Cheapest Teen Driver Auto Insurance in Arkansas (Save Money With These 10 Companies in 2025)

State Farm, Geico, and Nationwide have the cheapest teen driver auto insurance in Arkansas. As an at-fault insurance state, Arkansas has higher average rates, but State Farm and Geico have the lowest teen insurance at $65/mo and $70/mo. Read now to get cheap auto insurance for young drivers in AR.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Jan 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 17, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for Teen Drivers in Arkansas

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for Teen Drivers in Arkansas

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage for Teen Drivers in Arkansas

A.M. Best Rating

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsState Farm, Geico, and Nationwide have the cheapest teen driver auto insurance in Arkansas.

Arkansas auto insurance is more expensive, especially for teen drivers, but shopping at the cheapest new driver auto insurance companies can help some drivers save.

Our Top 10 Company Picks: Cheapest Teen Driver Auto Insurance in Arkansas

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $65 | B | Local Agents | State Farm | |

| #2 | $70 | A++ | Good Drivers | Geico | |

| #3 | $72 | A+ | Bundling Discounts | Nationwide |

| #4 | $75 | A+ | Loyalty Rewards | Progressive | |

| #5 | $77 | A | Safety Discounts | Farmers | |

| #6 | $80 | A+ | Tailored Policies | The Hartford |

| #7 | $84 | A++ | Unique Coverage | Travelers | |

| #8 | $86 | A | Discount Availability | American Family | |

| #9 | $92 | A+ | Drivewise Programs | Allstate | |

| #10 | $101 | A | Comprehensive Policies | Liberty Mutual |

Whether you want to find the cheapest insurance for a 16-year-old in Arkansas or a 20-year-old in Arkansas, start by getting quotes. Compare rates with our free comparison tool to quickly find cheap auto insurance in Arkansas.

- State Farm has the cheapest new driver car insurance in Arkansas

- Arkansas auto insurance laws require higher minimums to drive

- Young drivers will get the best rates by joining a parent’s policy

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Local Agents: Get personalized customer service with local agents at State Farm. Find out more in our review of State Farm.

- Good Student Discount: State Farm’s good student discount can save young drivers up to 25%.

- Coverage Options: Teen drivers can purchase full coverage policies for better protection on the road.

Cons

- No Quick Purchases: State Farm requires all purchases to be completed through an agent.

- Post-Accident Rates: State Farm’s rates aren’t as cheap for drivers with at-fault accidents on their record.

#2 – Geico: Best for Good Drivers

Pros

- Good Drivers: Teens who demonstrate good driving skills and go claims-free will be rewarded with discounts.

- Online Tools: Geico’s app is great for teens who want to manage policies from their smartphones.

- Add-On Coverages: Protect teens with add-ons like roadside assistance. For more details on coverage, read our Geico review.

Cons

- UBI Discount Availability: Teens may not have Geico’s good driver discount in their state.

- Personalized Service: Teens may not have a local agent from Geico near them.

#3 – Nationwide: Best for Bundling Discounts

Pros

- Bundling Discounts: Nationwide offers up to 20% off when customers bundle. Read about Naitonwide’s other saving opportunities in our Nationwide review.

- Vanishing Deductibles: Reduce your deductible over time if you stay claims-free.

- Good Driver Program: Teens can participate in Nationwide’s UBI program to get a chance to score a major discount.

Cons

- Claims Reviews: Nationwide isn’t as highly rated for claims processing.

- Agent Availability: Some teens won’t have access to a local agent.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Progressive: Best for Loyalty Rewards

Pros

- Loyalty Rewards: Loyal customers will receive a discount on their insurance.

- User-Friendly: Use Progressive’s app to make a number of changes to your policy.

- Coverage Options: Teens can personalize policies with Progressive’s options. Learn more in our Progressive review.

Cons

- Rate Increases: Drivers risk a rate increase in Progressive’s good driver discount program if they drive poorly.

- Personalized Assistance: Progressive’s local agents aren’t as numerous.

#5 – Farmers: Best for Safety Discounts

Pros

- Safety Discounts: Cars with great safety features will have lower rates at Farmers.

- Family Plans: Families can save when insuring multiple cars at Farmers.

- Good Student Discount: Having good grades will pay off for Farmers’ customers.

Cons

- Discount Availability: Farmers’ discount amounts can vary by state or performance.

- Rates for Poor Drivers: Having a DUI, accident, or ticket on your record will cost you at Farmers. Our Farmers review goes over its rates for different drivers.

#6 – The Hartford: Best for Tailored Policies

Pros

- Tailored Policies: Choose among several coverage and deductible options to tailor a policy to suit your needs.

- Teen Driver Program: The Hartford offers discounts and driving feedback to teens. Read our review of The Hartford for more information on savings.

- 24/7 Claims: File a claim, even if it’s the middle of the night, at The Hartford.

Cons

- Best for Teens Joining Policy: The Hartford’s rates for teens purchasing their own policies are much higher than for teens joining a policy.

- Local Agents: Personalized assistance from local agents may not be as easy to find.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Travelers: Best for Unique Coverage

Pros

- Unique Coverage: Teens can get unique coverage like rideshare insurance. Check out our Travelers review for a full list of Traveler’s coverage options.

- Student Away Discount: Teen drivers attending school 100 miles or more away without a car will qualify for a student away discount.

- Safe Driving Discount: Teens can demonstrate their safe driving skills and earn discounts in Traveler’s safe driving program.

Cons

- Personalized Service: Local agents may not be available for every Travelers’ customer.

- Rates for Poor Driving Records: Rates can be expensive for teens with poor driving records.

#8 – American Family: Best for Discount Availability

Pros

- Discount Availability: American Family offers plenty of discounts for teen drivers, which you can read about in our review of American Family.

- Customer Service Reputation: American Family scored well for its customer service.

- Accident Forgiveness: Teens with no prior accidents may escape rate increases after their first at-fault accident.

Cons

- State Availableness: Unfortunately, insurance from American Family isn’t always sold in customers’ states.

- Rates for Poor Driving Records: Specifically, American Family will charge drivers with DUIs significantly more.

#9 – Allstate: Best for Drivewise Programs

Pros

- Drivewise Programs: Teens who demonstrate safe driving skills will save on auto insurance.

- Claim Satisfaction Guarantee: Allstate will give policy rate credits if customers are unhappy with the claim service.

- Easy Online Management: Teens can make policy changes easily online.

Cons

- Complaint Ratio: Allstate’s number of complaints is a little higher than other companies.

- Rates for Poor Driving Records: Teens with accidents may want to shop elsewhere. Our Allstate review takes a closer look at rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Comprehensive Policies

Pros

- Comprehensive Policies: Liberty Mutual offers fully comprehensive policies to protect teens in numerous accident situations.

- Teen Discount Program: Liberty Mutual offers a discount program specifically for teen drivers.

- Support Offered 24/7: Teens can get help at any time. Find out more about the company in our Liberty Mutual review.

Cons

- Discount Amounts Can Vary: Liberty Mutuals’ discount amounts can vary by eligibility or location.

- Agent Accessibility: Local agents may not be placed widely enough for all customers to access in-person assistance.

Arkansas No-Fault Auto Insurance for Teen Drivers

Arkansas is an at-fault state, but drivers have the option to carry no-fault auto insurance coverages like personal injury protection (PIP). All drivers will need to meet Arkansas minimum auto insurance requirements, which is the cheapest option for teen drivers.

Arkansas Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $214 | $647 |

| 16-Year-Old Male | $249 | $724 |

| 17-Year-Old Female | $194 | $547 |

| 17-Year-Old Male | $232 | $636 |

| 18-Year-Old Female | $174 | $447 |

| 18-Year-Old Male | $214 | $548 |

| 19-Year-Old Female | $156 | $403 |

| 19-Year-Old Male | $191 | $492 |

| 20-Year-Old Female | $138 | $358 |

| 20-Year-Old Male | $167 | $435 |

| 21-Year-Old Female | $120 | $314 |

| 21-Year-Old Male | $144 | $379 |

While full coverage is more expensive, we recommend carrying it if you can afford it.

Arkansas teens with full coverage will be financially protected in case of car collisions, animal collisions, weather damages, and more.Kristen Gryglik Licensed Insurance Agent

Arkansas auto insurance minimums will cost more for poor drivers, which is why driving safely and staying claims-free is one of the best ways to get cheap insurance.

Comparing Teen Auto Insurance Rates in Arkansas

When shopping for auto insurance for drivers under 25, make sure you are comparing rates, especially if you have a poor driving record.

Arkansas Auto Insurance Monthly Rates by Age, Gender & Driving Record

| Age & Gender | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| 16-Year-Old Female | $517 | $517 | $603 | $861 |

| 16-Year-Old Male | $584 | $584 | $682 | $973 |

| 17-Year-Old Female | $445 | $445 | $519 | $741 |

| 17-Year-Old Male | $521 | $521 | $608 | $868 |

| 18-Year-Old Female | $373 | $373 | $435 | $621 |

| 18-Year-Old Male | $458 | $458 | $534 | $762 |

| 19-Year-Old Female | $336 | $336 | $391 | $559 |

| 19-Year-Old Male | $410 | $410 | $478 | $683 |

| 20-Year-Old Female | $298 | $298 | $347 | $496 |

| 20-Year-Old Male | $361 | $361 | $422 | $602 |

| 21-Year-Old Female | $261 | $261 | $304 | $434 |

| 21-Year-Old Male | $314 | $314 | $367 | $523 |

Teens should also get quotes from the cheapest Arkansas companies like State Farm.

Another factor that changes teens’ rates is where they live in Arkansas.

Arkansas Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Fayetteville | Hot Springs | Jonesboro | Little Rock | Springdale |

|---|---|---|---|---|---|

| 16-Year-Old Female | $103 | $110 | $109 | $120 | $103 |

| 16-Year-Old Male | $86 | $91 | $91 | $100 | $86 |

| 17-Year-Old Female | $117 | $124 | $123 | $136 | $116 |

| 17-Year-Old Male | $103 | $110 | $109 | $120 | $103 |

| 18-Year-Old Female | $131 | $139 | $138 | $152 | $130 |

| 18-Year-Old Male | $120 | $128 | $127 | $140 | $120 |

| 19-Year-Old Female | $144 | $154 | $152 | $168 | $144 |

| 19-Year-Old Male | $138 | $146 | $145 | $160 | $137 |

| 20-Year-Old Female | $158 | $168 | $167 | $184 | $157 |

| 20-Year-Old Male | $155 | $164 | $163 | $180 | $154 |

| 21-Year-Old Female | $172 | $183 | $181 | $200 | $171 |

| 21-Year-Old Male | $172 | $183 | $181 | $200 | $171 |

Teens who live in certain cities in Arkansas will have cheaper rates on average.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Save Money By Adding a Teen to a Parent’s Policy

Parents should look into adding a driver to car insurance rather than having teens purchase their own policy.

Arkansas Auto Insurance Monthly Rates by Age, Gender, & Policy Type

| Age & Gender | Individual Policy | Parent's Policy |

|---|---|---|

| 16-Year-Old Female | $563 | $358 |

| 16-Year-Old Male | $628 | $384 |

| 25-Year-Old Female | $185 | $115 |

| 25-Year-Old Male | $191 | $120 |

| 35-Year-Old Female | $162 | $105 |

| 35-Year-Old Male | $162 | $108 |

| 60-Year-Old Female | $142 | $92 |

| 60-Year-Old Male | $144 | $94 |

If you are looking for insurance with a permit in Arkansas, teens driving their parents’ cars should be added to the parent’s policy.

More Teen Auto Insurance Tips to Lower Rates

If you are wondering how to save money on teenager car insurance, start by shopping for quotes from companies that offer the best auto insurance for new drivers.

Teen Driver Auto Insurance in Arkansas: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $92 | $224 |

| American Family | $86 | $215 |

| Farmers | $77 | $200 |

| Geico | $70 | $185 |

| The Hartford | $80 | $205 |

| Liberty Mutual | $101 | $234 |

| Nationwide | $72 | $190 |

| Progressive | $75 | $200 |

| State Farm | $65 | $175 |

| Travelers | $84 | $211 |

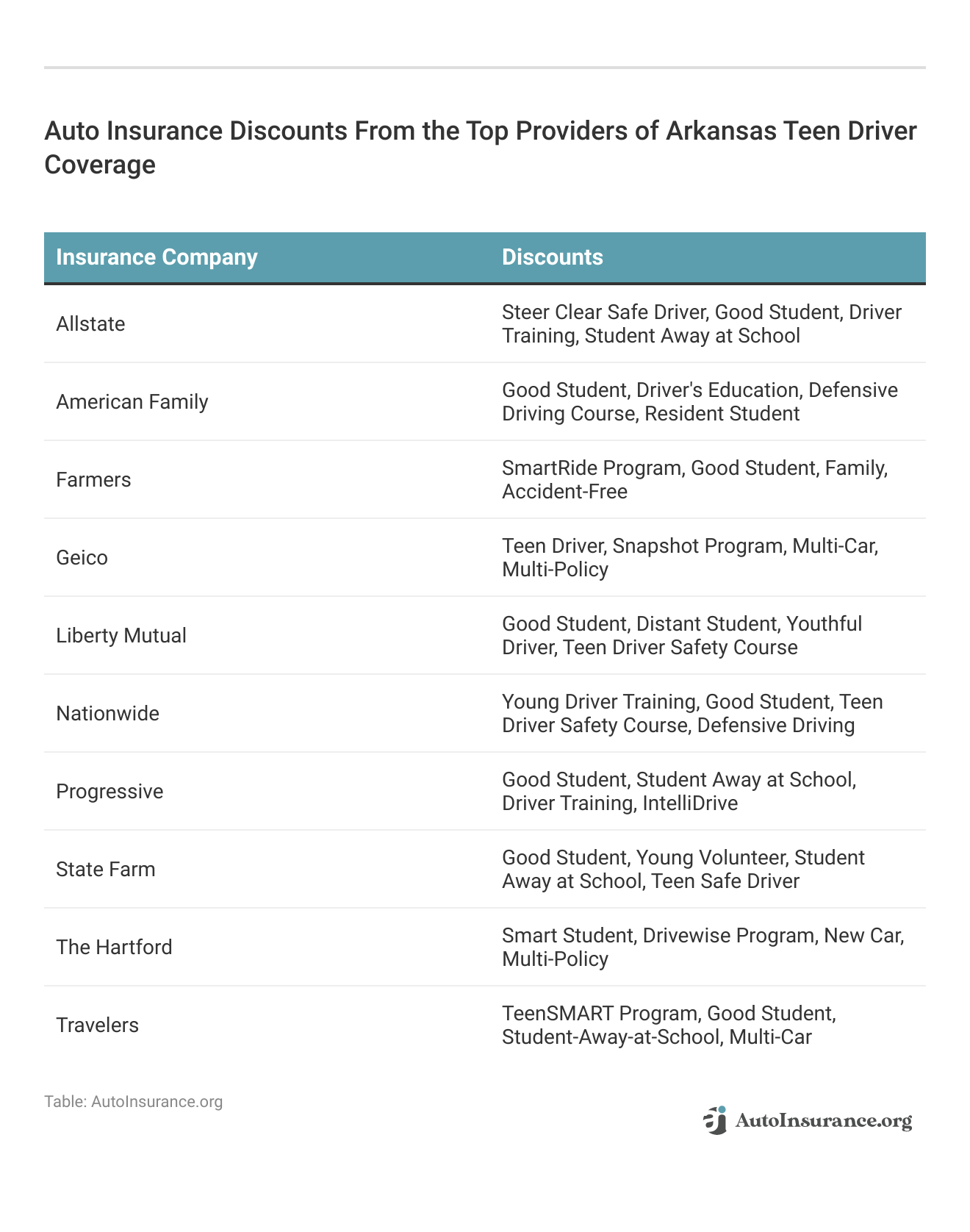

Auto insurance discounts are another great way to save.

Many companies offer teen driver discounts for driving safely or being a good student.

Taking defensive driving courses, like the Steer Clear program from State Farm, are also a great way for teens to save money on auto insurance.

The Best Way to Insure a Teen Driver in Arkansas

Joining a parent’s policy is the best option for teen drivers, but if teens have to purchase their own policy, they should make sure they shop at the companies with the cheapest teen auto insurance.

Teens can also apply for discounts or reduce coverages on their personal policy or a parent's policy to save money.Melanie Musson Published Insurance Expert

If you want to shop for the best auto insurance in Arkansas today, enter your ZIP code into our free tool to get free Arkansas car insurance quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Why is my Arkansas auto insurance quote so high?

Quotes for auto insurance for young drivers in Arkansas may be high because you are getting a quote from an expensive company or you have a poor driving record or an expensive car.

Which age group pays the most for auto insurance in Arkansas?

16-year-old drivers pay the most for auto insurance, which is why the best way to insure a teen driver is to add them to a parent’s policy.

What is the cheapest auto insurance for a 16-year-old in Arkansas?

Minimum coverage is the cheapest insurance for 16-year-olds (learn more: Cheap Auto Insurance for 16-Year-Olds).

Who has the cheapest auto insurance for a 17-year-old in Arkansas?

State Farm is the top pick for cheap auto insurance for 17-year-olds.

What is the cheapest auto insurance for an 18-year-old in Arkansas?

The cheapest insurance for a 18-year-old in Arkansas is minimum coverage.

Is Arkansas auto insurance more expensive if you have bad grades?

Insurance companies do not charge more if students have bad grades, but students with bad grades won’t be able to qualify for a good student discount (learn more: How to Get a Good Student Auto Insurance Discount).

Is it cheaper to be on your parents’ auto insurance in Arkansas?

Yes, it is cheaper to be added to your parent’s policy. Learn more in our article: Should I add my teenager to my auto insurance policy?

Who has the cheapest liability insurance in Arkansas?

State Farm has the cheapest liability insurance. Use our tool to get free Arkansas auto insurance quotes to see how much you would pay for liability insurance.

What is the minimum vehicle insurance in Arkansas?

Arkansas state minimum auto insurance is 25/50/25 of liability insurance.

What is full coverage insurance in Arkansas?

Full coverage auto insurance is liability insurance combined with collision and comprehensive insurance. Full coverage is the best insurance for teen drivers.

What happens if you don’t have car insurance in Arkansas?

Arkansas auto insurance requirements state that all drivers must have auto insurance. Driving without insurance can result in fines and loss of driving privileges.

Which brand of car has the cheapest Arkansas insurance?

Brands like Hondas are often the cheapest to insure. Learn more about car models and rates in our article: Does the car a teen drives affect auto insurance rates?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.