AIG Auto Insurance Review for 2025 (See Rates & Discounts Here)

Our AIG auto insurance review explores policy benefits, pricing, and satisfaction. With rates starting at $44 monthly, AIG offers features like accident forgiveness and new car replacement. Reviews of American International Group highlight its claims process and stability, helping drivers assess its reliability.

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Apr 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Apr 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

AIG

Monthly Rate

$44A.M. Best Rating:

AComplaint Level:

LowPros

- Offers coverage for high-value vehicles and tailored protection for high-net-worth clients

- Low NAIC complaint index score of 0.30

- Comprehensive coverage options, including worldwide liability coverage

- Extensive website with various resources and account management functions

Cons

- Higher rates compared to standard insurers

- Limited availability and eligibility to only Private Client Group members

- Higher customer satisfaction with other types of AIG insurance coverage

- AIG doesn't write standard personal auto insurance

- Only the Private Client branch of AIG writes auto insurance for high-value cars

- AIG is mainly focused on life and travel insurance as well as financial services [/su_box]

Our AIG auto insurance review will tell you if this company can provide the auto insurance you need and if it's the right auto insurance for you.We'll outline AIG insurance plans, average rates, and company history. We'll also walk you through the best way to obtain an AIG auto insurance quote. The next time you hear about AIG's services, you'll have all the details you need. If you'd like to compare auto insurance quotes now, you can enter your ZIP code into the quote box above.

This AIG auto insurance review covers key benefits, including accident forgiveness and complete replacement for totaled vehicles. American International Group, Inc. provides reliable coverage and repair guarantees at $44 monthly.

While AIG offers strong claims support and financial stability, its types of auto insurance policies have limited customization options.

AIG Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.5 |

| Business Reviews | 4.0 |

| Claims Processing | 3.0 |

| Company Reputation | 4.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 3.5 |

| Customer Satisfaction | 2.1 |

| Digital Experience | 4.0 |

| Discounts Available | 3.1 |

| Insurance Cost | 2.6 |

| Plan Personalization | 4.5 |

| Policy Options | 4.5 |

| Savings Potential | 2.8 |

American International Group reviews highlight its strong financial backing, making it a reliable choice for those prioritizing stability.

High-mileage drivers and individuals who need comprehensive benefits will benefit the most. Compare various insurance quotes before deciding on a policy to see if AIG suits your needs.

- AIG provides accident forgiveness and new car replacement

- Get an excess waiver of up to $1,000 with dashcam footage

- American International Group offers plans starting at $47 monthly

Enter your ZIP code into our free comparison tool above to instantly compare your AIG auto quote vs. the top insurers near you.

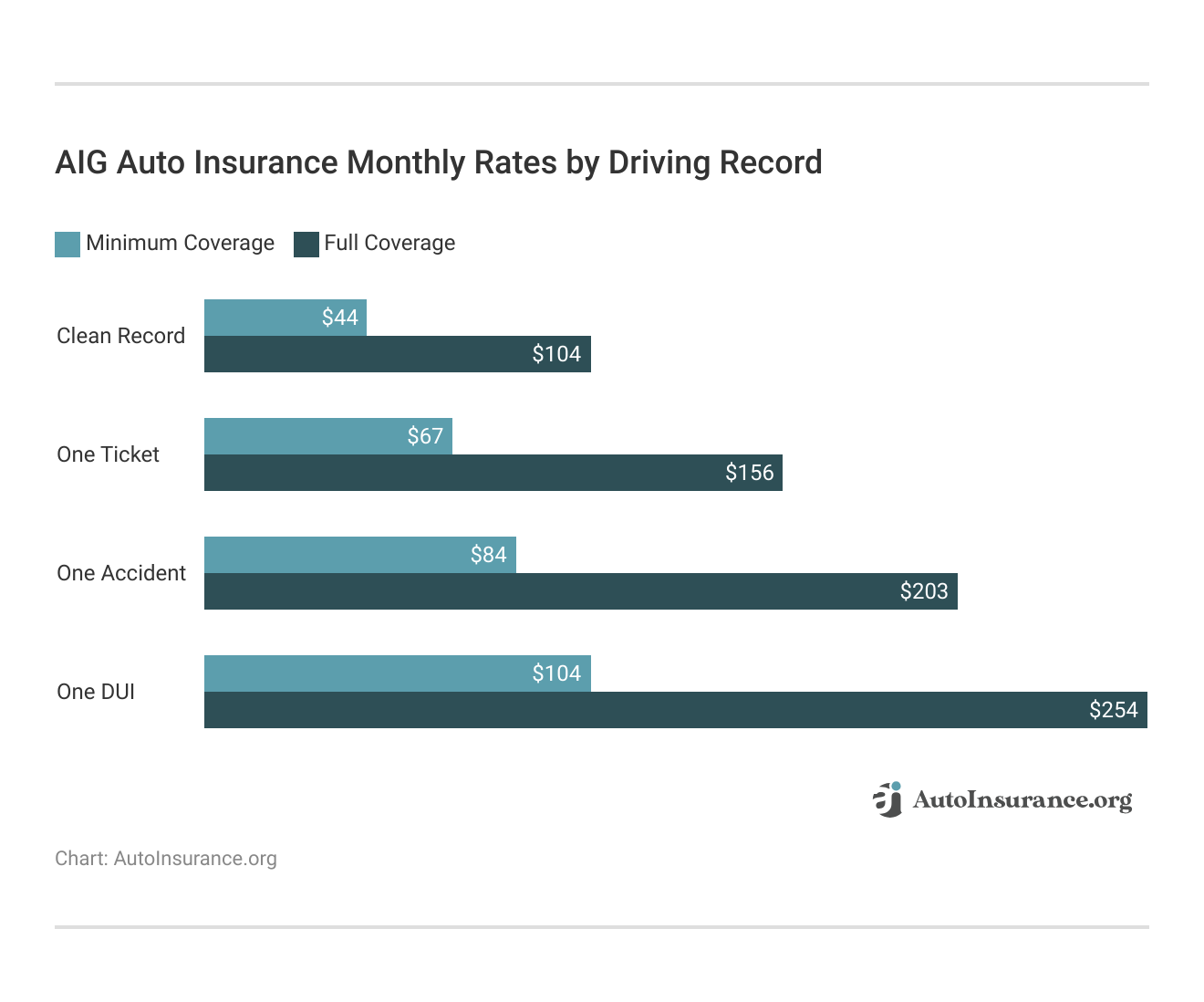

AIG Auto Insurance Rates Based on Age, Gender, and Driving History

AIG auto insurance rates differ based on the policyholder’s age, gender, and driving history.

AIG Auto Insurance Monthly Rates by Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $232 | $505 |

| 16-Year-Old Male | $246 | $518 |

| 18-Year-Old Female | $179 | $421 |

| 18-Year-Old Male | $203 | $443 |

| 25-Year-Old Female | $131 | $349 |

| 25-Year-Old Male | $142 | $362 |

| 30-Year-Old Female | $123 | $288 |

| 30-Year-Old Male | $118 | $312 |

| 45-Year-Old Female | $87 | $237 |

| 45-Year-Old Male | $44 | $104 |

| 60-Year-Old Female | $56 | $153 |

| 60-Year-Old Male | $52 | $142 |

| 65-Year-Old Female | $47 | $120 |

| 65-Year-Old Male | $50 | $128 |

Younger drivers pay the most, with 16-year-old males paying as much as $518 a month for comprehensive coverage, whereas 45-year-old males pay much lower premiums, at only $104.

Similarly, a spotless driving record means the lowest premiums, with basic coverage costing $44 monthly. A DUI, however, raises the premium to $104.

These rates emphasize the importance of having a good driving record and factor coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

American International Group, Inc. (AIG) Insurance Rate Breakdown

AIG is different from most large auto insurers in that it specializes in insuring luxury, exotic, and high-value cars. These vehicles are expensive to replace or repair, making them more challenging to insure.

Most insurers emphasize providing low yearly rates, but AIG’s policies emphasize value over cost. Compare AIG quotes with other companies to get the best rate. Below are the average rates you can expect to pay if you own one of the 20 most expensive vehicles.

Full Coverage Auto Insurance Monthly Rates: Top 10 Most Expensive Cars

| Vehicle | Rates |

|---|---|

| Audi R8 | $381 |

| BMW 7-Series | $294 |

| BMW i8 | $364 |

| Maserati Ghibli | $335 |

| Maserati Quattroporte | $419 |

| Mercedes AMG-GT | $344 |

| Mercedes S-Class | $312 |

| Porsche 911 | $311 |

| Tesla Model S | $302 |

Rather than provide standard auto insurance coverage, AIG prioritizes treating high-value vehicles with the right level of care. For example, if you damage your luxury vehicle in an auto accident, you would want to take it to a specialist.

AIG auto insurance is exclusive to Private Client Group members, meaning customer reviews are limited.Kristen Gryglik Licensed Insurance Agent

Luxury vehicle specialists are often two to three times more expensive than standard mechanics. AIG auto insurance covers costs that exceed standard policy limits, making it suitable for high-value vehicles. However, premiums are typically higher than those of standard insurers.

American International Group, Inc. (AIG) Insurance Coverage Options

AIG’s Private Client Group offers comprehensive auto insurance coverage, including:

- Personal Property Coverage: Compensates for stolen or damaged belongings in your car.

- Emergency Living Expenses: This covers costs incurred while away from home due to an emergency.

- Worldwide Liability Coverage: This covers accidents globally, with limits of up to $1 million per occurrence and up to $500 million in umbrella liability.

- Rental Car Reimbursement: Pays up to $12,500 for a comparable rental while your car is being repaired.

- Original Manufacturers’ Parts: Repairs use OEM parts, which are ideal for luxury or vintage vehicles.

- One-Policy Program: This program insures multiple vehicles under a single policy.

- AIG Premier Client Solutions (PCS): Dedicated customer service for policyholders.

These coverages cater to high-net-worth clients, frequent travelers, and owners of multiple or high-value vehicles. AIG also offers commercial auto insurance.

Private Client policyholders can bundle other coverage types, including luxury homeowners, private collections, yachts, excess liability, equine, and wildfire protection. Those outside the Private Client Group must use a separate insurer for auto coverage.

AIG Auto Insurance Coverage Availability

You can purchase and service an AIG Private Client Group auto insurance policy anywhere in the United States. AIG is in Atlanta, Denver, and every other major U.S. city.

AIG provides international coverage for auto insurance policyholders worldwide. Headquartered in New York City, AIG has offices in cities like Bratislava, Seoul, and Dubai. As the 17th-largest insurer, it offers worldwide liability protection.

AIG serves individuals, families, and businesses with a platform for managing policies, quotes, claims, and payments. However, it stopped offering standard auto insurance after selling that branch in 2009. The Private Client Group offers coverage for luxury assets to high-net-worth individuals, but this increases costs, making AIG less affordable compared to other providers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

AIG Insurance Reviews: Comparing its Luxury Coverage to Competitors

AIG auto insurance is only available to members of its Private Client branch. As a member, you’re eligible for customizable car insurance for high-end vehicles that are not typically available through standard insurance companies.

If you think🤔 auto insurance is just auto insurance, you might not have the coverage you need. There are many types🔢 of car insurance, and https://t.co/27f1xf1ARb can help you make sense of them and figure out what you need right here👉: https://t.co/Yk5tNvAQ7b pic.twitter.com/y76fVMxOil

— AutoInsurance.org (@AutoInsurance) January 15, 2024

Whether you don’t need luxury auto insurance or want more affordable exotic car insurance rates, compare your AIG auto insurance price with other top insurers to find the best deal. Seniors may benefit from the Best Auto Insurance for Seniors, while those seeking broader coverage can explore American General Car Insurance. Check AIG Direct Life Insurance Reviews or call the AIG Auto Insurance Phone Number for more details.

American International Group, Inc. (AIG) Discounts Available

Are you wondering if you can bundle a life insurance policy with AIG Direct auto insurance? Unfortunately, AIG’s Private Client Group does not provide options for bundling insurance policies.

AIG Auto Insurance Perks & Exclusive Programs

AIG auto insurance provides benefits designed to enhance coverage, convenience, and peace of mind for policyholders. These features offer value beyond standard insurance protection, from vehicle replacement to roadside assistance. Here are some key benefits:

- Brand New Replacement Car: AutoPlan and AutoPlus provide a brand-new replacement of the same make and model if the insured vehicle is damaged beyond repair within three years of purchase. For a comprehensive understanding, dive deeper into our “Best Auto Insurance for Luxury Cars.”

- Policy Lifetime Repair Guarantee: Repairs completed at authorized workshops and manufacturer-approved repair centers come with a lifetime guarantee on artistry and paintwork.

- Excess Waiver of Up to $1,000 with In-Car Camera Footage: Sharing in-car camera accident footage can result in an excess waiver of up to $1,090 (including Goods and Services Tax, or GST) while also helping to prevent fraudulent claims.

- Courtesy Car During Repairs: A courtesy car is provided while the insured vehicle is being repaired. This benefit is included with AutoPlus and available as an option for other plans.

- Free 24/7 Towing and Roadside Assistance: AutoPlus includes complimentary roadside assistance for minor issues such as flat tires or dead batteries and towing services after a breakdown. This service is available 24/7 throughout Singapore.

These benefits showcase the additional value AIG auto insurance offers beyond basic coverage. With features like repair guarantees, replacement vehicles, and roadside assistance, policyholders can experience greater convenience and financial protection. Understanding these benefits can help determine if AIG auto insurance is the right fit for individual coverage needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

AIG Auto Insurance for High-Value Vehicles and Private Clients

AIG car insurance is only for members of the Private Client Group since the company primarily focuses on other products, such as AIG Direct life insurance, AIG travel insurance, AIG health insurance, and AIG annuities. In addition, AIG only writes auto insurance for high-value cars, with coverage geared toward high-income policyholders.

Contact the AIG Private Client Group via its phone number at 1-888-978-5371 for eligibility questions. However, if you aren’t a luxury car owner or high-net-worth driver, you’ll see more savings with the other best auto insurance companies.

Read our AIG auto insurance review to see if this company offers the auto insurance types and customer service you need at a price that fits your budget.

Where to Buy AIG Auto Insurance

The Federal Reserve took control of AIG during the 2008 financial crisis. The takeover was later ruled illegal, and AIG regained power in 2012. AIG offers auto insurance through its Private Client Group.

To get car insurance, request a complimentary policy review by completing a form on AIG’s website. After you submit the form, an independent AIG agent will contact you. AIG auto insurance is available both in the United States and internationally.

Other AIG Insurance Products

In addition to AIG car insurance quotes, the company offers a range of other coverage options:

- Classic Car Insurance: AIG provides coverage for collector or vintage vehicles with an agreed-upon value between the owner and insurer, influencing the quote.

- Motorcycle Insurance: AIG offers motorcycle coverage. Call 1-800-225-5244 for details and compare quotes with other providers to find lower rates.

- Home Insurance: AIG offers coverage for high-value homes. Compare quotes with competitors to get the best deal.

- Life Insurance: Offered through American General, a subsidiary of AIG. It has numerous poor customer reviews and an F rating from the BBB.

- Annuities: These are sold through Corebridge Financial, which manages AIG’s annuity products. Corebridge has an average BBB rating of 1.06/5 stars and an F rating based on 66 reviews citing poor customer service.

You can purchase an annuity from AIG, a financial product that provides a set income for a specific period, often used for retirement planning. Corebridge Financial handles AIG’s annuities. On the BBB website, Corebridge has an average rating of 1.06/5 from 66 reviews citing poor customer service and an F rating.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to File an AIG Auto Insurance Claim

AIG recommends that all Private Client Group members file an auto insurance claim through their independent insurance advisors. However, you can also report AIG claims by calling directly.

Gather receipts and documentation for accidents, cancellations, or medical expenses before filing an AIG claim.Daniel S. Young Insurance Content Team Lead

If you’re in the U.S., you can report a claim by calling this AIG insurance contact number: 1-888-760-9195. You can also fax AIG using this insurance group number: 1-866-858-1472. If you’re a U.S.-based policyholder traveling abroad, the best way to report a claim is to call 1-302-482-6000.

How American International Group, Inc. (AIG) Ranks Among Providers

To get reliable auto insurance ratings for AIG, you need to go where trustworthy auto insurance company reports are for the best auto insurance companies.

AIG Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 835 / 1,000 Avg. Satisfaction |

|

| Score: A Good Business Practices |

|

| Score: 77/100 Good Customer Feedback |

|

| Score: 0.98 Fewer Complaints Than Avg. |

|

| Score: A Excellent Financial Strength |

Our AIG insurance review found that the company has exceptionally high ratings for financial strength, and its client satisfaction with other policies is also high. J.D. Power ranks AIG above average for life insurance satisfaction, which reflects a strong customer service team that addresses all insurance claims with the same level of integrity.

While it is important to compare your AIG insurance quote against cheaper providers, you should always consider a company’s customer service reviews and financial ratings.

AIG Car Insurance Reviews: Customer Service and Financial Stability

According to the National Association of Insurance Commissioners (NAIC), AIG automobile insurance has a 0.30 complaint index rating, whereas the national average is 1.00. This score indicates a low number of complaints, indicating good AIG customer service reviews.

AIG automotive insurance also has an A rating from A.M. Best, indicating a good financial outlook for the company.

On the other hand, the Better Business Bureau (BBB) website shows that the average AIG car insurance review, based on 107 customer reviews, is 1.01/5 stars. However, AGI auto insurance doesn’t have a rating from the BBB. Businesses looking for the best business auto insurance may also find value in AIG travel insurance reviews or contacting The General Insurance phone number for more options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of AIG Auto Insurance

Pros

- Exclusive High-Value Vehicle Coverage: Crafted for high-end and rare vehicles with unique protection.

- Comprehensive Policy Perks: This offers accident forgiveness and complete replacement for new cars.

Strong Financial Stability: Supported by American International Group, Inc., guaranteeing claim dependability. - Customizable Add-Ons: Policy owners can enjoy customized endorsements for high-end requirements.

Cons

- Restricted Eligibility: Comes with membership in the Private Client Group. Gain a deeper understanding through our article, “Best Auto Insurance Companies That Offer OEM Parts Coverage.”

- Higher Premiums: More costly than traditional auto insurance companies.

- Limited Availability: Not best suited for drivers who want simple or low-cost coverage.

Key Takeaways on AIG Auto Insurance Coverage and Benefits

The AIG Private Client Group offers AIG automobile insurance for high-net-worth people and luxury car owners. Policies include premium benefits like accident forgiveness, replacement of the entire car, and tailored coverage options. American International Group, Inc. backs AIG and has strong financial security and good claims service.

Yet, eligibility is limited to Private Client Group members, and auto insurance premiums are higher than standard insurers. While AIG stands out for personalized protection through AIG motor insurance, it may not be ideal for budget-conscious drivers. For broader options, consider an AIG car insurance policy or explore an AIG business insurance review for commercial coverage.

Enter your ZIP code into our free quote comparison tool below to see how AIG auto insurance quotes stack up against competitors.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

How much does AIG car insurance cost?

AIG car insurance premiums typically range from $1,200 to $2,500 annually. The exact cost depends on factors like the vehicle’s make and model, coverage options, and the driver’s profile. For a precise quote, it’s best to contact AIG directly.

What is the phone number of the AIG car insurance company?

The AIG auto insurance phone number is 1-888-978-5371. You can also find the best auto insurance company near you by entering your ZIP code into our free quote below.

Is AIG a good insurance company?

You may be wondering, “Is AIG car insurance good?” AIG has strong financial ratings and positive customer reviews, although customers are typically more satisfied with AIG life insurance than AIG auto insurance.

Is AIG auto insurance legit?

Yes, AIG is a reputable car and life insurance provider. In addition, AIG has an “A” rating of excellent from A.M. Best, meaning it’s financially stable and able to pay out claims.

Read More: Auto Insurance Companies With the Best Customer Service

How long does it take for AIG to settle an auto insurance claim?

AIG auto insurance claims can take up to 30-45 days to settle.

What is the AIG auto insurance address?

AIG’s company address is 175 Water Street, 18th Floor, New York, NY 10038. The AIG phone number is 1-855-853-3043.

Is AIG auto insurance affordable?

AIG auto insurance is not designed for budget-conscious drivers. Unlike cheap full coverage auto insurance, AIG vehicle insurance focuses on high-end cars and high-net-worth clients, leading to higher rates. AIG offers premium car insurance options, including AIG rental car insurance, while AIG home insurance reviews highlight its exclusive coverage.

What are the coverage options provided by AIG auto insurance?

AIG offers comprehensive coverage options for its private client group, including protections for high-value vehicles, fine homes, yachts, and private collections. It also provides worldwide liability coverage and other benefits.

What was the problem with AIG?

AIG is facing multiple liquidations due to losses in its mortgage-related investments.

Who owns AIG insurance?

The largest shareholder in AIG is The Vanguard Group, Inc., owning 10.05% of the company. Drivers looking for cheap, no-fault auto insurance can get an AIG car quote or apply for AIG car insurance online. Policyholders can also file an AIG car insurance claim or explore AIG commercial vehicle insurance for business coverage.

Is AIG auto insurance pulling out of Florida?

Lexington Insurance, an AIG subsidiary, is pulling out of Florida.

Why is AIG auto insurance leaving California?

AIG and other insurance companies have pulled out of California, citing extreme weather and economic conditions.

Can I bundle a life insurance policy with AIG Direct car insurance?

Unfortunately, AIG doesn’t offer any auto insurance discounts for bundling policies.

How are AIG Travel Guard reviews?

AIG travel insurance reviews are mostly negative, with customers complaining of lousy customer service and poor claims handling.

According to the BBB website, AIG travel reviews average 1.08/5 stars, with 293 customer reviews. However, Travel Guard is accredited by the BBB and carries an A+ rating.

Is AIG a good life insurance company?

You may also wonder, “How are AIG Direct life insurance reviews?” In addition to car insurance, AIG offers life insurance through American General Life Insurance.

While searching for an American General life insurance review, knowing the company has an F rating from the BBB is essential. The BBB website’s customer reviews average 1.04/5 stars, with only 47 reviews.

The American General Life Insurance phone number is 1-844-452-3832 for more information about coverage options.

Can I get AIG auto insurance in NJ?

AIG vehicle insurance is available in all 50 states and Washington, D.C., including New Jersey.

Read More: New Jersey Auto Insurance

What is AIG Insurance known for?

AIG Insurance is known mainly for its financial services for high-net-worth clients, although the company did gain notoriety during the 2008 financial crisis for misleading investors.

Can you buy AIG rental car insurance?

AIG’s Travel Guard program offers rental car insurance coverage with roadside assistance and up to $50,000 in rental vehicle damage coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

BVCHDCH

reliable.

robbed

SCAM

Bryan101

Good service provider

johwya

Good buy

mayesgr

well established insurance company

sunny51

MY experience.

Eliel01

It wast for me

bng

Don't make a claim

tinker98

nice bonus

Aquilar

Bad customer service