Best Auto Insurance for Social Workers in 2025 (Find the Top 10 Companies Here!)

The best auto insurance for social workers includes Geico, State Farm, and Progressive, offering the lowest rate at $43 per month. These companies excel due to their affordable rates and positive customer feedback, making them ideal choices for social workers seeking reliable coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Full Coverage Social Workers

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Full Coverage Social Workers

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Full Coverage Social Workers

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews

The top pick overall for the best auto insurance for social workers are Geico, State Farm and Progressive, offering affordable rates and comprehensive coverage.

Do you work for a social work foundation and are looking to secure cheap auto insurance? Explore further details below and use our tool to compare rates.

- Geico stands out as the top choice, offering rates at $55/mo

- Social workers get tailored coverage for work travel and liability

- Insurers provides social workers with peace of mind on the road

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Pick Overall

Pros

- Affordable Rates: Geico auto insurance discounts showcase some of the lowest premiums in the industry, making it an attractive option for budget-conscious consumers.

- A++ A.M. Best Rating: This high rating reflects Geico’s financial stability and reliability, ensuring policyholders are in safe hands.

- Low Customer Complaints: Geico consistently receives fewer complaints compared to other insurers, indicating high customer satisfaction.

Cons

- Limited Local Agents: Unlike some competitors, Geico has fewer local agents, which may be a disadvantage for those preferring in-person assistance.

- Higher Rates for High-Risk Drivers: While generally affordable, Geico’s premiums can be higher for drivers with poor driving records.

#2 – State Farm: Runner Up

Pros

- Extensive Agent Network: State Farm auto insurance review highlights the extensive network of local agents that offer personalized service and support.

- Great Discounts: You can get various discounts to help lower your rates with State Farm, such as good student, multiple policy, anti-theft, and usage-based discounts.

- Comprehensive Coverage Options: State Farm offers a wide range of coverage options, including various add-ons and endorsements to customize policies.

Cons

- Higher Premiums: State Farm’s rates can be higher compared to other insurers, potentially making it less affordable for some consumers.

- Variable Rates by Location: Premiums can vary significantly depending on the geographic area, which might lead to inconsistencies in pricing.

#3 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Rewards safe driving habits with discounts, offering an opportunity for lower premiums based on real driving behavior.

- Extensive Discounts: Progressive auto insurance review highlights a variety of discounts, such as those for bundling policies, safe driving, and insuring multiple vehicles.

- Online Tools and Resources: Provides comprehensive online tools for policy management, including easy quote comparisons and policy customization.

Cons

- Rate Variability: Rates can vary significantly by location, potentially leading to higher premiums in certain areas.

- Higher Rates for High-Risk Drivers: Drivers with poor records or high-risk profiles may face higher premiums compared to some competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Safe Driving Program

Pros

- Safe Driving Programs: Allstate auto insurance review highlights the Drivewise program, which showcases potential discounts and cash back rewards for safe driving habits.

- Comprehensive Coverage Options: Provides a wide range of coverage options, including standard policies and additional coverages like accident forgiveness and new car replacement.

- Local Agent Support: Strong network of local agents who provide personalized service and assistance with policy management and claims.

Cons

- Higher Premiums: Generally higher premiums compared to some competitors, which may not be ideal for budget-conscious customers.

- Mixed Customer Service Reviews: Customer service experiences can vary, with some customers reporting issues with claims processing and communication.

#5 – USAA: Best for Military Personnel

Pros

- Exclusive Membership Benefits: USAA offers membership exclusively to military personnel and their families, providing tailored services and understanding their unique needs.

- High Customer Satisfaction: Known for exceptional customer service, USAA consistently receives high marks in customer satisfaction surveys.

- Comprehensive Coverage Options: USAA auto insurance review highlights a broad selection of coverage options, such as standard auto insurance, rental reimbursement, and roadside assistance.

Cons

- Limited Eligibility: Only available to military members, veterans, and their families, restricting access to a broader audience.

- Average Online Tools: While functional, USAA’s online tools and mobile app can be less user-friendly compared to some competitors.

#6 – Liberty Mutual: Best for Diverse Discounts

Pros

- Diverse Discount Options: Offers a variety of discounts including multi-policy, safe driver, and new car discounts, helping customers save money.

- Customizable Coverage: Allows policyholders to customize their coverage with add-ons like accident forgiveness and new car replacement.

- Strong Nationwide Presence: Liberty Mutual auto insurance review showcases the company’s extensive local agent support through its robust network across the U.S.

Cons

- Higher Premiums: Generally, Liberty Mutual’s premiums can be higher compared to some competitors, especially without applied discounts.

- Mixed Customer Service Reviews: While many customers report positive experiences, there are notable instances of dissatisfaction with claims processing and customer support.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for On Your Side Review

Pros

- On Your Side Review: Nationwide offers an annual On Your Side Review to ensure that your coverage is still appropriate and cost-effective for your current situation.

- Diverse Discounts: Nationwide auto insurance review highlights various discounts, such as multi-policy, safe driver, and good student discounts, which can help reduce premiums.

- Extensive Coverage Options: Nationwide offers a wide range of coverage options, including accident forgiveness, vanishing deductible, and roadside assistance.

Cons

- Higher Premiums: Nationwide’s comprehensive coverage options and numerous benefits can lead to higher premiums compared to some other insurers.

- Limited Availability of Discounts: Some discounts are not available in all states, which can limit savings for some policyholders.

#8 – Farmers: Best for Occupational Discounts

Pros

- Occupational Discounts: Farmers offers special discounts for certain professions, including teachers and social workers, which can help reduce premiums.

- Extensive Coverage Options: Farmers provides a variety of coverage options, including rideshare coverage, new car replacement, and custom equipment coverage.

- Accident Forgiveness Program: The Farmers auto insurance review highlights the accident forgiveness program, which helps prevent rate increases after your first at-fault accident.

Cons

- Higher-than-Average Rates: Farmers’ premiums tend to be higher than some competitors, which may not be ideal for budget-conscious drivers.

- Mixed Customer Service Reviews: Some customers report dissatisfaction with the claims process and customer service, citing delays and lack of communication.

#9 – Travelers: Best for Extensive Coverage Options and Discounts

Pros

- Extensive Coverage Options: Travelers offers a wide range of coverage options, including liability, collision, comprehensive, and various add-ons such as rental reimbursement and gap insurance.

- Discount Opportunities: Travelers auto insurance review highlights several discounts including multi-policy, safe driver, good student, and homeownership discounts.

- Financial Stability: With a strong A++ A.M. Best rating, Travelers is recognized for its financial stability and ability to pay out claims.

Cons

- Higher Premiums: Travelers’ premiums can be higher than some competitors, particularly for those who do not qualify for multiple discounts.

- Limited Availability of Local Agents: Travelers has fewer local agents compared to other major insurers, which might be a disadvantage for those who prefer in-person service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Esurance: Best for DriveSense Program

Pros

- Tech-Savvy Platform: Esurance offers a highly user-friendly online platform and mobile app, making it easy for customers to manage their policies, file claims, and get quotes.

- Competitive Pricing: Esurance auto insurance review highlights that Esurance is recognized for its competitive pricing, frequently showcasing lower rates than traditional insurers.

- Customizable Policies: Customers can easily customize their coverage to fit their needs, adding or removing coverage options as necessary.

Cons

- Limited Physical Presence: As an online-focused insurer, Esurance has limited physical offices, which may be a drawback for customers who prefer face-to-face interactions.

- Mixed Customer Reviews: While many customers appreciate the tech-forward approach, some reviews indicate dissatisfaction with customer service and claims handling.

Impact of Social Work Profession on Auto Insurance Premiums

Auto insurance premiums vary depending on the demographic factors and occupation of the insured. One key consideration for insurance companies is the risk associated with each group of drivers. They invest resources in comprehensive risk assessments to determine insurance rates, analyzing various aspects of a typical driver’s routine and compiling data to gauge the likelihood of filing a claim.

Geico offers the best auto insurance for social workers with its affordable rates and high customer satisfaction.Daniel Walker Licensed Auto Insurance Agent

Factors such as age, gender, driving history, and occupation all play a role in determining premiums. For instance, certain professions may be perceived as more prone to accidents or claims, potentially influencing insurance costs. Therefore, individuals, including social workers, might experience fluctuations in their auto insurance premiums based on these assessments.

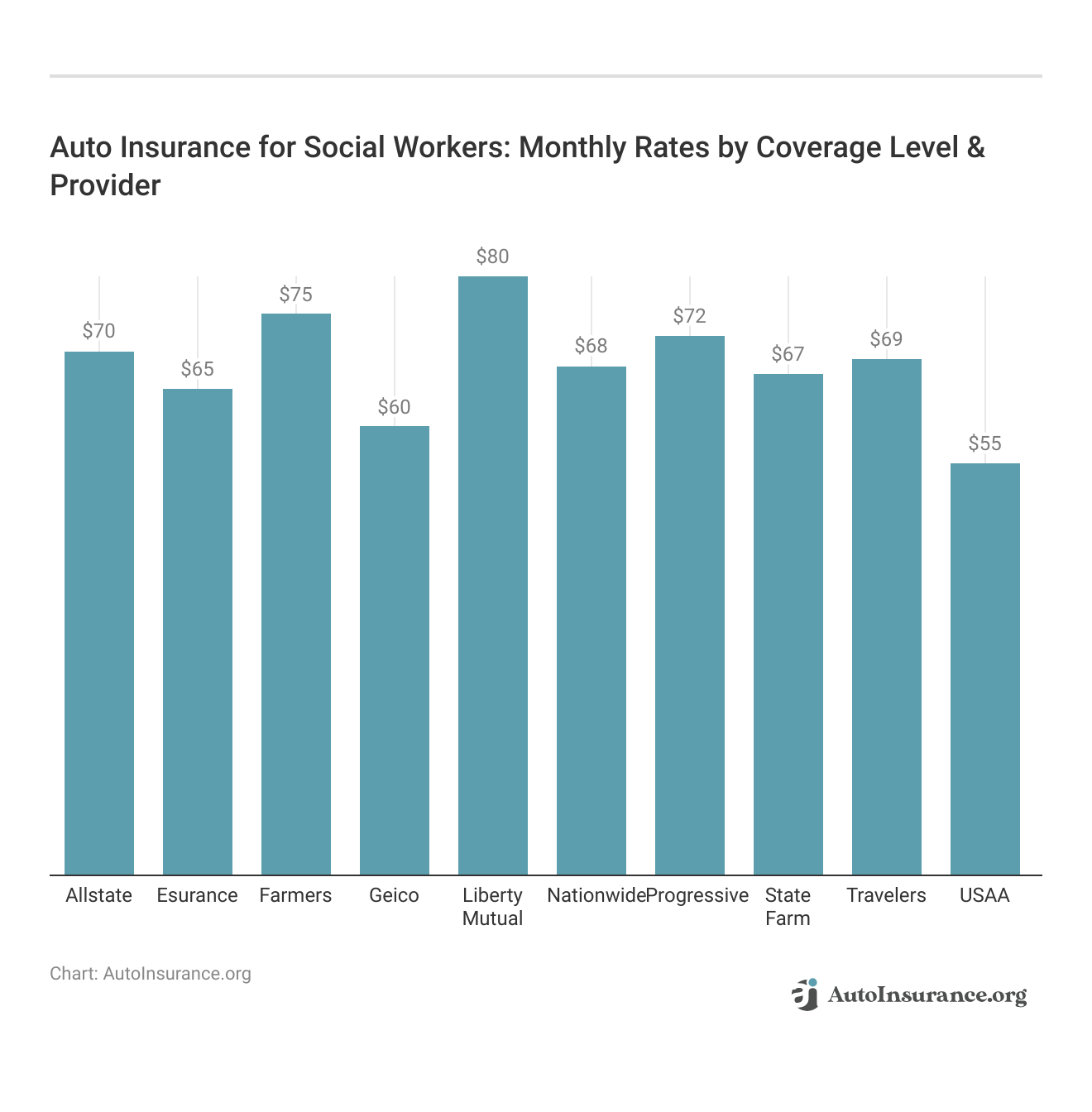

Auto Insurance for Social Workers: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$87 $228

$69 $163

$76 $198

$43 $114

$96 $248

$63 $164

$56 $150

$47 $123

$53 $248

$32 $84

Fortunately, social workers are perceived as responsible, low-risk drivers. Take a look at some national social worker statistics in the table below. Compare monthly auto insurance rates for social workers from top providers. Get coverage that fits your needs and budget with rates starting as low as $55 for minimum coverage and $135 for full coverage from USAA.

Social Worker National Statistics and Overview

| Social Worker Overview | Value |

|---|---|

| Total number of social workers in the US | 715,600 |

| Average monthly auto insurance rates | $135 |

| Average annual auto insurance rates | $1,620 |

| Average annual salary | $51,760 (as of 2020) |

| Average age of social workers | 42 years |

| Percent of social workers by gender | 83% Female, 17% Male |

The average social worker appears to be a woman around age 43. When you consider what factors influence how much a person pays for automobile insurance, the average social worker is apt to receive very competitive auto insurance premiums.

For example, women often receive cheaper premiums than their male counterparts. Why do men pay more than women on auto insurance? Statistically, men are responsible for more accidents, a trend that has taken place since 1975, according to the Insurance Institute for Highway Safety.

The Statistical Driving Safety of Social Workers

The social worker network is vast, and there are many different social work organizations that one could work for. To better understand why your day job as a social worker might affect your auto insurance rates, we have to understand what a social worker actually does.

However, statistically, social workers are not involved in a notable amount of car accidents. This is a major reason why social workers do not struggle to find affordable auto insurance rates. To gain further insights, consult our comprehensive guide titled ” Auto Insurance for Different Types of Drivers.”

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Difficulties Encountered by Social Workers Regarding Auto Insurance

One challenge social workers may face when finding auto insurance quotes is connected to income level. While companies cannot specifically use your annual salary as a means for determining auto insurance rates, it appears that some might make best-guess estimates depending on the job title you provide on your application.

A social worker’s average salary is $46,285, which does fall below the national average of $53,888. Another challenge social workers face in terms of auto insurance has to do with driving on the job. While personal auto policies will protect you when you’re driving your own car, there are a lot of exclusions if you use that vehicle for business-related purposes.

If you are a social worker who does a lot of commercial driving but do not have a company car, knowing these exclusions is extremely important. Commercial driving for social workers includes making home visits or transporting clients to and from various meetings or scheduled activities.

There is a chance that your personal auto insurance policy will not cover you during these circumstances should an accident occur. If you’re a social worker, make sure you understand how to get a commercial auto insurance policy and are aware of the differences between what your personal policy will cover, and what only commercial policies protect.

Impact of Professional Use on Auto Insurance Rates for Social Workers

Being a member of a social workers club and having access to a social work portal is not enough to get you cheap auto insurance rates. How you use your car is one of the largest determining factors in terms of car insurance premiums.

For example, if you have a messy driving record with too many speeding tickets and at-fault accidents on your record, your rates are going to be much higher than average, whether you’re a social worker or not. The table below looks at how traffic violations can impact your auto insurance rates.

Auto Insurance Rates by Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $228 | $268 | $321 | $385 | |

| $166 | $194 | $251 | $276 | |

| $198 | $247 | $282 | $275 | |

| $114 | $151 | $189 | $309 | |

| $248 | $302 | $335 | $447 |

| $164 | $196 | $230 | $338 |

| $150 | $199 | $265 | $200 | |

| $123 | $137 | $146 | $160 | |

| $141 | $192 | $199 | $294 | |

| $84 | $96 | $111 | $154 |

Too many traffic violations could even mean major companies will refuse to insure you altogether. Fortunately, if you only have one or two minor violations, you can ask companies about accident forgiveness programs. If you’re a social worker with a perfect driving record, be sure to apply for safe driver discounts.

Other vehicle usage factors to keep in mind when searching for cheap auto insurance rates is the average number of miles you drive. If you usually use public transportation when commuting for your social worker job, see if you qualify for low-mileage discounts. Even for social workers, applying for discounts and comparing quotes from as many different companies as possible will lead to low auto insurance rates.

Social Workers Auto Insurance Discounts

Discount Type Description

Auto-Pay By setting up automatic premium payments, social workers may qualify for a discount on their auto insurance.

Defensive Driving By completing an approved defensive driving course, social workers may qualify for a discount on their auto insurance premiums.

Federal Employee This discount is available to social workers who are federal government employees, providing them with potential savings on their auto insurance premiums.

Good Student Social worker students who achieve good grades may be eligible for a discount on their auto insurance premiums.

Loyalty Long-term customers, including social workers, may enjoy discounts as a loyalty reward for maintaining their policies with the same insurer.

Multi-Policy Social workers can benefit from lower rates by bundling multiple insurance policies, such as auto and home insurance, with the same provider.

Occupation-Based Insurance providers may offer specific discounts tailored for social workers and other professionals in recognition of their occupation.

Pay-in-Full Social workers can receive a discount by paying the entire policy premium upfront rather than opting for monthly payments.

Safe Driver Social workers maintaining a clean driving record can enjoy lower insurance rates as a reward for their safe driving habits.

Safety Equipment Social workers with vehicles equipped with safety features may qualify for reduced insurance rates, recognizing the added safety measures.

Whether you’re in search of independent social worker insurance coverage tailored for your vehicle’s needs or if you happen to be affiliated with the National Association of Social Workers Inc., the quest for optimal auto insurance rates demands thorough exploration. Navigating the realm of insurance necessitates a comprehensive understanding of your specific requirements and the diverse offerings available in the market.

Therefore, embarking on a diligent journey to compare policies, coverage options, and premiums from various providers is imperative. By engaging in this meticulous process, you can effectively safeguard your vehicle while ensuring financial prudence and peace of mind.

Case Studies: Auto Insurance Realities for Social Workers

Social workers play a crucial role in supporting communities, often requiring them to travel extensively for client visits and outreach programs. This dynamic work environment presents unique challenges when it comes to auto insurance.

- Case Study #1 – Navigating Auto Insurance as a Freelance Social Worker: Sarah, a freelance social worker, navigates the complexities of auto insurance as she establishes her counseling practice, ensuring adequate coverage for her unique needs.

- Case Study #2 – Auto Insurance Dilemma for Social Workers in High-Risk Areas: In high-crime urban areas, social worker David faces safety risks and vehicle security challenges, highlighting the need for comprehensive auto insurance and insurer support in addressing occupational hazards.

- Case Study #3 – Managing Auto Insurance Needs for Hybrid Social Work Roles: Maria, navigating hybrid social work duties, faces auto insurance challenges, balancing office, outreach, and client visits, prompting a need to optimize coverage and minimize premiums.

These case studies highlight the diverse scenarios faced by social workers in their quest for suitable auto insurance coverage. Whether it’s managing costs, addressing occupational risks, or balancing hybrid roles, each story underscores the importance of understanding individual needs and finding tailored solutions.

Geico emerges as the top choice for social workers with its low monthly premium of $82 and A++ Best rating, ensuring affordability and reliability.Jeff Root Licensed Insurance Agent

By understanding the specific challenges they face and exploring tailored coverage options, social workers can ensure they have the protection they need while fulfilling their vital roles in the community.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Summary: Navigating Auto Insurance Challenges for Freelance Social Workers

This guide provides a detailed overview of auto insurance for social workers, including key considerations, top insurance companies, average costs, and impact factors. It discusses the unique challenges social workers face in obtaining affordable coverage, such as usage for work-related travel and income levels.

The guide also offers insights into insurance discounts available for social workers and the importance of understanding coverage needs. Overall, it aims to help social workers navigate the complexities of auto insurance and find the best coverage options for their needs.

Uncover cheap auto insurance rates from the top providers by entering your ZIP code below.

Frequently Asked Questions

Do social workers need specific auto insurance?

Social workers typically need personal auto insurance like any other driver. However, depending on their work activities, they may require additional coverage options, such as liability coverage for transporting clients or professional liability insurance to protect against claims related to their professional services. It’s important to discuss specific job-related needs with an insurance professional.

What should social workers consider when selecting auto insurance coverage?

Social workers selecting auto insurance should consider usage frequency for work-related travel, assess liability coverage limits, explore additional options like uninsured motorist coverage, and inquire about discounts tailored for their profession to lower premiums.

Stop overpaying for auto insurance. Enter your ZIP code below to find out if you can get a better deal.

Are there any auto insurance discounts available for social workers?

Yes, social workers may be eligible for certain auto insurance discounts. These can include occupational discounts for professionals, safe driver discounts, or affiliation discounts if they belong to specific organizations or associations. It’s recommended to inquire with insurance providers to explore available discounts for social workers.

To gain further insights, consult our comprehensive guide titled “Auto Insurance Discounts.”

Can social workers be covered under their employer’s insurance policy?

It depends on the employer and their insurance policies. Some employers may provide coverage for social workers using their personal vehicles for work purposes under the employer’s commercial auto insurance policy. However, it’s important to verify with the employer and review the policy details to ensure proper coverage.

What is non-owned auto insurance coverage, and do social workers need it?

Non-owned auto insurance coverage provides liability protection when driving a vehicle that is not owned by the insured. Social workers who frequently use vehicles that are not their own, such as rental cars or clients’ vehicles, may benefit from non-owned auto insurance coverage.

Can social workers add additional liability coverage to their auto insurance policy?

Yes, social workers can typically add additional liability coverage to their auto insurance policy if they need higher limits. This can provide extra financial protection in case of accidents where they may be held liable for damages or injuries. It’s advisable to discuss specific coverage needs with an insurance professional to determine appropriate limits.

For a comprehensive analysis, refer to our detailed guide titled “Auto Insurance for Different Types of Drivers.”

How much is auto insurance for social workers per month?

The cost of auto insurance for social workers per month can vary significantly depending on factors such as location, driving history, coverage limits, the type of vehicle, and insurance provider. On average, however, social workers might expect to pay anywhere from $50 to $200 per month for auto insurance coverage.

Does using a personal vehicle for work purposes impact auto insurance coverage?

If social workers use their personal vehicle for work purposes, such as transporting clients or visiting different locations, it may impact their auto insurance coverage. It’s important to inform the insurance provider about the vehicle’s use to ensure appropriate coverage. Additional coverage options, such as hired and non-owned auto coverage, may be necessary to protect against potential work-related incidents.

Check out our ranking of the top providers: Cheap Auto Insurance After an Accident

Which company stands out as the best for auto insurance for social workers?

Determining the best auto insurance company for social workers can vary based on individual needs and preferences. However, some companies like Geico, Progressive, and State Farm often offer competitive rates and discounts tailored for professionals, including social workers.

What percentage of social workers are women?

Approximately 85% of social workers in the United States are women. However, this figure may vary depending on the region and specific demographics.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.