Cheap Gap Insurance in Tennessee 2025 (Your Guide to the Top 10 Companies)

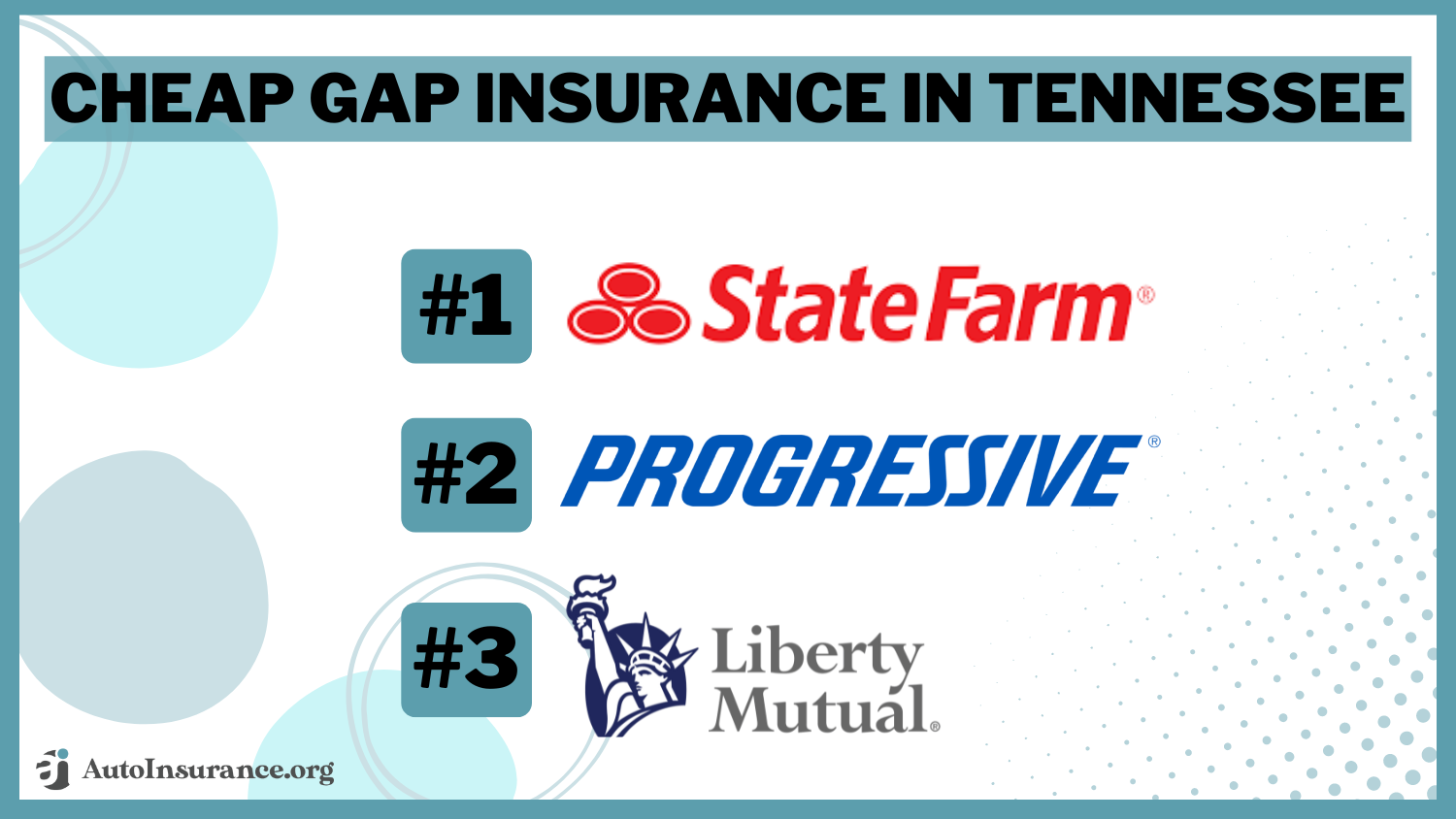

State Farm, Progressive, and Liberty Mutual are the top providers of cheap gap insurance in Tennessee, with rates starting at $25/month. Their combination of affordable premiums, comprehensive coverage, and strong customer service make them the best options for cheap Tennessee gap insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for Gap in Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for Gap in Tennessee

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviews 3,792 reviews

3,792 reviewsCompany Facts

Min. Coverage for Gap in Tennessee

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviewsThe top picks for cheap gap insurance in Tennessee are State Farm, Progressive, and Liberty Mutual. These providers stand out for offering competitive rates on new car insurance.

State Farm excels with cheap gap insurance rates and strong customer service. Progressive provides flexible policies and discounts, while Liberty Mutual offers a range of options to meet diverse needs.

Our Top 10 Company Picks: Cheap Gap Insurance in Tennessee

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $25 | B | Affordable Options | State Farm | |

| #2 | $32 | A+ | Flexible Coverage | Progressive | |

| #3 | $36 | A | Customizable Plans | Liberty Mutual |

| #4 | $39 | A | Discount Options | Farmers | |

| #5 | $40 | A++ | Comprehensive Policies | Travelers | |

| #6 | $42 | A+ | Customer Service | Erie |

| #7 | $43 | A++ | Claims Satisfaction | Auto-Owners | |

| #8 | $51 | A | Member Benefits | AAA |

| #9 | $62 | A+ | Usage-Based Savings | Allstate | |

| #10 | $69 | A+ | Low-Mileage Rates | Nationwide |

This article compares the best Tennessee auto insurance companies, helping you find affordable gap insurance to protect your new vehicle.

Just enter your ZIP code above to start discovering the best options for cheap gap insurance in Tennessee tailored to your needs.

- State Farm is the top pick for cheap gap insurance in Tennessee at $25/month

- Allstate and Nationwide have the best TN gap insurance for low-mileage drivers

- Tennessee drivers need cheap gap insurance to cover depreciation on new cars

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Affordable Rates: State Farm is one of the most affordable Tennessee insurance companies, with a monthly gap insurance rate of just $25. Get free quotes in our State Farm auto insurance review.

- Widespread Availability: State Farm is available nationwide, ensuring that Tennessee drivers can easily access cheap gap insurance even if they move out of state.

- Strong Reputation for Customer Service: State Farm is well-regarded for its customer service, providing reliable support for those seeking cheap gap insurance in Tennessee.

Cons

- Limited Policy Customization: State Farm may offer fewer options for tailoring coverage, which could be a drawback for those looking for more flexible cheap gap insurance in Tennessee.

- Lower A.M. Best Rating: With a B rating from A.M. Best, State Farm’s financial stability might be a concern for those seeking cheap gap insurance in Tennessee.

#2 – Progressive: Best for Flexible Coverage

Pros

- Flexible Coverage Options: Progressive allows for highly customizable policies, making it easy to find cheap gap insurance in Tennessee that suits individual needs.

- User-Friendly Online Tools: Progressive offers advanced digital tools to help drivers find cheap gap insurance in Tennessee. Get more information in our Progressive auto insurance review.

- Wide Range of Discounts: Progressive provides various discounts, helping Tennessee drivers lower their costs on cheap gap insurance.

Cons

- Higher Rates for Certain Driver Profiles: Some Tennessee drivers might find that Progressive gap insurance rates are higher than expected depending on their driving history.

- Mixed Customer Service Experiences: While generally positive, Progressive customer service has received mixed reviews from those seeking cheap gap insurance in Tennessee.

#3 – Liberty Mutual: Best for Customizable Plans

Pros

- Extensive Discount Options: Liberty Mutual offers a wide array of discounts, making it easier for Tennessee drivers to secure cheap gap insurance.

- Customizable Policies: Liberty Mutual provides flexible policy options, allowing Tennessee drivers to tailor their gap insurance coverage to their needs.

- Affordable Monthly Rates: With a monthly rate of $36, Liberty Mutual’s premiums for Tennessee gap insurance are cheaper than average

Cons

- Poor Claims Handling: Liberty Mutual receives poor ratings for claims processing in annual J.D. Power surveys. Find out more in our Liberty Mutual auto insurance review.

- Potential Rate Increases Upon Renewal: Some Liberty Mutual customers in Tennessee have reported rate increases when renewing their policies, which could affect the affordability of cheap gap insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Farmers: Best Discount Options

Pros

- Competitive Auto Insurance Discounts: Learn how much you can save on gap insurance in Tennessee in our Farmers auto insurance review.

- Good Customer Service: Farmers is known for its reliable customer service, which can be particularly beneficial for those seeking cheap gap insurance in Tennessee.

- Comprehensive Coverage Options: Farmers provides a wide range of coverage options, making it a versatile choice for Tennessee drivers looking for cheap gap insurance.

Cons

- Higher Premiums at Renewal: Some Tennessee drivers report gap insurance rate increases at their six- and 12-month policy renewals.

- Mobile Access: Other Tennessee gap insurance companies are more tech-savvy, so it might not be as easy for some drivers to manage Farmers policies and claims on a mobile app.

#5 – Travelers: Best for Comprehensive Policies

Pros

- Comprehensive Policy Options: Travelers offers extensive policy options and a range of endorsements to customize gap insurance coverage in Tennessee.

- Strong Claims Support: Travelers is recognized for its reliable claims process, providing peace of mind for those with cheap gap insurance in Tennessee.

- Industry Experience: With an A++ financial rating and over 100 years of selling insurance, Travelers is one of the most reliable Tennessee companies for gap insurance. Learn more in our Travelers review.

Cons

- Slow Claims Processing: Travelers consistently ranks below average in claims satisfaction for slow repair times in Tennessee, which could impact your gap insurance claims.

- Complex Policy Options: The extensive range of options and endorsements may be overwhelming for some Tennessee drivers seeking straightforward cheap gap insurance.

#6 – Erie: Best Customer Service

Pros

- Affordable Rates: Erie offers competitive pricing, with a monthly rate of $42, making it a good option for cheap gap insurance in Tennessee. Learn more in our Erie auto insurance review.

- High Customer Satisfaction: Erie is known for its excellent customer satisfaction, which is a key benefit for those seeking cheap gap insurance in Tennessee.

- Efficient Claims Handling: Erie has a reputation for quick and efficient claims processing, ensuring smooth service for Tennessee drivers with cheap gap insurance.

Cons

- Limited Availability Outside Certain Regions: Erie’s coverage is not nationwide, which might limit options for Tennessee drivers looking for cheap gap insurance if they relocate.

- Less Advanced Online Tools: Erie’s digital offerings may not be as robust as those of larger insurers, which could be a drawback for tech-savvy Tennessee drivers seeking cheap gap insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Auto-Owners: Best Claims Service

Pros

- Reliable Customer Service: Auto-Owners is known for its dependable customer service, making it a trustworthy choice for cheap gap insurance in Tennessee.

- Broad Coverage Options: Auto-Owners provides a variety of coverage options, ensuring that Tennessee drivers can find the right cheap gap insurance. Discover more in our Auto-Owners review.

- Easy Claims Process: Auto-Owners is recognized for its straightforward and efficient claims handling, providing a hassle-free experience for those with cheap gap insurance in Tennessee.

Cons

- Higher Monthly Premiums: At $43 per month, Auto-Owners’ rates may be higher than other options, which could be a consideration for those seeking cheap gap insurance in Tennessee.

- Limited Online Services: Auto-Owners may not offer the most advanced online tools, which could be inconvenient for Tennessee drivers looking to manage their cheap gap insurance policies digitally.

#8 – AAA: Best for Member Benefits

Pros

- Exclusive Member Benefits: AAA provides unique member benefits that can add value to cheap gap insurance in Tennessee.

- Complimentary Roadside Assistance: AAA often includes its renowned roadside assistance with policies, offering added peace of mind for Tennessee drivers with cheap gap insurance.

- Good Reputation for Claims Support: AAA is well-regarded for its claims handling, making it a solid option for reliable cheap gap insurance in Tennessee. Read more in our AAA insurance review.

Cons

- High Premiums: AAA’s average monthly rate of $51 may be considered expensive for Tennessee drivers looking for cheap gap insurance.

- Membership Requirement: AAA insurance requires membership, which adds an extra cost and may not appeal to those seeking the cheapest gap insurance in Tennessee.

#9 – Allstate: Best Usage-Based Discounts

Pros

- Driving Discounts: Allstate offers numerous discounts based on driving behavior and mileage to help Tennessee drivers lower their gap insurance costs. Get full details in our Allstate review.

- Comprehensive Coverage: Allstate provides a wide range of coverage options, making it a versatile choice for those seeking cheap gap insurance in Tennessee.

- Strong Reputation for Local Agents: Allstate is known for its network of local agents, providing personalized claims service for Tennessee drivers with gap insurance.

Cons

- Higher-Than-Average Rates: With a monthly premium of $62, Allstate’s rates might be too high for those seeking the cheapest gap insurance in Tennessee.

- Inconsistent Customer Service: Some Tennessee customers have reported mixed experiences with Allstate’s customer service, which could be a concern for those seeking cheap gap insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Nationwide: Best for Low-Mileage Rates

Pros

- Competitive Low-Mileage Rates: Low-mileage drivers who need Tennessee gap insurance can save money with pay-as-you-go insurance. Read our Nationwide SmartMiles review to learn how.

- Customizable Coverage: Nationwide provides customizable policy options, allowing Tennessee drivers to tailor their gap insurance. Explore your options in our Nationwide review.

- Reputable Claims Process: Nationwide is known for its efficient claims handling, providing reliability for those seeking cheap gap insurance in Tennessee.

Cons

- Higher Premiums Compared to Other Providers: At $69 per month, Nationwide gap insurance rates are higher than other TN auto insurance companies if you don’t qualify for SmartMiles.

- Limited Discount Options: Nationwide offers fewer discounts compared to some other insurers, potentially limiting savings opportunities for Tennessee drivers seeking

Factors That Affect the Cost of Tennessee Gap Insurance

Gap insurance costs in Tennessee are shaped by several important factors. The choice of provider impacts premiums, with rates starting as low as $25 per month with State Farm. Coverage levels also play a role. Minimum coverage is cheaper but less comprehensive, while more extensive policies come at a higher cost.

This table highlights the monthly gap insurance rates in Tennessee, detailing costs for both minimum and full coverage across different providers. State Farm offers the most affordable rates, while Liberty Mutual’s full coverage stands out as the most expensive.

Gap Insurance Monthly Rates in Tennessee by Provider & Coverage Level

| Insurance Company | Monthly Rates |

|---|---|

| $51 |

| $62 | |

| $43 | |

| $42 |

| $39 | |

| $36 |

| $69 |

| $32 | |

| $25 | |

| $40 |

Location affects insurance rates too, with urban areas potentially having higher premiums due to increased vehicle values and accident rates. The type and value of your vehicle are significant factors, as newer and higher-value cars typically require more coverage.

Finally, the terms and conditions of the policy, such as coverage limits and exclusions, impact the overall cost. Reviewing these details is essential to finding the most suitable and affordable gap insurance.

Read More: What are the recommended auto insurance coverage levels?

Tips for Finding Cheap Gap Insurance in Tennessee

Protecting your vehicle investment with gap insurance is a smart move, as it covers the difference between your car loan balance and the vehicle’s actual cash value in case of a total loss.

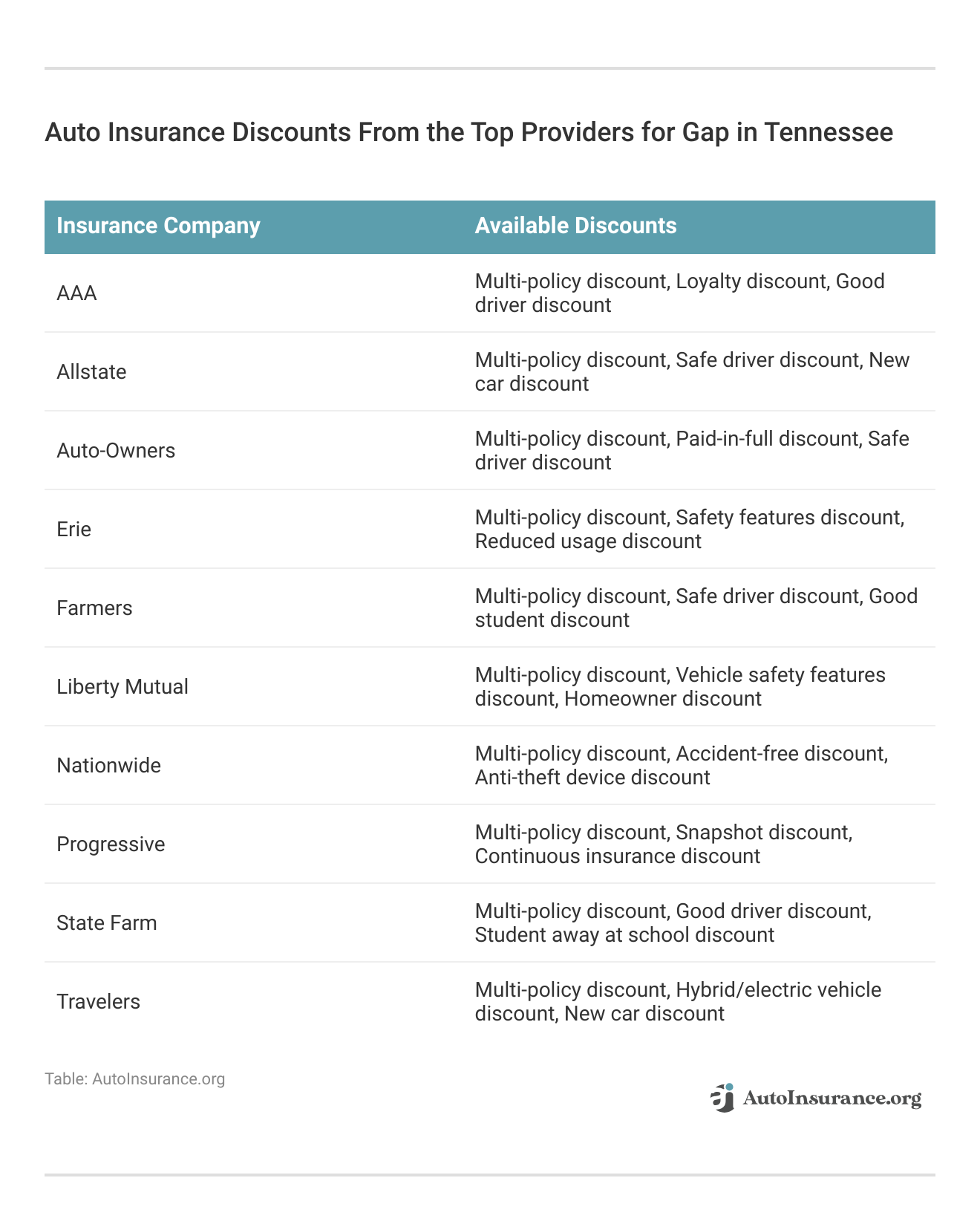

Discounts for multi-policy bundles, safe driving, and new car purchases can further reduce premiums. This table reveals a variety of auto insurance discounts for those seeking affordable gap insurance in Tennessee.

Compare offers, including multi-policy, safe driver, and new car discounts, to find the best ways to save on cheap gap insurance while ensuring you get the coverage you need. Loyalty discounts might also be available if you’ve been with the same Tennessee insurer for a long time.

To find affordable gap insurance in Tennessee, keep these general tips in mind. By following these steps and using online comparison tools, you can find a policy that provides excellent coverage and value:

- Compare Multiple Quotes: Start by obtaining quotes from several insurance providers. This allows you to identify the most competitive rates that align with your budget. Rates can vary significantly, so comparing options is crucial to finding the best deal.

- Evaluate Customer Service: The quality of customer service is an important factor when choosing an insurance provider. Companies with strong customer support are more likely to assist you effectively in case of claims or other issues. Look for insurers known for their reliability and customer satisfaction.

- Check Financial Stability and Complaints: Consider the financial strength and complaint history of potential insurers. Opt for companies with solid financial ratings and a low number of customer complaints. This ensures that the provider is reliable and capable of handling claims efficiently.

By leveraging these options, Tennessee residents can effectively manage the cost of gap insurance while ensuring adequate protection.

Learn More: How to Research Auto Insurance Companies Before Buying

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Comparing Quotes for Cheap Tennessee Gap Insurance

To find affordable gap insurance in Tennessee, comparing quotes from multiple providers is crucial. Most top companies provide free quotes on their websites, where you’ll enter driver and vehicle information to compare Tennessee auto insurance costs by policy, including gap insurance.

By evaluating quotes from different insurers, you can pinpoint which companies offer the most competitive rates and robust coverage.

Check out how to compare auto insurance quotes. If you’re not sure where to start, these fictional case studies illustrate how different drivers might benefit from certain gap insurance companies in Tennessee:

- Case Study #1 – Protecting a New Car Owner: Emily, a recent college graduate, purchased a new car with a low down payment. She chose State Farm full coverage with gap insurance at $79/month to ensure she wouldn’t be financially burdened if her car was totaled.

- Case Study #2 – Flexibility for a Growing Family: John and Sarah, expecting their second child, needed to upgrade their vehicle. They opted for Progressive gap insurance due to its flexible coverage options, which allowed them to adjust their policy as their family’s needs changed.

- Case Study #3 – Maximizing Savings with Discounts: Mark, a budget-conscious driver, selected Liberty Mutual for his gap insurance because of the available discounts. By bundling his auto and home insurance, he managed to secure cheaper Tennessee gap insurance.

These case studies illustrate how individuals in Tennessee can find affordable gap insurance tailored to their unique needs. Each scenario demonstrates the importance of selecting the right provider.

Compare Now to Get Cheap Gap Insurance in Tennessee

Choosing the best gap insurance to match your financial situation and personal circumstances ensures you protect both your budget and your vehicle investment.

State Farm stands out for its reliable coverage and personalized service, making it a top choice for comprehensive auto insurance.Daniel Walker Licensed Auto Insurance Agent

In Tennessee, some of the best options for cheap gap insurance in Tennessee start around $25 per month and include State Farm, Progressive, and Liberty Mutual.

Consider not only the monthly premium but also the quality of coverage, available discounts, and customer service. Using online tools to compare car insurance quotes by ZIP code can help you make an informed choice and secure the cheapest Tennessee gap insurance rates.

Frequently Asked Questions

What is gap insurance and why is it important for your vehicle?

How does gap insurance work after a car is stolen? Gap insurance covers the difference between what you owe on your car loan or lease and the actual cash value of the vehicle if it’s totaled or stolen. Your standard insurance only pays the vehicle’s market value, which would leave you responsible for the remaining loan balance.

What is full gap coverage?

This type of insurance coverage pays the difference between your vehicle’s cash value and the amount you still owe in car payments in the event of a total loss claim (such as if your vehicle is totaled or stolen).

How can I find cheap gap insurance in Tennessee?

Compare quotes from multiple providers using online tools. Companies like State Farm, Progressive, and Liberty Mutual often offer competitive rates for cheap gap insurance in Tennessee.

What factors influence the cost of gap insurance in Tennessee?

Costs are influenced by the provider’s rates, coverage amount, vehicle value, and available discounts. Here are seven factors that affect auto insurance rates. Comparing providers will help you find the best cheap gap insurance in Tennessee.

How does the location affect the cost of gap insurance in Tennessee?

Location impacts rates due to differences in vehicle values and accident rates. Urban areas may have higher premiums, so consider this when seeking cheap gap insurance in Tennessee. Enter your ZIP code below to explore which companies have the cheapest auto insurance rates for you.

Are there any discounts available for gap insurance in Tennessee?

Yes, discounts may include multi-policy bundles, safe driving, and good credit. Providers might offer these to reduce the cost of cheap gap insurance in Tennessee. Learn how to save money bundling insurance policies.

Can I get gap insurance if I have an existing auto insurance policy?

Yes, you can add gap insurance to your current auto policy. Compare quotes to find the best cheap gap insurance in Tennessee that complements your existing coverage.

What is the most gap insurance will pay?

The most gap insurance will pay is the full amount left on your loan or lease after your insurer pays your vehicle’s actual cash value for a covered collision or comprehensive insurance claim. The exact amount gap insurance will pay depends on the balance of your loan or lease and the value of your car.

What is the minimum coverage required for gap insurance in Tennessee?

Minimum coverage typically covers the difference between your loan balance and the vehicle’s value. Check with providers to ensure you get the best cheap gap insurance for your needs.

What is full coverage auto insurance in Tennessee?

Full coverage insurance in Tennessee is usually defined as a policy that provides more than the state’s minimum liability coverage, which is $25,000 in bodily injury coverage per person, up to $50,000 per accident, and $15,000 in property damage coverage. (Learn More: Collision vs. Comprehensive Auto Insurance Explained)

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.