-Go Coverage in South Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsProgressive, Metromile and State Farm offer the best pay-as-you-go auto insurance in South Carolina, starting at just $45 per month.

Progressive stands out for low-mileage South Carolina auto insurance because it offers drivers a variety of ways to save. However, drivers looking for a genuine pay-per-mile plan should consider Metromile instead.

Our Top 10 Picks: Best Pay-As-You-Go Auto Insurance in South Carolina

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% | A+ | Snapshot Program | Progressive | |

| #2 | 25% | A- | Personalized Service | Metromile | |

| #3 | 20% | B | Nationwide Coverage | State Farm | |

| #4 | 25% | A+ | Drivewise Program | Allstate | |

| #5 | 25% | A++ | Competitive Rates | Geico | |

| #6 | 20% | A+ | SmartRide Program | Nationwide |

| #7 | 25% | A | Customized Policies | Liberty Mutual |

| #8 | 8% | A++ | Usage-Based Insurance | Travelers | |

| #9 | 20% | A | Pay-Per-Mile | Farmers | |

| #10 | 10% | A+ | Safe Drivers | Root |

Read on to learn where to get pay-per-mile insurance in South Carolina. Then, enter your ZIP code into our free comparison tool above to find personalized rates from multiple companies.

- Tailored pay-as-you-go plans in South Carolina start at $45 per month

- Progressive leads with comprehensive coverage for low-mileage drivers

- Comparing rates can help you find the best South Carolina auto insurance deal

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Snapshot Program: Progressive doesn’t offer a straight pay-per-mile auto insurance option. Instead, low-mileage drivers can save by enrolling in the usage-based insurance (UBI) program Snapshot.

- Discounts for Safe Driving: Progressive offers 13 deals, including potentially significant savings for safe drivers.

- Easy Integration: Snapshot is easily set up through the mobile app or plug-in device. Learn more about setting Snapshot up in our Progressive auto insurance review.

Cons

- Snapshot Rate Increases: Snapshot is one of the few UBI programs that can increase your rates if you don’t drive well enough.

- Higher Initial Rates: Your Snapshot discount will not apply to your account until you go through a monitoring period.

#2 – Metromile: Best for Dedicated Pay-As-You-Go Insurance

Pros

- Pay-Per-Mile Pricing: Metromile is a pay-as-you-go company with a direct correlation between mileage and premium costs.

- Low Base Rates: Get the cheapest pay-as-you-go insurance with Metromile’s affordable base rates. See how Metromile determines your rates in our Metromile auto insurance review.

- Smart Driving App: Metromile’s mobile app offers detailed trip data and insights to help you manage your driving habits.

Cons

- High Mileage Costs: Metromile offers some of the cheapest pay-per-mile insurance for low-mileage drivers, but it can become expensive.

- Claims Process: Some Metromile drivers report a slower claims process.

#3 – State Farm: Best for Personalized Low-Mileage Coverage

Pros

- Drive Safe & Save Program: State Farm’s UBI plan offers savings based on driving performance and habits. Good drivers can save up to 30% with Drive Safe & Save.

- Good Student Discount: State Farm offers a variety of ways to save, especially for teen students with good grades. See all your discount opportunities in our State Farm auto insurance review.

- Local Agents: Buy a State Farm policy to access its vast network of local agents for personalized service.

Cons

- Privacy Issues: It may offer some of the best pay-per-mile insurance, but continuous monitoring through Drive Safe & Save might be seen as invasive.

- High Rates for Low Credit: State Farm’s average cost of car insurance in South Carolina is low unless you have a low credit score.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Full Coverage Options

Pros

- Milewise Program: See why Milewise has some of the best South Carolina pay-per-mile car insurance reviews in our Allstate Milewise review.

- Easy Monitoring: It’s simple to start driving with Milewise. Just plug the device into your car or download the mobile app.

- Discount Opportunities: Allstate offers 12 discounts to keep South Carolina auto insurance costs down, including safe driver and new car savings.

Cons

- Higher Rates for Frequent Drivers: Milewise is expensive for long-distance drivers. If you’re a high-mileage driver, consider the UBI program Drivewise instead.

- Mixed Customer Service Reviews: Some Allstate drivers report inconsistent customer service quality.

#5 – Geico: Best for Affordable Rates for All Drivers

Pros

- DriveEasy Program: Earn savings based on real-time driving data by signing up for Geico’s UBI program DriveEasy.

- User-Friendly App: Get the best pay-as-you-go insurance discount easily with DriveEasy, which is available on Geico’s user-friendly mobile app.

- Competitive Rates: Geico generally has low base rates combined with usage-based pricing. Learn more in our Geico auto insurance review.

Cons

- Rate Volatility: Geico premiums can change frequently based on driving behavior.

- Limited Agent Interaction: You get predominantly online service with Geico, meaning less personal interaction with agents.

#6 – Nationwide: Best for UBI Savings

Pros

- SmartMiles Program: SmartMiles offers accurate premiums reflecting your actual mileage, but you can save up to 40% with SmartRide if you’re not always a low-mileage driver.

- Accident Forgiveness: Get protection from rate increases after your first at-fault accident with this Nationwide add-on.

- Flexible Payments: SmartMiles offers monthly premiums based on the previous month’s mileage. Explore all of Nationwide’s payment options in our Nationwide auto insurance review.

Cons

- High Base Rates: Liberty Mutual’s higher minimum coverage rates might offset your per-mile savings.

- Limited Availability: SmartMiles may not be available in all areas. Check with a representative to see if you can sign up using your ZIP code.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Unique Coverage Options

Pros

- RightTrack Program: Liberty Mutual offers some of the best car insurance for low-mileage drivers with up to 30% savings with RightTrack.

- Customizable Coverage: There are plenty of options to tailor Liberty Mutual coverage to your individual needs.

- Good Driver Discounts: You can get additional savings for maintaining a clean driving record. Explore all 17 Liberty Mutual car insurance discounts in our review of Liberty Mutual auto insurance.

Cons

- Cost for High Mileage: High-mileage drivers will not get as big a discount from RightTrack as low-mileage drivers.

- Diverse Customer Experience: Liberty Mutual gets mixed reviews for its customer service experiences.

#8 – Travelers: Best Customer Service Experience

Pros

- IntelliDrive Program: For safe driving habits, including low-mileage driving, you can earn a discount of up to 30%.

- Excellent Customer Service: Travelers consistently receives high ratings for its customer service experience. See what customers have to say in our Travelers auto insurance review.

- Discounts for Good Driving: Travelers offer 15 deals, including additional savings for maintaining a clean driving record.

Cons

- Limited Digital Options: Travelers sells insurance the old-fashioned way, so its online tools aren’t as robust as those of many competitors.

- Some Drivers Pay More: Travelers is a great option for low-mileage car insurance for seniors, but you’ll see higher rates if you have a low credit score.

# 9 – Farmers: Best Selection of Discounts

Pros

- Signal Program: Download the Signal app to enroll in the Farmers’ UBI program and save up to 30%.

- Customizable Policies: Get the best comprehensive auto insurance in South Carolina with Famers’ additional coverage options.

- Ample Discounts: Farmers have an impressive 23 opportunities to save. Get the full discount list in our Farmers auto insurance review.

Cons

- Higher Premiums: Farmers is only a cheap option if you earn a good discount through Signal. Otherwise, the average cost of auto insurance in South Carolina at Farmers can be high.

- Rate Increases With Signal: Signal can increase your rates if you don’t drive well enough.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Root: Best for Safe Drivers

Pros

- App-Based Assessment: Drivers must pass an initial driving behavior assessment to receive personalized premiums. Learn more about the process in our Root auto insurance review.

- Affordable Pricing: As long as you drive well enough, you can get cheap car insurance rates.

- Simple Process: Root’s tracking program is easy to set up. Download the Root app, follow the setup instructions, and you’ll be ready to drive.

Cons

- Initial Assessment Period: You’ll have to pass the first evaluation period before Root will determine your quotes.

- Limited Coverage Options: Root is best if you want to meet South Carolina car insurance minimums, as the company does not offer many coverage options.

South Carolina Pay-As-You-Go Auto Insurance: How It Works

Traditional coverage and pay-per-mile insurance work in similar ways, with the major difference being how you’re charged. Standard car insurance plans charge you a flat fee every month that doesn’t change, while pay-as-you-go policies charge you for the miles you drive.

Pay-as-you-go South Carolina mileage rates consist of two parts. The first is a base rate that you’ll pay each month, no matter what. The second is a per-mile fee, which usually stays under $.10 per mile.

Pay-per-mile insurance differs from finding a low-mileage auto insurance discount or signing up for a UBI program. These offer a discount on standard insurance, whereas a pay-per-mile insurance policy’s rates are determined specifically by your mileage.

To get a better idea of how annual mileage affects auto insurance rates, check the rates below.

South Carolina Auto Insurance Monthly Rates by Age, Gender, & Annual Mileage

| Age & Gender | 6,000 Miles | 10,000 Miles | 12,000 Miles | 15,000 Miles |

|---|---|---|---|---|

| 16-Year-Old Female | $280 | $300 | $320 | $340 |

| 16-Year-Old Male | $300 | $320 | $340 | $360 |

| 20-Year-Old Female | $240 | $255 | $270 | $285 |

| 20-Year-Old Male | $260 | $275 | $290 | $305 |

| 30-Year-Old Female | $190 | $200 | $210 | $220 |

| 30-Year-Old Male | $200 | $210 | $220 | $230 |

| 40-Year-Old Female | $170 | $180 | $190 | $200 |

| 40-Year-Old Male | $180 | $190 | $200 | $210 |

| 50-Year-Old Female | $160 | $170 | $180 | $190 |

| 50-Year-Old Male | $170 | $180 | $190 | $200 |

| 60-Year-Old Female | $150 | $160 | $170 | $180 |

| 60-Year-Old Male | $160 | $170 | $180 | $190 |

| 70-Year-Old Female | $160 | $170 | $180 | $190 |

| 70-Year-Old Male | $170 | $180 | $190 | $200 |

As you can see, low-mileage drivers typically pay less for their insurance. This is because insurance providers see them as less of a risk for filing a claim, so they charge smaller rates.

South Carolina Auto Insurance Requirements

South Carolina minimum auto insurance requirements are relatively simple. All you need is a plan with 25/50/25 coverage for both liability and uninsured motorist coverage.

If you’re looking for the cheapest coverage possible, a plan that just meets the minimum South Carolina car insurance requirements is your best bet.Laura D. Adams Insurance & Finance Analyst

Check the rates below to see how much South Carolina auto insurance rates can vary based on coverage level.

South Carolina Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $378 | $1,036 |

| 16-Year-Old Male | $438 | $632 |

| 20-Year-Old Female | $312 | $659 |

| 20-Year-Old Male | $376 | $804 |

| 30-Year-Old Female | $85 | $208 |

| 30-Year-Old Male | $93 | $241 |

| 40-Year-Old Female | $79 | $192 |

| 40-Year-Old Male | $79 | $191 |

| 50-Year-Old Female | $140 | $290 |

| 50-Year-Old Male | $150 | $310 |

| 60-Year-Old Female | $72 | $270 |

| 60-Year-Old Male | $75 | $290 |

| 70-Year-Old Female | $78 | $196 |

| 70-Year-Old Male | $78 | $196 |

Although full coverage costs more, it’s usually worthwhile if it fits your budget. Full coverage insurance offers much better protection for your vehicle than a policy that only meets state requirements.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Affecting South Carolina Auto Insurance Rates

Annual mileage isn’t the only factor that affects your car insurance rates. For example, finding cheap auto insurance for drivers over 60 takes into account age as well as mileage.

Another important factor is where you live. Cities that have higher theft and vandalism rates, more accidents, and denser traffic pay higher rates. Check below to see the average rates of drivers in South Carolina’s biggest cities.

South Carolina Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Charleston | Columbia | Greenville | Mount Pleasant | Myrtle Beach |

|---|---|---|---|---|---|

| 16-Year-Old Female | $280 | $270 | $260 | $250 | $275 |

| 16-Year-Old Male | $300 | $290 | $280 | $270 | $295 |

| 20-Year-Old Female | $240 | $230 | $220 | $210 | $235 |

| 20-Year-Old Male | $260 | $250 | $240 | $230 | $255 |

| 30-Year-Old Female | $190 | $180 | $170 | $160 | $185 |

| 30-Year-Old Male | $200 | $190 | $180 | $170 | $195 |

| 40-Year-Old Female | $170 | $160 | $150 | $140 | $165 |

| 40-Year-Old Male | $180 | $170 | $160 | $150 | $175 |

| 50-Year-Old Female | $160 | $150 | $140 | $130 | $155 |

| 50-Year-Old Male | $170 | $160 | $150 | $140 | $165 |

| 60-Year-Old Female | $150 | $140 | $130 | $120 | $145 |

| 60-Year-Old Male | $160 | $150 | $140 | $130 | $155 |

| 70-Year-Old Female | $150 | $140 | $130 | $120 | $145 |

| 70-Year-Old Male | $160 | $150 | $140 | $130 | $155 |

For those seeking affordable car insurance in South Carolina, there are several options available. Top-rated auto insurance companies in South Carolina offer a variety of plans, including cheap SR-22 auto insurance and auto insurance discounts specific to the state.

Insurers consider factors like gender, marital status, car type, education, and credit score, using different formulas for quotes, making comparisons crucial.Travis Thompson Licensed Insurance Agent

Additionally, pay-as-you-go car insurance in South Carolina is becoming a popular choice for drivers looking to save money based on their driving habits.

This tailored approach ensures that drivers can receive coverage that aligns closely with their needs and budget, making it easier to manage car insurance expenses effectively.

Ways to Lower South Carolina Auto Insurance Costs

The best pay-as-you-go insurance companies can help you save a significant amount of money on your insurance, but there are other ways to save. To lower your insurance rates, take advantage of discounts, reduce coverage to the minimum, choose a higher deductible, and compare quotes from top companies to see the range of prices available.

Auto Insurance Discounts From the Top Providers for Pay-As-You-Go in South Carolina

| Insurance Company | Available Discounts |

|---|---|

| Drivewise Program, Bundling, Safe Driver, Anti-Theft | |

| Bundling, Good Student, Safe Driver, Homeowner | |

| Bundling, Good Driver, Defensive Driving, Military | |

| Bundling, Safe Driver, Anti-Theft, Good Student |

| Low-Mileage, Safe Driver, Multi-Car | |

| Safe Driver, Bundling, Good Student, Defensive Driving |

| Bundling, Snapshot Program, Safe Driver, Multi-Car | |

| Drive Safe & Save Program, Bundling, Good Student, Safe Driver |

| Bundling, Safe Driver, Good Student, Accident-Free | |

| Bundling, Safe Driver, Good Student, Homeowner |

Many residents seek a South Carolina auto insurance reduction by exploring options such as cheap pay-as-you-go insurance, which can be more cost-effective for infrequent drivers. Progressive Insurance in South Carolina and Root Insurance in South Carolina offer competitive auto insurance quotes that cater to diverse driving habits and budgets.

Car insurance discounts in South Carolina are readily available for those who meet criteria such as safe driving or low mileage. Metromile car insurance reviews often highlight the savings for those who drive less, while State Farm auto insurance remains a popular choice for comprehensive coverage and customer satisfaction.

Pay-As-You-Go Auto Insurance in South Carolina: Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $60 | $155 | |

| $47 | $128 | |

| $48 | $130 | |

| $52 | $140 |

| $45 | $125 | |

| $50 | $135 |

| $50 | $135 | |

| $53 | $142 |

| $55 | $145 | |

| $49 | $132 |

Finding affordable and reliable low-income car insurance options in South Carolina can be crucial for many drivers. These options are designed to provide financial relief while maintaining essential coverage.

The cheapest car insurance in South Carolina often comes from top-rated auto insurance companies that offer competitive rates and discounts. These discounts may include auto insurance discounts specific to South Carolina, such as those for safe driving or pay-as-you-go driving insurance plans.

Additionally, the best pay-as-you-go car insurance programs in the state provide a flexible and economical choice for motorists looking to save money based on their driving habits, further aligning with the needs of those seeking car insurance discounts in South Carolina.

Get The Best Pay-As-You-Go Auto Insurance in South Carolina

Pay-per-mile auto insurance is more than just cheap usage-based auto insurance that gives low-mileage drivers a discount. If you shop with the best South Carolina auto insurance companies for pay-per-mile coverage, you can find significant savings.

To find the best pay-as-you-go auto insurance in South Carolina, it’s essential to compare quotes from various providers. Enter your ZIP code into our free comparison tool below to get started.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How can I compare pay-as-you-go insurance rates in South Carolina?

You can compare rates using online comparison tools or visiting insurer websites to input your driving details and receive tailored quotes.

How does Metromile and Root car insurance compare for drivers with low annual mileage?

Metromile is ideal for those driving under 10,000 miles annually, charging a base plus per-mile fee. Root calculates premiums based on overall driving behavior, which may be less cost-effective for ultra-low-mileage drivers than Metromile.

See how much you could save on coverage by entering your ZIP code into our free quote comparison tool.

What are the benefits of pay-as-you-go car insurance in South Carolina?

Pay-as-you-go car insurance allows drivers to pay for insurance based on their miles, potentially lowering costs for low-mileage drivers. Find the best pay-as-you-go auto insurance companies.

Is Geico cheaper than Allstate for drivers in South Carolina?

It depends on individual profiles and coverage options, but Geico offers more competitive rates for drivers with clean driving records.

What should I know about the Go auto payment process?

Go Auto’s payment process includes online, over-the-phone, and automatic billing to simplify managing your car insurance payments.

What are the key features of pay-per-mile car insurance?

Pay-per-mile insurance features a base rate plus a per-mile rate that charges only for the miles you drive, making it ideal for infrequent drivers.

What are the differences between Metromile and Progressive pay-per-mile insurance?

Metromile charges primarily based on the miles driven, whereas Progressive’s pay-per-mile, Snapshot, also considers driving habits and times.

How does auto insurance by the mile work?

Pay-per-mile auto insurance has a base price and then charges a per-mile fee, as tracked by a telematics device. This budget-conscious option is best for those who drive rarely, as it bills based on real-life mileage and can help lower insurance dramatically.

Does State Farm offer a pay-per-mile insurance plan in South Carolina?

Yes, State Farm offers a pay-per-mile insurance option that may benefit South Carolina drivers with low annual mileage, making it one of the best low-mileage auto insurance discounts available.

What is the grace period for car insurance in South Carolina?

South Carolina offers a 30-day grace period for new car purchases, during which you can transfer or acquire new insurance without penalties.

How do I set up Progressive’s pay-as-you-go insurance?

To set up Progressive’s pay-as-you-go insurance, contact Progressive directly to enroll in their Snapshot program, which adjusts rates based on driving data.

What factors influence the cost of car insurance in South Carolina?

Due to varying risks and costs, factors influencing auto insurance rates include the driver’s age, driving record, type of vehicle, coverage level, and specific location within South Carolina. Additionally, it’s essential to compare auto insurance rates by vehicle make and model to get a more accurate estimate of potential costs.

What is Milewise auto insurance from Allstate?

Milewise is Allstate’s pay-per-mile car insurance program that charges customers based on the miles driven plus a daily base rate.

How does car insurance pay-as-you-drive differ from traditional insurance?

Pay-as-you-drive insurance charges premiums based on driving behavior and mileage rather than flat rates, potentially lowering costs for safer, less frequent drivers.

How to get cheap car insurance in South Carolina?

To find affordable car insurance in South Carolina, compare quotes from providers like Geico, Progressive, State Farm, and local insurers. Consider factors such as your driving history, vehicle type, desired coverage level, and types of auto insurance.

What is “Good to Go” auto insurance, and how does it work?

Good to Go auto insurance specializes in affordable minimum coverage options for drivers who might have trouble securing insurance due to poor driving records or other factors.

How does Progressive’s Snapshot differ from Root car insurance in terms of tracking driving behavior?

Progressive’s Snapshot program tracks driving habits like speed and braking using a device or app to offer discounts. Conversely, Root car insurance sets premiums entirely based on driving behaviors such as turns, braking, and mileage, tracked through their app.

What are the best car insurance companies in South Carolina?

Top car insurance companies in South Carolina, including State Farm, USAA, Allstate, and Progressive, offer competitive rates and comprehensive auto insurance coverage. Regional providers like Southern Farm Bureau and Auto-Owners also deliver personalized service with potentially lower rates.

What are some low-cost insurance options in South Carolina?

Options like Pay Low Insurance offer competitive rates, focusing on budget-conscious drivers who still want quality coverage.

What is the process for paying Go Auto insurance premiums via telephone?

Call the payment number listed on their website or billing statement to pay your Go Auto insurance premium by phone. Have your policy number and payment details ready. They accept credit or debit cards and possibly bank transfers.

Finding cheaper insurance rates is as easy as entering your ZIP code into our free quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.