Best Windshield Replacement Coverage in Connecticut (Top 10 Companies in 2025)

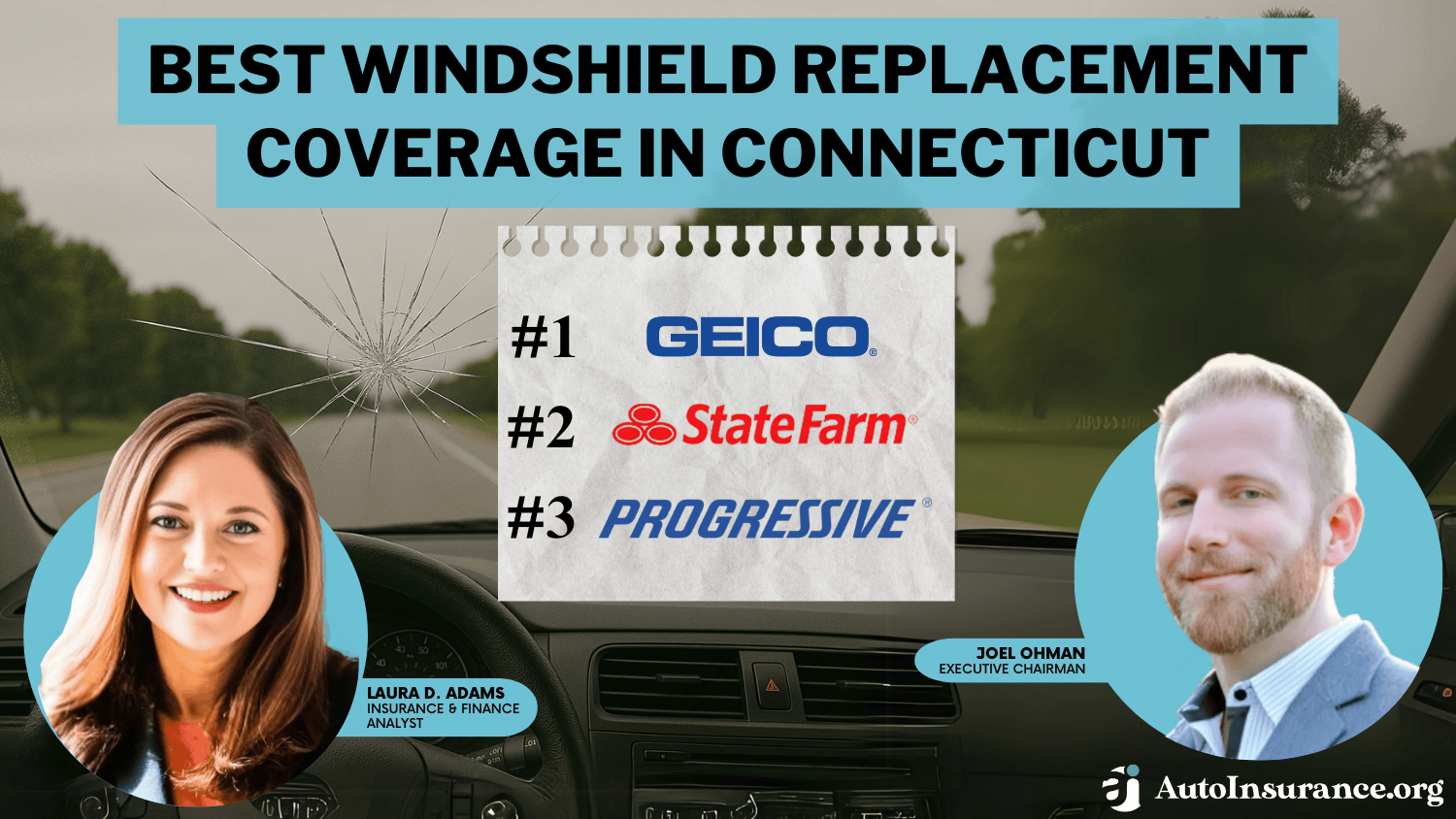

Geico, Progressive, and State Farm offer the best windshield replacement coverage in Connecticut, starting at $85 per month. Geico has the best rates, State Farm provides personalized service, and Progressive offers flexible options, making them the best choice for affordable and reliable windshield protection.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

UPDATED: Apr 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsGeico stands out as the top choice for the best windshield replacement coverage in Connecticut, with rates starting at just $85 per month.

Alongside State Farm and Progressive, they offer affordable plans and comprehensive coverage tailored to your driving needs.

Our Top 10 Company Picks: Best Windshield Replacement Coverage in Connecticut

| Company | Rank | A.M. Best | Repair Incentive | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | A++ | ✅ | Affordable Rates | Geico |

|

| #2 | A++ | ✅ | Personalized Service | State Farm |

|

| #3 | A+ | ✅ | Flexible Options | Progressive |

|

| #4 | A++ | ✅ | Premier Coverage | Travelers |

|

| #5 | A+ | ✅ | Deductible Rewards | Allstate |

|

| #6 | A+ | ✅ | Vanishing Deductible | Farmers | |

| #7 | A | ✅ | Better Replacement | Liberty Mutual |

| #8 | A++ | ❌ | Excellent Service | USAA |

|

| #9 | A | ❌ | Customizable Plans | Nationwide |

| #10 | A | ❌ | Member Rewards | AAA |

Replacing your windshield promptly in Connecticut is crucial for safety, despite legal allowances for driving with minor damage. Check your insurance coverage for glass repair options and explore local repair shops.

- Geico provides competitive pricing starting from $85 per month

- Leading insurance companies present opportunities for windshield replacements

- Numerous discount opportunities exist for windshield replacement coverage

Understanding car insurance, state laws, and your policy helps you make informed decisions about protecting your vehicle. Enter your ZIP code to compare windshield coverage in CT.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordable Rates: Known for offering some of the lowest premiums in the industry. Read more in our Geico auto insurance review.

- Strong Financial Stability: Rated A++ by A.M. Best, indicating excellent financial health.

- Convenient Online Tools: Provide a seamless website and app experience for all users.

Cons

- Limited Local Agents: Fewer in-person agents compared to other major insurers.

- Mixed Customer Service Reviews: Some customers report inconsistent service experiences.

#2 – State Farm: Best for Personalized Service

Pros

- Excellent Customer Service: Top-notch customer satisfaction ratings and a wide-reaching agent network.

- Complete Coverage Solution: Wide range of insurance products and add-ons. Read more in our State Farm auto insurance review.

- Financial Strength: A++ rating from A.M. Best, indicating robust financial health.

Cons

- Higher Premiums: Generally pricier than some competitors.

- Limited Discounts: Fewer discounts compared to some other insurance companies.

#3 – Progressive: Best for Flexible Options

Pros

- Snapshot Program: Provides usage-based insurance and potential discounts for safe driving.

- Extensive Protection Plans: Both have a wide variety of coverage plans with customizable options.

- Strong Online Presence: Our Progressive auto insurance review discusses the excellent website and app functionality for policy management.

Cons

- Price Variability: Prices vary significantly depending on the individual’s driving history and location.

- Fair Customer Service: Customer service experiences can be hit or miss.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Travelers: Best for Premier Coverage

Pros

- Premier Coverage Options: Provides a range of standard to full coverage options.

- Strong Financial Ratings: Rated A++ by A.M. Best.

- Discount Opportunities: A wide range of discount options, including safe driving discounts and multi-policy discounts.

Cons

- Limited Availability: Our Travelers auto insurance review shows that it is not as widely available in rural areas.

- Enhanced Premium Pricing: Can be more expensive compared to some competitors.

#5 – Allstate: Best for Deductible Rewards

Pros

- Deductible Rewards: A program that rewards safe driving with lower deductibles.

- Reliable Agent Team: Extensive network of local agents for personalized service.

- Total Coverage Plans: Wide variety of coverage and add-on options.

Cons

- Higher Rates: Generally, higher premiums than many competitors. Use our Allstate auto insurance review as your guide.

- Mixed Claims Satisfaction: Customers report varying experiences with claims processing.

#6 – Farmers: Best for Vanishing Deductible

Pros

- Vanishing Deductible: The deductible reduces over time with safe driving.

- Personalized Policies: Farmers, as mentioned in our Farmers auto insurance review, offers customizable policy options.

- Strong Agent Network: Personal service with thousands of local agents.

Cons

- Exclusive Discounts: Fewer discounts compared to some other insurers.

- Raised Policy Fees: Generally higher rates than many competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Better Replacement

Pros

- Better Car Replacement: Provides replacement of CT car glass as well as replacement of a new car in case of total loss.

- Wide Range of Discounts: Numerous discounts are available for various customer groups.

- Customizable Policies: Customize policies to fit different people.

Cons

- Higher Rates for Some Drivers: Premiums can be higher, especially for young or high-risk drivers.

- Average Customer Service: Customer service quality can vary. For further insights, refer to our Liberty Mutual auto insurance review.

#8 – USAA: Best for Excellent Service

Pros

- Exceptional Customer Service: High customer satisfaction ratings consistently.

- Competitive Rates for Military: Offers some of the best rates for military families.

- Comprehensive Coverage Options: A wide range of insurance products and coverages.

Cons

- Restricted Membership: Available only to members of the military and their families. Read more through our USAA auto insurance review.

- Average App Functionality: The mobile app is functional but not as advanced as some competitors.

#9 – Nationwide: Best for Customizable Plans

Pros

- Highly Customizable Plans: As discussed in our Nationwide insurance review, the company offers extensive customization options for coverage.

- Strong Mobile App: Excellent app for policy management and claims processing.

- Decreasing Deductible: Reduces your deductible for safe driving over time.

Cons

- Higher Rates for High-Risk Drivers: Rates can be higher for those with poor driving records.

- Uneven Customer Satisfaction: Customer service experiences can vary widely.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – AAA: Best for Member Rewards

Pros

- Member Rewards: Provides many benefits and discounts to its members.

- Reliable Roadside Assistance: Renowned for great roadside assistance services.

- Wide Coverage Options: A wide range of available insurance products. Learn more in our AAA auto insurance review.

Cons

- Membership Required: Must be an AAA member to access certain discounts and services.

- Costlier Premiums: Generally higher rates compared to some other insurers.

CT Windshield Replacement Insurance Rates

Connecticut auto insurers are required to offer full glass coverage for a cracked windshield, often referred to as zero-deductible or auto glass coverage. While not mandatory, drivers can opt for policies with higher deductibles to get lower rates.

CT Windshield Replacement Full Coverage Monthly Rates by Provider

| Insurance Company | Full Coverage |

|---|---|

| $116 |

| $269 | |

| $207 | |

| $85 | |

| $276 |

| $153 |

| $182 | |

| $125 | |

| $114 | |

| $106 |

Compare CT windshield replacement monthly rates by coverage level and provider. Geico offers the lowest full coverage at $85 per month, while rates can vary from $85 to $276 depending on the insurer.

Full coverage is pricier but offers better protection. Choose based on your vehicle’s value. For example, a higher deductible can help lower your premium.Jeff Root Licensed Insurance Agent

This coverage is usually part of comprehensive insurance, also covering theft, fire, or storms. Choosing the best car insurance for windshield coverage is ideal for newer cars, while older vehicles may see limited benefit.

Windshield Replacement Discounts in CT

In auto glass replacement, there are three options: OEM, Aftermarket, and Used. OEM matches your vehicle exactly, Aftermarket is more affordable, and Used comes from low-mileage vehicles. Most auto glass insurance companies cover these options, depending on your policy.

Auto Insurance Discounts for Windshield Replacement Coverage in CT

| Insurance Company | Anti-Theft | Auto-Pay | Bundling | Good Student | Loyalty |

|---|---|---|---|---|---|

| 8% | 5% | 15% | 14% | 12% |

| 25% | 4% | 25% | 25% | 15% | |

| 25% | 4% | 25% | 20% | 18% | |

| 10% | 5% | 20% | 15% | 12% | |

| 25% | 7% | 25% | 15% | 10% | |

| 35% | 15% | 25% | 12% | 10% |

| 25% | 12% | 10% | 10% | 13% | |

| 15% | 13% | 17% | 35% | 6% | |

| 15% | 10% | 13% | 8% | 9% | |

| 15% | 6% | 10% | 10% | 11% |

Consider your vehicle’s age and comprehensive auto insurance coverage, which may cover certain types of glass replacements.

The level of coverage and potential out-of-pocket costs can vary, so reviewing your policy details is essential.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Windshield Repair and Replacement Options in Connecticut

Your auto policy dictates how you address glass damage. Liability and uninsured/underinsured motorist coverage mean all repair costs are your responsibility. With comprehensive coverage that includes full glass coverage, filing a claim is a reasonable option. If repair costs are below your deductible, pay out-of-pocket.

Consult your agent if costs exceed your deductible slightly to avoid potential rate increases, especially if you’re on high-risk auto insurance. Some insurance companies offer smartphone applications to help with the claims process, allowing you to document damage and file claims directly within the app.

For cars equipped with ADAS safety features, insurance often mandates service from a dealer selling your car’s make due to required recalibration post-windshield replacement. Older cars offer more flexibility in choosing a service shop.

Reasons to opt out of insurer recommendations include past experience, OEM part preference, or cost differences, which, if exceeding the insurer’s estimate, require out-of-pocket coverage under state law. If you decide to file a car insurance claim, consider your options carefully.

Affordable Windshield Replacement Coverage in Connecticut

The best windshield replacement coverage in Connecticut is offered by top providers like Geico, State Farm, and Progressive.

These companies deliver affordable monthly rates starting at $85 per month, along with full glass coverage, low deductibles, and fast claims processing, highlighting the key benefits of auto insurance and making them the top choice for dependable auto glass protection.

Make sure to tackle broken glass quickly to ensure safe driving. Enter your ZIP code to get started comparing rates.

Frequently Asked Questions

Is auto glass insurance only available without a deductible?

Some insurers offer zero-deductible options for auto glass insurance only, but others may include a small deductible. It depends on your provider and policy.

Should I use insurance to replace my windshield if I have full glass coverage?

Yes, if you have full glass or zero-deductible coverage, it often covers the replacement without any cost to you.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

Do Progressive $0 glass deductible policies in states that automatically include free windshield replacement?

Not automatically. You must add full glass coverage to your comprehensive policy to qualify for a $0 auto insurance deductible windshield replacement.

Does Geico’s full glass coverage apply to side and rear windows?

Yes, Geico full glass coverage can extend to side and rear windows if your comprehensive policy includes full glass protection. Check your specific plan for details.

Will a Progressive windshield replacement claim raise my premium?

Typically, a single comprehensive claim, such as windshield replacement, does not increase your premium, but multiple claims could affect your rates.

Is it worth using insurance for windshield replacement after a minor chip or crack?

For small chips, paying out of pocket might be cheaper and faster, while a comprehensive auto insurance claim is better suited for major damage or full windshield replacement.

Are windshields covered by insurance in CT if the damage is from a rock or debris?

Yes, comprehensive insurance generally covers windshield cracks or chips caused by road debris, such as rocks.

Is auto glass insurance coverage included in standard auto insurance?

It’s typically part of comprehensive coverage, but not always included by default. Check your policy or ask your provider to confirm.

What car insurance covers windshield replacement for no out-of-pocket cost?

The cheapest full coverage auto insurance often includes full glass coverage, waiving your deductible for windshield replacement with no out-of-pocket cost.

How quickly can I schedule a windshield replacement in Connecticut?

Most repairs can be scheduled within 1–3 days, depending on availability and whether OEM parts are needed.

How can I improve my conversion rate with auto glass leads in CT?

Respond quickly, offer competitive pricing, provide mobile services, and highlight warranties to increase trust and conversion.

How do I tell if my insurance covers windshield replacement after a storm or vandalism?

Storm and vandalism damage are covered under comprehensive, usually part of full coverage auto insurance, so check your policy to confirm windshield replacement.

Does State Farm auto glass coverage require a deductible?

Yes, but if you have full glass coverage added to your comprehensive policy, State Farm may waive the deductible for repairs, especially for minor cracks or chips.

Are recalibration costs covered under the CT windshield replacement law?

CT windshield replacement law doesn’t mandate coverage for ADAS recalibration, so it depends on your insurer and specific policy terms.

Are there specific laws regulating windshield repair in Connecticut?

Yes, Connecticut law requires insurers to offer full glass coverage with zero deductible, but it’s optional for auto insurance policyholders.

Start saving on your CT auto insurance by entering your ZIP code and comparing quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Joel Ohman

Executive Chairman

Joel Ohman is the CEO of a private equity-backed digital media company. He is a published author, angel investor, and serial entrepreneur who has a passion for creating new things, from books to businesses. He has previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He has an MBA from the University of South Florida. Joel has been mentione...

Executive Chairman

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.