Best Bridgeport, Connecticut Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

USAA, Geico, and Travelers lead the way for the best Bridgeport, Connecticut auto insurance, offering competitive rates starting at $32 per month. These top providers stand out for their affordability, comprehensive coverage, and excellent customer service, making them ideal choices for drivers in Bridgeport.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

6,589 reviews

6,589 reviewsCompany Facts

Full Coverage in Bridgeport CT

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Bridgeport CT

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 1,733 reviews

1,733 reviewsCompany Facts

Full Coverage in Bridgeport CT

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsUSAA, Geico, and Travelers rank as the best Bridgeport, Connecticut auto insurance, offering competitive rates and comprehensive coverage options. With rates starting around $32 per month, these companies excel in affordability while maintaining strong customer service and a variety of discounts tailored to local drivers.

Their commitment to quality and value makes them the top choices for those seeking the best auto insurance in Bridgeport.

By exploring these options, drivers can secure the protection they need at a price that fits their budget.

Our Top 10 Company Picks: Best Bridgeport, Connecticut Auto Insurance

| Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 9% | A++ | Military Members | USAA | |

| #2 | 11% | A++ | Cheap Rates | Geico | |

| #3 | 13% | A++ | Bundling Policies | Travelers | |

| #4 | 10% | A+ | Online Management | Progressive | |

| #5 | 12% | A+ | Multi-Policy Savings | Nationwide |

| #6 | 10% | B | Local Agents | State Farm | |

| #7 | 15% | A | Policy Options | Liberty Mutual |

| #8 | 11% | A+ | UBI Discount | Allstate | |

| #9 | 12% | A | Claims Service | American Family | |

| #10 | 9% | A | Customizable Policies | Farmers |

Bridgeport, CT auto insurance is higher than both the state and national averages. It’s not that surprising since Connecticut auto insurance is also higher than the national average.

- USAA, Geico, and Travelers offer the cheapest auto insurance in Bridgeport

- Rates start around $32 per month with strong coverage and customer service

- These providers excel in customer service and comprehensive coverage options

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – USAA: Top Overall Pick

Pros

- Competitive Rates: USAA is renowned for offering exceptionally competitive auto insurance rates in Bridgeport, Connecticut. Their pricing frequently undercuts many of their competitors in Bridgeport, Connecticut, making them a standout option for those who qualify.

- Comprehensive Coverage Options: USAA provides an extensive range of coverage options tailored to diverse needs in Bridgeport, Connecticut. Whether you’re looking for standard protection or specialized coverage in Bridgeport, Connecticut, USAA’s offerings are designed to accommodate a variety of preferences and requirements.

- Military Discounts: A major draw of USAA is its substantial discounts for military members, veterans, and their families in Bridgeport, Connecticut. This feature is particularly appealing in Bridgeport, Connecticut, as it translates into considerable savings for eligible customers. This exclusive benefit, as highlighted in our USAA auto insurance review.

Cons

- Eligibility Restrictions: One of the main limitations of USAA is that their insurance is available only to military members, veterans, and their families in Bridgeport, Connecticut. This restriction excludes the general public in Bridgeport, Connecticut, from accessing their services, which can be a significant drawback for those who do not meet the eligibility criteria.

- Limited Local Branches: USAA has a limited number of physical offices in Bridgeport, Connecticut, which may be inconvenient for those who prefer face-to-face interactions over managing their insurance online or via phone. This limitation in Bridgeport, Connecticut, can impact the overall customer experience for individuals who value in-person service.

#2 – Geico: Best for Affordable Rates

Pros

- Affordable Rates: Geico is well-regarded for its highly competitive pricing and frequent discount opportunities in Bridgeport, Connecticut. Their ability to consistently offer affordable rates in Bridgeport, Connecticut, helps make insurance more accessible and budget-friendly for many customers, as highlighted in our Geico auto insurance review.

- Easy Online Access: Geico’s user-friendly online platform is a significant advantage for Bridgeport, Connecticut residents. It allows policyholders in Bridgeport, Connecticut to manage their insurance policies, file claims, and access customer support with ease, all from the comfort of their own homes.

- Wide Range of Discounts: Geico offers a variety of discounts in Bridgeport, Connecticut, such as those for safe driving, bundling multiple policies, and more. These discounts can further reduce insurance costs in Bridgeport, Connecticut, making Geico a cost-effective choice for many drivers in the area.

Cons

- Potential for Higher Rates: While Geico is known for its low initial rates in Bridgeport, Connecticut, some customers may see their premiums increase after initial discounts expire or if their driving record changes. This variability can impact long-term affordability in Bridgeport, Connecticut.

- Limited Personal Interaction: Geico’s emphasis on online and phone-based services might not appeal to everyone in Bridgeport, Connecticut, especially those who prefer personal, face-to-face interactions with their insurance provider. This lack of in-person service could be a drawback for customers who value direct, personal communication in Bridgeport, Connecticut.

#3 – Travelers: Best for Flexible Coverage Options

Pros

- Flexible Coverage Options: Travelers excels in providing a wide range of customizable coverage options in Bridgeport, Connecticut. This flexibility allows policyholders in Bridgeport, Connecticut to tailor their insurance plans to meet specific needs and preferences, offering a personalized approach to coverage.

- Good Local Presence: With multiple agents and offices throughout Bridgeport, Connecticut, Travelers offers the advantage of local, personalized service. This local presence in Bridgeport, Connecticut enables customers to receive face-to-face support and build relationships with their insurance agents, enhancing the overall customer experience.

- Various Discounts: Travelers provides several discount opportunities in Bridgeport, Connecticut, including those for safe driving, bundling policies, and more. These discounts can help lower overall insurance costs in Bridgeport, Connecticut, making Travelers a competitive choice for cost-conscious policyholders.

Cons

- Higher Rates for Some: Depending on individual driver profiles, Travelers’ rates in Bridgeport, Connecticut might be higher compared to some competitors. This could make the insurance less affordable for certain drivers in Bridgeport, Connecticut, especially those with less favorable driving histories, according to Travelers auto insurance review.

- Customer Service Variability: The quality of customer service with Travelers can vary based on the local agent in Bridgeport, Connecticut. This variability can impact the consistency and reliability of support, potentially affecting the overall customer experience.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Competitive Pricing

Pros

- Competitive Pricing: Progressive is widely recognized for its competitive pricing and various discount opportunities in Bridgeport, Connecticut. Their pricing structure makes them a strong contender for drivers looking for affordable auto insurance in Bridgeport, Connecticut without compromising on coverage quality, as highlighted in our Progressive auto insurance review.

- Innovative Tools: Progressive stands out for its innovative tools, such as the Snapshot program in Bridgeport, Connecticut. This tool allows drivers to potentially lower their rates based on their driving habits, offering a personalized approach to pricing that can reward safe driving behavior.

- Broad Coverage Options: Progressive offers a comprehensive range of coverage options and add-ons in Bridgeport, Connecticut, enabling policyholders to customize their insurance to meet their specific needs. This broad selection helps ensure that drivers in Bridgeport, Connecticut can find coverage that aligns with their individual requirements.

Cons

- Complex Policies: Some customers in Bridgeport, Connecticut may find Progressive’s policy options and discount structures to be complex and somewhat overwhelming. This complexity can make it challenging for policyholders to fully understand and select the most suitable coverage options.

- Variable Rate Increases: Rates with Progressive may increase significantly after the initial term in Bridgeport, Connecticut, which could affect long-term affordability. This variability in pricing might be a consideration for those looking for stable and predictable insurance costs in Bridgeport, Connecticut.

#5 – Nationwide: Best for Comprehensive Coverage Options

Pros

- Comprehensive Coverage Options: Nationwide offers a broad spectrum of coverage options in Bridgeport, Connecticut, ensuring that policyholders can find a plan that meets their specific needs. Their extensive coverage options in Bridgeport, Connecticut cater to a wide range of requirements.

- Flexible Payment Plans: Nationwide provides various payment options and plans in Bridgeport, Connecticut, accommodating different financial situations. This flexibility allows residents to manage their insurance payments in a way that aligns with their budget and financial needs, according to Nationwide auto insurance review.

- Discounts for Safe Drivers: Nationwide offers multiple discounts in Bridgeport, Connecticut, including those for safe driving and bundling policies. These discounts can help lower overall insurance costs, making Nationwide an appealing option for drivers who prioritize safety and value savings.

Cons

- Higher Premiums: Premiums with Nationwide in Bridgeport, Connecticut can be higher compared to some other insurers. This may make it less affordable for certain drivers, particularly those seeking lower-cost insurance options in Bridgeport, Connecticut.

- Claims Process: Some customers in Bridgeport, Connecticut have reported that Nationwide’s claims process can be slower than expected. This delay in processing claims can be frustrating and may impact the overall experience for those needing timely assistance.

#6 – State Farm: Best for Comprehensive Coverage Options

Pros

- Comprehensive Coverage Options: State Farm offers a wide array of coverage options in Bridgeport, Connecticut, including both standard and additional insurance tailored to local needs. Their extensive coverage selection ensures that policyholders in Bridgeport, Connecticut can find a plan that suits their specific requirements.

- Affordable Rates: In Bridgeport, Connecticut, State Farm provides affordable rates for auto insurance, often accompanied by a variety of discounts. Their competitive pricing in Bridgeport, Connecticut makes them a strong choice for budget-conscious drivers.

- Discount Opportunities: For residents of Bridgeport, Connecticut, State Farm provides a variety of discounts, including those for secure driving and stacking multiple policies. These savings might lower premiums and improve the overall worth of their Bridgeport, Connecticut insurance products.

Cons

- Higher Rates for Some: In comparison to other competitors, State Farm’s premiums in Bridgeport, Connecticut may be higher depending on the driving profile of the policyholder. This may have an impact on someone’s ability to pay in Bridgeport, Connecticut, particularly for those with less desirable driving records, as noted in our State Farm auto insurance review.

- Variable Service: The quality of service provided by State Farm in Bridgeport, Connecticut can vary depending on the local agent. This variability in service can lead to inconsistent customer experiences and affect overall satisfaction.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Liberty Mutual: Best for Customizable Coverage

Pros

- Customizable Coverage: Liberty Mutual offers a range of customizable coverage options in Bridgeport, Connecticut, allowing policyholders to tailor their insurance to their specific needs and preferences. This flexibility in Bridgeport, Connecticut is ideal for individuals seeking a personalized insurance experience, as mentioned in our Liberty Mutual auto insurance review.

- Discount Programs: In Bridgeport, Connecticut, Liberty Mutual offers a number of savings plans, such as those for bundling and safe driving practices. These initiatives can assist in bringing down insurance premiums and increasing residents’ affordability of coverage.

- Online Tools: The company’s useful online tools for managing policies and filing claims offer convenience for policyholders in Bridgeport, Connecticut. These digital resources make it easier for residents to handle their insurance needs efficiently.

Cons

- Higher Premiums: In Bridgeport, Connecticut, Liberty Mutual’s premiums may be more than those of certain other insurers. This price rise may have an effect on overall affordability and be something to think about for anyone searching for more affordable solutions.

- Customer Service Issues: Some customers in Bridgeport, Connecticut have reported issues with Liberty Mutual’s customer service, including delays in responses and resolution of claims. This can affect the overall satisfaction and experience for policyholders.

#8 – Allstate: Best for Extensive Coverage Options

Pros

- Extensive Coverage Options: Allstate provides a wide range of coverage options in Bridgeport, Connecticut, ensuring that policyholders can find a plan that meets their specific needs. Their diverse offerings make it easier for residents to customize their insurance coverage, as highlighted in our Allstate auto insurance review.

- Discounts and Rewards: In Bridgeport, Connecticut, Allstate has become known for its generous discount and incentive schemes, which include choices for driving safely and bundling regulations. These initiatives assist in lowering premiums and provide policyholders with extra savings.

- Competitive Rates: In Bridgeport, Connecticut, Allstate provides affordable automobile protection at affordable rates to fit a variety of circumstances.

Cons

- Potential for Higher Rates: In comparison to some other insurers, Allstate’s premiums in Bridgeport, Connecticut, may be more expensive. This could have an impact on some drivers’ capacity to pay insurance, especially those looking for less expensive options.

- Mixed Customer Service: Some customers in Bridgeport, Connecticut may find Allstate’s policy structure to be complex and challenging to navigate. This complexity could make it difficult for policyholders to fully understand their coverage options.

#9 – American Family: Best for Flexible Coverage

Pros

- Flexible Coverage: In Bridgeport, Connecticut, American Family offers a wide range of customizable insurance alternatives. These options let policyholders customize their coverage to meet a variety of requirements and preferences, offering flexibility that fits a range of lifestyles.

- Savings and Discounts: American Family provides a range of savings alternatives in Bridgeport, Connecticut, including incentives for careful driving and combining several insurance policies. For drivers on a tight budget, these savings choices can drastically lower their total insurance premiums, making them a desirable option.

- Budget-Friendly Premiums: Known for its competitive pricing, American Family frequently provides affordable insurance rates to drivers in Bridgeport, Connecticut, helping to make quality auto insurance accessible to a broader audience.

Cons

- Higher Rates: Despite their reputation for affordability, American Family’s premiums in Bridgeport, Connecticut can sometimes be on the higher side compared to other providers. This may render them less economical for certain drivers, as highlighted in our comprehensive review of American Family auto insurance, as noted in our American Family auto insurance review.

- Slower Claims Process: Some policyholders in Bridgeport, Connecticut have noted that the claims process with American Family can occasionally be more sluggish than anticipated. This could impact the overall customer experience, particularly for those seeking swift resolution of claims.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best for Expansive Coverage Options

Pros

- Expansive Coverage Options: Farmers boasts an extensive array of insurance offerings and customizable policy frameworks in Bridgeport, Connecticut, designed to cater to a diverse spectrum of needs and preferences, ensuring each policyholder finds the perfect fit for their unique circumstances., as noted in our Farmers auto insurance review.

- Discounts Available: In Bridgeport, Connecticut, Farmers offers a range of discounts, such as those for packaged plans and preserving a clean driving record. In addition to improving affordability, these savings can help lower total insurance costs.

- Accident Forgiveness Benefits: Farmers introduces accident forgiveness programs in Bridgeport, Connecticut that can shield you from rate hikes following your initial at-fault mishap, providing a financial safeguard and peace of mind in the wake of unforeseen incidents.

Cons

- Higher Premiums: Depending on the individual driver’s profile, Farmers’ rates in Bridgeport, Connecticut might be higher compared to some competitors. This could impact the overall cost of insurance for certain drivers in the area.

- Variable Customer Service: The quality of customer service with Farmers in Bridgeport, Connecticut can vary based on the local agent. This variability may affect the overall customer experience and satisfaction with their services.

Monthly Bridgeport, CT Car Insurance Rates by ZIP Code

Monthly car insurance rates in Bridgeport, CT, can fluctuate widely depending on the specific ZIP code. This variation stems from numerous factors including local traffic conditions, crime rates, and the overall risk profile of each area.

Bridgeport, Connecticut Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $40 | $115 |

| American Family | $39 | $118 |

| Farmers | $42 | $120 |

| Geico | $35 | $105 |

| Liberty Mutual | $36 | $112 |

| Nationwide | $37 | $109 |

| Progressive | $32 | $109 |

| State Farm | $37 | $110 |

| Travelers | $34 | $106 |

| USAA | $34 | $90 |

ZIP codes with high traffic density or elevated crime rates often experience higher insurance premiums due to the increased likelihood of accidents and theft, which impacts the overall cost of coverage.

Conversely, residents in ZIP codes with lower traffic volumes and fewer reported incidents may benefit from more affordable insurance rates. Insurance companies take these local variables into account when setting rates, leading to significant differences in premiums even within the same city.

Find more info about the monthly Bridgeport, CT car insurance rates by ZIP Code below:

Understanding these regional disparities is crucial for Bridgeport drivers, as it allows them to better assess their insurance options and make more informed choices about their coverage.

Bridgeport, CT Car Insurance Rates vs. Top US Metro Car Insurance Rates

The city you reside in can significantly impact your car insurance rates, with various factors such as local traffic patterns, accident rates, and regional insurance regulations playing a crucial role. This means that where you live is more than just a matter of preference; it directly affects how much you will pay for auto insurance.

For this reason, it’s essential to compare car insurance rates in Bridgeport, CT, with those in other major US metropolitan areas. Explore our detailed analysis on “Comparing Auto Insurance” for additional information.

By evaluating how Bridgeport stacks up against cities with similar demographics or risk profiles, you can gain a clearer understanding of how local conditions influence your insurance premiums and make more informed decisions about your coverage options. Enter your ZIP code now to compare Bridgeport, CT auto insurance quotes from multiple companies near you for free.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Cheapest Auto Insurance Company in Bridgeport, CT

State Farm offers the most affordable average auto insurance rates in Bridgeport, CT. However, it’s important to remember that insurance premiums can vary greatly depending on individual factors such as driving history, vehicle type, and personal risk profiles.

Therefore, while State Farm stands out for its competitive rates, the best option for you may differ based on your unique circumstances. To find the cheapest auto insurance company in Bridgeport, CT, you can explore the options listed below.

Additionally, you might wonder how these rates measure up against the average insurance premiums across the state of Connecticut. We also provide a comprehensive comparison to give you a better understanding of how local rates stack up against statewide averages.

There are many different factors that affect auto insurance rates, such as your age, gender, credit history, and driving record. Rates will vary for each driver based on these factors.

Required Auto Insurance Coverage in Bridgeport, CT

Most states, including Connecticut, require drivers to carry at least a minimum amount of auto insurance. See the minimum auto insurance requirements by state for more details.

Bridgeport drivers must carry at least:

- $25,000 per person and $50,000 per incident for bodily injury liability (BIL) insurance.

- $25,000 per incident for property damage.

- $25,000 per person and $50,000 per incident for uninsured motorist (UIM) auto insurance.

These minimums are very low, and drivers should consider raising these limits and carrying additional coverages. In a serious accident, these low minimums won’t fully cover you, and you’ll be left to pay out of pocket for anything not covered.

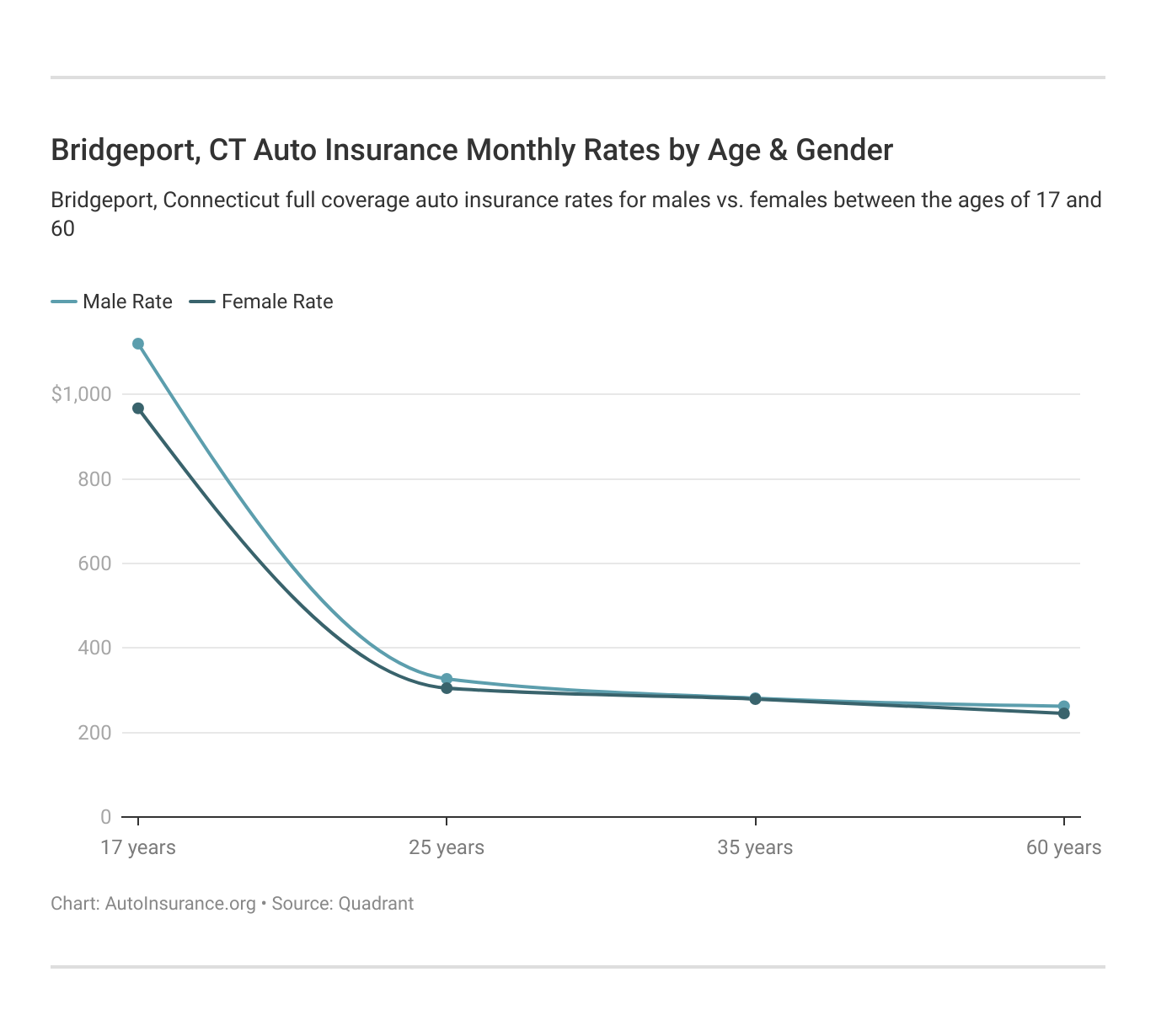

Bridgeport, Connecticut ,auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

Your coverage level will play a significant role in your Bridgeport, CT auto insurance rates. Find the cheapest Bridgeport, Connecticut auto insurance rates by coverage level below:

How does your credit score impact insurance rates? The short answer is in a big way. Your credit score will play a major role in your Bridgeport, CT auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, and Massachusetts. Find the cheapest Bridgeport, Connecticut auto insurance rates by credit score below.

Your driving record will affect your Bridgeport auto insurance rates. For example, a Bridgeport, Connecticut DUI may increase your auto insurance rates 40% to 50%. Find the cheapest Bridgeport, Connecticut auto insurance rates by driving record.

Factors that affect auto insurance rates in Bridgeport, CT may include your commute, coverage level, tickets, DUIs, and credit. Controlling these risk factors will ensure you have the cheapest Bridgeport, Connecticut auto insurance.

Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania no longer allow gender to be used in calculating auto insurance rates, ensuring a more equal approach to premium pricing.

But age is still a big factor because young drivers are considered high-risk drivers in Bridgeport. So auto insurance for teens can be expensive. Connecticut does use gender, so check out the average monthly auto insurance rates by age and gender in Bridgeport, CT.

Comprehensive Guide to Auto Insurance Pricing in Bridgeport, CT

Where you live significantly affects your insurance rates due to demographic factors beyond your control. If you own a modified car, there’s good news: Bridgeport is one of the top cities for custom and exotic cars, so you might find more affordable rates than average for such vehicles. Check out exotic car auto insurance coverage for further details. See exotic car auto insurance coverage for more details.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Bridgeport, CT Auto Insurance: The Bottom Line

Car insurance rates in Bridgeport, CT, tend to be higher than the national average due to various local factors such as traffic congestion, accident rates, and regional insurance regulations. Get more insights by reading our expert “How Much Coverage You Need” advice.

Given this, it’s crucial to thoroughly shop around and compare quotes before purchasing auto insurance in Bridgeport. Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

With competitive rates and a strong reputation for handling claims efficiently, USAA is a top choice for military families and veterans.Jeff Root Licensed Insurance Agent

Different insurance companies will offer varying rates based on their assessment of risk and local conditions, so exploring multiple options will give you a better chance of finding the most cost-effective coverage. By comparing rates from several providers, you can identify the best deal tailored to your specific needs and potentially save a significant amount on your insurance premiums.

Frequently Asked Questions

What are the cheapest car insurance rates in Bridgeport, Connecticut?

The cheapest car insurance rates in Bridgeport are typically offered by State Farm, Geico, and USAA. These companies are known for their competitive pricing, providing affordable options without compromising on essential coverage.

Which is the best insurance company for car insurance in Bridgeport, Connecticut?

State Farm is considered the best insurance company in Bridgeport due to its strong balance of affordability, comprehensive coverage options, and excellent customer service. It’s a top choice for many residents seeking reliable car insurance.

Who is the most trusted car insurance company in Bridgeport, Connecticut?

USAA is often regarded as the most trusted car insurance company in Bridgeport, particularly among military members and their families. Its reputation for exceptional customer service and specialized coverage makes it a preferred choice.

Discover our comprehensive guide to “Compare Cheap Online Auto Insurance Quotes” for additional insights.

Why is Connecticut auto insurance expensive in Bridgeport, Connecticut?

Auto insurance in Bridgeport is more expensive due to several factors, including higher traffic density, increased accident rates, and a higher frequency of insurance claims. The city’s urban environment and associated risks contribute to the elevated costs.

What is the cheapest legit car insurance in Bridgeport, Connecticut?

State Farm offers the cheapest legit car insurance in Bridgeport, providing reliable and comprehensive coverage at some of the lowest rates in the area. It’s a popular choice for drivers seeking both affordability and quality.

How can I get a lower rate on car insurance in Bridgeport, Connecticut?

To get a lower rate on car insurance in Bridgeport, consider comparing quotes from multiple providers, bundling your insurance policies, maintaining a clean driving record, and opting for higher deductibles. These strategies can significantly reduce your premiums.

For further details, check out our in-depth “How to Get a New Car Auto Insurance Discount” article.

Which is usually the cheapest insurance company in Bridgeport, Connecticut?

State Farm is usually the cheapest insurance company in Bridgeport, consistently offering low premiums across different coverage options. Geico and USAA also frequently provide competitive rates for residents.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Who is the best insurance provider in Bridgeport, Connecticut?

The best insurance provider in Bridgeport is often State Farm, thanks to its comprehensive coverage options, competitive pricing, and strong customer service. It’s a well-rounded choice for drivers seeking reliable insurance.

What is the best insurance for a car after 5 years in Bridgeport, Connecticut?

For cars over five years old in Bridgeport, Geico is a great option. It offers affordable rates and flexible coverage options tailored to older vehicles, ensuring you get the protection you need without overpaying.

Read our extensive guide on “Car Insurance Quotes: Compare Cheap Coverage” for more knowledge.

Which insurance company has the most complaints in Bridgeport, Connecticut?

Among major insurers, Allstate has a higher rate of customer complaints in Bridgeport compared to competitors like State Farm and Geico. These complaints often relate to claims handling and customer service experiences.

Which insurance company has the highest customer satisfaction in Bridgeport, Connecticut?

USAA holds the highest customer satisfaction ratings in Bridgeport, particularly among its military-affiliated members. Its reputation for excellent service and support makes it a favorite among local drivers.

What is the number 1 auto insurance in Bridgeport, Connecticut?

State Farm is widely recognized as the number 1 auto insurance provider in Bridgeport, offering the best overall value, comprehensive coverage, and strong customer support.

For more information, explore our informative “Where to Compare Auto Insurance Rates” page.

How much does car insurance cost in Bridgeport, Connecticut per month?

The average cost of car insurance in Bridgeport ranges from $120 to $160 per month, depending on the provider and coverage level. Rates can vary significantly based on factors like driving history, vehicle type, and coverage needs.

What is the minimum car insurance coverage in Bridgeport, Connecticut?

The minimum car insurance coverage required in Bridgeport includes liability limits of 25/50/25, which means $25,000 per person for bodily injury, $50,000 per accident, and $25,000 for property damage. This meets the state’s legal requirements for insurance.

What does full coverage insurance in Bridgeport, Connecticut include?

Full coverage insurance in Bridgeport typically includes liability coverage, collision coverage, comprehensive coverage, and sometimes additional protections like uninsured motorist coverage. This type of insurance offers more extensive protection for your vehicle.

Get more insights by reading our expert “Full Coverage Auto Insurance Defined” advice.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.