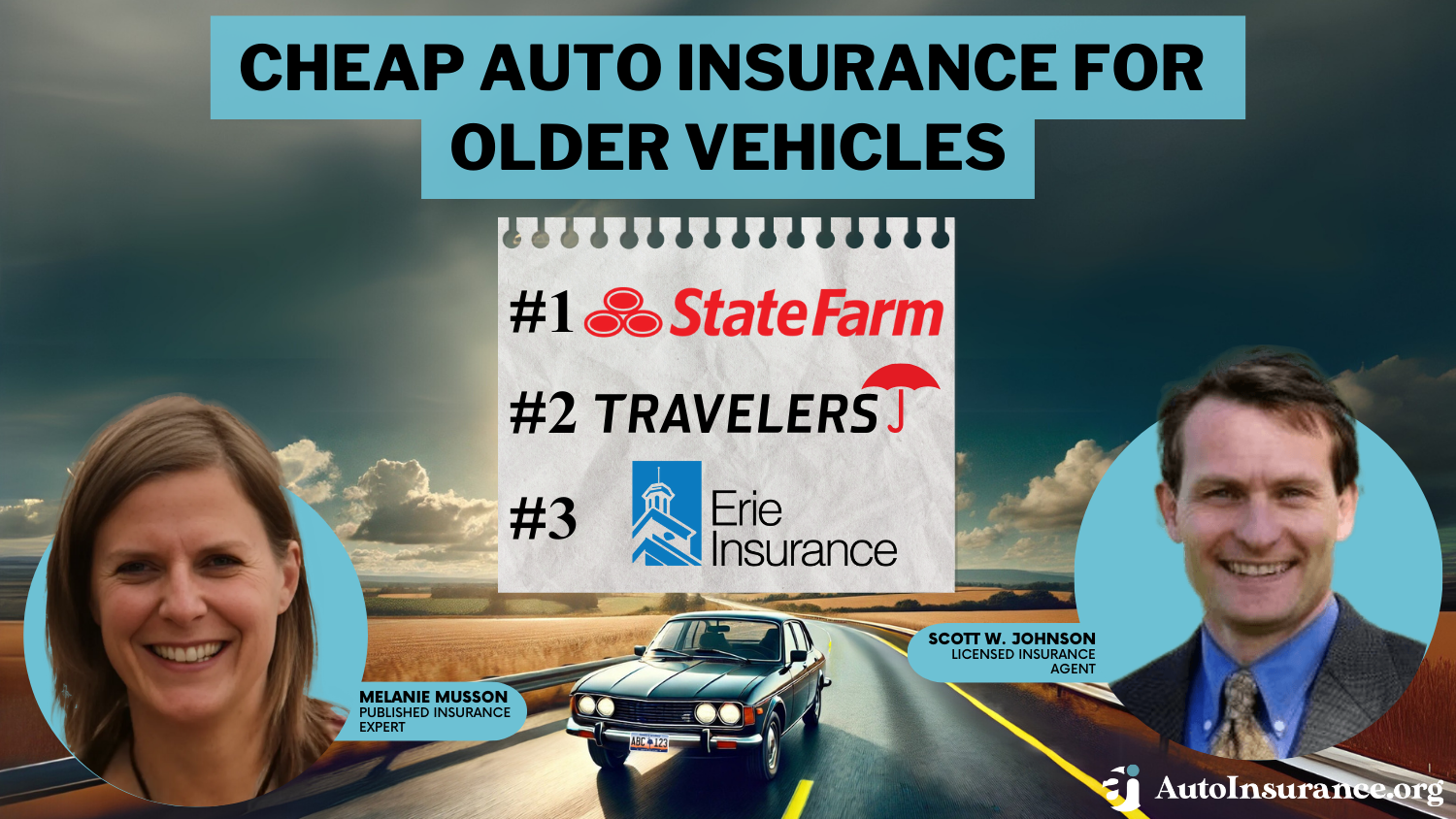

Cheap Auto Insurance for Older Vehicles in 2025 (Save With These 8 Companies)

State Farm, Travelers and Erie offer affordable auto insurance for older vehicles, with rates starting at just $64 per month. These companies provide value-focused coverage for decreased vehicle value and lower repair costs, ensuring cost-effective protection and savings suited for aging models.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for Older Cars

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 1,733 reviews

1,733 reviewsCompany Facts

Min. Coverage for Older Cars

A.M. Best Rating

Complaint Level

Pros & Cons

1,733 reviews

1,733 reviews 1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Older Cars

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviewsState Farm, Travelers and Erie are the top picks for cheap auto insurance for older vehicles, with rates starting as low as $64 per month.

These providers offer tailored, cost-effective policies for aging cars, with Erie excelling in pricing and coverage.

Our Top 8 Company Picks: Cheap Auto Insurance for Older Vehicles

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $64 | B | Agent Network | State Farm | |

| #2 | $67 | A++ | Coverage Options | Travelers | |

| #3 | $69 | A+ | Great Service | Erie |

| #4 | $76 | A++ | Custom Coverage | Auto-Owners | |

| #5 | $82 | A++ | Online Experience | Geico | |

| #6 | $87 | A+ | Customer Satisfaction | Country Financial |

| #7 | $93 | A+ | Nationwide Coverage | Nationwide |

| #8 | $98 | A | Discount Variety | American Family |

This makes it an ideal choice for drivers seeking reliable insurance from the cheapest auto insurance companies without overpaying for features they may not need.

Save on car insurance quotes for older cars with our free comparison search. Enter your ZIP code above to get started now.

- Tailored policies reduce costs for older vehicle insurance needs

- State Farm offers the best rates, starting at $64 per month for older cars

- Coverage adjusts to the lower value and repair costs of aged vehicles

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Agent Network: State Farm’s agent network is one of the best. Learn more in our review of State Farm.

- Value Range: State Farm offers good student discounts, bundling discounts, and more.

- Assurance Options: State Farm adds some specialty options that can result in full coverage insurance policies.

Cons

- Agent Purchases: State Farm policies can only be purchased through an agent.

- UBI Accessibility: State Farm’s UBI discount program is unavailable in all states.

#2 – Travelers: Best for Coverage Options

Pros

- Coverage Options: Travelers provides gap insurance, roadside assistance, and more. Our review of Travelers explains its coverages in further detail.

- Bundling Discount: Travelers has a bundling discount if you purchase more than one type of insurance.

- Accident Forgiveness: Travelers will forgive some drivers’ first at-fault accidents.

Cons

- Attainability: Travelers auto insurance isn’t sold in a few states.

- UBI Availability: Travelers’ UBI discount isn’t available in CA or NY.

#3 – Erie: Top Overall Pick

Pros

- Great Service: Erie has great customer service reviews. Find out more in our review of Erie.

- Add-On Coverages: Erie offers rideshare insurance, roadside assistance, and much more.

- Rate Lock: Erie’s rate lock program helps keep rates low.

Cons

- UBI Program Not as Robust: Erie’s YourTurn offers gift card rewards for drivers who do well but doesn’t offer auto insurance discounts.

- Accessibility: Erie insurance is not yet sold in every U.S. state.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Auto-Owners: Best for Custom Coverage

Pros

- Customer Coverage: Auto-Owners offers several coverage options, which we discuss in more detail in our Auto-Owners review.

- Community Representatives: Auto-Owners’ local agents work well for customers who prefer assistance in person.

- Multiple Discounts: Auto-Owners has more than enough discounts as well as accident forgiveness.

Cons

- No Online Quotes: You need to find a local agent to get a quote.

- Obtainability: Auto-Owners isn’t yet sold in every U.S. state.

#5 – Geico: Best for Online Experience

Pros

- Online Experience: Geico reviews are positive on online experience due to how easy its app is to use.

- UBI Discount: Drivers can save with Geico’s DriveEasy program. Learn more about the program in our Geico DriveEasy review.

- Accident Forgiveness Benefit: Geico forgives customers for their first at-fault accident.

Cons

- Fewer Local Agents: Geico doesn’t have as many local agents as other companies.

- Lower DUI Insurance Costs: Drivers with DUIs often won’t find the cheapest rate at Geico. Learn about Geico’s rates in our Geico review.

#6 – Country Financial: Best for Customer Satisfaction

Pros

- Customer Satisfaction: Country Financial has solid customer satisfaction ratings, which you can learn about in our review of Country Financial.

- Security: Country Financial has roadside assistance, rental insurance, and more.

- Discount Variety: Country Financial just has a bunch of legacy discounts, bundling discounts, and more.

Cons

- Reachability: Country Financial availability is not nationwide.

- Quote Process: Country Financial doesn’t offer online quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Nationwide Coverage

Pros

- Nationwide Coverage: Nationwide auto insurance is available in all but three states.

- Vanishing Deductible: Nationwide lets you reduce deductibles for claims-free drivers.

- Pay-Per-Mile Insurance: Nationwide SmartMiles is an affordable choice if you don’t drive frequently.

Cons

- Less Competitive DUI Rates: DUI drivers covered by Nationwide generally had a higher than average DUI rates.

- Customer Ratings: Nationwide has lower-than-average ratings for claims satisfaction. Learn more in our Nationwide review.

#8 – American Family: Best for Discount Variety

Pros

- Affordable Selection: American Family has good student discounts, bundling discounts, and more.

- Insurance Protection: American Family has plenty of add-on coverages, which we cover in our American Family review.

- Accident Damage Forgiveness: Safe drivers can save with the American Family’s accident forgiveness perk.

Cons

- Rates Not as Competitive for Some Drivers: High-risk drivers may not find the cheaepst rates at American Family.

- Usability: American Family isn’t available nationwide.

Older Vehicle Auto Insurance Coverage

Before buying coverage for your car, bear in mind that your auto insurance rates will vary depending on what type of auto insurance coverage you choose. Below, you can see average auto insurance rates for minimum and full coverage at the cheapest companies for older vehicle insurance.

Old Vehicles Auto Insurance Monthly Rates by Provider & Coverage level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $98 | $172 | |

| $76 | $142 | |

| $87 | $168 |

| $69 | $153 |

| $82 | $177 | |

| $93 | $197 |

| $64 | $127 | |

| $67 | $116 |

If you take the time to do proper research and compare auto insurance quotes from multiple companies, you might find a cheap policy that offers great coverage for your old car.

Older cars have lower insurance costs. Dropping extra coverage saves money. For example, if repairs exceed the car’s value, liability-only is best.Michelle Robbins Licensed Insurance Agent

Most insurers provide bonuses and discounts to those who meet certain criteria. When you compare car insurance quotes, try to find out more about the discounts that are being offered.

Learn about the types of auto insurance available on the market, make a list of insurance providers, and then go shopping online.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheap Auto Insurance For Older Vehicles

More companies are selling car insurance online. Processing online applications involves minimum costs, which is why most insurance carriers offer lower rates to those who buy coverage through their websites. You can save on your old vehicle insurance by shopping at the cheapest companies like Auto-Owners or Geico.

Comparison shopping saves you time from having to go to an agent. Statistics show that drivers who buy car insurance online pay up to 30% less on coverage than those who go shopping the old fashioned way.

One of the main pros of shopping for car insurance online is that you don’t need a middleman, as insurance websites feature online comparison tools, rate calculators, and other applications.

We often get the question, “Where can I compare online auto insurance companies?” Our comparison tool provides advanced tools that allow customers to customize their policies with a few mouse clicks. Our comparison search will help you save on auto insurance rates.

Comparing Auto Insurance Rates for Old Vehicles

Using a quote comparison tool is the best way to find a comprehensive auto insurance policy that meets your individual needs. These sites provide dozens and even hundreds of free auto insurance quotes from industry leading companies.

They work with local and national car insurance providers to bring you affordable policies with different levels of coverage. As long as you know how much insurance you need, shopping around for auto coverage will be easy and fun.

When shopping for car insurance online, you will need to provide relevant details about yourself and your vehicle, such as your age, gender, marital status, driving experience, credit history, location, ZIP code, and type of car, as these factors influence your insurance rates.

Be accurate in your answers. Don’t be afraid that you will pay more because you have a bad driving record or a poor credit score. Many auto insurance providers feature competitively priced policies for young drivers, seniors, and convicted drivers.

Apply for at least three quotes to find the best deal on old car insurance. Opt for minimum coverage on low-value vehicles to save more.Aremu Adams Adebisi Feature Writer

If you are on a tight budget, you can also look for policies with higher deductibles. Try to find out how raising your deductible will affect your car insurance premiums. The cost of your policy is directly related to your deductible.

How to Save on Auto Insurance for Older Cars

An old vehicle auto insurance policy is usually already affordable, but the following tips may help you save even more. From paying in full to bundling policies, there are plenty of ways to reduce the costs of your auto insurance policy.

Pay Your Auto Insurance Rates Upfront

One of the best ways to lower car insurance rates is to pay your premiums up front. Some companies require a very low down payment or no payment at all. If you own an older car, paying full to lower car insurance rates policy will be easy.

Learn More: Should I pay my auto insurance in full?

Monthly rates can fit seamlessly into your budget, but you will end up paying more on car insurance over the long run.

If you choose to pay your premiums monthly, you will be forced to manage more paperwork. In addition, many insurance providers will charge a small fee to process your monthly premiums.

In addition, many insurance providers will charge a small fee to process your monthly premiums.

Drive Fewer Miles to Lower Your Auto Insurance Rates

People who use their cars for long-distance commuting and business pay more for auto insurance than those who drive less. If you want to get lower car insurance rates, you may want to explore ways to limit your mileage.

Is it better to pay a flat premium for car insurance or pay a rate based on how many miles you drive⚖️? The answer is both🤔! It depends on how much you drive. Find out where you fit👉: https://t.co/gVlemk9X6D pic.twitter.com/GFy5RIVsSZ

— AutoInsurance.org (@AutoInsurance) June 17, 2024

Most insurance companies offer a low mileage auto insurance discount to those who agree to a mileage restriction. Walking, riding a bike, and using public transportation will result in lower premiums.

Consolidate Your Policies With One Insurance Company

Another way to save money on car insurance is to combine all of your policies into one. Most people have multiple insurance policies with different carriers. Not only is this confusing, but you’re probably spending more than you have to on insurance.

Insuring your home, car, boat, and motorcycle under the same roof can save you hundreds and even thousands of dollars a year. The best companies for bundling home and auto insurance offer discounts of up to 25% to those bundle their home, auto, and life insurance with the same provider.

Keep Your Auto Safe

Even if you have an older car, get ready to make a small investment in order to reduce the risk of theft. Drivers who install approved alarms and immobilizers on their vehicles pay up to 10% less on car insurance than those who don’t have any safety devices installed.

The safety of your car will be taken into consideration by your insurance provider.

Make sure your windows and windshields are free of cracks. Adding air bags, automatic seatbelts, and antilock brakes can also help improve the safety rating of your vehicle. Learn how to get an anti-theft auto insurance discount in our step-by-step guide.

Apply for Discounts

Discounts are a great way to get cheap car insurance for older cars. The best companies for old vehicle auto insurance offer the following discounts:

Numerous organizations are offering driving classes to those who want to improve their skills and lower their auto insurance rates. Some companies offer up to 35% discounts for completing advanced driving courses.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Buy Cheap Car Insurance for Older Vehicles Near You

Getting cheap car insurance for an older vehicle can be done in a few easy steps. Shopping online at the companies with the best insurance for older cars, knowing how to compare auto insurance quotes, and applying for various discounts can help you save a small fortune.

For extra savings when insuring an older car, cut down on policy extras and maintain a good credit rating. Protect your old vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool.

Frequently Asked Questions

Do I need auto insurance for my older car?

Auto insurance laws vary by state, but in general, it’s a good idea to insure your older vehicle. Even if a car is not new or particularly valuable, insurance provides financial protection when accidents, theft, and other catastrophes occur.

Will my older car insurance be more expensive than coverage for a new car?

Insurance premiums for older cars are usually lower than for newer vehicles due to their decreased value and lower replacement costs. However, rates vary depending on your driving history, location, and chosen coverage level.

Find the best auto insurance company near you by simply entering your ZIP code into our free quote tool.

What type of auto insurance coverage should I consider for my older car?

For your older car, choose coverage that fits your needs. Minimum liability auto insurance coverage is required, covering damages to others in accidents. Consider adding collision for accident damage and comprehensive for theft, vandalism, or natural disasters.

Is it worth getting comprehensive and collision coverage for an older car?

When considering comprehensive or collision coverage on an older model, weigh the value of the vehicle against the cost of coverage. If the value is low, it may not be worth it; otherwise, these coverages could be a good thing. Compare options with our comparison tool.

Are there any special discounts available for insuring older cars?

A few insurers provide savings specifically targeted to older cars. Those might include those for low mileage, safe driving histories, or anti-theft devices.

Should I consider dropping collision or comprehensive coverage if my car’s value decreases over time?

If your car’s value drops and the cost of collision auto insurance or comprehensive insurance outweighs the car’s worth, consider dropping these coverages. However, first, assess the potential risks, your ability to handle unexpected repairs, and your comfort with financial risks from accidents or damages.

Are old cars cheaper to insure?

Yes, most older vehicles are cheaper to insure due to decreased value, so insurance companies must pay less if you total your car or need repairs.

Is there an older car insurance trick?

There are a few tricks to saving on older car insurance. If your car’s value diminishes, you can drop collision and comprehensive insurance and shop for older auto insurance quotes.

What is classic car insurance?

Classic car insurance is insurance for cars older than 20 years, considered collector’s items, and rarely driven (learn more: Does my car qualify for classic car insurance?).

Is car insurance cheaper for older cars due to their decreased market value?

Yes, the cost of car insurance is generally lower for older cars because their market value is lower, which means lower risk for the insurer and likely lower comprehensive and collision coverage costs.

Do older cars have cheaper insurance even if they lack modern safety features?

Some older cars are still cheaper to insure even without modern safety features. With a lower replacement value, insurers may quote lower rates, which can offset the increased risk of offending technology being older.

How do insurance companies determine if an older car is cheaper to insure?

Factors that affect auto insurance rates include the car’s age, make, model, and the owner’s driving history, which insurance companies use to determine eligibility for lower premiums.

What factors should I consider when buying car insurance for an old car?

Take into account the car’s resale value, the feasibility of repairs, the potential cost of parts, and your driving habits. It is important to balance coverage level with the car’s depreciation to avoid over-insuring it.

Can I get a discount on car insurance for a car older than 10 years if it’s rarely driven?

Many insurers offer the best low-mileage auto insurance discounts for vehicles used infrequently. Submitting odometer readings as proof of limited use can help secure this discount.

Who has the cheapest insurance for older cars?

State Farm offers the cheapest insurance for older cars. Use our free tool to compare rates quickly and find cheap insurance for old cars that fits your budget and coverage needs.

Are older cars cheaper to insure due to their lower market value?

Yes, older cars are generally cheaper to insure due to lower replacement costs, as explained in how vehicle year affects auto insurance rates. However, the actual cost can vary based on the car’s condition, model, and chosen insurance coverage.

Stop overpaying for auto insurance. Enter your ZIP code to find out if you can get a better deal.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.