How to Cancel MetLife Auto Insurance in 2025 (Follow These 5 Steps)

To cancel MetLife auto insurance, follow specific steps to ensure proper transition. MetLife auto insurance rates for minimum coverage average $55/month. Learn how to cancel MetLife auto insurance by contacting customer service, setting a cancellation date, and securing a new policy to avoid gaps in coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

To cancel MetLife auto insurance, contact MetLife directly to set a cancellation date. With rates beginning at $55/month for minimum coverage, it’s crucial to have a new policy before finalizing your cancellation to ensure continuous protection.

When should I drop my full coverage auto insurance? It’s essential to check with MetLife about any potential fees during the cancellation process and confirm all the details to avoid misunderstandings regarding your auto insurance coverage.

Please find the best auto insurance company near you by entering your ZIP code into our free quote tool above.

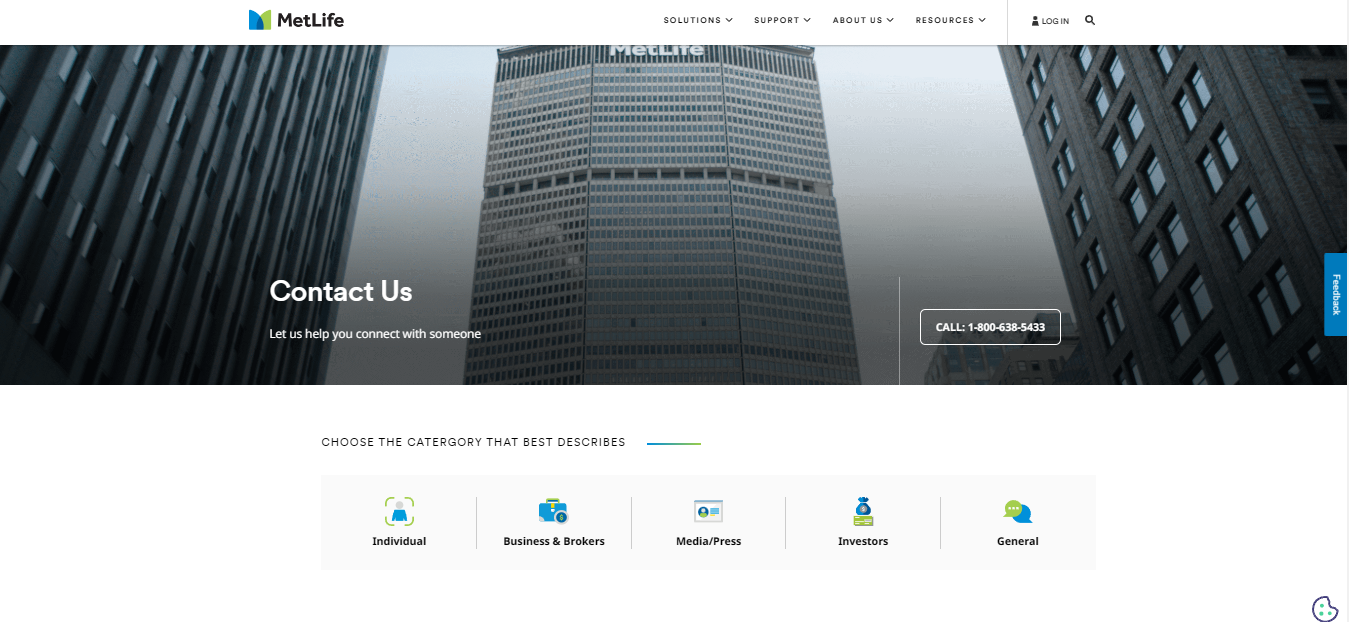

- Step #1: Contact MetLife – Call 1-800-638-5433 to cancel

- Step #2: Set End Date – Provide the cancellation date

- Step #3: Get a New Policy – Secure new insurance before canceling

- Step #4: Ask About Fees – Check for any cancellation charges

- Step #5: Confirm Cancellation – Request written confirmation

5 Steps to Cancel MetLife Auto Insurance

Follow these 5 steps to cancel your MetLife auto insurance smoothly and secure a new policy to avoid gaps in coverage.

Step 1: Contact MetLife

To start the cancellation process, call MetLife at 1-800-638-5433. Have your policy number ready, and be prepared to share personal info like your driver’s license or Social Security number for verification.

You might ask, do auto insurance companies need your Social Security number? Typically, yes, as it helps confirm your identity and ensures security.

Step 2: Set End Date

While speaking with the representative, clearly state your desired cancellation date. This is crucial for ensuring that your policy ends precisely when you want it to, preventing any coverage overlap with your new insurance.

Ask how this date affects your final premium payment. If you cancel before the policy expires, remember you might owe a prorated amount. Find out if there is a penalty for changing auto insurance.

Step 3: Get a New Policy

This analysis demonstrates how auto insurance rates fluctuate by provider and credit score, particularly when obtaining a new policy or following a cancellation. Providers such as State Farm offer competitive rates for good credit, starting at $90, while Allstate’s rates rise to $150 for those with poor credit.

Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Provider | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| 110 | 130 | 150 | |

| 105 | 125 | 145 | |

| 115 | 135 | 155 | |

| 95 | 115 | 135 | |

| 100 | 120 | 140 |

| 108 | 128 | 148 | |

| 102 | 122 | 142 |

| 98 | 118 | 138 | |

| 90 | 110 | 130 | |

| 112 | 132 | 152 | |

| 85 | 105 | 125 |

Additionally, auto insurance rates by age play a significant role in determining premiums, illustrating how insurers adjust costs based on credit history and age when renewing or securing coverage.

Step 4: Ask About Fees

During your conversation with MetLife, ask about any potential cancellation fees or penalties that may apply, including details on automatic payment auto insurance discounts.

When you speak with MetLife, ask about any potential cancellation fees, penalties, and automatic payment auto insurance discounts. You might wonder, Can I get a refund if I switch auto insurance? Some insurers may impose fees for early cancellation, while others have specific rules regarding refunds or outstanding balances.

Step 5: Confirm Cancellation

After completing the cancellation process, ask for written confirmation from MetLife. This document should include details such as your policy number, the cancellation date, and final premium adjustments.

To cancel MetLife auto insurance, simply contact their customer service or use the online account management tool for a hassle-free process.Justin Wright Licensed Insurance Agent

Having written confirmation is crucial for your records and can help you resolve any disputes or misunderstandings regarding your insurance status that may arise in the future. How auto insurance companies check driving records also plays a crucial role in maintaining accurate records and ensuring your policy reflects your driving history.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Essential Resources for Navigating MetLife Auto Insurance

When dealing with your MetLife auto insurance needs, it is essential to connect with a MetLife insurance agent for personalized assistance. For claims-related inquiries, the MetLife accident insurance customer service team is available to support you. For more details, read our MetLife auto insurance review.

If you need assistance bundling your policies, the MetLife auto & home national customer service can help you navigate options. MetLife Auto in Florida offers tailored coverage solutions for those in the Sunshine State. At the same time, residents in the Peach State can rely on MetLife auto insurance in Georgia for their insurance needs.

Simplifying MetLife Auto Insurance Cancellation Without Stress

Canceling your MetLife auto insurance is straightforward, requiring you to follow the abovementioned steps. You can ensure a smooth transition without coverage gaps by contacting MetLife directly, setting a clear cancellation date, securing a new policy, inquiring about fees, and confirming the cancellation.

Always prioritize continuous insurance coverage to protect yourself on the road. For a deeper dive, refer to our extensive Full Coverage Auto Insurance Insurance handbook.

Before you process your MetLife cancellation, ensure you have new coverage. The FREE online quote tool below allows you to compare auto insurance companies in your area by entering your ZIP code.

Frequently Asked Questions

How to cancel a term insurance policy online?

Log into your insurance provider’s website, navigate your policy settings, and look for the cancellation option. Follow the prompts to complete the process.

Can I cancel my insurance policy for free?

Many insurers allow free cancellation within a specified period, but check your policy terms for applicable fees.

Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Can I cancel the automatic insurance renewal?

Yes, you can cancel automatic renewal by contacting your insurer or adjusting the settings in your online account before the renewal date. If you want to learn more, read our article: When does my auto insurance renew?

How many days can I cancel my insurance policy?

Most insurers offer a free-look period of 10 to 30 days, during which you can cancel your policy without penalty, but this varies by state and company.

What happens if you don’t cancel your insurance?

If you don’t cancel your insurance, your policy will continue, and you will be responsible for any premiums until the policy expires or is canceled.

What are the three types of cancellations?

The three types are voluntary cancellation (initiated by the policyholder), non-renewal (insurer decides not to renew), and involuntary cancellation (policy is canceled due to non-payment or other violations). Check out article “Does not paying your auto insurance affect credit?” for more information.

Can I get money back from automatic renewal?

If you cancel your policy before the renewal period and have paid in advance, you may be eligible for a refund of the unused premium.

What is a good reason to cancel insurance?

Common reasons include finding a more affordable policy, changing coverage needs, or dissatisfaction with the insurer’s service.

Which insurance policy is refundable?

Permanent life insurance policies often offer a cash value component that can be refunded upon cancellation. Get more information about replacement cost vs. actual cash value.

Do you have 30 days to cancel your insurance?

Many policies, especially for life and health insurance, allow a 30-day cancellation period but check your specific policy for details.

What is the policy cancellation grace period?

A grace period is the time after a payment is due, during which you can pay your premium without losing coverage.

If you want coverage to drive legally, enter your ZIP code below to compare cheap auto insurance quotes near you.

How do I write a letter to the insurance company to cancel my policy?

Please include your auto policy number, a request for cancellation, the effective date, and your signature. Then, send it via certified mail for confirmation. Learn how to find your auto insurance policy number.

Can I cash out my MetLife insurance policy?

If you have a cash-value life insurance policy with MetLife, you may be able to cash it out. Contact MetLife for specific details.

How do I check my MetLife policy status?

You can check your policy status by logging into your MetLife account online or contacting customer service.

Today, explore your auto insurance options by entering your ZIP code into our free comparison tool below.

Do you lose money if you cancel your car and life insurance policy?

You may not receive a refund for already-paid premiums, especially for the car insurance policy. However, if your life insurance policy has a cash value, you could receive a refund based on that value.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.