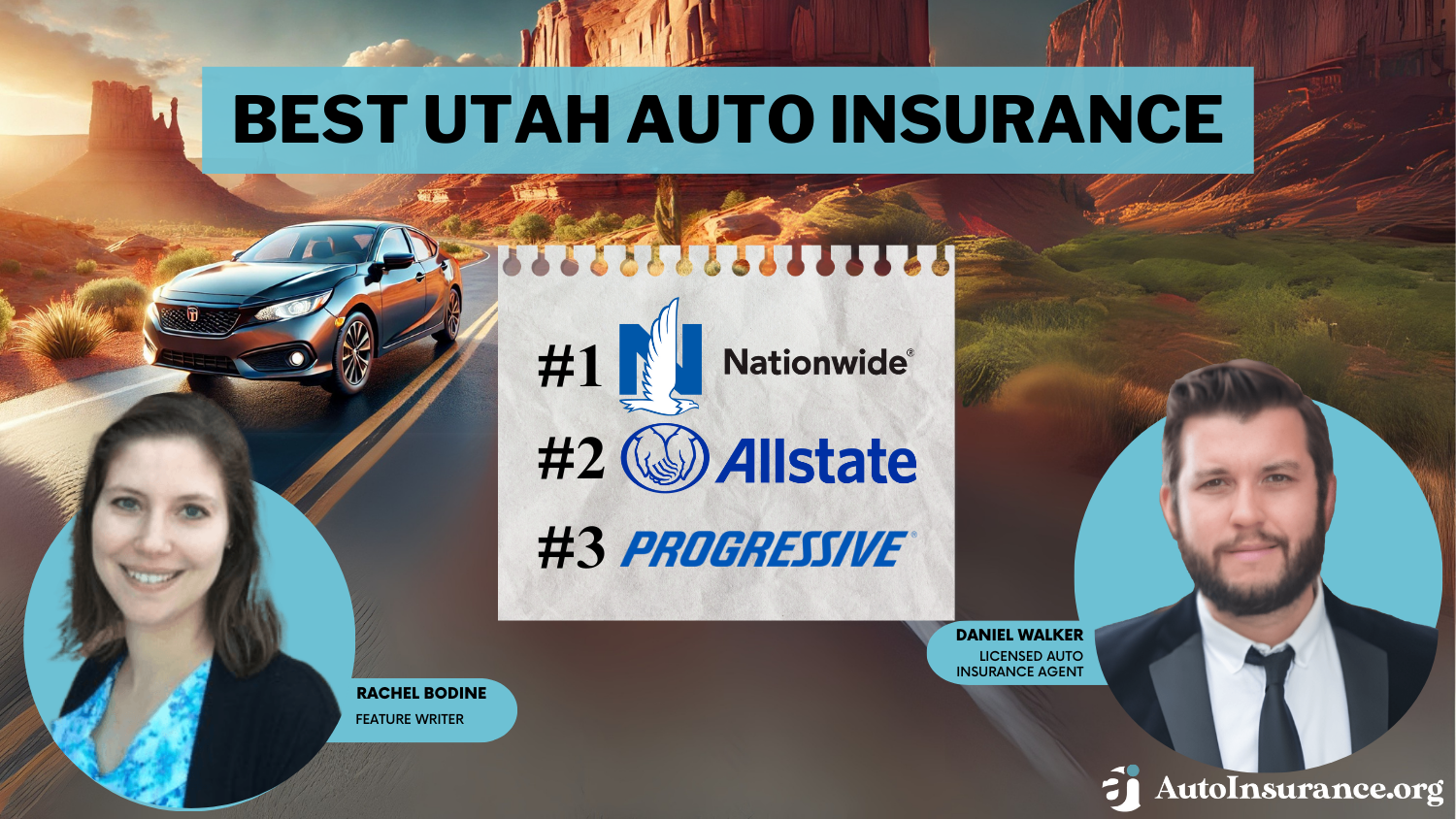

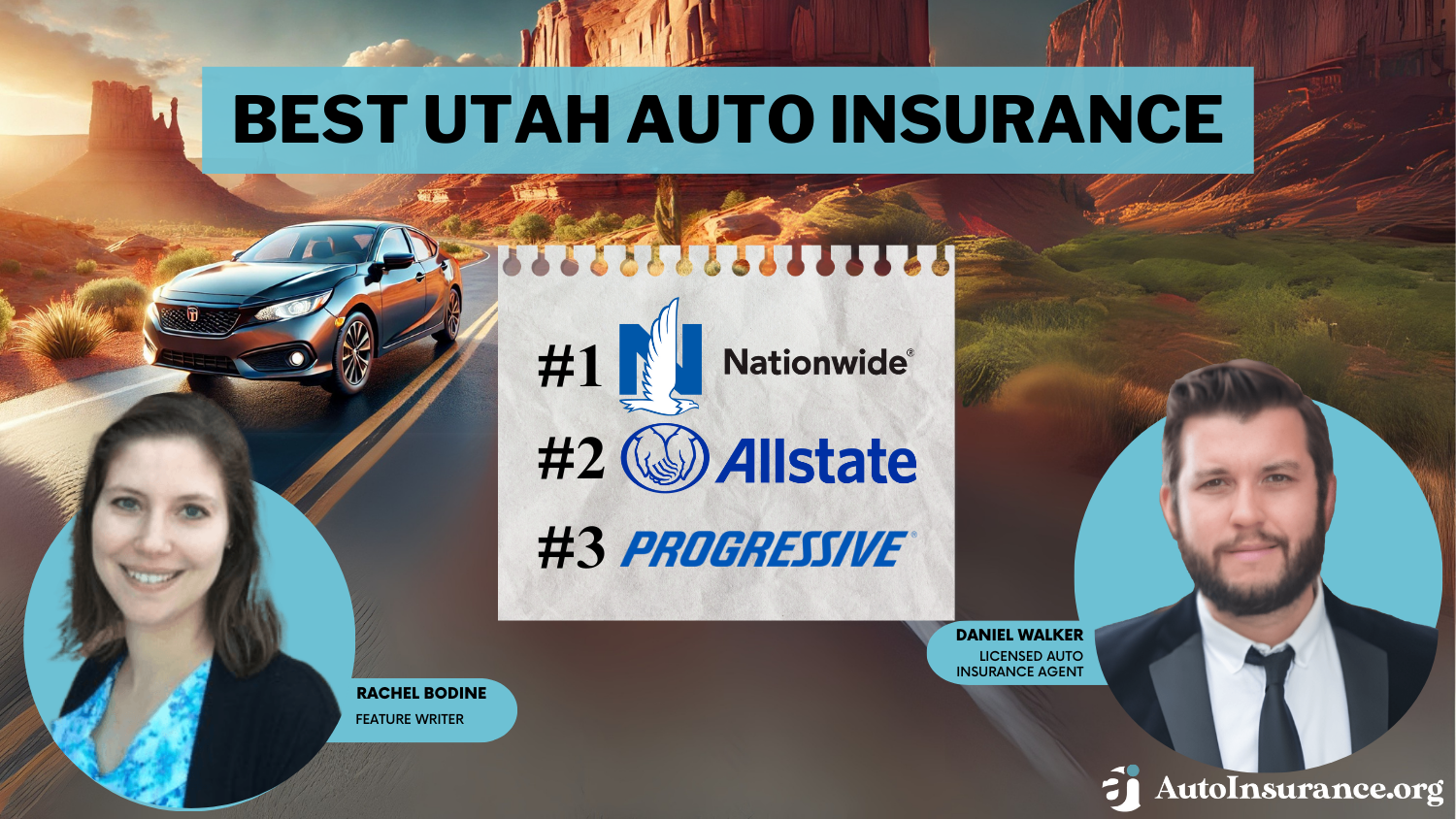

Best Utah Auto Insurance in 2025 (Compare the Top 10 Companies)

Nationwide, Allstate, and Progressive have the best Utah auto insurance. All Utah drivers must meet the minimum Utah liability insurance requirements to drive in the state, though full coverage provides better financial protection for Utah drivers. Minimum coverage at Nationwide is an average of $64/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Utah Auto Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 11,638 reviews

11,638 reviewsCompany Facts

Full Coverage for Utah Auto Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage for Utah Auto Insurance

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsNationwide, Allstate, and Progressive have the best Utah auto insurance, where rates are 10% lower than the national average. So, finding cheap auto insurance in UT is easy.

However, you can get even better rates when you compare quotes from the best auto insurance companies online.

Our guide to the best auto insurance in Utah compares rates from the top companies to help you find the most affordable coverage.

Our Top 10 Company Picks: Best Utah Auto Insurance

| Company | Rank | Multi-Policy Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A+ | Deductible Program | Nationwide |

| #2 | 24% | A+ | Discount Variety | Allstate | |

| #3 | 22% | A+ | Custom Plans | Progressive | |

| #4 | 20% | A++ | Local Agents | State Farm | |

| #5 | 18% | A++ | Military Benefits | USAA | |

| #6 | 20% | A | Custom Coverage | Farmers | |

| #7 | 19% | A | Policy Flexibility | Liberty Mutual |

| #8 | 16% | A++ | Affordable Rates | Geico | |

| #9 | 13% | A | Customer Satisfaction | American Family | |

| #10 | 10% | A++ | Broad Coverage | Travelers |

Keep reading to find the cheapest Utah auto insurance coverage for young and high-risk drivers and evaluate Utah car insurance quotes by city. Then, enter your ZIP code to compare cheap Utah car insurance rates.

- Nationwide has the best car insurance in Utah

- Utah minimum auto insurance requirements include 25/65/15 in liability

- Utah insurance laws also require $3,000 in personal injury protection

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Nationwide: Top Pick Overall

Pros

- Deductible Program: Nationwide’s deductible program lowers deductibles for claims-free customers in Utah.

- Multi-Policy Discount: Utah drivers can purchase more than one type of policy to save. Learn more by reading our Nationwide review.

- Coverage Variety: Utah customers can purchase several types of coverage for their vehicles.

Cons

- Customer Reviews: Customer service is usually rated as average by customers.

- High-Risk Driver Rates: Nationwide rates will be higher for risky Utah drivers.

#2 – Allstate: Best for Discount Variety

Pros

- Discount Variety: Allstate has good driver discounts, multi-policy discounts, and many more. Read more in our Allstate review.

- Claim Satisfaction Guarantee: Discontented customers may get lower rates.

- Coverage Variety: Utah drivers can purchase several different coverages for their vehicles.

Cons

- Customer Reviews: Utah drivers may find customer service at Allstate average or below average.

- Higher Rates: Allstate’s Utah rates are higher than the average for most drivers.

#3 – Progressive: Best for Custom Plans

Pros

- Custom Plans: Progressive offers custom plans to customers, with adjustable deductibles and coverages.

- Snapshot Discount: Successful program completion will result in lower rates for Utah drivers.

- High-Risk Rates: Progressive’s rates for higher-risk Utah drivers are competitive. Learn more in our review of Progressive.

Cons

- Customer Reviews: The majority of ratings left by customers are average.

- Snapshot Rates: Poor scores in Snapshot could lead to increased Utah auto insurance rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Best for Local Agents

Pros

- Local Agents: Utah State Farm agents are widely available. Read more in our State Farm review.

- Discount Selection: Utah policy rates can be reduced with discounts.

- Coverage Variety: State Farm offers several affordable add-ons to Utah customers.

Cons

- Financial Stability: State Farm’s financial management rating could be improved.

- Online Tools: Local agent support means State Farm’s online tools offer less online support.

#5 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA customers get benefits like shopping discounts and lower auto insurance rates.

- Customer Service: The company’s reputation for service is great. Learn more in our USAA review.

- Coverage Variety: Affordable add-on coverages, like roadside assistance, are available to Utah customers.

Cons

- Eligibility Restrictions: The company only insures Utah veterans and military members.

- Lack of In-Person Support: Local agents in Utah are few, so most support is provided online.

#6 – Farmers: Best for Safe Drivers

Pros

- Safe Drivers: Farmers has discounts and other perks for safe Utah drivers.

- Multi-Policy Discounts: Utah customers who bundle will have cheaper Utah auto insurance rates. Learn more in our review of Farmers.

- Coverage Variety: Affordable add-ons can be purchased from Farmers for more protection on Utah roads.

Cons

- Claims Processing: Farmers’ processing can be slower than normal, according to customer reviews.

- High-Risk Rates: High-risk Utah drivers will pay more.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Policy Flexibility

Pros

- Policy Flexibility: Utah customers can adjust policies easily. Read our review of Liberty Mutual for more information.

- 24/7 Assistance: Utah customer service is available 24/7 to drivers.

- Multi-Policy Discount: Save on Utah car insurance by bundling.

Cons

- Higher Rates: Liberty Mutual can be expensive for high-risk Utah drivers.

- Customer Reviews: Average service or below-average service reviews are generally left by customers.

#8 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico has some of the best cheap car insurance in Utah for safe drivers.

- Financial Rating: Ratings are high for Geico’s finances. Learn more in our review of Geico.

- Online Convenience: Geico is known for its simple app and website.

Cons

- No Local Agent Support: Most Utah customers will have online support available to them, not in-person agents.

- No Gap Coverage: Utah customers can’t purchase gap insurance.

#9 – American Family: Best for Customer Satisfaction

Pros

- Customer Satisfaction: The majority of customer reviews and ratings are positive.

- Discount Variety: Utah customers can lower costs by applying for discounts.

- Coverage Variety: Utah customers have plenty of affordable choices for their vehicles. Learn more in our American Family review.

Cons

- Online Services: Some functions may not be available online at the company.

- New Customer Rates: Utah customers who are new won’t have a loyalty discount, so rates may be higher at first.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Broad Coverage

Pros

- Broad Coverage: Travelers has many coverages available to Utah customers. Learn more in our Travelers’ review.

- IntelliDrive Discount: Successful program completion will lower Utah auto insurance rates.

- Financial Rating: The company’s financial management is excellent.

Cons

- IntelliDrive Rate Increases: Scoring poorly may raise Utah car insurance rates.

- Customer Service: The company could improve ratings from customers.

The Best Utah Auto Insurance

The best auto insurance in Utah depends on your unique qualities as a driver, including age and credit score (learn more: How Credit Scores Affect Auto Insurance Rates). However, the top companies that are good for most drivers are below.

Utah Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $80 | $180 | |

| $72 | $162 | |

| $79 | $177 | |

| $50 | $113 | |

| $82 | $183 |

| $64 | $144 |

| $65 | $146 | |

| $71 | $158 | |

| $61 | $136 | |

| $34 | $77 |

These top companies also offer discounts to help drivers save on Utah insurance.

Read our auto insurance company reviews to learn more about each insurer and the average cost of car insurance in Utah.

Best Car Insurance Company for Full Coverage: Geico

Geico auto insurance offers the best full coverage rates to Utah drivers with good records — around $95 per month. Drivers with accidents or speeding tickets pay more for full coverage, but Geico’s rates are still competitive.

Best Car Insurance Company for Young Drivers: Utah Farm Bureau

Utah drivers under 25 will find the most affordable rates with Utah Farm Bureau. The local insurance union offers full coverage rates to young drivers for under $300 per month. Read more: Farm Bureau auto insurance review.

Best Car Insurance Company After a DUI: Progressive

Every company raises rates after a DUI or DWI. However, Progressive auto insurance doesn’t increase your rates nearly as high as other insurers.

Do you know Flo? Progressive doesn't just have a memorable ad campaign history. They've also led the way in telematic car 🚘insurance with their Snapshot 🖼️program. https://t.co/27f1xf1ARb has reviewed Progressive, and you'll want to check it out here👉: https://t.co/yL6FtEW4OA pic.twitter.com/xZeejN5Qde

— AutoInsurance.org (@AutoInsurance) July 23, 2023

Utah drivers pay over $166 per month after a DUI with Progressive.

Best Car Insurance Company With Bad Credit: USAA

Insurance companies use your credit score to determine the likelihood of you filing a claim. Those with poor credit are more likely to file claims, but USAA auto insurance won’t raise your rates as much as other companies. However, USAA is only available to military members and their families.

Read more: USAA Auto Insurance Review

The Cheapest Utah Auto Insurance Companies

On average, Geico may offer the cheapest full coverage rates, but you’ll want to compare insurance quotes from multiple companies in Utah to guarantee you’re getting the best price.

Learn more: How to Evaluate Auto Insurance Quotes

Below, we compare Utah auto insurance company rates for minimum liability and full coverage.

The Cheapest Utah Auto Insurance Companies for Minimum Liability

Minimum liability insurance in Utah includes $25,000 in bodily injury coverage per person, $65,000 per accident, $15,000 in property damage liability, and $3,000 in personal injury protection insurance.

Liability auto insurance coverage often comes with the lowest rates for most drivers. Compare average Utah liability rates in the table below.

Utah Minimum Coverage Auto Insurance Average Rates From Top Providers

| Insurance Company | Monthly Rates |

|---|---|

| $80 | |

| $72 | |

| $79 | |

| $50 | |

| $82 |

| $64 |

| $65 | |

| $71 | |

| $61 | |

| $34 | |

| U.S. Average | $61 |

Geico offers the lowest liability-only rates to most drivers. Still, you should compare these quotes against local companies in your neighborhood to see which has the cheapest car insurance in Utah.

The Cheapest Utah Auto Insurance Companies for Full Coverage

Full coverage auto insurance in Utah includes the minimum liability and PIP discussed above, collision auto insurance, and comprehensive auto insurance coverage. The average rates by company are listed below.

Utah Full Coverage Auto Insurance Average Rates From Top Providers

| Insurance Company | Monthly Rates |

|---|---|

| $180 | |

| $162 | |

| $177 | |

| $113 | |

| $183 |

| $144 |

| $146 | |

| $158 | |

| $136 | |

| $77 | |

| U.S. Average | $165 |

Geico, again, offers the best average rates. Still, you may need above-average coverage or have a below-average driving record. It pays to compare rates from Geico and other companies based on your unique driving profile.

You can also get lower auto insurance rates by choosing your auto insurance deductibles. If you choose a higher deductible, you could save more money. For example, the rates listed above include a $1,000 deductible. Increasing your deductible to $2,000 would save you money on your monthly auto payments, but we don’t recommend doing so unless you can afford the higher out-of-pocket costs.

If you want cheap full coverage auto insurance in Utah, compare quotes online to get the cheapest Utah car insurance.

Cheap Auto Insurance for Young Drivers in Utah

According to the Utah Department of Public Safety’s Highway Safety Office, drivers between 13 and 20 years old are involved in more accidents than any other driver in Utah. So it’s no surprise that young drivers under 21 pay the most for auto insurance coverage, regardless of driving record.

Teens will start to see their rates decrease after turning 21, but average car insurance rates in Utah don’t get cheaper until you turn 25.

To save money on teen auto insurance in Utah, compare quotes from the companies below.

Utah Full Coverage Auto Insurance Monthly Rates for Teens

| Insurance Company | Age: 16 Female | Age: 16 Male | Age: 18 Female | Age: 18 Male |

|---|---|---|---|---|

| $743 | $482 | $541 | $604 | |

| $1,033 | $669 | $637 | $840 | |

| $1,199 | $777 | $951 | $975 | |

| $391 | $254 | $298 | $318 | |

| $823 | $533 | $604 | $669 |

| $752 | $487 | $469 | $611 |

| $1,217 | $789 | $883 | $989 | |

| $676 | $438 | $444 | $550 | |

| $1,250 | $811 | $729 | $1,017 | |

| $403 | $261 | $280 | $327 | |

| U.S. Average | $761 | $808 | $560 | $656 |

Utah Farm Bureau offers more competitive rates on auto insurance for teens and young drivers than the national companies, so compare quotes from it and other local insurers before buying.

You can also save money on teen coverage by adding young drivers to an existing policy. Your auto insurance rates will still go up, but not nearly as much as they would with a new policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Utah Auto Insurance Rates by City

Your location within Utah will significantly impact your car insurance rates. Companies use your ZIP code to study traffic rates and fatalities, auto thefts, and the average vehicle cost in your neighborhood to determine risk.

The cities with the most expensive auto insurance in Utah are:

- Kearns

- West Valley City

- Taylorsville

- Holladay

- Mill Creek

- Murray

- West Jordan

- Salt Lake

You may have difficulty finding cheap Salt Lake City, UT — rates in the capital are 10% more expensive than the state average. In Kearns and West Valley, car insurance rates are 15% – 17% higher.

Local drivers in Moab and Logan pay the lowest rates for Utah auto insurance. If you’re curious about quoting auto insurance rates by ZIP code in your city to find the cheapest insurance in Utah, enter your ZIP code above.

The Best Auto Insurance Companies in Utah by Driving Record

Utah auto insurance quotes are expensive after an accident or DUI since you’re considered high-risk and more likely to file a claim. Insurance companies also consider young drivers high-risk and charge them even more for coverage.

Fortunately, you can find affordable high-risk auto insurance in Utah by comparing rates from multiple companies. Companies assess risk differently, and you may find that one insurer doesn’t penalize you for your driving record as much as another.

Below, we compare the cheapest auto insurance companies in Utah for high-risk drivers.

Cheapest Auto Insurance in Utah With an At-Fault Accident

One at-fault accident can raise your monthly rates by $104. Accidents stay on your Utah driving record for four years, and you must file your insurance claim within that period to receive any benefits.

On average, American Family offers the best rates after an accident.

Utah Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| $238 | $180 | |

| $235 | $162 | |

| $259 | $177 | |

| $195 | $113 | |

| $249 | $183 |

| $249 | $144 |

| $268 | $146 | |

| $189 | $158 | |

| $191 | $136 | |

| $104 | $77 | |

| U.S. Average | $244 | $165 |

Every company on this list — except American Family — offers accident forgiveness. What is accident forgiveness? This policy add-on prevents your rates from increasing after your first accident. You’ll pay more per month for this coverage but could save money in the future.

Cheap Auto Insurance After a DUI in Utah

Progressive is a great provider of the best auto insurance for drivers with a DUI in Utah. A DUI will increase your insurance rates by 75% with most companies, but Progressive won’t raise them nearly as high as other companies on this list.

Utah Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $180 | $238 | $244 | $200 | |

| $162 | $235 | $312 | $192 | |

| $177 | $259 | $248 | $215 | |

| $113 | $195 | $213 | $140 | |

| $183 | $249 | $269 | $229 |

| $144 | $249 | $310 | $171 |

| $146 | $268 | $166 | $204 | |

| $158 | $189 | $174 | $174 | |

| $136 | $191 | $284 | $185 | |

| $77 | $104 | $138 | $87 | |

| U.S. Average | $165 | $244 | $295 | $203 |

If you have multiple DUIs on your record, you may be ineligible for coverage in Utah with these major insurers. If so, you’ll have to shop with high-risk companies, potentially requiring you to file for SR-22 auto insurance.

Cheap Auto Insurance in Utah With Bad Credit

Utah car insurance companies use credit scores to determine a driver’s risk — those with a lower credit score pay more for Utah car insurance.

Drivers with bad credit can pay $1,000 or more per year than the average driver. Use the table below to see how Utah auto insurance rates vary by credit score. For more information, see the best auto insurance companies for bad credit.

Utah Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $85 | $105 | $125 |

If you have a poor credit rating, consider raising your deductible for lower rates, and don’t forget to ask about discounts before buying a policy. Most companies in Utah reward drivers for paying bills online or managing coverage with a mobile app, regardless of credit score.

Utah Auto Insurance Laws

Utah is a no-fault insurance state, and drivers must carry minimum auto insurance if:

- They’re residents of Utah

- They’re a non-resident who owns and operates a vehicle in Utah for 90 consecutive days

- Their vehicle is registered in the state of Utah

According to the Utah Department of Motor Vehicles, failing to carry minimum insurance in Utah is a Class-B misdemeanor. Offenders pay between $400 and $1,000 in fines, and the court may suspend your vehicle registration until you buy the proper coverage amount.

Utah Auto Insurance Minimum Coverage Requirements

What auto insurance does Utah require? You must carry minimum liability auto insurance and personal injury protection insurance. This table breaks down the minimum coverage you need in Utah.

Utah Minimum Auto Insurance Requirements

| Liability Auto Insurance | Minimum Coverage Amounts |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person/ $65,000 per accident |

| Property Damage Liability Coverage | $15,000 per accident |

| Personal Injury Protection (PIP) Coverage | $3,000 per accident |

Since it’s a no-fault state, Utah requires PIP to cover you and your passengers’ medical bills after an accident. However, Utah no-fault insurance laws only apply to bodily injuries, not property damage. So you can’t sue the at-fault driver for medical costs unless your injuries are life-altering, including permanent disability or dismemberment.

However, Utahns can sue at-fault drivers for property damage and vehicle repairs. If you’re the at-fault driver, your minimum liability insurance will cover up to $15,000, but you’re responsible for any costs exceeding that limit.

You can choose to carry higher limits or additional coverages to better protect yourself in an accident or collision, but this will raise your insurance rates.

Optional Auto Insurance Coverage in Utah

Utah insurance companies offer additional coverages not required by law, which can protect you financially after an accident. For example, full coverage auto insurance — including the required minimums, collision, and comprehensive coverages — is optional.

Collision coverage applies in accidents involving other vehicles, while comprehensive coverage applies to everything else, from weather damage to auto theft and vandalism. Buying full coverage over liability-only will increase your Utah auto insurance rates, but you’ll pay less out of pocket after an accident.Dani Best Licensed Insurance Producer

If you have an auto loan or lease, your lessor will likely require you to carry full coverage. You may also want to carry GAP insurance in Utah, which covers the remaining amount on your auto loan if your vehicle gets totaled in an accident.

Other auto insurance options in Utah include:

- Uninsured/Underinsured Motorist (UIM): Helps to cover your injuries or property damage caused by another driver with no insurance or insufficient insurance.

- Roadside Assistance: This policy add-on is available with most companies, providing towing, locksmith, and flat tire services. Options vary by company. See best roadside assistance plans for more details.

- Rental Car Reimbursement/Loss of Use: This add-on pays for a rental car while your vehicle is in the shop for repairs.

- Accident Forgiveness: Some insurers won’t raise your rates after your first minor accident, while other companies forgive your first major collision.

Not all policy options are available with every insurance company, so research different insurers to find cheap insurance in Utah.

Utah DUI Laws

DUI laws in Utah are much stricter than in other states. What is a DUI, exactly? The state defines “driving under the influence” as having a blood alcohol concentration of .05% and will charge young drivers under 21 with any detectable amount of drugs or alcohol.

Fines, license suspensions, and jail time will vary based on a driver’s age and the number of offenses.

Utah DUI Laws

| Utah DUI Penalties | First Offense | Second Offense | Third Offense |

|---|---|---|---|

| Jail Time | Up to 180 days; mandatory 2 days with 48 hours community service | Up to 180 days; mandatory 10 days (or 5 with 30 days electronic monitoring) | Up to 5 years; mandatory 62 days |

| License Suspension | 120 days | Two years | Two years |

| Fines | $1,310+ | $1,560+ | $2,850+ |

| Ignition Interlock Device (IID) | Up to one year mandatory with BAC of .16% or more | Two years | Two years |

According to the Utah Department of Public Safety, If you get a DUI charge in Utah, you have 10 days to request a hearing with the Utah Drivers License Division. You’ll lose your driving privileges and likely need to file SR-22 insurance to drive again legally with a restricted license.

Your insurance rates will increase, so keep reading to learn how to save money on high-risk auto insurance in Utah.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Utah SR-22 Auto Insurance Coverage

SR-22 insurance in Utah isn’t an insurance policy. It’s a legal form proving financial responsibility after registration or license suspension. It proves you carry the minimum coverage levels required to drive.

Depending on your driving record, you may have to buy more than the 25/65/15 liability minimums. Utah state law requires SR-22 filings if you face charges for:

- DUI

- Driving without insurance

- Driving with a suspended license/without a license

- Causing an auto accident

You’ll also need SR-22 insurance if you accumulate too many points on your license for traffic violations, including speeding tickets.

How much does SR-22 cost in Utah? The filing fee costs between $15 – $25, but filing the SR-22 form with your insurance company puts you in the high-risk category. Insurers will charge higher rates, and you may even lose coverage with your current company if it doesn’t file SR-22.

The most popular companies for cheap SR-22 auto insurance in Utah are:

- USAA

- Geico

- State Farm

- Progressive

- Nationwide

- Farmers

If your insurer doesn’t offer SR-22 filings, you’ll have to shop with these or other local companies catering to high-risk drivers. These insurance companies will file SR-22 with the Utah DMV on your behalf and renew your policy for the mandatory three years as required by state law.

How to Acquire an SR-22 Certificate for Utah Auto Insurance

Filing SR-22 is easy once you find the right insurance company. So if you already have an auto policy, follow the steps below to get SR-22 insurance in Utah:

- Contact Your Insurance Agent: Ask them to file the SR-22 form for you.

- Confirm Coverage: You must carry at least liability insurance to file SR-22, and the court may order you to carry higher limits.

- Pay Filing Fee: The SR-22 filing fee costs between $15 and $25 in Utah.

- Confirm SR-22 Coverage: You’ll receive an email or letter in the mail confirming your SR-22 coverage is in place.

You must pay the SR-22 filing fee up front, and your insurance rates will increase at the next renewal period.

Utah SR-22 Without Auto Insurance

If you don’t have a current policy, you must ask for SR-22 when applying for coverage. Most agents will ask you directly if you need to file when buying over the phone or in person. Insurance websites will also prompt you to choose “yes” or “no” if you need SR-22 when shopping online.

Once you request SR-22 coverage, you may have to pay an additional fee before the insurer agrees to underwrite you and file the form. When the payment is processed, the insurance company will file SR-22 for you. You’ll receive confirmation of auto insurance coverage and SR-22 coverage in the mail.

Utah SR-22 Without a Vehicle

Knowing how to insure a car that is not in your name is just also important and requires a non-owner SR-22 insurance policy. You’ll need non-owner SR-22 insurance if you regularly drive a vehicle you don’t own.

Non-owner SR-22 insurance is more expensive, but you can still find affordable rates from most major companies in Utah, including USAA, Geico, and State Farm.

Once you choose your auto insurance company, follow the same steps above to file SR-22 without a vehicle. However, your insurance rates will increase once you file the non-owner SR-22 form.

The good news is that each company treats driving offenses differently — you could find cheaper rates with a new insurer based on your current driving record. So, save money and shop around for quotes from at least three other companies before asking your insurer to file.

More About How to Get Cheap Auto Insurance in Utah

The best Utah car insurance company for you depends on several personal factors, including your age and the coverage amount you need. We recommend carrying full coverage auto insurance to protect you and your vehicle completely, but you’ll pay more for the best Utah auto insurance.

On average, you can expect to pay $120 per month for full coverage insurance in Utah, with Geico offering the best rates. You will pay more if you’re a high-risk driver and need high-risk auto insurance. But you can still find affordable policies from State Farm or Progressive after an accident or DUI.

You can get cheap Utah auto insurance rates by increasing your deductibles or reducing your coverage. Utah law requires drivers to carry 25/65/15 in liability coverage and $3,000 in PIP. Maintaining these minimums will get you the lowest rates, but you’ll be financially responsible for your own bills after an accident.

Avoid that risk by shopping for auto insurance quotes online. Despite competitive rates from top companies like Geico, USAA, and State Farm, you may find much better prices with local companies like Bear River Car Insurance.

We recommend knowing how to get multiple auto insurance quotes and comparing affordable Utah auto insurance quotes from multiple companies to ensure you aren’t overpaying for coverage in your state. It’s the easiest way to get cheap car insurance in Utah.

Take advantage of our free comparison tool below and compare Utah auto insurance quotes from local companies today. Enter your ZIP to get started.

Frequently Asked Questions

Who has the cheapest car insurance in Utah?

Geico consistently offers the cheapest rates for full coverage auto insurance in Utah. If you have DUIs or speeding tickets on your record, you may find cheaper Utah car insurance with Progressive.

How much is car insurance in Utah per month?

Utah auto insurance rates average $147 monthly for full coverage and $45 for liability.

Can my auto insurance rates be affected by my credit score in Utah?

Yes, in Utah, insurance companies can consider your credit score when determining your auto insurance rates. Insurers may use credit-based insurance scores to assess the likelihood of you filing a claim. It’s essential to maintain a good credit score to potentially qualify for better insurance rates (read more: Best Companies for Credit-Based Auto Insurance).

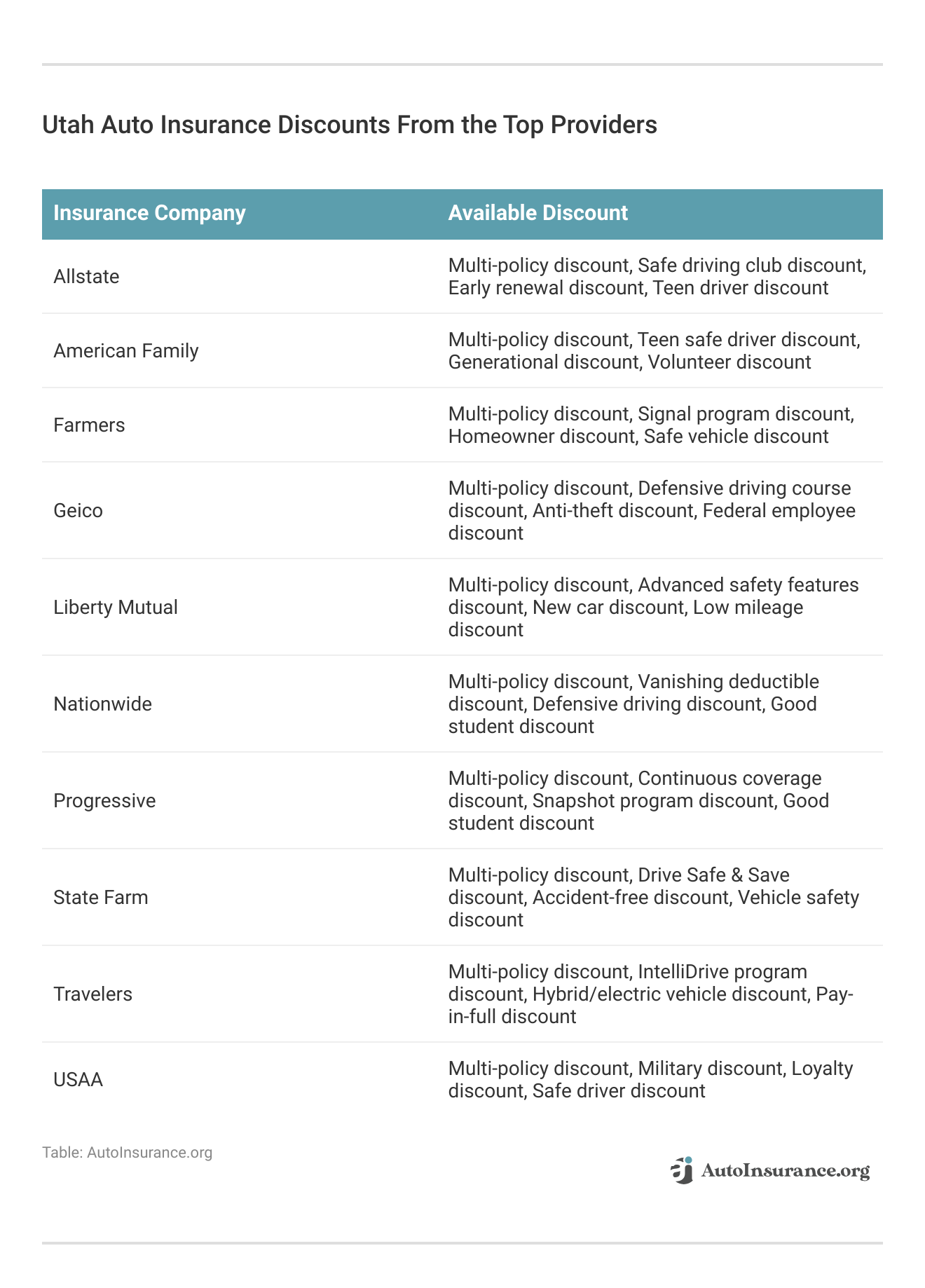

Are there any discounts available for auto insurance in Utah?

Yes, insurance providers in Utah often offer various discounts that can help you save on your auto insurance premiums. Some common discounts include safe driver discounts, multi-policy discounts, anti-theft device discounts, and discounts for completing defensive driving courses.

What is the minimum auto insurance required in Utah?

All drivers must carry bodily injury liability insurance, property damage liability insurance, and personal injury protection insurance in Utah.

Is full coverage auto insurance required in Utah?

No, full coverage insurance in Utah is not required by the state. However, your lender will require you to carry it (learn more: Do I need full coverage insurance to finance a car?).

Is no-fault insurance required in Utah?

Yes, Utah requires drivers to have personal injury protection insurance in Utah.

Do you need car insurance in Utah?

Yes, all drivers must carry the required Utah auto insurance coverage. Drivers who don’t carry insurance will be breaking the auto insurance laws in Utah.

Who is the best Utah auto insurance company?

Nationwide has the best UT car insurance for most drivers. However, you should still get Utah insurance quotes from multiple companies to find the best deal. Compare rates today with our free tool.

How can you get cheap SR22 insurance in Utah?

Utah SR22 will be more expensive than regular insurance, but shopping around for quotes may help lower rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.