Cheap GMC Auto Insurance in 2025 (Save Money With These 10 Companies)

The top companies for cheap GMC auto insurance are Safeco, AAA, and State Farm. Safeco GMC minimum insurance averages $27/mo, but rates vary by model. For example, a GMC Sierra 3500HD model costs more to insure than the majority of GMC models, while a GMC Acadia is relatively cheap to insure.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Shawn Laib

Insurance and Finance Writer

Since graduating from the University of WA with a B.A. in English Literature, Shawn has been professionally writing in the spheres of entertainment, insurance, business, marketing, and politics. He is passionate about using his writing skills and insurance knowledge to educate the general population on everyday issues surrounding these misunderstood topics. His work has been published on SUPERJ...

Insurance and Finance Writer

UPDATED: Mar 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 21, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

1,277 reviews

1,277 reviewsCompany Facts

Min. Coverage for GMC

A.M. Best Rating

Complaint Level

Pros & Cons

1,277 reviews

1,277 reviews 3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage for GMC

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for GMC

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsThe top companies for cheap GMC auto insurance are Safeco, AAA, and State Farm.

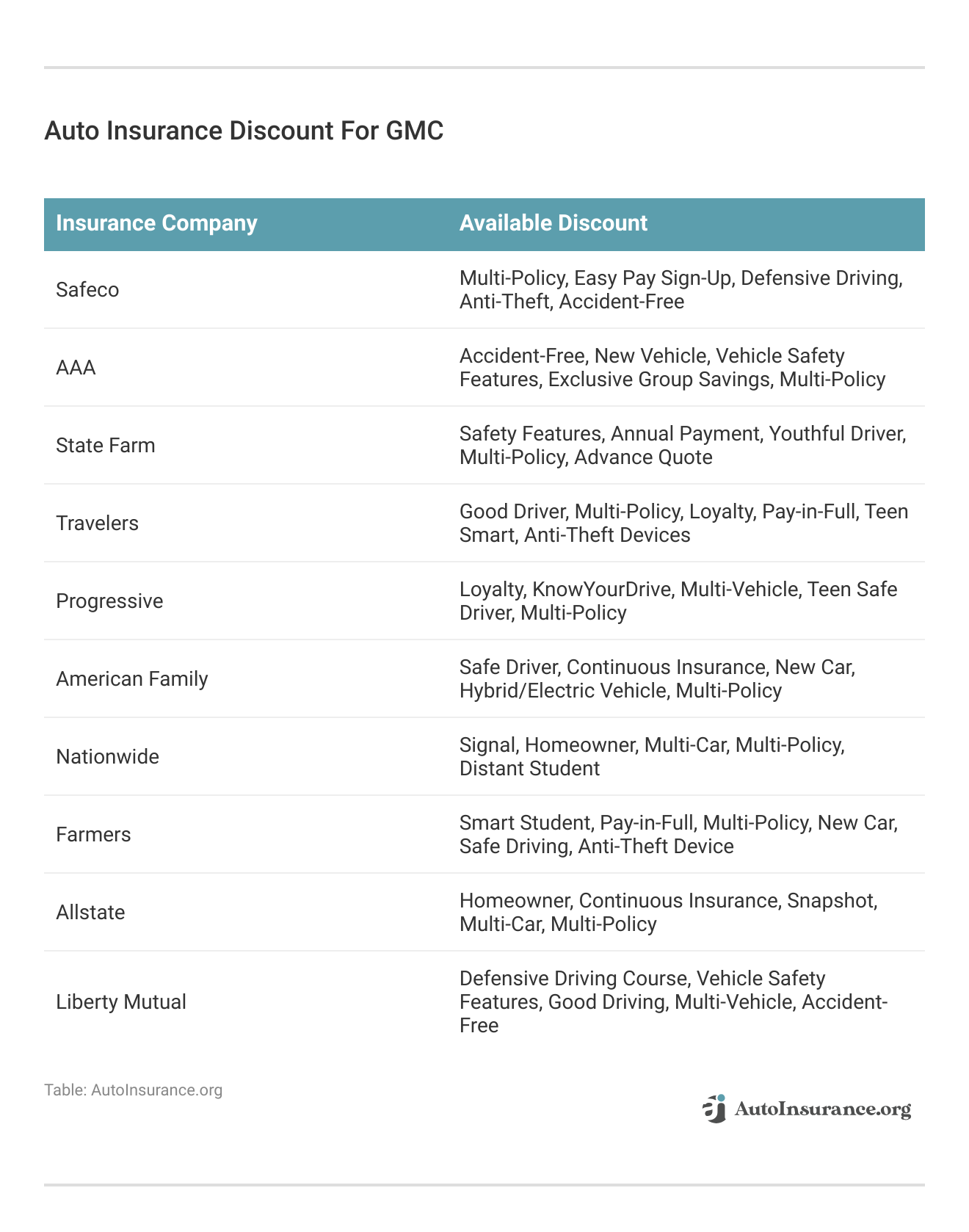

While finding affordable GMC car insurance coverage isn’t usually a challenge, there are always ways to save more. No matter how much auto insurance you need, you can find cheap auto insurance for your GMC by finding discounts, considering usage-based programs, and comparing quotes.

Our Top 10 Company Picks: Cheap GMC Auto Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $27 | A | Multi-Policy Discount | Safeco | |

| #2 | $32 | A | Roadside Assistance | AAA |

| #3 | $33 | B | Add-on Coverages | State Farm | |

| #4 | $37 | A++ | 24/7 Support | Travelers | |

| #5 | $39 | A+ | Online Tools | Progressive | |

| #6 | $44 | A | Customer Service | American Family | |

| #7 | $44 | A+ | Policy Options | Nationwide |

| #8 | $53 | A | Usage Discount | Farmers | |

| #9 | $61 | A+ | Online Convenience | Allstate | |

| #10 | $68 | A | Accident Forgiveness | Liberty Mutual |

Learn more about GMC auto insurance rates and how to find a cheap GMC car insurance policy below.

Then, compare GMC insurance quotes with as many companies as possible to find the best cost and auto insurance types for you.

- Safeco has the cheapest GMC auto insurance rates

- Auto insurance for GMC vehicles is usually affordable for most drivers

- The Sierra 3500HD is one of the most expensive GMCs to insure

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Safeco: Top Pick Overall

Pros

- Multi-Policy Discount: Safeco discounts customers purchasing GMC insurance and home or renters insurance.

- Claims-Free Rewards: Safeco offers cash back to GMC customers who stay claims-free.

- Add-On Coverages: GMC owners can select optional coverages to suit their coverage needs. Learn more in our Safeco review.

Cons

- Customer Satisfaction: Customers haven’t rated customer service as highly as preferred.

- No Online Enrollment: You must enroll in Safeco through an agent.

#2 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: Choose a plan from AAA to help with roadside repairs or towing.

- Member Benefits: AAA members can get discounts on some purchases.

- Coverage Options: GMC policies can be customized with extras. Read more in our AAA review.

Cons

- Membership Fee: GMC customers must sign up for an AAA membership to get coverage.

- Service Variations: Various clubs sell AAA coverage, so discounts, services, and coverages may vary among states.

#3 – State Farm: Best for Add-On Coverages

Pros

- Add-On Coverages: State Farm has extras like rental car reimbursement, rideshare insurance, and more.

- Local Agents: Local assistance is available in most states. Read more in our State Farm review.

- Adjustable Deductibles: Adjust your GMC rates by changing your deductibles.

Cons

- Financial Rating: State Farm has a B rating from A.M. Best.

- Agent Purchases: State Farm agents must be contacted to finalize a purchase.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Travelers: Best for 24/7 Support

Pros

- 24/7 Support: GMC customers can get assistance 24/7 at Travelers.

- Safety Features: GMC vehicles with safety features will have discounted rates.

- Coverage Options: GMC customers have plenty of options. Learn more in our Travelers review.

Cons

- UBI Rate Changes: Drivers who score poorly may have increased GMC rates.

- Customer Reviews: Reviews show customer service could still be improved.

#5 – Progressive: Best for Online Tools

Pros

- Online Tools: GMC customers have access to multiple useful tools, such as a tool for budgeting.

- Snapshot Program: Safe GMC drivers could save on their policies. Find out more in our Progressive Snapshot review.

- Competitive Rates: Rates are competitive for higher-risk GMC drivers.

Cons

- Snapshot Rate Changes: Poor scores could raise GMC rates.

- Customer Service: Reviews show Progressive has room for improvement. Learn more in our review of Progressive.

#6 – American Family: Best for Customer Service

Pros

- Customer Service: Our American Family review goes over the company’s high ratings.

- Loyalty Discounts: GMC owners could get a discount just for staying with the company.

- Coverage Variety: There are plenty of useful GMC coverage options for policies.

Cons

- Availability: Non-Costco members will only have access to purchase insurance in 19 states.

- DUI Rates: DUI American Family rates are less competitive for GMC drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Policy Options

Pros

- Policy Options: GMC customers can choose among optional coverages, different deductible amounts, and more. Learn more in our Nationwide review.

- Vanishing Deductible: GMC deductible amounts are reduced for drivers who don’t file claims.

- Usage-Based Coverage: Low-mileage GMC owners can purchase pay-per-mile insurance through SmartMiles.

Cons

- Local Agent Availability: GMC owners may not have access to local assistance.

- Customer Ratings: Ratings show Nationwide could improve customer service.

#8 – Farmers: Best for Usage Discount

Pros

- Usage Discount: Farmers has a good driving discount based on usage. Find out more in our review of Farmers.

- Accident Forgiveness: Claims-free GMC customers may be able to avoid rate increases.

- Family Plans: Farmers has great coverage and discount options for families purchasing GMC coverage.

Cons

- Online Functions: Online tools may limit what changes GMC customers can make online.

- Customer Satisfaction: Customer ratings suggest there are still improvements that need to be made.

#9 – Allstate: Best for Online Convenience

Pros

- Online Convenience: Allstate’s app allows GMC customers to conveniently make changes and file claims from their phones.

- Infrequent Drivers: Allstate’s pay-per-mile insurance can lower GMC auto insurance costs.

- Discount Options: Learn about the discounts for GMC policies in our Allstate review.

Cons

- Claim Satisfaction: Claim complaints are numerous at Allstate.

- Young Driver Rates: Teens purchasing their own GMC policy will find rates high.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: GMC customers may be able to avoid post-accident rate increases at Liberty Mutual.

- 24/7 Support: 24/7 representative assistance is available to GMC customers.

- Add-On Coverages: Add-ons are available to personalize GMC policies. Read more in our Liberty Mutual review.

Cons

- Customer Ratings: Reviews can be negative, showing a need for further improvement.

- Discount Availability: GMC customers may not have all discounts available to them in some states.

GMC Auto Insurance Coverage Options

When shopping for GMC coverage, the insurance you’ll benefit from most depends on your needs. Some GMC drivers can skip buying multiple coverages and purchase just enough to meet their state minimum auto insurance requirements.

However, you’ll need more insurance if you recently purchased a new GMC, as you’ll want relatively complete protection for your GMC.

Most car loans and leases require full coverage auto insurance. Even if you purchased your car with cash or paid off your loan, GMC full coverage car insurance might be right for you if you can't afford to replace your vehicle.Dani Best Licensed Insurance Producer

Most auto insurance companies offer various auto insurance types to get the exact amount of GMC auto insurance coverage you want. Some of the most commonly purchased coverage for a GMC includes the following:

- Liability: Liability auto insurance includes both bodily injury and property damage coverage. It pays for damages and injuries you cause in an at-fault accident but doesn’t help pay for repairs to your GMC.

- Collision: If you want help with car repairs after you cause an accident, you’ll need collision auto insurance. Collision insurance covers your GMC after an accident, no matter who was at fault. It also covers collisions with stationary objects.

- Comprehensive: There’s a lot more than car accidents that can damage your vehicle. Comprehensive auto insurance protects your GMC from fires, extreme weather, floods, vandalism, animal contact, and theft.

- Personal Injury Protection: Personal injury protection auto insurance pays for the health care expenses of you and your passengers after an accident. It also covers related expenses like lost wages or funeral costs.

- Medical Payments: Also called MedPay, medical payments coverage on auto insurance is similar to personal injury protection but doesn’t cover extra expenses like lost wages.

- Uninsured/Underinsured Motorist: Uninsured motorist coverage protects your GMC after a driver with inadequate coverage hits you. It also covers you if you’re the victim of a hit-and-run.

Most states require at least liability insurance before you can drive, and many others include uninsured motorist or personal injury protection insurance. Your GMC insurance policy will consist of everything listed above if you need full coverage — you’ll also buy personal injury protection or MedPay, depending on where you live.

Insurance companies usually sell add-ons with which you can customize your GMC auto insurance. Every company is different, but most sell roadside assistance, rental car reimbursement, and GMC gap insurance. If you want to increase your GMC insurance policy’s coverage, ask a representative from your insurance company to see what’s available.

GMC Auto Insurance Rates

Many factors go into GMC insurance quotes, including age, location, and GMC type. The best auto insurance companies consider the same factors but have unique formulas to set GMC car insurance rates.

While there are exceptions, GMC drivers tend to see higher GMC auto insurance rates than the national average. For example, the average American pays about $119 for full coverage and $45 monthly for liability insurance. Meanwhile, the average GMC driver spends about $145 for full coverage and $38 for liability insurance.

One of the most crucial roles in your insurance rates is which model you drive, with some costing as high as $163 a month. Before you sign up for a GMC insurance policy, explore the average rates below.

GMC Auto Insurance Rates by Company

A good place to start looking for GMC auto insurance is each company’s average cost for coverage. Some companies are consistently more expensive than others. While the most affordable GMC car insurance isn’t necessarily the best, knowing which companies offer the lowest rates is helpful when you want to keep your expenses down.

Since GMC insurance rates are close to the national average, looking at some of the biggest companies’ average rates can be helpful. Check below to compare rates from some companies with cheap auto insurance for GMC vehicles:

GMC Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $32 | $86 |

| Allstate | $61 | $160 |

| American Family | $44 | $117 |

| Farmers | $53 | $139 |

| Liberty Mutual | $68 | $174 |

| Nationwide | $44 | $115 |

| Progressive | $39 | $105 |

| Safeco | $27 | $71 |

| State Farm | $33 | $86 |

| Travelers | $37 | $99 |

These rates are from large, national companies — you might find cheaper coverage with a local option. For example, Wawanesa auto insurance is an affordable option if you’re looking for California auto insurance.

Looking at the average price for each company is a good start, but you should remember that these are just averages. Since companies use unique formulas, you can see different GMC insurance rates based on your circumstances. For example, our Geico auto insurance review showed Geico is normally the cheapest options. However, the company has some of the most expensive auto insurance for drivers with a DUI.

There's more to comparing📊 car insurance quotes than finding the cheapest🤑 premium. https://t.co/27f1xf131D has published an excellent guide to understand💡 the most important factors to compare between insurers. Check it out here👉: https://t.co/ax4M3DRVnp pic.twitter.com/JkvOOirl2A

— AutoInsurance.org (@AutoInsurance) August 4, 2023

While these rates represent a company’s offerings fairly, you should always get various GMC insurance quotes. Companies like State Farm offer quotes directly from their website.

For certain factors, some companies are more forgiving than others, so you can see different prices.

GMC Auto Insurance Rates by Model

While GMC insurance rates typically match the national average, that’s not always the case. Some GMC models cost more to insure than others, making it vital to compare auto insurance rates by vehicle make and model. If you’re curious how much you might pay for coverage based on the GMC model, check below:

GMC Auto Insurance Monthly Rates by Make and Model

| GMC Model | Full Coverage |

|---|---|

| GMC Yukon XL | $145 |

| GMC Yukon | $150 |

| GMC Terrain | $134 |

| GMC Sierra 3500HD | $163 |

| GMC Sierra 2500HD | $159 |

| GMC Sierra | $146 |

| GMC Canyon | $130 |

| GMC Acadia | $129 |

The Sierra 3500HD has the most expensive GMC auto insurance rates. While there are several reasons for this, it’s primarily due to Sierra’s hefty price tag. On the other end of the scale, the Acadia and Canyon have some of the lowest rates. The Acadia and Canyon are both affordable vehicles with solid safety ratings.

GMC Auto Insurance Rates by Age

There are many factors that affect auto insurance rates for GMCs, but one that significantly impacts them is age. Young, inexperienced drivers will pay more for GMC car insurance because they’re more likely to get into accidents, drive recklessly, and file other claims.

To see how much your age and gender affect GMC auto insurance, check the rates below:

Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $292 | $761 |

| 16-Year-Old Male | $323 | $808 |

| 30-Year-Old Female | $68 | $182 |

| 30-Year-Old Male | $71 | $191 |

| 45-Year-Old Female | $62 | $166 |

| 45-Year-Old Male | $61 | $165 |

| 55-Year-Old Female | $59 | $158 |

| 55-Year-Old Male | $58 | $157 |

| 65-Year-Old Female | $61 | $163 |

| 65-Year-Old Male | $61 | $161 |

Auto insurance for under 25-year-olds is five times more expensive than for older adults. However, you won’t pay higher rates forever. You’ll see lower GMC insurance rates when you turn 25.

Compare the Auto Insurance Costs Across GMC Models

Delving into the cost of auto insurance across different GMC models unveils notable variations, aiding in the swift identification of optimal coverage options for your vehicle.

Cost of Auto Insurance for GMC's by Model

| GMC Model |

|---|

| GMC Sierra 2500HD |

More expensive models will have higher insurance rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Factors Affecting Your GMC Auto Insurance Quotes

Whether you’re buying coverage for a luxury vehicle or need auto insurance for a classic car, the same factors affect your rates. Companies look at the following factors when deciding how much to charge you for your insurance:

- GMC Model: You saw rates for several models above, and the GMC you choose to buy plays a significant role in your GMC insurance quotes. Insurance companies look at how much each model costs, its safety ratings, and what type of vehicle it is.

- Age and Gender: So, why are auto insurance rates higher for males? Men and young drivers have higher GMC insurance quotes because they’re more likely to get into accidents and file claims. Read more about average auto insurance rates by age.

- Location: Auto insurance companies also track claims filed by location. You’ll see different GMC auto insurance rates by ZIP code due to factors like crime and theft rates.

- Marital Status: Single people tend to file more claims than married people. Since married people will likely cost the company less money in claims, they usually get cheaper insurance.

- Credit Score: Most states allow insurance companies to use your credit score as part of your rates. Drivers with higher credit scores pay less for auto insurance. Read more about auto insurance and your credit score.

- Driving History: Infractions like speeding tickets, at-fault accidents, and DUIs will drastically affect your rates. You’ll need to find high-risk auto insurance if you have too many incidents on your record.

Your GMC car insurance rates will also vary by how much insurance you want to buy. Drivers who only buy the minimum auto insurance required by their state will pay much less than those needing more coverage. While it costs more, full coverage gives your car much better protection. You’ll benefit from full coverage if you plan to buy or have recently purchased a new GMC.

How to Save on Your GMC Auto Insurance Policy

Drivers already enjoy cheap GMC auto insurance rates by buying a reliable, safe car, but there are always ways to save more. Companies understand that customers need to save every dollar they can, so most offer auto insurance discounts. Common discounts include savings for good drivers, policy bundling, and paying for your entire GMC insurance policy at once.

If you’re interested in keeping your GMC insurance as low as possible, also try the following tips:

- Consider Usage-Based Insurance: Most major insurance companies offer usage-based auto insurance programs to help low-mileage drivers save. For example, you could save up to 40% on your GMC auto insurance by enrolling in Nationwide SmartRide, which tracks behaviors such as hard braking, speeding, and miles driven.

- Keep Your Record Clean: Driving infractions on your record can have serious consequences for your insurance rates. To find the best GMC auto insurance, avoid getting traffic violations.

- Park in a Safe Spot: Parking in a safe place helps keep your car out of harm’s way. If you keep your vehicle in a covered garage or private driveway, your GMC insurance company will likely give you a better rate.

- Add Security: Most companies will give you a discount for installing safety systems, including audible alarms and GPS tracking.

While these are great ways to keep your rates down as much as possible, comparing GMC insurance quotes is the best way to find affordable GMC car insurance. Comparing GMC insurance quotes allows you to see exactly how much each company will charge you for coverage, which makes it simple to pick the lowest price.

Find the Best GMC Auto Insurance Today

On average, GMC auto insurance costs $145 monthly. While GMC car insurance quotes are usually a bit higher than the national average, it’s still not hard to find affordable car insurance for your GMC. However, you might see different GMC insurance rates depending on your driving record, demographics, or the model you buy.

The more companies you compare, the more likely you’ll find the best GMC auto insurance coverage for you. Compare GMC car insurance rates today by entering your ZIP into our free tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Are GMCs expensive to insure?

Generally speaking, GMC vehicles come with affordable insurance rates. The average driver pays about $145 a month for full coverage insurance, though the rates you’ll see depends on various factors. For example, some GMCs cost more to insure than others.

Can I purchase GMC Auto Insurance from any insurance provider?

GMC may have specific insurance partners or preferred providers through which customers can purchase GMC auto insurance. It’s recommended to inquire with GMC or their designated insurance partners to obtain the most accurate information on where and how to purchase GMC auto insurance.

Does GM offer auto insurance?

General Motors (GM) offers home and auto insurance through its OnStar program. Like any other insurance company, GM auto insurance rates vary by several factors. You might find the most affordable rates with GM insurance if you regularly practice safe driving. Read more in our GM auto insurance review.

How does GMC Auto Insurance work?

GMC auto insurance works by offering insurance coverage designed specifically for GMC vehicle owners. It typically includes various coverage options such as liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and more. GMC may collaborate with insurance partners to provide these coverage options to its customers.

How much is auto insurance on a GMC Yukon?

GMC Yukon auto insurance costs $150 monthly, around the overall average for GMC models. You will get the cheapest GMC insurance by shopping for GMC auto insurance quotes. Use our free quote tool to get started.

How much is auto insurance on a GMC Sierra?

Because of its larger price tag, GMC Sierra insurance is among the most expensive of the GMC models. For example, GMC Sierra 2500HD auto insurance costs $159 monthly, while the 3500HD has an average quote of $163/mo.

Can anyone purchase GMC Auto Insurance, or is it only available to GMC vehicle owners?

GMC auto insurance is primarily available to customers who own or lease GMC vehicles. It’s designed to provide insurance coverage specifically tailored to GMC vehicles. However, it’s recommended to check with GMC or their insurance partners to confirm eligibility requirements.

Which is cheaper, GMC or Chevy?

Chevy vehicles are slightly cheaper to purchase than GMC vehicles, making them cheaper to insure (learn more: Cheap Chevrolet Auto Insurance).

What does GMC stand for?

GMC stands for General Motors Company.

Who is GMC owned by?

GMC is owned by GM.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Shawn Laib

Insurance and Finance Writer

Since graduating from the University of WA with a B.A. in English Literature, Shawn has been professionally writing in the spheres of entertainment, insurance, business, marketing, and politics. He is passionate about using his writing skills and insurance knowledge to educate the general population on everyday issues surrounding these misunderstood topics. His work has been published on SUPERJ...

Insurance and Finance Writer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.