American Farmers & Ranchers Auto Insurance Review for 2025 (Find a Top-Rated Policy)

American Farmers & Ranchers auto insurance offers coverage tailored to Oklahoma farmers and ranchers with rates starting at $48/mo. This American Farmers & Ranchers auto insurance review highlights unique features like claims rewards for reporting illegal activities, ideal for agricultural needs.

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Jan 3, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 3, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

American Farmers & Ranchers Auto Insurance

Average Monthly Rate For Good Drivers

$48A.M. Best Rating:

B+Complaint Level:

LowPros

- Localized service through independent agents statewide.

- Unique claims rewards for reporting illegal activities.

- Covers rural communities, schools, and churches locally.

Cons

- Coverage is limited exclusively to the state of Oklahoma.

- Policies are less competitive for non-agricultural customers.

- Their original mission was to provide protection against catastrophic loss of farm buildings, equipment, livestock, and household goods as a result of a fire

- American Farmers & Ranchers makes the claims filing process easy by providing a 24-hour, toll-free claims hotline

- American Farmers & Ranchers is rated, on average, with a three out of five

This American Farmers & Ranchers auto insurance review highlights the company’s specialized offerings for Oklahoma farmers and ranchers, including coverage for farm vehicles, buildings, and equipment.

With a century-long legacy, it supports rural communities by insuring private schools and churches. Customers benefit from unique features like claims rewards for reporting theft or vandalism.

American Farmers and Ranchers Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Insurance Rating | 3.5 |

| Business Reviews | 4 |

| Claim Processing | 3.5 |

| Company Reputation | 3.5 |

| Coverage Availability | 2.4 |

| Coverage Value | 3.4 |

| Customer Satisfaction | 3.6 |

| Digital Experience | 3 |

| Discounts Available | 4.7 |

| Insurance Cost | 4 |

| Plan Personalization | 3.5 |

| Policy Options | 2.2 |

| Savings Potential | 4.2 |

Localized service from independent agents gives personal attention, and there are many coverage options like home, life, and farm insurance.

Because of this, AFR is a trusted choice for farming businesses looking for dependable protection. Discover American Farmers & Ranchers auto insurance deals by entering your ZIP code today.

- Rated 3.5 for coverage focused on farmers and ranchers

- Unique claims rewards for theft or vandalism information

- Covers farm vehicles, equipment, and rural community needs

Exploring American Farmers & Ranchers’ Mission

Today American Farmers & Ranchers (American Farmer insurance) provides insurance to cover almost every need of agricultural workers and business owners in Oklahoma.

They even cover rural churches, private schools, and community organizations in farming communities.

Because American Farmers & Ranchers (American Farmers & Ranchers mutual ins co) is licensed only in the state of Oklahoma, it maintains only one office. You can visit the local offices of agents in your area, or you can visit the corporate headquarters in Oklahoma City.

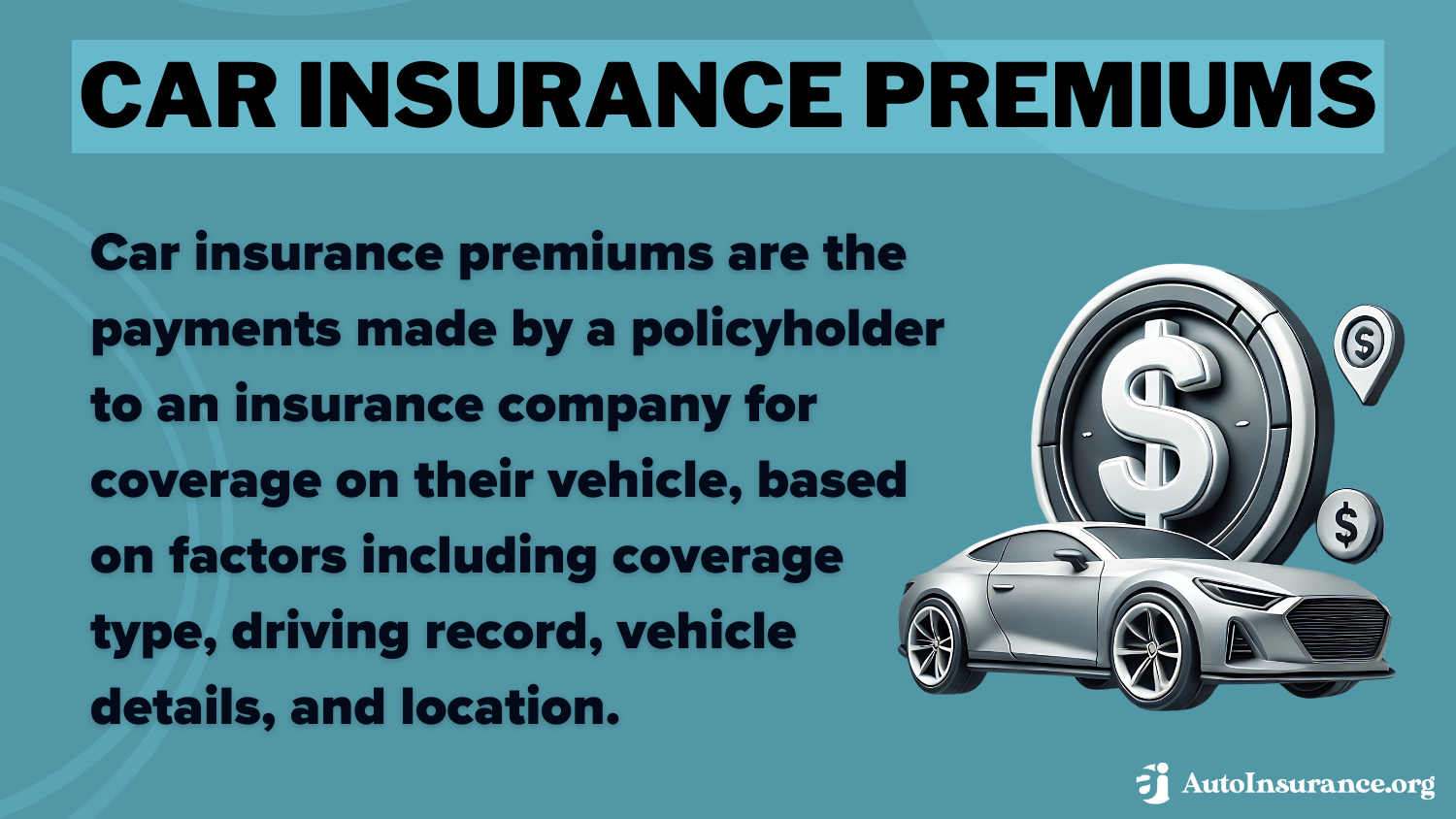

This table shows the monthly prices for American Farmers & Ranchers car insurance premiums, divided by coverage type, age, and gender. It emphasizes how elements such as age and gender affect the expense of basic and complete coverage plans.

American Farmers & Ranchers Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $300 | $470 |

| Age: 16 Male | $330 | $510 |

| Age: 18 Female | $260 | $430 |

| Age: 18 Male | $290 | $470 |

| Age: 25 Female | $165 | $250 |

| Age: 25 Male | $185 | $270 |

| Age: 30 Female | $140 | $220 |

| Age: 30 Male | $150 | $230 |

| Age: 45 Female | $120 | $190 |

| Age: 45 Male | $48 | $100 |

| Age: 60 Female | $110 | $180 |

| Age: 60 Male | $120 | $190 |

| Age: 65 Female | $115 | $185 |

| Age: 65 Male | $125 | $195 |

Young drivers have the most expensive rates. For example, 16-year-old boys need to pay $510 for full coverage while girls of the same age spend $470. When people reach 45 years old, they both experience much cheaper premiums; men might only pay around $48 for minimum coverage.

Women who are 30 years old find good prices, beginning at $140 for the least coverage. These differences show how important it is to consider demographics when deciding on insurance costs and highlight that older drivers can get affordable rates.

The table shows how driving history affect American Farmers and Ranchers car insurance rates. It give simple breakdown of price for minimum and full coverage in different situations.

Drivers who have no violations on their record get the cheapest insurance rates. They can pay around $48 for minimum coverage and about $100 for full coverage. But if a driver has one ticket, the cost goes up a lot. In that case, they might need to spend around $155 for just minimum coverage and roughly $240 to get full coverage.

More serious violations such as accidents or DUI have much higher insurance costs, with DUI charges going up to $215 for basic coverage and $350 for comprehensive. This shows that keeping a clean driving history can save you a lot of money.

Read more: What is needed for adequate auto insurance coverage?

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Top Alternatives to Farmers & Ranchers Coverage

The table shows monthly minimum and full coverage prices from American Farmers & Ranchers and other insurance companies. It give clear details of costs to help people decide which policy is the best deal for them.

American Farmers & Ranchers Monthly Auto Insurance vs. Top Competitors by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $55 | $150 | |

| $45 | $120 |

| $54 | $148 | |

| $47 | $130 | |

| $60 | $160 |

| $52 | $145 |

| $49 | $140 | |

| $50 | $135 | |

| $51 | $138 | |

| $40 | $115 |

American Farmers & Ranchers give minimum coverage deal at $45 and full coverage for $120, making it a strong competitor. On the other hand, USAA has the cheapest rates with $40 for minimum coverage and $115 for full one but is only available to people connected with military.

Geico is close behind with prices of $47 for minimum coverage and $130 for full coverage auto insurance, which makes it attractive to many people. The data shows that American Farmers & Ranchers continues to be a good option for Oklahoma’s farmers and ranchers who want affordable rates and customized protection.

Maximizing Savings With American Farmers & Ranchers Discounts

American Farmers & Ranchers auto insurance gives many discounts so people can pay less for their policy. If you drive safe, have more than one policy with them, or stay a long time customer, they will help lower the price of your insurance. These discounts make it cheaper to get covered if you qualify for them.

American Farmers & Ranchers Auto Insurance Discounts by Savings Potential

| Discount Name |  |

|---|---|

| Safe Driver | 20% |

| Multi-Policy | 15% |

| Multi-Vehicle | 12% |

| Good Student | 10% |

| Anti-Theft Device | 10% |

| Loyalty | 10% |

| Defensive Driving | 8% |

| Low Mileage | 7% |

| Pay-in-Full | 5% |

| Paperless Billing | 5% |

The table shows many discounts given by American Farmers & Ranchers auto insurance. Safe drivers can get up to 20% off, while signing up for paperless billing gives a 5% discount. People who combine different policies or insure more than one vehicle can save as much as 15% and 12%.

Students who keep good grades or have cars with anti-theft systems can save up to 10%. Drivers who don’t drive much and those who finish defensive driving classes might get extra discounts too. Paying premiums in full further reduces costs, offering a practical way to manage expenses. Discover the best auto insurance discounts available to save on coverage.

States Covered by American Farmers & Ranchers

American Farmers & Ranchers Insurance is a company that gives special attention only to the needs of farmers and ranchers in Oklahoma. They provide insurance coverage made just for farming businesses. The services include important protections, like covering farm machinery, vehicles used on farms, and properties in rural communities.

- AFR Insurance offers coverage tailored for farmers and ranchers.

- Recognizes and addresses the specific needs of agricultural workers.

- It is ideal for farmers, ranchers, and those in the agricultural sector.

The different coverage choices focus on what farmers need most, like insurance for farmhouses, tractors, and equipment. It shows how AFR is committed to helping countryside areas by also covering places such as schools and churches.

American Farmers & Ranchers prioritizes local expertise to serve farming communities effectively.Brandon Frady Licensed Insurance Producer

AFR Insurance Services pays close attention to the special problems in farming, making sure its services fit well with what farmers and ranchers in Oklahoma need.

Discover more by reading our guide: Cheap Farm Vehicle Auto Insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Finding Trusted American Farmers & Ranchers Agents

AFRMIC is pleased to offer personal, localized service by way of a network of independent agents throughout the state. Agents are located in all but six counties; Beaver, Cole, LeFlore, Nowata, Pittsburgh, and Rogers. However, customers in those counties have access to agents in the neighboring counties. The company website provides an agent locator tool consisting of a linked county map.

You simply select the county you’re interested in by clicking on it, and your browser is then redirected to a page which lists the available agents. Name, address, email, and telephone numbers are all included in the contact list. Local agents are available to help assist with new policies, modifications and additions, and claims. Find out how to find auto insurance agents in your area for expert assistance.

Steps to File a Claim With American Farmers & Ranchers

AFR Mutual Insurance makes the claims filing process easy by providing a 24-hour, toll-free claims hotline. If you have a car accident, you are encouraged to call the hotline as soon as possible so that a representative can help guide you through the process.

If you prefer, you can also contact your local agent during regular business hours. Either way, AFR insurance company stresses the need to make a call as soon as possible after an accident. American Farmers & Ranchers’ claims service has a somewhat unique program you don’t see from very many other providers.

View this post on Instagram

It is a cash reward program that pays individuals for any information leading to the arrest and conviction of anyone whose illegal activity resulted in an auto insurance claim by a policyholder. Explore how to file an auto insurance claim and ensure proper reimbursement.

For example, if someone broke into the barn of an AFR Insurance Group customer and stole equipment, and the theft resulted in a claim being made by the owner, you could receive a cash reward for information about the theft. American Farmer and Ranchers recently raised maximum reward amounts from $1,000 to $5,000.

Insights From American Farmers & Ranchers Reviews

Customer reviews of American Farmers & Ranchers are hard to come by. That might be due to the fact that they are a regional insurance provider catering to a select group of individuals and businesses. However, the reviews that do exist are generally good. You can find customer reviews by searching the company name on the Internet. Most customer review sites rate insurance companies according to four main criteria:

- Claims Service

- Cost

- Coverage Provided

- General Customer Service

Most of these sites also utilize a five-point system either represented in numerals or stars. American Farmers & Ranchers is rated, on average, with a three out of five. That rating is very good, seeing that most insurance companies don’t break the 2.5 mark.

It’s also pretty impressive when you consider that customer reviews generally are offered more by unhappy customers than happy ones. Despite that fact, there are comments that indicate American Farmers and Ranchers insurance in Oklahoma City is very easy to work with and offers great customer service.

View this post on Instagram

The only complaint uncovered during research for this review was related to a tendency among new American Farmers & Ranchers agents to be somewhat impersonal in their attitude to existing customers. Most likely that is just a matter of new agents not yet having developed relationships with customers. Hopefully, the issue corrects itself with time.

Learn more by checking out our guide: Best Auto Insurance Companies According to Consumer Reports

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Customized Policies From American Farmers & Ranchers

American Farmers & Ranchers Insurance gives important coverage choices for people who farm and ranch. They provide protection like liability, collision, and even help on the road if trouble happens with vehicles or drivers. Some of the coverage options typically offered by American Farmers and Ranchers Mutual insurance include:

- Liability: coverage pays for injuries or property damage caused in an accident.

- Collision: refers to damage from another vehicle or object.

- Comprehensive: coverage benefits help with things like theft, vandalism, and natural disasters.

- Uninsured/Underinsured Motorist: helps protect you if you’re involved in an accident with a uninsured or minimum coverage driver.

- Medical Payments: for everyone in your vehicle regardless of who was at fault are paid by this type of coverage.

- Roadside Assistance: can help with emergency services like towing, flat tire changes, and fuel delivery if you select this additional coverage option.

The above explains AFR’s responsibility coverage for accidents, protection from collisions, and full safeguards against theft or vandalism. It also includes coverage if the other driver doesn’t have enough insurance or no insurance at all and medical payments for passengers without considering who is at fault.

Roadside assistance gives emergency help like towing and bringing fuel. These services make sure rural drivers have dependable aid when needed. Explore the best roadside assistance plans for towing, lockouts, and more.

Compare American Farmers & Ranchers insurance quotes instantly by providing your ZIP code using our free tool.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What does American Farm & Ranch insurance cover?

American Farm & Ranch insurance covers farm vehicles, equipment, liability, and rural properties designed to meet the needs of farmers and ranchers. Monthly rates start at $48. Discover tips for finding the cheapest liability-only auto insurance available today.

What is American Farmers Insurance?

American Farmers Insurance company offers auto, home, farm, and life insurance policies tailored to farmers, ranchers, and rural communities. Coverage includes vehicles, farm structures, and liability.

What do American Farmers & Ranchers Insurance reviews say?

American Farmers and Ranchers Mutual Insurance company reviews highlight affordable rates, specialized agricultural coverage, and strong service in Oklahoma. Some reviews mention responsive customer support and personalized policies. Discover customized American Farmers & Ranchers policies by entering your ZIP code into our quote tool.

What do AFR Insurance reviews emphasize?

AFR Insurance reviews focus on competitive pricing, tailored policies for rural communities, and localized agent support in Oklahoma. Customers appreciate its coverage for farm equipment and vehicles.

What services does the American Farm Company provide?

The American Farm Company specializes in insurance for farmers, offering protection for farm vehicles, rural homes, and equipment with flexible monthly payment options. Find out which types of auto insurance are essential for your situation.

What do American Farmers & Ranchers in OKC specialize in?

American Farmers & Ranchers OKC is the headquarters for AFR, offering localized insurance solutions like auto, farm, and home coverage tailored for Oklahoma’s agricultural needs.

What is Farm and Ranch auto insurance?

Farm and Ranch auto insurance is a specialized policy that covers vehicles used in farming and ranching, offering liability, collision, and comprehensive coverage starting at competitive monthly rates.

What does American Farmers & Ranchers Mutual Insurance Company offer?

The American Farmers & Ranchers Mutual Insurance Company provides tailored insurance for Oklahoma farmers, covering farm equipment, vehicles, and properties with flexible monthly payment plans.

How do I access the American Farmers & Ranchers login?

To access the American Farmers & Ranchers login, visit their official website and use your account credentials to view policies, make payments, or file claims securely. Discover the best platforms where to buy auto insurance online effortlessly.

What is Oklahoma’s American Farmers & Ranchers Insurance?

Oklahoma’s American Farmers & Ranchers Insurance offers customized coverage for vehicles, equipment, and rural properties, focusing exclusively on the needs of Oklahoma’s agricultural community.

What is the American Farmers & Ranchers Insurance phone number?

The American Farmers & Ranchers Insurance phone number is 1-800-324-7771, available for inquiries, claims, and policy support.

What do Farmers insurance reviews say?

Farmers insurance reviews highlight strong customer service, various coverage options, and competitive monthly rates. Some reviews mention higher premiums compared to competitors.

What do Farmers renters insurance reviews emphasize?

Farmers renters insurance reviews often praise its customizable policies and quick claims process. However, some reviews mention limited discounts or slightly higher monthly premiums. Save on American Farmers & Ranchers insurance by entering your ZIP code into our free comparison tool.

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Mysticrey

AFR is a good company

clyy

Americans Farmers&Ranchers RULES!

Angiev97

Wonderful!

RChiggins

Great insurance

mlandherr

'Real' customer service and claims adjusters.

bloubeck

Good company

Honest12

Don't use them

vampirelover004

Nice company

Ryanvols

Would not recommend

NICKI7772

GREAT