Anchor General Auto Insurance Review for 2025 (See Cost & Options Here)

Explore this Anchor General auto insurance review to see how it serves high-risk drivers in California, Arizona, and Texas high-risk drivers starting at $32 a month. Anchor General auto insurance specializes in non-standard policies that are ideal for drivers with past violations.

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Feb 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Anchor General Auto Insurance

Monthly Rates:

$32A.M. Best Rating:

BComplaint Level:

HighPros

- Competitive rates for high-risk drivers in select states

- Accredited by the Better Business Bureau with a rating

- Specializes in non-standard auto insurance coverage

Cons

- Limited availability, only in California, Arizona, and Texas

- Customer service response times can be inconsistent

- Anchor General sells insurance through retail agents to customers in California and Arizona

- Anchor General states that it anticipates expansion into other states in the near future

- If you are considering Anchor General as an auto insurance provider you may want to think twice and consider other options

Explore this Anchor General auto insurance review, which focuses on high-risk drivers in California, Arizona, and Texas.

The company provides non-standard policies through retail agents, specializing in liability and physical damage coverage.

Anchor General Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Insurance Rating | 2.6 |

| Insurance Cost | 3.6 |

| Business Reviews | 2 |

| Claim Processing | 2 |

| Company Reputation | 2 |

| Coverage Availability | 1.5 |

| Coverage Value | 2.5 |

| Customer Satisfaction | 3.1 |

| Digital Experience | 2.5 |

| Discounts Available | 2.3 |

| Plan Personalization | 2 |

| Policy Options | 2.2 |

| Savings Potential | 3.2 |

Anchor General Insurance Agency is a San Diego based covering states in California, Arizona, and Texas. Policyholders benefit from flexible payment plans, including low-down payments and multiple payment options.

Despite limited availability, it serves thousands of drivers needing essential coverage. Click here and enter your ZIP code to get started comparing Anchor General car insurance quotes now.

- Anchor General auto insurance serves high-risk drivers affordably

- Offers non-standard policies in California, Arizona, and Texa

- Provides flexible payment options with low down payments

Anchor General Auto Insurance Pricing Compared

This table breaks down Anchor General auto insurance rates against top competitors, showing minimum and full coverage auto insurance costs.

Anchor General Auto Insurance Monthly Rates vs. Top Competitors by Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $104 | $254 | |

| $32 | $84 | |

| $63 | $164 |

| $43 | $114 | |

| $47 | $123 | |

| $76 | $198 | |

| $56 | $150 | |

| $87 | $228 |

Anchor General’s rates are significantly higher, with minimum coverage at $104 and full coverage at $254, making it less budget-friendly. USAA offers the lowest rates, while Allstate and Farmers remain on the higher end.

The table below highlights how age and gender affect monthly premiums for Anchor General auto insurance. Teen drivers pay the most, with 16-year-old males at $170 for minimum coverage.

Anchor General Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $160 | $290 |

| 16-Year-Old Male | $170 | $300 |

| 18-Year-Old Female | $140 | $260 |

| 18-Year-Old Male | $150 | $270 |

| 25-Year-Old Female | $100 | $180 |

| 25-Year-Old Male | $110 | $200 |

| 30-Year-Old Female | $90 | $160 |

| 30-Year-Old Male | $95 | $170 |

| 45-Year-Old Female | $75 | $130 |

| 45-Year-Old Male | $80 | $140 |

| 60-Year-Old Female | $70 | $120 |

| 60-Year-Old Male | $75 | $130 |

| 65-Year-Old Female | $80 | $140 |

| 65-Year-Old Male | $85 | $150 |

Rates decrease with age, with 60-year-olds seeing the lowest costs. Males generally pay more than females across all age groups.

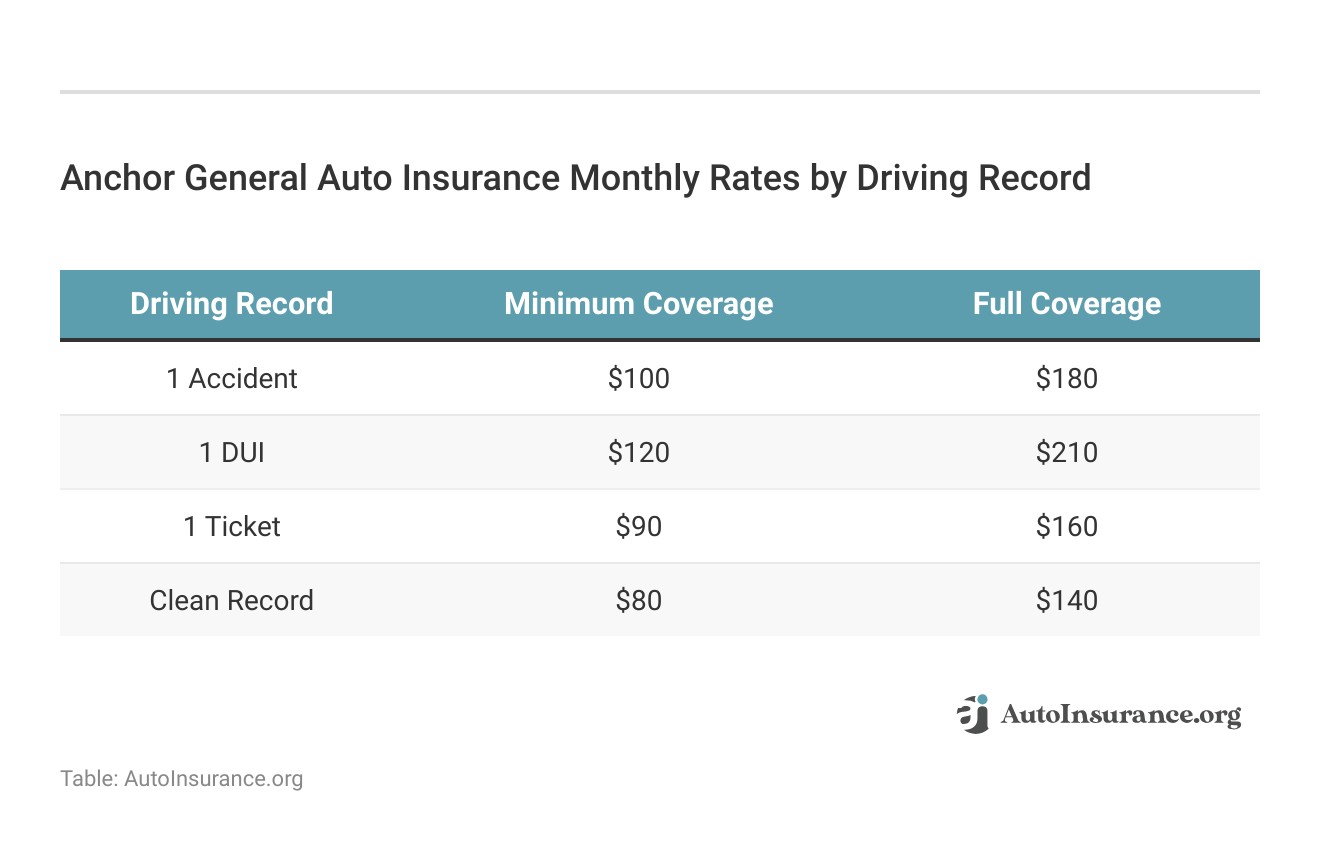

This table shows how violations impact monthly premiums with Anchor General auto insurance. Drivers with a DUI pay the most, with full coverage at $210 per month.

A single accident raises costs to $180, while a clean record secures the lowest rates at $80 for minimum coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Comprehensive Guide to Anchor General Insurance Coverage Services

Anchor General is distinguished because it offers many kinds of car insurance services specially made for drivers who may have difficulties finding coverage in other places. They offer the following:

- Liability Coverage: Essential for all drivers, covering damages to others if you’re at fault.

- Physical Damage Coverage: This covers damages to your vehicle from accidents or other incidents.

- Non-Standard Coverage: Specially made insurance for drivers with problems such as DUIs, accidents, or many tickets on their record.

Anchor General offers unique insurance coverage for high-risk drivers. It protects individuals with accidents, DUIs, or multiple violations. Discover the legal and financial impacts with DWI vs. DUI differences explained today.

Anchor General Auto Insurance Consumer and Website Reviews

This table highlights how Anchor General ranks across multiple rating agencies, reflecting customer satisfaction, financial stability, and complaints.

Anchor General Business Insurance Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 745/ 1,000 Lower-Than-Average Satisafaction |

|

| Score: A- Good Business Practices |

|

| Score: 67/100 Avg. Customer Feedback |

|

| Score: 1.85 More Complaints Than Avg. |

|

| Score: B Fair Financial Strength |

J.D. Power scores it below average at 745/1,000, while NAIC reports more complaints than average at 1.85. A.M. Best assigns a B rating, indicating fair financial strength.

Anchor General’s website contains very little information for potential customers. While there is minimal information about the company, contact information, and career opportunities, there is no information about the insurance policies that are offered, no place to get a quote, and no customer testimonials.

Most of the links on the website are for current customers and are geared towards online billing, account information, and car insurance claims information.

Most site features, including billing and claims management, are restricted to existing policyholders with login access. These links are password-protected for members only.

Read more: Who oversees auto insurance companies?

Anchor Insurance Group Discounts Available

This table shows the discounts available from Anchor General, which help policyholders decrease their expenses based on driving behavior and payment options. Discover the best auto insurance discounts and maximize your savings.

Anchor General Auto Insurance Discounts by Savings Potential

| Discount Type | |

|---|---|

| Multi-Car | 10% |

| Good Driver | 15% |

| Paid-in-Full | 12% |

| Defensive Driving | 8% |

| Good Student | 7% |

| Senior Driver | 5% |

| Telematics Program | 5% |

People who drive well can save up to 15%, whereas having multiple cars under one policy reduces rates by 10%. Students, older drivers, and those using telematics can also receive lower-percentage discounts, making it possible for them to afford insurance through intelligent decisions.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What You Should Know About Anchor Insurance Group

Anchor General Insurance Agency, Inc. is accredited by the Better Business Bureau and has a current rating of A-. Discover more by reading our guide “How to File a Complaint Against Your Auto Insurance Company.”

The most significant reason for this rating’s lowering is that 47 complaints have been filed against Anchor General in the past three years. Factors that have helped to raise Anchor General’s rating include:

- The length of time the company has been in business

- The company’s response to all complaints

- Anchor General had provided the BBB with sufficient company information

The majority of complaints were categorized as problems with service, including claims payouts, responses to claims, and customer service in general. Six complaints referred to billing issues.

Anchor General Auto Insurance Contact Information

Customers and potential customers of Anchor General Insurance Agency can contact the company for information via the following means. To send mail correspondence, you must use the P.O. Box address.

- Street Address: 10256 Meanley Drive, San Diego, CA 92131

- Mailing Address: P.O. Box 509020, San Diego, CA 92150-9020

- Phones: Anchor General insurance customer service number – (800) 542-6246; Fax – (858) 527-3750/Anchor General insurance claims phone number – (800) 542-6246; Fax – (858) 527-3740

Customer service and claims departments share the same phone number, making it essential to clarify your request. Fax options are available, but no online chat or direct email is listed. See what are the worst auto insurance companies and their biggest issues.

Anchor General Auto Insurance Careers

If you are interested in a career in the insurance industry you can contact Anchor General for a possible position. The company is relatively small, with a staff of 67 employees currently, but they are looking to expand. As of this review, Anchor General currently has openings for the following positions:

- Claims Examiner – Bodily Injury

- Computer Systems Analyst

- Quality Assurance

- Computer Software Developer

Anchor General’s website offers a link to email information, or you can call the company for further employment details. It also states that you can fax your resume to be considered for current and possible future positions. Learn how auto insurance companies check employment status and why it matters.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How to Get a Quote and Make Payments With Anchor General

Potential clients have the option to contact Anchor General Insurance directly with their specific phone number or to go to their website to get a quote online. Both methods are organized smoothly so that you get fast and thorough quotes that match your personal requirements.

Anchor General may allow mid-policy payment changes, letting drivers switch to quarterly billing to reduce fees and manage costs more effectively.Laura Berry Former Licensed Insurance Producer

Anchor General offers many convenient payment options. Customers can make payments online using their customer portal, by phone, or through mail. The company stresses ease and access when handling your policy.

Learn more by checking out our guide: How do auto insurance payments work?

Anchor General Insurance Reviews: What Customers Say

If you are thinking about selecting Anchor General for your car insurance, it is important to consider actual customer experiences. Reviews of the Anchor General insurance company often underline that their expertise lies in providing coverage to drivers who might not be able to find simple insurance options because of their past driving records.

Some customers like Anchor General’s affordable prices and simple process for getting insurance for high-risk situations, but others worry about how fast claims are handled and how customer service reacts. See how to file an auto insurance claim and avoid common mistakes.

This mix of opinions shows that while Anchor General meets a critical need in the car insurance market, people who want to become customers should carefully consider service and cost.

Explore Anchor General auto insurance options by entering your ZIP code into our free quote comparison tool.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

Is Anchor General insurance good?

Anchor General insurance provides coverage options for high-risk drivers, but customer reviews vary. Checking policy details, rates, and customer feedback can help determine if it meets your needs. Learn about the best auto insurance companies for high-risk drivers and their lowest rates.

How can you access your anchor policy account?

You can log in to your account through the official website. Once logged in, you can view your policy details, make Anchor General insurance payments, and manage your coverage.

What is the Anchor General insurance roadside assistance number?

You can contact Anchor General’s roadside assistance at the number listed on your policy documents. If you need immediate help, check your online account or call their customer service line. Get affordable Anchor General auto insurance by comparing quotes using our free comparison tool.

How do you log in to your Anchor General account?

To access your account, visit their website and enter your credentials. Once logged in, you can manage your policy, make payments, and update personal details.

What is the phone number for Anchor General insurance?

Anchor General insurance’s phone number is available on their official website or in policy documents. Contact support for assistance with claims, payments, or policy inquiries. If you’re looking for where to buy auto insurance online, compare top companies now.

How much is the Anchor General insurance cancellation fee?

The cancellation fee varies based on your policy terms. Check your policy documents or contact customer service to confirm the exact amount.

Where can you find Anchor General auto insurance rate reviews?

You can find Anchor General auto insurance rate reviews on sites like Trustpilot, Google Reviews, and the Better Business Bureau. These reviews provide insights into pricing, coverage, and customer satisfaction.

Is there an Anchor General insurance Reddit discussion?

Yes, you can find discussions about policies, claims, and customer experiences on Reddit. Search for threads related to Anchor General insurance for real user opinions.

Does the Anchor General insurance app exist?

There is no official anchor general insurance app available. You can manage your policy, payments, and claims through their official website. Curious if you can pay your auto insurance online? Discover how to pay your policy with ease here.

What is the Anchor General claims phone number?

Anchor General’s phone number for insurance claims is available on your policy documents or the official website. Contact their claims department directly for assistance with filing or tracking a claim. Get customized Anchor General auto insurance quotes instantly by entering your ZIP code.

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

James Shea

Anchor Insurance Group review

Katty

They gave my gurantee aa uauall

Walker29

Processing claims