Allstate vs. Liberty Mutual Auto Insurance in 2025 (Head-to-Head Review)

Allstate vs. Liberty Mutual auto insurance comes down to price and driving record. Allstate averages $87 per month for teen drivers, making it cheaper for new drivers. Liberty Mutual averages $96 for clean records. Both companies include telematics tools and accident forgiveness options.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 1, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

11,638 reviews

11,638 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

11,638 reviews

11,638 reviews 3,792 reviews

3,792 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviewsAllstate vs. Liberty Mutual auto insurance mainly depends on your budget, driving record, and what features you value.

Allstate vs. Liberty Mutual Auto Insurance Rating

| Rating Criteria |  |

|

|---|---|---|

| Overall Score | 3.8 | 4.2 |

| Business Reviews | 4.0 | 4.0 |

| Claim Processing | 3.0 | 3.3 |

| Company Reputation | 4.5 | 4.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 3.5 | 4.1 |

| Customer Satisfaction | 2.0 | 2.0 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.4 | 4.3 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.4 | 5.0 |

| Savings Potential | 3.9 | 4.5 |

| Allstate | Liberty Mutual |

Allstate leans tech-forward with Drivewise and a solid mobile app, while Liberty Mutual gives more flexibility for bundling and better options for high-risk drivers.

Allstate scores higher for customer service and claims, but Liberty Mutual can be cheaper for clean drivers or those with strong credit. Your best pick depends on how you drive, what you want to save, and whether you prefer digital tools or policy customization.

- Allstate monthly rates at $87, and Liberty Mutual at $96 for similar coverage

- Liberty Mutual offers more discounts, but Allstate has better bundling options

- Allstate’s Drivewise app helps cut rates more than Liberty Mutual’s RightTrack

If you’re looking to lower your auto insurance premiums, enter your ZIP code into our free quote comparison tool to compare your rates against the top insurers.

Liberty Mutual vs. Allstate: Which Auto Insurance Offers Better Value

Liberty Mutual and Allstate both offer full coverage auto insurance, but their monthly rates vary by age and gender. Allstate generally has lower monthly prices across most age groups. Sixteen-year-olds see the biggest difference—Liberty Mutual charges noticeably more. As drivers get older, the gap narrows, but Allstate usually remains the cheaper option.

Allstate vs. Liberty Mutual Full Coverage Auto Insurance Monthly Rates

| Age & Gender |  |

|

|---|---|---|

| 16-Year-Old Female | $868 | $1,031 |

| 16-Year-Old Male | $910 | $1,121 |

| 30-Year-Old Female | $240 | $249 |

| 30-Year-Old Male | $252 | $285 |

| 45-Year-Old Female | $231 | $244 |

| 45-Year-Old Male | $228 | $248 |

| 60-Year-Old Female | $214 | $211 |

| 60-Year-Old Male | $220 | $227 |

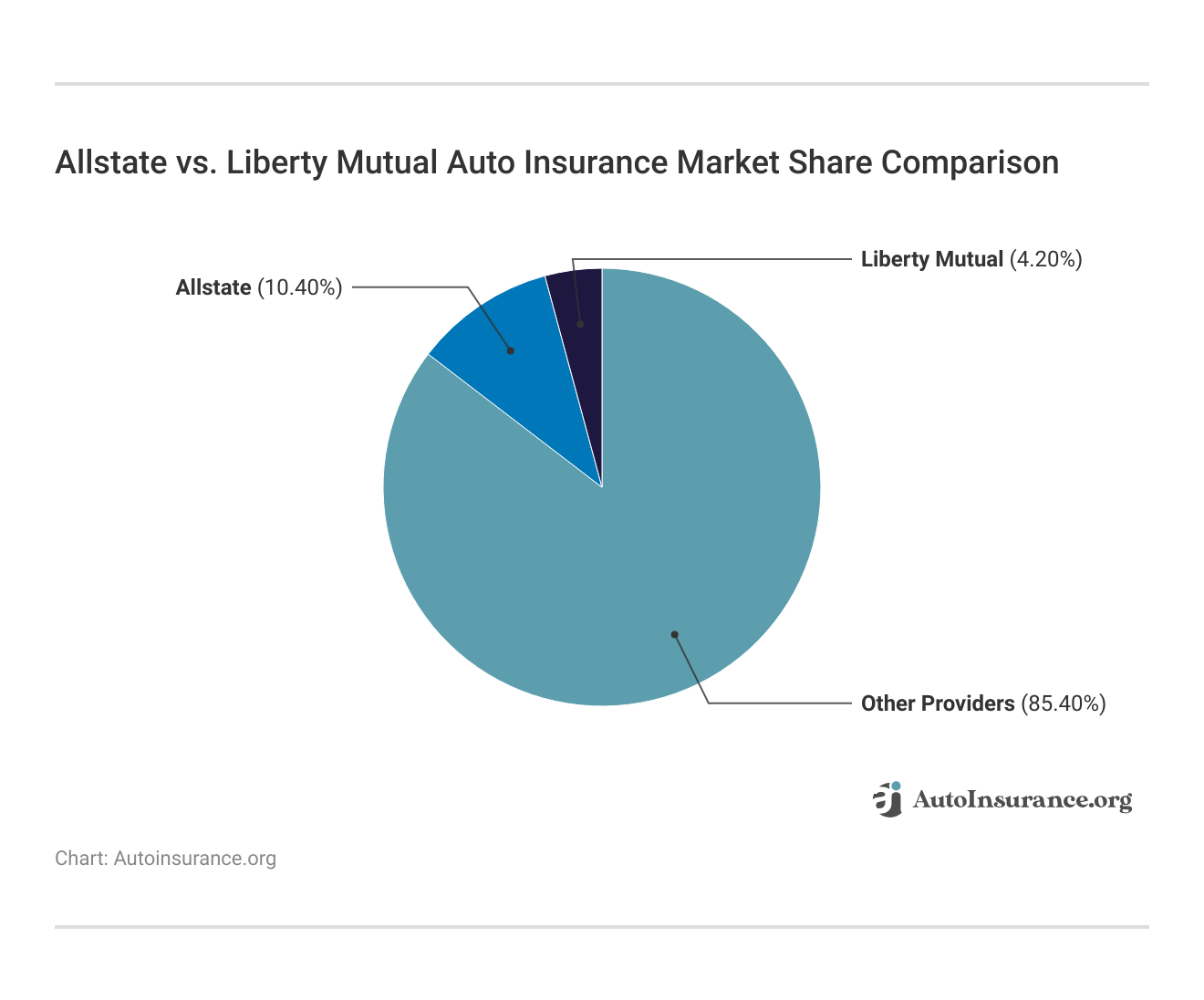

For example, a 30-year-old male typically pays less with Allstate than with Liberty Mutual. Even in their 60s, most drivers still get better pricing from Allstate. Aside from rates, Allstate also holds a larger share of the auto insurance market, suggesting stronger customer retention and brand loyalty.

This likely reflects better support, more service locations, or stronger policy deals. If you’re focused on keeping your monthly costs low, especially as a younger driver, Allstate is often the better pick. Liberty Mutual, however, offers strong coverage options that could justify the higher cost depending on your needs. Compare discounts, claims service, and features to see which insurer fits your situation best.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Allstate vs. Liberty Mutual: Auto Insurance Rates by Driving Record

Allstate and Liberty Mutual adjust monthly auto insurance rates based on your driving history, but Allstate usually costs less. Drivers with a clean record typically pay lower rates with Allstate, making it the better option for safe drivers.

Allstate vs. Liberty Mutual Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record |  |

|

|---|---|---|

| Clean Record | $228 | $248 |

| One Ticket | $268 | $302 |

| One Accident | $321 | $335 |

| One DUI | $385 | $447 |

If you have a speeding ticket or accident, both companies raise rates, but Liberty Mutual increases them more. The gap is even wider for drivers with a DUI—Liberty Mutual’s rates are significantly higher than Allstate’s. If keeping your costs down is the goal, Allstate is the more affordable choice across all driving records.

Drivewise rewards safe driving, Milewise bills per mile, and RightTrack adjusts rates after 90 days.Michelle Robbins Licensed Insurance Agent

Liberty Mutual could still be a good fit if you want specific coverage options, but for lower rates overall, Allstate has the edge. Compare discounts and policy features to see which one fits your needs.

Allstate vs. Liberty Mutual: Auto Insurance Rates by Credit Score

Both Allstate and Liberty Mutual adjust auto insurance rates based on your credit score, but Allstate consistently offers lower prices at every level. Drivers with good credit usually pay a bit less with Allstate, making it a better deal if your credit is strong.

Allstate vs. Liberty Mutual Full Coverage Auto Insurance Monthly Rates by Credit Score

| Credit Score |  |

|

|---|---|---|

| Good Credit | $115 | $120 |

| Fair Credit | $140 | $145 |

| Bad Credit | $180 | $185 |

If your credit is fair or poor, both companies raise rates—but Liberty Mutual’s are still a bit higher. The gap isn’t huge, but Allstate remains the cheaper option across the board. If you’re focused on saving money, Allstate is the stronger pick regardless of credit score.

That said, Liberty Mutual could be a better match if its coverage options line up with what you need. Look at discounts and features side by side to see how your credit affects what you’ll pay with each company.

Allstate vs. Liberty Mutual: Auto Insurance Discounts

Allstate and Liberty Mutual both offer discounts that can lower your monthly rate, but the savings depend on what applies to you. Liberty Mutual gives a bigger anti-theft discount, which is great if your car has built-in security features.

Allstate vs. Liberty Mutual Auto Insurance Discounts

| Discount |  |

|

|---|---|---|

| Anti-Theft Device | 10% | 35% |

| Bundling | 25% | 25% |

| Claims-Free | 10% | 8% |

| Defensive Driving | 10% | 10% |

| Good Student | 22% | 12% |

| Low Mileage | 30% | 30% |

| Loyalty | 15% | 10% |

| Multi-Car | 25% | 25% |

| Pay-in-Full | 10% | 12% |

| Safe Driver | 18% | 20% |

| Safety Features | 20% | 12% |

Both companies offer similar bundling and multi-car savings. However, Allstate gives better discounts to good students and long-time customers. Safe drivers see slightly better savings with Liberty Mutual, but the difference is small. Low-mileage discounts are about the same with both.

The better choice depends on which discounts fit your profile. If you’re focused on security or safe driving, Liberty Mutual might save you more. If you’re a student or have been with your insurer for a while, Allstate likely offers more value. Compare the available discounts and coverage options to find what works best for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Types of Auto Insurance Coverage Offered by Allstate and Liberty Mutual

Allstate and Liberty Mutual both offer the basics, but the details of their coverage can affect how claims are handled and what protection you actually get. Here’s a quick look at how they compare:

- Liability Coverage: Both cover injuries and property damage you cause in an accident. Allstate adds accident forgiveness, while Liberty Mutual gives you stronger new car replacement.

- Collision Coverage: Allstate speeds up claims with its QuickFoto Claim tool. Liberty Mutual also offers mobile support and optional accident forgiveness.

- Comprehensive Coverage: Covers theft, fire, and weather damage. Allstate includes no-deductible glass repair; Liberty Mutual adds OEM parts for newer cars.

- Personal Injury Protection (PIP): Offered where required. Liberty Mutual has stronger medical add-ons, while Allstate lets you bundle with roadside assistance.

- Uninsured/Underinsured Motorist Coverage: Allstate supports this with strong mobile tools. Liberty Mutual focuses on fast claims and a direct repair network.

Both companies offer the same basic protections, but their extras differ. Review add-ons like rental reimbursement, roadside help, gap coverage, mechanical breakdown insurance, and RV coverage.

Larger insurers often provide more than you expect. Call the Allstate or Liberty Mutual insurance phone number to find out what other policies are available.

Allstate vs. Liberty Mutual: Better Auto Insurance Mobile Apps

Most major insurers now offer a mobile app for managing your policy and a separate tool to track driving habits for discounts. Allstate uses Drivewise, and Liberty Mutual offers RightTrack—both reward safe driving. Their apps also let you view ID cards, update your coverage, and pay your bill.

Milewise saved me money by charging per mile—perfect for low-mileage drivers.Aremu Adams Adebisi Feature Writer

You can log in to your account on either company’s website or app. If you don’t want to use the app, you can still manage your policy or get a quote by calling customer service.

Allstate vs. Liberty Mutual: Consumer Ratings & Insurance Reviews Compared

Both Allstate and Liberty Mutual have strong industry ratings, but there are a few differences worth noting. Liberty Mutual scores higher with J.D. Power for customer satisfaction and gets fewer complaints, based on NAIC data. That points to smoother claims handling.

Insurance Business Ratings & Consumer Reviews: Allstate vs. Liberty Mutual

| Agency |  |

|

|---|---|---|

| Score: 691 / 1,000 Avg. Satisfaction | Score: 717 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A- Good Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 74/100 Good Customer Satisfaction |

|

| Score: 1.45 Avg. Complaints | Score: 0.55 Fewer Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: A Excellent Financial Strength |

Allstate, on the other hand, holds an A+ rating from the Better Business Bureau, while Liberty Mutual has an A-. That gives Allstate a slight edge in business reputation. Consumer Reports shows similar satisfaction levels for both companies.

When it comes to financial strength, both are solid—Allstate has an A+ from AM Best, and Liberty Mutual has an A. If you care more about fewer complaints and stronger satisfaction scores, Liberty Mutual may be the better fit. If you want a company with solid financial strength and a reliable business reputation, Allstate is a strong pick.

To figure out which one fits you better, look at the coverage options and discounts each offers. Then run a quote to see how the rates compare based on your driving profile.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of Allstate Auto Insurance

Allstate auto insurance is appealing to drivers looking for local support and practical digital tools. Its features, such as crash detection and replacement of new cars, are intended to provide security after an accident. Even so, not everything stands the test of time — some drivers report slow claims processing and prices higher than they expected. Here’s a closer look at what works and what doesn’t.

Pros

- Strong Claims Handling: Allstate uses QuickFoto Claim and a robust mobile app to streamline accident reporting and speed up payouts. Many customers report that the process is simple and well-organized, with fast follow-through.

- Wide Agent Network: Allstate has one of the largest agent networks nationwide, making it easy to work with someone locally for in-person support, policy questions, or claims help.

- Solid App Features: The Allstate Mobile app supports digital ID cards, roadside assistance requests, Drivewise tracking, and photo claims. It’s functional and user-friendly for everyday tasks.

Cons

- Higher Premiums for Some Drivers: For drivers with clean records, Allstate’s prices are often higher than you might find with some other groups, especially in urban or high-cost regions.

- Mixed Customer Service Reviews: While local agents are helpful, some customers report issues with claim delays or inconsistent communication from corporate support.

Allstate is best for drivers who want solid in-person support, useful digital tools and easy claims reporting. A Yelp reviewer describes how an agent-assisted an owner of a restaurant business with lower costs and more coverage, demonstrating the added value that Allstate provides to its customers.

While pricing and claim delays are concerns, Allstate may be a good fit if you value having a dedicated agent and a user-friendly app. To see if it works for you, get an Allstate auto insurance quote and compare it with other options based on coverage and service.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Pros and Cons of Liberty Mutual Auto Insurance

Liberty Mutual auto insurance offers strong coverage options like accident forgiveness, gap protection, and new car replacement. The app makes it easy to manage your policy, file claims, and access roadside help. It’s built for drivers who want control and convenience. But service quality and pricing can vary depending on what you need.

Pros

- Wide Range of Customization: Liberty Mutual sells several optional add-ons, including accident forgiveness, new car replacement and Deductible Fund. This enables you to customize your policy to suit your needs and your budget.

- Easy-to-Use App: Their mobile app supports claims filing, digital ID cards, and roadside assistance. It’s operable, no-frills, and makes managing your policy a breeze.

- Coverage for Unique Situations: Liberty Mutual offers what’s called gap insurance and an original parts replacement feature, which can make it a good fit if you lease or drive a newer car and you want full coverage.

Cons

- Mixed Claims Satisfaction: Some policyholders report slow processing times or difficulty with claims communication, especially for complex repairs or total losses.

- Higher Prices After Add-Ons: While base policies can be competitive, costs can rise when you add extras. Coverage can become expensive compared to similar offerings from other insurers.

Liberty Mutual is a solid choice for drivers who want flexible coverage and digital tools, but claim experiences vary. A post on Reddit describes how some customers, including home and motorcycle policyholders, have experienced no problems. Others say older cars are more at risk of being totaled in accidents because of their higher repair costs and fewer parts in the used parts supply chain.

Comment

byu/SaabStory06 from discussion

insaab

This is consistent with wider worries about Liberty Mutual’s claims process — for every person who sails through the claims process, other policyholders report that the company totals cars instead of authorizing repairs. Making comparisons is essential to make sure it meets your requirements.

Allstate vs. Liberty Mutual: Which Auto Insurance Company Is Right for You

Allstate works best for drivers who want a strong mobile app, personalized claims tracking, and flexible bundling. It’s a solid pick for families, tech-savvy users, and homeowners seeking digital support. If you’re already using Allstate for home or life, bundling makes sense. Liberty Mutual fits drivers who prioritize customizable coverage, especially young drivers or renters who benefit from usage-based insurance savings.

Its policy flexibility stands out, especially with optional add-ons and deductible options. If you value robust digital tools and brand longevity, Allstate is the better fit. If your focus is on building a tailored, discount-heavy policy, Liberty Mutual delivers more flexibility. Match the company to your needs, not just the rates.

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Which insurance is better, Liberty Mutual or Allstate?

Allstate is cheaper for most drivers, with teen rates averaging $87 per month compared to Liberty Mutual’s $96 for clean records. Allstate holds a higher BBB rating (A+) and offers strong digital tools like Drivewise. Liberty Mutual may be better if you want more custom coverage or qualify for larger anti-theft discounts. The better option depends on your driving record, credit score, and coverage needs.

Does Allstate offer a military discount?

Yes, Allstate offers a military discount in select states. Active-duty service members, veterans, and their families may qualify, but availability depends on state laws and underwriting guidelines. The discount typically ranges from 5% to 10% off premiums. To apply, you need to provide military identification or proof of service to an Allstate agent.

Are Allstate rental car discounts available for policyholders?

Yes, Allstate rental car discounts are available through partners like Enterprise, Hertz, and National. You can access savings of 15% to 25% based on location and length of rental. These discounts apply even without a claim. If you want coverage during repairs, add rental car reimbursement coverage to your policy.

Does Allstate cover windshield repair?

Yes, Allstate covers windshield repair comprehensively. If your windshield has a small chip or crack (typically less than 6 inches), Allstate will often waive the deductible and cover the full cost of repair. Repairs are usually handled through third-party partners like Safelite AutoGlass, which can come to your home or office.

How does Allstate vs. Liberty Mutual home insurance compare?

Allstate home insurance offers more digital tools, including the Digital Locker for home inventory tracking. Liberty Mutual provides unique add-ons like inflation protection and blanket jewelry coverage. Allstate has higher customer satisfaction, while Liberty Mutual may be more competitive in pricing for older homes. Coverage options like water backup and equipment breakdown are available with both but differ in cost.

Is Liberty Mutual better than Allstate for auto insurance?

Liberty Mutual may be better for drivers seeking customized policy features, such as new car replacement and accident forgiveness. Allstate may be a more substantial choice for digital tools, with its Drivewise app offering safe-driving rewards. However, Allstate generally has better customer satisfaction scores, while Liberty Mutual offers more flexible bundling options. Rates vary by driver profile.

Is Allstate better than Travelers for auto insurance?

Allstate and Travelers are close competitors. Allstate offers more user-friendly apps and better mobile claims filing, while Travelers typically provides lower premiums for drivers with clean records. Both offer accident forgiveness and new car replacement, but Allstate’s bundling with home or renters policies tends to produce more significant savings. Travelers may offer better rates for multi-car households.

How does Allstate vs. Progressive compare in terms of pricing and service?

Progressive is usually cheaper, especially for drivers with recent tickets or younger drivers, averaging $105–$145 per month for full coverage. Allstate has slightly higher premiums but offers stronger agent support and tools like a Claim Satisfaction Guarantee. Progressive leads in custom quotes and usage-based options via Snapshot, while Allstate focuses more on local agent accessibility and service quality.

What are Liberty Mutual car insurance rates like for average drivers?

Liberty Mutual car insurance rates average $140–$210 per month for full coverage, depending on driving history, location, and vehicle. Young drivers and those with recent accidents typically pay higher premiums. Discounts for good students, safe driving, and bundling with home or renters insurance can significantly reduce rates, sometimes by up to 30%.

Liberty Mutual vs. State Farm: Which one has better pricing?

State Farm offers lower rates than Liberty Mutual for most drivers. A full coverage policy with State Farm may average $115–$135 per month, while a Liberty Mutual policy could be $140–$165. State Farm also has a more vigorous telematics discount program (Drive Safe & Save), while Liberty Mutual’s RightTrack offers smaller savings. Both provide bundling discounts, but State Farm tends to be more consistent in rate stability.

What’s the difference between State Farm and Liberty Mutual in coverage and service?

State Farm has a broader agent network and more substantial ratings for claims service. It also provides better options for accident forgiveness and usage-based insurance. Liberty Mutual offers more flexible add-ons, like home computer coverage and better renters insurance bundles. Both cover standard auto protections but differ in digital tools and customer satisfaction levels.

Does Allstate cover windshield replacement?

Yes, Allstate windshield replacement is covered if you have comprehensive insurance and the damage cannot be repaired. You’ll usually have to pay a deductible unless you’ve purchased Full Glass Coverage, which eliminates out-of-pocket costs. Replacement work is completed by approved service providers and typically requires scheduling an appointment through Allstate’s claims portal or app.

How does Liberty Mutual vs. Safe Auto compare for high-risk drivers?

Safe Auto caters to high-risk drivers needing state-minimum liability coverage, often without credit checks. Premiums may start as low as $85 a month, but with limited options. Liberty Mutual provides more robust coverage, including optional add-ons like roadside assistance and custom parts coverage. While Liberty Mutual is more expensive, it’s better suited for drivers looking to improve coverage over time.

Find the best auto insurance rates no matter how much coverage you need by entering your ZIP code into our comparison tool today.

What are Allstate similar companies I should compare for auto insurance?

If you’re comparing Allstate, consider companies like State Farm, Progressive, Liberty Mutual, and Travelers. These insurers offer comparable products with competitive pricing. State Farm excels in agent availability and low rates, Progressive in high-risk affordability, Liberty Mutual in policy customization, and Travelers in bundling options. All provide online quotes and digital account management.

Which is better: Allstate vs. The General for car insurance?

Allstate offers more comprehensive coverage options, better customer service, and more tools like Drivewise to track driving habits. The General focuses on high-risk drivers and provides basic liability coverage with higher premiums. If you need full coverage or have a clean driving record, Allstate will likely offer better rates and value. The General may be suitable only for drivers who can’t qualify elsewhere.

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.