Best Tesla Model Y Auto Insurance in 2025 (Find the Top 10 Companies Here)

Discover American Family, Nationwide, and Progressive as the top picks for the best Tesla Model Y auto insurance, starting at just $80 monthly. These companies offer competitive rates, comprehensive coverage, and exceptional customer service tailored for your Tesla Model Y, ensuring optimal protection and value.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

2,235 reviews

2,235 reviewsCompany Facts

Full Coverage for Tesla Model Y

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Tesla Model Y

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews

Company Facts

Full Coverage for Tesla Model Y

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the best Tesla Model Y auto insurance are American Family, Nationwide, and Progressive, renowned for their exceptional coverage options and customer service.

These providers stand out in the competitive market by offering tailored policies that enhance the safety features of the Tesla Model Y. Unlock details in our guide titled, “Cheap Tesla Auto Insurance.”

Our Top 10 Company Picks: Best Tesla Model Y Auto Insurance

Company Rank UBI Discount A.M. Best Best For Jump to Pros/Cons

#1 30% A Excellent Service American Family

#2 40% A+ Multi-Policy Savings Nationwide

#3 30% A+ Coverage Options Progressive

#4 30% A++ Robust Options Travelers

#5 20% A+ Mature Drivers The Hartford

#6 30% A Custom Coverage Liberty Mutual

#7 30% A Great Service Farmers

#8 30% A Roadside Assistance AAA

#9 30% A++ Customer Satisfaction Auto-Owners

#10 25% A++ Affordable Rates Geico

With advanced security system discounts and coverage for unique electric vehicle needs, they ensure drivers receive comprehensive protection. Choosing the right insurer from these top contenders can significantly impact your experience and expenses. To compare Tesla Model Y auto insurance quotes from top companies, enter your ZIP code above now. It’s fast and free.

- American Family is the top pick for Tesla Model Y auto insurance

- Coverage includes Tesla-specific features like autopilot security

- Policies address the unique repair needs of electric vehicles

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – American Family: Top Overall Pick

Pros

- Generous UBI Discount: American Family offers a 30% usage-based insurance discount, encouraging Tesla Model Y owners to drive safely.

- High A.M. Best Rating: With an A rating, American Family is recognized for its financial stability, ensuring reliable claims service for Tesla Model Y insurance.

- Service Excellence: Known for excellent customer service, providing Tesla Model Y owners with supportive and efficient insurance handling. See more details in our guide titled, “American Family Auto Insurance Review.”

Cons

- Limited Policy Options: Compared to competitors, American Family may offer fewer tailor-made options for Tesla Model Y’s specific needs.

- Higher Rates for High-Risk Areas: Tesla Model Y owners in high-risk areas might face relatively higher premiums with American Family.

#2 – Nationwide: Best for Multi-Policy Savings

Pros

- Top Multi-Policy Discounts: Nationwide provides a 40% discount for bundling policies, beneficial for Tesla Model Y owners with multiple insurance needs.

- Superior Financial Strength: Nationwide’s A+ A.M. Best rating ensures robust backing for Tesla Model Y claims, even in massive payout scenarios.

- Specialized Tesla Coverage: Offers specific coverages that cater to the unique aspects of insuring a Tesla Model Y. Read up on the Nationwide auto insurance review for more information.

Cons

- Price Variability: Tesla Model Y insurance rates Nationwide can vary significantly based on the driver’s profile and location.

- Complex Claim Process: Some users report a more complex claims process, which can be a drawback for Tesla Model Y owners seeking simplicity.

#3 – Progressive: Best for Coverage Options

Pros

- Broad Coverage Choices: Progressive offers a wide array of insurance options, allowing Tesla Model Y owners to customize their policies extensively.

- UBI Opportunities: A 30% discount on usage-based insurance can significantly benefit Tesla Model Y drivers who prefer telematics-based plans.

- High A.M. Best Rating: With an A+ rating, Progressive is well-equipped to handle claims for Tesla Model Y owners reliably. Delve into our evaluation of Progressive auto insurance review.

Cons

- Inconsistent Customer Service: Service levels may vary, potentially affecting Tesla Model Y owners during claims or inquiries.

- Premium Fluctuation: Tesla Model Y insurance premiums may fluctuate due to Progressive’s dynamic pricing model, impacting budget predictability.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Travelers: Best for Robust Options

Pros

- Extensive Coverage Variety: Travelers offers a diverse range of policy options, allowing Tesla Model Y owners to tailor coverage to their specific needs. See more details in our guide titled, “Travelers Auto Insurance Review.”

- High A.M. Best Rating: With an A++ rating, Travelers demonstrates exceptional financial health, ensuring dependable claim payouts for Tesla Model Y insurance.

- UBI Savings: A 30% discount on usage-based insurance provides Tesla Model Y drivers with the opportunity to save significantly based on driving behavior.

Cons

- Higher Premiums: Despite extensive coverage options, Travelers may have higher base rates for Tesla Model Y insurance compared to other insurers.

- Complex Policy Management: The wide range of options can sometimes make policy management and selection confusing for Tesla Model Y owners.

#5 – The Hartford: Best for Mature Drivers

Pros

- Designed for Mature Drivers: The Hartford offers benefits and discounts specifically for mature Tesla Model Y drivers, enhancing value for this demographic.

- Strong Financial Standing: An A+ A.M. Best rating affirms The Hartford’s ability to support Tesla Model Y claims reliably. Learn more in our complete The Hartford auto insurance review.

- Specialized Programs: Tailored programs for mature drivers include perks that are particularly appealing to senior Tesla Model Y owners.

Cons

- Age Restrictions: Benefits and discounts are primarily available to older Tesla Model Y owners, which may limit appeal to a younger audience.

- Premium Costs: Despite specialized offerings, The Hartford’s rates for Tesla Model Y insurance may still be higher, especially outside the preferred age group.

#6 – Liberty Mutual: Best for Custom Coverage

Pros

- Customizable Policies: Liberty Mutual allows for highly personalized Tesla Model Y insurance policies, catering to individual coverage needs.

- Incentives for Safety Features: Offers discounts for Tesla Model Ys equipped with advanced safety technologies, rewarding owners for their vehicle’s capabilities.

- Strong Financial Rating: An A rating from A.M. Best ensures that Liberty Mutual can reliably manage Tesla Model Y insurance claims. Discover more about offerings in our complete Liberty Mutual auto insurance review.

Cons

- Variable Customer Service: Customer service quality can vary, which might affect the Tesla Model Y insurance experience during claims.

- Rate Inconsistency: Tesla Model Y owners may experience rate fluctuations based on the company’s dynamic pricing model, which could impact budget planning.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Great Service

Pros

- Exceptional Customer Service: Farmers is renowned for its customer service, providing Tesla Model Y owners with reliable and supportive interactions.

- Flexible Coverage Options: Offers a variety of coverage choices that cater to the diverse needs of Tesla Model Y owners. More information is available about this provider in our Farmers auto insurance review.

- Usage-Based Savings: Like others, Farmers offers a 30% UBI discount, rewarding safe driving behaviors for Tesla Model Y drivers.

Cons

- Higher Cost for Add-Ons: Adding specific coverages for Tesla Model Ys can significantly increase the overall cost of insurance with Farmers.

- Policy Complexity: The wide array of options can lead to complexity in managing and understanding the insurance policies for Tesla Model Y owners.

#8 – AAA: Best for Roadside Assistance

Pros

- Superior Roadside Assistance: AAA is particularly noted for its comprehensive roadside assistance, essential for Tesla Model Y owners.

- Bundled Discounts: Offers significant savings for Tesla Model Y owners who bundle their auto insurance with other policies.

- Financial Stability: An A rating from A.M. Best ensures AAA’s reliability in managing Tesla Model Y insurance claims. Learn more in our complete “AAA Auto Insurance Review.”

Cons

- Membership Requirement: AAA requires a membership to access insurance services, which might be an extra step for Tesla Model Y owners.

- Costlier Premiums: Despite discounts, AAA’s premiums for Tesla Model Y insurance can be higher compared to other insurers.

#9 – Auto-Owners: Best for Customer Satisfaction

Pros

- High Customer Satisfaction: Auto-Owners is known for its excellent customer service, providing a positive experience for Tesla Model Y insurance.

- Stable Financial Rating: An A++ rating from A.M. Best indicates exceptional financial health, which benefits Tesla Model Y claim processing. Discover insights in our guide titled, “Auto-Owners Auto Insurance Review.”

- Discounts for Safety Features: Auto-Owners offers discounts for Tesla Model Ys that include advanced safety technologies, reducing insurance costs.

Cons

- Limited Availability: Auto-Owners insurance may not be available in all areas, restricting access for some Tesla Model Y owners.

- Conservative Coverage Options: While reliable, the coverage options for Tesla Model Ys may not be as extensive as those offered by other insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Geico: Best for Affordable Rates

Pros

- Competitively Priced: Geico offers some of the most affordable rates for Tesla Model Y insurance, making it an attractive option for budget-conscious owners.

- Extensive Discounts: Includes discounts for good driving, multi-vehicle policies, and more, which can significantly lower Tesla Model Y insurance costs. Learn more by reading our guide titled, “Geico Auto Insurance Review.”

- Strong Financial Outlook: With an A++ rating from A.M. Best, Geico demonstrates robust financial strength for handling Tesla Model Y insurance claims.

Cons

- Generic Policy Offerings: While affordable, Geico’s policies for Tesla Model Y insurance may lack the customization options found with other insurers.

- Customer Service Variability: The quality of customer service can vary, potentially impacting Tesla Model Y owners during claims processes.

Tesla Model Y Insurance Costs: Detailed Breakdown

Understanding the cost of insuring a Tesla Model Y can help owners budget more effectively. Below, we provide a comprehensive breakdown of monthly rates for both minimum and full coverage across various insurance providers.

Tesla Model Y Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $92 $162

American Family $90 $160

Auto-Owners $80 $150

Farmers $97 $165

Geico $87 $158

Liberty Mutual $105 $190

Nationwide $95 $170

Progressive $85 $155

The Hartford $110 $180

Travelers $100 $175

The monthly insurance rates for a Tesla Model Y vary significantly depending on the level of coverage and the insurance company chosen. For instance, Auto-Owners offers the lowest minimum coverage at $80 and full coverage at $150 per month, making it an attractive option for cost-conscious drivers.

On the higher end, Liberty Mutual charges $105 for minimum and $190 for full coverage, reflecting its premium service offerings. Other notable providers include American Family and Progressive, which offer competitive rates of $90 and $85 for minimum coverage, respectively, and $160 and $155 for full coverage.

This table provides a clear view of how each provider positions itself in the market, allowing Tesla Model Y owners to make informed decisions based on their coverage needs and budget constraints. Access comprehensive insights into our guide titled “What are the recommended auto insurance coverage levels?“

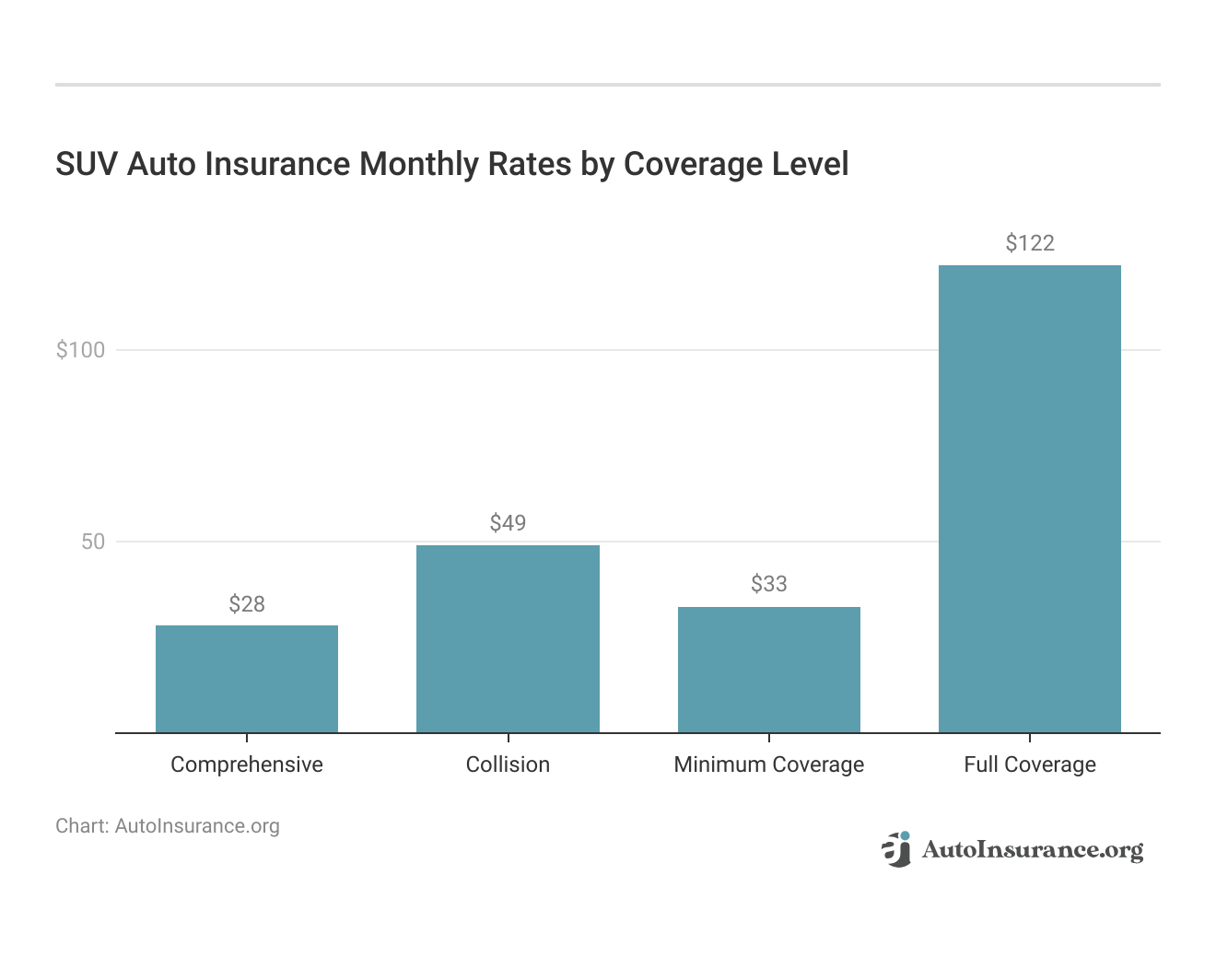

Are Vehicles Like the Tesla Model Y Expensive to Insure

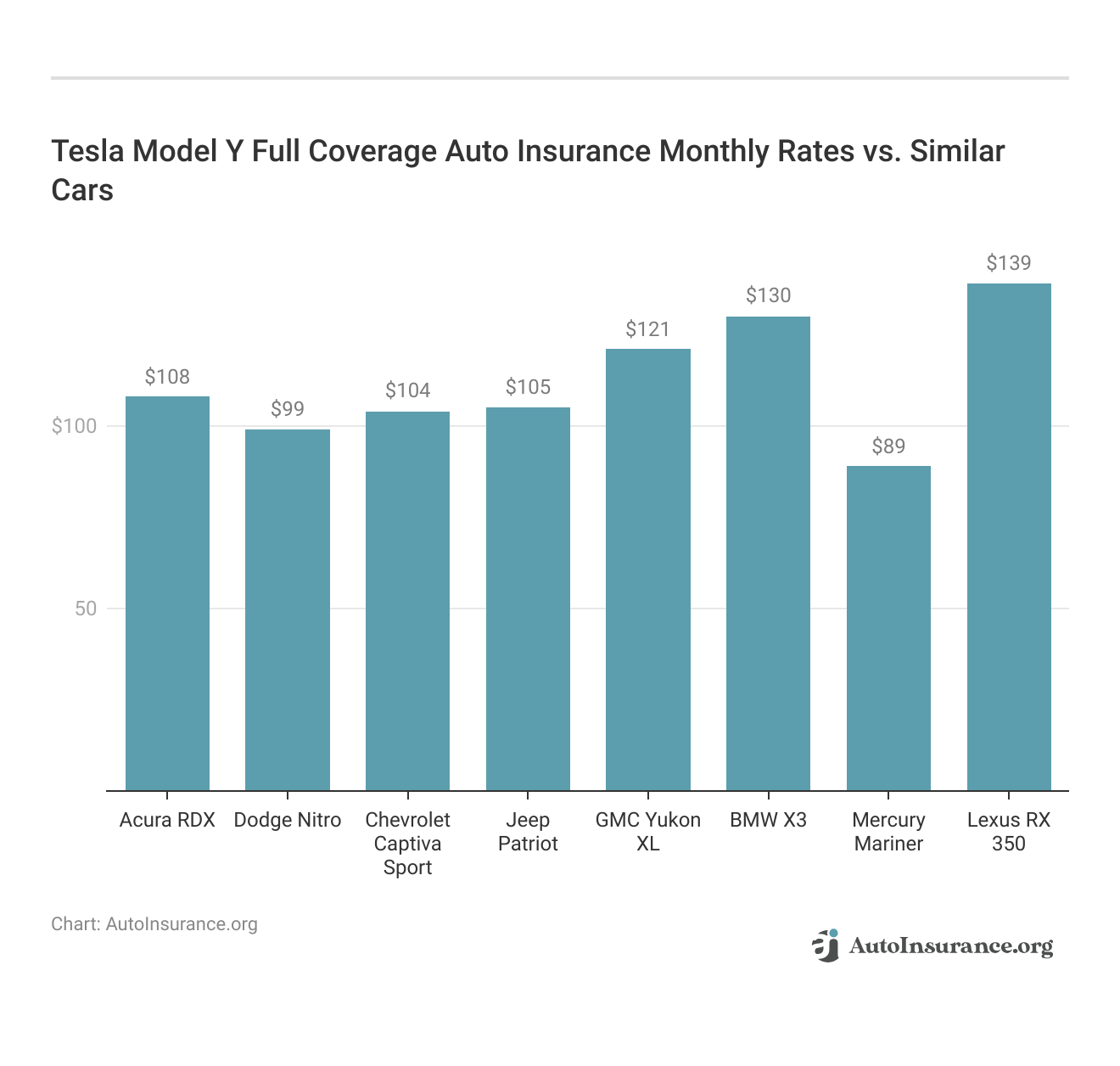

Insurance costs can vary widely for different models, and understanding these costs is crucial for prospective and current owners. Comparing the Tesla Model Y’s insurance rates with similar SUVs like the Lincoln Nautilus, Chevrolet Tracker, and BMW X2 offers valuable insights.

By examining the insurance rates of SUVs comparable to the Tesla Model Y, potential buyers and existing owners can better anticipate their expenses. This comparison not only provides a clearer financial picture but also assists in making informed decisions regarding vehicle insurance.

The diverse range of insurance rates for models like the Acura RDX, GMC Yukon XL, and Lexus RX 350 underlines the variability in insuring similar vehicles. Analyzing these figures helps prospective buyers of the Tesla Model Y and similar vehicles gauge their possible monthly insurance costs effectively.

Insurance Rates for Vehicles Similar to the Tesla Model Y

Exploring insurance rates for vehicles similar to the Tesla Model Y provides a broader perspective on potential costs across different coverage levels. This comparison helps prospective buyers understand how other vehicles in the same category stack up in terms of comprehensive, collision, and total coverage expenses.

Tesla Model Y Full Coverage Car Insurance Monthly Rates vs. Similar Vehicles by Coverage Level

| Vehicle | Comprehensive | Collision | Minimum Coverage | Full Coverage |

|---|---|---|---|---|

| Tesla Model Y | $28 | 49 | $33 | $122 |

| Volkswagen Atlas | $31 | $60 | $31 | $135 |

| Jaguar F-PACE | $39 | $82 | $33 | $167 |

| Toyota Sequoia | $28 | $47 | $33 | $121 |

| Land Rover Range Rover Evoque | $30 | $53 | $35 | $131 |

| Land Rover Range Rover | $38 | $73 | $35 | $158 |

| GMC Yukon | $31 | $50 | $31 | $125 |

| Subaru Forester | $30 | $44 | $26 | $112 |

| Ford Escape Hybrid | $18 | $32 | $38 | $102 |

The diverse range of insurance rates for vehicles like the Tesla Model Y highlights the importance of considering insurance costs when evaluating vehicle options.

From the Ford Escape Hybrid to the Land Rover Range Rover, these figures offer valuable insights for consumers aiming to balance vehicle performance with manageable auto insurance premium expenditures. For additional details, explore our comprehensive resource titled “What is the average auto insurance cost per month?“

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What Impacts the Cost of Tesla Model Y Insurance

As with any car, your Tesla Model Y car insurance costs will be affected by personal factors like where you live, your driving record, and your driving habits. The Tesla Model Y trim level you buy will also have an impact on the total price you will pay for Tesla Model Y insurance coverage. Unlock details in our guide titled “How Vehicle Year Affects Auto Insurance Rates.”

Ways to Save on Tesla Model Y Insurance

Securing affordable insurance for your Tesla Model Y is easier with the right strategies. Here are five effective ways to reduce your premiums and ensure your vehicle is protected without breaking the bank.

- Get cheaper Tesla Model Y car insurance rates as a full-time parent.

- Check the odometer on your Tesla Model Y.

- Take public transit instead of driving your Tesla Model Y.

- Reduce your coverage on an older Tesla Model Y.

- Buy a Tesla Model Y with an anti-theft device.

Implementing these strategies can lead to significant savings on your Tesla Model Y insurance. Whether it’s adjusting your coverage or enhancing vehicle security, each step can contribute to more manageable insurance costs while maintaining adequate protection for your Tesla.

Read more: Top 7 Factors That Affect Auto Insurance Rates

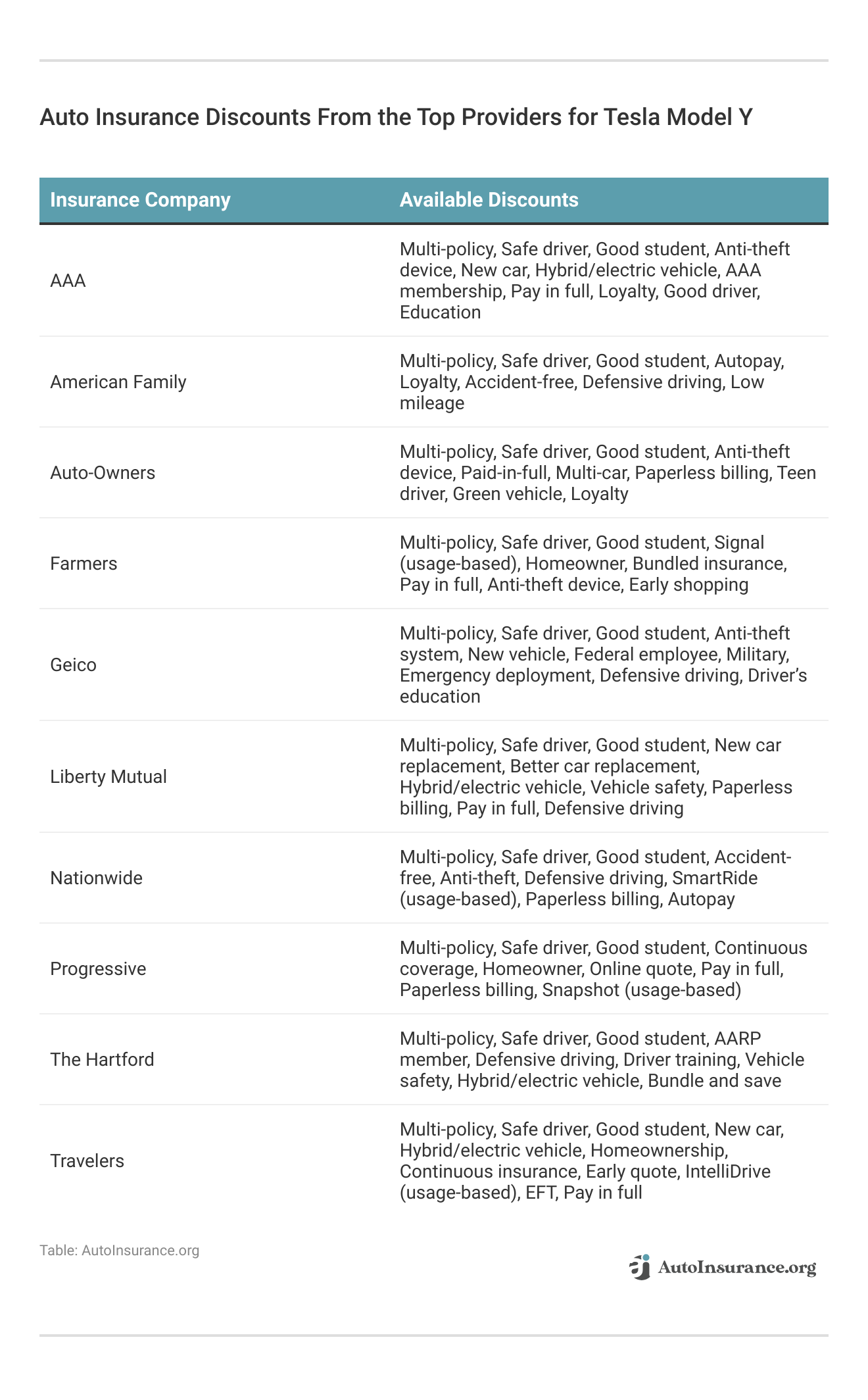

Top Tesla Model Y Insurance Companies

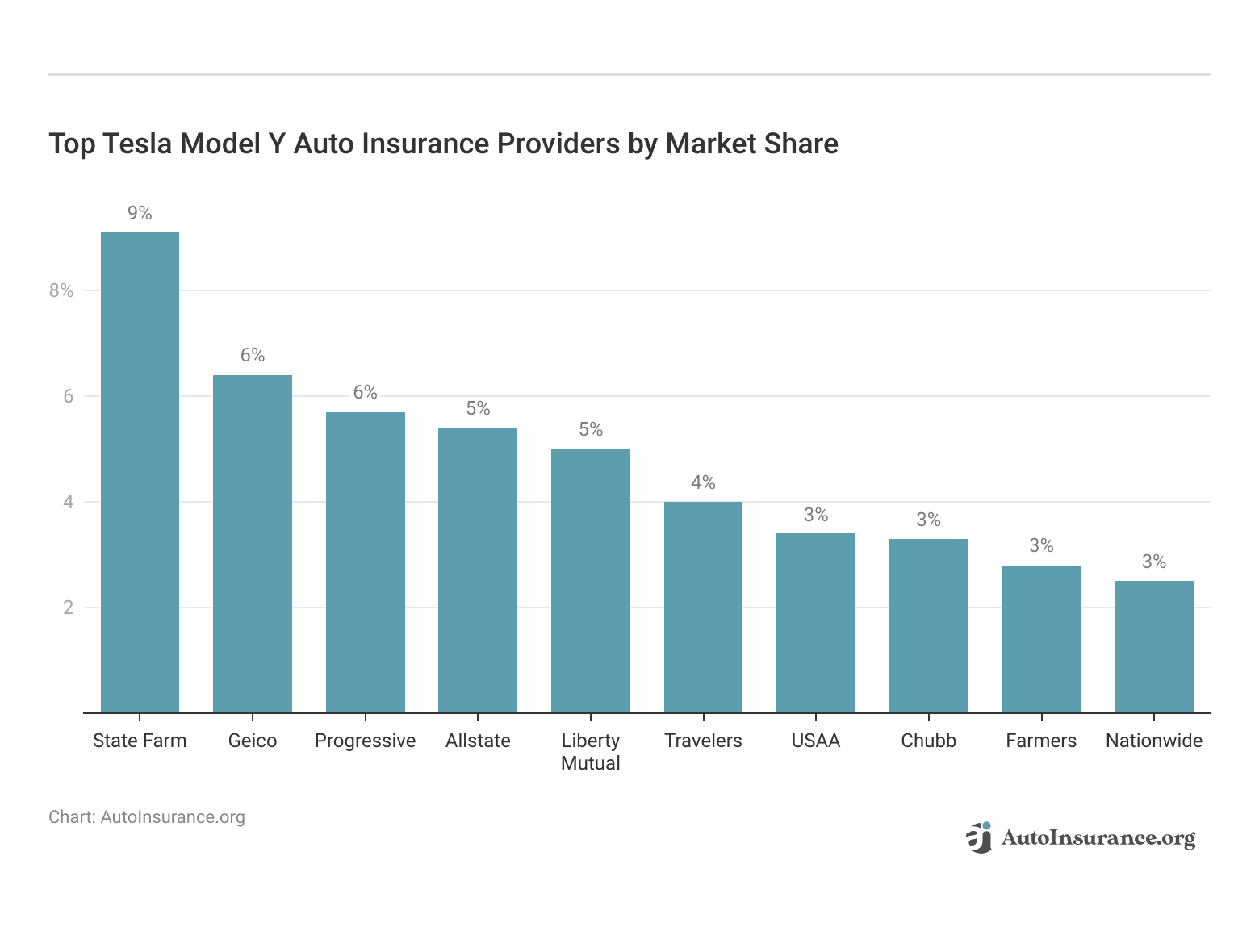

Selecting the right insurance provider for a Tesla Model Y involves understanding which companies offer the most affordable rates.

This guide lists the top insurers by market share, highlighting their unique discounts for security systems and other safety features of the Tesla Model Y.

Choosing an insurer for your Tesla Model Y should take into account more than just the cost; consider the benefits and discounts for safety features that each company offers. This list of top providers helps narrow down the options, making it easier to find coverage that meets your needs and budget.

Largest Auto Insurers by Market Share

Exploring the market landscape for Tesla Model Y insurance involves identifying the largest insurers by market share. This overview provides insight into which companies dominate the auto insurance sector and their relative influence. See more details in our guide titled, “How to Lower Your Auto Insurance Rates.”

Top Tesla Model Y Auto Insurance Providers by Market Share

| Rank | Company | Volume | Market Share |

|---|---|---|---|

| #1 | State Farm | $65.6 milllion | 9% |

| #2 | Geico | $46.1 milllion | 7% |

| #3 | Progressive | $39.2 milllion | 6% |

| #4 | Liberty Mutual | $35.6 milllion | 6% |

| #5 | Allstate | $35 milllion | 5% |

| #6 | Travelers | $28 milllion | 4% |

| #7 | USAA | $23.4 milllion | 3% |

| #8 | Chubb | $23.3 milllion | 3% |

| #9 | Farmers | $20.6 milllion | 3% |

| #10 | Nationwide | $18.4 milllion | 3% |

Understanding the market share distribution among top insurers like State Farm, Geico, and Progressive helps Tesla Model Y owners gauge the financial stability and customer service prowess of potential providers, aiding in making an informed insurance choice.

Choosing American Family means securing top-tier insurance with benefits specifically designed for Tesla Model Y drivers.Jeffrey Manola Licensed Insurance Agent

You can compare quotes for Tesla Model Y auto insurance rates from some of the best auto insurance companies by using our free online tool now.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Are vehicles like the Tesla Model Y expensive to insure?

Insurance rates for vehicles like the Tesla Model Y can vary, and it’s recommended to compare insurance rates for similar SUV models to get a better idea of what to expect (read more: Best Tesla Model X Auto Insurance, Best Tesla Model S Auto Insurance).

What factors affect the cost of Tesla Model Y auto insurance?

The cost of insurance on a Tesla Model Y is influenced by personal factors such as driving habits, location, driving record, and the specific trim level of the vehicle.

How can I save on Tesla Model Y insurance?

To get the best Tesla Model Y auto insurance price, you can consider strategies such as comparing quotes from multiple companies, maintaining a good driving record, and taking advantage of any available discounts.

What are the top insurance companies for Tesla Model Y coverage?

While rates may vary, some of the top insurance companies offering coverage for the Tesla Model Y (based on market share) include those that provide discounts for safety features and security systems found in the vehicle.

How can I compare Tesla Model Y auto insurance quotes online?

You can easily compare quotes for Tesla Model Y auto insurance from different insurance companies by using a free online tool provided by reputable sources. To find out more, explore our guide titled “Where to Buy Auto Insurance Online.”

What is the 2024 Tesla Model Y insurance cost?

The cost to insure a tesla Model Y typically ranges from $125 to $208 per month. Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

How much does Tesla Y insurance cost?

Tesla Model Y insurance costs can average about $150 per month, though this can vary based on factors like location and driving history.

What is the best car insurance for Tesla Model Y?

Top car insurance providers for Tesla Model Y include American Family, Nationwide, and Progressive, noted for their competitive rates and robust coverage.

What does car insurance for Tesla Model Y typically cover?

Auto insurance for Tesla Model Y typically includes collision, theft, liability coverage, and may include special provisions for electric vehicle parts like the battery. To learn more, explore our comprehensive resource on “Cheapest Liability-Only Auto Insurance.“

Please select which type of anti-theft device your 2024 Tesla Model Y has?

Identify if your 2024 Tesla Model Y is equipped with factory-installed anti-theft features such as GPS tracking or an immobilizer when applying for insurance.

How does a Tesla anti-theft device impact Geico insurance rates?

Installing a Tesla anti-theft device can lower your Geico insurance rates by reducing the risk profile of your vehicle.

How do insurers consider Tesla anti-theft device insurance discounts?

Insurers typically offer discounts on policies for Tesla Model Ys equipped with certified anti-theft devices due to the reduced theft risk.

What is the Tesla Model Y average insurance cost?

The average insurance quote for Tesla Model Y is about $150 per month, though rates can differ based on personal and regional factors. For additional details, explore our comprehensive resource titled, “What is full coverage auto insurance?“

What is the Tesla Model Y insurance cost in Florida?

Tesla Model Y insurance quotes in Florida averages around $183 per month, influenced by the state’s high insurance claim rates and environmental factors.

Does the Tesla Y insurance cost differ from other Tesla models?

Yes, the Tesla insurance cost for Model Y generally tends to be lower than that of the Tesla Model S and Model X, primarily due to its less expensive parts and lower repair costs. Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.