Best Subaru WRX Auto Insurance in 2025 (Find the Top 10 Companies Here)

Dairyland, Allstate, and Geico are the top providers for best Subaru WRX auto insurance, starting at just $30 a month. Renowned for their competitive rates, extensive coverage options, and superior customer service, these companies offer the most reliable and affordable insurance solutions for Subaru WRX owners.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Apr 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 2, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

175 reviews

175 reviewsCompany Facts

Full Coverage for Subaru WRX

A.M. Best Rating

Complaint Level

Pros & Cons

175 reviews

175 reviews

Company Facts

Full Coverage for Subaru WRX

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Subaru WRX

A.M. Best Rating

Complaint Level

Pros & Cons

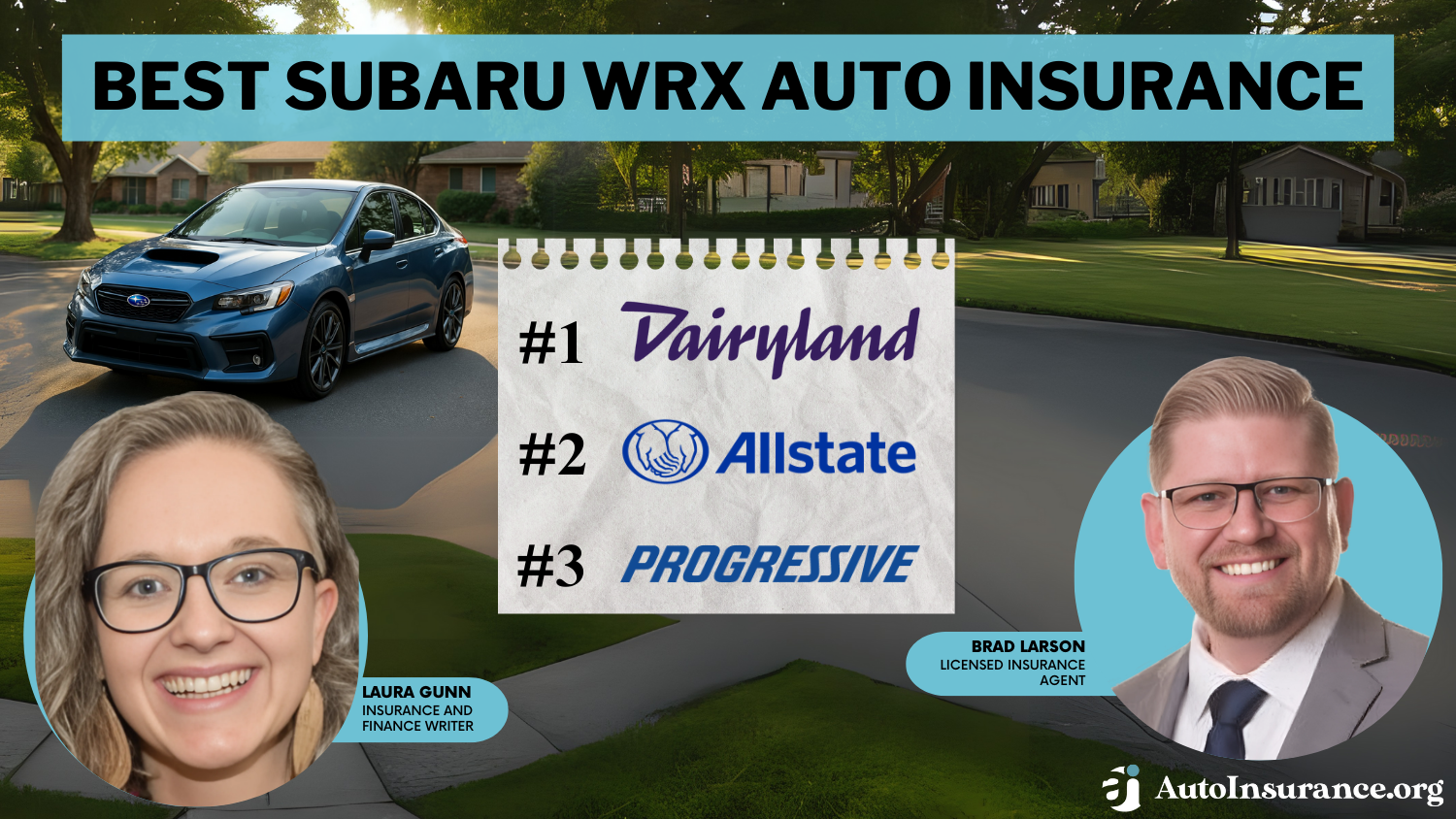

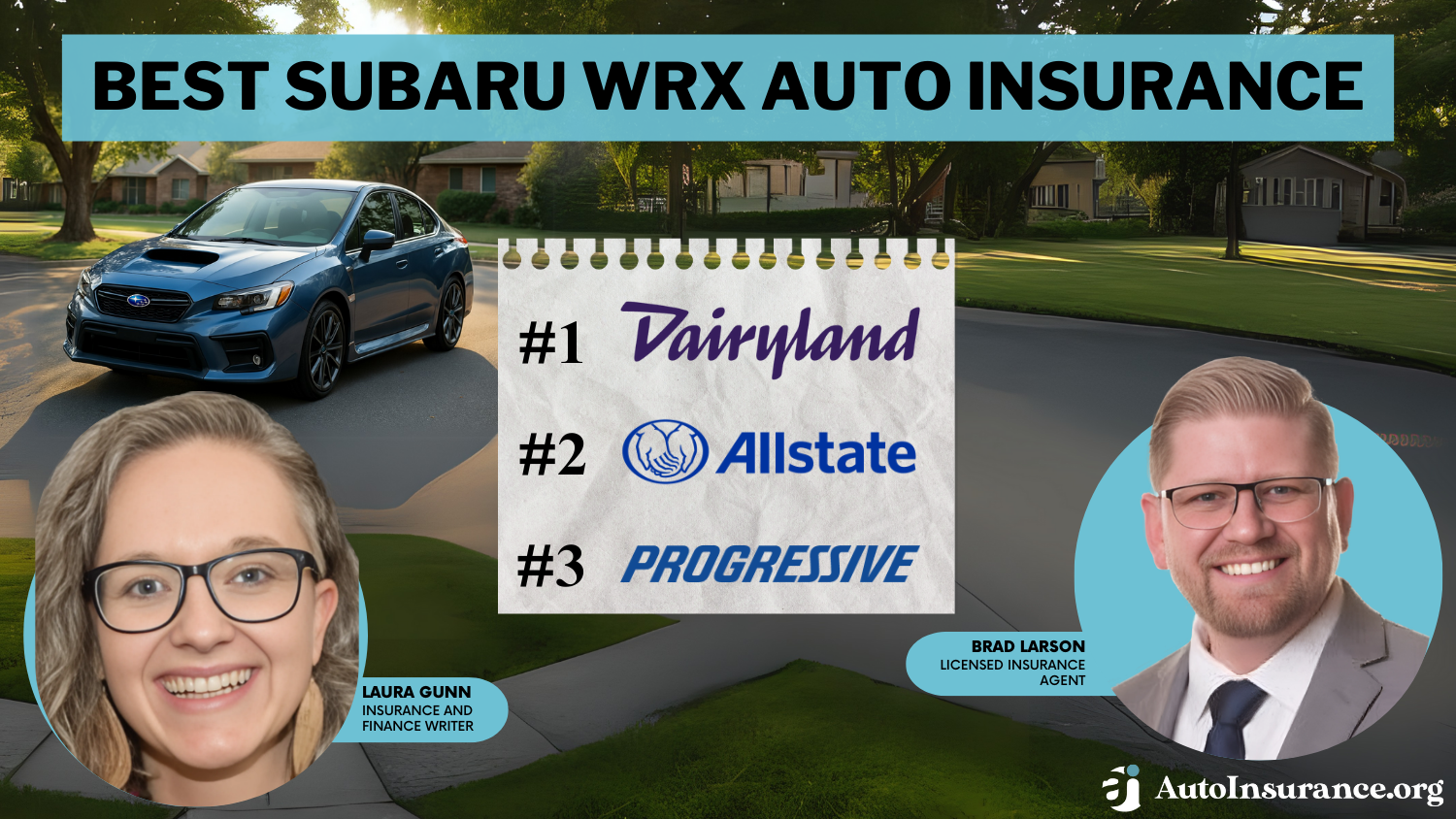

The best Subaru WRX auto insurance providers are Dairyland, Allstate, and Geico, known for their excellent coverage and customer service.

These companies stand out due to their ability to balance comprehensive features with competitive pricing, making them the go-to options for WRX owners. Each provider offers unique advantages, from Dairyland’s tailored policies for high-risk drivers to Geico’s extensive discount offerings and Allstate’s robust claims service.

Our Top 10 Company Picks: Best Subaru WRX Auto Insurance

Company Rank Accident-Free Discount A.M. Best Best For Jump to Pros/Cons

#1 15% A+ Loyalty Rewards Dairyland

#2 18% A+ Discount Availability Allstate

#3 12% A++ Claims Service Geico

#4 10% A+ Customer Service The Hartford

#5 14% A Loyalty Discounts The General

#6 17% A++ Dividend Payments Auto-Owners

#7 16% A++ High-Value Vehicles Travelers

#8 13% B Youth Discounts State Farm

#9 19% A+ Personalized Policies Nationwide

#10 11% A+ Filing Claims Amica

By choosing one of these insurers, Subaru WRX owners can enjoy peace of mind along with reliable protection on the road. Discover insights in our article titled “Cheap Subaru Auto Insurance.”

Uncover affordable auto insurance rates from the top providers by entering your ZIP code.

- Dairyland is the top pick for Subaru WRX auto insurance

- Subaru WRX owners benefit from tailored coverage options

- Features like advanced safety gear lower insurance costs

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Dairyland: Top Overall Pick

Pros

- Loyalty Discounts: Dairyland offers a 15% accident-free discount, especially valuable for Subaru WRX owners maintaining a clean driving record.

- Strong Financial Rating: An A+ rating from A.M. Best ensures reliable claims service for Subaru WRX insurance. Explore your high-risk insurance options in our article titled “Dairyland Auto Insurance Review.”

- Tailored Coverage Options: Dairyland provides customized insurance solutions suited to the specific needs of Subaru WRX owners.

Cons

- Higher Rates for High-Risk Profiles: Subaru WRX owners with previous claims may face higher premiums.

- Limited Availability: Dairyland’s coverage options for the Subaru WRX might not be available in all regions.

#2 – Allstate: Best for Discount Availability

Pros

- Generous Discounts: Allstate offers an 18% accident-free discount, making it a cost-effective choice for safe Subaru WRX drivers.

- Variety of Deductible Options: Allows Subaru WRX owners to tailor their deductibles to balance out-of-pocket costs and monthly premiums.

- Robust Online Tools: Allstate provides Subaru WRX owners with advanced online tools for easy policy management. Find more information about Allstate’s rates in our review of Allstate insurance.

Cons

- Premium Cost Variability: Allstate’s rates for Subaru WRX insurance can vary significantly based on driver history and location.

- Customer Service Inconsistencies: Some Subaru WRX owners may experience variability in customer service quality.

#3 – Geico: Best for Claims Service

Pros

- Efficient Claims Process: Geico’s A++ A.M. Best rating reflects its exceptional claims service, benefitting Subaru WRX insurance holders.

- Competitive Pricing: Offers competitive rates for Subaru WRX insurance, enhanced by a 12% accident-free discount. Learn more in our Geico review.

- Extensive Coverage Options: Provides a range of coverage levels for Subaru WRX, accommodating different insurance needs.

Cons

- Policy Customization Limits: While offering extensive coverage, Geico’s options for customizing Subaru WRX policies can be limited.

- Rate Fluctuations: Subaru WRX insurance rates may fluctuate after the initial policy term with Geico.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – The Hartford: Best for Customer Service

Pros

- Superior Customer Support: The Hartford is known for excellent customer service, ensuring a smooth experience for Subaru WRX insurance clients.

- Accident Forgiveness: Offers accident forgiveness policies, which can be particularly beneficial for Subaru WRX drivers. Our auto insurance experts share more in our The Hartford company review.

- Tailored Discounts: Provides specific discounts that can be advantageous for Subaru WRX owners, such as a 10% accident-free discount.

Cons

- Higher Premiums for Younger Drivers: The Hartford’s rates can be higher for younger Subaru WRX drivers, who are often considered higher risk.

- Eligibility Requirements: Some of The Hartford’s benefits may require meeting stringent criteria, affecting Subaru WRX owners.

#5 – The General: Best for Loyalty Discount

Pros

- Customizable Payments: The General offers flexible payment options that can help Subaru WRX owners manage their insurance expenses effectively.

- High-Risk Driver Acceptance: Ideal for Subaru WRX owners who might have a spotty driving record, offering a 14% loyalty discount.

- Rapid Insurance Quotes: Quick and easy quote process tailored for Subaru WRX insurance needs. Get more details in our full review of auto insurance from The General.

Cons

- Basic Coverage Options: Coverage for Subaru WRX might be more basic compared to other insurers.

- Customer Service Variability: The General’s customer service ratings can vary, potentially affecting the support Subaru WRX owners receive.

#6 – Auto-Owners: Best for Dividend Payments

Pros

- Dividend Payment Programs: Auto-Owners offers dividend payment options which can be particularly advantageous for long-term Subaru WRX owners.

- Comprehensive Coverage: Extensive coverage options cater specifically to the needs of Subaru WRX owners, backed by a strong A++ A.M. Best rating.

- Significant Accident-Free Discount: Provides a 17% discount for accident-free Subaru WRX drivers, promoting safe driving. Read our review of Auto-Owners to see if you’ll get cheaper rates by going with this provider.

Cons

- Geographic Restrictions: Auto-Owners may not offer their full range of Subaru WRX insurance services in all areas.

- Complex Claims Process: Some Subaru WRX owners might find the claims process to be more complicated and time-consuming than with other insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for High-Value Vehicles

Pros

- Tailored High-Value Coverage: Travelers offers specialized insurance policies designed for high-value vehicles like the Subaru WRX. Read our full review of Travelers insurance for more information.

- Protection Against Large Losses: Emphasizes comprehensive protection, which is crucial for owners of high-value Subaru WRX models.

- Competitive Discounts: Offers a 16% discount for accident-free driving, making it a cost-effective option for responsible Subaru WRX owners.

Cons

- Premium Pricing: Insurance premiums for Subaru WRX can be on the higher side due to the vehicle’s value and risk profile.

- Selective Policy Availability: Not all coverage options or discounts may be available to every Subaru WRX owner, depending on their location and vehicle specifics.

#8 – State Farm: Best for Youth Discounts

Pros

- Youth-Focused Discounts: State Farm offers discounts that can benefit younger Subaru WRX drivers, who typically face higher rates.

- Wide Range of Coverage: Provides diverse coverage options that cater to the different needs of Subaru WRX owners. Wondering about their level of customer service? Find out in our article titled “State Farm Auto Insurance Review.”

- Strong Local Agent Network: Extensive network of agents offers personalized service and support to Subaru WRX insurance holders.

Cons

- Higher Costs for High-Risk Profiles: Young or high-risk Subaru WRX drivers may face higher premiums with State Farm.

- Variable Customer Experiences: Customer satisfaction can vary significantly based on the local agent servicing the Subaru WRX policy.

#9 – Nationwide: Best for Personalized Policies

Pros

- Highly Personalized Policies: Nationwide allows Subaru WRX owners to highly customize their insurance policies to meet specific needs.

- Broad Accident-Free Discount: Offers a generous 19% discount for Subaru WRX owners who maintain a clean driving record. Find out if Nationwide might have the lowest rates for you in our Nationwide auto insurance review.

- Strong Customer Support: Known for excellent customer service, enhancing the insurance experience for Subaru WRX owners.

Cons

- Costly Premiums: Despite the discounts, Nationwide’s premiums for Subaru WRX can be higher than some competitors.

- Policy Customization Costs: While offering customization, the additional features and benefits can increase the overall cost of the Subaru WRX insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Amica: Best for Filing Claims

Pros

- Efficient Claims Service: Amica is renowned for its efficient claims processing, beneficial for Subaru WRX insurance claims.

- Customer-Focused Policies: Offers a range of policy options that cater specifically to Subaru WRX owners, ensuring a tailored insurance experience.

- Accident-Free Discount: Provides an 11% discount for accident-free Subaru WRX drivers, encouraging safe driving habits. Check out our article titled Amica auto insurance review to learn more about the company’s customer service and claims ratings.

Cons

- Higher Premiums for Certain Profiles: Amica’s rates can be higher for Subaru WRX owners with less-than-perfect driving histories.

- Limited Availability: Amica’s full range of benefits and coverage for the Subaru WRX might not be available in all regions.

Comparative Monthly Insurance Rates for Subaru WRX

Understanding the cost differences between minimum and full coverage for your Subaru WRX can help you make an informed decision about your auto insurance. The table below breaks down monthly rates provided by various insurance companies, highlighting how these costs can vary significantly depending on the level of coverage and the provider you choose.

Subaru WRX Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $61 | $160 |

| Amica Mutual | $46 | $151 |

| Auto-Owners | $33 | $87 |

| Dairyland | $85 | $237 |

| Geico | $30 | $80 |

| Nationwide | $44 | $115 |

| State Farm | $33 | $86 |

| The General | $54 | $232 |

| The Hartford | $43 | $113 |

| Travelers | $37 | $99 |

For the Subaru WRX, monthly insurance rates start as low as $30 for minimum coverage with Geico, which is the least expensive option listed. In contrast, Dairyland offers the highest minimum coverage rate at $85 per month. Compare your coverage options in our guide titled “Geico Auto Insurance Discounts.”

When looking at full coverage, Geico remains the most affordable at $80 per month, significantly lower than Dairyland, which charges $237 per month for comprehensive protection.

This variance underscores the importance of comparing rates and understanding what each type of coverage entails, as the right balance between cost and protection can differ for each Subaru WRX owner.

Subaru WRX Insurance Cost

The average Subaru WRX auto insurance rates are $113 a month. Unlock details in our article titled “What is the average auto insurance cost per month?”

Subaru WRX Auto Insurance Monthly Rates by Coverage Type

| Category | Rates |

|---|---|

| Average Rate | $113 |

| Discount Rate | $67 |

| High Deductibles | $98 |

| High Risk Driver | $241 |

| Low Deductibles | $143 |

| Teen Driver | $414 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Are Subaru WRXs Expensive to Insure

The chart below details how Subaru WRX insurance rates compare to other sedans like the Buick Regal, Audi S4, and Ford Fusion. Delve into our evaluation of article titled “Best Ford Fusion Auto Insurance.”

Subaru WRX Auto Insurance Monthly Rates vs. Similar Vehicles by Coverage Type

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Subaru WRX | $27 | $47 | $28 | $113 |

| Buick Regal | $26 | $45 | $33 | $117 |

| Audi S4 | $31 | $62 | $28 | $132 |

| Ford Fusion | $28 | $52 | $31 | $124 |

| Toyota Corolla | $25 | $45 | $33 | $115 |

| Nissan Altima | $26 | $48 | $33 | $119 |

| Nissan Maxima | $31 | $53 | $33 | $129 |

However, there are a few things you can do to find the cheapest Subaru insurance rates online.

What Impacts the Cost of Subaru WRX Insurance

You might have noticed that there is a multitude of factors that impact Subaru WRX car insurance rates.

Your age, location, driving record, and model year all play a role in what you will ultimately pay to insure the Subaru WRX. Access comprehensive insights into our guide titled “Auto Insurance Rates by Age.”

Age of the Vehicle

The average Subaru WRX auto insurance rates are higher for newer models. For example, auto insurance for a 2018 Subaru WRX costs about $113 per month, while 2015 Subaru WRX insurance costs approximately $109 per month, a difference of $4.

Subaru WRX Auto Insurance Monthly Rates by Age of the Vehicle

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| 2024 Subaru WRX | $28 | $49 | $29 | $117 |

| 2023 Subaru WRX | $28 | $49 | $29 | $116 |

| 2022 Subaru WRX | $28 | $48 | $29 | $116 |

| 2021 Subaru WRX | $27 | $48 | $29 | $115 |

| 2020 Subaru WRX | $27 | $48 | $29 | $115 |

| 2019 Subaru WRX | $27 | $47 | $28 | $115 |

| 2018 Subaru WRX | $27 | $47 | $28 | $113 |

| 2017 Subaru WRX | $26 | $46 | $30 | $113 |

| 2016 Subaru WRX | $25 | $44 | $30 | $111 |

| 2015 Subaru WRX | $24 | $43 | $31 | $109 |

As demonstrated, the cost of insuring a Subaru WRX tends to decrease slightly with older models, reflecting a modest drop in premiums as the vehicle ages.

Driver Age

Driver age can have a significant impact on the cost of Subaru WRX auto insurance. For example, 20-year-old drivers pay as much as $143 more each month for their Subaru WRX auto insurance than 40-year-old drivers.

Subaru WRX Auto Insurance Monthly Rates by Age

| Age | Rates |

|---|---|

| Age: 16 | $600 |

| Age: 18 | $414 |

| Age: 20 | $257 |

| Age: 30 | $118 |

| Age: 40 | $113 |

| Age: 45 | $108 |

| Age: 50 | $103 |

| Age: 60 | $101 |

As such, it’s clear that driver age plays a crucial role in determining the cost of Subaru WRX auto insurance, with younger drivers facing significantly higher rates.

Driver Location

Where you live can have a large impact on Subaru WRX insurance rates. For example, drivers in Houston may pay approximately $84 a month more than drivers in Columbus. Discover more about offerings in our guide titled “Best Pay-As-You-Go Auto Insurance in Texas.”

Subaru WRX Auto Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Los Angeles, CA | $194 |

| New York, NY | $179 |

| Houston, TX | $178 |

| Jacksonville, FL | $164 |

| Philadelphia, PA | $152 |

| Chicago, IL | $150 |

| Phoenix, AZ | $132 |

| Seattle, WA | $110 |

| Indianapolis, IN | $96 |

| Columbus, OH | $94 |

Given the significant variation in Subaru WRX insurance rates across different locations, it’s crucial to factor in your specific geographic area when budgeting for auto insurance costs.

Your Driving Record

Your driving record can have an impact on the cost of Subaru WRX car insurance. Teens and drivers in their 20’s see the highest jump in their Subaru WRX car insurance rates with violations on their driving record.

Subaru WRX Auto Insurance Monthly Rates by Age & Driving Record

| Age | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| Age: 16 | $600 | $780 | $1,050 | $720 |

| Age: 18 | $414 | $550 | $810 | $480 |

| Age: 20 | $257 | $370 | $620 | $340 |

| Age: 30 | $118 | $180 | $310 | $160 |

| Age: 40 | $113 | $170 | $300 | $150 |

| Age: 45 | $108 | $165 | $290 | $145 |

| Age: 50 | $103 | $155 | $280 | $140 |

| Age: 60 | $101 | $150 | $270 | $135 |

Maintaining a clean driving record is crucial, as accidents and violations can significantly increase the cost of Subaru WRX car insurance, especially for younger drivers.

Subaru WRX Safety Ratings

Your Subaru WRX auto insurance rates are tied to the Subaru WRX’s safety ratings. See the breakdown below:

Subaru WRX Safety Ratings

| Type | Rating |

|---|---|

| Small overlap front: driver-side | Good |

| Small overlap front: passenger-side | Good |

| Moderate overlap front | Good |

| Side | Good |

| Roof strength | Good |

| Head restraints and seats | Good |

The strong safety ratings of the Subaru WRX, as assessed by the Insurance Institute for Highway Safety, contribute positively to securing more favorable auto insurance rates.

Subaru WRX Crash Test Ratings

Good Subaru WRX crash test ratings mean the VW is safer, which could mean cheaper Subaru WRX car insurance rates.

Subaru WRX Crash Test Ratings

| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2024 Subaru WRX 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2023 Subaru WRX 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2022 Subaru WRX 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2021 Subaru WRX 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2020 Subaru WRX 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2019 Subaru WRX 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2018 Subaru WRX 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2017 Subaru WRX 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

| 2016 Subaru WRX 4 DR AWD | 5 stars | 5 stars | 5 stars | 5 stars |

The excellent crash test ratings for the 2020 Subaru WRX highlight its safety, potentially leading to lower insurance costs for this model.

Subaru WRX Safety Features

The more safety features you have on your Subaru WRX, the more likely it is that you can earn a discount. The Subaru WRX’s safety features include:

Subaru WRX Insurance Loss Probability

The Subaru WRX’s insurance loss probability varies for each form of coverage. The lower percentage means lower Subaru WRX auto insurance rates; higher percentages mean higher Subaru WRX car insurance rates.

Subaru WRX Auto Insurance Loss Probability by Coverage Type

| Coverage | Loss |

|---|---|

| Collision | 41% |

| Property Damage | -18% |

| Comprehensive | 58% |

| Personal Injury | -6% |

| Medical Payment | -19% |

| Bodily Injury | -16% |

Consequently, understanding the varying loss rates in different coverage categories can help Subaru WRX owners strategically choose their insurance to optimize cost and coverage.

Subaru WRX Finance and Insurance Cost

When purchasing a Subaru WRX, consider both financing and insurance costs for a complete financial picture. Financing varies by credit score, down payment, and loan terms, while insurance costs depend on driving history, location, and coverage level. See more details on our article titled “How Credit Scores Affect Auto Insurance Rates.”

Insurance costs for the Subaru WRX may be higher due to its classification as a high-risk performance vehicle. Potential owners should research and compare insurance rates from various providers to find the best deal that balances coverage needs with budget constraints, including opportunities for automatic payments auto insurance discount which can provide additional savings.

Additionally, some lenders may require more comprehensive insurance coverage as a condition of the auto loan, which could further influence the total cost of ownership. By carefully considering both aspects—financing and insurance—prospective Subaru WRX owners can better prepare for the overall cost associated with this vehicle, ensuring it fits within their financial planning.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ways to Save on Subaru WRX Insurance

There are many ways that you can save on Subaru WRX car insurance to get the best value possible. Below are five scenarios you can explore to help keep your Subaru WRX car insurance rates low.

- Buy your Subaru WRX with cash, or get a shorter-term loan.

- Park your Subaru WRX somewhere safe – like a garage or private driveway.

- Consider Subaru WRX insurance costs before buying a Subaru WRX.

- Consider renting a car instead of buying a second Subaru WRX.

- Ask for a new Subaru WRX auto insurance rate based on your improved credit score.

By exploring these practical strategies, you can effectively lower your Subaru WRX car insurance rates and maximize your savings. Learn more in our article titled “Is Honda’s safety rating on small SUVs better than Subaru’s?”

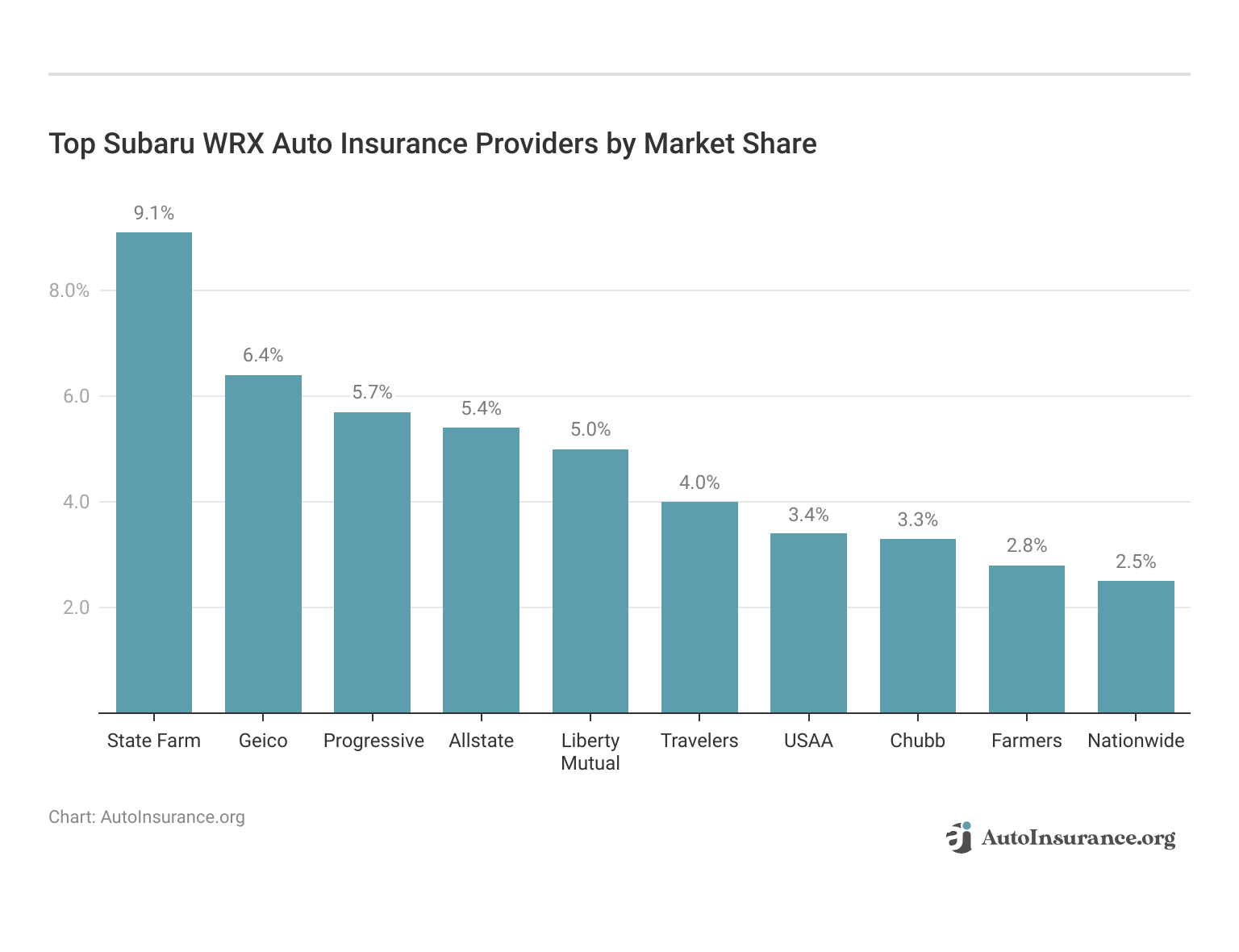

Top Subaru WRX Insurance Companies

Who is the best company for Subaru WRX insurance rates? While the actual rates you pay will depend on many factors, here are some of the top companies offering Subaru WRX insurance coverage (ordered by market share). Many of these companies offer discounts for security systems and other safety features that the Subaru WRX offers.

Top Subaru WRX Auto Insurance Providers by Market Share

| Rank | Insurance Company | Premiums Written | Market Share |

|---|---|---|---|

| #1 | State Farm | $66,153,063 | 9% |

| #2 | Geico | $46,358,896 | 6% |

| #3 | Progressive | $41,737,283 | 6% |

| #4 | Allstate | $39,210,020 | 5% |

| #5 | Liberty Mutual | $36,172,570 | 5% |

| #6 | Travelers | $28,786,741 | 4% |

| #7 | USAA | $24,621,246 | 3% |

| #8 | Chubb | $24,199,582 | 3% |

| #9 | Farmers | $20,083,339 | 3% |

| #10 | Nationwide | $18,499,967 | 3% |

Selecting the best insurance provider for your Subaru WRX involves considering various factors including rates, market share, and available discounts.

Companies like State Farm and Geico lead the market, offering competitive pricing and valuable safety feature discounts, making them excellent choices for WRX owners seeking reliable coverage. Discover insights in our article titled “State Farm Auto Insurance Discounts.”

Compare Free Subaru WRX Insurance Quotes Online

Exploring insurance options for your Subaru WRX? Easily compare quotes online to find the best rates tailored to your needs. Use our free tool to quickly gather quotes from top insurance providers, ensuring you get comprehensive coverage at the most competitive price. Unlock details in our guide titled “Comprehensive Auto Insurance Defined.”

Dairyland leads with a robust 15% accident-free discount, making it a top choice for cost-conscious Subaru WRX owners.Jeffrey Manola Licensed Insurance Agent

Whether you’re looking for full coverage or just the basics, our online comparison tool simplifies the process, saving you time and money. Start now to secure the perfect policy for your Subaru WRX and drive with confidence knowing you’re well-protected.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What should I do if I need to file an insurance claim for my Subaru WRX?

Contact your insurer promptly to report the claim and follow their instructions for the claims process.

For additional details, explore our comprehensive resource titled “How to File an Auto Insurance Claim.”

Are there additional factors that can affect Subaru WRX insurance rates?

Yes, factors like annual mileage, usage, lease/ownership status, and the primary driver’s occupation can impact rates.

Does Subaru offer any specific insurance programs or partnerships?

Check with Subaru dealerships or the official Subaru website for information on available insurance programs or partnerships.

What should I do to switch insurance providers for my Subaru WRX?

Research and obtain quotes from different insurers, compare coverage and rates, then inform your chosen provider.

To find out more, explore our guide titled “Types of Auto Insurance.”

Can I transfer my existing insurance policy to a new Subaru WRX?

Yes, contact your insurer and provide details of your new vehicle to transfer your policy.

Does the color of my Subaru WRX affect insurance rates?

No, the color of your vehicle does not typically affect insurance rates.

What is the average Subaru WRX insurance cost for a 16-year-old?

Insurance costs for a 16-year-old driving a Subaru WRX are typically higher, potentially exceeding $250 monthly due to their inexperienced driver status.

To learn more, explore our comprehensive resource on “Cheap Auto Insurance for 16-Year-Olds.”

How much does 2016 Subaru WRX insurance cost?

The average insurance cost for a 2016 Subaru WRX is around $150 per month, but this varies based on the driver’s profile and location.

What is the 2017 Subaru WRX insurance cost?

Insurance for a 2017 Subaru WRX generally costs about $145 monthly, subject to adjustments for driving history and geographic factors.

What can I expect for 2023 Subaru WRX insurance cost?

The 2023 Subaru WRX insurance cost can average around $158 per month, influenced by new model pricing and advanced features.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code below into our comparison tool today.

Are Subaru WRX expensive to insure?

Yes, Subaru WRXs are typically more expensive to insure due to their high-performance nature, which insurers associate with higher risk.

What is the average insurance cost for Subaru WRX?

The average insurance cost for a Subaru WRX is about $150 per month, varying widely with the driver’s age and accident history.

Which company offers the best car insurance for Subaru WRX?

Companies like Geico, State Farm, and Allstate are known to offer competitive rates and comprehensive coverage for Subaru WRX.

Learn more by reading our guide titled “Allstate Drivewise Review.”

How do I find car insurance for Subaru WRX?

You can obtain car insurance for a Subaru WRX by comparing quotes online from major insurers or consulting with an insurance broker.

Is a Subaru WRX considered a sports car for insurance purposes?

Yes, the Subaru WRX is classified as a sports car for insurance purposes, affecting premiums due to perceived higher risk of speeding and accidents.

How do I get a Subaru WRX insurance quote?

To get a Subaru WRX insurance quote, visit insurer websites to submit your vehicle details and driving history, or use online comparison tools.

What is the Subaru WRX average insurance rate?

The average insurance rate for a Subaru WRX typically falls around $150 per month, but this can vary significantly based on specific factors.

Access comprehensive insights into our guide titled “Factors That Affect Auto Insurance Rates.”

What is the Subaru WRX insurance cost for a 21-year-old?

For a 21-year-old, the insurance cost for a Subaru WRX can be around $183 per month, decreasing with age and driving experience.

What is the Subaru WRX insurance cost for an 18-year-old?

An 18-year-old can expect to pay about $292 per month for Subaru WRX insurance, reflecting the high risk associated with younger drivers.

What is the Subaru WRX insurance cost for a 19-year-old?

The insurance cost for a 19-year-old driving a Subaru WRX typically ranges near $267 per month, contingent on the driver’s location and driving record.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Why is WRX insurance so expensive?

WRX insurance is expensive due to the vehicle’s sporty nature, which statistics show is more likely to be involved in speed-related accidents, leading to higher claim rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.