Cheap Auto Insurance for High-Risk Drivers in Florida for 2025 (10 Most Affordable Companies)

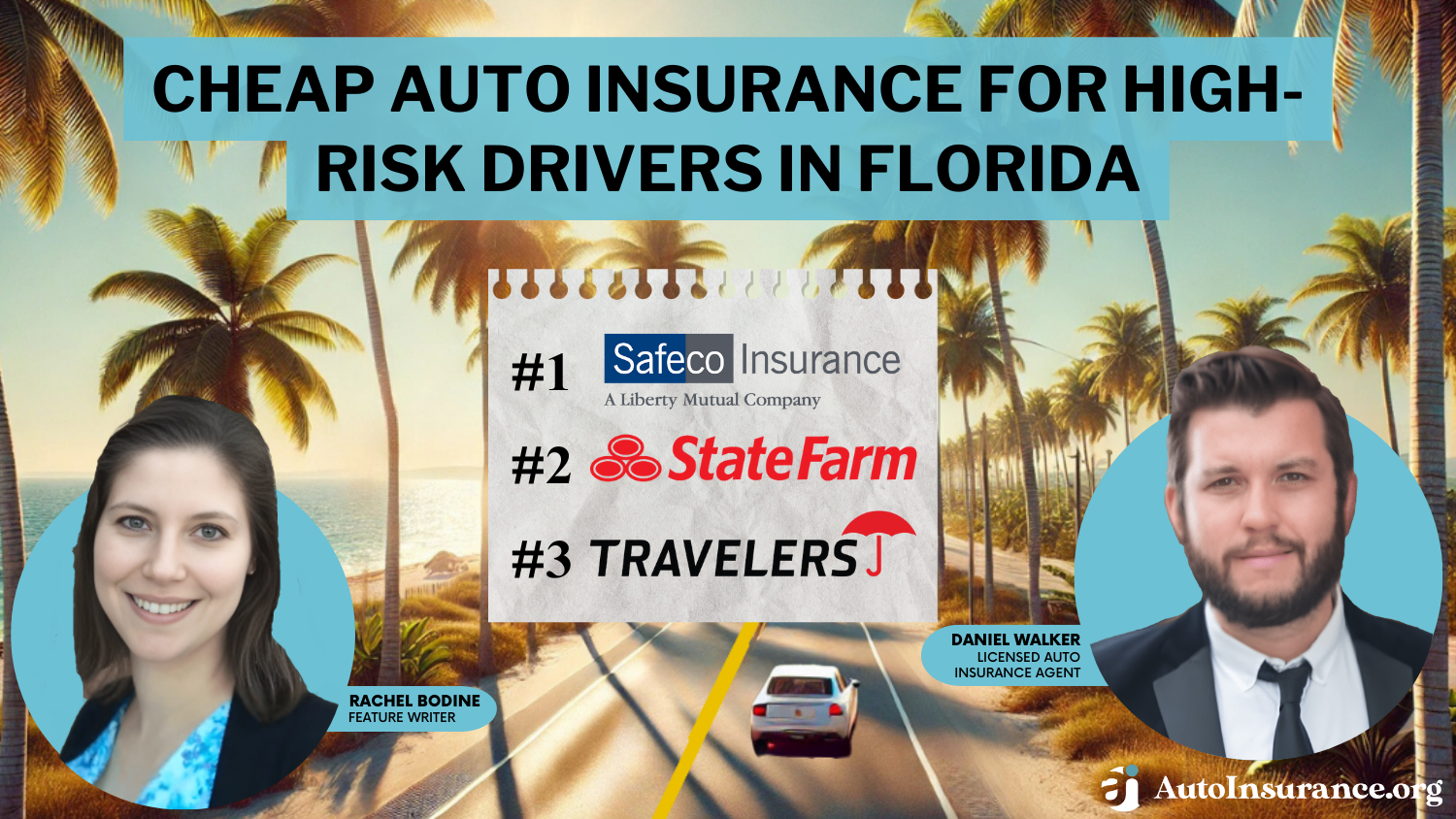

Safeco, State Farm, and Travelers offer cheap auto insurance for high-risk drivers in Florida, with rates starting as low as $38 per month. These providers offer car insurance for high-risk drivers with mandatory personal injury protection and property damage liability , ensuring compliance with FL state requirements.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,277 reviews

1,277 reviewsCompany Facts

FL High-Risk Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,277 reviews

1,277 reviews 18,154 reviews

18,154 reviewsCompany Facts

FL High-Risk Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 1,733 reviews

1,733 reviewsCompany Facts

FL High-Risk Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsSafeco, State Farm, and Travelers are the top picks for cheap auto insurance for high-risk drivers in Florida, starting at $38 per month.

High-risk insurance for bad drivers in Florida is higher than that for those with clean records, but savings are possible by shopping with the cheapest high-risk auto insurance insurers listed below.

Our Top 10 Company Picks: Cheap Auto Insurance for High-Risk Drivers in Florida

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $38 | A | Track Program | Safeco | |

| #2 | $47 | A++ | Broad Coverage | State Farm | |

| #3 | $53 | A++ | Safe Driver | Travelers | |

| #4 | $56 | A+ | Flexible Plans | Progressive | |

| #5 | $61 | A+ | AARP Discounts | The Hartford |

| #6 | $62 | A | Teen Driver | American Family | |

| #7 | $63 | A+ | Vanishing Deductible | Nationwide |

| #8 | $76 | A | Personalized Service | Farmers | |

| #9 | $87 | A+ | Accident Forgiveness | Allstate | |

| #10 | $96 | A | Custom Options | Liberty Mutual |

Our guide covers everything you need to know about these affordable, high-risk auto insurance companies in Florida. Want to get cheap Florida insurance quotes today? Enter your ZIP code in our free quote tool.

- Get high-risk car insurance in Florida with Safeco, State Farm, and Travelers

- Safeco offers the lowest starting rate at $38 per month

- Discover how to get discounts to lower high-risk car insurance rates in Florida

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Safeco: Top Pick Overall

Pros

- RightTrack Program: The Safeco RighTrack program is free to join, and good drivers should be able to score at least a small discount on Florida car insurance for high-risk drivers.

- Cash-Back for Safe Drivers: Claims-free customers get cash back on Florida high-risk auto insurance.

- Add-On Coverages: Safeco offers add-ons for high-risk drivers in Florida, such as new vehicle replacement. Read our Safeco auto insurance review to learn more about them.

Cons

- Client Contentment: A low rating from J.D. Power shows most Florida high-risk drivers aren’t satisfied with claims services.

- No Online Quotes: Safeco does not offer quick Florida high-risk auto insurance quotes online.

#2 – State Farm: Best for Broad Coverage

Pros

- Broad Coverage: State Farm has a broad range of coverages that Florida high-risk drivers can purchase if they desire.

- Local Florida Agents: Visit an agent to get in-person help with your high-risk insurance policy in Florida. Learn more about customer service in our State Farm insurance review.

- Available Discounts: Get cheap car insurance for high-risk drivers by applying for relevant discounts at the company.

Cons

- Financial Status: State Farm’s financial rating is currently lower than that of other high-risk auto insurance companies in Florida.

- Online Tools: It doesn’t offer many online tools, as local agents are available for high-risk drivers in FL.

#3 – Travelers: Best for Bundling Policies

Pros

- Insurance Bundling: Florida auto insurance rates could be lower for high-risk drivers if they bundle policies.

- Performance-Based Insurance: Travelers IntelliDrive is a way for high-risk drivers in FL to demonstrate safe driving skills and earn a lower rate.

- Coverage Options: Read our Travelers auto insurance review to see a full list of the great coverages it offers to high-risk drivers in Florida, like roadside assistance.

Cons

- UBI Premium Hikes: Florida high-risk drivers who drive poorly in the program may receive a rate hike instead of a discount.

- Customer Satisfaction: Levels of satisfaction with customer service for Florida high-risk insurance could be higher.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Flexible Plans

Pros

- Flexible Plans: High-risk plans in Florida have adjustable deductibles and coverages for high-risk drivers. Find out more by reading our review of Progressive.

- UBI Program: FL high-risk drivers who demonstrate safe driving skills in Snapshot, Progressive’s UBI program, save up to 40%.

- Loyalty Programs: Progressive has loyalty programs for high-risk drivers in Florida who renew their policies.

Cons

- UBI Rate Changes: Demonstrating bad driving skills potentially raises Florida high-risk insurance rates.

- Customer Ratings: Progressive has some lower ratings from high-risk drivers in Florida.

#5 – The Hartford: Best for AARP Discounts

Pros

- AARP Discounts: The Hartford has discounts specifically for Florida AARP members who are high-risk drivers.

- Policy Choices: The Hartford provides options like agreed value coverage when most Florida high-risk insurers don’t. Read our review of The Hartford for a full coverage list.

- Driving Behavior Insurance: The Hartford’s UBI program offers a chance for high-risk drivers in FL to demonstrate safe driving skills and get a discount.

Cons

- High Rates for Most Drivers: The Hartford is more expensive for Florida high-risk auto insurance if you aren’t a senior.

- Customer Reviews: The Hartford has some complaints about its high-risk insurance services in Florida.

#6 – American Family: Best for Teen Drivers

Pros

- Good for Teen Drivers: American Family has good student discounts, which are a great way to get affordable car insurance for high-risk drivers in Florida.

- Client Relations: Florida high-risk teen drivers can find local agents or get assistance remotely.

- Coverage Variety: Less common coverages, like gap coverage, are sold to Florida’s high-risk drivers. For a full list, visit our American Family auto insurance review.

Cons

- Availability Outside Florida: American Family isn’t sold in many states outside of Florida, so high-risk drivers who move may have to switch providers.

- Claims Processing: Some negative feedback for the company talks about slower processing for Florida high-risk insurance claims.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: High-risk Florida drivers who stay accident-free in the future could get deductible reductions.

- On Your Side Review: Every year, Florida high-risk drivers can talk to an agent if they wish to work on improving their policy.

- Coverage Plans: Nationwide has extras for high-risk drivers in Florida, like new car replacements. See a full list in our Nationwide auto insurance review.

Cons

- Consumer Satisfaction: Nationwide’s J.D. Power rating for Florida high-risk auto insurance claims could be higher.

- DUI Rates: High-risk drivers in FL with accidents or traffic rates will get slightly better quotes than high-risk drivers with DUIs.

#8 – Farmers: Best for Personalized Service

Pros

- Personalized Service: Farmers has local agents in Florida to provide personalized, knowledgeable assistance to high-risk drivers.

- Discount Availability: It has more discounts than other Florida high-risk auto insurance companies. Learn more by reading our Farmers insurance review.

- Local Agents: You can seek assistance with auto insurance for high-risk drivers in Florida from nearby agents.

Cons

- User Satisfaction: Most negative reviews from Florida high-risk customers are about claims processing.

- Must Purchase Accident Forgiveness: Accident forgiveness isn’t a free perk at Farmers, as high-risk drivers have to pay extra.

#9 – Allstate: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Allstate may forgive some high-risk drivers’ accidents in Florida if they stay claims-free for a few years.

- Milewise Program: Allstate’s Milewise program offers affordable Florida insurance if high-risk drivers have low annual mileage.

- Discount Options: Get cheap high-risk car insurance rates if drivers qualify for some of Allstate’s discounts.

Cons

- Consumer Feedback: Allstate’s complaint ratio is higher than that of other Florida high-risk insurance companies. Take a look at the ratings in our Allstate insurance review.

- Expensive Young Driver Rates: While Allstate is affordable for most high-risk drivers in Florida, teen drivers may want to shop elsewhere.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Custom Options

Pros

- Custom Options: Liberty Mutual offers custom policy options for high-risk drivers in FL, such as original parts replacement.

- Bundling Discount: High-risk drivers may be able to save on car insurance in Florida by bundling it with home insurance.

- 24/7 Roadside Assistance: Florida high-risk drivers can pay extra to add this coverage to their policy.

Cons

- Customer Complaints: Not all Florida high-risk drivers will be happy with services. See how the company ranks in our Liberty Mutual review.

- Fewer Local Agents: While Liberty Mutual has some insurance agents in Florida, most services for high-risk drivers will be remote.

Cheapest Florida Car Insurance Rates for High-Risk Drivers

High-risk auto insurance is more expensive, as insurance companies are taking on drivers who are more likely to be in an accident and file an expensive claim.

The good news is that the cheapest companies in Florida for high-risk drivers offer affordable rates for minimum and full coverage. Take a look at the average rates at our top companies below.

Florida High-Risk Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $76 | $198 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $38 | $101 | |

| $47 | $123 | |

| $61 | $161 |

| $53 | $141 |

Minimum coverage is the only legally required insurance, but Florida minimum auto insurance requirements don’t offer protection for your vehicle. Full coverage is optional unless a driver has a lease or loan on their vehicle.

While minimum coverage is the cheapest option, it will only cover other parties’ bills in an accident in Florida.

Full coverage in Florida offers protection for drivers in cases of collisions with other vehicles, animals, damages from vandalism, and more.Dani Best Licensed Insurance Producer

In many instances, the initial higher cost of full coverage insurance is justified and can effectively pay for itself following a covered claim.

For Florida drivers, maintaining full coverage is typically advisable unless their vehicles are significantly older, and the value does not justify the expense.

In such cases, considering the option to drop full coverage might be more economically practical. Cheap auto insurance for high-risk drivers can still be found through careful comparison shopping with high-risk auto insurance companies in Florida.

Learn More: When to Buy More Than Minimum Auto Insurance

Florida Auto Insurance Discounts for High-Risk Drivers

When purchasing full coverage insurance, it’s crucial for drivers to actively inquire about any available discounts that can help lower their overall costs for cheap full coverage insurance for high-risk drivers.

Insurance providers often offer discounts for safe driving, multiple vehicles, anti-theft devices, and customer loyalty.

Auto Insurance Discounts From Top Providers for High-Risk Drivers in Florida

| Insurance Company | Available Discounts |

|---|---|

| Safe Driving Club, Multiple Policy, Anti-lock Brakes, Anti-theft Device, Early Signing, Full Pay, Good Payer, Paperless | |

| Multi-Vehicle, Bundling, Steer into Savings, Defensive Driver, Good Student, Teen Safe Driver, Loyalty, Low Mileage | |

| Signal® by Farmers, Multi-Policy, Multi-Car, Homeowner, Good Student, Safe Driver, Alternative Fuel, Anti-Theft | |

| Multi-Policy, Multi-Car, Early Shopper, Good Student, Alternative Energy, Preferred Payment, Newly Married, Accident-Free |

| SmartRide®, Multi-Policy, Accident-Free, Defensive Driving, Anti-theft, Good Student, Paperless, Automatic Payments |

| Snapshot®, Multi-Policy, Multi-Car, Homeowner, Continuous Insurance, Teen Driver, Good Student, Pay-in-Full | |

| RightTrack®, Multi-Policy, Safe Driver, Anti-theft, Accident Forgiveness, Diminishing Deductible, Good Student, Homeowner | |

| Drive Safe & Save™, Steer Clear®, Multi-Line, Good Driving, Good Student, Student Away, Accident-Free, Defensive Driving | |

| AARP Member, Defensive Driver, Bundling, Vehicle Safety Features, Driver Training, Good Student, Anti-theft Device, Low Annual Mileage |

| IntelliDrive®, Multi-Policy, Safe Driver, Continuous Insurance, Good Payer, Hybrid/Electric Vehicle, Homeownership, New Car |

Even if your driving record isn’t perfect, you may still qualify for savings through various programs, such as loyalty discounts and other non-driving-related reductions. Many companies offer the cheapest car insurance in Florida for a bad driving record that can fit your budget.

High-risk drivers can always save money by bundling insurance policies, and it also offers the convenience of keeping insurance policies all at one provider.

Affordable insurance for high-risk drivers isn’t impossible to find if you work with the right company. With patience and persistence, even those with serious violations can find affordable high-risk insurance that meets their needs while staying within budget.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding Cheap Auto Insurance for High-Risk Drivers in Florida

State Farm, Nationwide, and Allstate stand out as cheap auto insurance for high-risk drivers in Florida. While drivers should still expect to pay more than a good driver, these companies offer Florida’s cheap auto insurance after an accident and other infractions.

With an average cost of less than a dollar a day, Safeco classic car insurance is surprisingly affordable. Talk to your local independent agent about ways to save on your classic car insurance. https://t.co/CyduqqPkfG

— Safeco Insurance (@Safecoinsurance) November 2, 2023

Many providers specialize in car insurance for bad drivers, offering competitive rates despite past violations. These insurers understand that everyone deserves a second chance at auto insurance, regardless of their driving history.

The top high-risk Florida companies also have auto insurance discounts that can help lower high-risk insurance rates.Kristen Gryglik Licensed Insurance Agent

Comparing multiple quotes from multiple companies can help you find low-cost insurance for high-risk drivers.

Want to get cheap, high-risk car insurance quotes in Florida today? Use our free tool to compare quotes from top Florida companies in your area.

Frequently Asked Questions

What is the cheapest auto insurance for high-risk drivers in Florida?

State Farm has the cheapest car insurance for high-risk drivers in Florida.

Do high-risk drivers pay lower insurance premiums?

No, high-risk drivers pay higher insurance premiums than low-risk drivers. If you are a high-risk driver looking for affordable auto insurance, the best thing you can do is compare quotes to finding cheap high-risk auto insurance in Florida. Use our free tool to get started.

What is the cheapest car insurance for a bad history?

Minimum auto insurance coverage is the cheapest type of insurance for drivers with a bad driving history. Read our guide on Florida minimum auto insurance requirements to learn about the bare minimum coverage and how to get the most affordable auto insurance in Florida.

How can I lower my car insurance in Florida?

Some things drivers can do to get low car insurance rates for high-risk drivers in Florida include shopping for quotes, keeping a clean driving record, and applying for discounts.

What is the last resort auto insurance in Florida?

The Florida Automobile Joint Underwriting Association (FAJUA) is a marketplace for high-risk drivers who cannot secure coverage from local providers.

What is the most expensive car insurance in Florida?

Full coverage auto insurance will be the most expensive type of car insurance in Florida. However, most drivers should carry full coverage insurance to protect their vehicles. Discounts help greatly in getting cheap full coverage car insurance for high-risk drivers.

Why is Florida auto insurance so high?

Florida automobile insurance is high because the state has many risk factors, such as a high number of uninsured drivers. Insurance will be even higher for high-risk drivers, which is why it’s so important to shop for the cheapest high-risk car insurance.

Which high-risk insurance company has the highest customer satisfaction in Florida?

State Farm’s high-risk auto insurance has some of the highest customer satisfaction levels in Florida, partly due to its local agent availability.

How much does the average person pay for car insurance in Florida?

An average person will pay an average of $63 per month for minimum coverage and an average of $209 per month for full coverage. However, shopping with the best Florida auto insurance companies can result in lower rates.

What age is car insurance most expensive in Florida?

Drivers under the age of 20 have the most expensive Florida auto insurance rates on average.

How can I qualify for cheap insurance for high-risk drivers?

To qualify, ensure you compare various insurers, maintain any possible clean driving record periods, and take advantage of discounts like defensive driving courses.

What is the cheapest car insurance in Florida for seniors?

Typically, Geico and USAA will have the most affordable car insurance for senior drivers in Florida, making them top contenders for the best auto insurance for seniors.

Which factors contribute to qualifying for cheap car insurance for bad drivers?

Key factors include maintaining a cleaner driving record over time, completing approved driving courses, and bundling policies with the same insurer to maximize discounts.

Are there specific discounts that apply to Florida car insurance for high-risk drivers?

Yes, discounts may still be available for high-risk drivers, such as those for completing defensive driving courses or for installing anti-theft devices in vehicles. Maximize these discounts to get affordable high-risk car insurance.

Are there specific discounts available for high-risk auto insurance policyholders in Florida?

Yes, high-risk drivers can access discounts like multi-policy, safe driving, and the best good student auto insurance discounts. It’s crucial to ask insurers about specific savings for high-risk profiles.

Can bundling policies lead to more affordable car insurance for high-risk drivers?

Absolutely, bundling auto insurance with other policies such as homeowners or renters insurance can lead to significant discounts, making overall insurance costs more affordable for high-risk drivers.

Why is cheap full coverage insurance important for high-risk drivers?

Cheap full coverage insurance helps high-risk drivers manage the potentially higher costs associated with accidents and violations by providing extensive protection without a significant financial burden.

Are there specific discounts that benefit drivers seeking the cheapest car insurance in Florida with a bad driving record?

Yes, drivers can get the cheapest high-risk insurance by seeking discounts like defensive driving course reductions, good student discounts, and multi-policy discounts. Additionally, choosing companies with the cheapest teen auto insurance can further reduce costs for young drivers.

Which discounts are applicable when seeking cheap auto insurance for bad drivers?

When seeking cheap auto insurance, bad drivers can still access discounts for completing defensive driving courses, bundling policies, or installing safety devices in their vehicles.

What role does vehicle choice play in securing low-cost insurance for high-risk drivers?

Choosing a car that is cheaper to insure, such as models with good safety ratings or less horsepower, can significantly reduce insurance costs for high-risk drivers.

Ready to find cheap insurance for high-risk drivers in Florida? Get cheap auto insurance quotes for high-risk drivers from our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.