Best Windshield Replacement Coverage in Minnesota (Top 10 Companies in 2025 )

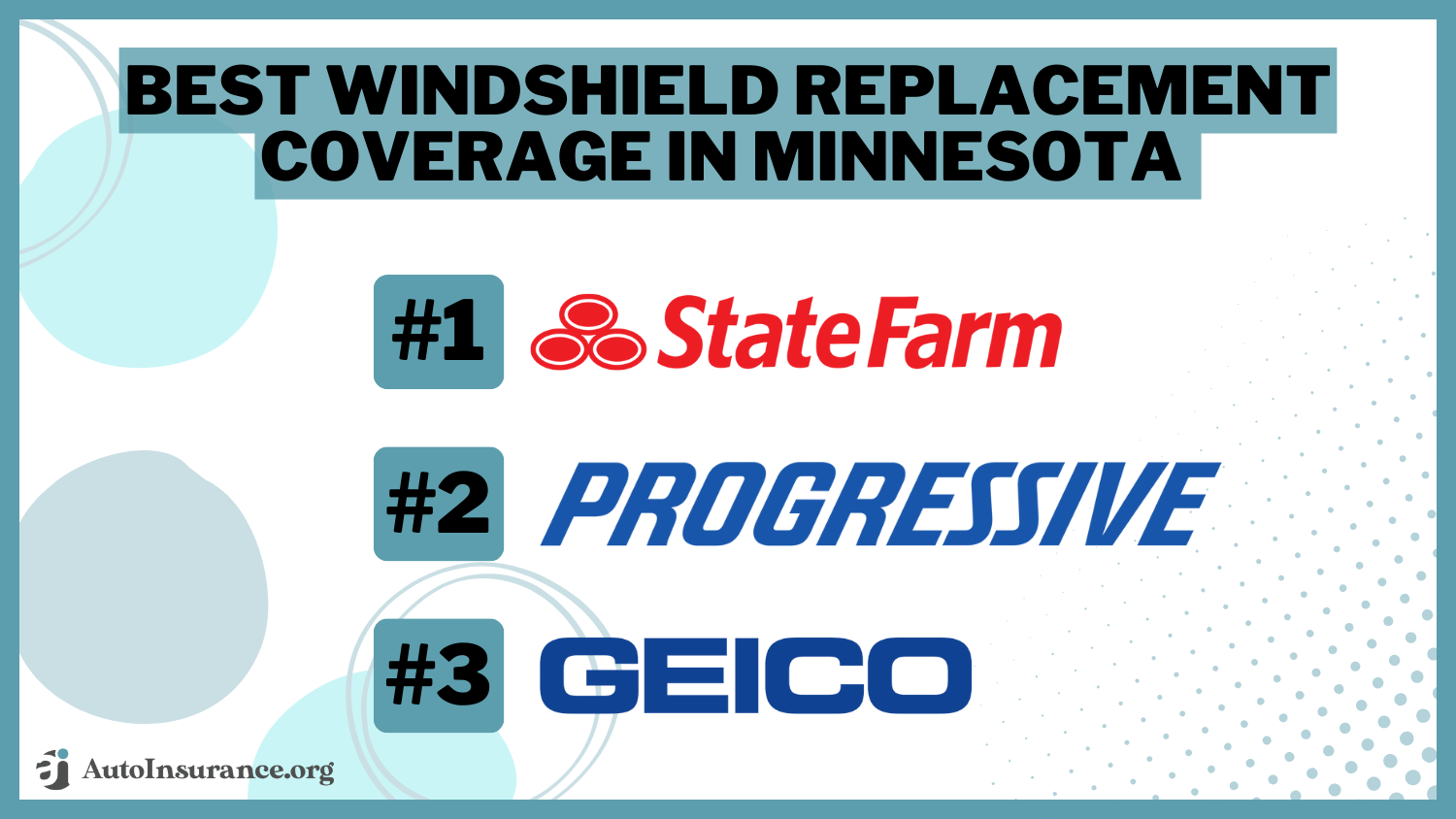

State Farm, Progressive, and Geico offer the best windshield replacement coverage in Minnesota, beginning at just $52 per month. We aim to assist you in comparing quotes from these trusted providers, ensuring you secure optimal coverage for your peace of mind, along with tailored discounts for your vehicle.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage Windshield Replacement in MN

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage Windshield Replacement in MN

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage Windshield Replacement in MN

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews- State Farm offers competitive rates beginning at $52 monthly

- Leading insurance firms offer potential savings for windshield replacement

- There are various discount options for windshield replacement coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Wide Network: State Farm has a vast network of agents and service centers across the country, providing convenience and accessibility for customers. Find out more in our State Farm auto insurance review.

- Strong Financial Stability: With its high financial strength ratings, State Farm offers peace of mind to customers knowing that their claims are backed by a financially stable company.

- Personalized Service: State Farm is known for its personalized customer service, with agents who are dedicated to understanding individual needs and providing tailored insurance solutions.

Cons

- Potentially Higher Rates: While State Farm offers comprehensive coverage and personalized service, its rates may be slightly higher compared to some competitors.

- Limited Online Tools: State Farm’s online tools and digital capabilities may not be as robust as some other insurance providers, which could be a drawback for customers who prefer managing their policies online.

#2 – Progressive: Best for Online Convenience

Pros

- Advanced Technology: Progressive is known for its innovative use of technology, offering tools like Snapshot, which can help customers save on their premiums by monitoring driving habits.

- Wide Range of Discounts: In our Progressive auto insurance review, Progressive offers a variety of discounts, including multi-policy, safe driver, and online quote discounts, making it easier for customers to save on their premiums.

- Convenient Claims Process: Progressive’s claims process is streamlined and user-friendly, with options for online claims filing and tracking, providing added convenience for customers.

Cons

- Varied Customer Service Experience: While some customers praise Progressive’s customer service, others have reported mixed experiences, with some encountering challenges in resolving issues.

- Limited Agent Availability: Progressive primarily operates online and through phone support, which means customers who prefer face-to-face interactions with agents may find their options limited.

#3 – Geico: Best for Cheap Rates

Pros

- Competitive Rates: Geico is often praised for its competitive rates, making it an attractive option for budget-conscious customers.

- Online Convenience: Geico’s website and mobile app offer a seamless and intuitive experience, allowing customers to manage their policies, file claims, and access resources easily.

- Strong Financial Strength: Geico’s strong financial stability and high ratings provide reassurance to customers that their claims will be handled promptly and efficiently.

Cons

- Limited Coverage Options: Geico may not offer as many optional coverages and endorsements as some other insurers, which could be a drawback for customers seeking extensive coverage. Read more in our Geico auto insurance review.

- Less Personalized Service: Due to its direct-to-consumer model, Geico may provide less personalized service compared to companies with a network of local agents, which could be a downside for customers who prefer more hands-on assistance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Add-on Coverages

Pros

- Extensive Coverage Options: Allstate offers a wide range of coverage options and customizable policies, allowing customers to tailor their insurance plans to suit their specific needs.

- Innovative Tools: Allstate provides innovative tools like Drivewise, which tracks driving behavior to offer potential discounts, and the QuickFoto Claim feature, which allows customers to submit claims quickly using their mobile devices.

- Strong Financial Stability: With its solid financial strength ratings, Allstate offers reliability and security to policyholders, ensuring that claims are handled promptly and efficiently.

Cons

- Higher Premiums: Allstate’s premiums may be higher compared to some competitors, especially for customers with certain risk profiles or coverage needs. Use our Allstate auto insurance review as your guide.

- Mixed Customer Service Reviews: While Allstate’s customer service receives praise for its responsiveness and professionalism from some customers, others have reported dissatisfaction with claims handling and communication.

#5 – American Family: Best for Student Savings

Pros

- Personalized Service: American Family emphasizes personalized service, with local agents who are dedicated to understanding customers’ needs and providing tailored insurance solutions.

- Strong Community Focus: American Family is known for its community involvement and support, fostering a sense of trust and loyalty among customers.

- Comprehensive Coverage: American Family offers a wide range of coverage options and discounts, allowing customers to build policies that meet their unique needs and budgets.

Cons

- Limited Availability: American Family operates primarily in select regions, which may limit its availability for customers in certain areas.

- Potentially Higher Rates: Our examination of American Family insurance review reveals, while American Family provides comprehensive coverage and personalized service, its rates may be higher compared to some competitors, depending on factors such as location and driving history.

#6 – Farmers: Best for Local Agents

Pros

- Variety of Discounts: Farmers offers a variety of discounts, including multi-policy, good student, and safe driver discounts, making it easier for customers to save on their premiums.

- Strong Claims Handling: Farmers is known for its efficient and responsive claims handling, with dedicated claims representatives who guide customers through the process and ensure timely resolution.

- Customizable Policies: Farmers, as mentioned in our Farmers auto insurance review, provides customizable policies with a range of coverage options and endorsements, allowing customers to tailor their insurance plans to their specific needs.

Cons

- Limited Online Tools: Farmers’ online tools and digital capabilities may not be as robust as some other insurers, which could be a drawback for customers who prefer managing their policies online.

- Potentially Complex Pricing: Farmers’ pricing structure may be complex, with various factors influencing premiums, which could make it challenging for customers to understand their rates and compare quotes effectively.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Usage Discount

Pros

- Nationwide Availability: Nationwide, as mentioned in our Nationwide insurance review, operates in all 50 states, providing coverage options to customers across the country, offering convenience and accessibility.

- Member Benefits: Nationwide offers various membership benefits and discounts through programs like the Nationwide SmartRide program, which rewards safe driving behaviors with potential premium discounts.

- Financial Strength: Nationwide boasts strong financial stability and high ratings, ensuring that policyholders can trust in the company’s ability to fulfill claims and provide reliable coverage.

Cons

- Mixed Customer Service Reviews: Nationwide’s customer service reviews are mixed, with some customers praising the company’s responsiveness and professionalism, while others have reported dissatisfaction with claims handling and communication.

- Limited Coverage Options: Nationwide may not offer as many optional coverages and endorsements as some other insurers, which could be a drawback for customers seeking extensive or specialized coverage.

#8 – Travelers: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Travelers offers accident forgiveness programs, allowing customers to maintain their rates even after a covered accident, providing added peace of mind.

- Flexible Policy Options: Travelers provides flexible policy options and customizable coverage, allowing customers to tailor their insurance plans to suit their individual needs and budgets.

- Strong Financial Stability: Our Travelers auto insurance review reveals that with its high financial strength ratings, Travelers offers reliability and security to policyholders, ensuring that claims are handled promptly and efficiently.

Cons

- Higher Premiums: Travelers’ premiums may be higher compared to some competitors, especially for customers with certain risk profiles or coverage needs.

- Limited Discounts: Travelers may not offer as many discounts as some other insurers, which could be a drawback for customers seeking additional savings opportunities.

#9 – Liberty Mutual: Best for Customizable Policies

Pros

- Customizable Policies: Liberty Mutual offers customizable policies with a range of coverage options and endorsements, allowing customers to tailor their insurance plans to their specific needs.

- 24/7 Support: Liberty Mutual provides 24/7 customer support, ensuring that policyholders can access assistance whenever they need it, whether it’s for claims, questions, or emergencies.

- Convenient Claims Process: Liberty Mutual’s claims process is streamlined and user-friendly, with options for online claims filing and tracking, providing added convenience for customers. For further insights, refer to our Liberty Mutual auto insurance review.

Cons

- Potentially Higher Rates: Liberty Mutual’s premiums may be higher compared to some competitors, especially for customers with certain risk profiles or coverage needs.

- Mixed Customer Service Reviews: Liberty Mutual’s customer service reviews are mixed, with some customers praising the company’s responsiveness and professionalism, while others have reported dissatisfaction with claims handling and communication.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Auto-Owners: Best for 24/7 Support

Pros

- Local Agents: Auto-Owners operates through a network of local agents, providing personalized service and expertise to customers in their communities.

- Strong Financial Stability: With its high financial strength ratings, Auto-Owners offers reliability and security to policyholders, ensuring that claims are handled promptly and efficiently.

- Wide Range of Coverages: Auto-Owners offers a wide range of coverages, including specialized options like umbrella insurance and identity theft coverage, allowing customers to build comprehensive insurance plans.

Cons

- Limited Availability: Auto-Owners operates primarily in select regions, which may limit its availability for customers in certain areas. Read more in our Auto-Owners auto insurance review for your guidance.

- Less Online Accessibility: Auto-Owners’ online tools and digital capabilities may be less robust compared to some other insurers, which could be a drawback for customers who prefer managing their policies online.

Understanding Windshield Replacement and Insurance in Minnesota

Minnesota’s Regulations for Damaged Windshields

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Minnesota’s Coverage

Occasionally, severe hailstorms may cause damage to other glass areas surrounding the car, in addition to the windshield. Some policies may include full glass coverage, which encompasses the rear, driver, and passenger windows.

To determine what your policy includes, it’s best to consult your insurance company. If your current policy does not cover windshield replacement, inquire about adding it to your existing coverage. Additionally, consider checking if liability auto insurance coverage extends to glass damage in your policy.

Understanding the Minnesota Windshield Replacement Law

Frequently Asked Questions

Does auto insurance in Minnesota cover windshield replacement?

Yes, auto insurance policies in Minnesota often include coverage for windshield replacement. However, the specific coverage and terms can vary depending on the insurance company and the policy you have.

What type of auto insurance coverage typically includes windshield replacement?

Windshield replacement coverage is usually part of comprehensive coverage. Comprehensive coverage helps protect against non-collision-related damages to your vehicle, including damage caused by factors like theft, vandalism, weather events, and falling objects, such as rocks or debris that can damage your windshield. Enter your ZIP code now.

Is windshield replacement covered under Minnesota’s mandatory auto insurance requirements?

Do I need to pay a deductible for windshield replacement?

The deductible is the portion of the repair or replacement cost that you are responsible for paying out of pocket. For windshield replacement coverage, some insurance policies have a separate deductible specifically for glass damage, while others may include a deductible that applies to all comprehensive claims. Review your policy documents or contact your insurance provider to determine the deductible amount and how it applies to windshield replacement.

Can I choose any windshield repair or replacement service provider?

Insurance policies may have preferred service providers or networks with which they work for windshield repair or replacement. These preferred providers often offer direct billing to the insurance company, making the process more convenient for policyholders. However, some policies may allow you to choose any reputable service provider, and you may need to submit the claim for reimbursement. Check your policy or contact your insurance provider for details on approved service providers. Enter your ZIP code now to start.

Will filing a claim for windshield replacement affect my insurance rates?

How do I file a windshield replacement claim in Minnesota?

To file a windshield replacement claim in Minnesota, follow these general steps:

- Contact your insurance provider: Notify your insurance company as soon as possible to report the windshield damage and initiate the claims process. They will guide you through the necessary steps.

- Provide necessary information: Be prepared to provide details about the damage, the circumstances surrounding the incident, and your policy information.

- Follow the insurance company’s instructions: Your insurance company will provide instructions on how to proceed, which may include scheduling an inspection or providing documentation.

- Schedule windshield replacement: If your claim is approved, work with your insurance company’s approved service provider or a provider of your choice to schedule the windshield replacement.

- Pay the deductible: If you have a deductible, you may need to pay it directly to the service provider at the time of repair or replacement.

What factors should be considered when comparing windshield replacement coverage options in Minnesota?

Factors to consider when comparing windshield replacement coverage options in Minnesota include coverage details, deductible amounts, repair shop options, and any additional benefits offered by the insurance providers. Enter your ZIP code now to start comparing.

How does Minnesota law impact auto insurance coverage for windshield replacement?

What features differentiate the top insurance providers mentioned?

The top insurance providers mentioned in the article differentiate themselves through factors such as competitive rates, wide coverage options, personalized service, innovative technology, and strong financial stability ratings. Each provider offers unique features and benefits tailored to meet the diverse needs of customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.