American Family vs. Progressive Auto Insurance in 2025 (Head-to-Head Review)

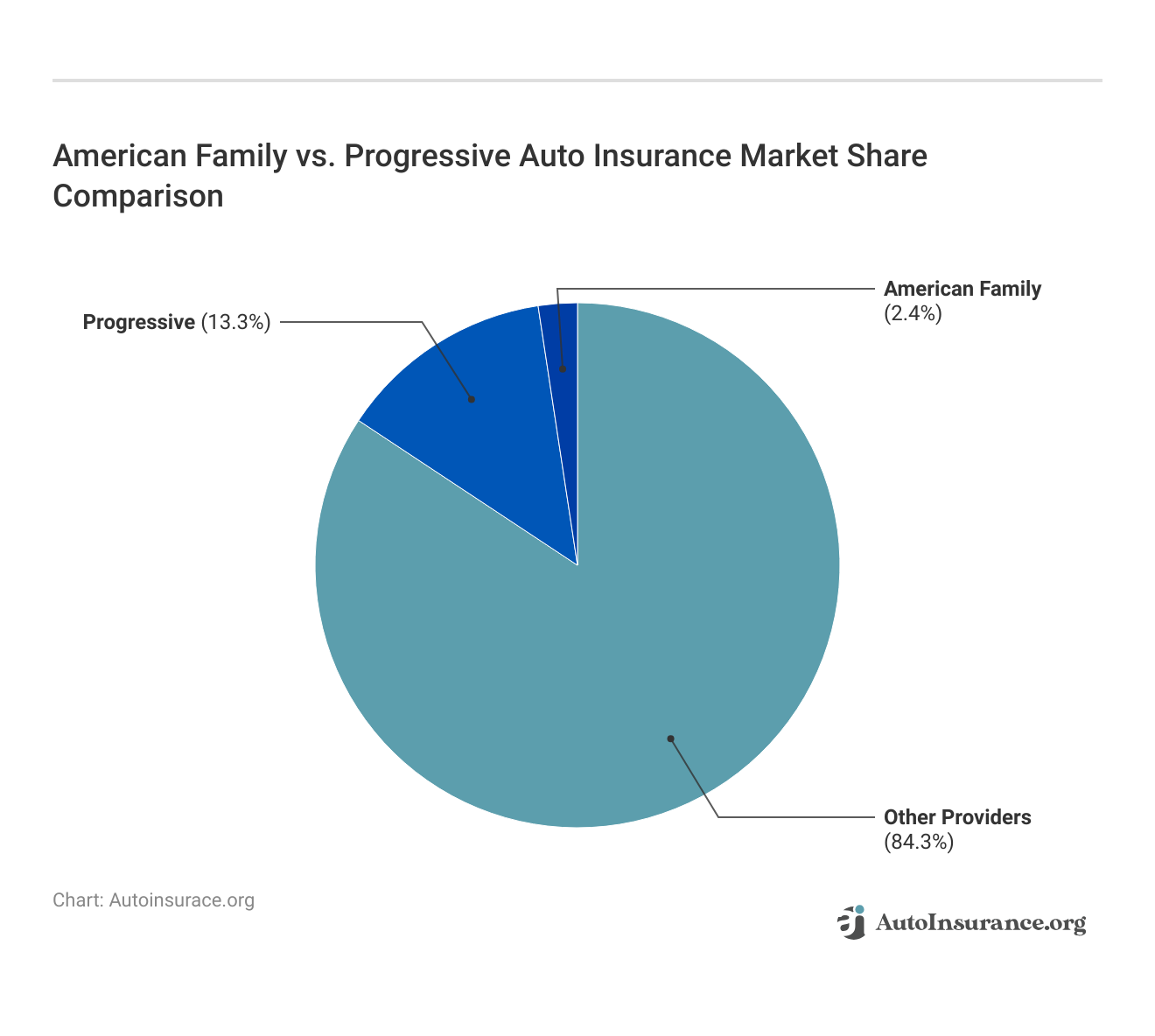

Our American Family vs. Progressive comparison reveals Progressive's lower rates, starting at $39/mo, while American Family averages $44/mo and offers bundling discounts. Coverage, support, and value this breakdowns reveal how the American Family differs from Progressive on auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Feb 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 13, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

2,235 reviews

2,235 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviews 13,283 reviews

13,283 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,283 reviews

13,283 reviewsWhen considering American Family vs. Progressive auto insurance, it’s essential to evaluate what each company offers before committing to a policy.

Choosing the lowest rates isn’t the only factor; Progressive offers competitive rates starting at $39 per month and benefits like accident forgiveness and a mobile app.

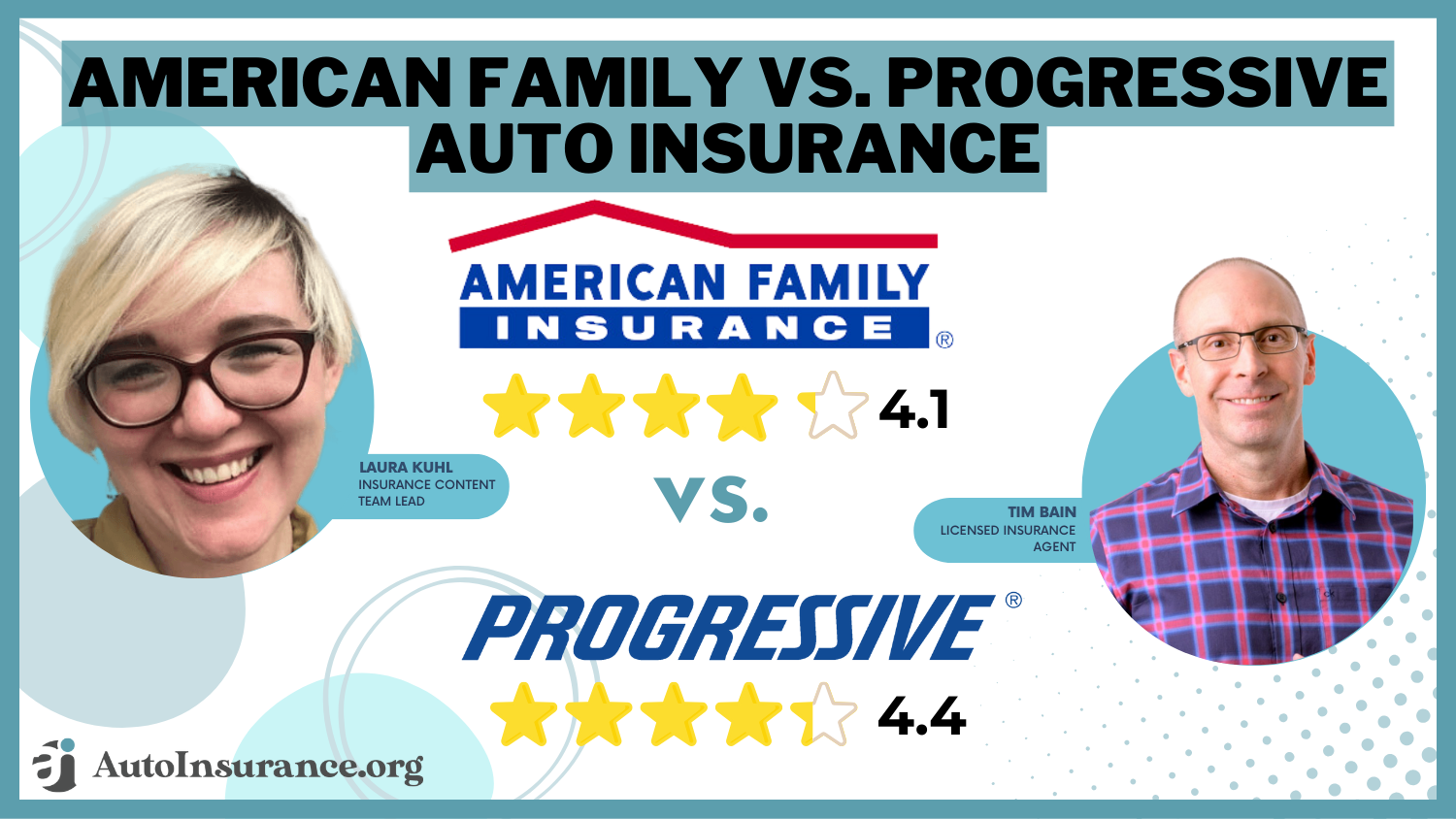

American Family vs. Progressive Auto Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.1 | 4.4 |

| Business Reviews | 4.0 | 4.0 |

| Claim Processing | 4.8 | 3.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 3.9 | 5.0 |

| Coverage Value | 4.0 | 4.2 |

| Customer Satisfaction | 4.0 | 4.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.7 | 4.3 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.4 | 5.0 |

| Savings Potential | 4.1 | 4.5 |

| American Family Review | Progressive Review |

In contrast, American Family is recognized for its personalized customer service and local agent support. Here’s how American Family and Progressive, two of the cheapest auto insurance companies, might be able to cover your need for auto insurance.

While you shop for affordable American Family vs. Progressive auto insurance coverage, enter your ZIP code above to start comparing free car insurance quotes from the companies in your area.

- Progressive’s rates start at $39/month, featuring accident forgiveness

- American Family emphasizes personalized service with local agents

- Both insurers offer unique discounts, with American Family rewarding loyalty

Progressive vs. American Family Insurance Rates

Factors like where you live, your driving record, age, gender, and more determine whether you will have less or more expensive auto insurance rates.

American Family vs. Progressive Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $414 | $801 |

| Age: 16 Male | $509 | $814 |

| Age: 30 Female | $116 | $131 |

| Age: 30 Male | $137 | $136 |

| Age: 45 Female | $115 | $112 |

| Age: 45 Male | $117 | $105 |

| Age: 60 Female | $104 | $92 |

| Age: 60 Male | $105 | $95 |

Unfortunately, American Family’s quotes are not readily available, so it isn’t easy to compare American Family vs. Progressive auto insurance quotes.

However, below are sample monthly and yearly full coverage auto insurance rates by state. This will hopefully give you an idea of what you may pay for auto insurance in your area.

American Family vs. Progressive Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $117 | $105 |

| Not-At-Fault Accident | $176 | $186 |

| Speeding Ticket | $136 | $140 |

| DUI/DWI | $194 | $140 |

It’s always smart to compare companies’ sample auto insurance rates, as it gives you a better idea of what each company has to offer. It also helps you find the right coverage at an affordable price.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

American Family vs. Progressive Auto Insurance Discounts

Because these companies are so diverse in their offerings, the car insurance discounts they offer are also diverse. Below is a list of the different deals available from American Family Car Insurance and Progressive Car Insurance.

American Family Auto Insurance Discounts

| Discounts |

|---|

| Auto Safety Equipment |

| Away at School |

| Defensive Driver |

| Early-Bird |

| Generational |

| Good Driving |

| Good Student |

| KnowYourDrive |

| Low Mileage |

| Loyalty |

| Multi-Product |

| Multi-Vehicle |

| Steer into Savings |

| Teen Safe Driver |

| Young Volunteer |

Drivers can save up to 29% on their rates by bundling American Family home and auto insurance or adding a discount to their car insurance policy with American Family. Learn how to save money by bundling insurance policies.

Be sure to ask about American Family vs. Progressive commercial auto insurance, especially if you are a food delivery driver. The amount of your Progressive vs. American Family car insurance quotes will likely be higher for commercial auto insurance.

Progressive Auto Insurance Discounts

Progressive offers a discount for drivers who bundle their insurance policies through the company. This discount includes bundling auto insurance, home insurance, or renters insurance.

Full Coverage Auto Insurance Monthly Rates by State

| State | Rates |

|---|---|

| Alabama | $139 |

| Alaska | $147 |

| Arizona | $156 |

| Arkansas | $162 |

| California | $219 |

| Colorado | $169 |

| Connecticut | $169 |

| Delaware | $183 |

| Florida | $190 |

| Georgia | $179 |

| Hawaii | $100 |

| Idaho | $106 |

| Illinois | $150 |

| Indiana | $143 |

| Iowa | $104 |

| Kansas | $135 |

| Kentucky | $176 |

| Louisiana | $201 |

| Maine | $115 |

| Maryland | $237 |

| Massachusetts | $144 |

| Michigan | $339 |

| Minnesota | $220 |

| Mississippi | $142 |

| Missouri | $156 |

| Montana | $153 |

| Nebraska | $148 |

| Nevada | $144 |

| New Hampshire | $122 |

| New Jersey | $197 |

| New Mexico | $142 |

| New York | $174 |

| North Carolina | $131 |

| North Dakota | $177 |

| Ohio | $114 |

| Oklahoma | $160 |

| Oregon | $147 |

| Pennsylvania | $179 |

| Rhode Island | $143 |

| South Carolina | $191 |

| South Dakota | $127 |

| Tennessee | $130 |

| Texas | $207 |

| Utah | $147 |

| Vermont | $133 |

| Virginia | $132 |

| Washington | $104 |

| Washington D.C. | $192 |

| West Virginia | $141 |

| Wisconsin | $133 |

| Wyoming | $105 |

Drivers who take advantage of either of these two bundling options will receive a multi-policy discount on their American Family auto insurance policy that will save them an average of 4%. See Progressive auto insurance discounts for more information.

Progressive vs. American Family Insurance Consumer Ratings

Another good way to find out which company is for you is to compare American Family vs. Progressive insurance consumer ratings. Look at the table below to see how each company was rated in a Consumer Reports auto insurance study.

Insurance Business Ratings & Consumer Reviews: American Family vs. Progressive

| Agency | ||

|---|---|---|

| Score: 831 / 1,000 Avg. Satisfaction | Score: 832 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 78/100 Positive Customer Feedback | Score: 72/100 Avg. Customer Feedback |

|

| Score: 0.77 Fewer Complaints Than Avg. | Score: 1.11 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A+ Superior Financial Strength |

As you can see, American Family and Progressive are close in Consumer Reports rankings.

When comparing American Family and Nationwide auto insurance, both companies offer a broad range of policy options. To make an informed choice, it’s helpful to check their A.M. Best ratings. Reading a Nationwide auto insurance review can give you a better understanding of its offerings, customer satisfaction, and how it stacks up against American Family.

- The American Family Insurance rating from A.M. Best is an A.

- Progressive Insurance rating from A.M. Best is an A+.

In J.D. Power’s 2020 U.S. auto insurance study on customer satisfaction, American Family tied with Geico for the highest-ranking auto insurance company in the southwest.

On a 1,000-point scale, Progressive scored 848, ranking second for the state of Texas.

American Family Insurance

American Family Insurance is a private mutual insurance company specializing in auto insurance and property and casualty insurance. Additional services offered by American Family include commercial, health, homeowners, and life insurance, as well as investment and retirement-planning services.

American Family is headquartered in Madison, Wisconsin, and serves customers across the United States. It’s important to note that American Family is a separate company from American Family Care.

Although similar in name, the latter is an urgent care practice, while American Family Insurance is a personal and business insurance company.

Progressive Corporation

Progressive Insurance provides auto insurance nationwide, with over 30 other insurance options for customers to select from. The company also offers Progressive auto insurance discounts for drivers who bundle multiple policies together.

Auto Insurance Policies Offered by American Family

American Family has a long list of auto insurance policies available to its members. Of course, the company offers different types of auto insurance coverage, like collision, comprehensive, and liability insurance.

However, apart from basic coverage, American Family insurance options also include:

- Underinsured And Uninsured Motorist insurance

- Classic Car Insurance

- Commercial Insurance

- Rideshare Insurance

- Gap insurance

American Family’s ForeverCar vehicle service plan covers extra repair costs in the event of an accident. It’s different from an extended warranty in that it adapts to your needs over time.

For more detailed information on AmFam auto insurance discounts, policies, and more, you have to have an American Family insurance login. You can log in to American Family Insurance on the company’s website, amfam.com, to make payments, file AmFam claims, and order new ID cards.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Policies Offered by Progressive

Similar to American Family, Progressive offers a full range of personal insurance policies. Although the company doesn’t openly advertise it, Progressive does offer a line of business insurance as well.

Connect by American Family vs American Family

byu/L8Z8 inInsurance

Let’s take a look at Progressive auto insurance policy options. Apart from standard and full coverage auto insurance, Progressive auto insurance policies include:

- Classic auto insurance

- Boat Insurance

- Snowmobile insurance

- ATV Insurance

- Motorcycle Insurance

For detailed information on Progressive car insurance discounts, policies, and more, you have to have a Progressive auto insurance login. Using a Progressive car insurance login, you can also make payments, file claims, and request new ID cards. The same options are available on the Progressive app.

Progressive Pros & Cons

Pros

- Low Prices Starting at $39/Month: Progressive offers full coverage options and gap insurance to SR-22 filings. Learn more about our “Progressive Auto Insurance Review” for a broader perspective.

- Extensive Coverage Options: Progressive offers extensive coverage options, from gap insurance to SR-22 filings.

- Substantial Discounts Available: Substantial discounts are available. Safe Driver Progressive offers bundling of policies and other paperless billing.

Cons

- Limited Local Agent Network: Customers may find limited face-to-face assistance compared to some competitors.

- Rates May Increase After Initial Term: Some customers report rate hikes after the first policy term, especially if they’ve filed claims.

American Family Pros & Cons

Pros

- Personalized Local Agent Support: American Family focuses on customer support by using local agents. Uncover more about our “American Family Auto Insurance Review” by reading further.

- Loyalty and Family Discounts: It provides unique discounts to multi-generational families and long-time customers.

- Strong Customer Satisfaction Ratings: It is very responsive and has high customer satisfaction ratings, especially for customers who need to interact with a local office.

Cons

- Higher Average Rates: Generally, it costs more than Progressive for simple coverage in most states.

- Limited Digital Tools: Its app and website have fewer tools available than those of other companies like Progressive.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Overall: American Family vs. Progressive

American Family and Progressive offer almost identical business auto insurance packages; thus, the choice most often depends on which one aligns with your preferences, among other unique factors.

With rates starting at $39, Progressive stands out for its impressive discounts and features, making it a top choice in the auto insurance market.Michelle Robbins Licensed Insurance Agent

Before you buy American Family vs. Progressive auto insurance, enter your ZIP code into our free online tool for instant auto insurance quotes from companies in your area.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What is the difference between American Family and Progressive auto insurance?

What is Progressive SR-22 insurance, and who needs it?

Progressive SR-22 insurance is a certificate of financial responsibility often required for high-risk drivers who have been involved in traffic violations, DUI convictions, or driving without insurance. Progressive provides SR-22 filing as a way to show the state that you carry the minimum required liability coverage.

How does American Family vs. Infinity compare in terms of coverage and pricing?

American Family generally offers more coverage options and discounts, especially for families and home bundling. Infinity, often preferred by high-risk drivers, may offer more competitive rates for those with driving violations but provides fewer discounts than the American Family. Reviewing the best comprehensive auto insurance companies will help you choose the best fit for your needs.

What should you know when comparing American Family vs. Mercury for auto insurance?

When comparing American Family vs. Mercury, consider that American Family is widely recognized for customer satisfaction and offers a range of discounts. Mercury, while typically more affordable, may be better suited for those primarily interested in basic auto insurance with essential coverage at a lower cost.

Which offers better coverage: Progressive vs. Infinity?

Progressive generally offers a wider variety of coverage options, including customizations for accident forgiveness, pet injury, and rideshare drivers, whereas Infinity focuses on more basic, budget-friendly policies geared toward high-risk drivers.

How does American Family vs. Liberty Mutual compare in customer satisfaction and policy options?

American Family is known for high customer satisfaction and discounts for young drivers, while Liberty Mutual offers broader bundling options but may score lower in satisfaction. For more details on safe driving discounts, see the American Family Insurance KnowYourDrive Review.

What is the Progressive AM Best rating, and why is it important?

The Progressive AM Best rating is A+ (Superior), indicating a strong financial position and ability to meet policyholder obligations. This rating is essential for customers because it reflects Progressive’s reliability in handling claims and financial stability.

When considering American Family vs. Erie, which is the better option?

American Family is well-known for affordable home and auto bundles and special discounts for families, while Erie is often favored for personalized customer service and low-cost coverage, particularly in certain U.S. regions. Erie is generally a stronger choice in states where it operates if personal service is a priority.

How does American Family vs. Nationwide stack up for home and auto insurance?

American Family and Nationwide both offer solid home and auto insurance, with American Family excelling in personalized discounts for families with teen drivers. Nationwide, known for extensive homeowner endorsements, provides more options for coverage customization. If you’ve wondered, “Why is auto insurance for new cars so expensive?“ this comparison sheds light on how coverage features and discounts can influence costs.

What should you consider from an American Family Insurance review?

American Family Insurance reviews often highlight the company’s affordable rates, strong customer service, and discounts tailored to young drivers and families. Additionally, its digital tools for claims management are widely regarded as user-friendly.

Which company offers better auto insurance: Progressive vs. State Farm?

Progressive and State Farm each offer unique advantages: Progressive is praised for its flexible, affordable policies and innovative options like usage-based insurance, while State Farm is known for extensive agent networks and high customer satisfaction. State Farm may be a better fit for those who prefer in-person service.

Start saving on your auto insurance by entering your ZIP code below and comparing quotes.

How does Allstate vs. American Family compare in terms of customer service?

Allstate is known for reliable customer service and budget-friendly policy options, while American Family stands out for its personalized service and discounts aimed at young drivers and families. Both companies are comparable, but American Family often gets extra points for community involvement and customized discounts. For more on Allstate’s offerings, check out the Allstate Drivewise review for insights on safe-driving savings and program features.

What is the AM Best rating for Progressive, and what does it indicate?

Progressive’s AM Best rating is A+ (Superior), which shows a high level of financial strength and stability. This rating means Progressive is well-positioned to pay out claims and meet its obligations, providing customers with confidence in the company’s reliability.

Are American Family renters insurance reviews generally positive?

Yes, American Family renters insurance reviews are typically positive, with customers appreciating its affordable premiums, easy-to-navigate online tools, and reliable customer service. Renters especially value the American Family’s prompt claims handling and helpful customer support.

How do American Families vs. Travelers compare in terms of policy variety?

American Family and Travelers provides a range of auto, home, and life insurance policies. American Family is particularly known for its family-oriented discounts and options for young drivers. On the other hand, Travelers offers a broader selection of specialized coverages, including umbrella insurance and policy endorsements. If you’re considering Travelers, you might want to check out the Travelers IntelliDrive review to see how safe driving can help you lower your premiums.

Is Progressive vs. The General better for high-risk drivers?

For high-risk drivers, The General typically offers more accessible coverage options without a long underwriting process, making it easier for those with a poor driving record to get insured. Progressive, however, provides more flexible policy customization and potential discounts for those improving their driving habits.

What are the key differences between Liberty Mutual vs. Progressive?

Liberty Mutual and Progressive differ primarily in their policy offerings and discount structures. Liberty Mutual provides extensive home and auto bundling discounts, while Progressive offers flexible options, including usage-based insurance and customized discounts based on driving behavior.

Which is a better choice for budget-conscious customers: American Family vs. The General?

For budget-conscious customers, it’s often a better choice to consider lower-cost options, especially for high-risk drivers, as highlighted in The General auto insurance review. While American Family may be slightly more expensive, it often delivers better coverage and discounts, particularly for multi-policy holders.

Are Progressive renters insurance reviews favorable among policyholders?

Yes, Progressive renters insurance reviews are generally favorable, with customers appreciating its affordable rates and convenience. The company’s digital tools and easy claims process also contribute to positive experiences among policyholders.

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.