Best Georgia Auto Insurance in 2025 (Compare the Top 10 Companies)

Explore the best Georgia auto insurance options with State Farm, Geico, and Progressive, known for their competitive rates as low as $24 monthly. These companies excel in affordability, customer service, and comprehensive coverage choices, making them top choices for Georgia drivers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

17,760 reviews

17,760 reviewsCompany Facts

Full Coverage in Georgia

A.M. Best Rating

Complaint Level

Pros & Cons

17,760 reviews

17,760 reviews 19,116 reviews

19,116 reviewsCompany Facts

Full Coverage in Georgia

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviews 13,128 reviews

13,128 reviewsCompany Facts

Full Coverage in Georgia

A.M. Best Rating

Complaint Level

Pros & Cons

13,128 reviews

13,128 reviews

State Farm, Geico, and Progressive are the top picks for the best Georgia auto insurance, offering competitive rates with discounts up to 17%. State Farm is particularly noted for its excellent customer service and comprehensive coverage options. Compare now to find the best auto insurance in Georgia that suits your needs and saves you money.

Georgia auto insurance varies significantly between minimum coverage and the state minimum. Rates are influenced by driving record and other factors, with options for collision and comprehensive coverage available.

Our Top 10 Company Picks: Best Georgia Auto Insurance

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 17% B Local Agents State Farm

#2 15% A++ Competitive Rates Geico

#3 14% A+ Comprehensive Coverage Progressive

#4 13% A+ Safe-Driving Discounts Allstate

#5 16% A++ Military Benefits USAA

#6 12% A Customizable Policies Liberty Mutual

#7 11% A+ Comprehensive Coverage Nationwide

#8 10% A Many Discounts Farmers

#9 9% A++ Safe-Driving Discounts Travelers

#10 8% A++ Customer Service Auto-Owners

Since Georgia auto insurance companies offer different rates, shop around to find affordable car insurance in Georgia. Start saving on your auto insurance by entering your ZIP code above and comparing quotes.

- Georgia Auto Insurance

- Cheapest SR-22 Insurance in Georgia for 2025 (Top 10 Low-Cost Companies)

- Cheap Gap Insurance in Georgia (Save Money With These 10 Companies in 2025)

- Cheap Auto Insurance for High-Risk Drivers in Georgia (Save Money With These 10 Companies in 2025)

- Best Valdosta, Georgia Auto Insurance in 2025

- Best Statesboro, Georgia Auto Insurance in 2025 (Check Out the Top 10 Companies)

- Best Rome, Georgia Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Oconee, Georgia Auto Insurance in 2025

- Best Norman Park, Georgia Auto Insurance in 2025

- Best Monroe, Georgia Auto Insurance in 2025

- Best Milledgeville, Georgia Auto Insurance in 2025 (Check Out the Top 10 Companies)

- Best Madison, Georgia Auto Insurance in 2025

- Best Macon, Georgia Auto Insurance in 2025

- Best Lawrenceville, Georgia Auto Insurance in 2025

- Best Lagrange, Georgia Auto Insurance in 2025

- Best Homerville, Georgia Auto Insurance in 2025

- Best Gainesville, Georgia Auto Insurance in 2025

- Best Dublin, Georgia Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Cuthbert, Georgia Auto Insurance in 2025

- Best Conyers, Georgia Auto Insurance in 2025

- Best Cairo, Georgia Auto Insurance in 2025

- Best Buford, Georgia Auto Insurance in 2025

- Best Augusta, Georgia Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Atlanta, Georgia Auto Insurance in 2025 (Compare the Top 10 Companies)

- Best Albany, Georgia Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Adel, Georgia Auto Insurance in 2025 (Top 10 Companies Ranked)

- Best Acworth, Georgia Auto Insurance in 2025 (Your Guide to the Top 10 Companies)

- Best Savannah, Georgia Auto Insurance in 2025 (Top 10 Companies for Savings)

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Competitive Premium: Well-known for reliability and customer satisfaction. Discover insights in our guide titled State Farm auto insurance review.

- Excellent Customer Service: Well-known for exceptional service.

- Range of Insurance Products: Offers a wide variety of coverage options.

Cons

- Higher Premiums for Some: Rates may be higher compared to other providers.

- Varied Rates: Premiums can vary significantly based on location and driving record.

#2 – Geico: Best for Comprehensive Coverage

Pros

- Wide Availability: Available in most areas across the country. See more details in our Geico auto insurance review.

- User-Friendly Tools: Easy-to-use online tools and mobile app.

- Discount Opportunities: Offers a variety of discounts.

Cons

- Average Customer Service: Some customers report average service experiences.

- Limited Personalization: Might not provide as many personalized coverage options.

#3 – Progressive: Best for Online Convenience

Pros

- Affordable Premium: Offers usage-based insurance through Snapshot.

- Discounts Available: Provides various discount opportunities.

- Innovative Tools: Offers tools like Snapshot for safe drivers.

Cons

- High Premiums for High-Risk Drivers: As mentioned in our Progressive auto insurance review, rates can be higher for high-risk drivers.

- Usability of Online Tools: Online and app interface could be more user-friendly.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#4 – Allstate: Best for Nationwide Coverage

Pros

- Robust Coverage Options: Offers comprehensive coverage.

- Unique Features: Includes features like accident forgiveness.

- Strong Reputation: As mentioned in our Allstate auto insurance review, the company is known for strong financial stability and customer service.

Cons

- Limited Availability: Availability may be limited in certain regions.

- Fewer Discounts: May not offer as many discounts as some other insurers.

#5 – USAA: Best for Personalized Policies

Pros

- Wide Coverage Options: Offers a variety of coverage options tailored to military needs.

- Top-Rated Service: Known for top-rated customer service. Check out our USAA auto insurance review to learn more details.

- Exclusive Membership: Available only to military members and their families.

Cons

- Limited Eligibility: Only available to military members and their families.

- Limited Availability: May not have physical locations in all areas.

#6 – Liberty Mutual: Best for Policy Bundling

Pros

- Convenient Online Tools: Easy-to-use website and mobile app for managing policies.

- Financial Stability: strong financial stability. Discover more about offerings in our complete Liberty Mutual auto insurance review.

- Discounts Available: Provides a variety of discounts.

Cons

- Complex Claims Process: Claims process may be more complex compared to other insurers.

- Customer Service Concerns: Some customers report average service experiences.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Accident Forgiveness

Pros

- Range of Coverage Options: Provides various coverage options.

- Discount Opportunities: Offers multiple discount opportunities.

- Financial Stability: Nationwide auto insurance review highlights their strong financial stability.

Cons

- Average Customer Service: Some customers report average service experiences.

- Limited Physical Locations: May not have as many physical locations.

#8 – Farmers: Best for Personalized Service

Pros

- Competitive Premium: Offers competitive pricing with customized coverage options.

- Customizable Policies: Offers customizable policies.

- Local Agents: Provides the convenience of local agents. (Read more: Farmers auto insurance discounts).

Cons

- Average Customer Service: Some customers report average service experiences.

- Potentially Higher Premiums: Rates may be higher depending on the driver’s profile.

#9 – Travelers: Best for Local Presence

Pros

- Ease of Use: User-friendly website and mobile app.

- Variety of Coverages: In our Travelers auto insurance review, the company offers a variety of coverage options.

- Strong Financial Stability: Known for strong financial standing.

Cons

- Customer Service: Some customers report average service experiences.

- Limited Discounts: May not offer as many discount opportunities.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

#10 – Auto-Owners: Best for Extensive Discounts

Pros

- Wide Range of Coverage Options: Offers a wide range of coverage options.

- Personalized Service: Provides personalized service. See more details in our page titled Auto-Owners auto insurance review.

- Strong Reputation: Known for a strong reputation.

Cons

- Limited Availability: Limited to certain states.

- May not Offer Digital Tools: May not offer as many digital tools as other insurers.

Average Georgia Auto Insurance Rates

There are many factors that affect auto insurance rates in Georgia. Age, driving record, credit, and ZIP code all play a part in determining car insurance rates. Additionally, the coverage choice affects Georgia car insurance rates.

Like most states, Georgia requires that drivers carry at least a minimum amount of liability coverage. However, those limits are low, and liability coverage only applies to injuries and property damage to others. It doesn’t cover your vehicle at all.

Georgia auto insurance costs $138 monthly on average for full coverage auto insurance. The best car insurance in Georgia varies by driver, and rates vary based on driving records and other personal factors.

It's crucial for Georgia drivers to understand that while the state minimum liability coverage is affordable, opting for full coverage ensures protection against a wider range of risks, including damage to their own vehicle.Daniel Walker LICENSED AUTO INSURANCE AGENT

However, if you only need to meet Georgia auto insurance requirements of 25/50/25 in liability, you’ll only pay $55 monthly on average. Liability auto insurance only covers other drivers’ bills in an at-fault accident, but additional coverages like collision, comprehensive, medical payments, and SR-22 insurance are also available.

Consider full coverage car insurance instead of the minimum amount of coverage required. Then, you’ll meet Georgia auto insurance requirements, and your vehicle also has coverage from damages due to an accident, act of nature, fire, theft, or vandalism.

For comparison, this table shows average monthly car insurance rates based on the types of auto insurance from top insurers:

Georgia Auto Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $66 $165

Auto-Owners $33 $87

Farmers $60 $149

Geico $24 $61

Liberty Mutual $106 $263

Nationwide $61 $152

Progressive $46 $115

State Farm $43 $107

Travelers $44 $110

USAA $29 $71

While full coverage is more expensive, it offers more protection than liability coverage. Remember that you may be required to carry full coverage if you have a car loan or lease.

Since all Georgia auto insurance companies offer different rates, shop around to find the cheapest car insurance in Georgia. Compare Georgia auto insurance quotes and coverage options to find your best fit.

Georgia Auto Insurance Rates by Age

Young drivers will see much higher Georgia auto insurance quotes regardless of where they live. Car insurance companies charge young drivers higher rates since they lack experience and are much more likely to get in an accident.

Auto insurance for teens in Georgia is three times higher than rates for older, more experienced drivers. This table shows average rates from top car insurance companies based on age:

Full Coverage Auto Insurance Monthly Rates by Age, Gender, & Provider

Insurance Company Age: 18 Female Age: 18 Male Age: 30 Female Age: 30 Male Age: 45 Female Age: 45 Male Age: 65 Female Age: 65 Male

$468 $540 $141 $147 $125 $122 $108 $119

$640 $740 $240 $252 $231 $228 $226 $223

$435 $591 $165 $195 $164 $166 $161 $163

$520 $600 $200 $210 $190 $185 $180 $175

$853 $897 $228 $239 $199 $198 $194 $194

$313 $362 $128 $124 $114 $114 $112 $112

$745 893.00 $249 $285 $244 $248 $239 $243

$404 $454 $124 $130 $112 $110 $110 $108

$432 $552 $177 $194 $161 $164 $158 $160

$843 $944 $187 $194 $159 $150 $156 $147

$362 $417 $109 $113 $103 $101 $101 $99

$327 $405 $133 $147 $146 $146 $120 $120

$580 $670 $180 $190 $164 $161 $159 $156

$757 $1,056 $142 $154 $139 $141 $136 $138

$257 $289 $106 $113 $84 $84 $82 $82

U.S. Average $560 $656 $182 $191 $166 $165 $163 $161

The cheapest car insurance in Georgia for young drivers varies based on several factors, including driving record and where they live. However, young drivers should expect Georgia auto insurance rates to be higher than average well into their 20s.

Compare average auto insurance rates by age in Georgia to find the best car insurance policy for your age group.

Georgia Auto Insurance Rates After an Accident

Driving record significantly affects car insurance rates. Auto insurance for drivers with a bad driving record is higher because your record indicates whether you’re a risky driver. Georgia auto insurance companies understand that drivers with at-fault accidents are high-risk drivers and charge higher rates.

This table shows the average cost of car insurance after an at-fault accident:

Full Coverage Auto Insurance Monthly Rates: One Accident vs. Clean Record

Insurance Company Clean Record One Accident

$180 $220

$166 $225

$116 $176

$119 $97

$140 $198

$95 $132

$177 $234

$140 $161

$120 $186

$105 $150

$175 $230

$160 $200

U.S. Average $123 $172

So, how long does an accident affect your car insurance rate? Accidents only affect your auto insurance rates for two years in Georgia.

Finding cheap Georgia auto insurance for drivers with accidents may be difficult. So, shop around to find the best car insurance in Georgia.

Georgia Auto Insurance Rates After a DUI

In Georgia, auto insurance for drivers with a DUI is twice as expensive as standard rates. However, a DUI only affects your Georgia car insurance rates for 10 years. After that, your rates should decrease significantly.

This table shows car insurance rates after a DUI from top insurers:

DUI Full Coverage Auto Insurance Monthly Rates vs. Clean Record by Provider

Insurance Company Clean Record One DUI

$86 $240

$160 $225

$117 $176

$97 $166

$139 $198

$80 $132

$174 $234

$115 $161

$105 $186

$86 $202

$112 $250

$99 $239

U.S. Average $119 $173

While the best auto insurance companies for drivers with a DUI only raise rates modestly, most insurers significantly increase rates since a DUI shows high-risk behavior. A DUI in Georgia costs you more than just money. Not only can you be fined up to $1,000, but you can also face a suspended license and 40 hours of community service.

Compare Georgia auto insurance quotes from various companies to find the cheapest car insurance in Georgia for drivers with a DUI.

Georgia Auto Insurance Rates by Credit Score

You might be wondering how credit scores affect auto insurance rates in Georgia. Studies show that drivers with a high credit score tend to pay for damages instead of filing an auto insurance claim. In turn, insurance companies offer lower rates since the likelihood of paying out a claim is lower.

This table shows how your credit score affects your Georgia car insurance rates:

Full Coverage Insurance Monthly Rates by Credit Score

| Insurance Company | Good Credit | Fair Credit | Bad Credit |

|---|---|---|---|

| $166 | $197 | $296 | |

| $116 | $136 | $203 | |

| $140 | $161 | $269 | |

| $82 | $100 | $148 | |

| $177 | $226 | $355 |

| $120 | $133 | $166 |

| $109 | $138 | $206 | |

| $91 | $118 | $200 | |

| $107 | $128 | $194 | |

| $71 | $90 | $136 |

Drivers with good credit scores pay significantly less than those with bad credit scores. While some states, like California, don’t allow credit scores to affect insurance rates, Georgia allows it. So, if you have a low credit score, expect higher car insurance rates in Georgia.

Georgia Auto Insurance Rates by Location

Auto insurance rates by ZIP code vary. Drivers who live in large cities with high crime rates and a large traffic volume see higher Georgia auto insurance rates since the chance of theft or an accident is much higher.

For example, auto insurance in Atlanta is very expensive since crime and traffic volume are so high. In addition, if you live in an area where severe weather often occurs, your Georgia car insurance rates are higher.

Consider adding collision auto insurance and comprehensive auto insurance to your policy to pay for damages from accidents, theft, vandalism, and acts of nature like hail, especially if you live in an area with a high crime rate, lots of traffic, or severe weather.

Georgia Auto Insurance Rates With a Ticket

Does a speeding ticket affect auto insurance rates? Any traffic violation you get, such as a speeding ticket, affects Georgia car insurance rates. Whether speeding, causing an accident, or passing a stopped school bus, expect higher Georgia auto insurance rates from a ticket.

This table shows traffic violations and how much they impact your Georgia car insurance rates:

Full Coverage Auto Insurance Monthly Rates by Provider: One Ticket vs. Clean Record

Insurance Company One Ticket Clean Record

$154 $122

$268 $228

$194 $166

$150 $124

$170 $138

$100 $83

$247 $198

$151 $114

$302 $248

$196 $164

$199 $150

$137 $123

$396 $331

$194 $161

$192 $141

U.S. Average $210 $170

Each Georgia auto insurance company decides how much a violation affects your rates. For example, one insurer may raise your rates for your first speeding ticket, but another may overlook it and keep your cheap Georgia auto insurance rates low.

Shop around to find the best auto insurance companies for drivers with speeding tickets in Georgia.

Cost of Auto Insurance in Your City: Explore Rates Across Georgia

Discover auto insurance rates in various cities across Georgia. Start comparing rates now to find the best insurance options for you.

Georgia Auto Insurance Cost by City

Compare auto insurance rates across different cities in Georgia to find the best coverage options that suit your needs and budget.

The Best Georgia Auto Insurance Companies

All of the best auto insurance companies in the U.S. offer coverage in Georgia. In addition, there are many local companies available. However, the best Georgia auto insurance companies depend on you.

Personal factors, the coverages you want, and available discounts determine the best Georiga auto insurance company for you.

For example, USAA auto insurance typically has the lowest car insurance rates. However, USAA only offers coverage to military members and their families. So, you’ll need to look elsewhere if you don’t qualify.

According to https://t.co/27f1xf1ARb research, Auto-Owners Insurance ranks superior for rates and customer service. Saving money 💰may be reason enough to check them out if you live in one of the 26 states they write policies. For more info, check out👉: https://t.co/rqMAQGb29Q pic.twitter.com/7C69v68Pjq

— AutoInsurance.org (@AutoInsurance) July 3, 2023

In addition, J.D. Power ranks companies on customer satisfaction, including billing, products, and customer service. Farm Bureau auto insurance, Auto-Owners auto insurance, and Erie auto insurance rank the highest in Georgia.

Shopping around is the best way to find an auto insurance company that meets your needs. Compare rates, coverages, and ratings from multiple companies to find the best car insurance in Georgia for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Georgia Auto Insurance Requirements

Georgia requires that drivers carry at least a minimum amount of auto insurance to drive legally. In addition, drivers must also show proof of insurance when needed.

Georgia auto insurance requirements include the following:

- $25,000 per person bodily injury liability

- $50,000 per accident bodily injury liability

- $25,000 per accident property damage liability

According to the Insurance Information Institute, around 12% of Georgia drivers are uninsured. So, what happens if you get caught driving without auto insurance in Georgia?

The penalty for no auto insurance in Georgia for the first offense includes fines, a suspended driver’s license for up to 60 days, and up to one year in jail. Subsequent offenses include a longer license suspension. You’ll also likely need high-risk auto insurance.

The minimum required insurance in Georgia is very limited. So, for example, if you cause an accident resulting in multiple injuries and a totaled vehicle, you’ll exceed your limits quickly. Not to mention, it won’t cover damages to your car at all. Learn more about Georgia minimum auto insurance requirements.

Consider collision, comprehensive, medical payments, and roadside assistance coverage for full protection. While more coverage equals higher Georgia auto insurance rates, you’ll pay less out of pocket if you get injured or damage your vehicle.

Georgia SR-22 Auto Insurance

High-risk drivers in Georgia can get coverage with SR-22 auto insurance. SR-22 forms get filed by your insurance company showing the state of Georgia that you have at least the minimum amount of mandatory car insurance.

Drivers considered high risk due to violations such as a DUI, driving without insurance, or having too many points on their driver’s license may be required to get SR-22 insurance. Georgia will let you know if the form is required.

While the SR-22 form is inexpensive, Georgia auto insurance companies significantly increase rates for high-risk drivers. If you have auto insurance coverage, your insurer could add the SR-22 to your policy, but your Georgia auto insurance rates will increase.

It may be challenging to find cheap insurance in GA if you don’t have car insurance and need SR-22 insurance. In addition, since you won’t have a continuous insurance history, insurers will be taking a risk by offering you coverage.

If Georgia requires you to carry SR-22 insurance, but you don’t have a vehicle, consider non-owner SR-22 auto insurance. Non-owner car insurance allows you to drive a vehicle you don’t own legally. However, it typically only allows you to meet Georgia car insurance requirements.

Finding Cheap Auto Insurance in Georgia

Georgia only requires that drivers carry a limited amount of liability coverage. However, mandatory coverage doesn’t offer much protection, so experts recommend increasing limits and adding collision and comprehensive coverage.

Whether you need liability, full, or SR-22 coverage, car insurance companies in Georgia can meet your needs. However, Georgia auto insurance rates vary depending on age, driving record, credit score, and ZIP code.

Enter your ZIP code below to compare rates from multiple Georgia auto insurance companies to help you find cheap car insurance with the coverage you need.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

How much is car insurance in GA?

On average, Georgia auto insurance costs $138 monthly. However, rates vary based on personal factors like age, driving record, coverage choices, credit score, and ZIP code. Each Georgia auto insurance company weighs your factors differently and offers different rates.

So how much is car insurance in Georgia? Finding cheap car insurance in Georgia requires you to shop around. Compare multiple companies to find your best deal.

What are Georgia auto insurance requirements?

Georgia minimum auto insurance requirements include a maximum of $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage per accident. These amounts represent the maximum amount Georgia auto insurance companies will pay after an accident.

Does Georgia have high car insurance?

Georgia full coverage auto insurance averages $138 monthly, 16% higher than the national average of $119. If you only need to meet Georgia car insurance requirements, you’ll pay $55. However, you can always find the cheapest car insurance in Georgia by comparing quotes and discounts from various companies.

What are the cheapest car insurance companies in Georgia?

Again, this varies by the driver. USAA typically has the cheapest Georgia auto insurance rates but isn’t available to every driver. Auto-Owners and Farm Bureau also offer low Georgia car insurance rates. However, personal factors determine the cheapest Georgia auto insurance companies for you.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

Can I purchase general liability insurance and commercial auto insurance from different insurance companies?

Yes, it’s possible to purchase general liability insurance and commercial auto insurance from different Georgia auto insurance companies. However, it can be easier and cheaper to bundle these coverages under a single Georgia auto insurance company.

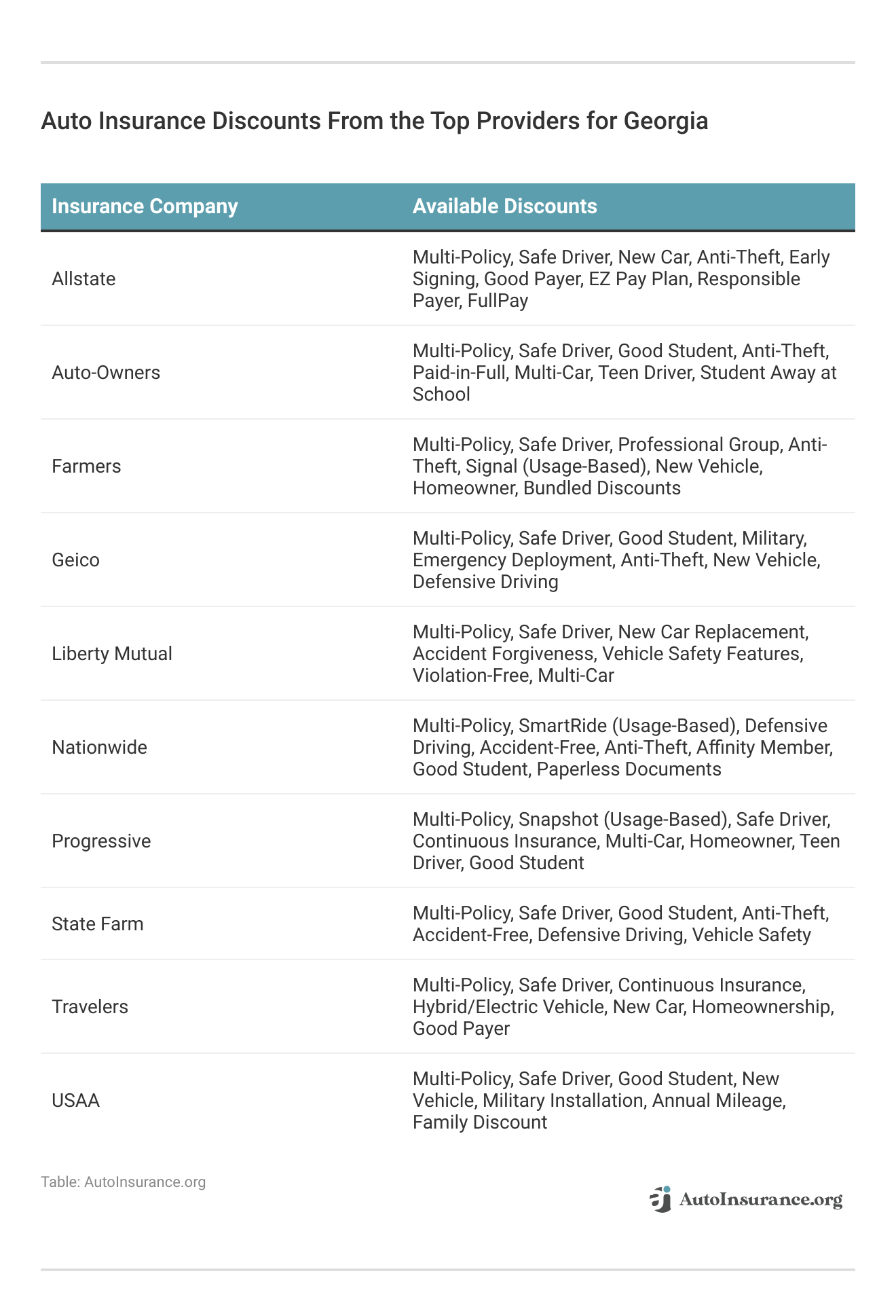

What types of discounts are available for auto insurance in Georgia?

Auto insurance companies in Georgia offer discounts such as multi-policy, safe driver, good student, multi-vehicle, safety features, payment, and affinity discounts. These auto insurance discounts can help you save on your premiums, so be sure to ask each insurer about available discounts when comparing quotes.

Does general liability insurance in Georgia cover damage to the property of others caused by my business vehicles?

Yes, general liability car insurance in Georgia can cover damage to the property of others caused by your business vehicles, including situations where your vehicle collides with another person’s property, such as a building, fence, or parked vehicle.

What factors should I consider when choosing the best auto insurance in Georgia?

When choosing the best auto insurance in Georgia, consider factors such as coverage options, customer service ratings, discounts offered, financial stability of the insurer, and how the premium rates fit into your budget. Comparing these factors across different insurers will help you find the best option for your needs.

Use our free comparison tool below to see what auto insurance quotes in Georgia looks like.

How do I find the cheapest auto insurance rates in Georgia?

To find cheap car insurance in GA, compare quotes from multiple insurers. Factors like your driving record, credit score, age, and the type of coverage you choose can influence your premium rates. Look for discounts that may apply to you, such as safe driver discounts, multi-policy discounts, or good student discounts.

Which auto insurance company is the best in Georgia for customer service?

State Farm, Geico, and Progressive are often recognized as the top auto insurance companies in Georgia for their customer service. State Farm, in particular, is well-regarded for its personalized service and extensive agent network. To determine the best company for you, consider reading reviews, checking customer satisfaction ratings, and comparing the specific features and benefits each insurer offers.

Read more: State Farm Auto Insurance Review

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Auto Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Auto Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.