Allstate Auto Insurance Review 2025 (See Actual Rates & Discounts)

With rates starting at $58 per month, Allstate auto insurance reviews typically say the company offers good coverage. Drivers appreciate Allstate auto coverage options, especially the UBI program Drivewise. However, not everyone is happy – many customers complain about Allstate’s customer service.

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Mar 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Allstate

Average Monthly Rate For Good Drivers

$228A.M. Best Rating:

A+Complaint Level:

MedPros

- Multiple Coverage Options

- Various Discounts

- Additional Savings Programs

- Low-Mileage Policy Option

Cons

- Higher Premiums

- Slow Claims Process

- Poor Customer Service

According to Allstate auto insurance reviews, Allstate averages $160 per month for full coverage auto insurance and offers reliable customer service. While the company has various types of auto insurance and high financial ratings, its rates are about 34% higher than the national average.

While it doesn’t top the list of our best auto insurance companies, Allstate is still a highly recommended company. In particular, safe drivers who can take advantage of the UBI program Drivewise should consider an Allstate policy.

Additionally, drivers tend to love Allstate’s long list of types of auto insurance coverages and discounts. However, it’s not usually the most affordable option for car insurance.

Allstate Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 3.8 |

| Business Reviews | 4.0 |

| Claim Processing | 3.0 |

| Company Reputation | 4.5 |

| Coverage Availability | 5.0 |

| Coverage Value | 3.4 |

| Customer Satisfaction | 4.0 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 3.2 |

| Plan Personalization | 4.5 |

| Policy Options | 3.4 |

| Savings Potential | 3.8 |

Despite having a ton of coverage options, generous discounts, and one of the best UBI programs on the market, Allstate may not be right for you. Read through our Allstate auto insurance review below, then enter your ZIP code in our free comparison tool above to compare rates in your area.

- Allstate offers two UBI programs to help low-mileage, safe drivers save

- Despite offering several discounts, Allstate’s average rates tend to be high

- Allstate receives excellent business ratings but mixed reviews from customers

Allstate Auto Insurance: Average Monthly Rates

Although Allstate auto insurance reviews generally paint a good picture, Allstate isn’t one of the cheapest auto insurance companies on the market. In fact, average rates for both Allstate basic car insurance and full coverage tend to be high.

Check below to see what an Allstate auto quote might look like for you.

Allstate Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $338 | $868 |

| Age: 16 Male | $371 | $910 |

| Age: 18 Female | $275 | $640 |

| Age: 18 Male | $318 | $740 |

| Age: 25 Female | $98 | $258 |

| Age: 25 Male | $102 | $271 |

| Age: 30 Female | $91 | $240 |

| Age: 30 Male | $95 | $252 |

| Age: 45 Female | $88 | $231 |

| Age: 45 Male | $87 | $228 |

| Age: 60 Female | $84 | $214 |

| Age: 60 Male | $86 | $220 |

| Age: 65 Female | $87 | $226 |

| Age: 65 Male | $86 | $223 |

Although Allstate car insurance costs are higher than many of its competitors, it doesn’t mean it’s not a company worth looking at. Allstate offers a variety of car insurance programs that may make the higher prices worth it.

Regardless of what Allstate car insurance reviews say, you should always compare rates with other companies before you sign up for a policy. Allstate makes it easy to get a personalized quote – simply visit its homepage and fill out the quote request form.

If you’d rather compare rates from multiple companies all at once, you can use an online quote-generating tool. Using such a tool can save you a significant amount of time and make comparing quotes simple.

Allstate Auto Insurance Rates for Teens

Finding the best auto insurance companies for teens takes a little more research than it does for older adults. That’s because teens typically pay much higher rates than more experienced drivers.

There are several reasons why teens pay higher rates, but the primary factors boil down to statistics. Teens are more likely to drive distracted, engage in reckless behaviors, and cause accidents.Michelle Robbins Licensed Insurance Agent

Check below to see Allstate auto insurance estimates for teen drivers.

Allstate Teen Auto Insurance Monthly Rates by Gender & Coverage Level

| Age | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $338 | $868 |

| Age: 16 Male | $371 | $910 |

| Age: 17 Female | $160 | $575 |

| Age: 17 Male | $177 | $610 |

| Age: 18 Female | $275 | $640 |

| Age: 18 Male | $318 | $740 |

| Age: 19 Female | $135 | $412 |

| Age: 19 Male | $148 | $473 |

Like other demographics, Allstate insurance estimates for teens are on the high side. However, teens benefit more than most drivers from a robust insurance plan, which sometimes means paying a little more.

Why cheap car insurance for teen drivers isn’t always enough: https://t.co/8dwugWg3hY pic.twitter.com/VeKuXjABkA

— Allstate (@Allstate) May 6, 2016

The good news for young drivers is that rates don’t stay high forever. As long as you keep your driving record clean, your rates will drop significantly by age 25.

Allstate Auto Insurance Rates for Seniors

Despite being on the pricier side, Allstate takes a spot on our list of the best auto insurance companies for seniors. From discount opportunities for seniors to special programs that help older drivers get the most out of their coverage, Allstate insurance company reviews often recommend these policies for seniors.

Still, knowing how much you might pay for Allstate insurance as an older driver is important. Check below for Allstate car insurance prices for seniors.

Allstate Senior Auto Insurance Monthly Rates by Gender & Coverage Level

| Age | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 55 Female | $83 | $219 |

| Age: 55 Male | $82 | $216 |

| Age: 65 Female | $87 | $226 |

| Age: 65 Male | $86 | $223 |

| Age: 75 Female | $63 | $145 |

| Age: 75 Male | $63 | $149 |

As you can see, Allstate auto quotes for seniors are not always the cheapest. However, you can always lower your rates by signing up for Allstate’s discounts or UBI program.

Allstate Auto Insurance Rates by Credit Score

Unless you live in California, Hawaii, Massachusetts, or Michigan, insurance companies can use your credit score while crafting your quotes. Drivers with higher scores pay less, while people with lower scores typically pay more.

There can be significant variations between average policy prices based on credit scores. Check below to see what an Allstate quote might look like for you based on your credit.

Allstate Auto Insurance Monthly Rates by Provider & Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $110 | $130 | $150 | |

| $90 | $110 | $130 | |

| $95 | $115 | $135 | |

| $100 | $120 | $140 |

| $102 | $122 | $142 |

| U.S. Average | $123 | $148 | $226 |

Despite being one of the more expensive options, Allstate makes our list of the best auto insurance companies for drivers with bad credit. While rates are high, Allstate’s Drivewise UBI program makes it easy to lower your monthly premium.

Allstate Auto Insurance Rates by Driving Record

Your driving record is one of the most important factors in your insurance rates. In fact, drivers with speeding tickets, at-fault accidents, or DUIs can pay double what someone with a clean record will pay.

If your driving record isn’t perfect, you won’t necessarily pay extremely high rates. For example, Allstate DUI insurance rates are much higher than quotes after a speeding ticket. Check below to see how much Allstate charges based on your driving record.

While you’ll always pay more if you have marks on your driving record, Allstate is one of the best auto insurance companies for high-risk drivers. Allstate insurance ratings mention several reasons for this, but one of the most popular is the opportunity to enroll in Drivewise.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Allstate vs. the Competition: Auto Insurance Rates Breakdown

Allstate may be one of the largest auto insurance companies in America, but it’s not necessarily the right choice for every driver.

While pricing isn’t the only thing to consider when shopping for car insurance, it’s certainly an important factor. Check below to see the average price of car insurance from some of Allstate’s top competitors.

Auto Insurance Monthly Rates for Allstate vs. Competitors by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 | |

| $32 | $84 |

The variation in prices listed above showcases why it’s so important to learn how to evaluate auto insurance quotes from multiple companies. If you skip this crucial step, you’ll almost certainly overpay.

Finding the lowest rates is important, but it’s not the only thing to keep in mind. When you compare quotes, you should also look at discount availability, add-on options, and other special programs. Allstate might not be the cheapest, but it offers reward programs that other companies lack.Jeff Root Licensed Insurance Agent

However, if getting the cheapest car insurance possible is the most important part of your search for a policy, most Allstate reviews say you’ll probably need to go elsewhere.

Allstate Auto Insurance Coverage Options

It may not be the cheapest option on the market, but Allstate has a reputation for offering a long list of insurance add-ons. When you shop at Allstate, customizing your plan into the perfect policy is easy.

First, you can get all of the basic types of coverage that make a full coverage auto insurance policy. This includes:

- Liability Auto Insurance

- Collision Auto Insurance

- Comprehensive Auto Insurance

- Uninsured/Underinsured Motorist Coverage

- Personal Injury Protection (PIP) Insurance/Medical Payments Coverage

Depending on where you live, you’ll be required to purchase liability, uninsured motorist, or PIP insurance. You can also purchase everything listed above for a full coverage plan. Aside from basic coverage options like liability, collision, and comprehensive coverage, Allstate offers the following add-ons:

The Allstate accident forgiveness add-on is one of the most popular add-ons, particularly for drivers worried about accidentally increasing their rates.

You can also buy specialty car insurance policies, like a Mexico travel policy and classic car insurance. No matter what add-ons or policies you wish to buy, it’s usually a good idea to speak with a representative. Insurance availability can vary depending on where you live.

Drivewise and Milewise by Allstate

Safe, low-mileage drivers have more ways than ever to save on their car insurance through usage-based insurance (UBI) and pay-per-mile programs. Allstate offers both through Drivewise and Milewise.

Allstate offers cheap usage-based auto insurance through Drivewise. Like other UBI programs, Drivewise tracks behaviors like speeding, hard braking, and the time of day you drive.

In return for tracking your driving habits, Drivewise offers a discount of up to 40%. While Allstate guarantees that your rates won’t go up for unsafe driving, it’s not always a good choice. Check out Allstate Drivewise reviews to see if this UBI program is a good fit for you.

Mileiwse is an alternative way to save that is meant for low-mileage drivers. This pay-per-mile or pay-as-you-go plan replaces a traditional policy’s flat monthly fee.

Pay-per-mile auto insurance policies are not the best fit for everyone. Make sure to read Allstate Milewise reviews to ensure a pay-as-you-go policy is the best choice for your driving habits.

Allstate Auto Insurance Discounts

When it comes to saving on your coverage, auto insurance discounts are one of the best and easiest ways to keep your rates low. Luckily for Allstate drivers, there are plenty of discounts to choose from.

Allstate discounts can be split into three categories: vehicle-based, driver-based, and policy-based. To start, check out Allstate’s vehicle-based discounts below.

Allstate Vehicle-Based Auto Insurance Discounts

| Discount Name | Savings Potential |

|---|---|

| Anti-Lock Brakes | 10% |

| Anti-Theft Devices | 10% |

| Daytime Running Lights | 2% |

| Electronic Stability Control | 2% |

| Farm Vehicle | 10% |

| Green Vehicle | 10% |

| New Vehicle | 30% |

| Passive Restraint Discount | 30% |

| Utility Vehicle | 15% |

| Vehicle Recovery Tracking Systems | 10% |

While those are an excellent start to savings, you can lower your Allstate auto insurance quotes even further with driver-based discounts. See which you might qualify for below.

Allstate Driver-Based Auto Insurance Discounts

| Discount Name | Savings Potential |

|---|---|

| Defensive Driver Course | 10% |

| Distant Student/Student Away at School | 35% |

| Driver's Education Course | 10% |

| Early Signing | 10% |

| Good Student | 20% |

| Military Discount | Varies by Location |

| Safe Driver | Earn $500 off |

| Senior Driver | 10% |

Finally, Allstate insurance reviews frequently mention how helpful the policy-based discounts are. Check below to see which policy-based discounts might work best for you.

Allstate Policy-Based Auto Insurance Discounts

| Discount Name | Savings Potential |

|---|---|

| Claim-Free | 35% |

| Continuous Coverage Discount | 25% |

| Full Payment | 10% |

| Multi-Policy | 25% |

| AutoPay Discount | 5% |

| Paperless Billing/Paperless Documents | 5% |

Most discounts automatically apply to your policy, but you can always ask a representative to ensure you’re getting all possible savings. Some discounts – like the good student discount – require that you submit proof before it applies to your Allstate car insurance policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Allstate Auto Insurance Customer Reviews

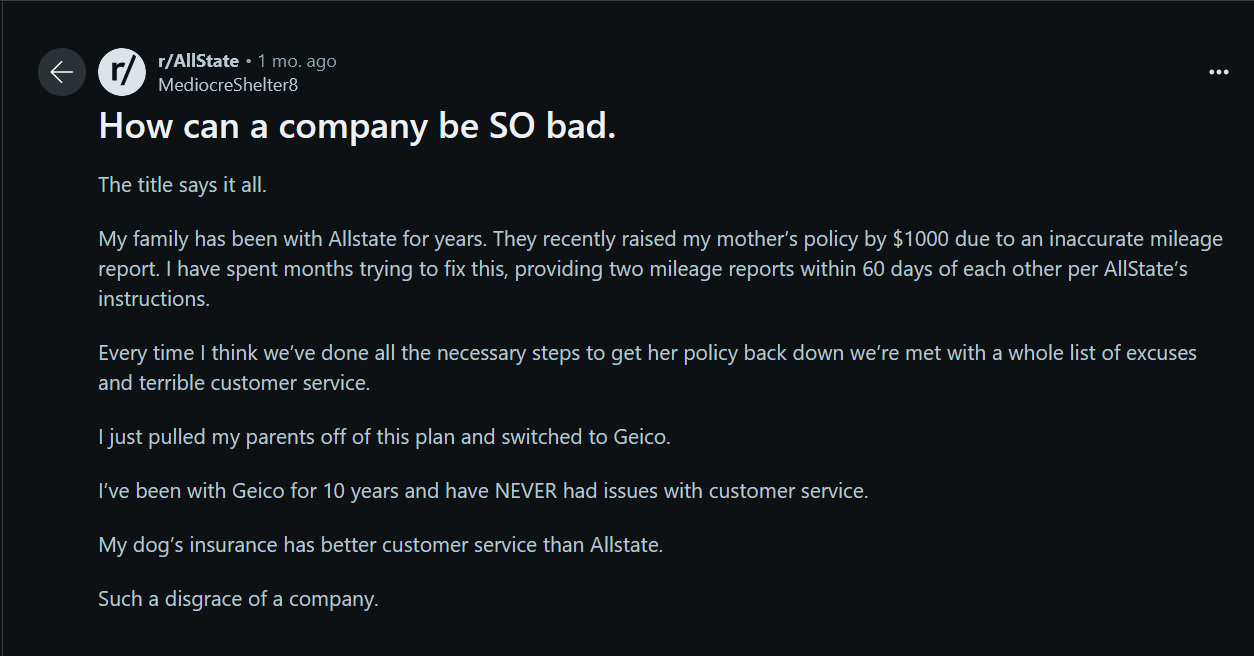

Although Allstate commands a loyal group of customers, not everyone is happy with the service. Many Allstate auto insurance reviews repeat sentiments similar to those of this Reddit user below discussing their time with Allstate.

As you can see, this Reddit user is unimpressed with Allstate’s customer service experience and actually recommends Geico insurance instead.

However, it’s not all bad news. Allstate offers a claims satisfaction guarantee, which ensures that policyholders are satisfied with how their claims are resolved. In fact, the claims satisfaction guarantee is the primary reason why Allstate is considered one of the best auto insurance companies for paying claims.

Most drivers also appreciate Allstate’s long list of coverage options, helpful representatives, and discount opportunities.

Allstate Auto Insurance Third-Party Ratings

Customer reviews for Allstate may be mixed, but third-party ratings companies usually leave good marks. Check below to see Allstate ratings.

Allstate Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 832 / 1,000 Avg. Satisfaction |

|

| Score: A+ Strong Customer Support |

|

| Score: 74/100 Good Customer Satisfaction |

|

| Score: 1.45 More Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength |

The ratings above can be extremely helpful during a search for coverage, especially if you’re learning how to get auto insurance for the first time. For example, Allstate’s rating of A- from A.M. Best indicates that the company is financially sound, and you won’t have to worry about your claims being left unpaid.

Pros and Cons of Allstate Auto Insurance

Allstate is one of the most recognizable names in car insurance in the U.S., and for good reason. When you shop at Allstate, you get access to the following perks:

- UBI Plans: Allstate offers two UBI plans – Drivewise and Milewise. Drivewise offers safe drivers a discount of up to 40%, and Milewise sets Allstate apart as one of the best pay-as-you-go auto insurance companies.

- Full Coverage Service: With a long list of add-ons and agents ready 24/7 to help, most Allstate car insurance ratings mention feeling like all their insurance needs were met.

- Claims Satisfaction Guarantee: Allstate promises that you’ll be satisfied with how your claims are resolved with a money-back guarantee.

- Rewards Programs: Allstate has a variety of rewards programs, offering incentives for things like staying safe, enrolling in Drivewise, and for not filing claims

Of course, no company is perfect, and that’s certainly true of Allstate. Before you sign up for an Allstate policy, be aware of the following:

- Higher Average Rates: No matter where you live, what type of vehicle you drive, or what kind of driver you are, Allstate is likely one of your more expensive options.

- Mixed Reviews: While it has plenty of loyal customers, not everyone is satisfied with Allstate’s customer service experience.

Getting the best insurance requires a little research. An Allstate auto insurance policy may be the right choice for you, but you’ll only know if you compare your options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Explore Allstate Auto Insurance Quotes Today

Allstate may not be the cheapest option on the market, but that doesn’t mean you should skip it. Learning how to get multiple auto insurance quotes is a vital step in getting the right insurance. Comparing Allstate with other companies will help you find the best coverage.

When you’re ready, enter your ZIP code into our free comparison tool below to see how Allstate’s rates stack up against other companies near you.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

How do you file an Allstate auto insurance claim?

If you’re wondering how to file an Allstate auto insurance claim, the company offers various ways to begin the process.

File your claim through the Allstate app, website, or by calling the Allstate insurance company phone number at 1-800-255-7828. The easiest way to start your claim is through the Allstate app. Not only can you file a claim, but you can also upload pictures of the damage.

How fast does Allstate auto insurance pay claims?

We suggest you read Allstate claim reviews before signing with Allstate as your provider. It’s essential you feel confident that you are getting the best provider in your area who will give you excellent customer service and make filing a claim a breeze.

Some good news: Allstate offers a claims satisfaction guarantee (for free) with all policies. So, if you’re unhappy with your settlement, Allstate credits a portion back to you.

However, do keep in mind that Allstate claims satisfaction is below average, according to J.D. Power, which rates companies in the industry on customer satisfaction.

Is Allstate a good auto insurance company?

Yes, Allstate is a good company – one of the industry leaders.

Here’s a quick summary: Allstate offers various auto insurance coverages, but rates are slightly higher than average. When it comes to customer service and claims handling, the Allstate insurance company scores at or just below average.

But, remember this will vary by location. We suggest you read the Allstate company reviews. Just one Allstate Insurance review in your area can provide valuable insights into the quality of service and coverage options offered by this insurance provider where you live.

Who should consider Allstate auto insurance?

Allstate auto insurance is one of the best auto insurance companies that bundle home, auto, boat, and personal liability. It’s a great fit for drivers who need several policies.

However, drivers looking for excellent customer service and low rates probably won’t find what they want with Allstate.

How do you get an Allstate auto insurance quote?

Get Allstate auto insurance quotes online or through a local agent. You’ll need your personal and vehicle information. Knowing what Allstate auto insurance coverage you need is also a good idea.

And remember Allstate doesn’t just offer auto insurance coverage. You can save money by bundling your lines of coverage.

To receive an accurate and personalized Allstate Insurance quote, simply fill out the necessary information on their website to discover the best coverage options for your car, home, and life insurance needs.

Is Allstate auto insurance expensive?

You’ll pay $160 monthly for full coverage Allstate auto insurance. On average, full coverage auto insurance costs $119.

Does Allstate auto insurance offer roadside assistance?

Yes, Allstate auto insurance sells roadside assistance as an add-on coverage. Learn more about the best roadside assistance coverage auto insurance companies.

What types of coverage does Allstate offer in addition to auto insurance?

Allstate offers homeowners, renters, life, boat, and RV insurance in addition to auto insurance.

Does Allstate provide insurance coverage in Las Vegas?

Yes, Allstate offers coverage in Las Vegas. In fact, Allstate is our top pick for the best auto insurance in Nevada.

Can I manage my Allstate policy online?

Use your Allstate auto insurance login to manage your policy through the company’s website or mobile app.

How do I find Allstate car insurance near me?

If you are looking for reliable insurance coverage for your vehicle, search for “Allstate car insurance near me” to find a nearby office that can help meet your needs.

But, if you aren’t sure which provider offers the best rates in your area, you should first try out our free quote tool below.

Just enter your ZIP code and in minutes, you will get several customized car insurance quotes from the best providers based on your vehicle and where you live.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Kebbeh_Family

Allstate Denied Responsibility-Customer Backed Into Us

EveC

Always lose arbitrations

Valencia Harris

ALLSTATE INSURANCE

Keith_G__

As Discriminatory As You Can Possibly Get

brenda_trammell

RUDE CUSTOMER SERVICE AND SCAMMERS!!!

Akiraw1_

The worst insurance ever

pirish101

Way overpriced! Will scam you if you cancel!

Carolyn0022

Untrained and Ignorant CS Team and Managers

Allstate_Sucks_in_CA

Allstate SUCKS

Shaytys50_

Unprofessional Agent