Allstate vs. Geico Auto Insurance in 2025 (Side-by-Side Review)

Allstate vs. Geico auto insurance compares two major providers with monthly rates starting at $87 for Allstate and $43 for Geico. Geico Auto Repair Xpress speeds up repairs through approved shops, while Allstate’s Drivewise provides discounts for safe driving. Here's how their rates and features compare.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 19,116 reviews

19,116 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

19,116 reviews

19,116 reviewsAllstate vs. Geico auto insurance compares two famous providers with clear differences in service, discounts, and driver benefits. Geico has better digital tools, speedier claims through Auto Repair Xpress, and fewer customer complaints.

Allstate vs. Geico Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.8 | 4.4 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.0 | 4.8 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 3.5 | 4.4 |

| Customer Satisfaction | 2.0 | 2.3 |

| Digital Experience | 4.5 | 5.0 |

| Discounts Available | 5.0 | 4.7 |

| Insurance Cost | 3.4 | 4.5 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.4 | 4.1 |

| Savings Potential | 3.9 | 4.5 |

| Allstate | Geico |

Allstate is a solid local agent network with stronger student, military, and safe-driver discounts. If you’re deciding between them, your driving history and service preferences will help determine the better fit.

- Allstate’s rates start at $87 a month, with bundling discounts for safe driving

- Geico offers the lowest rates, starting at $43 a month for good drivers

- Allstate includes the Drivewise program and Geico for Auto Repair Xpress claim

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

Allstate vs. Geico Auto Insurance Costs by Age and Gender

Geico vs. Allstate car insurance pricing difference by age group, with Geico offering substantially lower premiums most of the time. Geico’s monthly rate for 16-year-old male drivers is $445, but with Allstate, the charge is $910, a $465 difference. This pattern holds true for more senior drivers: Males in their 60s pay just $106 per month with Geico, whereas Allstate charges them $220.

Allstate vs. Geico Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $868 | $425 |

| Age: 16 Male | $910 | $445 |

| Age: 30 Female | $240 | $128 |

| Age: 30 Male | $252 | $124 |

| Age: 45 Female | $231 | $114 |

| Age: 45 Male | $228 | $114 |

| Age: 60 Female | $214 | $104 |

| Age: 60 Male | $220 | $106 |

The same pattern holds for female drivers, with Geico charging $425 for a 16-year-old female, while Allstate’s rate is $868. However, while Geico has cheaper base rates, its rate increases after an accident or a poor credit score, which is much higher than Allstate’s.

Allstate’s adjustments to its premiums are smaller, so it’s a good pick for high-risk drivers who might face a minor financial penalty for previous misdeeds.

Geico has lower rates, while Allstate gives better discounts for students, military, and safe drivers.Laura Berry Former Licensed Insurance Producer

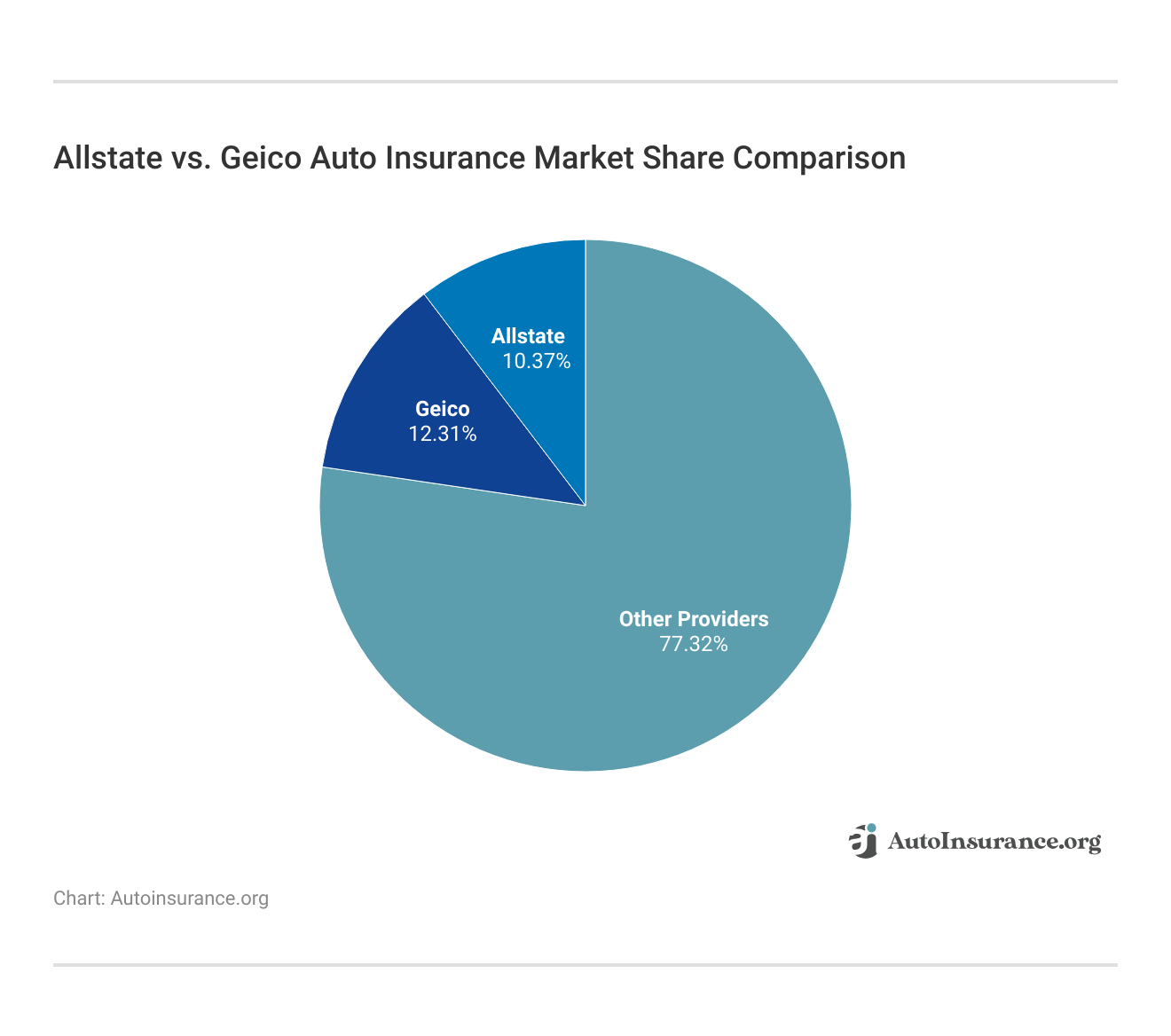

In terms of market share, Geico tops the list with 12.31% of the market, while the overall market share for Allstate is a mere 10.37%, signifying Geico’s better pricing and more extensive reach to a broader consumer base.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Compare Geico & Allstate Car Insurance Discounts Side by Side

Allstate and Geico have a long list of possible discounts, but not all types of savings are created equal. Geico provides a discount of 25% for vehicles with security features, while Allstate limits it to 10%. Installing a Geico anti-theft device can help lower your insurance costs by reducing the risk of theft and potential claims.

Allstate vs. Geico: Auto Insurance Discounts

| Discount | ||

|---|---|---|

| Anti-Theft | 10% | 25% |

| Bundling | 25% | 25% |

| Federal Employee | 10% | 8% |

| Good Driver | 25% | 26% |

| Good Student | 22% | 15% |

| Membership | 10% | 8% |

| Military | 25% | 15% |

| Multi-Vehicle/Car | 25% | 25% |

| Pay-in-Full | 10% | 10% |

| Usage-Based Insurance (UBI) | 30% | 25% |

Both companies match at 25% for bundling and multi-vehicle discounts, but Geico gives a slightly better rate for good drivers at 26% compared to Allstate’s 25%. Allstate, however, has a stronger usage-based insurance discount at 30% compared to Geico’s 25%. If you’re a student, Allstate offers a good student discount of 20%, whereas Geico provides only 15%.

Allstate offers a 25% military discount, while Geico provides 15%. Federal employees and certain organization members get 10% off with Allstate and 8% with Geico. Both companies offer a 10% pay-in-full discount. Allstate’s best discounts apply to military, students, and usage-based insurance, while Geico favors anti-theft features and good drivers.

Allstate vs. Geico Auto Insurance Rates by Driving Record

Allstate vs. Geico auto insurance rates vary significantly based on driving history. For a driver with a clean record, Geico has a much lower monthly rate at $114 versus Allstate at $228. For example, after one accident, Geico’s rate would be $189, while Allstate’s rate would jump to $321; that makes Allstate $132 more expensive.

Allstate vs. Geico Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $228 | $114 |

| One Accident | $321 | $189 |

| One Ticket | $268 | $151 |

| One DUI | $385 | $309 |

A single speeding ticket raises Geico’s premium to $151, while Allstate’s goes up to $268. The most significant increase occurs after a DUI, with Geico charging $309 and Allstate raising rates to $385.

While Geico starts with lower base rates, its increases after violations remain lower than Allstate’s. However, drivers with prior infractions may still find Allstate’s rate adjustments more predictable over time.

Allstate vs. Geico Auto Insurance Rates by Credit Score

Geico offers significantly lower rates than Allstate for drivers with all credit scores. For those with good credit (670-739), Geico charges $203 per month, while Allstate costs $322, a difference of $119. The trend continues for drivers with fair credit (580-669), where Geico’s rate is $249 compared to Allstate’s $382.

Allstate vs. Geico Full Coverage Insurance Monthly Rates by Credit Score

| Credit Score | ||

|---|---|---|

| Good Credit (670-739) | $322 | $203 |

| Fair Credit (580-669) | $382 | $249 |

| Poor Credit (300-579) | $541 | $355 |

The gap widens for poor credit (300-579), with Geico at $355 and Allstate at $541. This means Allstate policyholders with poor credit pay nearly $200 more per month than Geico customers in the same category. Geico consistently offers cheaper premiums, making it the more affordable option for drivers with lower credit scores.

Allstate’s prices tend to remain more stable over time, whereas Geico’s rates jump more steeply if you fall into a lower credit tier. This illustrates the impact of credit scores on auto insurance rates, which may matter more to drivers with bad credit in terms of increases than in the case of Geico versus Allstate.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Allstate vs. Geico Consumer Ratings & Reviews Compared

Allstate and Geico receive similar ratings across most consumer review agencies, but Geico holds a slight edge in customer satisfaction and complaint handling. J.D. Power scores Geico at 692/1,000, slightly above average, while Allstate follows closely at 691/1,000.

Insurance Business Ratings & Consumer Reviews: Allstate vs. Geico

| Agency | ||

|---|---|---|

| Score: 691 / 1,000 Avg. Satisfaction | Score: 692 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 74/100 Good Customer Satisfaction |

|

| Score: 1.45 Avg. Complaints | Score: 0.55 Fewer Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: A++ Superior Financial Strength |

Both companies earn an A+ from the Better Business Bureau for business practices and a 74/100 from Consumer Reports for customer satisfaction. The biggest difference appears in complaint volume. The National Association of Insurance Commissioners (NAIC) rates Allstate with a 1.45 complaint ratio, while Geico scores lower at 0.55, meaning Geico customers file fewer complaints on average.

Financial strength ratings also favor Geico, which receives an A++ from AM Best, compared to Allstate’s A+. Both companies are financially stable, but Geico is rated at the highest level.

Geico ranks higher in customer satisfaction and has fewer complaints, making it a better option for service quality. However, both companies are financially stable and provide dependable coverage, reinforcing their place among the best auto insurance companies.

Pros and Cons of Allstate Auto Insurance

Allstate auto insurance offers strong discounts and reliable customer service through its network of local agents. However, its higher base rates and customer complaint volume may be drawbacks for some drivers.

Pros

- Strong Discounts: Offers better savings for bundling, safe driving (Drivewise), students, and military members.

- Predictable Rate Increases: Premiums rise less sharply after accidents or credit score drops compared to Geico.

- Local Agents Available: Provides in-person service through a large network of agents for personalized support.

Cons

- Higher Base Rates: Higher Base Rates are more expensive than Geico across most categories, especially for younger and high-risk drivers.

- More Complaints: NAIC data shows a higher complaint ratio (1.45) compared to Geico (0.55), indicating more customer service issues.

A Yelp user provides a review highlighting Allstate’s strong agent support. He was praised for going above and beyond to fight a non-renewal policy and working directly with underwriters to resolve the issue. The service was exceptional, and he confirmed he truly felt “in good hands.”

Read Chris G.‘s review of Allstate Insurance: Jack Amran on Yelp

Allstate stands out for its discounts and agent support, but its higher premiums and customer service complaints may be dealbreakers for some. Comparing quotes can help determine if the benefits outweigh the costs in your situation.

Pros and Cons of Geico Auto Insurance

It is a good option for budget-conscious drivers due to its low rates and digital-first approach. Though it shines in pricing and claims speed, it isn’t for everyone — especially those who prefer in-person service. Here’s a closer look at Geico’s strengths and weaknesses.

Pros

- Lower Rates: Consistently offers cheaper premiums than Allstate, especially for drivers with clean records and good credit.

- Fewer Complaints: NAIC data shows a lower complaint ratio (0.55) compared to Allstate (1.45), meaning fewer reported customer service issues.

- Efficient Claims Process: The Geico Auto Repair Xpress program speeds up repairs with priority service and rental car coordination.

Cons

- Harsher Rate Increases: Premiums jump more after an accident or traffic violation, making it pricier for high-risk drivers over time.

- Limited Local Support: Primarily an online-based insurer with fewer local agents, which may be a downside for those who prefer in-person service.

A Yelp reviewer rated Geico car insurance customer service Five stars, noting that they had been reliable for 20 years. She emphasized that prompt payments and safe driving prevent problems and said Geico’s agents deal with difficult callers well and are an invaluable part of the company’s support team.

Digital-savvy, cost-conscious drivers will appreciate Geico’s low rates and easy online claims process. But if you’re looking for stable pricing when you get into an accident or if you prefer a local agent, it might not be the right fit for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Choosing Between Geico and Allstate Based on Your Needs

Geico is the cheaper option for most drivers, especially those with clean records and good credit, while Allstate’s rates are higher but increase less after an accident. Geico’s discounts favor good drivers and anti-theft features, while Allstate offers better savings for students, military members, and usage-based programs.

Geico saved me $500 a year, but I missed Allstate’s local help after an accident.Aremu Adams Adebisi Feature Writer

Geico processes claims faster with Auto Repair Xpress, while Allstate offers in-person agent support. Geico receives fewer complaints, but some drivers prefer Allstate’s personal service. When comparing auto insurance for different types of drivers, Geico is often the better option for those seeking lower rates and a fully digital experience.

Find the best auto insurance company near you by entering your ZIP code into our free quote tool.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Which is better car insurance, Geico or Allstate?

That depends on what you value more. Geico is generally cheaper, with minimum coverage starting around $43 per month. Allstate’s rates start closer to $87 but offer more local agent support and better bundling options. Geico performs better in digital tools and customer satisfaction scores, while Allstate gives more stable pricing after an accident.

Who is the parent company of Allstate?

Allstate operates independently under The Allstate Corporation. It is not owned by another company or conglomerate. The corporation also owns subsidiaries like Allstate Fire and Casualty Insurance. Co. and Allstate Vehicle and Property Ins. Co.

Is Allstate owned by Geico?

No, Allstate and Geico are two entirely separate companies. Allstate Corporation is a publicly traded company based in Northbrook, Illinois. Geico is a subsidiary of Berkshire Hathaway, owned by Warren Buffett. They compete in the same market but have no ownership ties.

Is Allstate a good insurance company?

Yes, Allstate is a reputable insurer with strong financial ratings (A+ from AM Best) and a large agent network. However, its complaint ratio is 1.45 according to NAIC, which is higher than average. Customers often cite helpful agents but also note higher premiums than competitors like Geico or State Farm.

What is Allstate’s deductible, and how does it affect your premium?

Allstate’s deductibles typically range from $500 to $2,000. A higher deductible usually means a lower monthly premium. For example, choosing a $1,000 deductible instead of $500 can reduce your rate by 10–15%, but you’ll pay more out of pocket if you file a claim.

Who is Geico’s biggest competitor?

State Farm is currently Geico’s biggest competitor by market share, holding the top spot in the U.S. auto insurance market. Allstate comes in third, making it another major rival. Geico and State Farm often go head-to-head in pricing, while Allstate competes more on service and agent access.

Is Allstate better than Geico for high-risk drivers?

Allstate tends to raise rates less dramatically after an accident or DUI. For example, after a DUI, Geico’s rate jumps to $309 per month, while Allstate’s average increases to $385. But Geico’s base rates are often lower, so the final cost depends on your profile. High-risk drivers may prefer Allstate for more predictable pricing.

What are people saying about Allstate vs. Geico auto insurance on Reddit?

Reddit threads on r/Insurance and r/PersonalFinance show mixed opinions. Geico users appreciate the low rates and easy claims process, while Allstate customers highlight strong local support but complain about higher costs. Many users recommend getting quotes from both since rates can vary wildly based on ZIP code and driving history.

Is Allstate cheaper than Geico for car insurance?

Geico is usually cheaper than Allstate, especially for drivers with clean records. On average, Geico’s full coverage rates are 25% lower than Allstate’s. However, Allstate’s price increases after an accident are smaller than Geico’s. If you have a bad driving record or poor credit, Allstate may be more stable in the long run.

Is there a business relationship between Geico and Allstate?

No, Geico and Allstate are direct competitors with no financial or operational relationship. Each company underwrites its own policies and runs independent networks of agents or digital platforms. Any similarities in coverage or discounts are due to market standards, not partnerships.

How do Geico car insurance rates vary by state?

Geico prices vary greatly by state because of local regulations, accident risks, and repair costs. California drivers pay about $133 per month, and Ohio drivers pay around $75 per month. Geico premiums tend to be higher in states with a lot of accidents, such as Florida.

Does Geico offer a student discount on car insurance?

Yes, Geico offers a student discount of up to 15% for full-time students under age 25 who maintain at least a B average (3.0 GPA or higher). Allstate’s good student auto insurance discount is 20%, making it a better option for students who qualify.

What is the average Geico monthly car insurance cost?

On average, Geico’s monthly car insurance cost is about $125 for full coverage and $43 for minimum coverage. However, rates differ by age, driving record, credit score, and state laws. As a result, Allstate charges an average of $87 per month for minimum coverage and $180 for full coverage, which means Geico is cheaper in the majority of cases.

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool.

Does Geico use your credit score to determine car insurance rates?

Yes, Geico uses credit scores in most states to determine rates, except in places where it’s banned (California, Hawaii, Massachusetts, and Michigan). Drivers with low credit scores can pay up to 2x more than those with good credit. Allstate also factors in credit scores but offers smaller rate increases for bad credit.

Does Allstate offer a military discount on auto insurance?

No, Allstate Insurance Company does not have a specific military discount, but it offers other discounts that may help military personnel save, such as bundling home and auto insurance. Geico, on the other hand, provides a 15% military discount for active-duty members, veterans, and National Guard or Reserves.

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.