Best Windshield Replacement Coverage in South Dakota (Top 10 Companies in 2025)

State Farm, Progressive, and Farmers offer the best windshield replacement coverage in South Dakota, starting for only $75 per month. Our objective is to aid you in comparing quotes from these insurers, guaranteeing you secure the finest coverage and personalized discounts tailored to your vehicle.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Full Coverage Windshield Replacement in South Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage Windshield Replacement in South Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 3,072 reviews

3,072 reviewsCompany Facts

Full Coverage Windshield Replacement in South Dakota

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews- State Farm presents cost-effective rates beginning at $75 monthly

- Leading insurance firms offer a range of choices for windshield replacements

- Various discounts are accessible for coverage on windshield replacement

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

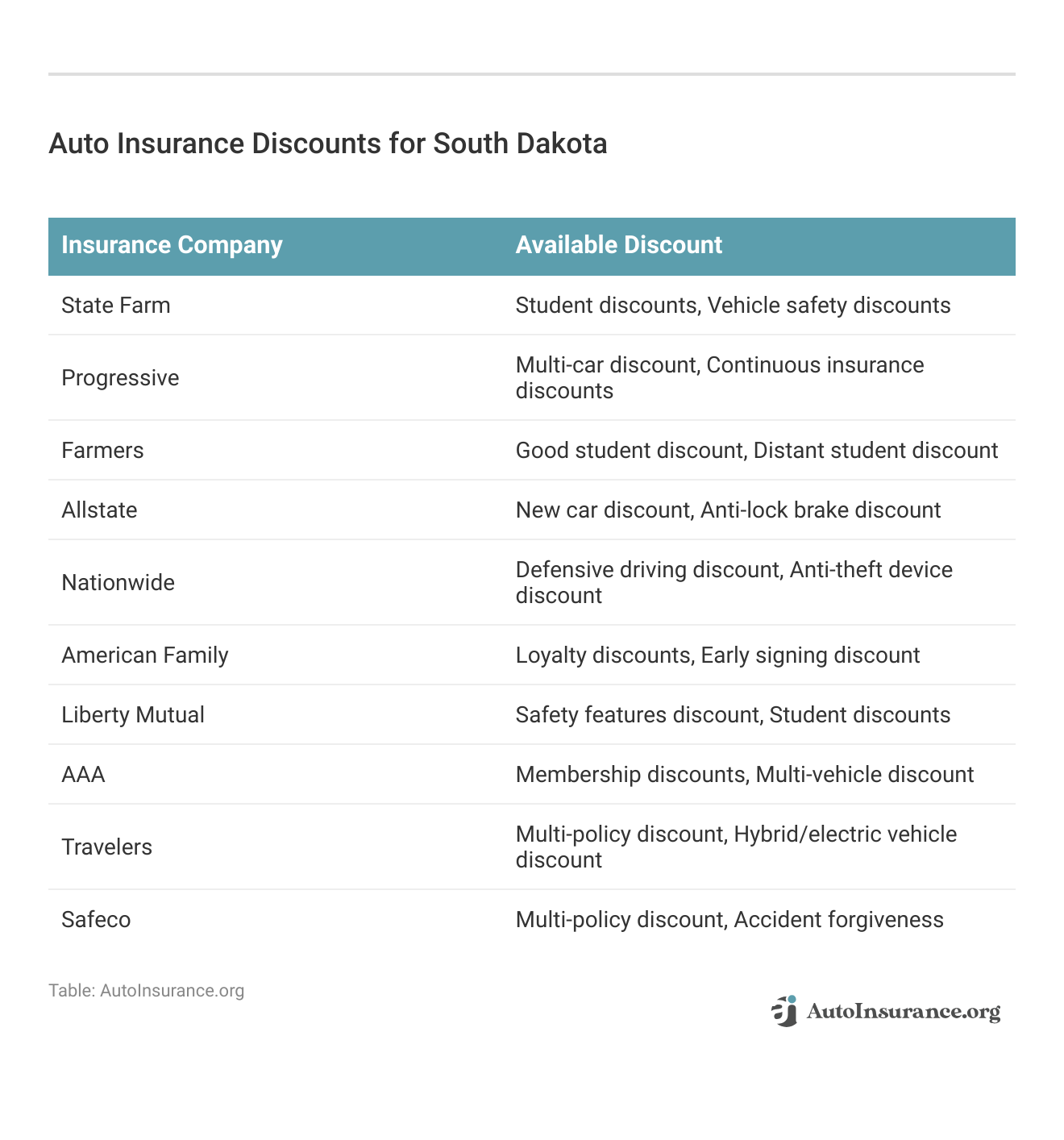

#1 – State Farm: Top Overall Pick

Pros

- Extensive Network: State Farm has a large network of agents and service centers, making it easy to access support and assistance. Find out more in our State Farm auto insurance review.

- Comprehensive Coverage: State Farm offers comprehensive coverage for windshield replacement, providing peace of mind knowing that your expenses will be covered in case of damage.

- Personalized Service: Customers often praise State Farm for its personalized approach to insurance, with agents offering tailored advice and support.

Cons

- Higher Premiums: Compared to some competitors, State Farm’s premiums may be slightly higher, particularly for certain coverage options.

- Limited Discounts: While State Farm offers a range of discounts, some customers may find that they qualify for fewer discounts compared to other insurers.

#2 – Progressive: Best for Coverage Options

Pros

- Wide Range of Coverage Options: In our Progressive auto insurance review, Progressive offers a diverse selection of coverage options, allowing customers to customize their policies to suit their needs.

- User-Friendly Technology: Progressive is known for its innovative and user-friendly online tools and mobile app, making it convenient for customers to manage their policies.

- Competitive Rates: Progressive often provides competitive rates, especially for drivers with clean records or those bundling multiple policies.

Cons

- Customer Service Concerns: Some customers have reported mixed experiences with Progressive’s customer service, citing long wait times and difficulty reaching representatives.

- Complex Claims Process: Progressive’s claims process may be more complicated compared to other insurers, leading to frustration for some policyholders.

#3 – Farmers: Best for Generous Discounts

Pros

- Comprehensive Coverage Options: Farmers offers a wide range of coverage options, including specialized coverage for unique needs such as collectible cars or recreational vehicles. Read more through our Farmers auto insurance review.

- Strong Customer Support: Farmers is known for its attentive customer service, with agents who are readily available to assist policyholders with their inquiries and claims.

- Loyalty Discounts: Farmers rewards long-term customers with loyalty discounts, providing savings for those who remain with the company over time.

Cons

- Higher Premiums: Farmers’ premiums may be higher compared to some other insurers, particularly for certain coverage types or demographic groups.

- Limited Online Tools: Some customers may find Farmers’ online tools and digital resources less robust compared to those offered by other insurers, potentially impacting convenience and accessibility.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Extensive Network

Pros

- Wide Range of Coverage Options: Allstate offers a variety of coverage options, including unique add-ons like roadside assistance and rental reimbursement.

- User-Friendly Mobile App: Allstate’s mobile app is highly rated for its ease of use and functionality, allowing customers to manage their policies, file claims, and access roadside assistance.

- Strong Financial Stability: Allstate is a financially stable company, providing peace of mind to policyholders that their claims will be paid promptly. Read more through our Allstate auto insurance review.

Cons

- Higher Premiums: Allstate’s premiums may be higher compared to some competitors, especially for drivers with less-than-perfect driving records.

- Mixed Customer Service Reviews: While some customers praise Allstate’s customer service, others have reported issues with claims processing and communication with representatives.

#5 – Nationwide: Best for Competitive Rates

Pros

- Member Benefits: Nationwide offers various benefits to its members, including discounts on travel, shopping, and entertainment through its MemberCare program.

- Strong Financial Stability: Nationwide is financially stable, providing assurance that claims will be paid promptly and reliably. Read more through our Nationwide auto insurance review.

- Flexible Coverage Options: Nationwide offers a range of coverage options and discounts, allowing customers to customize their policies to fit their needs and budget.

Cons

- Limited Local Agents: Nationwide’s network of local agents may be smaller compared to some competitors, potentially leading to less personalized service in certain areas.

- Average Customer Satisfaction Ratings: While Nationwide generally receives positive reviews for its coverage options, some customers have reported dissatisfaction with claims processing and customer service.

#6 – American Family: Best for Policy Options

Pros

- Personalized Service: American Family is known for its personalized service, with agents who take the time to understand each customer’s unique needs and provide tailored recommendations.

- Discount Opportunities: American Family offers various discounts, including those for safe driving, bundling policies, and loyalty, helping customers save on their premiums.

- Community Involvement: American Family is actively involved in supporting local communities through initiatives like the American Family Dreams Foundation, fostering goodwill among customers.

Cons

- Limited Availability: American Family’s coverage may not be available in all states, limiting options for potential customers in certain areas.

- Mixed Customer Reviews: While many customers are satisfied with American Family’s service, some have reported issues with claims processing and communication with agents. Read more through our American Family auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Financial Stability

Pros

- Customizable Policies: Liberty Mutual offers customizable policies with a variety of coverage options and add-ons, allowing customers to tailor their insurance to their specific needs. Read more through our Liberty Mutual auto insurance review.

- Online Tools and Resources: Liberty Mutual provides user-friendly online tools and resources, including a mobile app, making it convenient for customers to manage their policies and file claims.

- Strong Financial Strength: Liberty Mutual is financially stable, giving policyholders confidence that their claims will be paid promptly and efficiently.

Cons

- Higher Premiums: Liberty Mutual’s premiums may be higher compared to some competitors, particularly for certain coverage types or demographic groups.

- Mixed Customer Service Reviews: While some customers praise Liberty Mutual’s customer service, others have reported issues with claims processing and difficulty reaching representatives.

#8 – AAA: Best for Trusted Reputation

Pros

- Trusted Reputation: AAA has a long-standing reputation for reliability and excellent customer service, providing peace of mind to policyholders. Read more through our AAA auto insurance review.

- Member Benefits: AAA members enjoy various benefits beyond insurance, including roadside assistance, travel discounts, and exclusive savings opportunities.

- Discount Opportunities: AAA offers a range of discounts, including those for safe driving, membership loyalty, and bundling policies, helping customers save on their premiums.

Cons

- Membership Requirement: AAA insurance is only available to AAA members, which may limit options for non-members seeking coverage.

- Limited Availability: AAA’s coverage may not be available in all states or regions, potentially restricting options for customers in certain areas.

#9 – Travelers: Best for Claims Processing

Pros

- Strong Financial Stability: Travelers is financially stable, providing assurance that claims will be paid promptly and reliably. Read more through our Travelers auto insurance review.

- Flexible Coverage Options: Travelers offers a variety of coverage options and add-ons, allowing customers to customize their policies to fit their needs and budget.

- Discount Opportunities: Travelers provides various discounts, including those for safe driving, bundling policies, and loyalty, helping customers save on their premiums.

Cons

- Average Customer Service Ratings: While Travelers generally receives positive reviews for its coverage options, some customers have reported issues with claims processing and communication with representatives.

- Limited Local Agents: Travelers’ network of local agents may be smaller compared to some competitors, potentially leading to less personalized service in certain areas.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Safeco: Best for Online Tools

Pros

- Online Tools and Resources: Safeco offers a range of online tools and resources, including a user-friendly website and mobile app, making it convenient for customers to manage their policies and file claims.

- Flexible Coverage Options: Safeco provides customizable policies with various coverage options and add-ons, allowing customers to tailor their insurance to their specific needs.

- Discount Opportunities: Safeco offers a variety of discounts, including those for safe driving, bundling policies, and loyalty, helping customers save on their premiums.

Cons

- Mixed Customer Service Reviews: While some customers praise Safeco’s customer service, others have reported issues with claims processing and difficulty reaching representatives.

- Limited Availability: Safeco’s coverage may not be available in all states or regions, potentially restricting options for customers in certain areas. Read more through our Safeco auto insurance review.

Filing a Zero-Deductible Glass Replacement Claim in South Dakota

Legal Requirements for Glass Replacement Coverage

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Glass Replacement in South Dakota

Frequently Asked Questions

Can I choose my own glass vendor for windshield replacement in South Dakota?

Yes, South Dakota state law allows you to choose your own glass vendor for replacement needs.

Do I need to file a claim to get windshield replacement coverage in South Dakota?

No, you can choose to file a claim or pay for the replacement service on your own. Enter your ZIP code now to begin comparing.

Do I have to pay a deductible for windshield replacement claims in South Dakota?

Yes, if you file a claim, you may have to pay a deductible amount specified in your auto insurance policy or liability auto insurance policy.

Is zero-deductible glass replacement coverage available in South Dakota?

South Dakota state law does not require zero-deductible auto glass replacement coverage, and it varies among insurance companies.

Can I choose aftermarket crash glass for window replacement in South Dakota?

Yes, South Dakota law permits the use of aftermarket crash parts, including aftermarket crash glass, on vehicle repair or replacement projects. Enter your ZIP code now to start.

Which three insurance providers are highlighted as offering the best windshield replacement coverage in South Dakota?

What is the starting monthly rate for windshield replacement coverage offered by the top three insurers?

The starting monthly rate for windshield replacement coverage offered by the top three insurers is $75 per month.

What are some common issues drivers in South Dakota face regarding windshield damage?

Common issues drivers in South Dakota face regarding windshield damage include cracked or chipped windshields, which may pose risks and require immediate repair. Enter your ZIP code now to begin.

What legal requirements are mentioned for glass replacement coverage in South Dakota?

Legal requirements for glass replacement coverage in South Dakota include the use of aftermarket crash glass for window replacement, typically not covered by standard auto insurance or any type of auto insurance unless specified.

What are some frequently asked questions addressed regarding windshield replacement coverage?

Frequently asked questions addressed in the article regarding windshield replacement coverage include whether drivers can choose their own glass vendor, whether a claim needs to be filed for coverage, whether a deductible is required for claims, the availability of zero-deductible glass replacement coverage, and whether aftermarket crash glass can be used for window replacement in South Dakota.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.