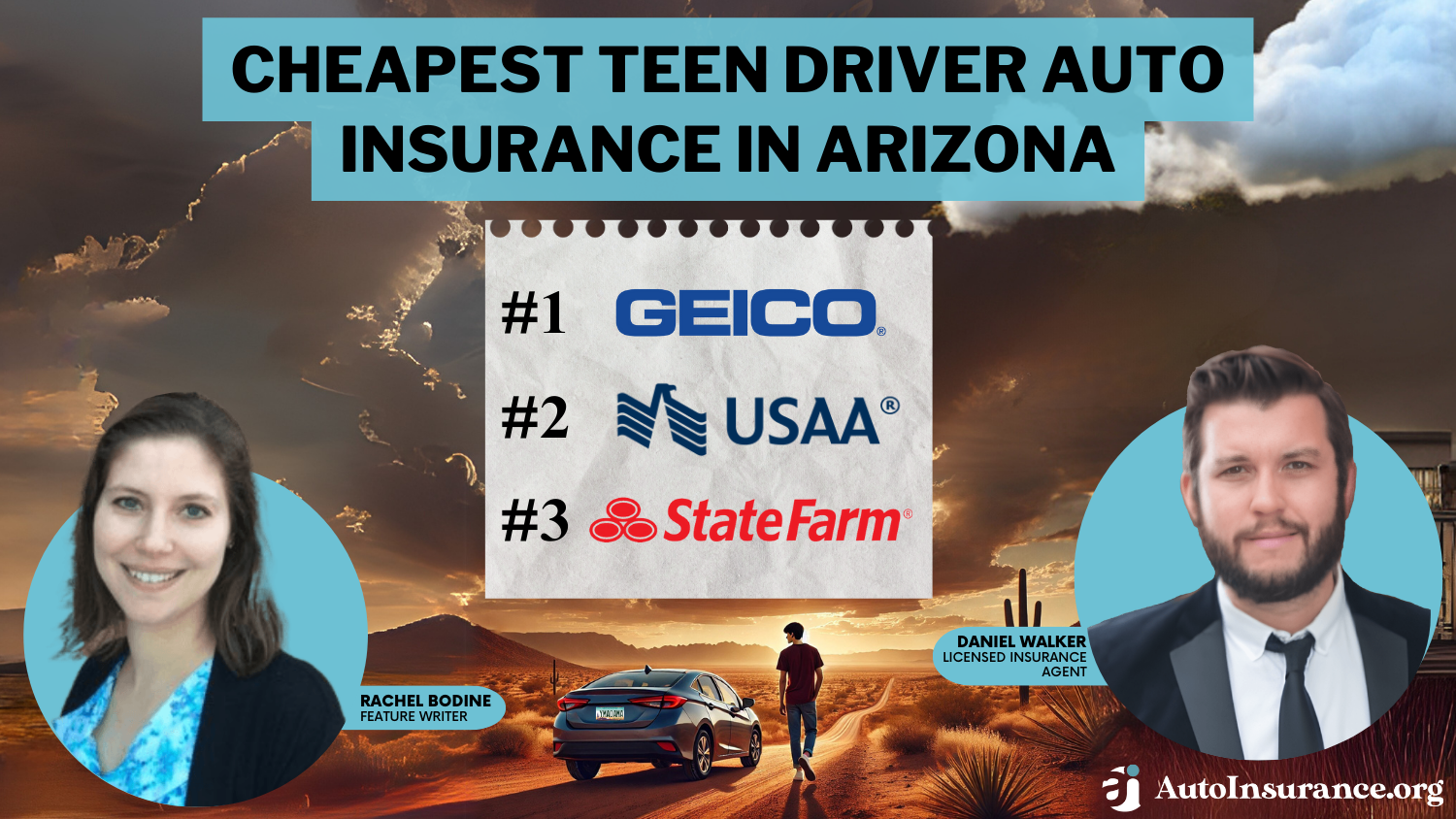

Cheapest Teen Driver Auto Insurance in Arizona for 2025 (10 Most Affordable Companies)

Geico, USAA, and State Farm offer the cheapest teen driver auto insurance in Arizona, starting at $121 per month. These insurers offer discounts for good students, military families, and safe drivers, as well as accident forgiveness and driver training benefits to help AZ teens lower insurance costs.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage for AZ Teens

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage for AZ Teens

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviews 18,154 reviews

18,154 reviewsCompany Facts

Min. Coverage for AZ Teens

A.M. Best Rating

Complaint Level

Pros & Cons

18,154 reviews

18,154 reviewsGeico, USAA, and State Farm provide the cheapest teen driver auto insurance in Arizona, with rates starting at $121 per month for minimum coverage.

Teen drivers face a high auto insurance premium due to inexperience, increased accident risk, and costly claims.

Our Top 10 Company Picks: Cheapest Teen Driver Auto Insurance in Arizona

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $121 | A++ | Cheap Rates | Geico | |

| #2 | $186 | A++ | Military Savings | USAA | |

| #3 | $197 | B | Many Discounts | State Farm | |

| #4 | $228 | A++ | Accident Forgiveness | Travelers | |

| #5 | $268 | A+ | Usage Discount | Nationwide |

| #6 | $279 | A | Student Savings | American Family | |

| #7 | $403 | A+ | Add-on Coverages | Allstate | |

| #8 | $427 | A+ | Online Convenience | Progressive | |

| #9 | $450 | A | Customizable Polices | Liberty Mutual |

| #10 | $510 | A | Local Agents | Farmers |

However, the right provider lowers costs with discounts, safe driving programs, bundling, and accident forgiveness while promoting responsible driving.

Start saving on your Arizona auto insurance by entering your ZIP code and comparing quotes.

- Geico offers top rates for good students and safe drivers, maximizing teen savings

- The cheapest teen driver auto insurance in Arizona starts at $121 per month

- Teen drivers save with good student discounts, accident forgiveness, and bundling

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – Geico: Top Overall Pick

Pros

- Affordability: Geico offers low cheap car insurance for teenagers in Arizona. See what affordable car insurance in Arizona looks like for you in our Geico auto insurance review.

- DriveEasy: Young drivers can earn a discount of up to 25% by enrolling in Geico’s UBI program DriveEasy and consistently driving safely.

- Young Driver Discounts: With 16 discounts, getting affordable Geico teenage driver insurance costs is easy. Geico discounts include savings for maintaining good grades.

Cons

- Mixed Customer Service Reviews: Geico offers affordable insurance, but many complain about its claims process.

- Limited Agents: Understanding car insurance can be difficult, especially for teens. Unfortunately, Geico does not have the most agents available to help.

#2 – USAA: Best for Military Savings

Pros

- Low Rates: USAA is usually the cheapest Arizona car insurance for teen drivers of all ages. See how USAA offers the cheapest car insurance in AZ in our USAA auto insurance review.

- Excellent Customer Service: Arizona auto insurance laws can be confusing, but USAA’s experts are ready to help.

- Good Student Savings: USAA offers 14 discounts, including savings for students with a 3.0+ GPA, lowering rates in Arizona.

Cons

- Membership Requirements: You have to be a USAA member to buy car insurance from USAA. Only active or retired military members and their direct families are eligible for membership.

- Limited Local Offices: USAA maintains fewer brick-and-mortar stores to help keep rates low. Drivers who want ease of access to an office might be more comfortable elsewhere.

#3 – State Farm: Best for Student Driver Discounts

Pros

- Young Driver Safety Program: Teens can find cheap car insurance for new drivers under 21 by completing the Teen Safe Driver program with State Farm.

- Student Discounts: State Farm helps young drivers save with good student, driver education, and away-at-school discounts.

- Drive Safe & Save: Young drivers can save up to 30% with State Farm’s Drive Safe & Save program. See if Drive Safe & Save is right for you in our State Farm auto insurance review.

Cons

- Limited Digital Tools: Teens looking to manage their insurance policies online won’t find the best digital tools with State Farm.

- Fewer Coverage Options: If you’re looking for an Arizona auto insurance company with tons of add-on options, State Farm isn’t the best choice.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Travelers: Best for Teen Driving Support

Pros

- Supportive Representatives: Travelers representatives have the knowledge and experience young drivers need to get the most out of their coverage.

- IntelliDrive: Save up to 30% with IntelliDrive, Travelers’ UBI program. See if IntelliDrive would suit your driving habits in our Travelers auto insurance review.

- Ways to Save: With 17 available discounts, meeting Arizona car insurance requirements at an affordable price is easy with Travelers.

Cons

- Service Reviews Vary: Some Phoenix drivers say they are completely happy with their Travelers policy, while others are less satisfied. Complaints mainly focus on the claims process.

- Fewer Digital Options: Travelers is one of many insurance companies that seem to lag in digital innovation. If online policy management is important to you, you might want to try a different company.

#5 – Nationwide: Best for Accident Forgiveness

Pros

- Coverage Options: Nationwide offers add-ons like accident forgiveness to keep Arizona teen rates low.

- SmartRide: Nationwide’s SmartRide can cut teen driver rates by up to 40%. Check our Nationwide auto insurance review to see if SmartRide can lower teen auto insurance costs.

- Discount Opportunities: Get cheap car insurance in Arizona by taking advantage of Nationwide’s 11 discounts. Teens can find cheap auto insurance in AZ with Nationwide’s good student discount.

Cons

- Fewer Digital Tools: Nationwide prioritizes human interaction over digital tools, offering limited online options.

- Average Rates: Nationwide might offer affordable car insurance in AZ for teens, but it’s often a more expensive option for other drivers. It might not be the best option for families.

#6 – American Family: Best for Young Volunteers

Pros

- KnowYourDrive: Most Arizona car insurance providers offer a UBI program to help safe drivers save, and American Family is no different. Teens can save 30% by consistently practicing safe habits.

- Teen Driver Discounts: American Family offers teen discounts in Arizona, including savings for young volunteers. See how you can save in our American Family auto insurance review.

- Teen Safe Driver Program: American Family offers Arizona teens a discount for completing a safe driving course.

Cons

- Slow Claims: It might be one of the cheapest places for insurance for a 16-year-old in Arizona, but many customers report being unsatisfied with the claims process.

- Limited Availability: American Family sees insurance in just 19 states. You might need a new insurance policy if you move to an uncovered state for college.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Allstate: Best for Full Coverage Policies

Pros

- Tons of Coverage Options: Allstate offers a variety of coverage options so you can find the best auto insurance for teens. Popular options include roadside assistance and accident forgiveness.

- UBI Savings: Allstate’s Milewise and Drivewise help safe drivers save but may require experience. Pick the best plan for you in our Allstate auto insurance review.

- TeenSMART: TeenSMART offers interactive driving tips and can lower Arizona auto insurance costs.

Cons

- Low Claims Satisfaction: Phoenix drivers often give Allstate less than satisfactory ratings on its claims handling process.

- Higher Premiums: Allstate is one of the priciest options, making it harder to add a teen to a policy. For the cheapest car insurance in Arizona for families, it’s likely not the best choice.

#8 – Progressive: Best for Phoenix Teens on a Budget

Pros

- Teen Discounts: Progressive has 13 discounts to help young drivers find low Arizona car insurance quotes, including a few just for teens.

- Name Your Price Tool: Enter your monthly budget into the Name Your Price tool to see coverage options that fit. Explore all of Progressive’s innovative online tools in our Progressive auto insurance review.

- Snapshot: Enroll in Snapshot to save up to 30% on your insurance. However, you should be aware that your rates can increase with Snapshot if you don’t drive safely enough.

Cons

- Low Customer Loyalty: Progressive may have some of the best auto insurance in Arizona for young drivers, but it struggles to retain customers.

- Unexpected Price Hikes: Phoenix drivers report that Progressive has unexpectedly raised their rates without an obvious cause.

#9 – Liberty Mutual: Best for Unique Coverage Options

Pros

- RightTrack: Liberty Mutual is one of many Arizona auto insurance companies that offers UBI savings. Teens can enroll and lower their rates by 30% by practicing safe driving habits.

- Unique Coverage: Get cheap teen car insurance quotes with extra coverage by adding Liberty Mutual add-ons. Popular options include original parts replacement insurance and accident forgiveness.

- 24/7 Support: Teens can call Liberty Mutual’s 24/7 hotline whenever they need it, no matter what time.

Cons

- Claims Issues: Many Liberty Mutual customers complain that the claims process can be slow. See what else customers have to say in our Liberty Mutual auto insurance review.

- Higher Than Average Rates: Compare Liberty Mutual’s teen auto insurance rates, as they’re often above average.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Farmers: Best Discount Selection for Teens

Pros

- Ample Discounts: Farmers offers 23 discounts to help drivers save, including several designed just for teens. Learn more in our Farmers auto insurance review.

- Solid Add-On Selection: You can exceed Arizona’s minimum coverage with options like glass and equipment insurance.

- Helpful Representatives: Farmers representatives are known for their knowledge of insurance and are especially ready to help young drivers.

Cons

- Slow Roadside Assistance: Roadside assistance is an excellent add-on for teens, but many Phoenix drivers report excessive wait times with Farmers’ emergency help.

- Limited Digital Options: Farmers focuses more on agent-customer interaction, so it doesn’t have all the digital tools that many other companies do.

Arizona Auto Insurance Laws and Requirements

While it doesn’t offer the best protection, many teen drivers choose to purchase the bare Arizona minimum auto insurance requirements. Purchasing a policy that only meets Arizona auto insurance requirements is a great way to find low-cost coverage.

Arizona has relatively low insurance requirements. All you need to legally drive in Arizona is a 25/50/15 liability plan.Jeff Root Licensed Insurance Agent

However, minimum insurance leaves your car unprotected. You should compare the benefits of more coverage with the savings of a minimum insurance policy – check below to see average rates for each.

Arizona Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $272 | $794 |

| 16-Year-Old Male | $307 | $571 |

| 17-Year-Old Female | $182 | $502 |

| 17-Year-Old Male | $207 | $543 |

| 18-Year-Old Female | $221 | $520 |

| 18-Year-Old Male | $263 | $618 |

| 19-Year-Old Female | $145 | $340 |

| 19-Year-Old Male | $173 | $405 |

| 20-Year-Old Female | $135 | $315 |

| 20-Year-Old Male | $160 | $370 |

| 21-Year-Old Female | $67 | $178 |

| 21-Year-Old Male | $74 | $197 |

As you can see, finding affordable auto insurance for drivers under 25 is more difficult than it is for older adults. Purchasing the minimum amount of coverage you need can help you get affordable insurance for a 16-year-old in Arizona.

Arizona Teen Driver Auto Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $403 | $718 | |

| $279 | $497 | |

| $510 | $909 | |

| $121 | $215 | |

| $450 | $804 |

| $268 | $477 |

| $427 | $760 | |

| $197 | $352 | |

| $228 | $406 | |

| $186 | $333 |

When it comes to finding affordable auto insurance for teenage drivers in Arizona, several options stand out for their budget-friendly rates. When it comes to the cheapest auto insurance companies, Geico leads the pack, starting at just $121 for minimum coverage and $215 for full coverage.

USAA follows closely behind, offering rates starting at $186 for minimum coverage and $333 for full coverage. State Farm also presents a competitive choice, with minimum coverage starting at $197 and full coverage at $352. These insurers understand the financial challenges young drivers face and provide tailored coverage options to ensure both safety and affordability on the road.

Teen Driver Auto Insurance Rates in Arizona

While there are several factors that affect auto insurance rates, teen drivers always pay more for coverage than older, more experienced drivers. However, some teen drivers pay more than others. For example, it’s a lot easier to find cheap auto insurance for a 16-year-old when they have a clean record.

Arizona Auto Insurance Monthly Rates by Age, Gender, & Driving Record

| Age & Gender | Speeding Ticket | At-Fault Accident | DUI/DWI |

|---|---|---|---|

| 16-Year-Old Female | $582 | $634 | $794 |

| 16-Year-Old Male | $628 | $685 | $857 |

| 17-Year-Old Female | $552 | $603 | $753 |

| 17-Year-Old Male | $597 | $651 | $815 |

| 18-Year-Old Female | $411 | $448 | $561 |

| 18-Year-Old Male | $490 | $534 | $668 |

| 19-Year-Old Female | $374 | $408 | $510 |

| 19-Year-Old Male | $446 | $486 | $608 |

| 20-Year-Old Female | $347 | $378 | $473 |

| 20-Year-Old Male | $407 | $444 | $555 |

| 21-Year-Old Female | $319 | $348 | $435 |

| 21-Year-Old Male | $374 | $408 | $510 |

These price differences highlight why it’s so important to compare auto insurance rates with multiple companies. Some companies offer better prices than others to drivers with traffic infractions – you’ll likely overpay for your insurance if you don’t compare quotes. See how much the average driver pays in your city below.

Arizona Auto Insurance Monthly Rates by Age, Gender, & City

| Age & Gender | Mesa | Phoenix | Scottsdale | Tempe | Tucson |

|---|---|---|---|---|---|

| 16-Year-Old Female | $550 | $580 | $560 | $570 | $540 |

| 16-Year-Old Male | $600 | $630 | $610 | $620 | $590 |

| 17-Year-Old Female | $520 | $550 | $530 | $540 | $510 |

| 17-Year-Old Male | $570 | $600 | $580 | $590 | $560 |

| 18-Year-Old Female | $490 | $520 | $500 | $510 | $480 |

| 18-Year-Old Male | $540 | $570 | $550 | $560 | $530 |

| 19-Year-Old Female | $460 | $490 | $470 | $480 | $450 |

| 19-Year-Old Male | $510 | $540 | $520 | $530 | $500 |

| 20-Year-Old Female | $430 | $460 | $440 | $450 | $420 |

| 20-Year-Old Male | $480 | $510 | $490 | $500 | $470 |

| 21-Year-Old Female | $400 | $430 | $410 | $420 | $390 |

| 21-Year-Old Male | $450 | $480 | $460 | $470 | $440 |

Phoenix teens typically have the highest insurance rates in Arizona, while getting cheap car insurance in Tempe, AZ, is a bit easier. There are numerous reasons auto insurance costs more for young drivers in Phoenix, but the primary causes are more traffic, car thefts, and accidents. On the other hand, finding cheap car insurance in Scottsdale is a bit more difficult because of the higher average cost of repairs in the area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Adding a Teen to a Parent’s Policy in Arizona

Finding cheap auto insurance for 17-year-olds and other teens can be challenging, but there’s a simple way to help get the cheapest insurance for teens: add them to an existing policy.

Most insurance companies make adding a new driver to a parent or guardian’s policy easy, and it can save teenagers up to 50% of what they’d normally pay. Check the rates below to see the price differences between adding a teen to your policy vs. getting them their own plan.

Arizona Auto Insurance Monthly Rates by Age, Gender, & Policy Type

| Age & Gender | Individual Policy | Parent's Policy |

|---|---|---|

| 16-Year-Old Female | $529 | $265 |

| 16-Year-Old Male | $571 | $286 |

| 17-Year-Old Female | $502 | $251 |

| 17-Year-Old Male | $543 | $272 |

| 18-Year-Old Female | $374 | $187 |

| 18-Year-Old Male | $445 | $223 |

| 19-Year-Old Female | $340 | $170 |

| 19-Year-Old Male | $405 | $203 |

| 20-Year-Old Female | $315 | $158 |

| 20-Year-Old Male | $370 | $185 |

| 21-Year-Old Female | $290 | $145 |

| 21-Year-Old Male | $340 | $170 |

Adding a driver to auto insurance is a great idea if you have a young driver in your house, especially since you can get cheap car insurance for drivers under 21 this way.

However, you should be aware that their driving habits will impact your rates. If a teen on your policy gets into an accident or gets a speeding ticket, your rates will increase.

Arizona Auto Insurance Savings Strategies for Young Drivers

Teen rates are high, but there are plenty of ways to find low-cost teenage car insurance, especially if you qualify for low-income car insurance in AZ. For starters, teens should seek out auto insurance discounts that are friendly toward young drivers. Popular options include savings for maintaining good grades and taking driver education courses. Improving driving skills is also a great way to keep rates low.

However, discount availability varies by company. Check below to see what’s available from the top 10 providers offering low-cost car insurance in Arizona for teen drivers.

Cheapest Teen Driver Auto Insurance in Arizona

| Insurance Company | Available Discounts | Percentage of Discounts |

|---|---|---|

| Smart Student, Drivewise, TeenSMART | 20% | |

| Good Student, Teen Safe Driver, Defensive Driving | 25% | |

| Good Student, Teen Driver, Distant Student | 25% | |

| Good Student, Driving Course, Membership or Employee | 25% | |

| Good Student, Student Away at School, Driver Training | 35% |

| Good Student, Accident-Free, Defensive Driving | 10% |

| Good Student, Teen Driver, Distant Student | 10% | |

| Steer Clear, Good Student, Student Away at School | 25% | |

| Good Student, Student Away at School, Driver Training | 8% | |

| Good Student, Driver Training, Safe Driving | 10% |

Getting a teen discount is a great way to get the best car insurance for teen drivers, but most require proof. For example, many teens ask if auto insurance companies check grades before giving a good student discount. For driver’s education discounts, you’ll need to submit proof of course completion.

Your insurance company won’t check your grades itself, but it will likely require that you submit proof. You’ll have to submit proof after you sign up for a policy, as there’s generally no option to state your grades when requesting a quote, as seen below. You can also try the following tips to keep your rates low:

- Raise your deductible. Your deductible is the portion you pay before your insurance kicks in. If you want cheap auto insurance in Arizona, a higher deductible will lower your monthly premiums.

- Lower your coverage. If getting the cheapest possible insurance is your goal, choosing Arizona minimum insurance is your least expensive option.

- Add your teen to your policy. As you saw above, adding a teen can cut insurance rates in half.

- Find discounts. Aside from teen discounts, insurance companies offer savings for things like being a safe driver or having safety features in your car.

Of course, the most essential step to finding cheap coverage is to compare rates. It’s almost impossible to find the companies with the cheapest teen auto insurance without comparing rates.

3 Case Studies: Navigating Teen Auto Insurance in Arizona

As teens start to experience this rite of passage of getting their driver’s license, families cope with figuring out how to get affordable and comprehensive auto insurance. In Arizona, where finding the cheapest insurance for teenage drivers can be particularly difficult, finding the right coverage is essential.

- Case Study #1 — Navigating Teen Insurance: USAA’s affordable rates, starting at $186 per month for minimum coverage, gave Mark’s family peace of mind for their teen driver.

- Case Study #2 — Empowering Teens to Drive Safely: The Andersons chose Geico for Sarah’s 16th birthday, starting at $121/month. She used the DriveEasy app to drive safely and earn discounts.

- Case Study #3 — Protecting Teen Drivers in Style: Emily felt confident as a new driver with Liberty Mutual’s tailored coverage, accident forgiveness, and rates from $450 per month.

From finding affordable rates to prioritizing safe driving habits, these case studies highlight the importance of proactive insurance choices for teen drivers in Arizona.

As a feature writer, I’ve found that accident forgiveness and student discounts help families save while keeping teen drivers properly covered.Aremu Adams Adebisi Feature Writer

Whether through innovative solutions from Geico, renowned providers like USAA, or personalized options from Liberty Mutual, families can navigate the road ahead confidently, giving their teen drivers the best chance to find cheap Arizona auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Find the Cheapest Teen Driver Auto Insurance Companies in Arizona

The cheapest teen driver auto insurance in Arizona starts at $121 per month, with Geico, USAA, and State Farm offering the best affordable rates. No matter which you purchase, finding affordable rates for Arizona teens isn’t an impossible challenge.

Whether you need insurance for a 17-year-old in Arizona or coverage for a senior citizen, comparing quotes is the most important step you can take.

You have an idea of which companies have low-cost car insurance in Arizona for teens, but they may not be the cheapest for you. Enter your ZIP code into our free comparison tool to see which companies offer the lowest rates for you.

Frequently Asked Questions

Who has the cheapest car insurance in Arizona?

While it depends on your unique circumstances, our research shows that USAA, Geico, and Liberty Mutual have the cheapest auto insurance for teens in Arizona.

Is car insurance cheaper in Arizona than in California?

Arizona drivers tend to pay less than Californians for their car insurance. However, you should always compare rates to ensure you find the cheapest rates, no matter where you live. To see how much you might pay for insurance in your area, enter your ZIP code into our free comparison tool.

What age is Arizona auto insurance cheapest?

Auto insurance rates by age can vary significantly when factors like ZIP code or driving record are considered, but drivers between the ages of 35 and 55 typically see the lowest rates. While finding affordable car insurance for teenagers in Arizona can be challenging, older residents usually have a much easier time.

How much is insurance for an 18-year-old in Arizona?

Wondering, “How much is insurance for a new driver under 18?” The average 18-year-old driver pays $121 for minimum car insurance and $215 for full coverage auto insurance.

How much is car insurance in Arizona for a 20-year-old?

The average 20-year-old driver pays $45 for minimum car insurance and $97 for full coverage auto insurance.

How much is car insurance in AZ for a 16-year-old

The average 16-year-old driver pays $121 for minimum car insurance and $214 for full coverage auto insurance.

Does cheap full coverage auto insurance in AZ include roadside assistance?

Some insurers include roadside assistance, but it’s often an optional add-on, so check policy details before purchasing.

Is Allstate cheaper than Geico auto insurance in Arizona?

No matter what type of driver you are, Allstate is almost always one of the most expensive options for car insurance. On the other hand, Geico is frequently one of the top choices for cheap full coverage auto insurance in AZ.

Does driving school lower teen driver auto insurance in Arizona?

Many companies offer a discount for completing a driver’s education course. The best driver’s ed auto insurance discounts help you get the lowest car insurance in Arizona and teach teens valuable driving skills.

Why is affordable car insurance for teenagers more expensive than for adults?

Teen drivers face higher rates due to inexperience, increased accident risk, and costly claims.

How much car insurance should I have in Arizona?

In Arizona, you must meet the minimum liability requirement of 25/50/15. Other coverage types, like collision and comprehensive, are optional but add significant value to your policy.

Who is cheaper in Arizona, Geico or Progressive?

While Progressive is a solid Arizona option, Geico teenage car insurance rates tend to be cheaper overall. However, drivers who need high-risk auto insurance will likely find cheaper rates with Progressive. However, if you need low-income car insurance in AZ, you have a good chance at finding affordable coverage with both companies.

Can I get cheap car insurance in Tempe, AZ with a low credit score?

Some insurers offer affordable rates despite low credit, but improving your score can help reduce premiums.

What discounts does Geico offer for adding a teenage driver?

Geico provides good student discounts, driver training savings, and multi-vehicle discounts to lower teen insurance costs.

Do I have to add my child to my auto insurance in Arizona?

Insurance companies require that you add any licensed driver living in your house to your policy, with the exception of roommates. The good news is that adding a teen is usually straightforward. Typically, you can buy auto insurance for someone else when they’re not present if you add them to your policy.

Can you go to jail for driving without insurance in Arizona?

You won’t go to jail specifically for driving without insurance, but you can have your license suspended. If you drive with a suspended license in Arizona, you’ll face jail for up to six months. Finding cheap auto insurance for teenagers might be difficult in some cases, but it’ll cost you less than having your license suspended for driving without coverage.

Does driving less help get the lowest auto insurance in Arizona?

Low-mileage drivers can qualify for usage-based or pay-per-mile policies, reducing costs significantly.

Does insurance follow the car or the driver in Arizona?

Unless you have non-owners auto insurance, insurance follows the car in Arizona. Non-owner insurance is a better option than trying to find temporary car insurance in AZ because you can maintain consistent coverage. Your insurance history affects your rates, so you should keep a policy if possible.

Which cars are the cheapest to insure in Arizona?

The cheapest cars to insure in Arizona are the Subaru Outback, Honda CR-V, Toyota RAV4, Mazda CX-5, Jeep Wrangler, and Ford Explorer. Driving one of these cars makes finding cheap car insurance for Arizona drivers a little easier.

Does Geico teenage car insurance offer good student discounts?

Yes, Geico discounts students with a B average or higher, helping young drivers save on their premiums.

Is full coverage affordable with cheap car insurance in Scottsdale?

Full coverage costs more but can be affordable by selecting higher auto insurance deductibles and applying available discounts.

Which vehicles are the cheapest cars to insure in Arizona for teen drivers?

Due to their safety ratings and low repair costs, the cheapest cars to insure in Arizona for teens include the Honda Civic, Toyota Corolla, Subaru Outback, and Mazda CX-5.

Find the best auto insurance company in Arizona by entering your ZIP code into our free quote tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.