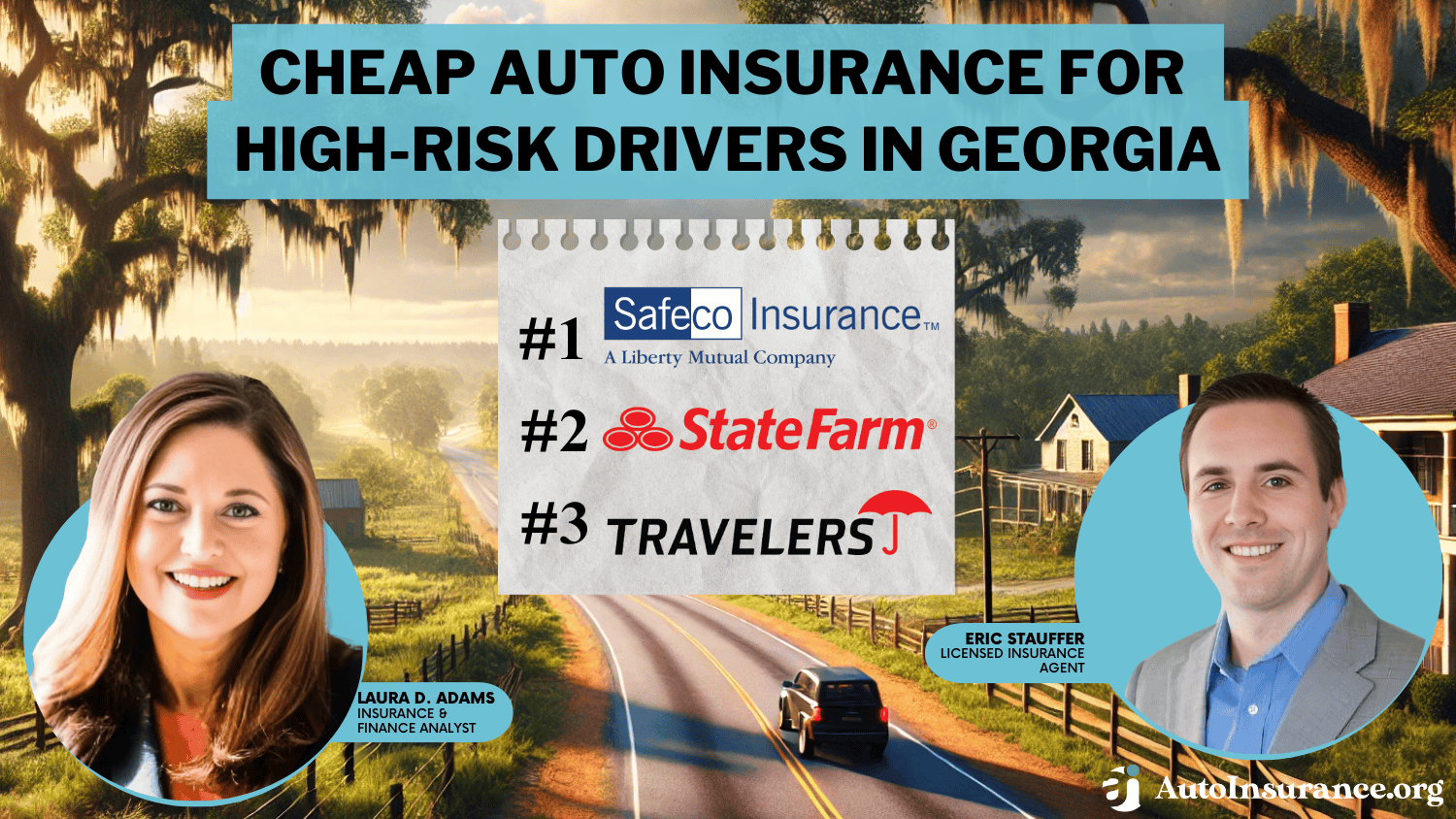

Cheap Auto Insurance for High-Risk Drivers in Georgia for 2025 (Top 10 Companies Ranked)

Safeco, State Farm, and Travelers are the leading providers of cheap auto insurance for high-risk drivers in GA. Safeco offers the lowest rates, starting at $38 per month. Drivers with violations like DUIs or accidents can compare auto insurance for high-risk drivers in GA for the best coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,277 reviews

1,277 reviewsCompany Facts

GA High-Risk Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,277 reviews

1,277 reviews 18,154 reviews

18,154 reviewsCompany Facts

GA High-Risk Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 1,733 reviews

1,733 reviewsCompany Facts

GA High-Risk Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviewsExplore cheap auto insurance for high-risk drivers in Georgia with Safeco, State Farm, and Travelers, the top picks for affordability and coverage.

Safeco offers the lowest rate at $38 per month, while State Farm and Travelers provide competitive options for drivers with DUIs, accidents, or violations.

Our Top 10 Company Picks: Cheap Auto Insurance for High-Risk Drivers in Georgia

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $38 | A | Competitive Rates | Safeco | |

| #2 | $47 | A++ | Customer Service | State Farm | |

| #3 | $53 | A++ | Wide Options | Travelers | |

| #4 | $56 | A+ | Flexible Policies | Progressive | |

| #5 | $61 | A+ | Special Programs | The Hartford |

| #6 | $62 | A | Customizable Plans | American Family | |

| #7 | $63 | A+ | Bundling Discounts | Nationwide |

| #8 | $65 | A | Good Service | AAA |

| #9 | $76 | A | Good Discounts | Farmers | |

| #10 | $96 | A | High Coverage | Liberty Mutual |

Compare quotes now to find the best SR-22, non-standard, or liability coverage for your needs.

Enter your ZIP code into our free quote tool and find the best insurance companies for high-risk drivers near you.

- Safeco offers the cheapest car insurance for high-risk drivers in Georgia

- Affordable coverage for high-risk drivers in Georgia starts at $38 per month

- Flexible policies and customizable plans cater to high-risk drivers’ needs

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Safeco: Top Overall Pick

Pros

- Economical Insurance Pricing: Safeco is known for its affordable rates, making it a budget-friendly option for high-risk drivers in Georgia. Learn more in our Safeco auto insurance review.

- Versatile Coverage Options: Safeco’s diverse range of coverage plans allows high-risk drivers in Georgia to choose policies that best match their financial and protection needs.

- Attractive Discount Potential: High-risk drivers in Georgia can benefit from Safeco’s numerous discount opportunities, which can further reduce their overall insurance expenses.

Cons

- Variable Service Experiences: Safeco’s customer service quality may vary, which could be a drawback for high-risk drivers in Georgia who need consistent and reliable support.

- Potential Regional Limitations: In certain regions of Georgia, Safeco might have fewer local agents, which could affect the accessibility and convenience of the company for high-risk drivers in those areas.

#2 – State Farm: Best for Customer Service

Pros

- Personalized Consultations: State Farm’s agents offer one-on-one consultations for GA high-risk insurance, helping drivers sort through their coverage options and find what works best.

- Quick Response Times: State Farm is known for its effective customer service, especially in assisting high-risk drivers in Georgia, as detailed in our State Farm auto insurance review.

- Localized Expertise: State Farm’s robust local agent network offers comprehensive insights into Georgia’s driving conditions and regulations for high-risk drivers.

Cons

- Potential for Rate Increases: If high-risk drivers in Georgia change their risk profile, their rates might increase over time, impacting long-term affordability.

- Less Aggressive Discounts: Compared to other insurers, State Farm may provide fewer substantial discounts explicitly aimed at high-risk drivers in Georgia.

#3 – Travelers: Best for Wide Options

Pros

- Broad Coverage Choices: Travelers offers customizable coverage options for high-risk drivers in Georgia, ensuring they receive comprehensive, tailored insurance solutions.

- Flexible Policy Adjustments: Offers flexibility for high-risk drivers in Georgia to adjust coverage as needs change. Read our Travelers auto insurance review for a full list.

- Innovative Policy Features: High-risk drivers in Georgia can access unique features like accident forgiveness and deductible rewards, enhancing their coverage flexibility.

Cons

- Complex Policy Selection: The extensive array of choices can be overwhelming, which may make it challenging for high-risk drivers in Georgia to select the most suitable coverage.

- Potentially Higher Costs for Customization: Extensively customizing coverage could result in increased costs, which might impact overall affordability, especially for high-risk drivers in Georgia.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Flexible Policies

Pros

- Behavior-Based Discounts: Progressive’s Snapshot program offers discounts based on driving behavior, benefiting high-risk drivers in Georgia who improve their driving.

- Versatile Coverage Plans: Provides a range of policy options that can be adjusted based on the evolving needs of high-risk drivers in Georgia. Learn more in our Progressive auto insurance review.

- Pay-as-You-Go Options: Enables high-risk drivers in Georgia to opt for pay-per-mile or usage-based insurance, which could reduce expenses for individuals who drive less often.

Cons

- Initial High Costs: The initial costs for high-risk drivers in Georgia might be higher until discounts are applied, which can be a financial burden.

- Complex Discount Structure: The variety of discount options and policies may be confusing for high-risk drivers, complicating the process of finding the best high-risk car insurance in Georgia.

#5 – The Hartford: Best for Special Programs

Pros

- Innovative Driver Programs: The Hartford offers unique programs like accident forgiveness and safe driver discounts, catering specifically to high-risk drivers in Georgia with advanced protection options.

- Flexible Payment Solutions: High-risk drivers in Georgia can use The Hartford’s flexible payment plans to manage costs. Read our The Hartford auto insurance review to learn what else is offered.

- Focused Support for Risky Profiles: The Hartford provides specialized support services designed to assist high-risk drivers in Georgia in improving their driving record.

Cons

- Higher Starting Premiums: The Hartford’s specialized programs might result in higher initial premiums, which could be a concern for those seeking cheap insurance for high-risk drivers in Georgia.

- Limited Discount Variety: The Hartford may offer fewer discount opportunities compared to other insurers, potentially affecting the overall cost savings for high-risk drivers in Georgia.

#6 – American Family: Best for Customizable Plans

Pros

- Custom Coverage Add-Ons: American Family provides customizable add-ons, ideal for high-risk drivers in Georgia seeking tailored coverage. Find out more in our American Family auto insurance review.

- Adaptable Coverage Limits: Offers choices to modify coverage limits and types, enabling high-risk drivers in Georgia to customize their policies according to their unique needs.

- Personalized Risk Management: High-risk drivers in Georgia gain from tailored risk management strategies that assist in lowering their premiums over time.

Cons

- Higher Costs for Comprehensive Coverage: High-risk drivers in Georgia looking for comprehensive coverage might face increased costs, impacting overall affordability.

- Discount Limitations: The discounts for high-risk drivers in Georgia may be restricted, which could limit the potential savings on their premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Bundling Discounts

Pros

- Substantial Savings With Bundling: Get significant savings on high-risk insurance in Georgia by bundling auto insurance with other Nationwide policies. Read more in our review of Nationwide.

- Cost-Effective Bundled Plans: High-risk drivers in Georgia can enjoy reduced overall insurance costs by taking advantage of Nationwide’s bundling discounts, making it a cost-effective choice.

- Adaptable Coverage Options: Nationwide provides a range of coverage options that can be customized for high-risk drivers in Georgia, balancing affordability with comprehensive protection.

Cons

- Bundling Complexity: The bundling process can be complex, potentially making it difficult for high-risk drivers in Georgia to manage effectively.

- Potential for Non-Bundled Costs: Standalone auto insurance policies can be more costly, which might disadvantage high-risk drivers in Georgia who prefer not to bundle their insurance.

#8 – AAA: Best for Good Service

Pros

- Member-Only Discounts: AAA members in Georgia receive discounts on auto insurance, which is particularly beneficial for high-risk drivers. Read more in our review of AAA.

- High Standard of Service: AAA is well-known for its exceptional customer service, providing dependable support and assistance specifically tailored for high-risk drivers in Georgia.

- Reliable Roadside Assistance: Offers dependable roadside assistance services that are particularly valuable for high-risk drivers in Georgia dealing with unforeseen problems.

Cons

- Membership Fee Requirement: The requirement for AAA membership to access certain benefits might not be ideal for all high-risk drivers in Georgia.

- Possibly Higher Overall Rates: Insurance rates for high-risk drivers in Georgia may be elevated compared to other providers, potentially affecting cost-effectiveness.

#9 – Farmers: Best for Good Discounts

Pros

- Generous Multi-Policy Discounts: Farmers offers substantial discounts for bundling multiple policies, which is advantageous for high-risk drivers in Georgia who need multiple types of coverage.

- Safe Driver Rewards: Offers discounts for high-risk drivers in Georgia with clean records. Click for a complete list of Farmers auto insurance discounts.

- Unique Policy Discounts: High-risk drivers in Georgia can benefit from specialized discounts for features such as vehicle safety enhancements and low mileage.

Cons

- Potentially Higher Base Rates: High-risk drivers in Georgia may encounter higher base rates at first, potentially affecting affordability until discounts are applied.

- Discounts May Not Apply Immediately: Discounts may take some time to be applied, potentially affecting the short-term affordability for high-risk drivers in Georgia.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for High Coverage

Pros

- Broad Coverage Limits: Liberty Mutual offers extensive coverage options, providing high-risk drivers in Georgia with a robust safety net and peace of mind against various risks.

- Customizable Insurance Plans: Their policies are highly customizable, allowing high-risk drivers in Georgia to tailor their coverage precisely to their needs and preferences.

- Enhanced Coverage Benefits: It offers extra benefits and coverage options for added security for high-risk drivers in Georgia. Find out more in our Liberty Mutual auto insurance review.

Cons

- Elevated Premium Costs: Liberty Mutual’s extensive coverage often results in higher premiums, which might not suit high-risk drivers in Georgia looking for more affordable options.

- Risk of Over-Insurance: High-risk drivers in Georgia might find themselves paying for extensive coverage features that exceed their actual needs, leading to higher costs without proportional benefits.

Exploring Competitive Insurance Rates for High-Risk Drivers in Georgia

For high-risk drivers in Georgia, auto insurance rates and coverage levels can differ widely between providers. When looking at auto insurance options for high-risk drivers in Georgia, it’s crucial to compare monthly rates for both minimum and full coverage from various insurers.

Georgia High-Risk Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $65 | $122 |

| $62 | $166 | |

| $76 | $198 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $38 | $101 | |

| $47 | $123 | |

| $61 | $161 |

| $53 | $141 |

What is the cheapest car insurance in Georgia for high-risk drivers? Providers like Safeco offer the lowest minimum coverage rates at $38, while Liberty Mutual charges the highest at $96. For full coverage, Safeco is the most affordable at $101, and Liberty Mutual again leads with $248. Rates can vary widely, so comparing options is essential to find the best deal for your needs.

Higher coverage levels lead to higher premiums. Balancing affordability with protection is key. For example, a manageable deductible can lower rates.Jeff Root Licensed Insurance Agent

Understanding the range of auto insurance rates for high-risk drivers in Georgia can help you find a policy that meets your needs and budget. Compare the rates and coverage options of different high-risk car insurance companies to identify the best deal.

Factors Influencing Auto Insurance Costs for High-Risk Drivers in Georgia

When it comes to auto insurance, high-risk drivers in Georgia face unique challenges that can significantly impact their premiums.

Understanding what impacts high-risk auto insurance costs is essential for managing a budget. Here’s a breakdown of the primary elements that contribute to higher insurance rates besides your driving record:

- Vehicle Type: High-performance or luxury vehicles incur higher costs due to repair and replacement expenses, while cars with advanced safety features may qualify for discounts.

- Location: Your insurance rate can be influenced by your ZIP code. State-specific laws and market competition in Georgia also impact the cost of insurance.

- Credit Score: In Georgia, insurers often use credit scores to determine premiums. A bad credit score can lead to higher insurance rates because it may be associated with a higher likelihood of filing claims.

Choosing higher coverage limits and additional options like comprehensive or collision insurance will also raise premiums. Opting for higher deductibles lowers monthly costs but increases out-of-pocket expenses during claims, necessitating careful balance to manage overall insurance expenses effectively.

Understanding how elements like your driving record, vehicle type, location, credit score, and coverage levels impact your premiums can help you make more informed decisions and potentially reduce your insurance costs.

Remember, maintaining a clean driving record, choosing the right vehicle, and managing your credit can all help lower your premiums. For more personalized advice, consider consulting with an insurance professional to tailor your coverage to your unique needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Ways to Reduce Auto Insurance for High-Risk Drivers in Georgia

With higher insurance rates, especially for high-risk drivers, you might wonder, “How can I lower my car insurance in Georgia?” Luckily, several strategies can help.

Compare Multiple Quotes

Insurance rates vary widely among providers, especially for high-risk drivers.

Comparing insurance quotes is one of the best ways to find lower auto insurance rates. But how do you do it? And how much does it cost? At https://t.co/27f1xf1ARb, car insurance quote comparisons are FREE 🥳. Check out our easy guide to comparing quotes 👉 https://t.co/wKUJsuX6su pic.twitter.com/PlXGXe7UMn

— AutoInsurance.org (@AutoInsurance) June 6, 2023

Learn how auto insurance companies check driving records and use online comparison tools to regularly review personalized quotes for the most cost-effective coverage.

Increase Your Deductible

A higher auto insurance deductible generally lowers monthly premiums, so assess your finances to choose an affordable deductible amount and ensure you have sufficient savings to cover it if necessary.

Maintain a Clean Driving Record

Maintaining a clean driving record by following traffic laws, avoiding speeding tickets, and practicing safe driving can significantly lower insurance premiums over time, as it demonstrates lower risk to insurers and may qualify you for discounts from some providers.

Learn More: Do points affect auto insurance rates?

Take Advantage of Discounts

Many insurers provide discounts, such as safe driver discounts for maintaining a clean record, bundling discounts for combining policies, and discounts for completing defensive driving courses. Discover valuable auto insurance discounts offered by top insurance providers for high-risk drivers in Georgia.

Auto Insurance Discounts From the Top Providers for High-Risk Drivers in Georgia

| Insurance Company | Available Discounts |

|---|---|

| Bundling, Safe Driver, Good Student, Defensive Driving Course, Anti-Theft Device, Vehicle Safety |

| Bundling, Safe Driver, Good Student, Loyalty, Early Bird, Anti-Theft Device, Generational | |

| Bundling, Safe Driver, Good Student, Homeowner, Signal App (Telematics), Professional Group | |

| Bundling, Safe Driver, Good Student, Anti-Theft Device, New Car, Accident-free, Vehicle Safety |

| Bundling, Safe Driver, Good Student, Accident-free, Anti-Theft Device, Defensive Driving Course |

| Bundling, Safe Driver, Good Student, Snapshot (Telematics), Homeowner, Continuous Insurance | |

| Bundling, Safe Driver, Good Student, Anti-Theft Device, New Car Replacement, Accident Prevention | |

| Bundling, Safe Driver, Good Student, Drive Safe & Save (Telematics), Accident-Free, Defensive Driving Course | |

| Bundling, Safe Driver, Good Student, Defensive Driving Course, Anti-Theft Device, Vehicle Safety |

| Bundling, Safe Driver, Good Student, Homeowner, New Car, Continuous Insurance, Hybrid/Electric Vehicle |

Each company provides a range of savings opportunities tailored to different needs. Ask your insurance provider about the eligibility criteria for these savings opportunities. Make sure to review all available discounts and get personalized quotes — you might need to switch companies if you can get better high-risk insurance rates somewhere else.

Improve Your Credit Score

Insurers use credit scores to assess risk, so managing your credit by paying bills on time, reducing debt, and checking your credit report for inaccuracies can improve your credit score and potentially lower your premiums.

After boosting my credit score, I found insurers offered lower rates, proving good credit can reduce auto insurance costs.Tonya Sisler Insurance Content Team Lead

Implementing these strategies can significantly impact your insurance expenses, making it easier to manage and reduce your overall costs. By taking a proactive approach, you can not only lower your premiums but also ensure that you’re getting the best value for your coverage.

Learn More: How Credit Scores Affect Auto Insurance Rates

Comprehensive Auto Insurance Guide for High-Risk Drivers in Georgia

As a high-risk driver in Georgia, it’s crucial to understand personal injury protection (PIP) and bodily injury liability auto insurance coverage. PIP covers medical expenses, lost wages, and rehab costs for you and your passengers, while bodily injury liability protects against financial liability for injuries you cause to others, including medical costs and legal fees.

Providers like State Farm, Progressive, and American Family offer cheap high-risk auto insurance in Georgia with customizable plans. To choose the right coverage, assess limits, consider add-ons like uninsured motorist coverage, and manage deductibles. Get better rates by comparing insurance quotes online and asking about available discounts.

Case Studies: Cheap Auto Insurance for High-Risk Drivers in GA

Finding affordable car insurance for high-risk drivers in Georgia can be tough due to their past traffic violations and incidents. However, with the right strategies and tools, you can get a good policy at a reasonable price. In this set of case studies, we look at how three high-risk drivers successfully found budget-friendly insurance solutions.

- Case Study #1 – The Safe Driver Turned High-Risk: Alex, a 32-year-old from Georgia with traffic violations, found the best high-risk driver rates through Safeco at $38 a month using an online tool. He chose a policy with flexible, budget-friendly coverage.

- Case Study #2 – Balancing Flexibility and Affordability: Maria, a 29-year-old with a high-risk driving record, chose Progressive for its flexible policies starting at $56 a month through an insurance comparison tool. She obtained comprehensive coverage within her budget.

- Case Study #3 – High Coverage Without Breaking the Bank: John, a 45-year-old driver with a history of violations, chose American Family’s customizable plans for high coverage at reasonable rates. He obtained extensive protection for $62 a month, effectively balancing coverage and cost.

These case studies demonstrate that high-risk drivers in Georgia can indeed find affordable auto insurance by utilizing comparison tools to compare the best auto insurance companies for high-risk drivers.

These tools enable drivers to compare rates, coverage options, and policy features across various insurance companies, helping them to find the best possible deal. As a result, high-risk drivers can make informed decisions and access affordable insurance options tailored to their unique needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Affordable Auto Insurance for High-Risk Drivers in Georgia

Finding cheap car insurance for high-risk drivers can be challenging, but several of the best Georgia auto insurance companies offer competitive rates. Safeco, State Farm, and Travelers lead the way, with rates starting at $38 a month. These companies provide flexible, customizable plans suitable for high-risk drivers.

Factors influencing high-risk insurance costs in Georgia include your driving record, vehicle type, location, credit score, and coverage levels. To lower premiums, compare quotes, adjust deductibles, maintain a clean driving record, and take advantage of discounts. Check out our guide on how to get a quote from an auto insurance company.

Get free high-risk car insurance quotes today and compare rates from top insurers by entering your ZIP code into our comparison tool.

Frequently Asked Questions

Who has the cheapest insurance for a bad driving record in Georgia?

Safeco has the most affordable auto insurance in Georgia, with rates starting at around $38 per month for high-risk drivers. Other providers like State Farm and Travelers also offer cheap car insurance for bad drivers.

Who has the absolute cheapest auto insurance in Georgia?

Among the cheapest auto insurance companies in Georgia, State Farm frequently offers the cheapest auto insurance rates, especially for high-risk drivers. It’s beneficial to compare quotes from multiple insurers to find the lowest rates available.

What is the cheapest full coverage car insurance for high-risk drivers in Georgia?

Safeco often has the cheapest insurance for high-risk drivers. State Farm and Travelers also have competitive rates for full coverage, depending on your driving history. So, if you are wondering how to get low full coverage insurance, these companies are great options.

How much does insurance cost per month in Georgia?

The cost of auto insurance in Georgia varies based on factors like driving record and coverage level. For high-risk drivers, monthly premiums can start around $38 for minimum coverage with companies like Safeco and may be higher for more comprehensive plans.

What is the best insurance for high-risk drivers in Georgia?

The best Georgia high-risk auto insurance often comes from providers like State Farm, Progressive, and American Family, which offer tailored policies and competitive rates. These companies provide flexible and customizable plans to meet the needs of high-risk drivers.

Does full coverage cover at-fault accidents in Georgia?

Yes, full coverage auto insurance in Georgia typically includes liability coverage that can help cover damages from at-fault accidents. High-risk drivers should ensure their policy includes comprehensive and collision coverage for maximum protection.

How does a DUI impact car insurance costs for high-risk drivers in Georgia?

A DUI can significantly increase insurance premiums due to the elevated risk associated with insuring drivers with DUI convictions. Insurers may also require an SR-22 form to prove insurance coverage.

Which insurance involves the highest risk?

Insurance policies that involve the highest risk usually include high-risk driver policies, where insurers may charge higher premiums due to the driver’s history. Providers assess various risk factors, so high-risk drivers may face higher rates and stricter coverage terms.

Who is considered high risk for insurance in GA?

Drivers with multiple traffic violations, serious infractions like DUIs, or a history of accidents are often required to obtain high-risk auto insurance in Georgia. This type of coverage is also applicable to those who have been without insurance for extended periods.

How long can you drive without insurance in Georgia?

In Georgia, driving without insurance is illegal. If caught driving without the required insurance, you could face significant penalties, including fines, license suspension, and vehicle impoundment. High-risk drivers must ensure they maintain proper coverage to comply with state laws.

How can drivers with a bad driving record secure cheap auto insurance in GA?

To secure cheap auto insurance in GA with a bad driving record, drivers should compare quotes from multiple insurers specializing in high-risk coverage. They should also consider increasing their deductibles and look for discounts aimed at high-risk drivers, such as those for taking defensive driving courses.

Are there special discounts associated with low-income auto insurance in Georgia?

Currently, there are no specific discounts for Georgia low-income auto insurance. However, some insurers may offer options like payment plans, low-income hardship programs, or discounts for bundling policies (e.g., home and auto) to help make coverage more affordable for eligible drivers.

Can the choice of vehicle impact my rates for cheap car insurance in Valdosta, GA?

The type of vehicle you drive significantly impacts your insurance rates. Vehicles with higher safety ratings or lower repair costs typically receive lower premiums from the best auto insurance companies, whereas high-performance or luxury vehicles often incur higher costs.

If you’re searching for auto insurance for high-risk drivers near me or high-risk car insurance quotes, use our free quote comparison tool to find the cheapest coverage in your area.

How much does a speeding citation raise car insurance rates in Georgia?

In Georgia, a speeding ticket can increase your car insurance rates by an average of $200 to $300 per year. For example, if your current premium is $1,200 annually, a speeding ticket could cause your rates to rise to around $1,400 or $1,500.

The increase depends on how much over the speed limit you were driving. Tickets for speeding over 15 mph over the limit are more likely to increase significantly.

How does a ticket for distracted driving impact car insurance premiums in Georgia?

A ticket for distracted driving, like texting while driving, can raise your insurance premiums in Georgia by 15% to 25%, which could mean an increase of $200 to $400 annually. This is similar to the premium increase seen with auto insurance after at-fault accidents in Georgia, where rates also tend to jump significantly based on the offense’s severity.

How does a citation for reckless driving impact Georgia car insurance rates?

A reckless driving citation in Georgia can increase car insurance rates by 40% to 70%. For example, if your current premium is $1,200, your new rate could jump between $1,680 and $2,040. The increase depends on your insurer and driving history, but multiple offenses can lead to even higher premiums or policy cancellation.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.