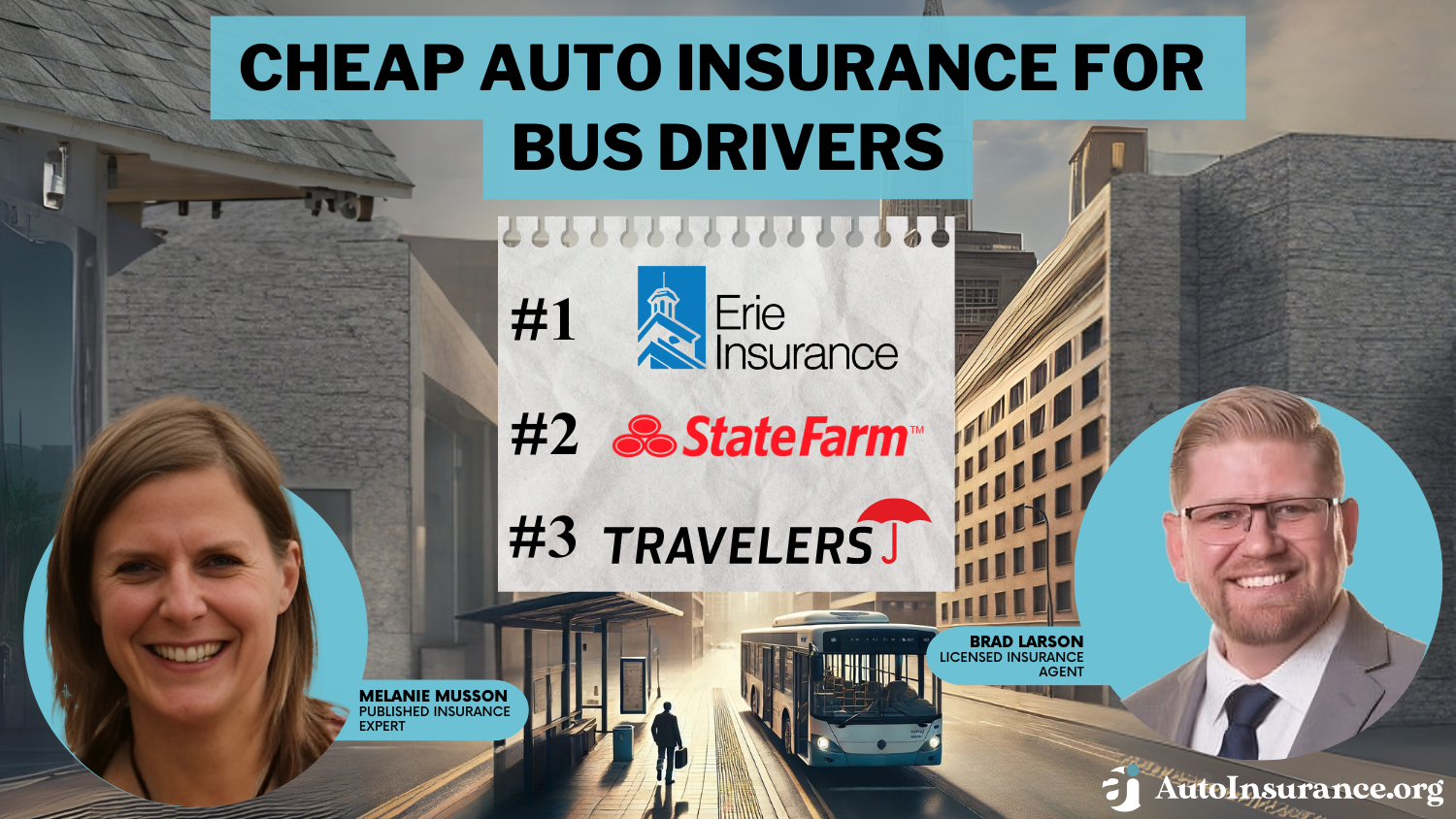

Cheap Auto Insurance for Bus Drivers in 2025 (9 Most Affordable Companies)

When it comes to cheap auto insurance for bus drivers, Erie, State Farm, and Travelers offer top rates. Bus driver auto insurance costs as low as $32 per month, but you can save more by enrolling in a UBI program like Erie's YourTurn or taking advantage of a safe driver discount.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Apr 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 7, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Bus Driver Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 18,154 reviews

18,154 reviewsCompany Facts

Bus Driver Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 1,733 reviews

1,733 reviewsCompany Facts

Bus Driver Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsErie, State Farm, and Travelers are the top providers of cheap auto insurance for bus drivers, especially if they are safe drivers and sign up for a usage-based insurance (UBI) program.

At $32 per month, Erie offers the cheapest auto insurance for bus drivers thanks to its long list of car insurance discounts and personalized service.

Our Top 9 Company Picks: Cheap Auto Insurance for Bus Drivers

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $32 | A+ | Personalized Service | Erie |

| #2 | $47 | A++ | Cheap Rates | State Farm | |

| #3 | $53 | A++ | Unique Coverage | Travelers | |

| #4 | $56 | A+ | Budget Shopping | Progressive | |

| #5 | $62 | A | Discount Availability | American Family | |

| #6 | $63 | A+ | Deductible Savings | Nationwide |

| #7 | $76 | A | Safety Discounts | Farmers | |

| #8 | $87 | A+ | UBI Discounts | Allstate | |

| #9 | $96 | A | Add-on Options | Liberty Mutual |

These providers balance low rates with quality coverage, making them ideal for bus drivers seeking affordable protection, especially those with clean records or enrolled in a usage-based insurance (UBI) program.

- Erie has the overall cheapest bus driver insurance rates

- Cheapest car insurance for bus drivers costs $32 per month

- Usage-based insurance programs and safe driving discounts can help you save

Explore our picks for the best cheap auto insurance for bus drivers below, and enter your ZIP code to compare personalized quotes from multiple companies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Erie Insurance: Top Overall Pick

Pros

- Personalized Service: Erie focuses more on its customer experience, ensuring that bus drivers get as much attention as they want.

- Competitive Rates: Erie is a top affordable choice for bus drivers, often beating larger competitors. Our Erie insurance review highlights its coverage and discounts.

- YourTurn: Erie’s YourTurn UBI tracks driving habits and rewards safe drivers with a gift card or donation instead of a discount.

Cons

- Limited Availability: Erie offers excellent insurance plans for bus drivers, but only in 12 states.

- No online Quotes: Bus drivers looking for a new Erie policy will need to contact a local agent for a quote, as there is no online quote option.

#2 – State Farm: Best for Cheap Rates

Pros

- Drive Safe and Save: Bus drivers can maximize their driving skills by signing up for Drive Safe and Save, which can earn them a discount of up to 30%.

- Affordable Rates: State Farm is often the cheapest option for car insurance, regardless of where bus drivers live. Compare State Farm’s rates with others in our State Farm auto insurance review.

- Young Driver Savings: State Farm offers bus drivers under 25 plenty of ways to lower their rates, including the Steer Clear program and student discounts.

Cons

- Add-On Availability: Despite being one of the largest insurers, State Farm lacks some add-ons for bus drivers, including gap insurance.

- Some Drivers Pay More: Although State Farm is usually affordable, bus drivers with bad credit scores often find lower rates with other providers.

#3– Travelers: Best for Unique Coverage

Pros

- IntelliDrive: Bus drivers can Save up to 30% on insurance by enrolling in Travelers’ IntelliDrive program and downloading the app.

- Unique Coverage Options: Bus drivers will find plenty of coverage options at Travelers, including rideshare and gap insurance.

- Excellent Discount Availability: Travelers offers bus driver policyholders 15 discounts to lower their rates, including savings for bundling policies and driving a hybrid vehicle.

Cons

- Mixed Customer Satisfaction: While bus driver policyholders love the service, many report dissatisfaction with the claims process. Read our full review of Travelers insurance for more information.

- Average Insurance Rates: Travelers’ rates for bus drivers usually match the national average. While it’s not the most expensive option, it can be difficult to find competitive Travelers’ quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Budgeting Shopping

Pros

- Name Your Price Tool: Progressive helps bus drivers save with the Name Your Price tool. This tool allows you to name your monthly budget, and Progressive creates a list of coverage options that fit it.

- Safe Driving Discounts: Bus drivers, with their good records, can benefit from Progressive’s discounts for safe driving. See more discounts in our review of Progressive insurance.

- User-Friendly Mobile App: Progressive’s mobile app allows bus drivers to view documents, manage coverage, file claims, and download ID cards.

Cons

- Mixed Customer Service Ratings: Progressive may have the cheapest auto insurance for bus drivers, but that doesn’t matter to some customers. The company struggles with low customer loyalty ratings.

- Rates Can be High for Some Drivers: Young bus drivers and people with at-fault accidents in their records might be able to find cheaper rates elsewhere.

#5 – American Family: Best Discount Availability

Pros

- Discount Options: With 18 discounts, most American Family bus drivers find a way to save. Popular AmFam discounts include savings for

- KnowYourDrive: American Family offers a respectable savings of 30% for bus drivers who consistently practice safe driving. Learn more about KnowYourDrive in our American Family auto insurance review.

- Underwrites Costco Auto Insurance Policies: Bus drivers who are Costco members might find lower car insurance rates from the warehouse, which American Family sells through CONNECT. Learn more about your eligibility for coverage in our Costco car insurance review.

Cons

- Limited Availability: American Family sells car insurance for bus drivers in just 19 states, but it operates CONNECT in 44.

- Higher Rates: While it’s rarely the cheapest option for insurance, bus drivers with bad credit scores will see particularly high rates.

#6 – Nationwide: Best for Deductible Savings

Pros

- Vanishing Deductible Program: If a bus driver enrolls in Nationwide’s Vanishing Deductible program, the deductible will decrease by $100 for every year spent claims-free, up to $500.

- Ample Discount Opportunities: Bus drivers can save on insurance by taking advantage of Nationwide’s 11 discounts, including savings for bundling policies and staying accident-free.

- Low Rates for Bad Credit: Bus drivers with bad credit scores typically pay more for their insurance, but you’ll pay much less at Nationwide than at other companies.

Cons

- Limited Local Agents: Nationwide is a great option if a bus driver prefers buying insurance online but has a harder time finding a local agent if they prefer face-to-face help.

- Higher Quotes for Some Drivers: Nationwide has low rates for the average bus driver, but many others see higher quotes. That’s particularly true for drivers with a DUI. Find out how much you might pay for coverage in our Nationwide auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Safety Discounts

Pros

- Safety Discounts for Bus Drivers: Farmers offers safety discounts for bus drivers with clean records and safe habits, significantly lowering premiums.

- Signal App: With Farmers’ UBI app Signal, bus drivers can save up to 15% on policy for good driving behaviors. Check out our Farmers review for more information.

- Affinity Discount: Bus drivers who work for the city might be eligible for Farmers’ affinity discount for government workers.

Cons

- No New Policies in Florida: If you’re a bus driver who lives in Florida, you won’t be able to purchase a new Farmers policy for your car.

- Higher-Than-Average Rates: Although Farmers’ rates usually aren’t the most expensive, they also aren’t cheap car insurance for bus drivers. Farmers rates tend to stay a bit above the national average.

#8 – Allstate: Best UBI Discounts

Pros

- Drivewise: Drivewise has one of the best UBI discounts on the market. Bus drivers who regularly practice safe driving habits can save up to 40% with Drivewise.

- Ample Coverage Options: Allstate provides top full coverage options, ensuring complete protection for bus drivers’ cars. Read more about this provider in our Allstate auto insurance review.

- Claims Satisfaction Guarantee: Allstate guarantees all its claims, promising a credit on future premiums if bus drivers are unsatisfied with the service they receive.

Cons

- Mixed Customer Reviews: While it usually gets positive reviews from bus drivers, Allstate struggles with reports about its customer service experiences.

- High Rates: Allstate is typically one of the most expensive insurance options, no matter where a bus driver lives.

#9 – Liberty Mutual: Best Add-on Options

Pros

- Diverse Coverage Options: Liberty Mutual offers coverage for bus drivers that can be hard to find elsewhere, including original parts replacement and better car replacement insurance.

- Ample Discounts: Liberty Mutual offers 17 discounts for drivers to take advantage of, including government employee savings that city bus drivers might qualify for.

- RightTrack: Enroll in the UBI program RightTrack for an automatic 10% savings. After a 90-day observation period, bus drivers could save up to 30% on their insurance.

Cons

- Rates are Sometimes High: Young bus drivers may find good deals with Liberty Mutual, though it’s rarely the cheapest option. For premiums and honest rankings, read our Liberty Mutual review.

- Claims Satisfaction Rating is Below Average: Bus drivers praise Liberty Mutual’s customer service but note issues with claims satisfaction.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Rates for Bus Drivers

Although bus drivers are professional operators, many are surprised to learn that their occupation doesn’t guarantee low car insurance rates. However, that doesn’t mean finding affordable coverage is hard. Check below to see how much the average bus driver pays for minimum insurance.

Bus Drivers Minimum Coverage Monthly Rates From Top Providers

| Insurance Company | 21-Year-Old Female | 21-Year-Old Male | 25-Year-Old Female | 25-Year-Old Male | 30-Year-Old Female | 30-Year-Old Male | 35-Year-Old Female | 35-Year-Old Male | 40-Year-Old Female | 40-Year-Old Male | 45-Year-Old Female | 45-Year-Old Male |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| $358 | $400 | $74 | $77 | $69 | $72 | $80 | $85 | $90 | $95 | $59 | $56 | |

| $144 | $178 | $55 | $60 | $51 | $56 | $85 | $90 | $95 | $100 | $47 | $47 | |

| $275 | $318 | $98 | $102 | $91 | $95 | $90 | $95 | $100 | $105 | $88 | $87 | |

| $187 | $239 | $74 | $81 | $69 | $76 | $95 | $100 | $105 | $110 | $62 | $63 |

| $99 | $116 | $37 | $38 | $34 | $35 | $100 | $105 | $110 | $115 | $32 | $32 |

| $368 | $387 | $94 | $98 | $87 | $91 | $105 | $110 | $115 | $120 | $76 | $76 | |

| $329 | $398 | $103 | $119 | $96 | $110 | $110 | $115 | $120 | $125 | $95 | $96 |

| $187 | $253 | $66 | $78 | $62 | $73 | $115 | $120 | $125 | $130 | $62 | $62 | |

| $319 | $443 | $57 | $62 | $53 | $58 | $120 | $125 | $130 | $135 | $53 | $53 |

As you can see, auto insurance for bus drivers typically matches the national average.

Being a bus driver doesn’t affect your rates, but you can lower premiums by using safe driving discounts or enrolling in a UBI program.Heidi Mertlich Licensed Insurance Agent

Other factors like your location, age, and driving record play a much bigger role in your car insurance quotes. Reasons auto insurance costs more for young drivers include limited driving experience, higher accident rates, and the increased risk young drivers pose to insurers.

The Best Auto Insurance for Bus Drivers

It makes no financial sense to purchase auto insurance policies you probably don’t need. In addition to that, nobody really enjoys writing checks to car insurance providers every month.

Below, we have detailed the essential types of coverage and tips for getting the right amount of protection at a cheaper price.

Liability Coverage

In most cases, this type of coverage is required to legally drive in U.S. states. If you get into an accident and it is determined that your actions on the road led to the unfortunate incident, liability auto insurance coverage will cover the costs of resultant bodily injuries as well as damage to the vehicle or any other third-party property.

Of course, the level of coverage will depend on the set limits. If the financial loss from an at-fault accident exceeds your coverage limit, you will have to pay for the upper limit of the settlement from your own pocket.

If you can afford it, it is important to purchase liability coverage above the state-mandated level, which will add an extra layer of protection. That way, you won’t have to dig deep into your pockets if you get involved in an at-fault accident.

Personal Injury Protection

Some states include personal injury protection (PIP) coverage in their auto insurance laws as a requirement for all drivers. If you get in an accident and you or other occupants in your car sustain bodily injuries, PIP will cover all medical expenses, even if the accident was your fault.

Depending on your insurer and your coverage, PIP may even pay for the funeral expenses in case of any deaths resulting from the accident. To learn more about which providers have the best coverage, explore what companies offer cheap PIP auto insurance here.

Uninsured/Underinsured Motorist Protection

Despite all the state laws demanding all motorists get minimum liability coverage, there are still a large number of uninsured drivers on the road. The uninsured/underinsured coverage protects you from financial losses if you get hit by an uninsured or underinsured driver.

Worse still, you could be a victim of a hit-and-run. The uninsured/underinsured is a policy you can ill afford to skimp on, given that it’s one of the cheapest policies in the insurance business.

Read More: Best Uninsured and Underinsured Motorist (UM/UIM) Coverage

Comprehensive Coverage

If it fits into your budget, comprehensive auto insurance is an important policy to have on your vehicle. This type of coverage will pay for the damages to your vehicle caused by natural disasters, vandalism, and theft.

Whether or not you purchase this coverage depends on the value of your car. It’s probably not worth it if you drive a relatively old, inexpensive car. If you decide to buy this coverage, installing anti-theft tracking devices in your vehicle can slightly reduce the coverage costs.

Collision Coverage

Collision insurance pays for the cost of repairing or replacing the vehicle in the event of a covered accident. Your auto insurer will pay for the market value of the vehicle if it’s totaled if the cost of fixing the damage exceeds 70 percent of the vehicle’s value.

There are other types of auto insurance coverage suitable for bus drivers, but these are the most critical ones. You can purchase a combination of all of them to get what is commonly referred to as full coverage, or you can select either of them as you see fit. This also applies to school bus insurance options, ensuring comprehensive protection tailored to your specific needs.

Bus Drivers Insurance: Discounts & Savings Tips

Although millennials tend to pay average rates compared to younger drivers, there are always ways to save more. Consider the following tips to help keep your insurance rates as low as possible:

- Don’t pay for coverage you don’t need. Research on your own and decide what you need and what you don’t.

- Avoid getting flagged for traffic offenses. This will ruin your driving records and raise your rates. You are a bus driver; you should know all the rules. Follow them.

- Start your search for car insurance early. The earlier you start comparing, the higher the chances of getting a better quote. If it’s possible, pay upfront. You may be subjected to interest if you spread your payments throughout the year.

- If you have an older, more experienced driver in your household, add them to the policy and significantly drop your rates.

- Apply for organizational, low-mileage, professional discounts, and any other types of discounts you qualify for.

To further cut down costs, explore the available discounts from the best auto insurance companies. Here’s a quick comparison:

Auto Insurance Discounts From the Top Providers

| Insurance Company | Bundling | Safe Driver | Multi-car | Anti-Theft Device | Loyalty |

|---|---|---|---|---|---|

| 15% | 10% | 25% | 8% | 12% |

| 25% | 18% | 25% | 10% | 15% | |

| 25% | 18% | 20% | 25% | 18% | |

| 20% | 20% | 20% | 10% | 15% | |

| 25% | 15% | 25% | 25% | 10% | |

| 25% | 20% | 25% | 35% | 10% |

| 20% | 12% | 20% | 5% | 8%% |

| 10% | 10% | 12% | 13% | 13% | |

| 17% | 20% | 20% | 15% | 15% | |

| 13% | 17% | 8% | 15% | 10% |

You can effectively reduce your auto insurance expenses by stacking these discounts and tailoring your coverage to your actual needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Affordable Options for Bus Drivers’ Auto Insurance

Finding the cheapest auto insurance for bus drivers means balancing affordability with reliable coverage. How to choose an auto insurance company depends on comparing coverage options, customer reviews, and discounts.

Erie stands out for its budget-friendly rates and strong customer service. State Farm offers customizable policies and extensive agent support, while Travelers provides flexible options and solid savings. These top companies cater to bus drivers’ unique needs, helping lower costs without sacrificing protection.

Finding cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code to find the most affordable quotes in your area.

Frequently Asked Questions

Which auto insurance companies for bus drivers have the cheapest rates?

The companies with the cheapest bus driver auto insurance quotes are Progressive, State Farm, and Allstate.

However, you should always compare bus insurance quotes before signing up for insurance because you might find lower rates with a different company. Exploring multiple bus insurance companies can help you secure the best deal.

Read More: Do auto insurance quotes change daily?

Do bus drivers need car insurance?

Bus drivers usually need commercial auto insurance for buses used for business. However, non-commercial bus insurance is available for personal or recreational use, covering the vehicle, passengers, and liabilities. Find your cheapest auto insurance quotes by entering your ZIP code into our free comparison tool.

What does commercial auto insurance for bus drivers cover?

Commercial auto insurance for bus drivers typically includes coverage for property damage, bodily injury liability, medical payments, collision, and comprehensive and uninsured/underinsured motorist coverage.

Additionally, it may provide coverage for passenger injuries, employee liability, and physical damage to the bus.

What factors affect the cost of commercial auto insurance for bus drivers?

Several factors influence the cost of commercial auto insurance for bus drivers. These include the driver’s experience and driving record, the type and size of the bus, the number of passengers transported, the geographical area of operation, and the coverage limits selected.

Additionally, factors such as the bus’s safety features, maintenance records, and the insurance provider’s underwriting criteria can also impact the premiums.

Read More: Best Commercial Auto Insurance Companies

Are there different types of commercial auto insurance policies for bus drivers?

Bus drivers can choose from various commercial auto policies like public transportation, charter bus insurance, limousine service, and insurance for school bus drivers, each tailored to specific operational risks.

Can bus drivers use personal auto insurance for their vehicles?

Personal auto insurance usually excludes coverage for commercial use, including buses. Bus drivers need personal bus insurance or commercial auto insurance to ensure proper coverage for their vehicles and liabilities.

What factors affect charter bus insurance costs?

The charter bus insurance cost depends on factors like the size of the bus, number of passengers, driving records, coverage limits, and the routes driven. Comparing quotes from multiple insurers can help bus drivers find the most affordable option.

Read More: Factors that Affect Auto Insurance Rates

Are bus drivers required to have a certain amount of liability coverage?

The specific liability coverage requirements for bus drivers vary depending on the jurisdiction and the type of bus operation. Public transportation or commercial passenger carriers are generally subject to higher liability coverage requirements due to the increased risks associated with transporting multiple passengers.

It’s crucial for bus drivers to familiarize themselves with the local regulations and consult with their insurance provider to determine the appropriate liability coverage limits.

Do bus drivers get cheaper car insurance rates?

Unfortunately, bus driver auto insurance rates typically match the national average. However, your driving skills can help lower your rates with a safe driving discount. Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Can bus drivers purchase additional coverage beyond liability insurance?

Yes, bus drivers can purchase additional coverage beyond liability insurance to enhance their insurance protection. Additional coverage options may include comprehensive coverage, collision coverage, medical payments coverage, and coverage for roadside assistance or rental vehicles.

Discussing your specific needs with an insurance provider can help determine the most suitable coverage options.

Are there any discounts available for commercial auto insurance for bus drivers?

Some insurance providers offer discounts to bus drivers for various reasons. These may include factors such as the driver’s experience, safety training, implementation of safety measures on the bus, or bundling multiple insurance policies with the same provider. It’s advisable to inquire with your insurance provider about available discounts to potentially reduce the cost of commercial auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.