Cheap Auto Insurance for High-Risk Drivers in California (Find Savings With These 10 Companies in 2025)

The top picks for cheap auto insurance for high-risk drivers in California are State Farm, Progressive, and American Family. State Farm leads the way with the cheapest high-risk insurance rates at $46/month and top-rated customer service. High-risk drivers can lower rates with usage-based insurance discounts.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for High-Risk Drivers in California

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews

Company Facts

Min. Coverage for High-Risk Drivers in California

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage for High-Risk Drivers in California

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews

The top picks for cheap auto insurance for high-risk drivers in California are State Farm, Progressive, and American Family. State Farm emerges as number one among the best providers, offering competitive rates of $46/month.

High-risk auto insurance in California is more expensive than average. These companies offer cheaper rates and outstanding customer service that ensures drivers receive support and guidance to maximize their savings.

Our Top 10 Company Picks: Cheap Auto Insurance for High-Risk Drivers in California

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $46 B Safe Driver State Farm

#2 $57 A+ Snapshot Program Progressive

#3 $75 A Customer Service American Family

#4 $76 A Signal Program Farmers

#5 $83 A++ IntelliDrive App Travelers

#6 $96 A+ Vanishing Deductible Nationwide

#7 $110 A+ Deductible Rewards Allstate

#8 $127 A Accident Forgiveness Liberty Mutual

#9 $140 A RightTrack Program Safeco

#10 $160 A+ Comprehensive Coverage The Hartford

These top providers excel with their comprehensive and affordable usage-based auto insurance, which tracks driving habits and mileage to reward high-risk drivers who improve their driving records.

To find out if you can get cheaper auto insurance rates, enter your ZIP code into our free quote tool above to instantly compare prices from various companies near you.

- State Farm offers cheap auto insurance for high-risk drivers at $46/mo

- State Farm gives a 30% discount to low-mileage high-risk drivers

- American Family is the cheapest for full coverage at $137/month

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Affordable Rates for High-Risk Drivers: State Farm offers rates as low as $46/month, making it a top choice for high-risk drivers in California. Learn more in our State Farm review.

- Steer Clear Program: The safe driver programs, such as the Steer Clear program, help high-risk drivers in California potentially lower their rates by improving their driving habits.

- Strong Customer Support: State Farm is known for its extensive network of agents who can provide personalized assistance to high-risk drivers in California.

Cons

- Limited High-Risk Discounts: While State Farm offers safe driver programs, high-risk drivers in California may find fewer specialized discounts compared to some competitors.

- Variable Rates Based on Risk Factors: The rates for high-risk drivers in California can vary significantly depending on individual driving records and other risk factors.

#2 – Progressive: Best for Snapshot Program

Pros

- Innovative Snapshot Program: Progressive’s Snapshot Program rewards safe driving with potential discounts, benefiting high-risk drivers in California. Read our Progressive review for a full list.

- Encourages Safer Driving: High-risk drivers in California can improve their driving habits and potentially lower their premiums by using the Snapshot Program.

- Flexible Policy Adjustments: Progressive offers customizable insurance policies that cater specifically to the needs of high-risk drivers in California.

Cons

- Rates Can Fluctuate: High-risk drivers in California may experience fluctuating rates based on the data collected by the Snapshot Program, which could be unpredictable.

- Privacy Concerns: Some high-risk drivers in California might be uncomfortable with the level of tracking and data collection required by the Snapshot Program.

#3 – American Family: Best for Customer Service

Pros

- Exceptional Customer Service: American Family is known for its high-quality customer service, which can be particularly valuable for high-risk drivers in California needing personalized assistance.

- Comprehensive Coverage Options: American Family offers a variety of coverage options tailored to the needs of high-risk drivers in California, which you can read more about in our review of American Family.

- Potential Discounts for Safe Driving: High-risk drivers in California may benefit from various discounts and programs designed to improve driving behavior.

Cons

- Inconsistent Discount Application: High-risk drivers in California might face inconsistencies in how discounts are applied, potentially leading to variable savings.

- Lengthy Claims Process: High-risk drivers in California may encounter a longer claims process, which can be frustrating when dealing with insurance claims.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Farmers: Best for Signal Program

Pros

- Incentives for Improved Driving: Farmers’ Signal Program offers rewards and discounts for high-risk drivers in California who improve their driving behavior. Read our Farmers Signal review to learn more

- Usage-Based Discounts: High-risk drivers in California can save up to 30% for improved driving habits with Signal.

- Low-Mileage Discount: Even with a bad record, high-risk drivers in California can save 10% on Farmers Insurance if they drive fewer than 7,500 miles a year.

Cons

- Difficulty in Meeting Program Requirements: High-risk drivers in California may find it challenging to meet the specific requirements of the Signal Program to receive rewards.

- Program Participation Required: To benefit from the Signal Program, high-risk drivers in California must actively participate and may need to meet certain driving behavior criteria.

#5 – Travelers: Best for IntelliDrive App

Pros

- IntelliDrive App: The IntelliDrive app helps high-risk drivers in California earn discounts based on their driving habits, potentially lowering premiums, which you can check out in our Travelers review.

- Real-Time Feedback: High-risk drivers in California receive real-time feedback on their driving, which can assist in improving driving behavior and reducing rates.

- IntelliDrive Savings: Save 30% on high-risk auto insurance rates for high-risk drivers in California by practicing safe habits behind the wheel.

Cons

- Savings Depend on App Data: Discounts for high-risk drivers in California are contingent on data from the IntelliDrive app, which may not always reflect improved driving.

- App Performance Issues: High-risk drivers in California may experience issues with the IntelliDrive app’s performance, which could affect the accuracy of their driving data.

#6 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: High-risk drivers in California can see their deductible decrease as a reward for improved driving behavior.

- Usage-Based Discounts: Use our Nationwide SmartRide app review to learn how tracking driving habits can lower high-risk car insurance rates for high-risk drivers in California.

- Low-Mileage Discounts: Even with poor driving habits, high-risk drivers in California can earn mileage-based discounts with Nationwide SmartMiles.

Cons

- Slow Deductible Reduction Process: High-risk drivers in California may experience a slow reduction in their deductible, which can be frustrating if immediate relief is needed.

- Eligibility Restrictions: Some high-risk drivers in California may face restrictions or exclusions that limit their ability to benefit fully from the Vanishing Deductible program.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Allstate: Best for Deductible Rewards

Pros

- Deductible Rewards Program: Allstate’s Deductible Rewards helps high-risk drivers in California lower their deductible through safe driving. Read more in our review of Allstate.

- Wide Range of Coverage Options: Allstate provides extensive coverage options suitable for high-risk drivers in California.

- Strong Support Network: Allstate provides robust customer support, which is valuable for high-risk drivers in California seeking assistance with their insurance needs.

Cons

- Eligibility for Rewards: High-risk drivers in California might struggle to qualify for Deductible Rewards due to stringent eligibility requirements.

- Higher Costs Before Rewards Apply: Allstate’s Deductible Rewards program may result in higher upfront costs for high-risk drivers in California until rewards begin to apply.

#8 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Avoid rate hikes after the first at-fault accident with Liberty Mutual Accident Forgiveness for high-risk drivers in California.

- Stable Premiums With Forgiveness: The Accident Forgiveness program offers stability in premiums for high-risk drivers in California who may have had previous accidents.

- Big Discounts: High-risk drivers in California can save up to 25% with multi-vehicle and multi-policy discounts. For a complete list, read our Liberty Mutual review.

Cons

- Forgiveness Limitations: Liberty Mutual’s Accident Forgiveness applies only to the first accident, which may not be sufficient for high-risk drivers in California with multiple incidents.

- Potential for Higher Overall Rates: The program might result in higher overall rates for high-risk drivers in California who do not meet accident forgiveness criteria.

#9 – Safeco: Best for RightTrack Program

Pros

- RightTrack Program Discounts: Safeco’s RightTrack Program offers discounts based on driving behavior, which can benefit high-risk drivers in California by lowering premiums.

- Encourages Safe Driving Practices: High-risk drivers in California receive feedback from the RightTrack Program to help improve their driving habits and earn discounts.

- Suitable Coverage Options: Safeco provides various coverage options suitable for high-risk drivers in California, which you can learn about in our Safeco review.

Cons

- Data-Dependent Discounts: Discounts for high-risk drivers in California are based on the data collected by the RightTrack Program, which might not always reflect improvements in driving habits.

- App Usage Required for Savings: High-risk drivers in California must consistently use the RightTrack app to qualify for discounts, which can be cumbersome.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – The Hartford: Best for Comprehensive Coverage

Pros

- Broad Coverage for High-Risk Drivers in California: The Hartford offers comprehensive coverage options that cater to the diverse needs of high-risk drivers in California.

- Strong Support for High-Risk Drivers: The Hartford provides tailored support and coverage solutions for high-risk drivers in California. Find out more in our The Hartford review.

- Competitive Rates for Comprehensive Plans: High-risk drivers in California can find competitive rates for comprehensive coverage with The Hartford.

Cons

- Complex Policy Terms: High-risk drivers in California might find The Hartford’s comprehensive policies to be more complex, requiring more careful review to fully understand coverage.

- Potential for Limited Discounts: High-risk drivers in California might not benefit as much from discounts when opting for comprehensive coverage plans with The Hartford.

Monthly Auto Insurance Rates for High-Risk Drivers in California

Looking for cheap high-risk auto insurance in California? Our top 10 picks offer competitive rates and valuable benefits tailored to your needs.

What is the best auto insurance for high-risk drivers in California? This chart compares monthly insurance rates for high-risk drivers in California across various providers and coverage levels:

California High-Risk Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $110 $202

American Family $75 $137

Farmers $76 $167

Liberty Mutual $127 $214

Nationwide $96 $140

Progressive $57 $140

Safeco $140 $230

State Farm $46 $108

The Hartford $160 $270

Travelers $83 $121

Minimum coverage ranges from $46 with State Farm to $160 with The Hartford, while full coverage spans from $108 with State Farm to $270 with The Hartford. Cheap high-risk auto insurance companies in California include State Farm, Progressive, and American Family.

State Farm is the top choice for high-risk drivers in California due to its competitive rates and excellent customer service.Dani Best Licensed Insurance Producer

Choosing the right auto insurance for a high-risk driver in California doesn’t have to be overwhelming. Whether you prioritize minimal coverage or comprehensive protection, keep reading to make an informed decision that aligns with your budget and insurance requirements.

Read More: Compare Auto Insurance Rates by Vehicle Make and Model

Why High-Risk Auto Insurance is So Expensive in California

Understanding what drives up high-risk auto insurance costs is crucial in California where rates are already high. Consider your credit score, vehicle type, location, and chosen coverage levels, along with your driving record. Each of these factors plays a significant role in determining your premiums:

- Credit Score: Maintaining a strong credit score leads to cheaper insurance rates. Improving your credit can help reduce premiums over time.

- Vehicle Type: The make and model of your vehicle affect insurance costs. Choosing a vehicle with good safety features and lower repair costs can help reduce your rates.

- Location: Your living area influences your insurance costs. Big cities in California and areas along the coast will pay more for insurance.

- Coverage Levels: Opting for minimum coverage might be cheaper initially, but full coverage auto insurance offers more protection.

You can strategically manage your California auto insurance costs by evaluating and possibly improving your driving record, maintaining a good credit score, selecting a vehicle with favorable insurance rates, understanding regional insurance trends based on location, and choosing the appropriate coverage.

Key components of auto insurance include coverage for bodily injury, property damage, collision, and comprehensive auto insurance, which safeguards against the financial impact of accidents and injuries. Find out the state minimum insurance requirements in California to buy the right coverage.

Saving Money on High-Rish Auto Insurance in California

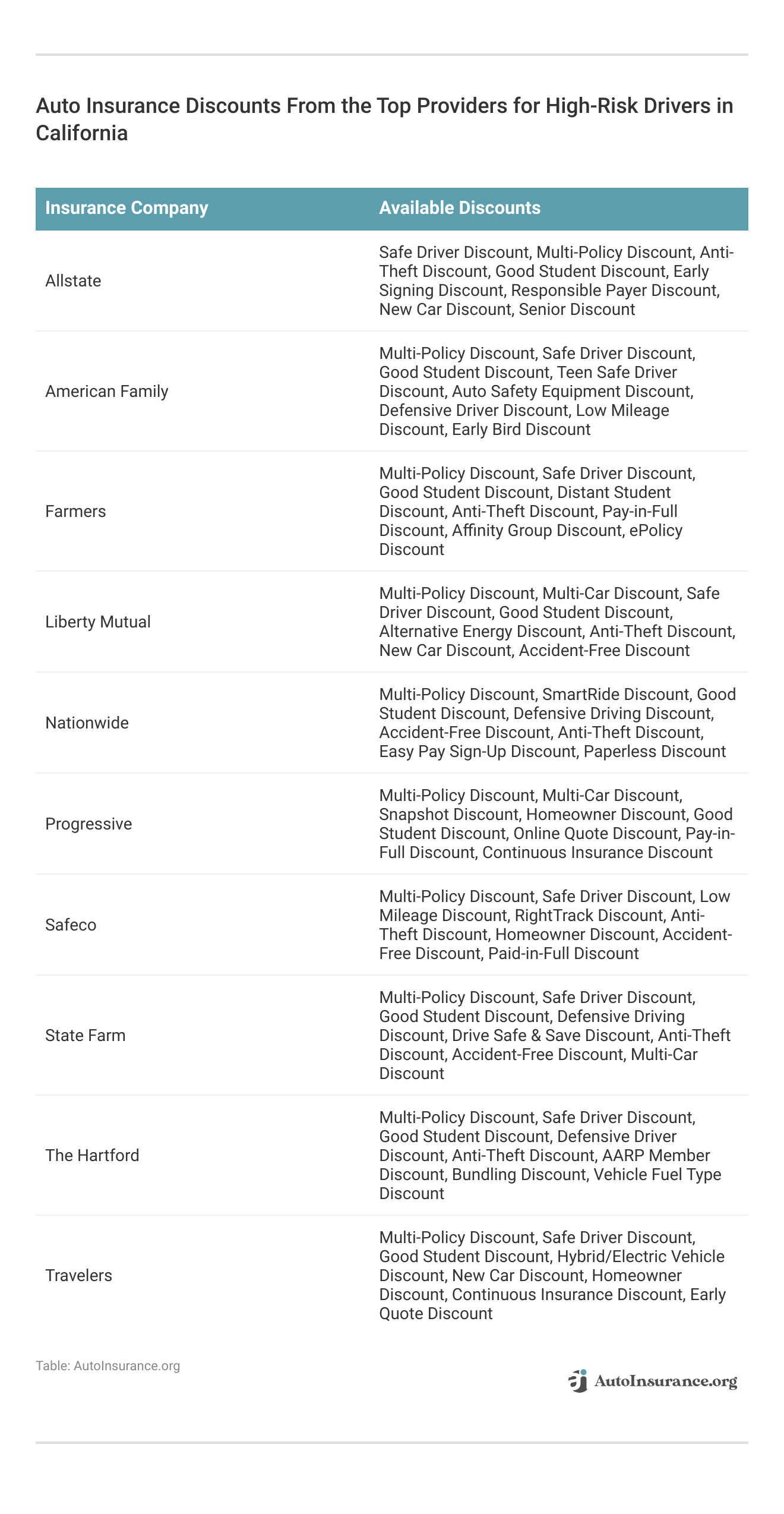

Finding affordable high-risk insurance in California can be challenging, but there are still plenty of auto insurance discounts and savings unrelated to driving history:

For example, it’s easy to save money by bundling insurance policies with multi-policy discounts. American Family offers 25% off to high-risk drivers who bundle auto policies with home insurance.

And since high-risk drivers often face higher rates due to past incidents or driving behaviors, there are a range of tactics designed to lower their insurance costs:

- Choose a Higher Deductible: Opting for higher auto insurance deductibles means you’ll pay more out-of-pocket in the event of a claim but will significantly reduce your monthly insurance premium.

- Take a Defensive Driving Course: Enroll in a certified defensive driving course to demonstrate your commitment to safe driving. Many insurers offer discounts for completing such courses.

- Shop Around for Quotes: Each company has its own criteria for assessing risk, so premiums can vary widely. Obtain and compare quotes from multiple insurance providers.

Insurers often use your driving history to determine your risk level and rates. Focus on enhancing your driving habits to avoid future accidents and traffic violations to get rates back to normal quickly.

By maintaining a clean record over time, you can potentially qualify for lower premiums as insurers see you as a more responsible driver. Consider enrolling in a usage-based insurance program that tracks your driving behavior, such as State Farm Drive Safe & Save.

Programs like these often offer discounts based on your actual driving data, potentially lowering your overall premium. Learn how high-risk drivers can save 30% in our Drive Safe and Save review.

Remember to regularly shop around and compare quotes to ensure you're getting the best rates available.Leslie Kasperowicz Farmers CSR for 4 Years

With careful planning and proactive measures, you can find affordable auto insurance that meets your needs while keeping your budget in check.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Case Studies: Affordable Auto Insurance for High-Risk Drivers in California

High-risk drivers in California often face steep auto insurance premiums due to traffic violations, at-fault accidents, or other driving infractions:

- Case Study #1 – From High Premiums to Manageable Rates: Jane, a 35-year-old from Los Angeles with traffic violations and a recent at-fault accident, paid $250/month for insurance as a high-risk driver. By switching to State Farm Drive Safe & Save, she reduced her premium to $108/month.

- Case Study #2 – Leveraging Technology for Savings: Mark, a 28-year-old with a history of speeding tickets and a DUI, faced high insurance premiums at $300/month. By using Progressive Snapshot and demonstrating safe driving, his premium decreased to $120/month.

- Case Study #3 – Comprehensive Coverage and Customer Support: Sarah, a 42-year-old driver from San Diego, switched to American Family, reducing her monthly premium from $275 to $150 with accident forgiveness and safe driving discounts.

Whether it’s through State Farm’s budget-friendly rates, Progressive’s innovative Snapshot program, or American Family’s excellent customer support, there are viable options for high-risk drivers.

By leveraging safe driver initiatives, technology-based monitoring, and customer-focused services, you can significantly reduce high-risk car insurance rates in California.

Read More: Cheap Auto Insurance for Teens After an Accident

Affordable Auto Insurance Options for High-Risk Drivers in California

High-risk drivers who may have a history of collisions, traffic violations, or other issues need to focus on policies that offer adequate protection while managing costs. Find out how long an accident affects your car insurance rates.

State Farm, Progressive, and American Family have cheap auto insurance for high-risk drivers in California, with rates starting as low as $46 per month. These companies offer valuable programs and discounts for safe driving, exceptional customer service, and comprehensive coverage options.

State Farm excels for high-risk drivers in California, offering top-notch customer service and robust safe driving incentives.Daniel Walker Licensed Auto Insurance Agent

Whether you’re seeking innovative tracking apps or deductible rewards, these California insurance companies provide a range of choices to help high-risk drivers reduce their premiums while ensuring adequate protection.

Protect your vehicle at the best price by entering your ZIP code into our free auto insurance quote comparison tool below.

Frequently Asked Questions

Who has the cheapest auto insurance in California?

State Farm is often cited as having the cheapest auto insurance for high-risk drivers in California, with rates starting as low as $46 per month.

Who are the most expensive drivers to insure?

High-risk drivers, including those with multiple traffic violations, DUIs, or at-fault accidents, are generally the most expensive to insure in California.

What is California minimum car insurance?

State minimum car insurance requirements in California include $15,000 for injury/death to one person, $30,000 for injury/death to more than one person, and $5,000 for property damage.

What is the recommended auto insurance coverage in California?

For high-risk drivers in California, it is recommended to have full coverage, which includes liability, comprehensive, and collision coverage, along with uninsured/underinsured motorist protection and medical payments coverage.

What is the best insurance for high-risk drivers in California?

The best insurance for high-risk drivers in California is typically offered by State Farm, Progressive, and American Family due to their competitive rates and comprehensive safe driver programs.

Wondering if another provider has lower rates? Find out by entering your ZIP code into our free quote comparison tool below.

What is the best insurance for a DUI in California?

Progressive is known for offering competitive rates and specialized programs for high-risk drivers, including those with a DUI in California. Find cheap auto insurance after a DUI.

Which insurance is the cheapest after an accident?

State Farm is frequently noted for providing affordable rates for high-risk drivers in California, including those who have been in an accident.

What is the best insurance for high-risk drivers in California?

The best auto insurance in California for high-risk drivers is often provided by State Farm and Progressive due to their low rates and robust customer service.

What is the cheapest full coverage car insurance in California?

American Family has the cheapest full coverage auto insurance for high-risk drivers in California at $137/month.

What type of insurance covers all risks?

Does auto insurance cover tire theft? Comprehensive insurance covers a wide range of risks, including theft, vandalism, natural disasters, and collisions with animals, making it ideal for high-risk drivers in California.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.