Best Windshield Replacement Coverage in Vermont (Top 10 Companies for 2025)

Progressive, Geico, and State Farm have the best windshield replacement coverage in Vermont. Insurance rates start at $70/mo, and you can get full glass coverage from State Farm for a zero-deductible windshield replacement. Progressive and Geico offer free windshield repairs when you buy comprehensive coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

13,283 reviews

13,283 reviewsCompany Facts

Full Coverage Windshield Replacement in Vermont

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage Windshield Replacement in Vermont

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage Windshield Replacement in Vermont

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsThe best windshield replacement coverage in Vermont comes from Progressive, Geico, and State Farm.

While Progressive doesn’t offer full glass coverage, it takes our top spot for its affordable Vermont auto insurance, excellent coverage options, and robust digital tools.

Our Top 10 Company Picks: Best Windshield Replacement Coverage in Vermont

| Company | Rank | Multi-Vehicle Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 12% - 22% | A+ | UBI Discount | Progressive | |

| #2 | 11% - 21% | A++ | Online Convenience | Geico | |

| #3 | 14% - 24% | B | Personalized Policies | State Farm | |

| #4 | 13% - 23% | A | Family Plans | Farmers | |

| #5 | 10% - 20% | A+ | Local Agents | Allstate | |

| #6 | 16% - 26% | A | Diverse Coverage | Liberty Mutual |

| #7 | 11% - 21% | A | Loyalty Rewards | American Family | |

| #8 | 10% - 20% | A+ | Accident Forgiveness | Nationwide |

| #9 | 13% - 23% | A++ | Unique Coverage | Travelers | |

| #10 | 10% - 20% | A | Roadside Assistance | AAA |

Explore the best options for car windshield replacement in Vermont below. Then, enter your ZIP code into our free comparison tool above to find the lowest rates for you.

- Vermont state laws do not require companies to offer drivers full glass coverage

- Drivers who purchase comprehensive insurance can use it for windshield damage

- Progressive and Geico are the best companies for windshield replacement coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Progressive: Top Pick Overall

Pros

- Snapshot: Save up to 30% on your policy by enrolling in Snapshot, Progressive’s UBI program that tracks driving behaviors like speeding, hard braking, and what time of day or night you drive.

- Name Your Price Tool: Need to find Vermont windshield replacement coverage on a budget? The Name Your Price tool shows coverage options that match what you want to spend on your insurance.

- Generous Discounts: Get the cheapest car insurance with windshield coverage by taking advantage of Progressive’s 13 discounts. See how many you qualify for in our Progressive auto insurance review.v

Cons

- No Full Glass: While you can use your comprehensive insurance to start a Vermont windshield repair, Progressive does not offer zero-deductible glass coverage.

- Small Network of Repair Shops: If you use your comprehensive insurance for a windshield repair, you’ll have to use an approved glass technician. Progressive’s network of acceptable technicians is on the smaller size.

#2 – Geico: Best for Affordable Rates for Almost Everyone

Pros

- Government Employee Discount: Most of Geico’s 16 discounts are traditional ways of saving, but it offers a unique government employee discount.

- DriveEasy: Geico offers a discount of up to 25% if you enroll in its UBI program, DriveEasy. Explore how much you can save with DriveEasy in our Geico auto insurance review.

- Mechanical Breakdown Coverage: Geico’s mechanical breakdown coverage works similarly to a car warranty and helps ensure that your vehicle is always ready to go.

Cons

- Less Competitive Rates for Some: If you have a DUI on your driving record, you’ll likely find cheaper auto insurance with glass coverage elsewhere.

- Fewer Coverage Options: Despite being one of the largest insurance companies in the country, Geico has a surprisingly small collection of add-ons from which to choose.

#3 – State Farm: Best for Personalized Service

Pros

- Solid Claims Reviews: Customers appreciate that State Farm’s agents are always ready to offer personalized help, which makes the claim process fast and easy.

- Drive Safe & Save: Drive Safe & Save offers a discount on your State Farm glass coverage of up to 30%, but it’s not available in every state.

- Large Glass Repair Network: State Farm has a large network of windshield repair techs that can help you get your glass damage fixed fast.

Cons

- Mixed Customer Service Reviews: State Farm may have made our list of the best windshield replacement companies, but drivers aren’t always impressed with the company’s customer service.

- Higher Premiums: State Farm is usually the cheapest option for insurance, but teens see much higher rates. See how much you might pay in our State Farm auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Farmers: Best Car Insurance Discount Selection

Pros

- Original Parts Glass Replacement: Ensure that only an OEM windshield is used to replace yours with this specialty coverage.

- Signal: Enjoy savings of up to 30% by downloading the Signal app and agreeing to its tracking terms. Signal works equally well on Apple and Android systems.

- Ample Discounts: Farmers offers 23 discounts to help drivers save, meaning you’ll probably find at least a few ways to save. Explore all of Farmers’ discounts in our Farmers auto insurance review.

Cons

- Higher Average Quotes: No matter if you need a windshield replacement in Burlington, VT, or you’re a high-risk driver in Brattleboro, Farmers usually has higher rates than the national average.

- Lacking Coverage Options: Farmers is missing a few popular insurance options, like a vanishing deductible and gap insurance.

#5 – Allstate: Best for Full Coverage Policies

Pros

- ADAS Recalibration: Allstate takes windshield repair in Vermont one step further by including ADAS recalibration in what comprehensive insurance covers.

- Drivewise: Drivewise sets itself apart from Allstate’s competitors with a whopping 40% maximum discount for safe driving. Allstate’s other UBI program – Milewise – offers pay-per-mile coverage suited for low-mileage drivers.

- Coverage Options: Personalize your full coverage policy with Allstate’s excellent selection of add-ons.

Cons

- Mixed Customer Satisfaction: Some customers are completely satisfied with their Allstate experience, while others leave less positive reviews.

- Higher Premiums: Allstate is almost always one of the most expensive options for car insurance. See how much the average driver pays in our Allstate auto insurance review.

#6 – Liberty Mutual: Best Selection of Auto Insurance Add-ons

Pros

- Add-on Selection: Liberty Mutual offers a ton of ways to customize your policy with add-on options like rental car reimbursement and better car replacement. However, drivers should be aware that adding coverage increases their rates, so they should only add what they need.

- RightTrack: Save up to 30% with RightTrack, Liberty Mutual’s UBI program. Explore what RightTrack tracks in our Liberty Mutual auto insurance review.

- Valuable Discounts: With 17 available discounts, there are plenty of ways to keep your Liberty Mutual insurance rates low.

Cons

- Higher-Than-Average Rates: Despite offering so many discounts, Liberty Mutual drivers tend to pay more for their insurance than the national average.

- No Full Glass Coverage: You can use your comprehensive coverage for Vermont window replacement, but Liberty Mutual does not offer a zero-dollar glass deductible option.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – American Family: Best for OEM Glass Coverage

Pros

- KnowYourDrive: If you regularly avoid things like using your phone while driving and excessive speeding, KnowYourDrive might be right for you. You can save up to 20% on your policy for your good habits.

- OEM Glass Coverage: You can elect to add OEM coverage to your policy, which ensures that only original manufacturer windshields will be used when you need a replacement. Explore other coverage options in our American Family auto insurance review.

- Costco Policies: American Family’s subsidiary company, CONNECT, underwrites auto insurance policies for Costco members to help them find deep coverage savings.

Cons

- Limited Availability: American Family sells insurance in just 19 states, and Vermont is not included. However, you can buy a policy through CONNECT that offers the same perks American Family provides.

- Older Drivers Pay More: Drivers over 60 should probably look for coverage at a different company as American Family’s rates are above average for older drivers.

#8 – Nationwide: Best for UBI Savings

Pros

- SmartRide: Nationwide offers two UBI programs – SmartRide and SmartMiles. You can save up to 40% by joining SmartRide, and SmartMiles offers affordable pay-per-mile insurance.

- Bundling Discounts: Save on your insurance when you bundle auto and either home or renters insurance policies from Nationwide. Explore more discount options in our Nationwide auto insurance review.

- Excellent Coverage Options: Customize your policy with Nationwide’s excellent selection of insurance add-ons. Popular choices include roadside assistance and gap insurance.

Cons

- Average Customer Service Ratings: Nationwide doesn’t have the worst customer service ratings, but it also doesn’t have the most satisfied customers either.

- Some Customers Pay More: While it’s usually an affordable option for insurance that covers window replacement in Vermont, drivers with a DUI will likely find cheaper rates with a different company.

#9 – Travelers: Best for Customer Service

Pros

- Excellent Customer Service: Drivers looking for Vermont auto glass coverage from a company that treats its customers well will find a good fit with Travelers.

- Ample Coverage Options: Travelers offers plenty of ways to increase the coverage in your policy, with options like new car replacement coverage and rideshare insurance.

- IntelliDrive: Save up to 30% by enrolling in IntelliDrive and practicing safe habits every time you get behind the wheel. Learn how to maximize your savings in our Travelers auto insurance review.

Cons

- Coverage Costs More: More often than not, Travelers’ average rates are a little higher than the national average.

- No SR-22 Insurance: If you need SR-22 coverage after a traffic violation, you’ll need to find a different company – Travelers does not file SR-22 forms.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance Plans: AAA offers three stellar roadside assistance plans so you can pick the perfect plan for your needs.

- Windshield Reimbursement: While it doesn’t offer free windshield replacement, you can get free windshield repairs through AAA’s reimbursement plan.

- AAADrive: Agree to let AAA track your driving habits and save up to 30% for your good driving habits.

Cons

- Higher Rates: AAA is a great choice for car insurance with glass coverage, but it comes at a slightly higher price than most other companies.

- Membership Fees: One of the reasons AAA’s auto insurance costs more is that you have to pay an annual membership fee. Fees vary by location and plan, but most don’t cost more than $130 per year.

Windshield Replacement Coverage Rates in Vermont

Car insurance rates are on the rise, but Vermont drivers typically see affordable rates. Check below to see how much you might pay for your insurance.

Vermont Windshield Replacement Coverage Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $100 | $225 |

| Allstate | $85 | $200 |

| American Family | $95 | $210 |

| Farmers | $110 | $215 |

| Geico | $70 | $175 |

| Liberty Mutual | $115 | $235 |

| Nationwide | $100 | $200 |

| Progressive | $100 | $200 |

| State Farm | $100 | $225 |

| Travelers | $100 | $225 |

As you can see, Vermont car windshield replacement insurance doesn’t have to be outrageously expensive. However, there’s always room to improve, and there are plenty of ways you can save on your insurance.

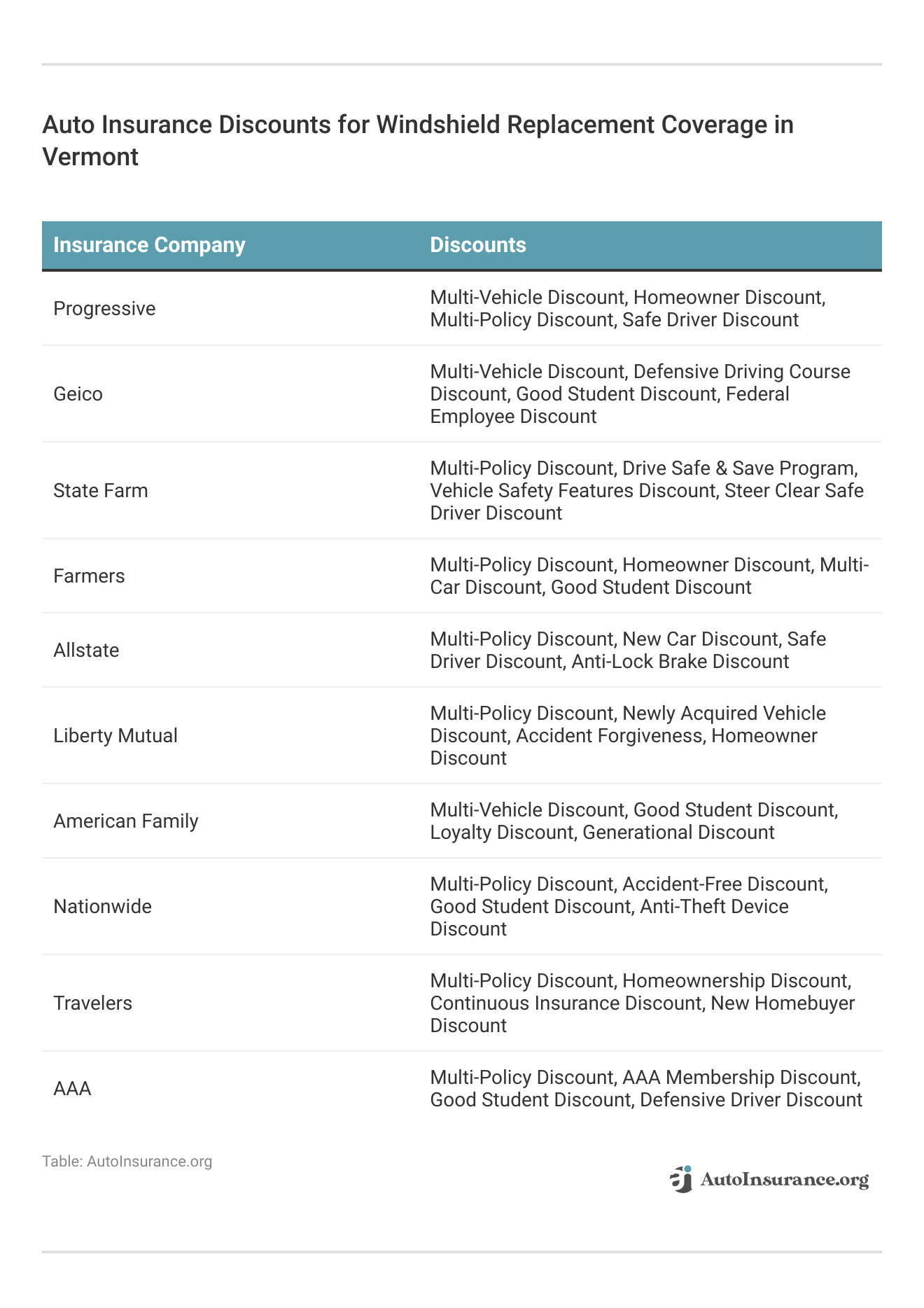

For starters, you should look for auto insurance discounts. Check below to see some of the discounts available from our top companies.

Other ways to save on your insurance include lowering your coverage levels, raising your deductible, and keeping your driving record clean.

The most important step in finding the lowest rates is to compare quotes. You can get individual quotes from companies by filling out request forms on their websites.

If you don’t have that much time to spend gathering quotes, you can use a quote comparison tool to evaluate multiple auto insurance quotes at once.

Zero-Deductible Glass Coverage in Vermont

When a Vermont driver files a claim against his or her auto insurance policy, the driver typically must pay a deductible.

After the deductible is paid, the insurance company may pay the remainder of the cost to repair the damage up to the coverage limits established in the policy.

In some cases, Vermont auto insurance may offer a special zero-deductible benefit that specifically pertains to auto glass services. The zero-deductible benefit, however, is not mandated by law.

Because there are no legal requirements pertaining specifically to the deductible that can be charged for auto glass claims in Vermont, each insurance company has a unique policy. For example:

- Some have a zero-deductible benefit

- Others may charge a reduced amount for this type of claim

- Some require drivers to pay the full deductible amount just as they would if they file a claim for a car accident

While the deductible amount for auto glass benefits is one matter to research thoroughly, another matter involves the type of coverage that you purchased. Some drivers in Vermont only purchased a liability auto policy or a collision policy, and neither of these coverage types offers glass replacement benefits in most cases.

Comprehensive insurance, on the other hand, pays for repairs to your vehicle for many types of damaging events, including rocks flying at your car and more. It also covers damage from things like fires, vandalism, theft, weather, and animals.Daniel Walker Licensed Auto Insurance Agent

Full glass replacement coverage is not always included in a comprehensive auto policy. In addition, the deductible amount for your full glass replacement service may be different than the rest of your policy.

You also need to confirm the coverage limit for this coverage before you file a claim.

Look at the #glass as half-full, even when it’s half-cracked.

— Progressive (@progressive) December 28, 2020

Spend a few minutes comparing the glass replacement quotes that you have obtained against the terms of your coverage. By doing so, you can better ascertain the true financial benefits associated with filing a claim.

For many drivers, the rather affordable cost of a windshield replacement may be more affordable than paying a car insurance deductible.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Vermont’s Requirement for Window Replacement Materials

With many types of automotive repairs, you may assume that new parts are being installed in your vehicle unless you are specifically notified beforehand. However, Vermont law allows windshield repair companies to use aftermarket or used materials for replacements.

The only legal requirement Vermont has regarding windshield replacement is that the new glass must be of like-kind.

If you pay for this service outside of an auto insurance claim, you may have a greater opportunity to shop around for a provider that does not use aftermarket or used glass for a replacement if this is important to you.

If you choose to file an insurance claim, your auto coverage company may only pay for the more affordable material option to be used.

You’ll still need to meet Vermont car insurance requirements, but the Green Mountain State does not have any auto insurance laws regarding glass coverage.

Find the Best Windshield Repair Coverage in Vermont Today

Your windshield can crack or shatter at any time, and it may even shatter within a week or two following your current replacement service. This is a risk that you face each time you drive down the road, and you may prefer to update your coverage now so that you can more easily take advantage of auto insurance benefits. Once you know how to compare multiple auto insurance quotes, finding the right coverage is easy.

Look for a reputable provider that offers zero-deductible or low-deductible coverage for auto glass services. Don’t miss out on our free quote tool below — just enter your ZIP code and start comparing rates now.

Frequently Asked Questions

What are the best insurance companies for windshield replacement in Vermont?

You can get the best windshield coverage in Vermont from Progressive, Geico, or State Farm. However, you should still shop around — the best auto insurance companies for you might take different factors into account.

Does auto insurance in Vermont cover windshield replacement?

Yes, auto insurance in Vermont typically covers windshield replacement under comprehensive coverage. However, it’s important to review your policy details to confirm the specific coverage and any deductibles that may apply.

Is windshield replacement covered by the mandatory minimum liability insurance in Vermont?

No, the mandatory minimum liability insurance in Vermont does not cover windshield replacement. Liability insurance only covers damages you may cause to others in an accident. To have windshield replacement coverage, you would need to add comprehensive coverage to your policy.

Are there any deductible amounts for windshield replacement claims?

Deductible amounts for windshield replacement claims can vary depending on your insurance policy. Some policies may offer a separate and lower deductible for windshield replacement specifically. Review your policy or contact your insurance provider to determine the deductible amount applicable to your claim.

What are the cheapest insurance companies for glass coverage?

The cheapest auto insurance companies in Vermont for windshield insurance include Geico, Allstate, and American Family. However, many factors affect insurance rates, so you’ll need to compare quotes to find the lowest rates.

Are there any restrictions or limitations for windshield replacement coverage in Vermont?

While coverage details can vary between insurance providers, four common restrictions or limitations for windshield replacement coverage may include:

- Coverage limitations on the number of windshield replacements within a specified time period.

- Restrictions on using non-original equipment manufacturer (OEM) glass for replacement.

- Limits on coverage for windshield repairs, which may be preferred over replacements when feasible.

- Exclusions for windshield damage caused intentionally or through acts of negligence.

To find the best windshield coverage for your needs, enter your ZIP code into our free comparison tool to see your options.

What steps should I follow to file a windshield replacement claim in Vermont?

Learning how to file an auto insurance claim is simple. To file a windshield replacement claim in Vermont, follow these six general steps:

- Review your insurance policy to ensure you have comprehensive coverage that includes windshield replacement.

- Document the damage to your windshield with photographs if possible.

- Contact your insurance provider’s claims department or use their online claims portal to initiate the claim. Provide them with accurate and detailed information about the damage.

- Follow any instructions provided by your insurance company regarding windshield replacement service providers or inspections.

- Pay any applicable deductible, if required, when the repair or replacement is completed.

- Keep copies of all communication, receipts, and documentation related to the claim for your records.

If you have any issues filing your claim, a representative from your insurance company can help.

Are there any alternative options for windshield replacement financing in Vermont?

Yes, there are alternative options for financing windshield replacement in Vermont if you do not have comprehensive insurance coverage or if the deductible is high. Popular options include loans, credit cards, assistance programs, and emergency funds.

Does insurance cover windshield replacement in Vermont?

Your insurance can cover windshield replacement, if you buy the right kind. You’ll need comprehensive insurance to cover windshield damage.

If you buy liability-only auto insurance, it won’t include windshield protection insurance.

What are Vermont’s windshield laws?

According to Vermont state laws, you can’t have anything obstructing the view of the driver, even small chips. For the rest of the windshield, anything over two inches needs to be fixed. If you have a severely damaged windshield, ask an insurance representative from your company to see which Vermont glass company you should use.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.