Cheap Auto Insurance for Snowbirds in 2025 (10 Most Affordable Companies)

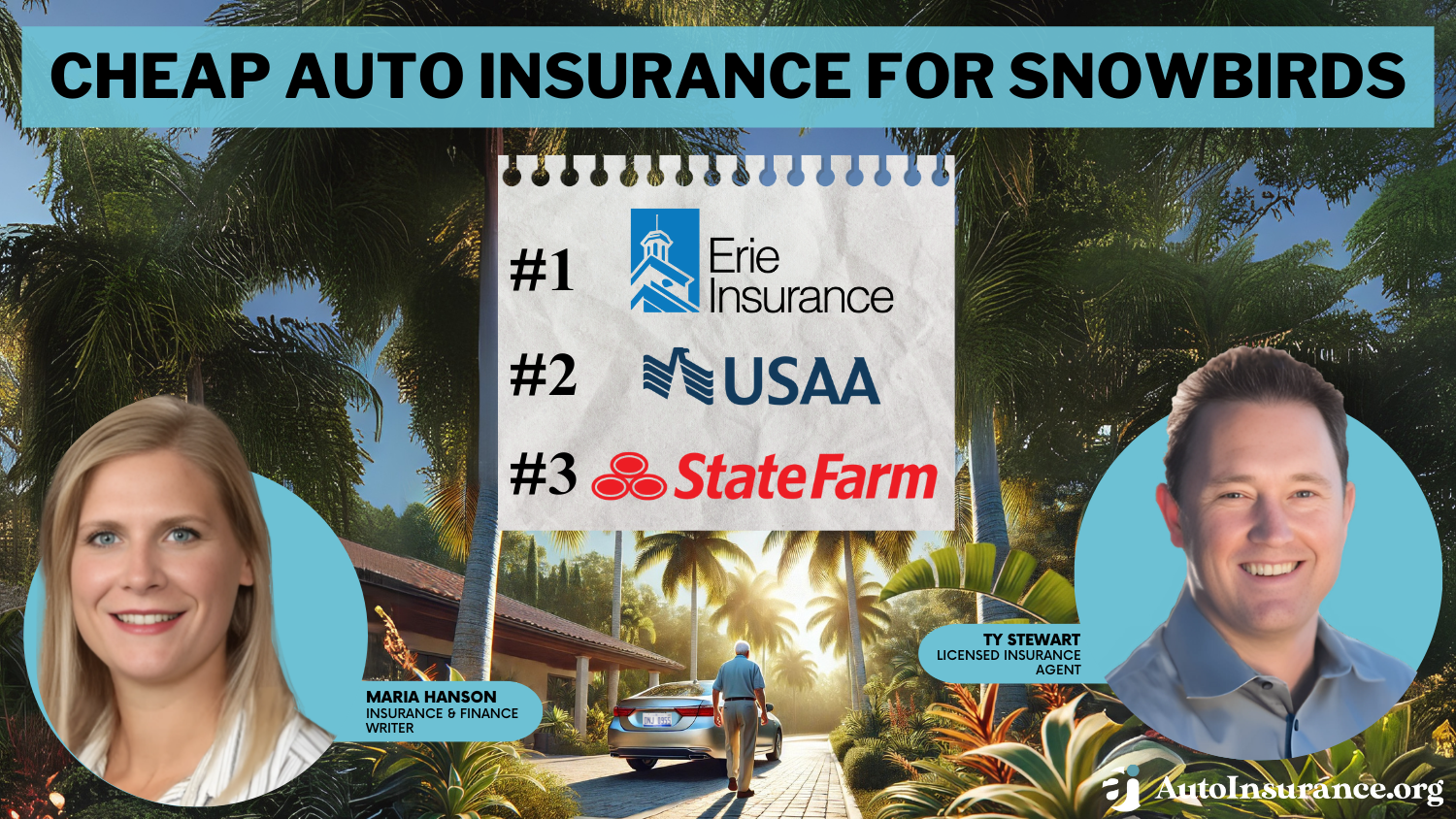

Erie, USAA, and State Farm are the top three companies for cheap auto insurance for snowbirds, with rates starting around $32/month for minimum coverage. Snowbirds are people who move to a warmer, more southern state for the winter, and states like Florida often have specific rules drivers will need to follow.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Snowbirds

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for Snowbirds

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for Snowbirds

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsWhen looking for cheap auto insurance for snowbirds, Erie, USAA, and State Farm are the top options, with premiums for as low as $32 a month.

Our Top 10 Company Picks: Cheap Auto Insurance for Snowbirds

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $32 | A+ | Youth Discounts | Erie |

| #2 | $34 | A++ | Military Members | USAA | |

| #3 | $47 | B | Customer Service | State Farm | |

| #4 | $53 | A++ | Bundling Policies | Travelers | |

| #5 | $56 | A+ | Qualifying Coverage | Progressive | |

| #7 | $62 | A | Loyalty Rewards | American Family | |

| #6 | $63 | A+ | Usage-Based Coverage | Nationwide |

| #8 | $76 | A | Safe-Driving Discounts | Farmers | |

| #9 | $87 | A+ | Infrequent Drivers | Allstate | |

| #10 | $96 | A | Add-on Coverages | Liberty Mutual |

Planning for your winter snowbird escape to Florida, there are going to be a lot of things to consider, from where you will stay to who will take care of your pets while you’re gone. One thing you may not have given much thought about is the benefits of auto insurance.

Florida has certain requirements for auto insurance, even if you are just a part-time visitor to the Sunshine State.

If you’re just looking for coverage to drive legally, enter your ZIP code above to compare cheap auto insurance quotes near you.

- There are special requirements for snowbird insurance

- Even part-time residents may be susceptible to Florida requirements

- Many insurance companies offer discounts for snowbirds

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Erie: Top Overall Pick

Pros

- Youth Driver Discounts: Erie offers affordable car insurance for snowbirds traveling with younger family members, providing youth driver discounts that help reduce premiums.

- Windshield Deductible Waiver: An add-on that waives your deductible for windshield repairs, helpful for snowbirds who frequently travel between seasonal homes.

- Accident Forgiveness: After three accident-free years with Erie, your rates won’t increase after your first accident. Ideal for snowbirds to maintain a clean driving record across states. You can learn more with our Erie auto insurance review.

Cons

- Availability: Erie auto insurance is not offered in most states, limiting options for snowbirds with seasonal residences.

- Customer Service: Some snowbirds have reported negative experiences with Erie’s customer support.

#2 – USAA: Best for Military Members

Pros

- Exclusive Military Benefits: USAA provides affordable snowbird car insurance with military ties, offering flexible policies, storage discounts, and deployment options for service members.

- Young Drivers Pay Less: Teens in snowbird families see much more affordable rates with USAA. You can learn more with our USAA auto insurance review.

- SafePilot: With this program, snowbirds can save up to 30% on their auto insurance, depending on their driving habits.

Cons

- No Gap Coverage: Snowbirds won’t be able to purchase this particular add-on, which helps pay for the difference between a car’s value and what is left on a payment in the event it’s totaled in an accident.

- Customer Service: Snowbirds have reported a higher number of complaints than some competing companies.

#3 – State Farm: Best for Customer Service

Pros

- Exceptional Customer Service: State Farm offers personalized support and 24/7 claims service, ideal for snowbirds managing policies between seasonal homes.

- Drive Safe & Save: This program is usage-based and provides snowbirds who practice safe habits a discount on coverage, up to 50% off in some cases.

- Travel Insurance: Protects snowbirds while traveling domestically or internationally and will cover cancellations, delays, and even emergency medical expenses.

Cons

- Limited Coverage Flexibility: The company may lack flexibility for snowbirds needing seamless multi-state coverage. You can learn more with our State Farm auto insurance review.

- Missing Gap Coverage: This protects snowbirds against paying off any amount still owed on a vehicle after it’s in an accident. It can help financially, but it is not offered by State Farm.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Travelers: Best for Bundling Policies

Pros

- Bundling Policy Savings: Travelers offers significant savings for snowbirds by bundling auto and home insurance, helping reduce overall costs for those managing multiple properties.

- Additional Coverage: Snowbirds can also get a gap, accident forgiveness, rideshare, and rental car insurance. You can learn more with our Travelers auto insurance review.

- At-Fault Rates: Snowbirds with tickets or at-fault accidents on record will still be able to get affordable coverage, with rates being less than the national average.

Cons

- No SR-22 Coverage: If Snowbirds are high-risk drivers, they may not be able to purchase the coverage you need.

- No Classic Insurance: Snowbirds who own classic cars won’t be able to purchase special coverage for their vehicles.

#5 – Progressive: Best for Qualifying Coverage

Pros

- Flexible Coverage Options: Progressive offers customizable auto insurance for snowbirds. This allows them to adjust coverage levels and qualify for discounts based on seasonal driving habits.

- Affordable High-Risk Coverage: Snowbirds who are determined to be high-risk will still be able to have low rates, though not as low as they would be with a clean driving record.

- Snapshot Program: Progressive’s reward program works well if Snowbirds are a safe driver. You can learn more with our Progressive auto insurance review.

Cons

- Customer Service: Snowbirds have reported lower-than-average satisfaction with the levels of customer service received.

- Snapshot Program: Snowbirds might actually see an increase in rates based on driving habits.

#6 – American Family: Best For Loyalty Rewards

Pros

- Loyalty Discounts: American Family offers savings and perks for long-term customers, helping snowbirds reduce auto insurance costs by rewarding their continued commitment.

- Discount Opportunities: More than a dozen discounts are offered for Snowbirds, including mileage, good driving, and autopay. Learn more with our Nationwide auto insurance review.

- Affordable Rates for High-Risk Drivers: If you’re a Snowbird with a speeding ticket, you will not have to pay expensive prices for auto insurance.

Cons

- Poor Claim Handling: Snowbirds report frustrating wait times, and the process of seeing a claim through is frustrating.

- Availability: This company may not be available in all states for Snowbirds.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Usage-Based Coverage

Pros

- Add-Ons: In addition to collision and comprehensive insurance, drivers can also purchase gap insurance, medical payment, rental car insurance, and bodily injury coverage.

- SmartMiles: With this program, Snowbirds can save up to 18% off auto insurance based on monthly mileage. It’s also excellent for low-mileage drivers.

- Financial Stability: A.M. Best rates Nationwide as superior, giving snowbirds peace of mind that their coverage remains reliable across seasonal homes (Read More: Nationwide Auto Insurance Review).

Cons

- Availability: Not offered in every state, which may limit options for snowbirds with seasonal residences.

- Poor Claim Handling: Some snowbirds have reported delayed claims processing or denied claims without clear explanations.

#8 – Farmers: Best for Safe-Driving Discounts

Pros

- Discounts for Safe Drivers: Farmers reward snowbirds with savings for maintaining a clean driving record, helping reduce auto insurance premiums during seasonal travels.

- Financial Strength: Necessary to showcase company stability, Farmers has an A+ with A.M. Best, offering snowbirds confidence in reliable coverage across seasonal homes.

- Available SR-22 Insurance: This is something that some high-risk snowbirds may need and is not offered by every auto insurance company.

Cons

- Low Availability: Farmers auto insurance can’t be purchased in all 50 states for snowbirds. You can learn more with our Farmers auto insurance review.

- Expensive Policies: Auto insurance is going to be higher than the national average for snowbirds.

#9 – Allstate: Best for Low-Mileage Drivers

Pros

- Milewise: Offered for low-mileage snowbirds, this allows you to pay-per-mile, which isn’t offered by most competitors. You can learn more with our Allstate auto insurance review.

- Financial Strength Rating: Allstate has an A.M. Best rating of A+, which means claim payout will not be an issue for snowbirds insurance policyholders.

- Reward Program: With the Allstate reward program, snowbirds can get a new car replacement, deductible rewards, and accident forgiveness.

Cons

- Young Drivers Pay More: Teen drivers in snowbird families around 16-18 years old will pay more than the national average for auto insurance.

- Poor Credit, High Rates: Snowbirds with a low credit score will pay almost double for coverage with Allstate.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Accident-Free Drivers

Pros

- Accident-Free Discount: Liberty Mutual offers discounts for accident-free drivers, helping snowbirds keep seasonal auto insurance costs low while staying covered.

- RightTrack Program: Snowbirds can save up to 30% on your auto insurance based on your driving habits. Low-mileage and slower drivers will save the most money.

- Lifetime Replacement Guarantee: Repairs at an approved shop will get a lifetime guarantee for snowbirds. You can learn more with our Liberty Mutual auto insurance review.

Cons

- Claim Satisfaction: Snowbirds have reported being unhappy with the way claims are handled and paid out.

- Customer Service: There have been reports of poor wait times for customer service on the phone and claim handling, according to some snowbird insurance policyholders.

Florida Auto Insurance Requirements

According to the Florida Department of Highway Safety and Motor Vehicles, anyone living in Florida for more than 90 days in a year must comply with Florida’s insurance laws. Those 90 days do not have to be consecutive either, so if you would like to make multiple trips to Florida throughout the year, you could be subject to those laws. This includes following Florida minimum auto insurance requirements.

To meet Florida state law requirements, you need to have at least:

- $10,000 of Personal Injury Protection

- $10,000 of Property Damage Liability

Personal injury protection, otherwise known as Florida no-fault insurance, protects you regardless of who was at fault. When an accident leaves you with expensive medical bills, lost wages, or other unexpected expenses, personal injury protection can help compensate you for these additional costs.

Not only will PIP protect your injuries, but it will also cover other injured passengers in your vehicle. Since it is no-fault insurance, compensation is quick and stress-free.

While most states have a required minimum amount of auto insurance, it's advisable to look into full coverage in order to be truly protected on the road.Heidi Mertlich Licensed Insurance Agent

Property damage liability pays for property damages when you are at fault in an accident. Most commonly, property damage will be to someone else’s car, but it could include damage to buildings, trees, fences, guardrails, telephone poles, lamp posts, and more.

Different Types of Florida Insurance

Florida’s car insurance requirements are quite minimal when compared with other states. If you exceed damages outside of the $10,000 limits, however, you will be held responsible for the remaining costs. It is recommended that you purchase a policy similar to what you have at home to give yourself a cushion of protection while driving around in Florida.

Snowbirds Auto Insurance Monthly Rates

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $32 | $83 |

| $76 | $198 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $248 | |

| $34 | $84 |

There are a few different common types of car insurance you may want to consider in addition to what is required by Florida law.

Bodily Injury Liability Coverage

Bodily Injury Liability pays for medical expenses or funeral costs for the injured party when you are at fault in an accident. It also provides protection from being sued in a lawsuit. If the other party sues you for damages, it will provide you compensation for a defense attorney.

Bodily injury liability is usually denoted by a fraction such as 50/100. The first number is the maximum amount the insurance company will pay out for injuries to a single person ($50,000), and the second number is the maximum amount the insurance company will pay out for all individuals who were injured in an accident ($100,000).

Is your insurance knowledge full of “ums,” “I thinks,” and “maybes”? If so, follow us for some helpful info everyone should know. pic.twitter.com/Ppgehjg18Y

— Farmers Insurance (@WeAreFarmers) June 11, 2024

Without bodily injury liability insurance, you could be sued for hundreds of thousands of dollars. If you can’t afford to pay, then your assets and future income could be taken away from you.

Collision Coverage

Collision auto insurance pays for damages to your vehicle when you are in an accident with another vehicle or object, regardless of who caused the crash. It can also be applied to parked cars as well.

Would you know what to do if someone hit your parked car? Here are some tips on what to do if this happens to you. https://t.co/jGoBYAFD12 pic.twitter.com/hsrMs9Qka5

— Liberty Mutual (@LibertyMutual) October 19, 2023

This type of coverage only applies to your vehicle in an accident and does not include injuries or property damage.

Comprehensive Coverage

Comprehensive pays for damages from accidents other than a collision. Comprehensive will cover damages to your vehicle due to hurricanes, which are considered to be a frequent threat to Florida.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage helps with costs from injuries sustained from a car accident with an uninsured driver. If you are hit by someone who is at fault and does not have car insurance, then having this insurance is important.

Uninsured covers medical expenses, lost wages, and compensation for pain and suffering. This coverage also applies if you or your passengers happen to be the victim of a hit-and-run accident.

Florida just so happens to be in the top ten states for people driving uninsured. You certainly don’t want to be in an accident with someone who has no coverage and can’t afford to pay for your damages.

The amount of coverage you have will affect the price of your premium. Always stay within the lines of what you know you can afford.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Essential Auto Insurance Discounts for Snowbirds

Seasonal travelers who head south for winter can benefit from numerous auto insurance discounts. Understanding these savings opportunities is crucial for snowbirds looking to reduce their insurance costs.

Snowbirds Auto Insurance Discounts From the Top Providers

| Insurance Company | Bundling | Safe Driver | Good Student | Anti-Theft | Loyalty |

|---|---|---|---|---|---|

| 25% | 18% | 22% | 10% | 15% | |

| 25% | 18% | 20% | 25% | 18% | |

| 25% | 15% | 15% | 15% | 10% |

| 20% | 20% | 15% | 10% | 12% | |

| 25% | 20% | 12% | 35% | 10% |

| 20% | 12% | 18% | 5% | 8% |

| 10% | 10% | 10% | 25% | 13% | |

| 17% | 20% | 35% | 15% | 6% | |

| 13% | 17% | 8% | 15% | 9% | |

| 10% | 10% | 10% | 15% | 11% |

Multi-policy auto insurance discount offers up to 25% savings when bundling with home insurance. Safe driver discounts provide 15-18% reductions. Good student discounts range from 10-35%, while anti-theft measures save 5-25%. Loyalty rewards long-term customers with 8-25% savings. Snowbirds may qualify for additional specialized discounts based on their seasonal travel patterns.

When comparing insurance options, inquire about regional offers or snowbird-specific packages. Some providers offer better bundling rates, while others prioritize safe driving records or loyalty.

Read More: How to Save Money by Bundling Insurance Policies

Review your discount eligibility annually, as changes in your situation could qualify you for additional savings opportunities, ensuring you receive the maximum benefit from your insurance provider.

Snowbird Insurance in Florida

Some people try to save money by registering their vehicle for auto insurance in their home state only. Doing this ensures they only have one insurance policy and one insurance agent to deal with. This could turn out badly if you get into an accident in Florida. Your home insurance could refuse to pay your claim because you misrepresented your location.

It is important that you buy Florida insurance through a Florida insurance agency. The good news is many of the big name insurance agencies around your area will likely have agencies in Florida.

Saving Money on Snowbird Insurance in Florida

Fortunately, Florida is known for having the lowest rates on car insurance in the country. One way to get the best rates is to shop around and compare multiple quotes. Make sure the company is reputable and do some research with the Better Business Bureau. Erie, USAA, and State Farm lead the market with rates starting at just $32/month.

Erie offers youth discounts, USAA provides exclusive military benefits, and State Farm delivers exceptional customer service—making these three companies ideal for seasonal travelers needing reliable coverage. You can also look into whether or not your provider offers any sort of auto insurance discounts.

There are plenty of ways to save money on your auto insurance in addition to making sure you’re fully covered for the time you’ll spend as a snowbird. Find the best auto insurance company near you by entering your ZIP code into our free quote tool below.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

What is a snowbird in terms of auto insurance?

A snowbird refers to individuals who temporarily relocate to warmer climates during the winter months. Snowbirds often drive their vehicles to their winter destinations and may need specific insurance considerations for this seasonal change. This often includes comprehensive auto insurance coverage since it covers damage done to a vehicle by weather conditions.

How do snowbirds handle car insurance?

Snowbirds typically adjust their car insurance by informing their insurer about their seasonal moves. Options include low-mileage discounts, suspending certain coverages while away, or obtaining “snowbird insurance direct” policies tailored for part-time residents.

What is snowbird insurance in Florida?

Snowbird insurance in Florida refers to car insurance policies designed for seasonal residents. These policies often offer flexible terms, allowing snowbirds to maintain coverage only during their stay, with options to pause or reduce coverage during off-seasons. Explore your auto insurance options by entering your ZIP code into our free comparison tool below today.

What factors should snowbirds consider when reviewing their auto insurance policy?

Snowbirds should consider several factors when reviewing their auto insurance policy, including coverage limits, vehicle usage, and storage options. Knowing the types of auto insurance you need to purchase will also help you feel more confident in your auto insurance buying choices.

How does car insurance work for Canadian snowbirds in Florida?

Canadian snowbirds can maintain their Canadian car insurance but may need additional coverage for extended stays in Florida. Some opt to purchase Florida-specific policies to comply with state laws, ensuring they’re fully protected during their visit.

Can I register a car in Florida with an out-of-state license?

If your car is registered at a different address than where you live, you need to make sure you fall under one of the exceptions to the rule since most companies don’t allow this. While this does make it slightly more difficult to find hassle-free, cheap winter insurance, it’s not impossible.

What is the Steer Clear program with State Farm?

The Steer Clear program by State Farm is a discount initiative for young drivers under 25, but snowbirds with younger family members on their policy can benefit. Completing the program’s safe driving course can help reduce premiums.

What state is the least expensive for snowbirds?

The least expensive states for snowbirds vary but states like Florida, Texas, and Arizona often have affordable car insurance options. Comparing quotes and seeking “snowbird insurance direct” plans can help secure the best rates.

How do snowbirds handle health insurance?

Snowbirds use nationwide health plans, Medicare Advantage with travel benefits, or short-term insurance to cover medical expenses while living in their seasonal home.

Does changing address affect car insurance?

Since your location is one factor that affects auto insurance rates, it will affect your auto insurance rates.

Who typically has the cheapest car insurance?

This all depends on the type of coverage you want. Most snowbirds are going to have insurance on a car in multiple states, and if there are weather advisories, it may be in their best interest to carry full coverage.

Can you legally drive in Florida without insurance?

No, you will face consequences if you are an uninsured motorist caught driving without auto insurance.

Can a snowbird register a car in Florida?

Yes, snowbirds can register a car in Florida if they reside in the state for more than 90 days annually, even if the days are not consecutive. Florida law requires vehicle registration and insurance from a Florida-licensed insurer for those staying long-term.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.