Cheapest Teen Driver Auto Insurance in Nevada (10 Most Affordable Companies in 2025)

The top picks for the cheapest teen driver auto insurance in Nevada are State Farm, USAA, and Geico. Nevada teen auto insurance rates start as low as $69/month with State Farm, but USAA and Geico offer competitive discounts and safe driving incentives to keep teen driver insurance costs affordable.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Oct 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Min. Coverage in Nevada

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Nevada

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Nevada

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for the cheapest teen driver auto insurance in Nevada are State Farm, USAA, and Geico, with rates starting as low as $69/month.

State Farm stands out for its competitive pricing and teen driver education programs. USAA excels with its personalized policies for military families, while Geico offers attractive online and mobile app features young drivers are looking for.

Our Top 10 Company Picks: Cheapest Teen Driver Auto Insurance in Nevada

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $69 B Customer Service State Farm

#2 $100 A++ Military Families USAA

#3 $105 A++ Mobile App Geico

#4 $135 A++ Good Student Auto-Owners

#5 $175 A+ Local Agents American Family

#6 $177 A+ Roadside Assistance Nationwide

#7 $269 A High-Risk Policies The General

#8 $280 A+ Personalized Service Allstate

#9 $330 A Discount Variety Farmers

#10 $401 A++ Industry Experience Travelers

These providers offer the best combination of affordability and coverage options for cheap teen auto insurance in Nevada, ensuring that families can secure comprehensive protection without breaking the bank.

Enter your ZIP code into our free quote tool above to find the best NV auto insurance providers for your needs and budget.

- State Farm has the cheapest teen car insurance in Nevada

- The General has the best auto insurance for teen drivers with accidents

- Teens in Nevada pay more for car insurance than older drivers

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Cheap Teen Insurance Rates: State Farm is the cheapest Nevada teen auto insurance company with minimum rates starting at $69/month.

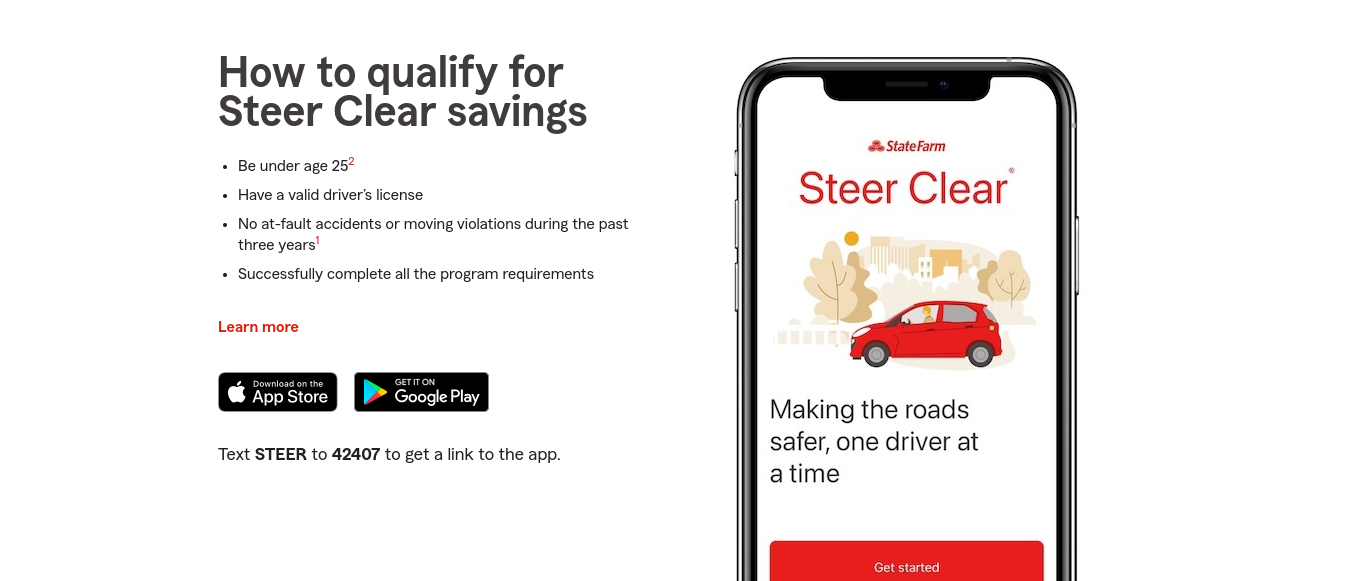

- Steer Clear Safe Driving Discount: What is the Steer Clear program from State Farm? Teen drivers can download the app to complete driving lessons and save up to 30% on Nevada car insurance.

- Excellent Claims Service: State Farm is among the top three companies for claim satisfaction in J.D. Power’s annual surveys.

Cons

- Low Financial Grade: State Farm’s A.M. Best Rating is a B, which is lower than most teen auto insurance companies in Nevada. Read our State Farm insurance review for full ratings.

- Limited Coverage Options for New Cars: Nevada teens driving new vehicles will have to find gap insurance with another company unless they finance their auto loan with State Farm.

#2 – USAA: Best for Military Families

Pros

- Customized Coverage: USAA’s personalized policies are tailored to meet the unique needs of military families in Nevada with teen drivers.

- Exclusive Military Benefits: Unique benefits for military families make USAA an attractive option for teen driver auto insurance in Nevada, which you can learn about in our USAA review.

- Superior Customer Service: USAA teen auto insurance is #1 for customer and claims satisfaction in Nevada.

Cons

- Member Eligibility Required: USAA teen driver auto insurance is restricted to active and retired military and their families.

- Fewer Physical Locations: Limited physical offices may affect the ability to get in-person assistance for teen driver auto insurance in Nevada.

#3 – Geico: Best Mobile App for Teen Drivers

Pros

- Affordable Rates: Geico offers competitive teen driver auto insurance rates in Nevada, starting at $105/month. For a complete list, read our Geico review.

- Comprehensive Online Tools: Geico’s strong online presence provides easy access to policy customization for teen drivers in Nevada and their parents.

- Streamlined Mobile App: Teen drivers in Nevada can quickly access their policy, learn about coverage, and file claims directly from their smartphone or tablet.

Cons

- Average Customer Service: Geico’s customer service is rated as average, which might affect the satisfaction of families seeking teen driver auto insurance in Nevada.

- High Rates for High-Risk Drivers: Teen drivers in Nevada with accidents or claims may face higher rates with Geico compared to other insurers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Auto-Owners: Best Good Student Discounts

Pros

- Good Student Discounts: Auto-Owners offers notable 20% discounts for good students, making teen driver auto insurance more affordable in Nevada.

- Educational Incentives: Offers financial rewards for good grades to help improve academic performance among teen drivers, specifically through teen driver auto insurance in Nevada.

- Reliable Coverage Plans: Provides strong and dependable coverage options tailored specifically for teen drivers in Nevada. Read more in our review of Auto-Owners.

Cons

- Higher Base Rates: While discounts are available, the base rates for teen driver auto insurance in Nevada may be higher compared to some competitors.

- Limited Online Services: Fewer online tools and resources for managing policies might be less convenient for tech-savvy teens, especially when it comes to teen driver auto insurance in Nevada.

#5 – American Family: Best for Local Agents

Pros

- Hands-On Customer Service: Local agents provide personalized customer support, and teen drivers in Nevada have fewer complaints against AmFam than other companies.

- Competitive Student Discounts: Nevada teen drivers who maintain good grades can earn 20% off auto insurance. Compare costs in our AmFam insurance review.

- Loyalty Discounts: Teen drivers will automatically receive a policy discount if their parents have American Family insurance in Nevada.

Cons

- Limited Additional Features: American Family has fewer online tools and mobile features than other teen driver auto insurance companies in Nevada.

- Teen Driver Rate Increases: American Family raises teen auto insurance rates in Nevada higher than other companies after an accident or speeding ticket.

#6 – Nationwide: Best Roadside Assistance

Pros

- Roadside Assistance: Nationwide includes robust roadside assistance with its teen driver auto insurance in Nevada, which is a valuable feature for new drivers.

- Multi-Vehicle Discounts: Adding a teen driver to Nevada auto insurance can save up to 20% on your rates if you insure multiple vehicles. Check out how in our Nationwide review.

- Multi-Policy Discounts: Bundle your home and auto insurance with Nationwide to get an additional 20% off Nevada teen driver insurance.

Cons

- Potentially Higher Costs: The extensive roadside assistance and coverage options could lead to increased overall expenses for teen driver auto insurance in Nevada.

- Complex Discount Qualifications: Securing discounts on teen driver auto insurance in Nevada through Nationwide can be a complicated and lengthy process.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – The General: Best for Teen Drivers With Accidents

Pros

- Student-Specific Discounts: The General provides discounts designed for students, helping to make teen driver auto insurance more budget-friendly in Nevada.

- Affordable High-Risk Rates: The General offers affordable Nevada auto insurance to teen drivers who have accidents or multiple speeding tickets.

- Accessible Enrollment: Easy enrollment with minimal barriers for teen driver auto insurance in Nevada. Read our The General review to learn what else is offered.

Cons

- Basic Customer Service: Customer service may be more basic and less personalized compared to other providers offering teen driver auto insurance in Nevada.

- Limited Additional Features: The General may provide fewer extra features and benefits beyond the standard teen driver auto insurance coverage in Nevada.

#8 – Allstate: Best for Personalized Service

Pros

- High-Touch Customer Service: Allstate offers highly personalized customer service for teen driver auto insurance in Nevada, which you can read more about in our review of Allstate.

- Comprehensive Policy Customization: Extensive customization options ensure that Allstate policies meet the specific needs of teen drivers in Nevada.

- Innovative Safe Driving Programs: Allstate’s innovative safe driving programs help encourage safe driving habits among teen drivers in Nevada.

Cons

- Premium Price Tags: Customized service and a wide range of options can lead to increased premiums for teen driver auto insurance in Nevada.

- Overwhelming Choices: For families who are new to buying teen driver auto insurance in Nevada, the variety of choices available can be quite overwhelming.

#9 – Farmers: Best Teen Driver Discount Variety

Pros

- Long List of Discounts: Teen driver insurance in Nevada is eligible for multiple discounts, including good student and safe driver. Here is a full list of the best Farmers auto insurance discounts.

- Exceptional Customer Support: Farmers is renowned for exceptional customer support, which is beneficial for teen driver auto insurance in Nevada.

- Educational Resources: Farmers offers a wide range of educational materials to assist teen drivers in Nevada with understanding their auto insurance.

Cons

- Potentially Higher Prices: The focus on customer service might lead to higher prices for teen driver auto insurance with Farmers in Nevada.

- Complex Claims Process: The claims process could be more intricate with certain providers of teen driver auto insurance in Nevada compared to others.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Travelers: Best for Industry Experience

Pros

- Advanced Online Management: Travelers offers advanced online tools for easy management of teen driver auto insurance policies in Nevada. Learn more in our Travelers review.

- Teen Driver Experience: Travelers has over a hundred years of experience selling teen auto insurance in Nevada.

- Efficient Claims Processing: With Travelers in Nevada, managing teen driver auto insurance is straightforward thanks to streamlined online claims processing.

Cons

- Less Personalized Interaction: Relying too much on digital tools can reduce personal interaction, even for topics like teen driver auto insurance in Nevada.

- Potential Technical Issues: Technical issues with digital tools could disrupt access to teen driver auto insurance in Nevada.

Our Guide to Nevada Teen Driver Auto Insurance Costs

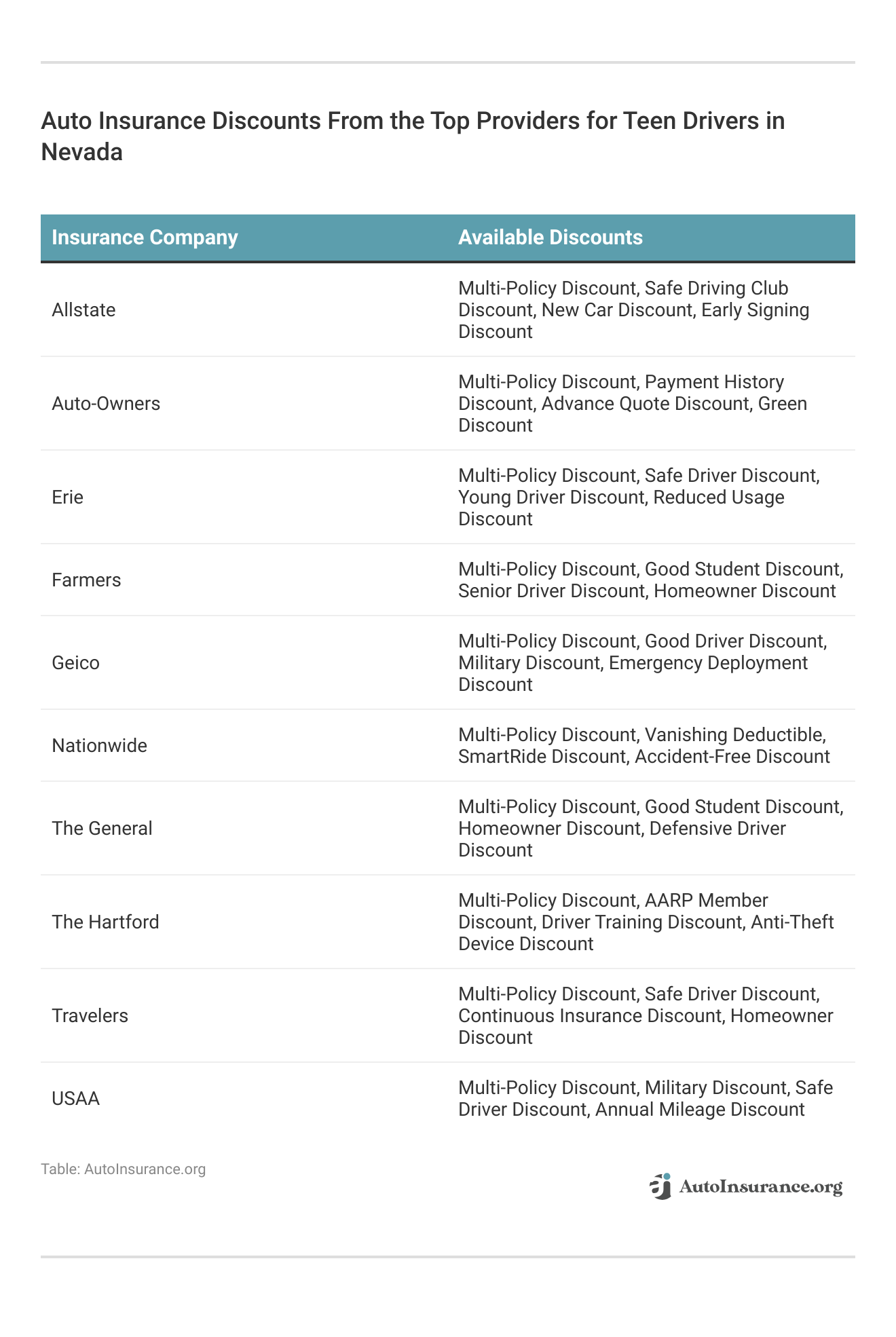

The best auto insurance in Nevada for teenage drivers varies significantly by provider and coverage level. For minimum coverage, monthly rates range from $69 with State Farm all the way up to $401/month with Travelers.

Teen Driver Auto Insurance Monthly Rates in Nevada by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $280 | $589 |

| American Family | $175 | $469 |

| Auto-Owners | $135 | $364 |

| Farmers | $330 | $694 |

| Geico | $105 | $222 |

| Nationwide | $177 | $373 |

| State Farm | $69 | $189 |

| The General | $269 | $734 |

| Travelers | $401 | $845 |

| USAA | $100 | $210 |

Full coverage rates also show considerable variation, from $189/month with State Farm up to $845/month with Travelers. Geico and USAA offer some of the most affordable options, while companies like The General and Travelers are on the higher end.

Teen drivers are typically seen as high-risk due to their lack of driving experience. This inexperience makes them more prone to accidents, leading to higher insurance premiums.

A teen driver’s history of traffic violations and accidents directly influences insurance premiums. A clean driving record with no accidents or violations can help lower NV auto insurance costs, while any infractions will likely result in higher premiums.

Read More: How Auto Insurance Companies Check Driving Records

Getting Cheap Teen Driver Auto Insurance in Nevada

To effectively lower teen driver insurance premiums, start by leveraging good student discounts, which many insurers offer for high academic performance.

Encouraging safe driving through education courses and maintaining a clean driving record can also lead to reduced rates. Choosing a safe, reliable car, opting for higher deductibles, and bundling auto insurance with other policies can further cut costs.

Installing telematics devices or signing up for cheap usage-based auto insurance are additional ways to save. In addition, most teen driver auto insurance companies in Nevada offer specialized programs to teach teens better driving skills and reward them with discounts.

Reducing coverage on older vehicles and comparing quotes from different insurers regularly can ensure you get the best deal. Finally, maintaining continuous coverage prevents rate increases associated with lapses.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Nevada Teen Driver Auto Insurance Examples & Case Studies

Auto insurance costs more for young drivers, but teens can still get affordable rates by leveraging discounts and usage-based insurance:

- Case Study #1 – Saving Big With Good Student Discounts: Sarah, a 17-year-old in Las Vegas, just got her driver’s license, so her parents compared auto insurance quotes with student discounts. They chose Auto-Owners Insurance for its 15% discount and a lower monthly premium of $89.

- Case Study #2 – Maximizing Savings With Telematics: Jason, a 19-year-old college student with a used Toyota Corolla, chooses State Farm for Steer Clear, offering the highest potential discount. This decision lowers his monthly premium to $110 and promotes safe driving.

- Case Study #3 – Leveraging Bundling and Multi-Policy Discounts: Emily, a 16-year-old driver in Henderson, Nevada, and her family chose to bundle their auto and home insurance with Nationwide for the best discount and convenience, saving $5 per month.

With varying rates, discounts, and coverage options, it’s essential to evaluate multiple factors to find the best deal. By exploring these strategies, families can make informed decisions that not only fit their budget but also provide adequate coverage for their young drivers.

Bottom Line on Affordable Auto Insurance for Teen Drivers in Nevada

Finding the cheapest teen driver auto insurance in Nevada can be challenging, but State Farm, USAA, and Geico offer some of the best rates, starting at $69 per month. Teen insurance rates will go up after a claim, so check out our ranking. State Farm is one of the best companies with cheap auto insurance after an accident.

To save on Nevada teen auto insurance, explore discounts such as good student and safe driving incentives, and consider factors like vehicle safety and driving records.Michelle Robbins Licensed Insurance Agent

Comparing quotes from multiple insurers can help secure the best deal. Enter your ZIP code below to compare cheap NV teen auto insurance quotes near you.

Frequently Asked Questions

How much is auto insurance for a 16-year-old in Nevada?

Car insurance for a 16-year-old in Nevada can be quite costly due to the high risk associated with young drivers. On average, premiums cost around $650/month for full coverage.

What is the minimum insurance coverage for teen drivers in Nevada?

Nevada requires drivers to carry a minimum of 15/30/10 liability insurance coverage. This includes $15,000 for bodily injury per person, $30,000 for total bodily injury per accident, and $10,000 for property damage.

Find your cheapest auto insurance quotes by entering your ZIP code below into our free comparison tool.

What is the average cost of auto insurance in Nevada?

The average cost of auto insurance in Nevada varies based on factors like age, driving record, and type of coverage. For adults, average rates can range from $120 to $200 per month, while teen drivers might pay significantly higher premiums due to their higher risk profile.

Is it illegal to drive without insurance in Nevada?

Yes, it is illegal to drive without auto insurance in Nevada. The state mandates that all drivers carry minimum liability insurance to cover damages and injuries in the event of an accident.

What percentage of Nevada drivers are uninsured?

Approximately 12% of drivers in Nevada are uninsured. This high rate underscores the importance of having adequate insurance coverage to protect against potential accidents involving uninsured motorists.

What is the new law in Nevada for auto insurance?

Recent changes in Nevada law emphasize stricter enforcement of auto insurance requirements. New regulations may include higher penalties for driving without insurance and increased fines for repeat offenders. It’s essential to stay updated on current laws to ensure compliance.

Do permit drivers need auto insurance in Nevada?

Yes, permit drivers in Nevada must be covered by insurance. Typically, the insurance policy of the vehicle owner will extend coverage to permit drivers, but it’s important to verify this with your insurance provider.

Can you register a car without insurance in Nevada?

No, you cannot register a car in Nevada without proof of insurance. When registering a vehicle, you must provide evidence of a valid insurance policy that meets the state’s minimum coverage requirements. (Read More: How to Buy a Car Without Auto Insurance)

What happens if the person at fault in an accident has no insurance in Nevada?

If the at-fault driver in an accident is uninsured, the injured party may need to file a claim with their own insurance provider, especially if they have uninsured motorist coverage. The uninsured driver could also face legal consequences, including fines and license suspension.

What happens if you get caught driving without insurance in Nevada?

If you are caught driving without insurance in Nevada, you could face substantial fines, license suspension, and vehicle impoundment. Additionally, you may be required to provide proof of insurance before your license and registration are reinstated.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.