Cheap Auto Insurance for High-Risk Drivers in North Carolina (Top 10 Companies for 2025)

American Family, Farmers, and Erie are the best for cheap auto insurance for high-risk drivers in North Carolina, starting from as low as $57 monthly. These companies offer competitive rates and discounts, such as for good students, safe drivers, and anti-theft devices, to help lower high-risk insurance costs in NC.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage for High-Risk Drivers in North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 3,072 reviews

3,072 reviewsCompany Facts

Min. Coverage for High-Risk Drivers in North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for High-Risk Drivers in North Carolina

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsAmerican Family, Farmers, and Erie are the best for cheap auto insurance for high-risk drivers in North Carolina. American Family is our top pick with rates starting as low as $57 per month.

If you’re a high-risk driver in North Carolina, you’ll pay higher auto insurance premiums compared to drivers with clean records.

Our Top 10 Company Picks: Cheap Auto Insurance for High-Risk Drivers in North Carolina

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $57 | A | Comprehensive Coverage | American Family | |

| #2 | $58 | A | Risk Programs | Farmers | |

| #3 | $130 | A+ | Local Expertise | Erie |

| #4 | $136 | B | Broad Coverage | State Farm | |

| #5 | $137 | A | Customizable Plans | Liberty Mutual |

| #6 | $170 | A+ | Flexible Options | Progressive | |

| #7 | $177 | A++ | Good Drivers | Geico | |

| #8 | $187 | A+ | Insurance Discounts | Nationwide |

| #9 | $193 | A++ | Coverage Options | Travelers | |

| #10 | $309 | A+ | Safe Driving | Allstate |

The exact increase depends on how serious your violations are. For instance, having several DUIs will likely result in much higher premiums than a few speeding tickets.

- American Family is best for cheap car insurance for high-risk drivers in NC

- Traffic violations, accidents, and DUIs can classify you as a high-risk driver

- Auto insurance discounts can lower NC car insurance costs

Finding the cheapest auto insurance companies can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code above to find the most affordable quotes in your area.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – American Family: Top Pick Overall

Pros

- Affordable Rates: American Family offers competitive rates for high-risk drivers in North Carolina looking to save on auto insurance with a less-than-perfect driving record.

- Flexible Coverage Options: North Carolina auto insurance can be tailored to meet the specific needs of high-risk drivers, including add-ons like roadside assistance.

- Strong Customer Support: American Family’s responsive support team is there to help high-risk drivers in North Carolina. Get full ratings in our American Family review.

Cons

- Limited Discounts: Compared to other insurers in North Carolina, American Family offers fewer discount opportunities for high-risk drivers, which might mean missing out on potential savings.

- Varied State Regulations: American Family is a solid choice in North Carolina, but it might not offer the same benefits in other states if you move.

#2 – Farmers: Cheapest With Risk Programs

Pros

- Tailored Risk Programs: Farmers offers specialized programs designed to address the needs of high-risk drivers in North Carolina, which can help reduce overall insurance costs.

- Discounts for Risk Management: Farmers provides high-risk car insurance discounts for North Carolina drivers who participate in risk management programs, like defensive driving or vehicle tracking.

- Flexible Coverage Options: With Farmers, you can customize your coverage to better fit your unique needs as a high-risk driver in North Carolina. Learn how in our Farmers review.

Cons

- Low Customer Satisfaction: High-risk drivers in North Carolina rank Farmers last for auto insurance customer service satisfaction in the region.

- Limited Availability of Discounts: Some Farmers insurance discounts may not be available for every high-risk driver in North Carolina.

#3 – Erie: Best Local Expertise

Pros

- Local Expertise: Erie’s strong local presence means they’re familiar with North Carolina’s specific insurance requirements and risk factors, which can help high-risk drivers secure cheap coverage.

- Personalized Service: Erie’s agents in North Carolina offer personalized support, helping high-risk drivers navigate discounts and coverage options.

- Customizable Coverage Options: Erie offers a variety of coverage options in North Carolina that can be tailored to meet the unique needs of high-risk drivers. Check out our Erie auto insurance review for more.

Cons

- Limited Coverage Area: Erie is not available in every state, so if you’re a North Carolina resident who might move out of state, you could face limitations with your policy.

- Fewer Digital Tools: In North Carolina, Erie may not offer as many online tools or mobile apps as some larger insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – State Farm: Cheapest Broad Coverage

Pros

- Broad Coverage: State Farm offers a wide range of coverage options that can be tailored to high-risk drivers in North Carolina. Read more in our full review of State Farm’s auto insurance.

- Accident Forgiveness Program: For high-risk drivers in North Carolina, State Farm’s accident forgiveness program can prevent premium increases after their first at-fault accident.

- Discounts for Safe Driving: State Farm’s Drive Safe & Save™ program in North Carolina rewards high-risk drivers who improve their driving habits.

Cons

- Higher Premiums for High-Risk Drivers: Despite the broad coverage, State Farm North Carolina auto insurance rates may still be higher for high-risk drivers compared to other insurers.

- Limited Discounts for High-Risk Profiles: While State Farm offers various discounts, high-risk drivers in North Carolina might find that the available discounts don’t significantly reduce their premiums.

#5 – Liberty Mutual: Cheap Customizable Plans

Pros

- Customizable Plans: Liberty Mutual allows high-risk drivers in North Carolina to tailor their policies with a variety of add-ons and coverage levels. You can learn more in our Liberty Mutual insurance review.

- RightTrack® Program for Savings: High-risk drivers in North Carolina can enroll in Liberty Mutual’s RightTrack® program. Read our RightTrack review for discounts based on safe driving habits.

- Flexible Deductible Choices: Liberty Mutual lets high-risk drivers in North Carolina choose higher deductibles to lower their monthly premiums, making coverage more budget-friendly.

Cons

- Potentially Higher Base Rates: Liberty Mutual’s base rates in North Carolina may be higher for high-risk drivers compared to some competitors, even after applying discounts.

- Mixed Customer Service Reviews: While Liberty Mutual offers strong coverage options, some high-risk drivers in North Carolina have reported mixed experiences with customer service.

#6 – Progressive: Cheap Flexible Options

Pros

- Flexible Options for Coverage: Progressive allows high-risk drivers in North Carolina to customize their policy features and limits. Find more details in our Progressive auto insurance review.

- Name Your Price® Tool: With Progressive’s Name Your Price® tool, high-risk drivers in North Carolina can easily set their budget and get insurance options that fit their financial situation.

- Snapshot® Program for Personalized Rates: High-risk drivers in North Carolina can use Progressive’s Snapshot® program to potentially lower their premiums by demonstrating safe driving habits.

Cons

- Rates Can Vary Significantly: High-risk drivers in North Carolina may find that their rates vary significantly based on their driving history and other factors, making it challenging to predict costs.

- Mixed Satisfaction with Claims Process: Some high-risk drivers in North Carolina have reported mixed experiences with Progressive’s claims process.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Geico: Cheapest for Good Drivers

Pros

- DriveEasy® Program for Savings: Geico DriveEasy® offers personalized driving feedback to help high-risk drivers in North Carolina improve their habits and rewards safe driving with discounts.

- Quick Claims Process: Geico’s fast and efficient online claims handling means high-risk drivers in North Carolina can get back on the road quickly after an accident or damage.

- Broad Coverage Options: Geico offers a range of coverage options, from basic to extensive, allowing North Carolina drivers to find a plan that fits their needs and budget. Explore your options in our Geico auto insurance review.

Cons

- Higher Rates for Persistent High Risk: Even if you’re a careful driver, Geico’s rates for high-risk profiles in North Carolina might still be on the higher side.

- Less Focus on Individual Risk: Coverage options may not fully address certain high-risk factors unique to individual drivers in North Carolina, such as previous DUI convictions or frequent at-fault accidents.

#8 – Nationwide: Cheapest With Discounts

Pros

- Bundling Benefits: High-risk drivers in North Carolina can benefit from Nationwide’s bundling options, which allow them to combine auto insurance with other policies.

- Low-Mileage Savings: North Carolina high-risk drivers with low annual mileage can save up to 20% on auto insurance rates. You can learn more in our Nationwide auto insurance review.

- Variety of Discounts: Nationwide provides a range of discounts, such as bundling policies and safe driver discounts, which can help high-risk drivers in North Carolina lower their overall insurance costs.

Cons

- Limited Coverage Add-Ons: Nationwide’s range of optional coverage add-ons might not provide the comprehensive protection needed by high-risk drivers in North Carolina.

- Availability of Discounts Varies: Certain Nationwide discounts may be limited to specific areas in North Carolina, which could affect savings for high-risk drivers based on where they live.

#9 – Travelers: Best Coverage Options

Pros

- Wide Range of Coverage Options: Travelers offers an extensive selection of coverage options tailored for high-risk drivers in North Carolina with add-ons like rental car coverage and roadside assistance.

- Gap Insurance Availability: Travelers offers gap insurance in North Carolina, which is valuable for high-risk drivers with auto loans or leases. Read our review of Travelers insurance for more information.

- Customizable Deductibles and Limits: Travelers offers flexible deductible and coverage limit options, letting high-risk drivers in North Carolina tailor their policies.

Cons

- Higher Premiums for Extensive Coverage: High-risk drivers in North Carolina may find the premiums for comprehensive protection to be more expensive.

- Complex Policy Structure: The extensive options and add-ons can make Travelers’ policies more complex, requiring more effort from high-risk drivers in North Carolina to manage coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Allstate: Best for Safe Driving

Pros

- Safe Driving Rewards: Allstate’s Drivewise® program offers discounts specifically for high-risk drivers in North Carolina who demonstrate safer driving habits. Learn how in our Drivewise review.

- Crash Sensors and Telematics: The Drivewise® app includes crash detection and telematics features that provide feedback and can help high-risk drivers in North Carolina save on premiums.

- Broad Range of Discounts: Allstate offers various discounts based on driving behavior, vehicle safety features, and more, which can help high-risk insurance costs in NC.

Cons

- Tech Requirements: The Drivewise® program relies on technology that may not be compatible with all devices, which could be a limitation for some high-risk drivers in North Carolina.

- Potential Privacy Concerns: The data collected by Drivewise® could raise privacy concerns for high-risk drivers in North Carolina who prefer not to have their driving habits closely monitored.

Cheapest Insurance Companies for High-Risk Drivers in North Carolina

Just because you’re considered high-risk doesn’t mean you can’t find affordable car insurance in North Carolina. Check out the table below to see monthly rates for minimum and full coverage from our cheapest auto insurance companies.

North Carolina High-Risk Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $309 | $730 |

| American Family | $57 | $136 |

| Erie | $130 | $200 |

| Farmers | $58 | $137 |

| Geico | $177 | $419 |

| Liberty Mutual | $137 | $325 |

| Nationwide | $187 | $443 |

| Progressive | $170 | $402 |

| State Farm | $136 | $321 |

| Travelers | $193 | $457 |

As you search for affordable auto insurance, remember that high-risk drivers must meet North Carolina minimum auto insurance requirements to avoid fines.

North Carolina High-Risk Auto Insurance Defined

What makes you a high-risk driver? The auto insurance company will check your driving record and may classify you as high risk if you have a history of accidents, traffic violations, or a DUI. Even factors like your age, credit score, or the type of vehicle you drive can contribute to this label.

It’s not just your driving record that can impact your insurance rates — it’s about how likely the insurer believes you are to file a claim in the future, which could result in higher premiums or fewer coverage options. Other non-driving factors can affect your car insurance rates in North Carolina.

Let’s take a look at the most common factors that influence this designation and how they might impact your insurance rates.

Traffic Violations

If you’ve got a history of speeding tickets, reckless driving, or other traffic offenses like running red lights, insurance companies may see you as a higher risk. They worry that these behaviors might mean you’re more likely to have accidents or make claims. When applying for insurance, make sure to declare any speeding points you have. Hiding this information will most likely affect your coverage and rates.

Accidents

If you have been involved in multiple accidents, even if they were not at-fault accidents, insurance companies may view you as a high-risk driver.

They may anticipate that you are more likely to experience another incident, leading to more claims and increased costs for them.

DUI/DWI

A DUI on your record is a major red flag for auto insurance companies, as it indicates a higher risk of impaired driving in the future. This can lead to extremely high insurance rates, and in some cases, insurers might even decide to drop you entirely.

Read more: DWI vs. DUI Differences Explained

Vehicle Type and Usage

The type of car you drive and how you use it can significantly affect your insurance costs. Sports, high performance, and cars you often use for businesses or ridesharing are typically more expensive to insure than a sedan or minivan. Compare auto insurance rates by vehicle make and model in our guide.

Poor Credit History

In North Carolina, insurance companies are allowed by law to use credit scores to determine car insurance rates.

Remember, the best way to lower your insurance costs as a high-risk driver is to maintain a clean driving record and work on improving your credit score.Brad Larson Licensed Insurance Agent

Since credit scores affect auto insurance rates, a poor or low credit score, can signal a higher risk of filing a claim, which often results in higher premiums from insurers to cover that increased risk.

Lapses in Coverage

Insurance providers can raise an eyebrow if you have had periods where you didn’t have car insurance at all. They want to see you have been consistently insured. Otherwise, they’ll view your lapses as a sign that you may be less responsible for maintaining your policy, charging you more.

Read more: What to Do if You Can’t Pay Your Auto Insurance

Filling Too Many Claims

If you have filed a lot of claims in the last three years, you’ll be a high risk to your auto insurance company. Frequent claims are a sign that you’re prone to accidents. You can check your auto insurance claims history by requesting a copy from your insurance company or going through LexisNexis.

Having a High-Value Vehicle

Driving a luxury or high-end vehicle can increase insurance costs even with a clean record. These cars are expensive to repair or replace if you get into an accident. See our ranking of the best auto insurance for luxury cars for more information.

Being a New Driver

A first-time driver, without prior auto insurance coverage, is considered high risk by insurance providers. Since you lack a driving history, insurers charge higher premiums until you establish a record of safe driving.

Read more: Cheap Auto Insurance for New Drivers Over 20

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

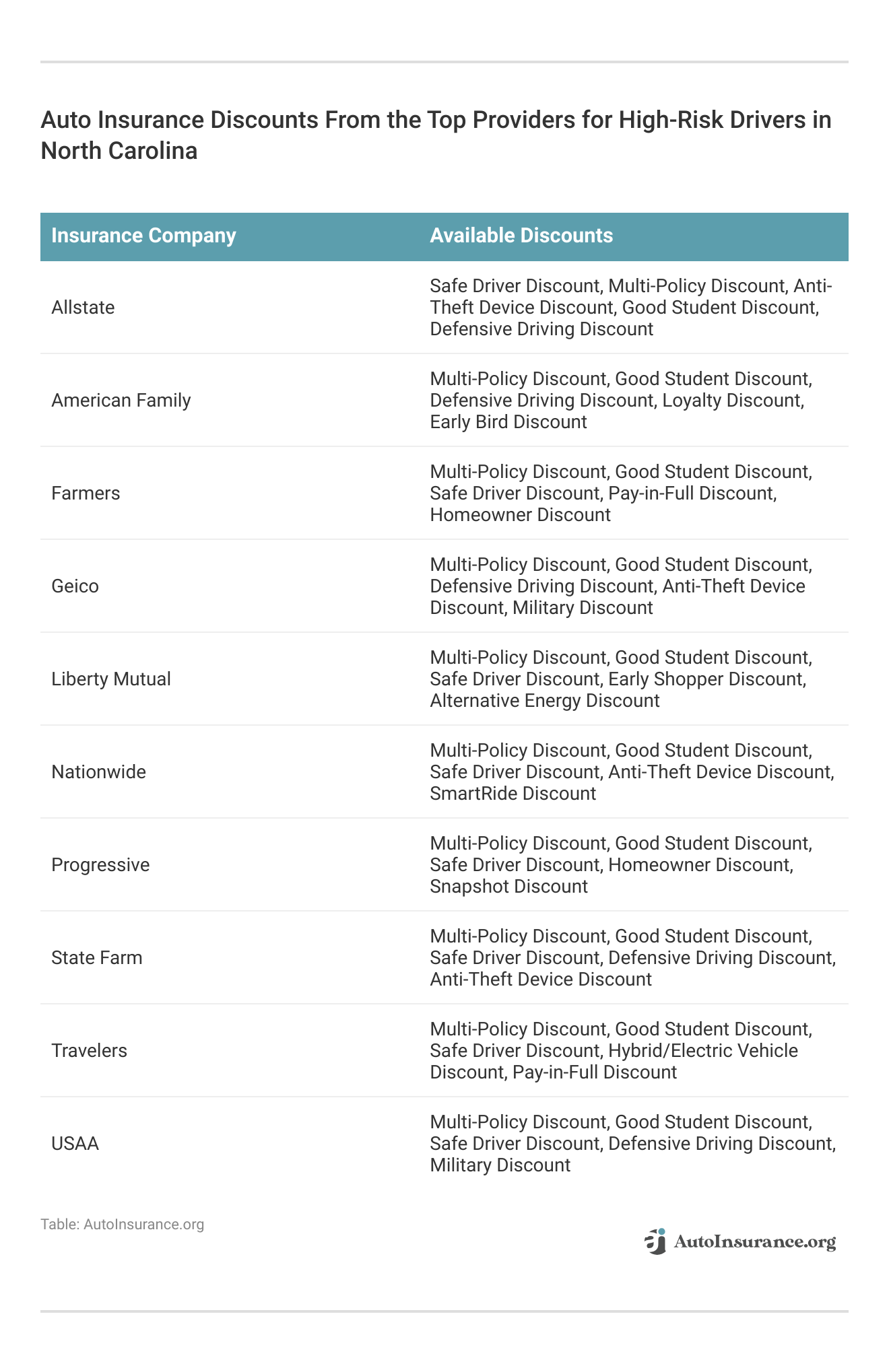

North Carolina Auto Insurance Discounts for High-Risk Drivers

Auto insurance discounts are a great way to get cheap car insurance in North Carolina. As a high-risk driver, you may qualify for specific discounts such as defensive driving or student discounts.

As you can see, most of these companies offer safe driver discounts, which can help high-risk drivers in North Carolina lower their insurance costs.

Multi-policy and good student discounts are also available from insurers like Allstate, American Family, and Geico, providing more ways to reduce premiums.

More Ways North Carolina High-Risk Drivers Can Reduce Auto Insurance Costs

Besides taking advantage of discounts, there are other ways to reduce your auto insurance costs as a high-risk driver in North Carolina. These include:

- Drop Unnecessary Coverage: If you have an older car that’s not worth much, consider dropping collision and comprehensive coverage, which cover damages to your vehicle.

- Improve Your Credit Score: Improving your credit score may lower your premiums even as a high-risk driver.

- Choose a Higher Deductible: A higher auto insurance deductible can lower your monthly premium.

Ensure you have enough savings to cover the higher deductible if you need to file a claim. Of course, maintaining a clean driving record is crucial. As a high-risk driver, consistently demonstrating safe driving can help lower your insurance costs in the future.

Find Cheap Auto Insurance for High-Risk Drivers in North Carolina Today

American Family, Farmers, and Erie have affordable auto insurance for high-risk drivers in North Carolina starting at $57/month.

Car insurance discounts can make a significant difference in insurance rates, so be sure to ask about discounts that you may qualify for.

You can find affordable auto insurance no matter what your driving record looks like by entering your ZIP code below in our free quote comparison tool.

Frequently Asked Questions

Can I get insurance after a DUI conviction in North Carolina?

Yes, you can get auto insurance in North Carolina even if you have a DUI on your record. However, your rates will likely be higher than someone with a clean driving history, as insurers consider DUI offenders as high risk.

How much does auto insurance cost for high-risk drivers in North Carolina?

The best insurance for high-risk drivers in North Carolina costs between $57 and $309 per month.

What qualifies me as a high-risk driver in North Carolina?

In North Carolina, you may be considered a high-risk driver if you have a history of traffic violations, accidents, DUIs/DWIs, or poor credit. Insurance companies also look at factors like the type of vehicle you drive and your overall claims history.

Can I still get affordable auto insurance in North Carolina if I have a poor driving record?

Even with a poor driving record, you can still find affordable car insurance in North Carolina. The key is improving your driving habits over time, taking advantage of any available discounts, and shopping around with multiple providers. Learn how to get multiple auto insurance quotes in our guide.

Are there discounts available for high-risk drivers in North Carolina?

Yes, there are several discounts that you can take advantage of as a high-risk driver in North Carolina to lower your car insurance costs. Some common ones include good driver discounts, defensive driving course discounts, and multi-policy discounts for bundling your home and auto insurance.

How long does a DUI or accident stay on my driving record in North Carolina?

In North Carolina, a DUI conviction will remain on your driving record for your entire life but does expire after 10 years. Accidents can stick around for 3-5 years, depending on the details of the incident.

What is the minimum auto insurance in NC for high-risk drivers?

The minimum auto insurance requirements in North Carolina for high-risk drivers are the same as for all drivers. You must carry at least $30,000 in liability coverage per person, $60,000 per accident, and $25,000 in property damage coverage.

How can I lower my high-risk auto insurance premiums in North Carolina?

Improving your driving record, taking a defensive driving course, increasing your deductible, and utilizing available discounts can help lower your high-risk auto insurance premiums in North Carolina.

Who has the cheapest auto insurance rates in NC?

American Family, Farmers, and Erie have the cheapest auto insurance rates in NC. These providers specialize in insuring high-risk drivers and offer competitive rates.

What is the cheapest high-risk auto insurance in North Carolina?

American Family is the cheapest high-risk car insurance in North Carolina with full coverage rates starting from as low as $136 per month.

Find cheap auto insurance quotes by entering your ZIP code below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.