Best Tesla Model S Auto Insurance in 2025 (Top 10 Company Ranking)

State Farm, Nationwide, and Geico offer the best auto insurance for a Tesla Model S, with monthly rates starting at just $43. These top providers deliver affordable Tesla Model S auto insurance with solid coverage, making them smart picks for Tesla owners looking to save and stay protected.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Apr 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Tesla Model S Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Tesla Model S Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Tesla Model S Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, Geico, and Progressive have the best Tesla Model S auto insurance because they offer affordable rates, electric vehicle discounts, and specialized coverage.

Our Top 10 Company Picks: Best Tesla Model S Auto Insurance

| Insurance Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $123 | B | Wide Coverage | State Farm | |

| #2 | $114 | A++ | Affordable Rates | Geico | |

| #3 | $150 | A+ | Service Excellence | Progressive | |

| #4 | $228 | A+ | Broad Discounts | Allstate | |

| #5 | $248 | A++ | Customer Resources | Travelers | |

| #6 | $164 | A+ | Comprehensive Options | Nationwide |

| #7 | $166 | A | Policy Flexibility | American Family | |

| #8 | $83 | A+ | Family Coverage | Erie |

| #9 | $84 | A++ | Military Support | USAA | |

| #10 | $198 | A | Eco Innovations | Farmers |

Regardless of the model, State Farm is an excellent pick for Tesla owners because of its electric vehicle coverage.

State Farm includes EV equipment like charging stations in its policies, which is especially beneficial when comparing Tesla Model S auto insurance rates across different providers.

- Tesla Model S insurance costs more than coverage for standard vehicles

- The best Tesla Model S auto insurance should include coverage for EV equipment

- State Farm and Geico offer the best Tesla Model S coverage

Read on to learn more about cheap auto insurance companies for Teslas. Then, enter your ZIP code into our free comparison tool to see how much you might pay for Tesla Model S insurance today.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Specialized Electric Vehicle Coverage: A Tesla Model S auto insurance policy from State Farm covers everything you need, including charging station equipment.

- Competitive Rates: While it’s not always the cheapest option, State Farm usually offers affordable rates. See how much you might pay in our State Farm auto insurance review.

- Bundling Discounts: State Farm offers bundling savings among its 13 discounts. Simply bundle your auto and home insurance to earn this discount.

Cons

- Limited UBI Options: You can save up to 30% by enrolling in Drive Safe and Save, but this UBI program is not available in every state.

- No Gap Insurance: Gap insurance offers valuable protection when you owe more on your car loan than the vehicle is worth. Unfortunately, State Farm does not offer it.

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico is well-known for its low insurance prices. Learn how Geico keeps rates low in our Geico auto insurance review.

- Robust Online Tools: For drivers seeking a modern insurance experience, Geico offers a variety of digital tools for online policy management.

- 24/7 Customer Service: Geico makes sure you always have access to help with its 24/7 customer service phone line.

Cons

- Mixed Claims Reviews: Geico typically receives positive reviews in most areas except one: it struggles with claims resolution satisfaction rates.

- Limited Specialized Coverage for Teslas: Geico is a Tesla-friendly insurance company, but you won’t find specialty high-end or EV coverage options.

#3 – Progressive: Best Digital Tools for Policy Management

Pros

- Name Your Price Tool: Progressive’s Name Your Price tool shows coverage options that match your budget. It’s a great way to find the cheapest auto insurance for the Tesla Model S.

- Safety Features Discount: Progressive offers lower Tesla Model S car insurance costs by providing a discount for all the safety features included in your Tesla.

- Deductible Options: The deductible on the average car insurance for a Tesla is $500, but Progressive offers a variety of alternatives to meet any budget.

Cons

- Unexpected Rate Increases: Many customers report that their Progressive rates increased without cause after the first policy period.

- Low Customer Loyalty: Despite efforts to improve, Progressive struggles with its customer loyalty. Learn how Progressive is addressing this problem in our Progressive auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Full Coverage Insurance

Pros

- UBI Programs: Allstate offers two UBI programs – Drivewise and Milewise. Read our Allstate auto insurance review to see which might be best for your needs.

- Policy Add-On Options: Allstate offers excellent Tesla car insurance options, including accident forgiveness and new car replacement coverage.

- Extensive Network of Local Agents: Allstate has one of the largest networks of agents in the country, making it easy to find help when you need it.

Cons

- Higher Rates: No matter where you live or what type of driver you are, Allstate is likely one of your most expensive options for auto insurance.

- Mixed Reviews: Allstate is one of the largest companies in the country, but it’s not without complaint. Claims handling and customer service are common complaints.

#5 – Travelers: Best for Unique Coverage Options

Pros

- Dedicated Electric Vehicle Coverage: Travelers offers a variety of unique coverage options, including charging stations and battery coverage for Teslas.

- Electric Vehicle Discount: Travelers offers a discount specifically for driving an electric or hybrid vehicle.

- UBI Savings: Save up to 30% on your insurance by enrolling in IntelliDrive and practicing safe driving habits.

Cons

- Fewer Discounts: While it offers a variety of ways to save, Travelers doesn’t have as many options as others. Explore your discount options in our Travelers auto insurance review.

- Less Competitive Rates: By no means does Travelers have the highest Tesla Model S insurance quotes, but it’s also not the cheapest.

#6 – Nationwide: Best for Deductible Savings

Pros

- Enhanced Total Loss Coverage: Nationwide covers your Tesla with ample coverage options, including total loss coverage.

- SmartRide: Nationwide’s SmartRide has one of the largest potential discounts of any UBI program. See how much you can save in our Nationwide auto insurance review.

- Vanishing Deductible: Save $100 on your deductible for every year you spend claims-free with this program. Deductible savings max at $500.

Cons

- Average Rates: The average Tesla Model S car insurance cost per month at Nationwide usually matches the national average, meaning you won’t likely find deep savings here.

- Limited Local Agents: Drivers in some states report having difficulty finding local Nationwide representatives.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – American Family: Best Customer Service

Pros

- Discount Availability: With 18 discount options, American Family makes it easy to save on Tesla auto insurance.

- User-Friendly Mobile App: Most reviews state that the American Family app is easy to use and convenient. Learn more about the app in our American Family auto insurance review.

- Excellent Customer Service: American Family does well in many areas, but the company shines in its customer service ratings.

Cons

- Not Available Everywhere: Unfortunately, American Family is only available in 19 states.

- Fewer Add-On Options: While American Family has coverage options to fit most basic needs, you’ll find a wider variety of add-ons at larger competitors.

#8 – Erie Insurance: Best for Filing Claims

Pros

- Personalized Service: As a smaller company, Erie focuses on providing the best customer experience to its drivers. Getting personalized help from Erie is usually easy.

- High Customer Satisfaction: Most customers report high levels of satisfaction with their Erie policies.

- Flexible Coverage: You have plenty of coverage options when you get Tesla insurance from Erie, including add-ons like pet injury and new car replacement.

Cons

- Limited Availability: Erie is another insurance company with limited availability. See if you live in one of the 12 states Erie provides coverage in our Erie auto insurance review.

- Fewer Discounts: With only eight available discounts, Erie offers fewer ways to save than many other insurance companies.

#9 – USAA: Best for Military Members

Pros

- Low Rates: USAA typically offers the lowest Tesla monthly insurance rates, no matter where you live. See how it keeps rates so low in our USAA auto insurance review.

- Special Military Coverage: USAA provides insurance for military members, so it has special programs designed with service members in mind.

- Ample Coverage Options: There are plenty of coverage options for your Tesla Model S at USAA, including roadside assistance and accident forgiveness.

Cons

- Membership Requirements: Only active or retired military members and their families are eligible for USAA membership.

- No Gap Insurance: USAA does not offer gap insurance, but it does have a similar coverage called total loss protection. However, you can only use it if you financed your loan through USAA.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Electric Vehicle Discounts

Pros

- Electric Vehicle Discounts: Get a Tesla Model S insurance discount with Farmers’ savings for electric vehicles. Explore 22 more discount options in our Farmers auto insurance review.

- Strong Financial Stability: Farmers has a solid A rating from A.M. Best, meaning Tesla owners won’t have to worry about their claims being paid.

- Plenty of Coverage Options: If you’re interested in more than Tesla Model S auto insurance minimums, Farmers offers a variety of ways to customize your coverage.

Cons

- High Rates: You likely won’t find the cheapest Tesla monthly insurance rates from Farmers.

- Limited Local Agents: Farmers is a better choice for drivers who want to manage their policies online rather than through the help of an agent.

Tesla Model S Auto Insurance Rates by Driver

Like all other types of vehicles, several factors affect your insurance rates for a Tesla Model S. Before exploring how your driving profile affects your rates, take a look at average Tesla Model S auto insurance rates from our top companies.

Tesla Model S Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $32 | $83 |

| $76 | $198 | |

| $43 | $114 | |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $32 | $84 |

For starters, the age of your Tesla is an important consideration, with newer models typically costing slightly more to insure. Check out the average rates by age below.

Tesla Model S Auto Insurance Monthly Rates by Model Year and Coverage Level

| Model Year | Minimum Coverage | Full Coverage |

|---|---|---|

| 2020 Tesla Model S | $193 | $263 |

| 2021 Tesla Model S | $209 | $271 |

| 2022 Tesla Model S | $216 | $289 |

| 2023 Tesla Model S | $223 | $294 |

| 2024 Tesla Model S | $238 | $306 |

Drive profiles are an important part of insurance rates, too. Insurance companies consider everything from your age to your driving history when determining how much to charge for insurance.

To get an idea of how much you might pay for insurance, check the average rates below.

Tesla Model S Auto Insurance Monthly Rates by Driving Record

| Age & Gender | Clean Record | Speeding Ticket | At-Fault Accident | DUI/DWI |

|---|---|---|---|---|

| 16-Year-Old Male | $883 | $1,104 | $1,271 | $1,474 |

| 16-Year-Old Female | $808 | $1,010 | $1,171 | $1,414 |

| 20-Year-Old Male | $425 | $531 | $617 | $743 |

| 20-Year-Old Female | $430 | $538 | $624 | $752 |

| 25-Year-Old Male | $213 | $266 | $309 | $373 |

| 25-Year-Old Female | $198 | $248 | $287 | $346 |

| 35-Year-Old Male | $198 | $248 | $287 | $346 |

| 35-Year-Old Female | $183 | $229 | $265 | $320 |

| 45-Year-Old Male | $170 | $210 | $246 | $298 |

| 45-Year-Old Female | $170 | $210 | $247 | $298 |

| 55-Year-Old Male | $161 | $201 | $233 | $282 |

| 55-Year-Old Female | $162 | $203 | $235 | $283 |

| 65-Year-Old Male | $167 | $209 | $242 | $292 |

| 65-Year-Old Female | $167 | $209 | $242 | $292 |

Finally, insurance rates vary significantly by location. Insurance companies have detailed claims numbers for each ZIP code, which means you can see different rates simply by moving a town over.

Insurance rates vary by ZIP code due to tracked factors like accidents, theft, weather, traffic, and vehicle crime, making even short moves impactful.Eric Stauffer Licensed Insurance Agent

Local insurance laws also play an integral role in your insurance rates. States with weaker insurance requirements usually have cheaper average rates than states with higher requirements. Check the average Tesla Model S auto insurance costs by state below.

Tesla Model S Auto Insurance Monthly Rates by State

| State | Minimum Coverage | Full Coverage |

|---|---|---|

| Alaska | $50 | $147 |

| Alabama | $50 | $139 |

| Arkansas | $56 | $162 |

| Arizona | $59 | $156 |

| California | $72 | $219 |

| Colorado | $51 | $169 |

| Connecticut | $87 | $169 |

| District of Columbia | $81 | $192 |

| Delaware | $96 | $183 |

| Florida | $64 | $190 |

| Georgia | $72 | $179 |

| Hawaii | $37 | $100 |

| Iowa | $26 | $104 |

| Idaho | $30 | $106 |

| Illinois | $57 | $150 |

| Indiana | $49 | $143 |

| Kansas | $43 | $135 |

| Kentucky | $64 | $176 |

| Louisiana | $54 | $201 |

| Massachusetts | $56 | $144 |

| Maryland | $126 | $237 |

| Maine | $51 | $115 |

| Michigan | $163 | $339 |

| Minnesota | $90 | $220 |

| Missouri | $55 | $156 |

| Mississippi | $53 | $142 |

| Montana | $42 | $153 |

| North Carolina | $55 | $131 |

| North Dakota | $49 | $177 |

| Nebraska | $39 | $148 |

| New Hampshire | $50 | $122 |

| New Jersey | $126 | $197 |

| New Mexico | $56 | $142 |

| Nevada | $61 | $144 |

| New York | $90 | $174 |

| Ohio | $44 | $114 |

| Oklahoma | $52 | $160 |

| Oregon | $75 | $147 |

| Pennsylvania | $60 | $179 |

| Rhode Island | $61 | $143 |

| South Carolina | $79 | $191 |

| South Dakota | $20 | $127 |

| Tennessee | $37 | $130 |

| Texas | $77 | $207 |

| Utah | $66 | $147 |

| Virginia | $56 | $132 |

| Vermont | $43 | $133 |

| Washington | $45 | $104 |

| Wisconsin | $47 | $133 |

| West Virginia | $52 | $141 |

| Wyoming | $24 | $105 |

As you can see, some states pay more for insurance than others. This is in part due to local auto insurance laws, with some states having higher minimum insurance requirements than others.

The rate differences listed above are the primary reason why you should compare quotes before signing up for insurance. Enter your ZIP code to see how much you might pay for your Tesla Model S insurance.

Sports Vehicle Auto Insurance for Tesla Model S

Auto insurance for supercars is usually more expensive than standard vehicles, and that’s true of Tesla Model S cars. Check below to compare Tesla Model S rates with similar sports cars.

Popular Sports Cars Auto Insurance Monthly Rates

| Car Model | Minimum Coverage | Full Coverage |

|---|---|---|

| Acura NSX | $275 | $351 |

| BMW i4 | $255 | $321 |

| BMW i7 | $290 | $363 |

| Mustang Mach-E | $197 | $269 |

| Porsche 911 Turbo S | $307 | $388 |

| Porsche Taycan | $299 | $376 |

| Tesla Model S | $248 | $313 |

| Toyota Mirai | $217 | $282 |

| Volvo S60 | $219 | $290 |

| Volvo S90 | $244 | $310 |

You might notice that other Tesla models aren’t included in our list of supercars above. Tesla Model S Plaid insurance costs are currently the highest because it’s Tesla’s most expensive model.

Tesla Model 3 auto insurance and coverage for other models are usually less expensive because they aren’t considered sports cars for insurance purposes.

Additionally, sports vehicle auto insurance for the Tesla Model S is more expensive than regular cars because it’s a high-performance vehicle. The Plaid version costs the most to insure since it’s Tesla’s top model. If you’re comparing options,

Travelers auto insurance for Tesla Model S offers plans that may fit your needs. It’s smart to shop around for the best insurance company for the Tesla Model S to get the right coverage and price.

Many drivers also look for the best Tesla auto insurance to ensure they’re fully protected. Don’t forget to ask if Tesla Model S auto insurance includes gap insurance for extra peace of mind.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Why Tesla Model S Owners Need Specialized Auto Insurance

To own a Tesla Model S involves specialized auto insurance because of its high capabilities and higher repair charges. The average cost of insurance for a Tesla Model S is normally higher than that of regular vehicles due to its luxury brand and state-of-the-art technology.

This leads to a higher Tesla Model S insurance premium, which can vary depending on where you live and your driving history. For example, the Tesla Model S auto insurance cost per month will differ in various states that offer Tesla Model S insurance because of local laws and risk factors.

To ensure the right coverage, owners should consider providers like Geico auto insurance for the Tesla Model S, which offers plans tailored for electric vehicles. If you own a Tesla Plaid, you’ll likely pay more for Tesla Plaid insurance because of its high performance. Many owners also choose USAA in-network collision center for Tesla Model S repair for efficient repair services.

If you’re leasing a Tesla Model S Plaid rental, your insurance needs might be different, especially since it’s a high-end electric car. You’ll need special coverage to protect this kind of high-tech and valuable vehicle.

Read more: Best Auto Insurance Companies

Important Factors That Influence Tesla Model S Insurance Rates

The insurance cost of a Tesla Model S depends on several significant factors. Familiarity with these can enable you to secure the best deal.

- Vehicle Value and Trim: The most costly model, the Tesla Model S Plaid, will typically be more costly to insure since it is more costly to repair or replace.

- Driver’s Record: If you have a good driving record, your insurance will probably be less expensive. If you’ve had tickets or accidents, it might increase your rates.

- Location: Where you reside impacts your rates. For instance, Tesla Model S auto insurance in Indiana may be cheaper than Tesla Model S auto insurance in North Carolina, based on varying local legislation and accident rates.

- Coverage Options: The amount of coverage you choose will also impact the price of your insurance.

- Mileage and Usage: If you drive a lot, your insurance could be higher because there’s more risk.

For you to find the cheapest auto insurance for Tesla Model S, it’s important to shop around and get a Tesla Model S auto insurance quote from different providers.

State Farm Insurance for a Tesla Model S is one option many people consider. Keep in mind that the Tesla Plaid insurance cost will likely be higher than that of other models.

Tesla Model S insurance costs more due to its luxury features and expensive repairs, but shopping around can help you find the best rates.Schimri Yoyo Licensed Agent & Financial Advisor

Finally, make sure to check the cost to insure a Tesla Model S in the states where Tesla Model S auto insurance is available to see how prices differ.

Read more: Full Coverage Auto Insurance

How to Lower Your Tesla Model S Auto Insurance Rates

Saving money on your insurance for a Tesla might sound difficult, but you can follow the same steps as you would with any other car. Try the following steps to save on your Tesla insurance:

- Find discounts. Finding discounts is an integral part of keeping your rates low. Looking at companies with electric vehicle auto insurance discounts can help you save significantly.

- Lower your coverage. Selecting the least amount of coverage possible keeps your rates as low as possible. However, purchasing less coverage leaves you open to financial risk.

- Raise your deductible. Your Tesla Model S insurance deductible is the portion you pay when you file a claim. Selecting a higher deductible will keep your monthly rates low, but you’ll have to pay more if you file a claim.

- Keep your driving record clean. Avoiding traffic violations and accidents is an excellent way to keep your rates low.

One of the most important factors in keeping your rates low is comparing car insurance quotes. Skipping this step will likely mean you’ll overpay for your insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Understanding Tesla Auto Insurance Policies

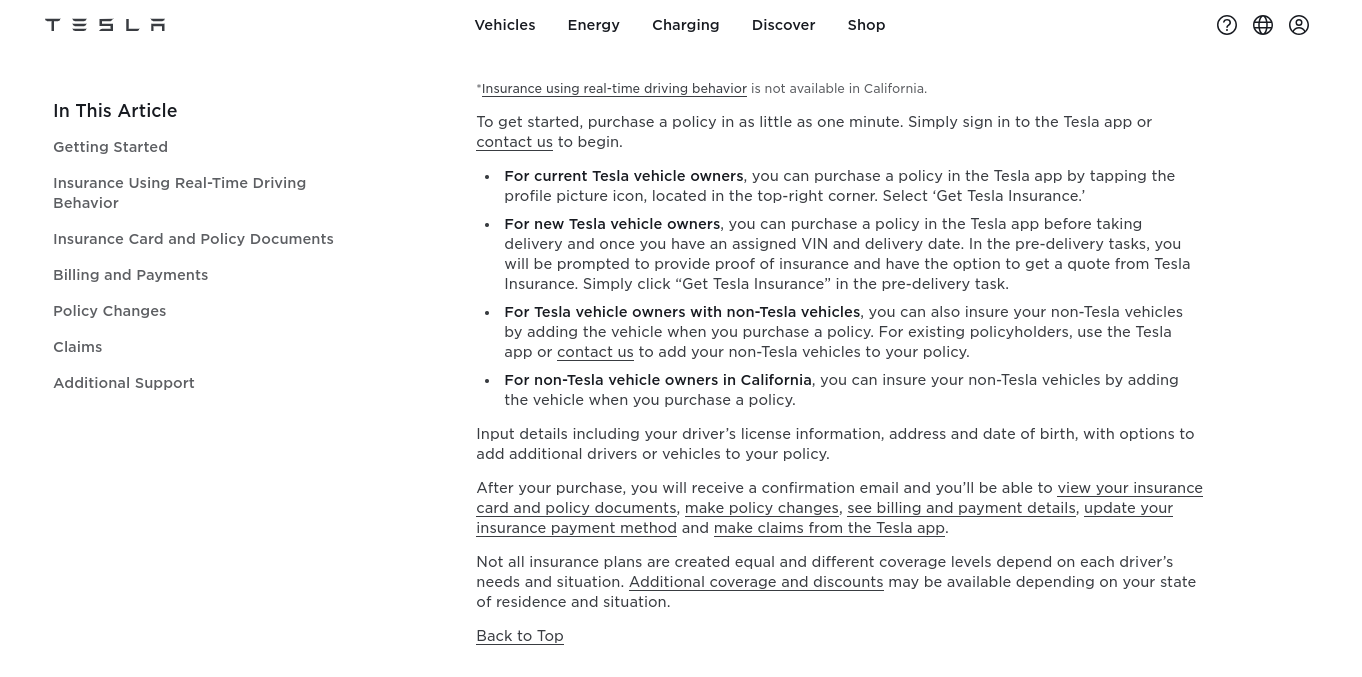

Tesla is one of the foremost companies creating self-driving cars. In a bid to keep itself at the top, Tesla offers insurance specifically for its vehicles.

Insurance from Tesla works similarly to other insurance providers. Read our Tesla auto insurance review to learn more about how Tesla policies work. However, there are a few things you should know before you get started.

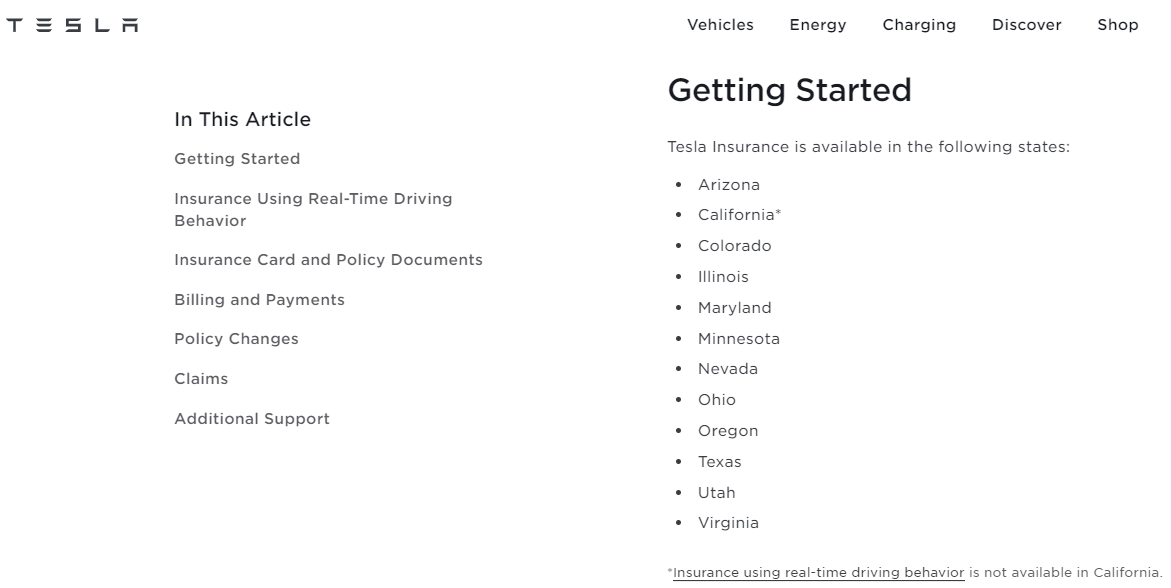

First, Tesla insurance is not available in every state, as you can see below.

You’ll also need to check your eligibility – only Tesla owners can purchase a Tesla policy. Read below to see if and how you can purchase a policy.

Like any other insurance provider, you should always check rates before signing up. Tesla insurance offers excellent coverage for a Tesla, but it’s probably not the cheapest. If you need to stick to a budget, comparing quotes is imperative—especially when looking for the best auto insurance for a Tesla Model S that fits both your needs and your wallet.

Repair and Replacement Costs: Why Tesla Model S Insurance Can Be High

The primary reason the insurance cost of a Tesla Model S is more expensive is its high repair and replacement prices. The sophisticated technology and luxury components of the Tesla Model S make it much more expensive to repair than regular vehicles. This results in a more expensive Tesla Model S insurance cost per month.

Additionally, the Tesla Model S insurance price is often higher because specialized parts and expert labor are required to fix the car. That’s why insurance is expensive for a Tesla Model S—it needs to cover these higher repair costs.

Many Tesla Model S auto insurance reviews mention the importance of having comprehensive coverage to deal with these pricey repairs. Another factor is the tires for the Tesla Model S, which are more expensive than regular tires, adding to the overall repair and insurance expenses.

Tesla Model S Insurance for New Buyers vs. Experienced EV Owners

When it comes to Tesla Model S insurance, new buyers and experienced EV owners may have different needs. New buyers will need to get to know your Tesla Model S auto insurance since they might not be familiar with how insurance works for electric cars. They may consider options like State Farm Tesla Model S auto insurance, which offers coverage specifically for electric vehicles.

Experienced EV owners, however, are more familiar with their insurance options and often know the best insurance for a Tesla Model S. They also may be more aware of whether Tesla auto insurance covers flat tires, a detail that could matter for some.

For those interested in financing their Tesla, a USAA auto loan for a Tesla Model S is an ideal option, particularly for military personnel. Whether you’re a new purchaser or a seasoned owner, it’s crucial to compare insurance policies to determine the proper coverage for you.

Read more: Types of Auto Insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Compare the Best Tesla Model S Auto Insurance Companies

When you compare the best Tesla Model S auto insurance companies, you’ll find that the insurance cost of a Tesla Model S is higher than Tesla Model Y auto insurance because the Model S is more expensive to fix or replace.

Still, you can lower your Tesla Model S insurance rates by driving safely, keeping a clean record, and finding discounts. It’s smart to get quotes from top companies like State Farm, Geico, or Progressive to see who offers the best Tesla insurance for your budget.

When insuring a Tesla Model S, it's crucial to factor in the vehicle’s high repair costs, which significantly impact your monthly premium.Daniel Walker Licensed Auto Insurance Agent

Many people ask, “How much is insurance for a Tesla Model S?” It depends on factors like your driving history, where you live, and what coverage you choose, but full coverage usually costs over $125 a month.

If you add a Tesla Model S insurance glass coverage deductible, that can also raise your rate. Also, if you’re wondering, “Does Tesla auto insurance cover flat tires?” Yes, it often includes roadside help.

Comparing multiple quotes is also an essential step in finding affordable Model S coverage. Enter your ZIP code into our free comparison tool to get started today.

Frequently Asked Questions

What is the most affordable auto insurance for a Tesla Model S?

The most affordable auto insurance for a Tesla Model S depends on your unique circumstances, but the cheapest companies are usually USAA, Geico, and Progressive.

Does Tesla insurance cover flat tires?

A regular insurance policy from Tesla does not cover flat tires. However, you can add roadside assistance to your Tesla policy, which covers flat tires in emergency situations. You’ll still have to pay for your tire, but emergency assistance will be covered.

Tesla isn’t the only company that offers roadside assistance. Enter your ZIP code into our free comparison tool to see other companies that offer this valuable coverage.

How much is Tesla Model S insurance?

The average driver pays about $285 per month for full coverage insurance on a Tesla Model S. However, you can save by comparing quotes, keeping your driving record clean, and learning how to get a green vehicle auto insurance discount.

Which insurance company is best for a Tesla Model S?

Our pick for the best Tesla Model S auto insurance is State Farm. State Farm offers affordable rates, solid discounts, an excellent UBI program, and specialty coverage for electric vehicles.

Why are Teslas totaled so easily?

On top of ACV concerns, you must purchase parts from Tesla, which means you can’t use third-party parts. Tesla often struggles to keep up with parts demands, making it even harder to get a Tesla repaired. This drives up the cost of repairs, which makes it easier to total a vehicle.

What kind of insurance does the Tesla Model S require?

The amount of coverage you need depends on your situation. If you own your Tesla outright, you technically only need to meet the minimum insurance requirements in your state. If you have a loan, you’ll need a full coverage policy.

Since Teslas are expensive vehicles, there are other considerations to keep in mind. For example, does your auto insurance cover battery replacements? What about charging stations? Getting the right coverage for your Tesla can save you thousands of dollars in the long run.

Does Tesla sell its own insurance?

Yes, you can purchase insurance directly from Tesla instead of a traditional insurance provider. Signing up for Tesla insurance is simple and can be done from the dealership when you purchase your car.

While Tesla insurance is an excellent option, you should always compare your choices. For example, comparing Tesla vs. Geico insurance can tell you which company has the lowest rates and best coverage options.

When will Tesla insurance be available in other states?

Today, Tesla insurance is only available in 12 states, and there has been no announcement to expand it to other states.

Why is Tesla auto insurance so expensive?

There are several reasons why Tesla Model S insurance is so expensive. First, Teslas are pricey vehicles, which means they cost more to repair or replace. Part of the higher repair costs are also associated with electric vehicles.

Finally, Model S vehicles are considered sports cars, which are associated with higher insurance rates. Make sure to compare rates to find the best auto insurance for sports cars, or you’ll likely overpay.

Does Tesla insurance include glass?

Yes, Tesla insurance covers glass if you add comprehensive coverage to your policy.

Can you add a non-Tesla to Tesla insurance?

Only some drivers are eligible to purchase a Tesla policy for a non-Tesla policy. To purchase a plan, you need to own at least one Tesla. If you have other non-Tesla vehicles, you can add them to your policy.

What is considered a totaled Tesla?

Insurance companies total a car once it reaches a certain threshold of damage compared to your car’s actual cash value (ACV). This is why looking at replacement cost vs. ACV auto insurance is important – your vehicle’s ACV could be much lower than how much it costs to repair it.

Are Teslas expensive to repair?

All expensive vehicles have higher repair costs because their parts are pricier. Teslas are also electric vehicles, which usually have more sensitive equipment.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.