Best Bluffton, SC Auto Insurance in 2025 (Top 10 Companies Ranked)

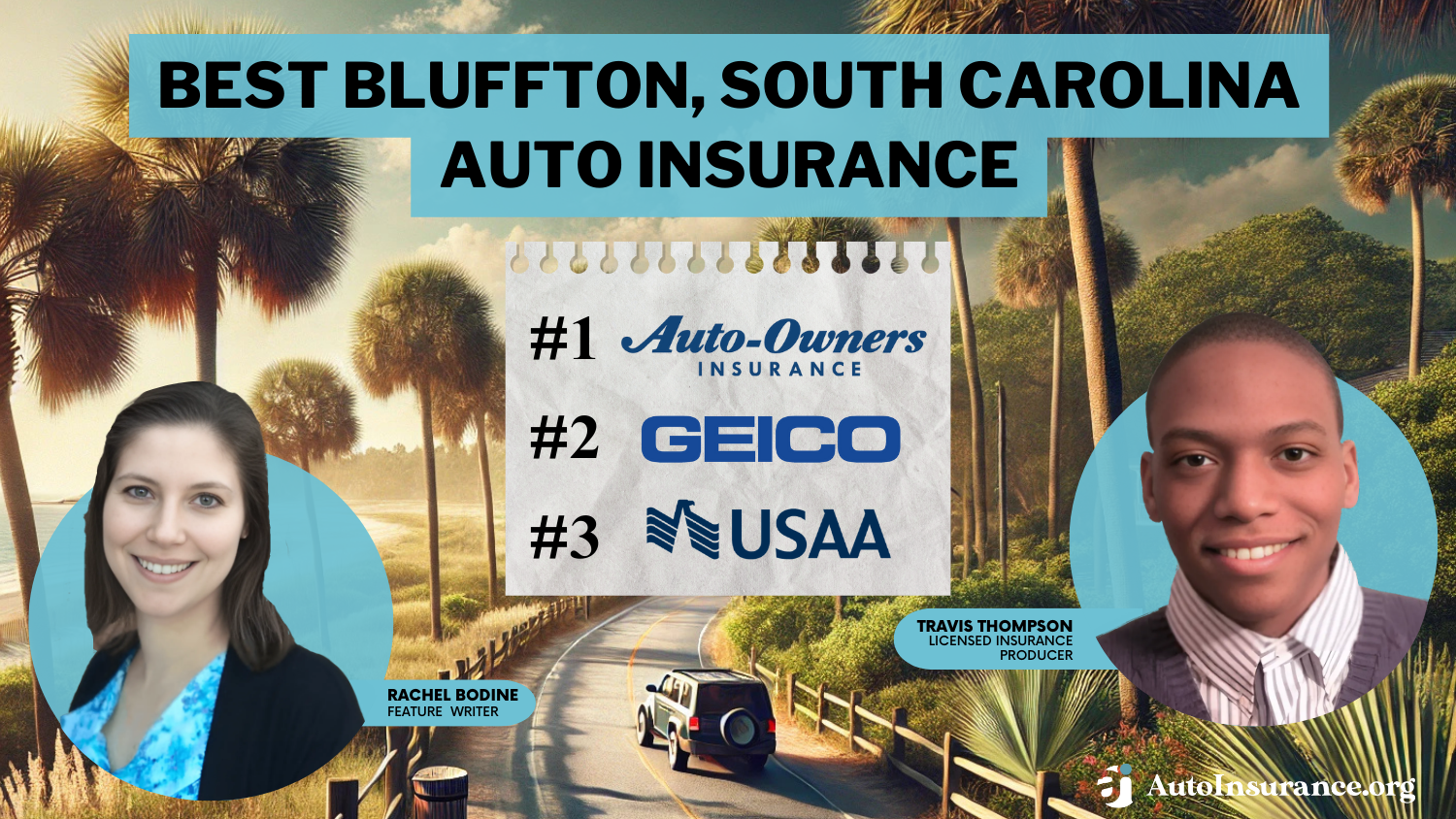

Auto-Owners, Geico, and USAA offer the best Bluffton, SC auto insurance, with rates starting at $30/mo. Auto-Owners offers reliable coverage and claims service. Geico provides low rates and easy online tools. USAA delivers excellent benefits for military families, making it the top pick for the best Bluffton auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Apr 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

563 reviews

563 reviewsCompany Facts

Full Coverage in Bluffton SC

A.M. Best Rating

Complaint Level

Pros & Cons

563 reviews

563 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Bluffton SC

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Bluffton SC

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsThe best Bluffton, SC auto insurance providers are Auto-Owners, Geico, and USAA, offering affordable rates starting at $30 per month. Auto-Owners excels because of its dependable claims process and overall coverage.

Geico has competitive rates with easy web-based management features, and USAA offers exceptional benefits to military families.

Our Top 10 Company Picks: Best Bluffton, South Carolina Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $96 | A++ | Client Centric | Auto-Owners | |

| #2 | $100 | A++ | Lowest Rates | Geico | |

| #3 | $110 | A++ | Military Members | USAA | |

| #4 | $120 | A+ | Budgeting Tools | Progressive | |

| #5 | $130 | A | Loyalty Rewards | American Family | |

| #6 | $135 | B | Student Savings | State Farm | |

| #7 | $140 | A+ | Vanishing Deductible | Nationwide |

| #8 | $145 | A+ | UBI Savings | Allstate | |

| #9 | $148 | A++ | Unique Coverage | Travelers | |

| #10 | $150 | A | Policy Options | Liberty Mutual |

In this article, we compare these top insurers based on price, coverage, and customer satisfaction to assist you in discovering the best policy for your situation.

- Auto-Owners offers the best Bluffton, SC auto insurance with affordable rates

- Drivers in Bluffton, South Carolina, can get coverage for about $30 per month

- The best Bluffton, SC auto insurance balances cost and protection

You can find affordable auto insurance, no matter your driving record, by entering your ZIP code into our free quote comparison tool.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#1 – Auto-Owners: Top Overall Pick

Pros

- Personalized Service: Auto-Owners offers hands-on customer service, making it an exceptional choice for drivers searching for the best auto insurance in Bluffton, SC.

- Flexible Coverage Options: Drivers will be able to personalize their policies so that they will get tailored protection in Bluffton. Unlock details in our Auto-Owners auto insurance review.

- Strong Claims Support: Auto-Owners provides efficient claims handling, giving Bluffton drivers peace of mind during stressful situations.

Cons

- Higher Premiums: Auto-Owners tend to have slightly higher rates, making it less budget-friendly for the best Bluffton, SC auto insurance seekers.

- Limited Digital Tools: The company’s fewer online features may frustrate tech-savvy Bluffton drivers looking for convenient management.

#2 – Geico: Best for Lowest Rates

Pros

- Affordable Rates: As per our Geico auto insurance review, they offer some of the lowest premiums, making it a top pick for the best Bluffton, SC, auto insurance.

- User-Friendly Mobile App: Geico’s app makes managing policies and filing claims easy for Bluffton drivers.

- Extensive Discounts: Geico provides multiple savings opportunities, helping Bluffton residents reduce their auto insurance costs.

Cons

- Limited Local Support: Geico’s online-first model may not suit Bluffton drivers who prefer in-person assistance.

- Fewer Specialized Coverages: Geico offers fewer add-on options, which may limit flexibility for Bluffton drivers seeking more comprehensive protection

#3 – USAA: Best for Military Members

Pros

- Exclusive Military Benefits: USAA offers special benefits that are well-suited to military families looking for the best in auto insurance in Bluffton, SC.

- Outstanding Customer Service: USAA provides excellent service, with reliable support for Bluffton drivers.

- Competitive Rates: On our USAA auto insurance review, the company has competitive rates, making it a cost-effective option for Bluffton drivers.

Cons

- Membership Restrictions: Only military personnel and their families are allowed to access USAA, thus limiting it for residents of Bluffton.

- Limited Local Presence: A lack of face-to-face offices prevents Bluffton drivers from accessing direct support at USAA offices.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Budgeting Tools

Pros

- Budget-Friendly Rates: According to our Progressive auto insurance review, the company has competitive rates, making it a good choice for the best Bluffton, SC, car insurance shoppers.

- Name Your Price Tool: Drivers can customize their policies based on their budget, which is perfect for Bluffton’s cost-conscious residents.

- Strong Digital Tools: Progressive’s robust app and website make managing policies easy for Bluffton drivers.

Cons

- Average Customer Service: Some Bluffton drivers complain about inconsistent assistance, which may be frustrating during claims.

- Rate Hikes After Claims: Filing of claims with Progressive usually results in higher premiums, making it expensive for frequent Bluffton drivers.

#5 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Rewards: In line with our American Family auto insurance review, they offer discounts for long-term customers, helping Bluffton drivers save over time.

- Customizable Policies: Drivers can personalize their coverage, making it a flexible option for the best Bluffton, SC auto insurance.

- Helpful Local Agents: American Family’s strong agent network offers reliable, in-person support for Bluffton drivers.

Cons

- Higher Starting Rates: Premiums may be less competitive for new policyholders in Bluffton.

- Limited Availability: American Family’s coverage options may be restricted in certain areas around Bluffton.

#6 – State Farm: Best for Student Savings

Pros

- Reliable Local Agents: State Farm’s strong Bluffton presence offers drivers easy access to in-person support.

- Accident Forgiveness: Bluffton drivers can avoid rate hikes after their first accident with this coverage.

- Extensive Coverage Options: In accordance with our State Farm auto insurance review, they offer flexible policies, meeting the diverse needs of the best Bluffton, SC auto insurance shoppers.

Cons

- Above-Average Rates: State Farm’s premiums can be higher, making it less appealing for budget-conscious Bluffton drivers.

- Fewer Digital Features: The online platform lacks some advanced tools, which may be inconvenient for tech-savvy Bluffton drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Bluffton drivers can reduce their deductibles over time by maintaining a clean driving record. Discover more in our Nationwide auto insurance review.

- On Your Side Review: Policyholders receive regular coverage reviews, ensuring they have the right protection in Bluffton.

- Strong Digital Tools: Nationwide’s online resources make managing the best Bluffton, SC, auto insurance policies quick and convenient.

Cons

- Average Customer Service: Some Bluffton drivers may find Nationwide’s support less responsive than competitors.

- Slower Claims Processing: Claims may take longer to resolve, which could frustrate Bluffton policyholders.

#8 – Allstate: Best for UBI Savings

Pros

- Usage-Based Discounts: Bluffton drivers can save with Allstate’s Drivewise program by practicing safe driving habits. Explore further in our Allstate auto insurance review.

- Comprehensive Coverage Options: Allstate offers a variety of add-ons, making it a flexible choice for the best Bluffton, SC, auto insurance.

- Local Agent Support: Bluffton drivers can benefit from personalized, in-person assistance from Allstate’s local agents.

Cons

- Higher Premiums: Allstate’s rates can be more expensive, making it less attractive for budget-conscious Bluffton drivers.

- Mixed Customer Reviews: Some Bluffton drivers report inconsistent claims experiences with Allstate.

#9 – Travelers: Best for Unique Coverage

Pros

- Unique Coverage Options: Based on our Travelers auto insurance review, they offer specialized policies, making it ideal for Bluffton drivers with specific needs.

- Strong Bundling Discounts: Bluffton residents can save by combining their auto and home insurance policies.

- Excellent Online Tools: Travelers’ website and app make managing the best Bluffton, SC auto insurance policies simple and efficient.

Cons

- Limited Local Presence: Bluffton drivers may have fewer in-person support options with Travelers.

- Complex Policy Options: Some Bluffton drivers may find Travelers’ coverage plans confusing or difficult to navigate.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Policy Options

Pros

- Customizable Policies: Per our Liberty Mutual auto insurance review, they offer flexible coverage, letting Bluffton drivers tailor their protection.

- Accident Forgiveness: Bluffton drivers can avoid premium increases after their first accident.

- Convenient Digital Tools: Liberty Mutual’s app and website make managing the best Bluffton, SC, auto insurance policies quick and easy.

Cons

- Higher Premiums: Liberty Mutual’s rates can be steeper, making it less affordable for some Bluffton drivers.

- Mixed Claims Satisfaction: Some Bluffton policyholders report slower claims processing times.

Minimum Auto Insurance in Bluffton, South Carolina

Car insurance in Bluffton, SC, is essential for drivers to meet the state’s legal requirements and protect their finances in case of an accident. The tables below outline the minimum auto insurance requirements in Bluffton, SC, and compare monthly rates from leading car insurance companies in Bluffton, SC. Reviewing these details can help you find the best coverage at an affordable price.

| Liability Insurance Required | Minimum Coverage Limits Required |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person $50,000 per accident |

| Property Damage Liability Coverage | $25,000 minimum |

Auto insurance in Bluffton, SC, must include liability protection for bodily injury and property damage. State law mandates at least $25,000 per person and $50,000 per accident in bodily injury liability coverage, along with $25,000 in property damage liability coverage.

Bluffton, South Carolina Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $48 | $145 | |

| $42 | $130 | |

| $55 | $96 | |

| $30 | $100 | |

| $52 | $150 |

| $46 | $140 |

| $35 | $120 | |

| $44 | $135 | |

| $50 | $148 | |

| $32 | $110 |

Monthly rates for car insurance in Bluffton, SC vary by provider and coverage level. Geico offers the lowest minimum coverage at $30 per month, while Auto-Owners provides the most affordable full coverage at $96 monthly. Comparing rates from multiple car insurance companies in Bluffton, SC helps you find the best value.

Finding affordable auto insurance in Bluffton, SC, requires understanding the state’s minimum coverage requirements and comparing rates from different providers. By evaluating monthly costs and coverage options, you can choose the best car insurance in Bluffton, SC, to suit your needs and budget.

Unlocking Auto Insurance Savings in Bluffton, South Carolina

Bluffton, South Carolina, car insurance providers offer discounts that can significantly reduce rates. Top companies like Liberty Mutual, Nationwide, and State Farm offer high discounts for safe drivers, students, and bundlers.

Auto Insurance Discounts From Top Bluffton, South Carolina Providers

| Insurance Company | Anti-Theft | Bundling | Good Driver | Good Student | Loyalty |

|---|---|---|---|---|---|

| 10% | 25% | 25% | 22% | 15% | |

| 25% | 25% | 25% | 20% | 18% | |

| 12% | 16% | 25% | 20% | 10% | |

| 25% | 25% | 26% | 15% | 10% | |

| 35% | 25% | 20% | 12% | 10% |

| 5% | 20% | 40% | 18% | 8% |

| 25% | 10% | 30% | 10% | 13% | |

| 15% | 17% | 25% | 35% | 6% | |

| 15% | 13% | 10% | 8% | 9% | |

| 15% | 10% | 30% | 10% | 11% |

Bluffton drivers can benefit from various discount opportunities. Liberty Mutual has the highest anti-theft insurance discount at 35%, making it a smart choice for those prioritizing vehicle security. Nationwide takes the lead with a 40% good driver discount, which is a good option for drivers who practice safe driving. State Farm gives a 35% discount to students, giving young drivers an effective way to decrease their premium rates.

Bundling policies also pay off, with Allstate, American Family, and Geico providing 25% discounts, which are good for multi-policyholders.

Bluffton, South Carolina Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Discount Availability | A | Many insurers offer multiple discount opportunities |

| Cost of Minimum Coverage | B | Rates are slightly lower than the state average |

| Cost of Full Coverage | C | Premiums are moderate but not the cheapest |

| Rates for Young Drivers | D | Teen drivers face high insurance costs |

| Rates After a DUI | F | Highest penalties for DUI violations |

Bluffton’s auto insurance market receives an A grade for its broad discount availability, giving drivers multiple ways to save. Minimum coverage premiums receive a B, with rates that are slightly below average. Full coverage premiums, though, receive a C, which means moderate but not the lowest-priced premiums.

Young drivers pay high prices, earning a D grade, and DUI offenses have the highest financial consequences, with an F grade for affordability.

To find the best Bluffton, SC auto insurance, it's crucial to leverage discounts that align with your driving profile.Dani Best Licensed Insurance Producer

Bluffton, SC, drivers can maximize their savings by leveraging discounts from top insurers. Nationwide and Liberty Mutual provide substantial safe-driving discounts, and State Farm offers exceptional student savings. Comparing these discounts with the market report card helps you get the best Bluffton, South Carolina, auto insurance rates for your record.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How Age and Gender Impact Auto Insurance Rates in Bluffton, South Carolina

Bluffton, South Carolina, auto insurance premiums differ considerably by age, gender, marital status, and provider. Teen drivers face the highest premiums, with 17-year-old males paying up to $480 monthly with Liberty Mutual, while 60-year-old females enjoy the lowest rates, as low as $85 per month with USAA. This table compares monthly insurance costs by provider across different age and gender groups.

| Insurance Company | Age: 17 Female | Age: 17 Male | Age: 25 Female | Age: 25 Male | Age: 35 Female | Age: 35 Male | Age: 60 Female | Age: 60 Male |

|---|---|---|---|---|---|---|---|---|

| $410 | $470 | $175 | $195 | $135 | $140 | $110 | $115 | |

| $390 | $445 | $170 | $190 | $130 | $135 | $105 | $110 | |

| $380 | $440 | $160 | $185 | $125 | $130 | $100 | $105 | |

| $350 | $400 | $140 | $160 | $110 | $120 | $90 | $95 | |

| $420 | $480 | $180 | $200 | $140 | $145 | $115 | $120 |

| $370 | $430 | $155 | $175 | $120 | $125 | $95 | $100 |

| $390 | $450 | $165 | $185 | $130 | $135 | $105 | $110 | |

| $360 | $420 | $145 | $165 | $115 | $125 | $95 | $100 | |

| $400 | $460 | $170 | $190 | $130 | $135 | $105 | $110 | |

| $330 | $380 | $130 | $150 | $100 | $110 | $85 | $90 |

Monthly auto insurance rates in Bluffton, South Carolina, show evident trends by age and gender. Young drivers, particularly men, pay the highest prices, while older drivers pay lower premiums.

USAA has the lowest rates across all demographics, while Liberty Mutual and Allstate generally charge higher prices. This comparison highlights how demographic factors influence insurance pricing in Bluffton.

Finding Affordable Auto Insurance Rates for Teen Drivers in Bluffton, SC

Finding the cheapest teen auto insurance in Bluffton, South Carolina, can be challenging due to the high-risk nature of young drivers. Teens are prone to paying higher premiums, and therefore, one needs to shop around for auto insurance quotes in Bluffton, SC, to get the best rates.

Rates can vary significantly by provider and gender, with male teens often paying more due to their statistically higher accident risk. The following comparison of monthly rates for 17-year-old male and female drivers from top insurance companies in Bluffton, SC, can help you identify the most cost-effective options.

| Insurance Company | Age: 17 Female | Age: 17 Male |

|---|---|---|

| $410 | $470 | |

| $390 | $445 | |

| $380 | $440 | |

| $350 | $400 | |

| $420 | $480 |

| $370 | $430 |

| $390 | $450 | |

| $360 | $420 | |

| $400 | $460 | |

| $330 | $380 |

This comparison identifies the lowest car insurance quotes in Bluffton, SC, for 17-year-old drivers by gender and provider. USAA has the lowest rates, at $330 for females and $380 for males. Geico is also very competitive at $350 for females and $400 per month for males.

On the higher side, Liberty Mutual has the highest rates, with females paying $420 and males $480 monthly. The data shows that male teens generally face higher premiums for auto insurance across all providers.

Affordable Auto Insurance Options for Senior Drivers

Senior auto insurance rates in Bluffton, South Carolina, differ by provider and gender, with women generally paying slightly lower premiums. USAA has the lowest rates, at $85 per month for 60-year-old women and $90 for men. Geico is close behind, at $90 and $95 per month, respectively. At the higher end, Liberty Mutual is $115 for women and $120 monthly for men.

Comparing car insurance quotes in Bluffton, SC, helps older drivers find the most cost-effective coverage.

| Insurance Company | Age: 60 Female | Age: 60 Male |

|---|---|---|

| $110 | $115 | |

| $105 | $110 | |

| $100 | $105 | |

| $90 | $95 | |

| $115 | $120 |

| $95 | $100 |

| $105 | $110 | |

| $95 | $100 | |

| $105 | $110 | |

| $85 | $90 |

Monthly auto insurance quotes in Bluffton for 60-year-old drivers reveal that USAA and Geico provide the most budget-friendly options, while Liberty Mutual is the most expensive. Male drivers generally face higher premiums, with differences ranging from $5 to $10 across providers.

Exploring car insurance companies in Bluffton, SC, allows seniors to identify insurers offering the best rates and coverage for their needs.

The Impact of Driving Record on Auto Insurance Rates in Bluffton, SC

Auto insurance rates in Bluffton, South Carolina, significantly increase with driving violations. Drivers with a clean record pay lower monthly premiums, while those with a ticket, accident, or DUI face higher costs. This table shows the monthly rates from top providers based on driving history.

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $248 | $268 | $321 | $385 | |

| $173 | $190 | $225 | $270 | |

| $160 | $176 | $210 | $252 | |

| $200 | $257 | $386 | $386 | |

| $166 | $182 | $218 | $261 |

| $200 | $257 | $386 | $386 |

| $272 | $398 | $398 | $332 | |

| $218 | $268 | $321 | $385 | |

| $161 | $177 | $212 | $254 | |

| $212 | $262 | $312 | $362 |

Monthly auto insurance rates in Bluffton vary widely based on driving records. Auto-Owners has the lowest premium for a clean record at $160 monthly, while Progressive is the most expensive at $272. Geico and Nationwide charge the most for drivers with a DUI at $386 monthly, while Auto-Owners is still the least expensive at $252 per month.

This comparison brings out the benefits of having a clean driving record in order to save a lot of money.

Maintaining a clean driving record in Bluffton, South Carolina, is the best way to ensure low auto insurance rates. Just one ticket or accident could raise the rates dramatically. Comparing quotes from multiple providers can help drivers find the most affordable coverage, especially if they have violations on their record.

Auto Insurance Rates After a DUI in Bluffton, SC

Finding affordable auto insurance in Bluffton, SC, after a DUI is challenging, but comparing rates can help you secure the best deal. Auto-Owners offers the lowest monthly rate at $252, followed closely by Travelers at $254 and Liberty Mutual at $261. Reviewing these rates can help you choose the most budget-friendly option from the best car insurance companies in Bluffton, SC.

| Insurance Company | One DUI |

|---|---|

| $385 | |

| $270 | |

| $252 | |

| $386 | |

| $261 |

| $386 |

| $332 | |

| $385 | |

| $254 | |

| $362 |

The costs for monthly auto insurance policies for drivers with one DUI in Bluffton, SC, are very different across providers. Auto-Owners, Travelers, and Liberty Mutual have the lowest rates, which range from $252 to $261 monthly.

Geico and Nationwide, on the other hand, have the highest rates at $386 per month. Comparing auto insurance quotes in Bluffton, SC, can help you find the best coverage at the lowest price.

How Credit Scores Influence Auto Insurance Rates in Bluffton, SC

Credit history significantly impacts auto insurance rates in Bluffton. Drivers with good credit typically pay lower monthly premiums, while those with poor credit face higher costs. The table below compares full coverage monthly rates by credit score across top insurance companies in Bluffton.

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $164 | $197 | $230 | |

| $164 | $197 | $230 | |

| $163 | $196 | $229 | |

| $109 | $131 | $153 | |

| $164 | $197 | $230 |

| $164 | $197 | $230 |

| $164 | $197 | $230 | |

| $125 | $150 | $175 | |

| $126 | $151 | $176 | |

| $98 | $118 | $138 |

Full coverage auto insurance rates in Bluffton vary widely by credit score. USAA has the lowest rates, starting at $98 per month for good credit, followed by Geico at $109. State Farm and Travelers have middle-range prices between $125 and $126 monthly. At a higher cost, Allstate, American Family, and Liberty Mutual set the price at $164 for good credit, and rates rise to $230 for bad credit.

Paying attention to maintaining good credit helps lower car insurance in Bluffton, SC. Comparing quotes from companies like USAA and Geico can help drivers find the most affordable coverage based on their credit history.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Impact of ZIP Codes and Accidents on Auto Insurance in Bluffton, SC

Auto insurance rates by ZIP code in Bluffton, SC, vary slightly, with drivers in 29910 paying a higher monthly rate of $278 than $274 monthly in 29909. Accident rates, claim payments, and the financial burden of accidents caused by insured drivers determine insurance prices.

| ZIP Code | Monthly Rate |

|---|---|

| 29909 | $274 |

| 29910 | $278 |

Average monthly auto insurance premiums differ slightly between Bluffton’s ZIP codes, with ZIP code 29910 facing marginally higher rates than 29909.

Bluffton, South Carolina Auto Accident & Insurance Claim Statistics

| Factor | Value |

|---|---|

| Auto Insurance Premium | $3,646 |

| Percentage of Drivers with an At-Fault Accident | 12% |

| Rate Increase After One At-Fault Accident | 42% |

| Rate Increase After Two At-Fault Accidents | 86% |

| Percentage of Claims Resulting in Injury | 28% |

| Claim Payout for Property Damage | $4,500 |

| Claim Payout for Bodily Injury | $22,300 |

Key factors affecting insurance costs include an average annual premium of $3,646, a 42% rate increase after one at-fault accident, and an 86% hike after two. Property damage claims average $4,500, while bodily injury claims reach $22,300.

A single accident can raise your rates by 40% or more. Consider accident forgiveness and compare ZIP code-based quotes for the best rate.Kristen Gryglik Licensed Insurance Agent

Bluffton, South Carolina, auto insurance rates vary by ZIP code, with drivers in 29909 paying a slightly lower premium than those in 29910. Accident records have a big influence on rates, with drivers who cause accidents seeing large increases. Knowing about these ZIP code fluctuations and claims rates will assist drivers in making good choices when comparing auto insurance.

Impact of Commute Length on Auto Insurance Rates in Bluffton, SC

Bluffton, South Carolina, auto insurance rates vary depending on commute time and annual mileage. State Farm provides the lowest-priced coverage, at $234 for 6,000 miles and $246 for 12,000 miles per month. Geico and USAA also offer low prices, which is why they are best suited for drivers looking for low-cost coverage regardless of mileage.

| Insurance Company | 6,000 Miles | 12,000 Miles |

|---|---|---|

| $323 | $337 | |

| $300 | $315 | |

| $290 | $305 | |

| $259 | $262 | |

| $310 | $325 |

| $304 | $304 |

| $332 | $332 | |

| $234 | $246 | |

| $270 | $285 | |

| $266 | $271 |

Auto insurance in Bluffton differs remarkably depending on mileage, with some companies keeping the premiums the same for both short and long commutes. State Farm has the lowest premiums, but Progressive charges $332 a month for both short and long distances. Geico, USAA, and Auto-Owners also have competitive pricing, making them ideal for all drivers, regardless of how long their commute is.

State Farm provides the lowest-priced auto insurance in Bluffton for drivers with 6,000-mile and 12,000-mile annual drives. Geico and USAA are also budget-friendly options, with consistently low rates. To get the best coverage, shop around at several providers and take into consideration how your annual mileage impacts your premiums.

How Coverage Levels Affect Auto Insurance Costs

The coverage level you choose would largely determine how much auto insurance would cost you in Bluffton, SC. Higher coverage usually offers better protection but comes at a higher monthly premium. The table below breaks down the rates from top insurance companies in Bluffton, showing how your coverage choice impacts your premium.

| Insurance Company | Low | Medium | High |

|---|---|---|---|

| $309 | $328 | $353 | |

| $265 | $289 | $315 | |

| $280 | $302 | $328 | |

| $309 | $346 | $382 | |

| $243 | $258 | $280 |

| $330 | $350 | $380 |

| $298 | $304 | $309 | |

| $307 | $329 | $362 | |

| $221 | $240 | $259 | |

| $254 | $268 | $284 |

Travelers has the lowest premiums, beginning at $221 per month for minimum coverage, while Nationwide charges as much as $380 for full coverage. Liberty Mutual and USAA have mid-level premiums, with minimum coverage beginning at $243 and $254 per month, respectively. On average, moving from low to high coverage increases rates by 10-15%, making it important to balance cost with the protection you need.

When shopping for auto insurance in Bluffton, South Carolina, it’s important to weigh the cost against the protection you need. While low coverage keeps your monthly bill down, it may leave you vulnerable in an accident. On the other hand, higher coverage gives you more security but at a higher price. Comparing quotes from different companies can help you strike the right balance. Read more: How Much Car Insurance Do I Need?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Influencing Auto Insurance Rates in Bluffton, South Carolina

There are a lot of reasons why auto insurance rates in Bluffton, South Carolina, are higher or lower than in other cities. These include traffic and the number of vehicle thefts in Bluffton, South Carolina. Many local factors may affect your Bluffton auto insurance rates.

Bluffton Commute Time

Longer commute times often lead to higher auto insurance rates due to increased time on the road and a greater risk of accidents. According to City-Data, the average commute in Bluffton is 25.8 minutes, which can contribute to slightly higher premiums compared to areas with shorter travel times.

Read more: 7 Factors That Affect Auto Insurance Rates

Vehicle Theft Rates in Bluffton

Higher rates of vehicle theft usually translate to higher auto insurance costs. The vehicle theft rate in Bluffton is not as high as that in large cities; hence, it can help lower the auto insurance premium rate. But those with high-risk vehicles or residents in more crime-prone areas might still pay higher premiums. Read more: Does Auto Insurance Cover Vehicle Theft?

Finding the Best Bluffton, SC Auto Insurance Options

Auto-Owners, Geico, and USAA offer the best Bluffton, SC auto insurance, but rates vary based on factors like age, driving history, and credit score. Teenage drivers have the highest rates, as high as $480 a month, while seniors pay as low as $85 monthly. Those with DUIs or bad credit experience significant increases, with monthly premiums for some climbing as high as $386 per month.

Bluffton drivers can save money by comparing quotes and taking discounts. Liberty Mutual has a 35% anti-theft discount, while Nationwide has a 40% off for defensive drivers. Commute length and ZIP code also impact rates, with drivers in 29910 paying a bit more than those in 29909. Rate comparison and taking discounts are the keys to getting the best Bluffton, SC, car insurance. Read more: Why You Should Take a Defensive Driving Class

Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

Frequently Asked Questions

What discounts are available for auto insurance in Bluffton, SC?

Many insurance companies in Bluffton, SC, offer discounts for safe driving, multi-policy bundling, good students, and anti-theft devices. Liberty Mutual and Nationwide also provide vanishing deductible discounts.

How can I find reliable car insurance agents in Bluffton, SC?

You can find reputable car insurance agents in Bluffton, SC, by checking online reviews, visiting local agency websites, or asking for referrals from friends and family. Independent agents can provide multiple quotes from different providers.

Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

What is the minimum auto insurance coverage required in Bluffton, SC?

South Carolina law mandates a minimum coverage of $25,000 per person and $50,000 per accident for bodily injury liability, plus $25,000 for property damage liability.

Do group benefits brokers in Bluffton, SC, offer auto insurance discounts?

Yes, some group benefits brokers in Bluffton, SC, partner with insurance providers to offer discounted auto insurance rates for employees. Check with your employer or local brokers for group coverage options.

How do I file a claim with my car insurance company in Bluffton, SC?

To file a claim with your insurance company in Bluffton, SC, contact your provider directly or use their online portal or mobile app. Provide all necessary details, including accident reports and photos, to expedite the process.

Are there insurance companies in Bluffton, SC, that specialize in high-risk drivers?

Yes, several insurance companies in Bluffton, SC, offer policies for high-risk drivers, including Progressive, The General, and Dairyland, which specialize in SR-22 auto insurance and coverage for drivers with DUIs or multiple violations.

Where can I find cheap liability insurance near me in Bluffton, SC?

To find cheap liability insurance near you in Bluffton, SC, compare quotes from providers like Geico, Auto-Owners, and State Farm, which often offer competitive rates. Local agents can also help you find budget-friendly options.

Can I get temporary car insurance in Bluffton, SC?

Yes, some insurance companies in Bluffton, SC, offer short-term or temporary auto insurance policies, which are ideal for visitors or drivers needing coverage for a few weeks or months.

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

What factors affect car insurance rates in Bluffton, SC?

Car insurance rates in Bluffton, SC, depend on factors such as your driving history, vehicle type, age, and credit score. Local elements like accident frequency and theft rates also impact pricing. Auto insurance rates by vehicle make and model can further influence how much you pay.

Is it cheaper to buy car insurance from a local agent or directly online in Bluffton, SC?

Buying car insurance directly online in Bluffton, SC, is often cheaper due to fewer agent fees. However, working with a local agent can help you find personalized coverage and better service, especially for complex policies.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.