Best Scion tC Auto Insurance in 2025 (Check Out the Top 10 Companies)

Progressive, State Farm, and Geico are the top picks for the best Scion tC auto insurance, offering plans starting at just $70 monthly. These companies are highly recommended due to their competitive rates and comprehensive coverage options, making them the preferred choices for Scion tC owners.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Mar 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 24, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Scion tC

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Scion tC

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Scion tC

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best Scion tC auto insurance are Progressive, State Farm, and Geico, known for their excellent coverage options and customer service.

These providers offer comprehensive insurance solutions tailored to the unique needs of Scion tC owners, ensuring optimal protection and peace of mind. Learn more by reading our guide titled, “What are the benefits of auto insurance?“

Our Top 10 Company Picks: Best Scion tC Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 10% A+ Snapshot Program Progressive

#2 17% B Personalized Service State Farm

#3 16% A++ Extensive Discount Geico

#4 20% A+ Vanishing Deductible Nationwide

#5 10% A+ Drivewise Program Allstate

#6 12% A Customizable Policies Liberty Mutual

#7 7% A++ IntelliDrive Discounts Travelers

#8 10% A+ Local Agents Farmers

#9 15% A+ Dividend Policies Amica

#10 10% A- Low-Mileage Drivers Metromile

Their reputations for reliability and affordability make them standout choices in a competitive market. Whether you’re looking for basic liability or full coverage, these companies deliver quality and value to Scion tC drivers nationwide.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool above to instantly compare prices from various companies near you.

- Progressive is the top pick for the best Scion tC auto insurance

- Scion tC insurance caters to its sporty style and safety features

- Coverage options address the specific needs of Scion tC drivers

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Overall Pick

Pros

- Snapshot Discounts: Progressive offers substantial discounts for Scion tC drivers through its Snapshot program, rewarding safe driving habits.

- High A.M. Best Rating: With an A+ rating, Progressive provides reliable coverage for Scion tC owners, ensuring financial stability. Delve into our evaluation of Progressive auto insurance review.

- Flexible Deductibles: Scion tC drivers can benefit from Progressive’s flexible deductible options, making insurance more affordable.

Cons

- Limited Multi-Policy Discount: Progressive’s 10% multi-policy discount is less competitive for Scion tC owners compared to others.

- Snapshot Privacy Concerns: The Snapshot program requires continuous monitoring, which may raise privacy concerns for some Scion tC drivers.

#2 – State Farm: Best for Personalized Service

Pros

- Bundling Policies: State Farm offers significant discounts for Scion tC owners bundling multiple policies. Discover insights in our guide titled, State Farm auto insurance review.

- High Low-Mileage Discount: State Farm provides a substantial discount for Scion tC drivers with low-mileage usage.

- Wide Coverage Options: State Farm tailors various coverage options specifically for the unique needs of Scion tC owners.

Cons

- Limited Multi-Policy Discount: State Farm’s 17% discount may not be as high for Scion tC owners compared to competitors.

- Higher Premium Costs: Despite discounts, premiums for Scion tC coverage at State Farm may be higher relative to other providers.

#3 – Geico: Best for Extensive Discount

Pros

- Wide Range of Discounts: Geico offers a variety of discounts for Scion tC insurance, including safe driver and good student discounts.

- Top A.M. Best Rating: With an A++ rating, Geico ensures superior financial health and claims-paying ability for Scion tC policies.

- Comprehensive Coverage: Geico provides extensive coverage options that cater specifically to the needs of Scion tC drivers. Learn more by reading our guide titled, “Geico Auto Insurance Review.”

Cons

- Customer Service Variability: Some Scion tC owners might experience variability in customer service quality with Geico.

- Policy Customization Limitations: While Geico offers many discounts, options for customizing Scion tC insurance policies are limited compared to competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide rewards Scion tC drivers with a deductible that decreases annually for safe driving. Read up on the Nationwide auto insurance review for more information.

- High Multi-Policy Discount: With a 20% discount, Nationwide offers one of the best multi-policy discounts for Scion tC insurance.

- Strong A.M. Best Rating: Nationwide’s A+ rating assures Scion tC owners of its solid financial footing and reliability in claims handling.

Cons

- Higher Initial Premiums: Initial premiums for Scion tC insurance can be higher at Nationwide, despite the vanishing deductible benefit.

- Complex Claim Process: Some Scion tC drivers may find Nationwide’s claim process more cumbersome compared to other insurers.

#5 – Allstate: Best for Drivewise Program

Pros

- Drivewise Rewards: Allstate’s Drivewise program offers personalized driving feedback and potential savings for Scion tC drivers who drive safely.

- Diverse Coverage Options: Allstate provides a range of coverage options tailored to the needs of Scion tC owners, from standard to comprehensive plans.

- Robust Multi-Policy Discounts: With a 10% multi-policy discount, Allstate makes bundling policies more attractive for Scion tC insurance. Access comprehensive insights into our guide titled Allstate auto insurance review.

Cons

- Premium Costs: Despite offering discounts, Allstate’s premiums for Scion tC insurance might still be relatively high compared to industry averages.

- Drivewise Data Sharing: The Drivewise program requires data sharing that might concern Scion tC drivers cautious about privacy.

#6 – Liberty Mutual: Best for Customizable Policy

Pros

- Customization Options: Liberty Mutual stands out for offering highly customizable insurance policies for Scion tC, suiting diverse driver needs.

- Competent A.M. Best Rating: With an A rating, Liberty Mutual promises financial stability and dependable claims service for Scion tC owners.

- Dedicated Support: Scion tC drivers can access dedicated customer support from Liberty Mutual, enhancing the insurance experience. Discover more about offerings in our complete Liberty Mutual auto insurance review.

Cons

- Moderate Multi-Policy Discount: At 12%, Liberty Mutual’s multi-policy discount for Scion tC insurance is moderate and may not compete well with other providers.

- Variable Premium Rates: Premiums for Scion tC insurance at Liberty Mutual can vary significantly, affecting affordability for some drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for IntelliDrive Discount

Pros

- IntelliDrive Program: Travelers offers the IntelliDrive program, which monitors driving behavior and could reduce Scion tC insurance rates significantly for safe drivers.

- Excellent A.M. Best Rating: With an A++ rating, Travelers guarantees superior financial strength and claims reliability for Scion tC insurance.

- Flexible Payment Options: Travelers provides flexible payment plans, making it easier for Scion tC drivers to manage their insurance costs. See more details in our guide titled, “Travelers Auto Insurance Review.”

Cons

- IntelliDrive Privacy Concerns: Participation in the IntelliDrive program involves constant monitoring, which might be seen as invasive by some Scion tC owners.

- Complex Discount Structure: The discount structure at Travelers can be complex, making it challenging for Scion tC drivers to maximize their savings.

#8 – Farmers: Best for Local Agent

Pros

- Local Agent Support: Farmers provides personalized service through local agents, offering tailored advice and support for Scion tC insurance needs. More information is available about this provider in our Farmers auto insurance review.

- Robust Coverage Options: Farmers offers a comprehensive range of coverage options, allowing Scion tC drivers to customize policies to their specific requirements.

- Reliable Financial Standing: With an A+ rating from A.M. Best, Farmers ensures financial reliability and trustworthiness in handling claims for Scion tC drivers.

Cons

- Limited Discount Opportunities: Compared to other insurers, Farmers offers fewer discount opportunities for Scion tC insurance, which may impact overall affordability.

- Inconsistency in Customer Service: The quality of customer service can vary depending on the local agent, which might affect the consistency of service for Scion tC drivers.

#9 – Amica: Best for Dividend Policies

Pros

- Dividend Policies: Amica offers unique dividend policies that can return a portion of premiums to Scion tC drivers at the end of the policy term. See more details in our guide titled, “Amica Auto Insurance Review.”

- High Customer Satisfaction: Amica is known for its high customer satisfaction ratings, providing excellent service and support to Scion tC insurance holders.

- Competitive Multi-Policy Discounts: Offering a 15% discount for bundling, Amica makes it financially advantageous for Scion tC drivers to consolidate their insurance needs.

Cons

- Higher Premiums Without Bundling: Scion tC drivers may face higher premiums at Amica if they do not bundle their policies, affecting cost-effectiveness.

- Limited Availability: Amica’s coverage and services for Scion tC insurance may not be available in all areas, limiting options for some drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Metromile: Best for Low-Mileage Driver

Pros

- Pay-Per-Mile System: Metromile’s innovative pay-per-mile system is ideal for Scion tC drivers who have lower annual mileage, potentially reducing insurance costs significantly.

- Transparent Cost Structure: With clear pricing based on mileage, Metromile offers a straightforward and predictable cost model for Scion tC insurance.

- Tailored for Urban Drivers: Metromile is particularly advantageous for Scion tC drivers in urban areas where driving mileage tends to be lower. Discover insights in our guide titled, “Metromile Auto Insurance Review.”

Cons

- Limited to Certain States: Metromile’s services are only available in select states, which might not benefit all Scion tC drivers looking for such specific coverage.

- Less Effective for High-Mileage Drivers: Scion tC drivers with higher mileage may find Metromile’s insurance model less cost-effective compared to traditional policies.

Scion tC Insurance Rates Breakdown

The following section provides a detailed look at the monthly rates for both minimum and full coverage for Scion tC auto insurance across various providers. This information is crucial for drivers seeking to balance cost with coverage depth.

Scion tC Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $83 $160

Amica $76 $148

Farmers $81 $157

Geico $72 $140

Liberty Mutual $85 $165

Metromile $70 $135

Nationwide $80 $155

Progressive $75 $145

State Farm $78 $150

Travelers $79 $152

The table showcases monthly insurance rates for Scion tC, categorized by minimum and full coverage levels from various leading providers. Allstate offers rates at $83 for minimum and $160 for full coverage, positioning itself in the mid to higher end of the spectrum.

On the more economical side, Metromile presents the lowest rates with $70 for minimum and $135 for full coverage, appealing to budget-conscious drivers. Other notable providers include Geico with attractive rates at $72 and $140, and Amica close behind at $76 and $148 respectively for minimum and full coverages.

This diversity in pricing reflects the competitive nature of the market and the range of options available to Scion tC owners, ensuring they can find a policy that fits their financial and coverage needs. Discover insights in our guide titled, “What is full coverage auto insurance?“

Scion

Scion is a vehicle brand produced by the auto manufacturer Toyota. While Toyota is headquartered in Tokyo, Japan, the Scion branch of the company is based in Torrance, California. Scion started producing cars in 2004.

There are several different types of Scion models; however, the look and driving capabilities of the brand are designed to attract younger drivers and professionals.

Traditionally, Toyota has focused on producing vehicles catering to older drivers and families. According to its official website, Scion builds cars that allow owners to express their individuality. For example, various types of accessories can be purchased for Scion cars.

Learn more by reading our guide: Cheap Toyota Auto Insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scion tC

While there have been several different models of it built to date, typically the Scion tC has been a two-door hatchback with an appearance similar to luxury sedans and sports cars. Despite their stylish design, Scion tCs are affordable cars that get good mileage and have plenty of safety features.

The 2013 Scion tC is a two-door, front-wheel drive coupe, which can seat five passengers. It comes equipped with a four-cylinder, 2.5-litre engine that can deliver 180 horsepower. Delve into our evaluation of “Cheap Scion Auto Insurance.”

With Progressive, Scion tC drivers enjoy the flexibility of customizing their deductibles, making insurance affordable on any budget.Justin Wright Licensed Insurance Agent

The latest model gets approximately 23 miles per gallon in the city and 31 mpg on the highway. The car has a six-speed transmission and a starting price of just under $20,000. You can learn more about the latest Scion tC by referring to the car’s official website or automobile publications like the Car Connection.

How to Determine Your Average Auto Insurance Rates

Insurance companies consider many things when they determine what to charge someone for their coverage. While they will look at your car and consider whether it’s durable, safe, and valuable, providers also must review the personal circumstances of each customer.

They will also look at where and how much the car is going to be driven, and whether the person appears to be a good driver or a reliable customer.

As a result, two people may be asked to pay something quite different to insure the same Scion tC model.

In other words, when you examine the average insurance rates that people pay to cover their Scion tC, it’s important to remember that you could be charged more or less. According to Automobile Magazine, the average cost to insure a 2013 Scion tC per month is approximately $164.25. In 2012, the average monthly cost was around $146.

Drive Safely

Driving safely is one of the most effective ways to keep a lid on your insurance rates. A driver who causes several accidents or is pulled over numerous times for speeding will pay much more to insure their Scion tC. Insurance providers know that bad drivers are more likely to file claims that will cost them money. In turn, they will charge them more for their insurance.

If your driving record is already bad, then be extra cautious behind the wheel and slow down. By avoiding additional traffic-related incidents or violations your rates should come down over time.

On the other hand, if you cause another accident or even worse, get charged with a criminal, traffic-related offense, your rates could go through the roof. A good way to show an insurance provider you’re a safe driver is to take driving lessons.

Most insurance companies offer lower rates to people who have completed driver’s education.

There are also driving courses for mature and experienced drivers. By taking these, you can show an insurance provider that you’re dedicated to driving safely.

Get a Scion tC With Great Safety Ratings

If you want to lower your insurance rates then it’s important to buy a Scion tC that’s equipped with modern safety features and that has good safety ratings. If an insurance company is confident that your Scion tC is more likely to avoid an accident, then it will charge you less. In addition, if it believes that the car will protect its passengers in the event of a crash, your rates will be lower.

If a car helps prevent serious injuries from occurring, then insurance companies won’t have to pay as much for medical bills.

The latest model of the Scion tC comes equipped with many safety features, including multiple airbags, anti-lock brakes, brake assist, a tire pressure monitoring system, and electronic stability control. Newer versions of the Scion tC have also scored quite well in safety tests.

For example, the Insurance Institute for Highway Safety assigned the 2011 and 2012 models of the Scion tC a “good rating” for impact and strength tests conducted on the front, side, and top of the car. Earlier models received an “acceptable” rating. The U.S. Department of Transportation’s Safe Car website awarded the 2011, 2012, and 2013 models a five out of five-star rating for safety.

Keep a Good Credit Score

You can also save money on your car insurance by paying your bills on time and keeping a good credit score. If you’ve fallen behind in your insurance payments before or had other financial issues, then a company might raise your rates.

If a provider is worried that they may not get their money every month, they will charge more upfront. On the other hand, if you have a great credit rating and have been a reliable customer, a provider may even offer you a discount.

Agree to a Higher Deductible

If you agree to pay a higher deductible, you can also lower the premiums for your Scion tC. This is a good way to save some money on your insurance rates and keep the coverage you want. The deductible is the amount you’re required to put towards any claim you file.

If you agree to pay a $700 deductible, then you will have to pay that amount if you file a claim with your insurance provider. They will pay the remainder.

By raising your deductible, your insurance company won’t have to pay as much for damages. As a result, they can charge you less for your insurance. To do this, however, make sure you have the money saved to put towards a higher deductible if you need it.

Consider Your Options

Before you buy your Scion tC insurance it’s a good idea to sit back and review your driving circumstances. If you’re not driving as much these days or have moved to a rural setting then you may not need as much insurance as you did before.

It’s important to protect yourself financially by carrying a solid amount of liability insurance. This insurance helps pay for the damages of other people in a crash you cause.

You’re required by law in nearly every state to have liability insurance.

Collision insurance will pay for the repairs your Scion tC needs after you cause an accident. Comprehensive insurance will help cover damages your car needs in an incident not involving another car. For example, a break-in or flood.

If you own an older Scion tC or rarely drive the car, then you may not need as much collision or comprehensive coverage as someone who drives a newer model daily. Less valuable cars are cheaper to repair. Vehicles that aren’t on the road very much are less likely to be involved in an accident.

Shop Around

One of the best ways to save money on your Scion tC is to look around and find great deals on insurance. A very convenient and effective way to do this is to use a website that specializes in comparing insurance quotes. The site will ask you several questions regarding your driving circumstances, and once you’ve provided the info it will send you quotes from several major providers.

You can look and choose the best deal from the comfort of your own home. It’s also a good idea to search online and see which providers have received good customer feedback. Just because one company has cheap insurance, doesn’t mean you’ll be happy as their customer.

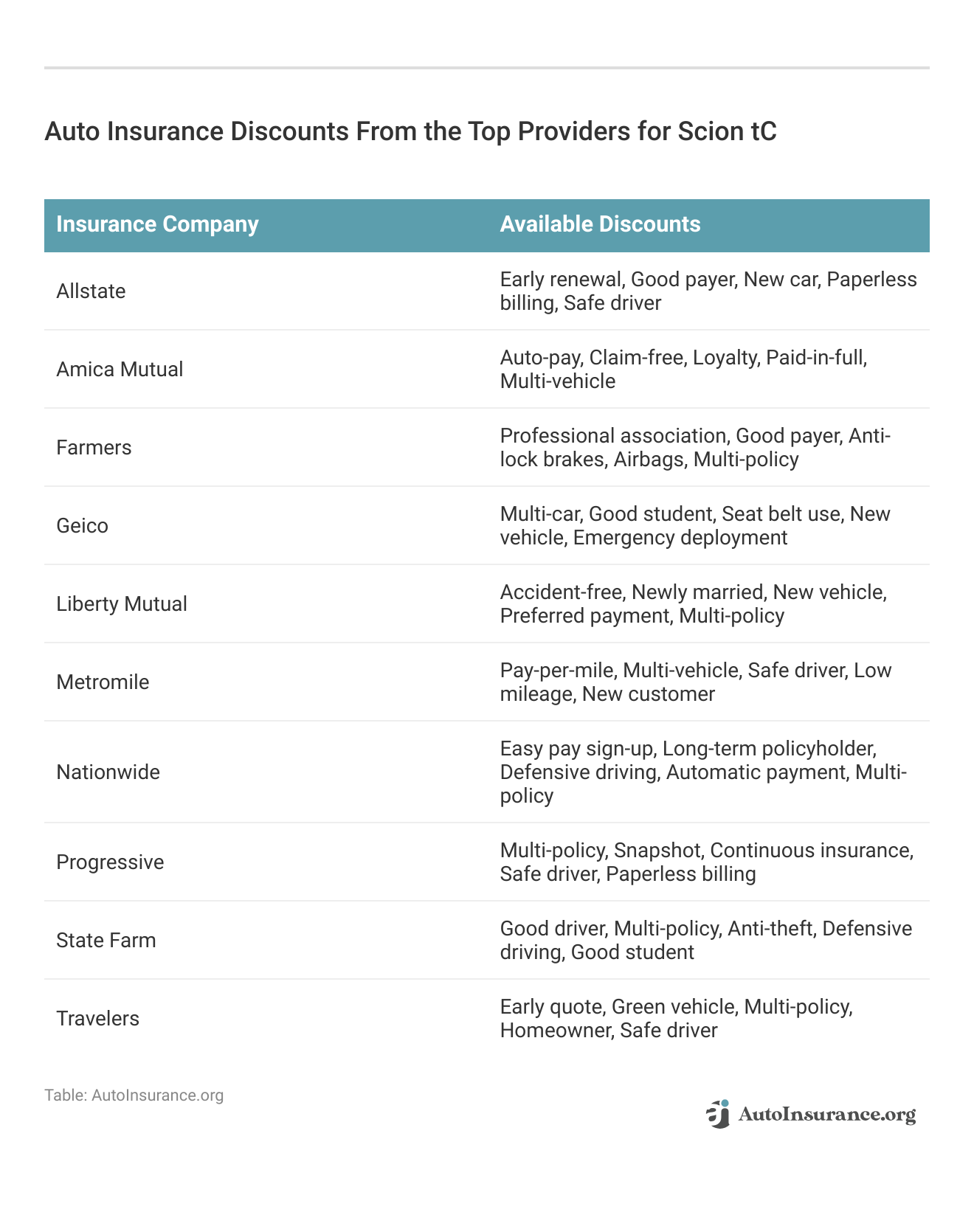

Ask for a Discount

You could save some serious money by asking for a discount. Many providers will offer discounted rates to reliable customers who have good driving records. If you’ve been with the same company for a while, they may offer you a discount to keep you as a customer. Many companies also offer cheaper rates to Armed Forces vets and students who are excelling in school.

Conclusion: Best Scion tC Auto Insurance

Choosing the right auto insurance for your Scion tC involves weighing various factors, from cost to coverage. The comprehensive overview provided here, highlighting the top insurers like Progressive, State Farm, and Geico, underscores the variety of options available to meet the diverse needs of Scion tC owners. See more details in our guide titled “Best Auto Insurance Companies.”

Progressive’s Snapshot program offers an innovative approach to insurance, rewarding safe driving with lower premiums for Scion tC drivers.Kristen Gryglik Licensed Insurance Agent

Whether prioritizing affordability, extensive coverage, or customer service excellence, the insights shared offer a robust foundation for making an informed decision. To secure the best possible deal tailored to your specific requirements, utilizing tools like the free car insurance comparison will ensure that you find the optimal coverage at the most competitive rates.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What factors affect the cost of insurance for a Scion tC?

Several factors can influence the cost of insurance for a Scion tC. These may include your age, driving record, location, credit score, insurance history, coverage options, deductible amount, and the overall market conditions for auto insurance. Additionally, the specific model year, trim level, and installed safety features of your Scion tC can also impact the insurance premiums.

Learn more by reading our guide: What is the average auto insurance cost per month?

Are Scion tCs expensive to insure?

The insurance rates for Scion tCs can vary depending on various factors. Generally, Scion tCs tend to have reasonable insurance rates compared to some high-performance or luxury vehicles. However, the actual cost of insurance can vary based on individual circumstances and the insurance provider you choose.

What type of coverage do I need for my Scion tC?

The type of coverage you need for your Scion tC will depend on your personal preferences, state requirements, and your budget.

Generally, you will need to have liability insurance, which covers damages and injuries you cause to others in an accident. Additionally, you may consider collision coverage to protect your vehicle in case of a collision, comprehensive coverage for non-collision incidents (e.g., theft, vandalism), and uninsured/underinsured motorist coverage.

Can I get discounts on insurance for my Scion tC?

Yes, many insurance companies offer various discounts that you may be eligible for when insuring your Scion tC. These discounts can include safe driver discounts, multi-policy discounts (if you have other insurance policies with the same company), anti-theft device discounts, good student discounts, and more.

Do Scion tCs have high theft rates?

Scion tCs have generally not been associated with high theft rates compared to some other vehicle models. However, theft rates can vary depending on the specific region and other factors. Installing anti-theft devices, such as alarms or tracking systems, can help reduce the risk of theft and potentially lower your insurance premiums.

Unlock details in our guide titled “How Vehicle Year Affects Auto Insurance Rates.”

Why is Scion tC insurance so high?

Scion tC insurance cost is typically high due to its classification as a sporty vehicle, which insurers see as having a higher risk of accidents and theft.

Where can I find 2006 Scion tC for sale?

You can find a 2006 Scion tC for sale on various online automotive marketplaces, at local dealerships, or by checking classified ads in your area.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Where can I find a 2011 Scion tC for sale?

A 2011 Scion tC can be purchased from used car dealers, private sellers, or through online car selling platforms that list vehicles from across the country.

How can I find a 2013 Scion tC for sale?

To locate a 2013 Scion tC for sale, browse local dealership inventories, online car shopping sites, or community bulletin boards.

To learn more, explore our comprehensive resource on “Where to Compare Auto Insurance Rates.”

What are the key features of a 2014 Scion tC?

The 2014 Scion tC features a sporty design, a robust 2.5L engine, enhanced handling, and a suite of modern infotainment and safety technologies.

Which is the best Scion tC year to buy?

Many consider the 2016 Scion tC as the best year due to its refined features, reliability, and the inclusion of advanced safety technology.

What are some cars similar to Scion tC?

Cars similar to the Scion tC include the Honda Civic Coupe, Ford Focus Coupe, and Hyundai Veloster, all offering similar sporty aesthetics and performance.

Is a Scion tC considered a sports car on insurance?

Yes, the Scion tC is often considered a sports car by insurance companies, which can influence the higher insurance premiums due to perceived risk. Learn more in our complete “Best Auto Insurance Companies.”

What should I know about Scion car insurance?

Scion insurance generally involves higher premiums due to the brand’s sporty vehicle models, which are viewed as higher risk.

How can I find a Scion for sale near me?

To find a Scion for sale near you, check local dealership listings, and online car sales websites, or use car shopping apps that filter by location and car model.

Where can I find a 05 Scion tC for sale?

You can find a 05 Scion tC for sale at local used car dealerships, online automotive marketplaces, and sometimes through private sellers on social media platforms.

What are my options for a Scion for sale under $10,000?

To find a Scion for sale under $10,000, check online car sales websites, local dealerships, and classified ads for a range of models, ensuring you compare conditions and mileage to get the best deal.

Access comprehensive insights into our guide titled, “Understanding Auto Insurance Premiums.”

Is the Scion tC RS 10.0 often available for sale?

The Scion tC RS 10.0, a limited edition model, is less commonly available for sale, so keep an eye on specialty car forums and dealerships known for sports and collector cars.

What should I expect to pay for Scion xD car insurance?

Scion xD car insurance costs vary based on your location, driving history, and the level of coverage, but generally, it’s considered affordable due to the car’s safety features and economic repair costs.

How do I find a used Scion tC for sale?

To find a used Scion tC for sale, search through car-buying websites, explore local dealership inventories, and check community boards or social media groups dedicated to car sales.

If you’re just looking for coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.