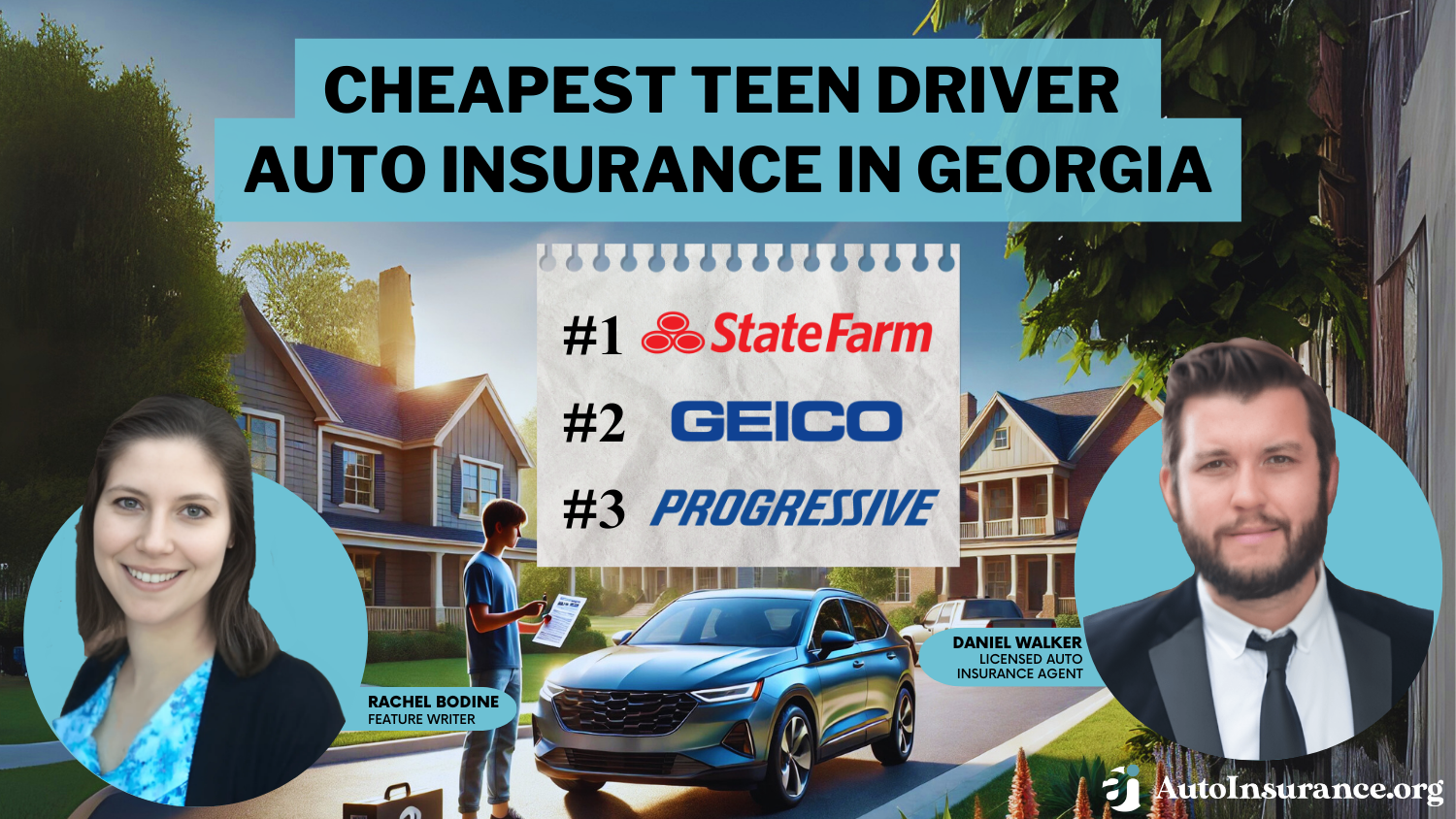

Cheapest Teen Driver Auto Insurance in Georgia for 2025 (Save With These 10 Companies)

State Farm, Geico, and Progressive offer the cheapest teen driver auto insurance in Georgia at just $132 per month. These Georgia insurance companies offer driver’s ed, good grades, and safe driving discounts. Comparison shopping can help you find rates that are lower than the average auto insurance cost in Georgia.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 28, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for GA Teens

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for GA Teens

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage for GA Teens

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsState Farm, Geico, and Progressive have the cheapest teen driver auto insurance in Georgia, especially for teens who complete a driver’s education course.

Teen drivers usually pay extremely expensive car insurance rates, but State Farm, one of the companies with the cheapest teen auto insurance, offers average rates in Georgia starting at just $132 per month.

Our Top 10 Picks: Cheapest Teen Driver Auto Insurance in Georgia

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $132 | A++ | Many Discounts | State Farm | |

| #2 | $135 | A++ | Cheap Rates | Geico | |

| #3 | $148 | A+ | Online Convenience | Progressive | |

| #4 | $209 | A++ | Military Savings | USAA | |

| #5 | $204 | A+ | Add-on Coverages | Allstate | |

| #6 | $301 | A+ | Usage Discount | Nationwide |

| #7 | $308 | A | Local Agents | Farmers | |

| #8 | $356 | A | Customizable Policies | Liberty Mutual |

| #9 | $372 | A++ | Accident Forgiveness | Travelers | |

| #10 | $467 | A+ | 24/7 Support | Erie |

You can save more by qualifying for teen driver discounts. Continue reading to find out your best options for teen auto insurance in Georgia.

Then, enter your ZIP code into our free comparison tool to compare quotes and find the lowest rates.

- The cheapest teen driver auto insurance in Georgia starts at just $132 monthly

- Teens can save more with discounts for driver’s ed, good grades, and safe driving

- State Farm is our top pick for affordable and reliable teen auto insurance coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Pick Overall

Pros

- Drive Safe & Save: Signing up for Drive Safe & Save can save you up to 30% on your teen insurance rates. However, it is not available everywhere.

- Teen Safe Driver Program: Complete the Teen Safe Driver program from State Farm to earn special savings that last until you turn 21.

- Teen Discounts: Teenagers can lower their rates by taking advantage of State Farm’s student discounts, including the student away at school, driver education, and good student discounts.

Cons

- Limited Coverage: While State Farm has a few good options for car insurance, it lacks some popular choices. See what you can add to your policy in our State Farm auto insurance review.

- Slow Claims: If you need to file a State Farm claim, get ready to wait. Many customers report long claims resolution times.

#2 – Geico: Cheapest Teen Auto Insurance Rates

Pros

- Competitive Rates for Teens: Geico is almost always an affordable option for insurance, and that’s particularly true for teens. Explore Geico’s average rates in our Geico auto insurance review.

- DriveEasy Discounts: Geico offers savings of up to 25% for enrolling in DriveEasy and practicing good driving habits.

- Teen Driver Discounts: Teens have 16 discounts available to them, so there are many ways for young drivers to save on their insurance.

Cons

- Lacking Coverage Options: Geico doesn’t sell some of the most popular car insurance add-ons, like gap insurance, a vanishing deductible, or rideshare insurance.

- Mixed Reviews: It may offer affordable rates, but some drivers say the savings are not worth the headache of dealing with Geico’s customer service representatives.

#3 – Progressive: Best Online Tools

Pros

- SnapShot: Teens who agree to let Progressive track their driving behaviors with SnapShot can lower their rates by up to 30%.

- Name Your Price Tool: Since teen rates are usually high, using the Name Your Price tool to find coverage that matches your monthly budget can be invaluable.

- Teen Driver Discounts: Progressive offers several ways to save, including teen discounts for things like completing a driver’s education course and maintaining good grades.

Cons

- SnapShot Can Increase Rates: Progressive’s SnapShot is one of the few UBI programs on the market that will actually increase your rates if you don’t drive well enough.

- Rates Increase Unexpectedly: Many Progressive customers report that their rates unexpectedly increased. Read more customer experiences in our Progressive auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – USAA: Cheapest for Military Families

Pros

- Military Savings: USAA offers special savings and coverage options for military families.

- Top-Tier Customer Service: USAA strives to offer the best customer service for every driver. See how it accomplishes its high ratings in our USAA auto insurance review.

- Low Rates: USAA is consistently one of the cheapest car insurance options for teen drivers.

Cons

- Limited Offices: There aren’t as many physical offices for USAA, so finding help from a local agent can be difficult.

- Membership Requirements: Only active-duty or retired military personnel and their immediate family can join USAA.

#5 – Allstate: Best Full Coverage Add-Ons

Pros

- Excellent Teen Coverage Options: Get the most out of your Allstate policy by adding coverage like accident forgiveness and roadside assistance.

- TeenSMART: Complete the TeenSMART driving program to earn a special discount from Allstate.

- UBI Savings: Allstate offers up to 40% savings with its UBI program, Drivewise. If you’re a low-mileage teen driver in Georgia, consider Allstate’s Milewise, a pay-per-mile program.

Cons

- Less Competitive Rates: Allstate tends to be more expensive, making family coverage less affordable. Learn more about its rates in our Allstate auto insurance review.

- Customer Complaints: Allstate does not receive the best customer reviews, especially regarding its claims resolution process.

#6 – Nationwide: Best UBI Savings

Pros

- Accident Forgiveness: Sign up for Nationwide’s accident forgiveness add-on to have your first accident wiped from your insurance record.

- SmartRide: Offers one of the best UBI discounts in the nation. In addition to saving up to 40%, SmartRide provides valuable feedback on your teen’s driving behavior.

- Generous Discounts: With 11 discounts, Nationwide makes teen auto insurance in Georgia more affordable. See how many discounts you might qualify for in our Nationwide auto insurance review.

Cons

- Average Rates: Nationwide’s rates aren’t very impressive — they tend to stay around the national average for all drivers.

- Lacking Digital Tools: Nationwide doesn’t focus on its online offerings, preferring to have its customers manage their policies with the help of an agent instead.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Farmers: Best for Local Agents

Pros

- Long List of Discounts: With 23 discount options, Farmers gives young drivers a variety of ways to save.

- Friendly Representatives: Teens can get help with any insurance issue from a Farmers representative. Learn how to get in contact with agents in our Farmers auto insurance review.

- Excellent Coverage Options: Personalize your policy with Farmers’ add-on options. Popular teen choices include roadside assistance and customized equipment coverage.

Cons

- Higher Average Rates: Most drivers see higher rates at Farmers than they would at a different provider.

- Slow Response Time: Teens who add roadside assistance to their policies report that Farmers is slow to send help.

#8 – Liberty Mutual: Cheapest Customizable Policies

Pros

- RightTrack: Save up to 30% by enrolling in Liberty Mutual’s UBI program, RightTrack. See if RightTrack is right for you in our Liberty Mutual auto insurance review.

- Young Driver Support: Liberty Mutual representatives are available 24/7 to help young drivers when they need it.

- Unique Coverage Options: Liberty Mutual offers excellent features for teen drivers including widespread coverage, accident forgiveness, and 24/7 roadside assistance.

Cons

- Claims Issues: Many Liberty Mutual customers say they are experiencing difficulties with the claims process, especially when it comes to the length of the resolution time.

- Higher Rates: Liberty Mutual is not usually the cheapest car insurance option, no matter how old you are.

#9 – Travelers: Cheapest Accident Forgiveness

Pros

- Customer Support: Understanding car insurance can be difficult, especially for new drivers. However, Travelers has the experience and knowledge to help teens through any tricky situation.

- Discount Options: Travelers offers 17 discounts, including several ways for teens to save.

- IntelliDrive: Rewards drivers up to 30% for practicing safe driving habits.

Cons

- Limited Online Tools: Travelers takes a more traditional approach to insurance by selling policies through representatives. It doesn’t have the most robust online policy management tools.

- Mixed Customer Reviews: While Travelers has plenty of satisfied customers, it also receives its fair share of complaints. See what customers have to say in our Travelers auto insurance review.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Erie: Best Customer Support

Pros

- Rate Lock: As long as you don’t make significant changes to your policy, Erie will keep your insurance rates the same.

- Excellent Customer Service: Erie has a reputation for offering some of the best customer service on the market.

- YourTurn: Save up to 30% on your teen insurance with YourTurn. Learn more about YourTurn in our Erie auto insurance review.

Cons

- Fewer Discounts: Erie Insurance does not have the extensive selection of discounts many of its competitors offer.

- Online Service Limited: Erie doesn’t have the robust digital tools that teen drivers will likely expect.

Teen Auto Insurance Rates in Georgia by Provider

The best car insurance for young drivers in Georgia isn’t necessarily the most expensive. Many teens choose a policy that only meets Georgia minimum auto insurance requirements to save as much as possible.

This comparison table highlights monthly premiums for teen driver auto insurance in Georgia, showcasing both minimum and full coverage rates from top providers.

Teen Driver Auto Insurance in Georgia: Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $204 | $769 | |

| $467 | $305 |

| $308 | $750 | |

| $135 | $412 | |

| $356 | $1,050 |

| $301 | $453 |

| $148 | $778 | |

| $132 | $571 | |

| $372 | $950 | |

| $209 | $595 |

Companies like State Farm and Geico offer the most affordable options, starting at just $132 per month for minimum coverage, while Travelers and Erie have higher rates, especially for full coverage.

Use this data to compare and choose the best plan for your budget and coverage needs.

How to Compare Teen Auto Insurance Rates in Georgia

Comparing quotes from multiple providers who offer cheap auto insurance for young drivers will help you find the cheapest auto insurance in Georgia. Companies like Geico often offer cheaper insurance for teenage drivers than the competition, making Geico a smart choice for cheap car insurance for teens.

data-media-max-width=”560″>

When your child goes away to college, there are options to lower your insurance premiums. Here’s how: https://t.co/RaefBSO3Ty#carinsurance pic.twitter.com/9M1Zk15gbP

— State Farm (@StateFarm) October 8, 2024

Whether you’re a teen or a first-time driver, there are plenty of options for affordable car insurance for new drivers to help you stay protected without overspending. Check the table below to see how much car insurance for teens might cost based on their driving records.

Georgia Auto Insurance Monthly Rates by Age, Gender & Driving Record

| Age & Gender | Speeding Ticket | At-Fault Accident | DUI/DWI |

|---|---|---|---|

| 16-Year-Old Female | $780 | $949 | $1,017 |

| 16-Year-Old Male | $863 | $1,050 | $1,125 |

| 17-Year-Old Female | $736 | $896 | $960 |

| 17-Year-Old Male | $816 | $994 | $1,065 |

| 18-Year-Old Female | $546 | $665 | $713 |

| 18-Year-Old Male | $666 | $810 | $869 |

| 19-Year-Old Female | $506 | $616 | $660 |

| 19-Year-Old Male | $610 | $742 | $795 |

| 20-Year-Old Female | $466 | $567 | $608 |

| 20-Year-Old Male | $558 | $679 | $728 |

| 21-Year-Old Female | $437 | $532 | $570 |

| 21-Year-Old Male | $518 | $630 | $675 |

Comparing Georgia car insurance prices is more important than ever if you have a teenage driver because the cost of coverage can vary considerably from company to company. Young drivers will find State Farm teen insurance among the cheapest auto insurance in GA, making it a common choice for budget-minded coverage.

While age and driving record are some of the most important factors in Georgia car insurance quotes, your ZIP code plays a crucial role, too.Eric Stauffer Licensed Insurance Agent

Your ZIP code is so important that it’s actually the first thing car insurance companies ask for when you fill out a quote request. See below how much drivers pay for insurance on average in your city. Teens typically see the highest rates in Atlanta, Georgia’s largest city. Georgia car insurance rate increases in Atlanta are due to more traffic and higher theft rates.

Georgia Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Athens | Atlanta | Augusta | Macon | Savannah |

|---|---|---|---|---|---|

| 16-Year-Old Female | $523 | $628 | $545 | $510 | $570 |

| 16-Year-Old Male | $585 | $702 | $609 | $570 | $637 |

| 25-Year-Old Female | $75 | $90 | $78 | $73 | $82 |

| 25-Year-Old Male | $78 | $94 | $82 | $76 | $86 |

| 35-Year-Old Female | $56 | $68 | $59 | $55 | $62 |

| 35-Year-Old Male | $56 | $68 | $59 | $55 | $62 |

| 60-Year-Old Female | $56 | $68 | $59 | $55 | $62 |

| 60-Year-Old Male | $56 | $68 | $59 | $55 | $62 |

Although teen rates are high, shopping at companies with the cheapest teen auto insurance will help you save. If possible, teens can also save by joining an existing family policy.

Whether searching for auto insurance for young drivers or simply seeking inexpensive auto insurance for 18-year-olds, State Farm offers competitive prices and discounts to get monthly premiums down without skipping out on coverage that’s critical to protecting young drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Adding Georgia Teen Drivers to a Parent’s Policy

Getting auto insurance for teen drivers can be expensive, especially since the legal driving age in Georgia starts at 16. A parent or guardian can help a new driver save significantly by adding a teen to your auto insurance policy.

The best car insurance for 18-year-olds often comes from providers that offer discounts for good grades, safe driving, or completing driver’s education. Check below to get an idea of how much teens can save by joining a family policy.

Georgia Auto Insurance Monthly Rates by Age, Gender, & Policy Type

| Age & Gender | Individual Policy | Parent's Policy |

|---|---|---|

| 16-Year-Old Female | $678 | $407 |

| 16-Year-Old Male | $750 | $450 |

| 17-Year-Old Female | $640 | $384 |

| 17-Year-Old Male | $710 | $426 |

| 18-Year-Old Female | $475 | $285 |

| 18-Year-Old Male | $579 | $347 |

| 19-Year-Old Female | $440 | $264 |

| 19-Year-Old Male | $530 | $318 |

| 20-Year-Old Female | $405 | $243 |

| 20-Year-Old Male | $485 | $291 |

| 21-Year-Old Female | $380 | $228 |

| 21-Year-Old Male | $450 | $270 |

Parents and guardians must realize adding a teen risks their auto insurance rates. If your teenager is a reckless driver or has accidents under your policy, you’re rates will go up as well. Shopping around for insurance specifically geared toward teenage drivers is a good way to find the lowest rates for teens.

Many companies offer the cheapest auto insurance for new drivers or the cheapest auto insurance for young men through family policies or usage-based programs, helping teens access better auto insurance rates without compromising coverage.

How to Lower Your Georgia Teen Auto Insurance Rates

The best car insurance in Georgia for young drivers often comes from a cheap insurance company that offers generous young drivers insurance discounts. Teens have to pay higher insurance prices, but there are plenty of steps you can take to get lower Georgia car insurance rates.

For starters, the Georgia auto insurance companies list of those offering teen driver discounts is long. Below, you’ll find a list of teen discounts offered by our top companies. Many insurance companies in Georgia provide competitive rates and tailored teenage driving insurance options to help lower costs.

Auto Insurance Discounts From the Top Providers for Georgia Teen Coverage

| Insurance Company | Savings Potential | Available Discount |

|---|---|---|

| 20% | Bundling | |

| 10% | Defensive Driving |

| 18% | Homeowners | |

| 15% | Good Driver | |

| 10% | Student |

| 10% | Accident-Free |

| 12% | Safe Driver | |

| 10% | Multi-Policy | |

| 15% | Hybrid/Electric Car | |

| 25% | Military |

Most insurance companies require proof before teen driver insurance discounts will apply to your account. For example, teens figuring out how to get a defensive driver discount will need to submit proof of course completion to earn the discount.

Other options to keep your rates low include:

- Find Other Discounts: Most insurance companies offer 10 or more discounts to help drivers save.

- Lower Your Coverage: Choosing a policy with less coverage will lower your rates, but your vehicle won’t be as protected.

- Add Teens to Existing Policies: A parent or guardian adding a teen to their policy can cut rates for auto insurance for new drivers in half.

- Increase Your Deductible: Choosing a higher deductible will lower your monthly premium, but you’ll have to pay more if you need to file a claim.

Several top providers deliver budget-friendly coverage without sacrificing quality for those seeking the cheapest car insurance for drivers under 25. Whether you’re a new driver or a college student, the best car insurance in Georgia for young adults combines affordability with reliable protection.

State Farm offers lower teen rates with good student and driver’s ed discounts, helping meet Georgia’s minimum coverage and save money.Aremu Adams Adebisi Feature Writer

While the steps listed above are great tips, the most crucial step in getting affordable coverage as a teen driver is comparing quotes. If you don’t compare quotes, you’ll probably overpay for your insurance.

Get the Cheapest Teen Driver Auto Insurance in Georgia Today

State Farm, Geico and Progressive provide the cheapest teen driver auto insurance in Georgia. It starts at only $132 a month, and discounts are available for drivers with good grades, those enrolled in driver’s ed, and safe drivers.

Whether it’s getting a driver’s ed auto insurance discount or raising your deductible, there are plenty of ways to save on your Georgia auto insurance. However you decide to save on your insurance, make sure to compare quotes with as many car insurance companies as possible.

Enter your ZIP code to see how much you might pay in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Does adding a teen to a parent’s policy lead to cheap car insurance for teens?

Yes, joining a parent’s policy is typically much cheaper than purchasing a separate policy for a teen.

How do age and experience impact auto insurance for teenagers?

Teenagers typically face the highest auto insurance rates due to limited driving experience and a statistically higher risk of accidents, making them more expensive to insure than older, more experienced drivers.

Stop overpaying for teen auto insurance in Georgia. Enter your ZIP code to see if you qualify for a better rate today.

How much does an 18-year-old typically pay for car insurance in Georgia?

An 18-year-old in Georgia can expect to pay around $263 per month for liability auto insurance coverage and up to $527 per month for full coverage, depending on driving history, vehicle type, and location.

Can a 17-year-old get their own car insurance policy?

Yes, a 17-year-old can legally obtain their own car insurance policy in most states, but it often requires a parent or guardian to co-sign the policy if the teen is under 18, and standalone teen policies tend to be more expensive.

How do insurance providers determine the cheapest cars to insure for 17-year-olds?

Insurers consider factors like crash test ratings, theft statistics, repair costs, and historical claim data to determine how risky a vehicle is, which directly impacts premium prices for teen drivers.

Why is teenage driver insurance more expensive than adult coverage?

Teenage driver insurance is typically more expensive because insurers classify young drivers under high-risk auto insurance due to their inexperience and a higher likelihood of accidents and traffic violations.

How much is car insurance in GA for a 16-year-old with minimum coverage?

Car insurance in GA for a 16-year-old with minimum coverage typically costs around $270 per month, though rates vary depending on the insurer, ZIP code, and whether the teen is added to a parent’s policy.

Who qualifies for the cheapest full coverage car insurance rates in Georgia?

Drivers with a clean driving record, high credit score, and no prior claims are more likely to qualify for the lowest full coverage rates. Discounts for safe driving, bundling policies, and vehicle safety features can also lower costs.

Does cheap car insurance still provide adequate coverage?

Yes, but it often only includes basic liability; consider adding collision auto insurance or comprehensive coverage for better protection against vehicle damage.

How to find the best auto insurance for under 25 with a clean driving record?

Young drivers under 25 with clean driving records could often earn lower rates by comparing quotes from the top providers and finding good student and safe driver discounts.

Can I get affordable car insurance for new drivers over 21 with no prior driving history?

Yes, but it may be more expensive initially. Insurance companies often consider new drivers to be higher-risk, even at age 21 or older. Shopping around and comparing quotes is crucial to finding affordable rates.

Is it cheaper to add car insurance for 16-year-olds to a parent’s policy?

Yes, adding cheap auto insurance for 16-year-olds to a parent’s existing policy is usually much more affordable than getting a separate one, often lowering costs and unlocking multi-driver or family discounts.

Who provides the cheapest car insurance in Georgia for military families?

USAA consistently offers the cheapest car insurance for military members, veterans, and their families in Georgia. USAA combines low rates with excellent customer service and exclusive military benefits, but eligibility is limited to those with a military affiliation.

Can you get full coverage car insurance for teenage drivers, and is it worth it?

Yes, full coverage car insurance for teenage drivers is available and often recommended if the teen is driving a newer or financed vehicle. While more expensive than minimum coverage, full coverage includes collision and comprehensive protection, offering peace of mind for new drivers.

What are the minimum requirements for car insurance Georgia drivers must carry?

Car insurance Georgia laws require at least $25,000 in bodily injury per person, $50,000 per accident, and $25,000 for property damage. Georgia minimum auto insurance requirements may not cover all costs in major accidents, so higher coverage is often recommended.

Get cheap teen auto insurance in Georgia today with our quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.