Best Oregon Auto Insurance in 2025 (See Our Top 10 Company Picks)

Secure the best Oregon auto insurance with State Farm, Geico, and Progressive and enjoy rates as low as $55 monthly. These companies offer affordable coverage options, ideal for reliable auto insurance. Compare quotes to find out how much car insurance costs in Oregon and save on your premium.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Oregon

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Oregon

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Oregon

A.M. Best Rating

Complaint Level

Pros & Cons

The best Oregon auto insurance providers are State Farm, Geico, and Allstate, offering rates as low as $55 per month. Among all top Oregon auto insurance companies, State Farm leads with competitive rates and excellent customer service. Compare quotes from these providers to find the best deal for you.

If your Oregon auto insurance is expensive, you can save by choosing the right company and coverages. Learn about insurance laws in the Beaver State and discover which companies offer cheap car insurance in Oregon.

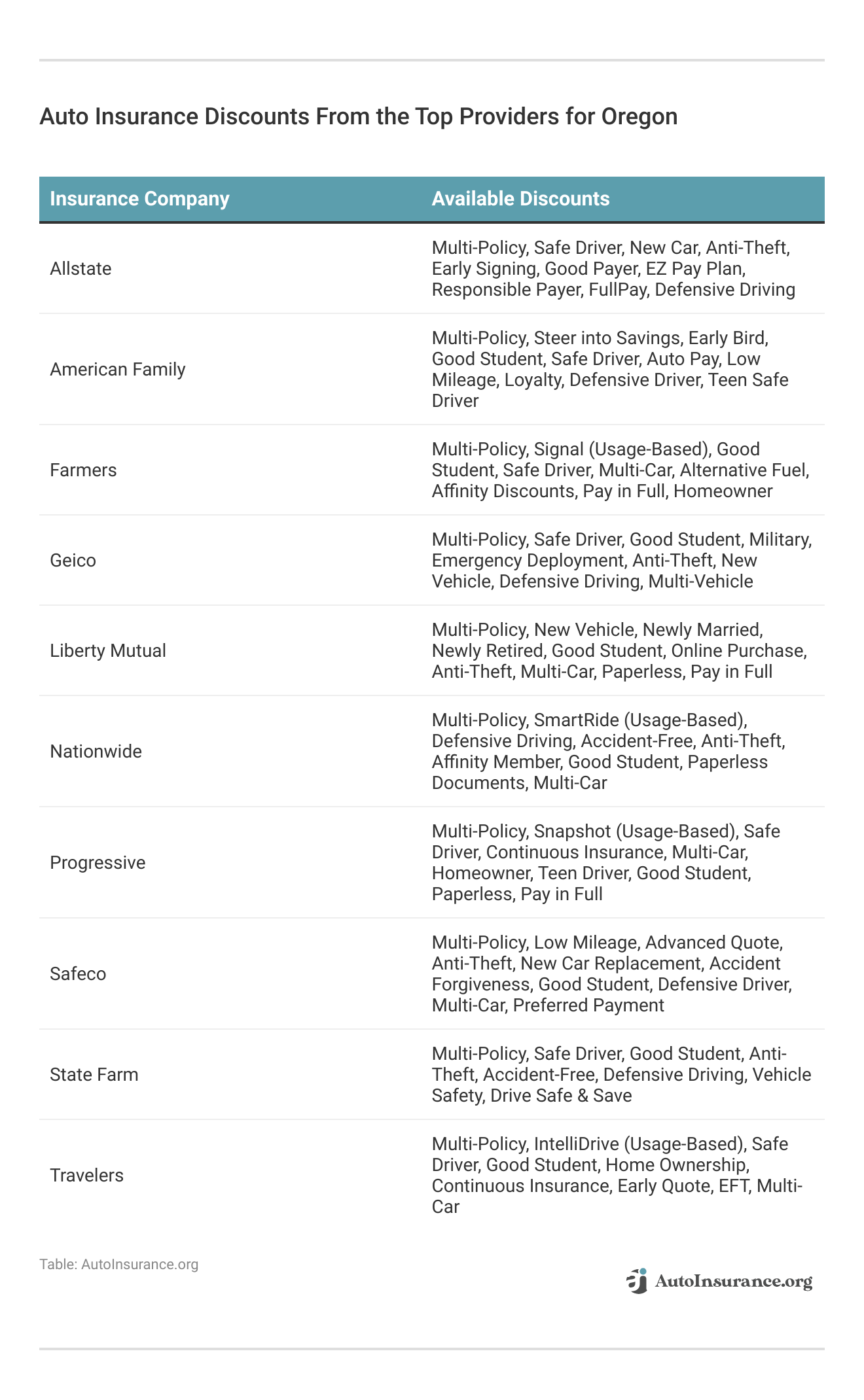

Our Top 10 Company Picks: Best Oregon Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Local Agents State Farm

#2 15% A++ Many Discounts Geico

#3 14% A+ Competitive Rates Progressive

#4 13% A+ Safe-Driving Discounts Allstate

#5 12% A Customizable Policies Liberty Mutual

#6 11% A+ Comprehensive Coverage Farmers

#7 10% A+ Customer Service Nationwide

#8 9% A Personalized Service American Family

#9 8% A++ Affordable Premiums Travelers

#10 7% A Good Discounts Safeco

From state minimum requirements to the cheapest full coverage auto insurance, compare quotes to find the best policy. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- Oregon Auto Insurance

- Best Portland, Oregon Auto Insurance in 2025 (Check Out These 10 Companies)

- Best Philomath, Oregon Auto Insurance in 2025

- Best Mcminnville, Oregon Auto Insurance in 2025

- Best Hereford, Oregon Auto Insurance in 2025

- Best Gladstone, Oregon Auto Insurance in 2025 (Check Out the Top 10 Companies)

- Best Beaverton, Oregon Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Salem, Oregon Auto Insurance in 2025 (Check Out the Top 10 Companies)

- Best Eugene, Oregon Auto Insurance in 2025 (Top 10 Companies Ranked)

- Save on car insurance by choosing the right coverage and company

- Get affordable policies tailored to Oregon’s laws

- State Farm offers competitive rates and excellent service

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates and Discounts: State Farm offers competitive rates, especially when bundling policies like auto and home insurance. They also provide various discounts that can help customers save money. For discounts read our State Farm auto insurance discounts.

- Excellent Customer Service: State Farm is known for its excellent customer service, with a large network of local agents who can provide personalized assistance.

- Strong Financial Stability: State Farm has a strong financial stability rating, ensuring they can meet their financial obligations to policyholders.

Cons

- Higher Rates for Certain Demographics: Rates can be higher for younger drivers and some other demographics compared to other insurers.

- Limited Digital and Mobile App Features: State Farm’s digital and mobile app features are not as extensive as some competitors, which may be a drawback for customers who prefer managing their policies online.

#2 – Geico: Best for Many Discounts

Pros

- Low Rates: Geico offers some of the lowest rates in the industry, especially for good drivers with a clean record.

- User-Friendly Website and Mobile App: As mentioned in our Geico auto insurance review, Geico’s website and mobile app are easy to use, allowing customers to manage their policies, file claims, and access information conveniently.

- Extensive Range of Discounts: Geico provides a wide range of discounts, including discounts for good drivers, military personnel, federal employees, and more.

Cons

- Limited Customer Service Options: Geico primarily offers customer service online or via phone, with limited in-person support compared to some other insurers.

- Rate Increases After Accidents: Rates can increase significantly after an accident or traffic violation, which may not be favorable for customers looking to maintain lower premiums.

#3 – Progressive: Best for Competitive Rates

Pros

- Innovative Tools for Personalized Rates: Progressive offers innovative tools like Name Your Price® and Snapshot® that allow customers to get personalized quotes based on their driving habits and needs.

- Competitive Rates for High-Risk Drivers: Progressive is known for offering competitive rates for high-risk drivers and those with poor credit histories.

- Excellent Digital Tools and Mobile App: Progressive auto insurance review highlights the excellent digital tools and a mobile app that makes it easy for customers to manage their policies, file claims, and track their driving behavior.

Cons

- Variable Customer Service: Customer service satisfaction can vary among Progressive customers, with some experiencing issues with claims handling and support.

- Rates May Not Be as Competitive for Low-Risk Drivers: Progressive’s rates might not be as competitive for drivers with clean records compared to other insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Safe-Driving Discounts

Pros

- Wide Range of Coverage Options: Allstate offers a wide range of coverage options and add-ons, allowing customers to tailor their policies to fit their specific needs. Learn more about their premiums in our Allstate auto insurance review.

- Strong Customer Service Network: Allstate has a large network of agents and strong customer service ratings, ensuring customers can get assistance when they need it.

- Innovative Safe Driving Tools: Allstate offers tools like Drivewise® that reward safe driving behaviors with discounts and incentives.

Cons

- Higher Costs for Basic Coverage: Allstate can be more expensive than competitors, especially for basic coverage options.

- Mixed Reviews on Claims Handling: Some customers have reported mixed experiences with Allstate’s claims handling process, which may affect overall satisfaction.

#5 – Liberty Mutual: Best for Customizable Policies

Pros

- Personalized Coverage Options and Discounts: As mentioned in our Liberty Mutual auto insurance review, Liberty Mutual provides personalized coverage options and a variety of discounts to help customers save on their premiums.

- Strong Financial Stability and Customer Service: Liberty Mutual has strong financial stability and good customer service ratings, providing peace of mind to policyholders.

- Convenient Online Tools and Mobile App: Liberty Mutual offers convenient online tools and a mobile app that makes it easy for customers to manage their policies and access important information.

Cons

- Higher Rates Compared to Some Competitors: Rates may be higher compared to some other insurers, which could be a consideration for cost-conscious customers.

- Limited Availability in Some States: Liberty Mutual is not available in all states, which may limit options for customers looking for coverage in certain areas.

#6 – Farmers: Best for Comprehensive Coverage

Pros

- Personalized Service: Farmers is known for its personalized service, with a network of local agents who can provide tailored advice and assistance. Check out this page Farmers auto insurance review to know more details.

- Variety of Coverage Options: Farmers offers a wide range of coverage options, including add-ons like rideshare coverage and guaranteed replacement cost coverage for homes.

- Strong Financial Stability: Farmers has strong financial stability ratings, ensuring they can meet their financial obligations to policyholders.

Cons

- Higher Premiums: Farmers’ premiums can be higher compared to some competitors, especially for certain demographics and coverage types.

- Limited Digital Tools: Farmers’ digital tools and mobile app features are not as advanced as some other insurers, which may be a drawback for tech-savvy customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Customer Service

Pros

- Wide Range of Insurance Products: Nationwide offers a wide range of insurance products, including auto, home, and life insurance, making it a convenient choice for bundling policies.

- Good Discounts: Nationwide provides various discounts, such as multi-policy discounts and accident-free discounts, to help customers save on their premiums.

- Strong Customer Service: Nationwide has a good reputation for customer service, with a network of agents and good claims handling support. For more information, read our Nationwide auto insurance review.

Cons

- Mixed Customer Reviews: Nationwide has received mixed customer reviews regarding claims handling and customer service, which may vary by region.

- Higher Rates in Some Areas: Rates can be higher in certain areas compared to other insurers, which may affect affordability for some customers.

#8 – American Family: Best for Personalized Service

Pros

- Customizable Policies: American Family offers customizable policies and a variety of coverage options, allowing customers to tailor their insurance to their specific needs.

- Innovative Discounts: American Family provides innovative discounts, such as the Teen Safe Driver Program and the KnowYourDrive program, which reward safe driving behaviors.

- Strong Community Involvement: American Family is involved in various community initiatives and has a strong presence in supporting local communities.

Cons

- Higher Premiums for Basic Coverage: American Family’s premiums can be higher compared to some other insurers, especially for basic coverage options.

- Limited Availability: American Family is not available in all states, which may limit options for customers looking for coverage in certain areas. (Read More: American Family Auto Insurance Review).

#9 – Travelers: Best for Affordable Premiums

Pros

- Competitive Rates: Travelers offers competitive rates, especially for drivers with clean records and good credit.

- Wide Range of Coverage Options: Travelers provides a wide range of coverage options, including add-ons like roadside assistance and rental reimbursement.

- Strong Financial Strength: As outlined in our Travelers auto insurance review, Travelers has strong financial strength ratings, ensuring they can meet their financial obligations.

Cons

- Mixed Customer Service Reviews: Travelers has received mixed reviews regarding customer service, with some customers reporting issues with claims handling and support.

- Limited Discounts: Travelers may not offer as many discounts as some other insurers, which could affect affordability for customers seeking additional savings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Safeco: Best for Good Discounts

Pros

- Convenient Online Tools and Mobile App: Safeco offers convenient online tools and a mobile app that makes it easy for customers to manage their policies and file claims.

- Good Discounts: Safeco provides various discounts, such as the RightTrack® program and multi-policy discounts, to help customers save on their premiums.

- Solid Customer Service: In our Safeco auto insurance review highlights company’s good customer service ratings, with positive feedback on their claims handling process and customer support.

Cons

- Higher Premiums in Some Regions: Safeco’s premiums can be higher in certain regions compared to other insurers, which may impact affordability.

- Limited Availability: Safeco is not available in all states, which may restrict options for customers looking for coverage in specific areas.

Cost of Auto Insurance in Oregon

While car insurance quotes in Oregon are 15% lower than the national average, the actual amount you’ll pay for coverage depends on a variety of factors. Insurance companies use your age, gender, marital status, credit score, driving history, and what car you drive to determine how much you’ll pay.

For example, you will pay more for insurance if you have bad credit, even if you shop at the best auto insurance companies for bad credit.

Car insurance companies take your unique set of circumstances into account when they craft your quotes. However, you can get an idea of where to start your search for cheap car insurance in Oregon by comparing companies.

Minimum Car Insurance Rates in Oregon

Most states have laws regarding how much insurance drivers must carry, and Oregon is one of them.

Here are Oregon’s car insurance requirements:

- Bodily Injury: $25,000 per person

- Bodily Injury: $50,000 per accident

- Property Damage: $20,000 per accident

- Bodily Injury for Uninsured/Underinsured Motorist: $25,000 per person

- Bodily Injury for Uninsured/Underinsured Motorist: $50,000 per accident

- Personal Injury Protection: $15,000 per person

Oregon has stricter insurance requirements than many other states, but this is your cheapest option for insurance. You can get an idea of how much different companies might charge you for minimum auto insurance in Oregon below.

Oregon Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

$112 $220

$78 $153

$81 $160

$68 $134

$103 $202

$81 $160

$57 $111

$62 $114

$55 $108

$71 $139

State Farm, Progressive, and Travelers are the cheapest options for minimum coverage in Oregon, though there is a significant difference between State Farm auto insurance and Travelers.

Purchasing the minimum coverage is a great way to keep your insurance costs down, but it also comes with the risk of having to pay for costly repairs by yourself. Although Oregon’s insurance laws are thorough, an additional risk is that you might do more damage than your policy can cover.

The risk of having to pay for car repairs or other damage after an accident is why many drivers elect full coverage instead of the minimum insurance.

If you’re interested in more coverage, most companies offer a list of add-ons you can purchase.

Some of the most popular add-ons with Oregon drivers include the following:

- Rental car reimbursement

- Roadside assistance

- Gap insurance

- Mechanical breakdown insurance

While it’s tempting to add as much coverage as possible to your policy, you should only buy what you need. Each option you add to your policy raises your rates and can make insurance unaffordable. If you’re unsure what the best options are for your car, an insurance representative can help you decide.

Oregon Car Insurance Rates by age

Many insurance companies calculate average car insurance rates by age, as it’s a very important factor. Insurance companies keep careful track of claims data, and those numbers show that young drivers are statistically more likely to drive recklessly and get in accidents.

Young drivers pay some of the highest rates for car insurance, with Oregon youths paying about double what older adults pay.

Let’s take a look at the average annual rates for teenagers to get a better idea of what you can expect from the top insurance companies.

Oregon Full Coverage Auto Insurance Monthly Rates for Teens

| Insurance Company | 16-Year-Old Female | 16-Year-Old Male | 18-Year-Old Female | 18-Year-Old Male |

|---|---|---|---|---|

| $863 | $600 | $630 | $701 | |

| $673 | $468 | $348 | $547 | |

| $1,077 | $749 | $865 | $875 | |

| $360 | $250 | $335 | $292 | |

| $734 | $510 | $550 | $597 |

| $592 | $411 | $380 | $481 |

| $1,031 | $717 | $752 | $838 | |

| $484 | $337 | $314 | $394 | |

| $540 | $376 | $362 | $439 | |

| $302 | $210 | $228 | $245 | |

| U.S. Average | $706 | $491 | $476 | $541 |

While rates for teen drivers in Oregon match more closely with the national average, prices are still high. Young drivers from military families can find especially low rates with USAA, which offers prices that are over $500 lower than the next cheapest company.

Although Geico’s rates are a little higher than Travelers and State Farm, it has one of the longest lists of student and youth-based discounts young drivers might be eligible for.

Below we go into more detail on the average annual rates for the average adult.

Oregon Full Coverage Auto Insurance Monthly Rates for Adults

| Insurance Company | 30-Year-Old Female | 30-Year-Old Male | 45-Year-Old Female | 45-Year-Old Male |

|---|---|---|---|---|

| $236 | $237 | $238 | $220 | |

| $146 | $154 | $153 | $153 | |

| $186 | $193 | $166 | $160 | |

| $150 | $131 | $139 | $134 | |

| $184 | $189 | $191 | $202 |

| $185 | $196 | $161 | $160 |

| $148 | $142 | $124 | $111 | |

| $118 | $135 | $108 | $108 | |

| $138 | $141 | $137 | $139 | |

| $108 | $112 | $86 | $84 | |

| U.S. Average | $160 | $163 | $150 | $147 |

For nonmilitary families, Travelers, State Farm, and Geico are excellent options. Seniors’ car insurance rates tend to increase as they get older. Take a look below for the average rates for seniors at the top insurance companies.

Oregon Full Coverage Auto Insurance Monthly Rates for Seniors

| Insurance Company | 55-Year-Old Female | 55-Year-Old Male | 60-Year-Old Female | 60-Year-Old Male |

|---|---|---|---|---|

| $226 | $209 | $217 | $218 | |

| $145 | $145 | $133 | $133 | |

| $158 | $152 | $138 | $149 | |

| $132 | $127 | $123 | $122 | |

| $182 | $192 | $155 | $170 |

| $153 | $151 | $140 | $148 |

| $117 | $106 | $102 | $106 | |

| $102 | $102 | $97 | $97 | |

| $130 | $132 | $111 | $116 | |

| $82 | $79 | $81 | $79 | |

| U.S. Average | $149 | $146 | $163 | $163 |

Rates in Oregon will differ slightly depending on several factors. So make sure you compare at least three different insurance quotes before deciding on what company to use.

Oregon Car Insurance Rates by Credit Score

You probably know that your credit score affects your ability to buy a house or refinance a loan, but did you know it also affects your insurance rates?

Insurance companies look at your credit score to help determine how risky you’ll be to insure. Data shows that drivers with low credit scores file more claims, which translates to higher rates — people with poor credit scores pay up to 60% more for their insurance.

Oregon Full Coverage Auto Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $105 | $125 | $145 | |

| $115 | $135 | $155 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| $98 | $118 | $138 | |

| $90 | $110 | $130 | |

| $112 | $132 | $152 | |

| $85 | $105 | $125 |

Oregon drivers with low credit scores should consider quotes from Geico, Nationwide, and Travelers. Although State Farm typically offers affordable insurance in Oregon, it’s not as forgiving of low credit scores.

The good news about low credit scores is that they don’t need to stay low forever. If you raise your credit score, your insurance rates will decrease.

Oregon Car Insurance Rates After an Accident

No one wants to get into an accident, but you can’t always avoid them. Unfortunately, an at-fault accident on your driving record can increase your insurance rates by up to 50%.

The overall number of car accidents in your state also affects your car insurance rates — the more accidents your neighbors get in, the more you’ll pay for coverage. According to the Insurance Institute for Highway Safety (IIHS), Oregon drivers get into an average number of accidents, with the number of fatal collisions just slightly above the national average.

To get a better idea of how much your rates will increase, take a look at the table below.

Oregon Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

| Insurance Company | One Accident | Clean Record |

|---|---|---|

| $330 | $220 | |

| $255 | $153 | |

| $232 | $160 | |

| $230 | $134 | |

| $219 | $202 |

| $182 | $160 |

| $257 | $111 | |

| $140 | $108 | |

| $188 | $139 | |

| $116 | $84 | |

| U.S. Average | $226 | $147 |

Once again, State Farm, USAA, and Travelers offer the cheapest car insurance in Oregon after an accident.

However, there’s a difference of $241 between State Farm and Travelers. If you have an accident on your record, State Farm is an excellent place to start looking for insurance.

Your rates won’t stay high forever, though. After about three years, your rates will start to look like they did before your accident. However, that only works if you remain accident-free during those three years. If you continuously get into accidents, you might have to find the best auto insurance companies for high-risk drivers.

Oregon Car Insurance Rates After a DUI

Technically called driving under the influence of intoxicants (DUII), Oregon law classifies the following as a DUI:

- Having a blood alcohol concentration (BAC) of 0.08% or higher

- Being under the influence of liquor, controlled substances, or inhalants

- Being under the influence of any combination of liquor, inhalants, and controlled substances

You can also be charged with attempted DUI if an officer believes you are about to get behind the wheel of a car while intoxicated.

Oregon punishes offenders based on how many DUI incidents the driver has committed.

The consequences of a DUI charge include up to a year in jail and the following:

- First Conviction: $1,000 fine

- Second Conviction: $1,500 fine

- Third and Subsequent Conviction: $2,000 fine

The circumstances of the DUI also affect how much the state charges you. For example, if you have a BAC over 0.15%, your minimum fine will be $2,000 for your first conviction. If you have a minor in the car more than three years younger than you, your minimum penalty will be $10,000.

It’s imperative that you compare the best auto insurance for drivers with a DUI, as your current rates will spike. Take a look below to see how insurance companies throughout the country handle DUI rates.

Oregon Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $330 | $220 | $294 | $262 | |

| $255 | $153 | $286 | $205 | |

| $232 | $160 | $224 | $210 | |

| $230 | $134 | $281 | $186 | |

| $219 | $202 | $266 | $227 |

| $182 | $160 | $293 | $191 |

| $257 | $111 | $154 | $151 | |

| $140 | $108 | $118 | $118 | |

| $188 | $139 | $208 | $180 | |

| $116 | $84 | $138 | $97 | |

| U.S. Average | $226 | $147 | $236 | $192 |

State Farm is still your best bet for cheap insurance in Oregon, with rates more than $200 less than the second most affordable option. However, you’ll still be paying more for coverage, and DUIs stay on your insurance record longer than at-fault accidents. The average length of time insurance companies look for DUIs is seven years.

Navigating the Cost of Auto Insurance in Your City

The table below provides a glimpse into the varying costs of auto insurance across different cities in Oregon. From Beaverton to Portland, explore how insurance rates fluctuate based on location. Compare and find insights into the cost of auto insurance in your city.

Cost of Auto Insurance in Your City

| City | Insurance Company | Rank | Bundling Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|---|

| Beaverton, OR | #1 | 17% | B | Broad Coverage | State Farm | |

| #2 | 25% | A++ | Affordable Rates | Geico | ||

| #3 | 10% | A++ | Military Families | USAA | ||

| Eugene, OR | #1 | 17% | B | Broad Coverage | State Farm | |

| #2 | 10% | A++ | Military Families | USAA | ||

| #3 | 10% | A+ | Custom Plans | Progressive | ||

| Gladstone, OR | #1 | 17% | B | Broad Coverage | State Farm | |

| #2 | 25% | A++ | Affordable Rates | Geico | ||

| #3 | 10% | A+ | Custom Plans | Progressive | ||

| Hereford, OR | #1 | 13% | A++ | Reliable Coverage | Travelers | |

| #2 | 25% | A+ | Comprehensive Plans | Allstate | ||

| #3 | 17% | B | Broad Coverage | State Farm | ||

| McMinnville, OR | #1 | 10% | A+ | Custom Plans | Progressive | |

| #2 | 25% | A | Family Discounts | American Family | ||

| #3 | 25% | A++ | Affordable Rates | Geico | ||

| Philomath, OR |  | #1 | 20% | A+ | Full Coverage | Nationwide |

| #2 | 25% | A | Flexible Options | Liberty Mutual | |

| #3 | 20% | A | Local Agents | Farmers | ||

| Portland, OR | #1 | 17% | B | Broad Coverage | State Farm | |

| #2 | 10% | A++ | Military Families | USAA | ||

| #3 | 25% | A++ | Affordable Rates | Geico | ||

| Salem, OR | #1 | 25% | A++ | Affordable Rates | Geico | |

| #2 | 17% | B | Broad Coverage | State Farm | ||

| #3 | 10% | A+ | Custom Plans | Progressive |

Cheapest Cities for Auto Insurance in Oregon

Whether you’re keeping it weird in Portland, enjoying some dry weather in Medford, or hiking in Redmond, you can find affordable insurance in every Oregon city.

Your location plays a critical role in your insurance rates. Car insurance companies look at things like the number of accidents, car theft, and weather risks in an area to formulate your quotes. You can see vastly different rates by moving even a single ZIP code over.

Portland, OR, auto insurance is some of the most expensive in the state, and understandably so. Factors like increased traffic, more car theft, and wildfire risks add together to make Portland rates high.

If you’re looking for cheap auto insurance in Oregon and need to be in the Portland area, you can save by choosing nearby cities like Beaverton and Lake Oswego.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Oregon Auto Insurance Laws

You know how much insurance you need before legally driving on an Oregon road, but what are other car insurance laws for Oregon?

For starters, you must present proof of insurance when you register a car or request a light trip permit. You need to keep a copy of your insurance card in your car, and Oregon requires companies to send you a physical copy that states your policy’s expiration date.

In Oregon, it's vital to keep proof of insurance on hand, as failure to do so can lead to hefty fines, license suspension, and vehicle impoundment.Scott W. Johnson LICENSED INSURANCE AGENT

If you’re caught without insurance, you’ll face a fine of up to $1,000, the suspension of your license and registration, vehicle impoundment, and a reinstatement fee of $75. You’ll also have to submit proof of financial responsibility.

If you’re struggling to find car insurance you can afford due to DUIs, multiple at-fault accidents, or any other reason, you can apply for the Automobile Insurance Plan of Oregon. Since all drivers must have insurance, Oregon will help you get minimum coverage when you can’t find it elsewhere.

Oregon SR-22 Auto Insurance

Cheap SR-22 auto insurance isn’t technically coverage. Instead, it’s a form that your insurance company submits to the Oregon DMV as proof that you carry at least minimum coverage.

You may be required to submit an SR-22 form for the following reasons:

- Driving without insurance

- Convicted of a DUI

- Failed to pay for damages after an at-fault accident

- Are trying to reinstate your driving privileges

- Applied for a probationary or hardship permit after a license suspension

- Need to comply with a court order

The length of time you’ll need SR-22 coverage depends on why you were ordered to get it. For example, you’ll need to submit an SR-22 form every month for three years if you’re convicted of a DUI.

How to Get SR-22 Auto Insurance in Oregon

Receiving orders to submit SR-22 insurance every month can feel stressful, but the process is simple. If you already have insurance, you can contact a representative from your company to find out how much it will cost for them to file your SR-22 insurance.

For drivers looking for new insurance, you should include that you need SR-22 insurance when you request a quote. Your rates will likely be higher, but having SR-22 insurance will keep you legal on the road.

In some situations, you might need your license reinstated but no longer have a car. Getting your license reinstated requires SR-22 insurance in Oregon, but it can be tricky to get without a car. In this situation, you should consider non-owner car insurance.

Non-owner car insurance gives you coverage when you occasionally drive someone else’s car. It’s usually much cheaper than what standard auto insurance insurance companies offer, and you’ll be able to file SR-22 certification with the DMV.

Find the Best Car Insurance in Oregon Today

Along with its natural beauty and unique personality, Oregon drivers can look forward to insurance rates 15% cheaper than the national average. Some areas — especially Portland and surrounding cities — see slightly higher rates, but most drivers can find affordable auto insurance in Oregon.

One of the best ways to find affordable Oregon auto insurance, no matter what part of the state you live in, is to compare Oregon auto insurance quotes. While State Farm, USAA, and Travelers have the lowest average rates in Oregon, you might find that the best Oregon auto insurance is elsewhere.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What factors should I consider when choosing the best auto insurance in Oregon?

When choosing the best auto insurance in Oregon, consider factors that affect auto insurance rates like affordability, coverage options (including state minimum requirements and comprehensive coverage), customer service ratings, and discounts offered by the insurance companies.

What company offers the cheapest car insurance in Oregon?

Although rates vary by your unique circumstances, State Farm, USAA, and Travelers consistently offer low rates to Oregon drivers. Geico might be a good choice for young drivers looking for student discounts, and Nationwide offers affordable rates for people with low credit scores.

How much is car insurance in Oregon per month?

Oregon’s average minimum insurance policy costs $610 a year, or $50 a month. For full coverage, the average price is $1,346 a year or $112 a month. Keep in mind that these are just averages — your actual rate might be much different.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Why is car insurance so expensive in Oregon?

Oregon drivers actually pay about 15% less for insurance than the rest of the country. You might see higher rates based on factors like age, driving history, and location.

How can I find the best car insurance in Oregon?

By comparing auto insurance quotes from multiple insurance companies, considering coverage options, customer service, financial strength, and pricing. Review policy terms, coverage limits, and additional features before making a decision.

How do you get SR-22 insurance in Oregon?

To get SR-22 insurance in Oregon, contact an insurance provider authorized to issue SR-22 certificates. They will file the SR-22 form with the Oregon DMV on your behalf.

Does Oregon require SR-22 insurance?

Yes, Oregon requires SR-22 insurance for drivers with a suspended or revoked license due to certain violations like DUI convictions or reckless driving offenses. Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

What are Oregon minimum auto insurance requirements?

All drivers in Oregon must carry bodily injury and property damage auto insurance in Oregon.

What optional coverages are recommended for drivers in Oregon?

In addition to liability insurance, optional coverages recommended for drivers in Oregon include Uninsured motorist (UM) coverage, comprehensive coverage (for damage from theft, vandalism, and natural disasters), and collision coverage (for damage from accidents).

5. What penalties will I face if caught driving without insurance in Oregon?

Is Oregon a no-fault insurance state?

No, Oregon has an at-fault system for Oregon auto insurance coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.