Cheap Auto Insurance for High-Risk Drivers in Virginia (10 Most Affordable Companies for 2025)

State Farm, Progressive, and American Family are the leading insurers for cheap auto insurance for high-risk drivers in Virginia, rates starts at $29/month. They offers snapshot usage-based coverage, provides competitive discounts of up to 25% on Virginia high-risk auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for High-Risk Drivers in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews

Company Facts

Min. Coverage for High-Risk Drivers in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage for High-Risk Drivers in Virginia

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews

State Farm, Progressive, and American Family are the leading insurers for cheap auto insurance for high-risk drivers in Virginia, with rates starting at $29/month.

These top auto insurance companies for high-risk drivers provide affordable coverage and competitive insurance discounts for high-risk drivers in Virginia.

Our Top 10 Company Picks: Cheap Auto Insurance for High-Risk Drivers in Virginia

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $29 B Strong Reputation State Farm

#2 $34 A+ Usage-Based Progressive

#3 $58 A Discount Options American Family

#4 $59 A Personalized Plans Farmers

#5 $63 A+ Accident Forgiveness Allstate

#6 $64 A++ Financial Stability Travelers

#7 $80 A++ Good Drivers Geico

#8 $98 A Custom Coverage Liberty Mutual

#9 $110 A High-Risk Coverage The General

#10 $128 A Comprehensive Discounts Safeco

To find out if you can get cheaper VA auto insurance rates, enter your ZIP code into our free quote tool above to instantly compare prices from various companies near you.

- State Farm is the cheapest for high-risk drivers in Virginia at $29/month

- Progressive Snapshot can save high-risk drivers 30%

- American Family offers 25% discounts to high-risk drivers in Virginia

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Strong Reputation: State Farm has a solid reputation for providing reliable coverage to high-risk drivers in Virginia, which can be reassuring. Learn more in our State Farm review.

- Affordable Rates: Offers competitive high-risk auto insurance rates in Virginia starting at $29/month.

- Wide Network of Agents: State Farm’s extensive network of agents ensures personalized service for high-risk drivers in Virginia.

Cons

- Limited High-Risk Discounts: State Farm may not offer as many discounts specifically tailored for high-risk drivers in Virginia compared to other providers.

- Financial Downgrades: State Farm’s financial rating is a B, which isn’t as strong as other Virginia high-risk auto insurance company ratings.

#2 – Progressive: Cheapest Usage-Based Insurance

Pros

- Snapshot Program: High-risk drivers in Virginia can benefit from the Snapshot usage-based program (UBI), which offers up to 30% off rates for good driving habits.

- Variety of Coverage Levels: Progressive offers various coverage levels suitable for high-risk drivers in Virginia. Discover our Progressive review for a full list.

- Flexible Options: Progressive provides a range of flexible coverage options tailored to high-risk drivers in Virginia.

Cons

- Variable Pricing: Rates can be inconsistent, which may result in higher premiums for high-risk drivers in Virginia.

- Limited Personalized Service: Progressive’s focus on digital services might mean less personalized support for high-risk drivers in Virginia.

#3 – American Family: Cheapest With Discounts

Pros

- Discount Options: American Family offers multiple discount options that can benefit high-risk drivers in Virginia, which you can read more about in our review of American Family.

- Flexible Coverage: Provides customizable coverage plans to meet the specific needs of high-risk drivers in Virginia.

- Good Customer Service: Known for excellent customer service, which can be advantageous for high-risk drivers in Virginia needing assistance.

Cons

- Higher Initial Premiums: Initial premiums for high-risk drivers in Virginia might be higher compared to some competitors.

- Fewer Discounts for Severe Risks: Discounts might be less significant for high-risk drivers in Virginia with severe risk factors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Farmers: Cheapest Personalized Plans

Pros

- Personalized Plans: Farmers offers personalized insurance plans that cater to the unique needs of high-risk drivers in Virginia starting at $59/month.

- Local Agents: Provides access to local agents who can offer tailored advice for high-risk drivers in Virginia. Read our Farmers review to learn what else is offered.

- Flexible Payment Options: Farmers offers various payment options to accommodate high-risk drivers in Virginia.

Cons

- Poor Customer Service: Farmers Insurance for high-risk drivers in Virginia is dead last for customer satisfaction and claims service.

- Limited Online Tools: Farmers may not have as many online tools or resources for high-risk drivers in Virginia compared to other insurers.

#5 – Allstate: Cheap Accident Forgiveness

Pros

- Accident Forgiveness: Allstate offers accident forgiveness, which can be beneficial for high-risk drivers in Virginia to avoid premium hikes after a first accident.

- Discount UBI Programs: Offers various Allstate Milewise and Drivewise UBI that can help lower VA high-risk auto insurance rates.

- Comprehensive Coverage: Provides comprehensive coverage options that address the specific needs of high-risk drivers in Virginia, which you can check out in our Allstate review.

Cons

- Accident Forgiveness Eligibility: Accident forgiveness may not be available to high-risk drivers in VA who have multiple accidents already on their records.

- Variable Customer Service: Some high-risk drivers in Virginia report poor or slow claims service.

#6 – Travelers: Best Financial Stability

Pros

- Financial Stability: Travelers is known for its strong financial stability, providing reliable coverage for high-risk drivers in Virginia.

- Customizable Coverage: Offers customizable high-risk insurance coverage options to VA drivers, which you can learn about in our Travelers review.

- Usage-Based Savings: High-risk drivers in Virginia can save up to 30% if they sign up for Travelers IntelliDrive.

Cons

- Higher Premiums: Financial stability might come with higher monthly car insurance rates in Virginia.

- Limited Discount Options: May offer fewer discounts specifically for high-risk drivers in Virginia compared to competitors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Geico: Cheapest for Good Drivers

Pros

- Good Driver Discounts: Virginia high-risk drivers who maintain safe driving records can save up to 25%.

- Affordable Teen Rates: Known for competitive teen car insurance rates, which can be advantageous for high-risk drivers in Virginia.

- Easy Online Access: Offers an easy-to-use online platform for high-risk drivers in Virginia to manage their insurance. Read more in our review of Geico.

Cons

- Limited High-Risk Options: Geico may have fewer specialized options for VA drivers who are high-risk due to accidents, speeding tickets, or DUIs.

- Customer Service Issues: May experience issues with customer service that can be challenging for high-risk drivers in Virginia needing more assistance.

#8 – Liberty Mutual: Cheapest Custom Coverage

Pros

- Custom Coverage: Provides custom coverage options tailored to high-risk drivers in Virginia. For a complete list, read our Liberty Mutual review.

- Multiple Discounts: Offers various auto insurance discounts that can benefit high-risk drivers in Virginia.

- Flexible Payment Plans: Liberty Mutual offers flexible payment plans suitable for VA high-risk drivers.

Cons

- Higher Initial Rates: Monthly VA high-risk auto insurance rates start at $98 with Liberty Mutual, nearly three times more expensive than our top picks.

- Complex Policies: The complexity of policies might be challenging for high-risk drivers in Virginia to navigate.

#9 – The General: Best for High-Risk Coverage

Pros

- High-Risk Coverage: The General specializes in VA high-risk auto insurance coverage.

- No Down Payment Options: Offers no-down-payment car insurance, which can be helpful for high-risk drivers in Virginia.

- Flexible Terms: Provides flexible terms and coverage options suitable for high-risk drivers in Virginia, which you can learn about in our The General review.

Cons

- Higher Premiums: Premiums may be higher due to the high-risk focus of the coverage for drivers in Virginia.

- Limited Discount Opportunities: The General has fewer discount options for high-risk drivers in Virginia compared to other insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Safeco: Cheap Comprehensive Discounts

Pros

- Comprehensive Discounts: Offers a range of comprehensive discounts that can benefit high-risk drivers in Virginia. Find out more in our Safeco review.

- Customizable Coverage: Provides customizable coverage plans tailored to the needs of high-risk drivers in Virginia.

- Good Customer Service: Known for good customer service, which is valuable for high-risk drivers in Virginia.

Cons

- Potentially Higher Rates: The comprehensive discounts might not be enough to offset potentially higher base rates for high-risk drivers in Virginia.

- Limited High-Risk Specific Programs: Safeco ha fewer programs specifically designed for high-risk drivers in Virginia.

Exploring Auto Insurance Costs for High-Risk Drivers in Virginia: A Monthly Comparison

Finding auto insurance as a high-risk driver in Virginia can be tough due to the varying rates and discounts from different providers. This guide offers a clear comparison of monthly rates for high-risk drivers, showing differences by coverage level and insurance company.

Virginia High-Risk Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $63 $151

American Family $58 $138

Farmers $59 $139

Geico $80 $191

Liberty Mutual $98 $233

Progressive $34 $81

Safeco $128 $218

State Farm $29 $69

The General $110 $210

Travelers $64 $153

State Farm offers the lowest rates starting at $29 for minimum coverage, while Liberty Mutual is the highest at $98. The cheapest full coverage car insurance in Virginia for high-risk drivers is State Farm and Progressive.

Factors Contributing to Rising Auto Insurance Rates in Virginia

If you’re a high-risk driver, expect to pay more for car insurance. Virginia auto insurance increases for each traffic violation, missed insurance payment, or drop in your credit score. Explore more factors that affect auto insurance rates below:

- Vehicle Type: High-performance or luxury cars typically cost more to insure due to higher repair costs and theft risk, while vehicles with advanced safety features may qualify for discounts that lower your rates.

- Age and Driving Experience: Younger drivers, particularly those under 25, generally face higher rates due to increased accident risk, while a longer driving history with a clean record can result in lower premiums.

- Location: Virginia auto insurance rate increases happen if you live in the metro area or have a long commute for work, while drivers in more rural areas have cheaper rates.

Maintaining a clean driving record and understanding the impact of their location can also lead to lower premiums. Proactively managing these aspects allows drivers to potentially reduce their insurance costs and secure more affordable coverage.

Finding the right auto insurance for a high-risk driver can be easier than it seems. Compare monthly rates and discounts from various insurers to find the best deal. Since rates and discounts vary, get personalized quotes from multiple providers to secure the best coverage at the most affordable rate.

Read More: Cheap Auto Insurance After an Accident

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Effective Ways to Lower Virginia High-Risk Auto Insurance Costs

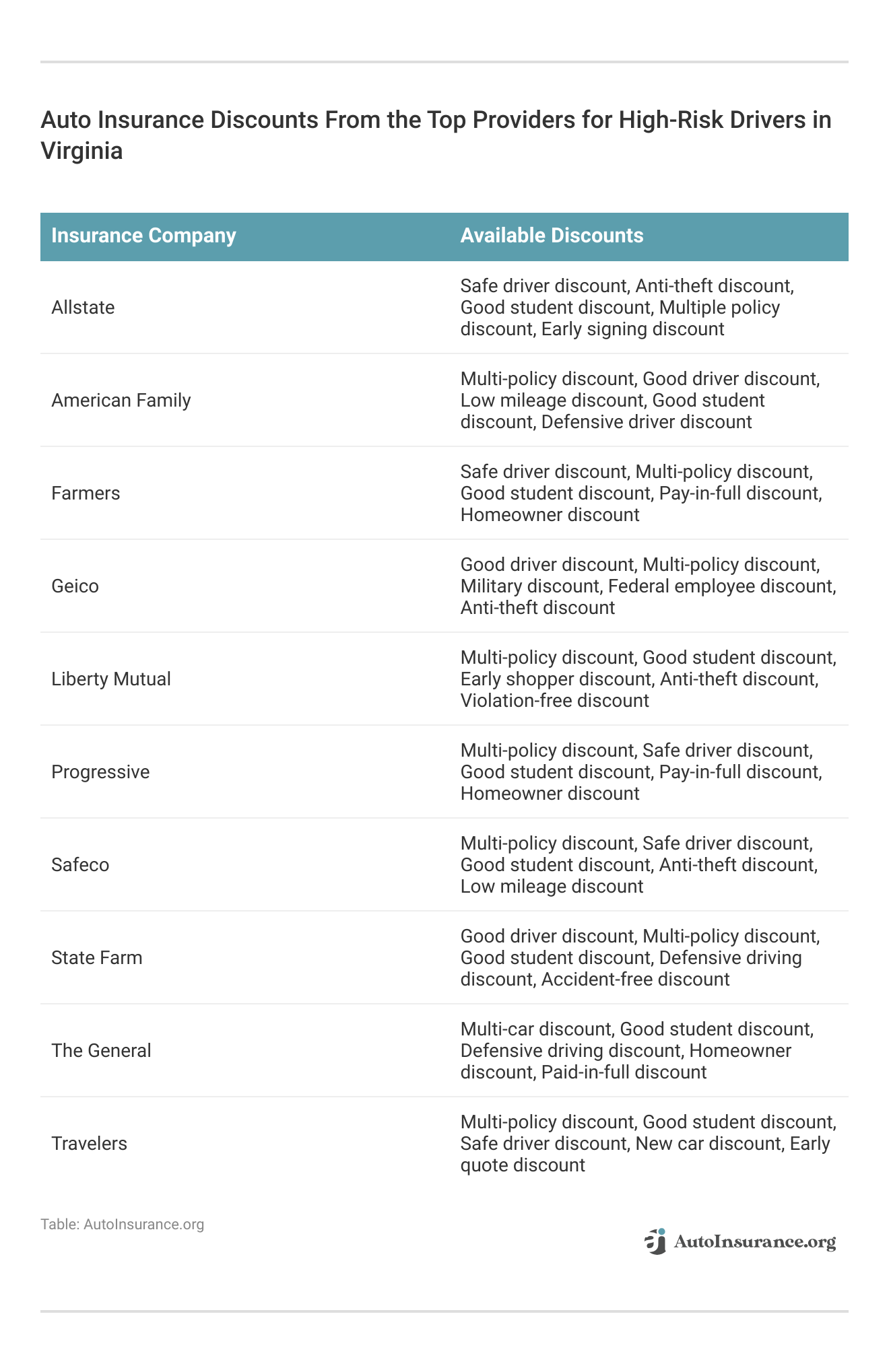

Explore auto insurance discounts for high-risk drivers in Virginia, each offering various discounts such as safe driver, multi-policy, good student, and more.

High-risk drivers in Virginia can lower their car insurance costs by comparing quotes, improving their driving record, and taking defensive driving courses. Opting for higher deductibles, seeking discounts, and choosing safer vehicles can also help.

Improving your credit score and installing anti-theft devices may reduce rates. Consider usage-based insurance and regularly review your policy. Learn more in our guide to finding cheap usage-based auto insurance.

Navigating Affordable Auto Insurance Options for High-Risk Drivers in Virginia

If you’re looking for cheap auto insurance for high-risk drivers in Virginia, State Farm, Progressive, and American Family have the most affordable coverage with rates starting around $29 per month. These providers offer comprehensive coverage and various auto insurance discounts to lower rates even more.

State Farm offers the most affordable auto insurance for high-risk drivers in Virginia, with rates starting as low as $29 per month.Jeff Root Licensed Insurance Agent

To find the best rates, it’s advisable to compare quotes from multiple insurers. Factors influencing insurance costs include driving record, credit score, and vehicle safety features. See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool above.

Frequently Asked Questions

What is the best insurance for high-risk drivers in Virginia?

The best auto insurance for high-risk drivers in Virginia often includes State Farm, Progressive, and American Family. These providers offer competitive rates and flexible coverage options tailored to high-risk drivers.

Who has the cheapest auto insurance in Virginia for high-risk drivers?

For high-risk drivers in Virginia, State Farm has the cheapest coverage starting at $29/month. Enter your ZIP code to find the cheapest VA car insurance quotes near you.

What is the cheapest full coverage auto insurance in Virginia?

The cheapest full coverage auto insurance in Virginia can vary by provider and personal circumstances, but typically companies like State Farm and Progressive offer competitive rates for comprehensive and collision coverage.

What type of auto insurance is required in Virginia?

Virginia minimum auto insurance requires drivers to have liability insurance: $25,000 for bodily injury per person, $50,000 for total bodily injury per accident, and $20,000 for property damage.

What is the new law in Virginia about auto insurance?

Recent changes to Virginia auto insurance laws include stricter penalties for driving without insurance and the implementation of a new electronic insurance verification system to improve enforcement and compliance.

What is the average cost of auto insurance in Virginia?

The average cost of auto insurance in Virginia varies, but as of 2024, it typically ranges from $1,000 to $1,500 annually for full coverage auto insurance. Rates can be higher for high-risk drivers based on their specific profiles.

How long can you go without auto insurance in Virginia?

In Virginia, driving without insurance is illegal, and if you are caught, you could face fines, suspension of your driver’s license, and registration fees. It’s essential to maintain continuous coverage to avoid legal and financial penalties.

What is the term for high-risk insurance?

High-risk insurance, also known as non-standard auto insurance, refers to coverage designed for drivers who are considered high-risk due to factors like a poor driving record, recent accidents, or other risk factors. Find out how long an accident stays on your driving record.

What is the highest risk age for auto insurance?

Typically, drivers aged 16-25 are considered the highest risk due to their inexperience and higher likelihood of accidents. Insurance rates are generally higher for this age group compared to more experienced drivers.

What are the cheapest full coverage auto insurance options for high-risk drivers?

For high-risk drivers seeking full coverage, providers like State Farm, Progressive, and American Family often offer some of the most affordable options. Comparing quotes from multiple companies is recommended to find the best rates.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.