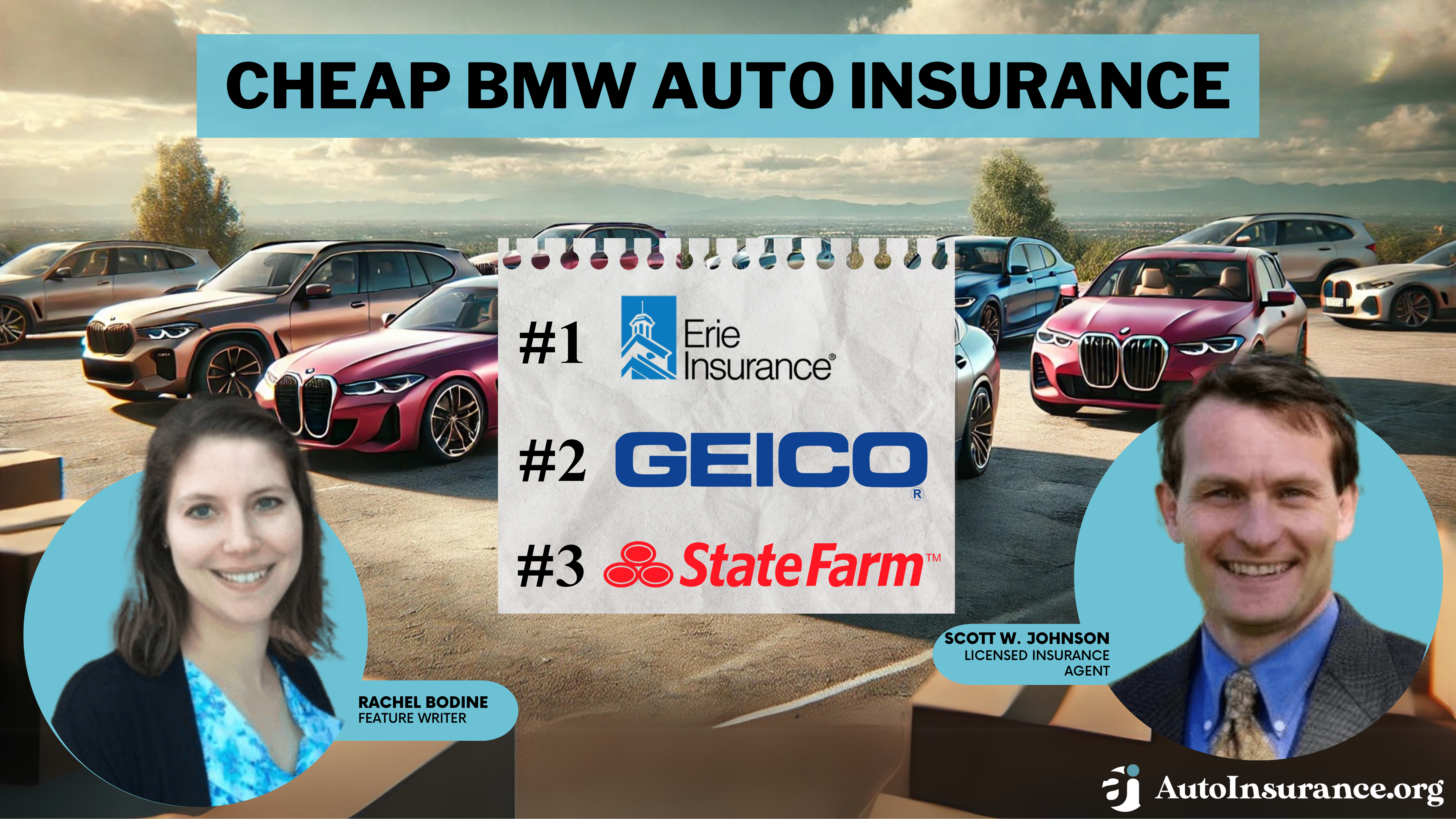

Cheap BMW Auto Insurance in 2025 (Find Savings With These 10 Companies!)

Erie, Gieco, and State Farm are our top picks for cheap BMW auto insurance. Erie has the lowest BMW insurance rates, with minimum coverage averaging $32/mo. However, BMW car insurance costs vary by model. For example, BMW X3 insurance premiums are significantly lower than BMW insurance rates for an X6.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for BMW

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for BMW

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for BMW

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsDrivers looking for cheap BMW auto insurance will find the cheapest rates at Erie, Geico, and State Farm.

Finding the best auto insurance for luxury cars starts by shopping at the best companies for cheap BMW insurance.

Our Top 10 Company Picks: Cheap BMW Auto Insurance

| Company | Rank | Monthly Rates | AM Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $32 | A+ | Customer Service | Erie |

| #2 | $43 | A++ | Government Discounts | Geico | |

| #3 | $47 | B | Agency Network | State Farm | |

| #4 | $53 | A++ | Budgeting Tools | Travelers | |

| #5 | $56 | A+ | Loyalty Discounts | Progressive | |

| #6 | $62 | A | Accident Forgiveness | American Family | |

| #7 | $63 | A+ | Deductible Savings | Nationwide |

| #8 | $76 | A | Safe Drivers | Farmers | |

| #9 | $87 | A+ | Multi-Policies | Allstate | |

| #10 | $96 | A | 24/7 Support | Liberty Mutual |

Read this BMW car insurance review to learn all about BMW auto insurance and how to find cheap auto insurance for your BMW. We’ll discuss everything from what car insurance coverages you might want for your BMW to average BMW insurance costs. You can also enter your ZIP code into our free tool to start comparing quotes right away.

- Erie offers the cheapest BMW insurance rates

- On average, full coverage BMW auto insurance is $162 monthly

- Always compare BMW insurance cost by model for the best rates

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Erie: Top Pick Overall

Pros

- Customer Service: The majority of reviews are positive. Read more in our Erie review.

- YourTurn: You can save up to 30% on your insurance if you score well.

- Safety Feature Discounts: Having a BMW with the latest safety technology could help you save at Erie.

Cons

- Availability: You’ll have to check to see if Erie is sold in your state, as it isn’t available everywhere.

- Digital Tools: Erie’s online tools may be fewer than those of other companies.

#2 – Geico: Best for Government Discounts

Pros

- Government Discounts: Government employees can get a small discount from Geico on their auto insurance.

- Online Tools: Geico’s online tools have good customer ratings. Learn more in our Geico auto insurance review.

- Financial Stability: A.M. Best gave Geico an A++ rating for financial management.

Cons

- Limited Add-Ons: Geico doesn’t offer as many add-ons as some companies. For example, it doesn’t sell gap insurance.

- Limited In-Person Interaction: BMW customers will communicate with Geico primarily over the phone or online.

#3 – State Farm: Best for Agency Network

Pros

- Agency Network: State Farm’s agency network makes it simple to find personalized help.

- Drive Safe & Save: BMW owners may be able to save up to 30% on their insurance with State Farm’s UBI program.

- Coverage Options: BMW owners should be able to find coverage for whatever need they have. Take a look at coverage options in our State Farm auto insurance review.

Cons

- Bad Credit Rates: In states where credit score is a rate factor, State Farm has higher rates for bad credit scores.

- Discount Savings: State Farm’s discount savings may be lower in some states.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Travelers: Best for Budgeting Tools

Pros

- Budgeting Tools: BMW drivers on a budget will benefit from Travelers’ budgeting tools.

- Flexible Coverages: Find what coverage fits your needs and adjust as needed. Learn more in our Travelers review.

- Discount Programs: Save up to 30% by participating in Travelers’ UBI program.

Cons

- Claims Experience: Claims processing doesn’t always have great reviews from customers.

- Rate Increases After UBI Participation: Travelers may raise rates in some states for poor drivers.

#5 – Progressive: Best for Loyalty Discounts

Pros

- Loyalty Discounts: Progressive offers rewards like small accident forgiveness to loyal customers. Discover more perks in our Progressive auto insurance review.

- Snapshot: Save up to 30% by driving safely in Progressive’s UBI program.

- Full Coverage Perks: Progressive throws in perks like pet injury coverage if customers carry full coverage insurance.

Cons

- Rate Increases After UBI Participation: Progressive may raise rates for bad drivers.

- Customer Satisfaction: Progressive struggles with negative reviews about claims processing.

#6 – American Family: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Some BMW customers may be given accident forgiveness if they have great driving records.

- KnowYourDrive: Sign up for KnowYourDrive to save up to 30% on your policy. Discover more ways to save in our American Family auto insurance review.

- Customer Service: American Family focuses on community involvement and satisfied customers.

Cons

- Availability: American Family sells coverage in only a few states to most drivers, although Costco members will be able to purchase it in more states.

- Average Rates: American Family rates may not be as competitive for some driver demographics.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Deductible Savings

Pros

- Deductible Savings: You can save on your deductible at Nationwide if you don’t file claims during a policy period.

- SmartRide: Nationwide’s UBI program may allow you to save up to 40%. Find more ways to save in our Nationwide auto insurance review.

- Coverage Options: Nationwide’s options include gap insurance and roadside assistance.

Cons

- Limited Agents: BMW drivers who prefer face-to-face help should know local agents aren’t available in every area.

- DUI Driver Rates: DUI drivers will see higher Nationwide rates, especially if they are repeat DUI offenders.

#8 – Farmers: Best for Safe Drivers

Pros

- Safe Drivers: Safe drivers will have the cheapest rates at Farmers and can qualify for good driver discounts.

- Discount Selection: Farmers has over 20 discounts, which you can read about in our Farmers auto insurance review.

- Coverage Selection: Protect your BMW with add-on coverage from Farmers.

Cons

- Limited Online Management: You will have to contact a Farmers’ representative for most policy issues.

- Claim Reviews: Farmers’ claims experience has mixed ratings from customers.

#9 – Allstate: Best for Multi-Policies

Pros

- Multi-Policies: Allstate sells much more than just auto insurance and offers a bundling discount for multi-policy purchases.

- Coverage Selection: Protect your BMW with coverages like new car replacement. Learn about Allstate’s options in our Allstate auto insurance review.

- Drivewise: Maintain safe driving habits to save at Allstate.

Cons

- Higher Rates for Some Demographics: Allstate’s affordability can change among different demographics, such as young drivers.

- Claim Reviews: Allstate’s claims experience isn’t always recommended by customers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Support: Get assistance at any hour from a Liberty Mutual representative.

- Discount Choices: Learn about Liberty Mutual’s discounts for drivers in our Liberty Mutual auto insurance review.

- Coverage Choices: Fully protect your assets with options like better car replacement.

Cons

- Expensive Rates After Violations: If you have a DUI or other violations, Liberty Mutual’s rates are likely not your cheapest option.

- Claim Reviews: Liberty Mutual’s claims handling isn’t always well-rated.

BMW Auto Insurance Coverage Options

Plenty of BMW luxury car insurance coverage options are available. Your state may require you to carry some coverages, like liability. Liability auto insurance is one of the most important coverages on your BMW since it pays for other parties’ accident bills after an at-fault accident.

Learn more: How much car insurance do I need?

If your state only requires you to carry a low limit of liability insurance, we recommend carrying more than the minimum auto insurance requirement, or you could be stuck with huge bills after an accident.

BMW Auto Insurance Monthly Rates by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $32 | $83 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 |

Your state may also require you to carry a form of medical insurance, such as medical payments coverage or personal injury protection insurance, to help pay for your and your passenger’s medical bills after an accident, regardless of fault.

You may also need to carry uninsured/underinsured motorist auto insurance, which helps cover your bills if you’re in an accident caused by someone else and they don’t have the proper insurance to cover your damages.

If you have a loan or lease on your BMW, your lender will require you to carry collision auto insurance and comprehensive auto insurance. Even if these coverages aren't a requirement, I recommend them for BMW owners.Daniel Walker Licensed Insurance Producer

Collision auto insurance pays for your repair bills if you crash into another car or object. Comprehensive auto insurance pays for your repair bills if your car gets damaged by an animal collision, vandalism, or inclement weather, among other incidents.

Insurance covers your car in the event of an accident, but what about vandalism or bad weather?😱That's where comprehensive coverage comes in! At https://t.co/27f1xf131D, we want to help you decide if this coverage add-on is worth it! Learn more here👉: https://t.co/ii0sdamcEp pic.twitter.com/BSMBfTAaIx

— AutoInsurance.org (@AutoInsurance) May 31, 2023

When considering how much coverage to put on your BMW, consider how much you can pay for repairs and what coverages your vehicle needs. Generally, we recommend a full coverage policy consisting of liability, collision, and comprehensive coverages, as this offers the most protection.

BMW Auto Insurance Rates

How much is BMW insurance? BMW insurance quotes depend on what type of auto insurance you choose and the model you have. While a liability auto insurance policy costs less than a full coverage policy, your own car repairs don’t have coverage after an accident you cause.

Below, you can see the average BMW insurance cost by model and coverage:

BMW Auto Insurance Monthly Rates by Coverage Level & Model

| Model | Comprehensive | Collision | Liability | Full Coverage |

|---|---|---|---|---|

| 2024 BMW X6 | $45 | $88 | $45 | $196 |

| 2024 BMW X5 | $48 | $81 | $40 | $186 |

| 2024 BMW X3 | $41 | $71 | $40 | $169 |

| 2024 BMW M6 | $54 | $119 | $51 | $243 |

| 2024 BMW M3 | $42 | $84 | $45 | $189 |

On average, BMW M6 car insurance costs are the highest of all BMW models. One of the models with the cheapest BMW car insurance rates, the X3, has a purchase price of about half what a BMW M6 costs. So, you should always compare auto insurance rates by vehicle make and model to find the lowest BMW insurance premiums.

Two other factors that impact BMW car insurance rates are age and driving record. Auto insurance for teens and drivers with poor driving records is more expensive. Take a look at the table below to see age and driving record affect your BMW car insurance costs:

BMW Auto Insurance Monthly Rates by Driving Record, Age, & Model

| Model | 20-Year-Old | 30-Year-Old | 40-Year-Old | 50-Year-Old | 60-Year-Old | High-Risk Driver |

|---|---|---|---|---|---|---|

| 2024 BMW X3 | $382 | $176 | $169 | $153 | $150 | $359 |

| 2024 BMW X5 | $422 | $194 | $186 | $170 | $166 | $396 |

| 2024 BMW M3 | $429 | $198 | $189 | $173 | $169 | $403 |

| 2024 BMW X6 | $442 | $203 | $196 | $178 | $174 | $415 |

| 2024 BMW M6 | $552 | $254 | $243 | $223 | $217 | $518 |

If you’re a young driver, keeping a clean driving record will ensure your BMW rates decrease significantly as you age. You should also compare average auto insurance rates by age to find the best car insurance for your BMW.

Compare the Auto Insurance Costs Across BMW’s Models

If you own a more expensive model, make sure to compare rates to find the best BMW car insurance. Start by shopping for quotes at cheap companies like Erie.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Save on BMW Auto Insurance

Now that you know how much BMW car insurance costs, we’ll list a few things you can do to lower your auto insurance rates and save on your insurance for a BMW. The first thing you can do is see if there are any auto insurance discounts you haven’t qualified for yet at your insurance company. For example, you might be eligible for a good driver auto insurance discount.

Other steps to take to score the cheapest BMW auto insurance include:

- Raise your deductible. If your auto insurance deductible is low, raising it will reduce your auto insurance rates, but you shouldn’t raise it to an amount you can’t pay out of pocket after an accident.

- Get multiple BMW quotes. Shopping around for affordable BMW car insurance quotes will ensure you find the cheapest rates available in your area.

- Keep a clean driving record. Auto insurance companies check driving records, so safe drivers enjoy much cheaper BMW auto insurance rates than drivers with a traffic ticket, accident, or DUI on their record.

- Drop coverages. You could drop full coverage if your BMW is old and no longer worth much since liability-only is cheaper. In addition, you can eliminate add-on coverages such as rental car reimbursement, gap insurance, or roadside assistance to save on your BMW luxury car insurance rates.

Following the tips above can help you reduce your BMW car insurance rates. Just ensure you don’t sacrifice coverage for a cheaper rate, and take time to read customer reviews on a company before choosing insurance for a BMW.

Finding the Best Auto Insurance for a BMW

Since BMWs are luxury cars, the average auto insurance cost per month is naturally higher for BMW owners. BMW car insurance premiums are also more expensive for models with higher purchase prices, young drivers, and drivers with poor driving records.

You can reduce your car insurance rates by looking for discounts and shopping around for BMW insurance quotes. Compare rates with our free quote tool to get started finding the best rates for insurance on a BMW.

Frequently Asked Questions

Are BMW cars expensive to insure?

BMW auto insurance costs more than average, as they’re a luxury brand. Replacement or repairs for a luxury vehicle will cost more than for a cheaper, mass-manufactured car. Hence, insurance companies charge more for car insurance for BMWs because of this financial risk, making it harder to find cheap auto insurance.

Is Mercedes or BMW insurance more expensive?

Wondering is insurance higher for BMW? It depends on what model you have, as a Mercedes that costs more than a BMW to purchase will also cost more to insure. However, Mercedes and BMW car insurance rates tend to be similar for the most common models of both brands. Rates also depend on chosen coverages, age, driving record, and more.

Is luxury car insurance expensive?

Yes, luxury car insurance is more expensive. Since BMWs are luxury vehicles, insurance companies charge higher rates than non-luxury cars. Parts and repairs cost more for luxury cars, so insurance companies raise rates to lessen the financial risk of filing an expensive claim. Rates for BMWs may also be expensive based on the BMW model, driving record, and more.

How much is BMW 325i insurance?

Since the BMW 325i is an older car, it won’t cost as much to insure as the BMWs we covered in our post, as its overall value is depreciated. So, if you total your BMW 325i, insurance won’t have to give you as much money for a replacement vehicle.

How much is insurance on a BMW for a 16-year-old?

BMW car insurance costs $665 on average for teen drivers, more than double the overall average BMW insurance premiums.

What is the best auto insurance for BMWs?

BMW full coverage insurance provides the best protection (learn more: Full Coverage Auto Insurance).

Who has the cheapest insurance for BMWs?

Erie has the cheapest car insurance for BMWs.

Who has cheap BMW car insurance for young drivers?

Companies like Erie, Geico, and State Farm will have the best BMW insurance for drivers, regardless of age.

How much is insurance for a BMW?

BMW insurance costs will vary by company and driver. The best way to determine what you’ll pay for BMW insurance is to get BMW quotes.

Are BMWs expensive to maintain?

Yes, BMWs can be expensive to maintain, so ensure you have the best auto insurance for regular maintenance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.