Auto Insurance America (AIA) Company Review for 2025 (Real Customer Feedback)

Explore this Auto Insurance America (AIA) company review, featuring affordable liability coverage for high-risk drivers, with rates starting at $55 per month in Nevada and New Mexico. Auto Insurance America offers 5% lifetime discounts, multi-vehicle bundling, as well as short-term policy trials.

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Auto Insurance America Company

Monthly Rates:

$55A.M. Best Rating:

N/AComplaint Level:

LowPros

- Delivers high-risk drivers SR-22 automobile insurance.

- Provides a lifetime five percent discount for online quote requests

- Makes cost-saving use of multi-vehicle policy bundling choices

Cons

- Drivers from Nevada and New Mexico only have limited availability

- There isn’t an A.M. Best score to confirm AIA’s economic stability

- Auto Insurance America provides a wide range of insurance products to customers in New Mexico and Nevada

- Auto Insurance America offers cheap insurance rates, starting at $21 per month

- Auto Insurance America has been in business for more than 40 years

This Auto Insurance America (AIA) company review shows that AIA has been offering affordable insurance options in the Southwest for more than 40 years.

AIA has helped tens of thousands of motorists in Nevada and New Mexico secure coverage with SR-22 auto insurance filing and cash payment options.

America Company Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 3.0 |

| Business Reviews | 3.0 |

| Claim Processing | 3.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 1.5 |

| Coverage Value | 3.1 |

| Customer Satisfaction | 2.5 |

| Digital Experience | 2.5 |

| Discounts Available | 4.7 |

| Insurance Cost | 3.7 |

| Plan Personalization | 2.5 |

| Policy Options | 2.5 |

| Savings Potential | 4.0 |

All drivers in Reno, Las Vegas, Albuquerque, and Arizona can take advantage of affordable insurance, multi-vehicle discounts, and short-term policy trials.

With bundling options and a 5% lifetime policy discount, AIA remains a top choice for affordable, flexible coverage.

- Auto Insurance America reviews highlight SR-22 filing

- AIA offers cash payments, short-term policies, and bundling deals

- Drivers in Nevada, New Mexico, and Arizona get low-cost coverage

Once you’re ready to see if Auto Insurance America is the cheapest company for you, enter your ZIP code into our free tool to compare car insurance quotes from the top providers.

Auto Insurance America (AIA) Rate Differences by Age, Gender, and Provider

Younger drivers pay the highest insurance rates; 16-year-olds spend more than $175 a month for minimal coverage. In all age categories, males often pay more than women. By 25, rates decline dramatically; senior drivers have the lowest rates.

Auto Insurance America Monthly Rates by Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $175 | $340 |

| 16-Year-Old Male | $185 | $355 |

| 18-Year-Old Female | $150 | $310 |

| 18-Year-Old Male | $160 | $325 |

| 25-Year-Old Female | $85 | $175 |

| 25-Year-Old Male | $90 | $185 |

| 30-Year-Old Female | $75 | $155 |

| 30-Year-Old Male | $80 | $165 |

| 45-Year-Old Female | $60 | $135 |

| 45-Year-Old Male | $65 | $145 |

| 60-Year-Old Female | $55 | $125 |

| 60-Year-Old Male | $60 | $130 |

| 65-Year-Old Female | $58 | $128 |

| 65-Year-Old Male | $62 | $140 |

Premiums drop significantly by age 25, with the lowest rates seen among 60-year-old policyholders. Full coverage remains costlier but follows a similar pattern.

With minimum coverage rates starting at $85, Auto Insurance America (AIA) rivals large companies on cost. At $70 USAA boasts the lowest rates; Liberty Mutual costs $95.

Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $90 | $160 | |

| $85 | $150 |

| $88 | $155 | |

| $75 | $140 | |

| $95 | $170 |

| $80 | $145 |

| $78 | $138 | |

| $82 | $142 | |

| $87 | $158 | |

| $70 | $130 |

Full coverage follows the same pattern, with Geico and Progressive offering cheaper rates than Allstate and Liberty Mutual. Understanding how much car insurance you need can help you save on premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

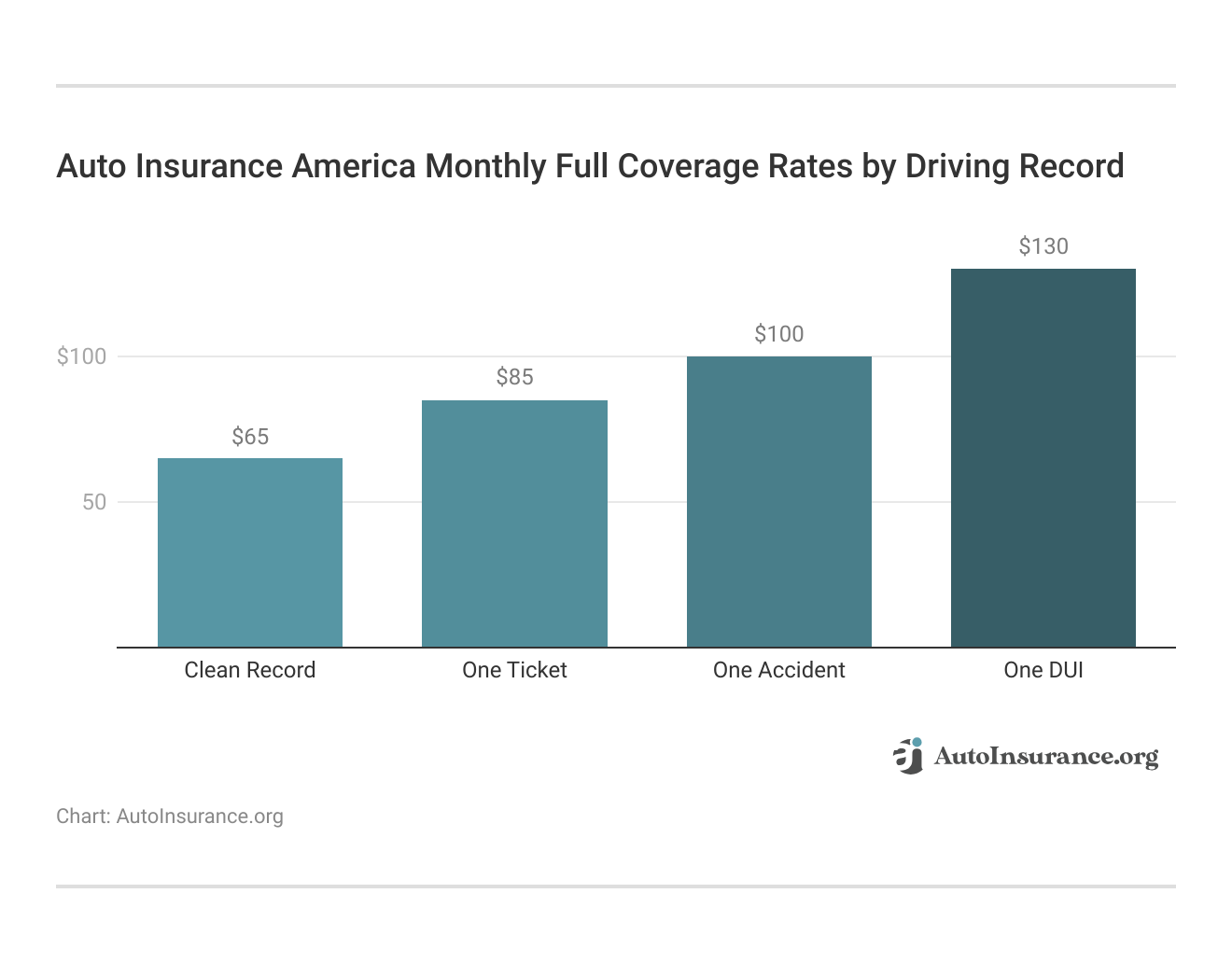

How Driving History Affects AIA Vehicle Insurance Costs

Insurance premiums vary according to driving history, with clean records yielding the lowest rates of $65 for little coverage.

Auto insurance costs vary depending on driving history and provider, with USAA giving the lowest rates of $60 for drivers with clean records.

Auto Insurance America Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $75 | $95 | $115 | $145 | |

| $65 | $85 | $100 | $130 |

| $72 | $92 | $112 | $142 | |

| $70 | $90 | $110 | $140 | |

| $80 | $100 | $120 | $150 |

| $68 | $88 | $108 | $138 |

| $66 | $86 | $106 | $136 | |

| $69 | $89 | $109 | $139 | |

| $74 | $94 | $114 | $144 | |

| $60 | $80 | $95 | $125 |

A single ticket hike rates by around $20, while an accident raises prices much higher. DUI convictions cause the greatest increases, with some insurers costing up to $150. Find out why the DWI vs. DUI differences explained matter for drivers.

Auto Insurance America Insurance Coverage Options

When you’re shopping for car insurance, all those coverage options can get a little overwhelming. To make things easier, here’s a quick rundown of some common add-ons you might see in your policy:

- Medical Payments Coverage: Helps cover medical bills for you and your passengers after an accident, no matter who’s at fault.

- Uninsured/Underinsured Motorist Coverages: These coverages protect you if the other driver has little or no insurance and causes an accident.

- Personal Injury Protection (PIP) or No-fault Insurance: Pays for medical expenses, lost wages, and more—no matter who caused the crash (especially important in no-fault states).

- Towing and Labor Coverage: This covers the cost of roadside help, like towing, battery jumps, or flat tire changes.

- Rental Car Reimbursement: Helps pay for a rental while your car’s in the shop after an accident.

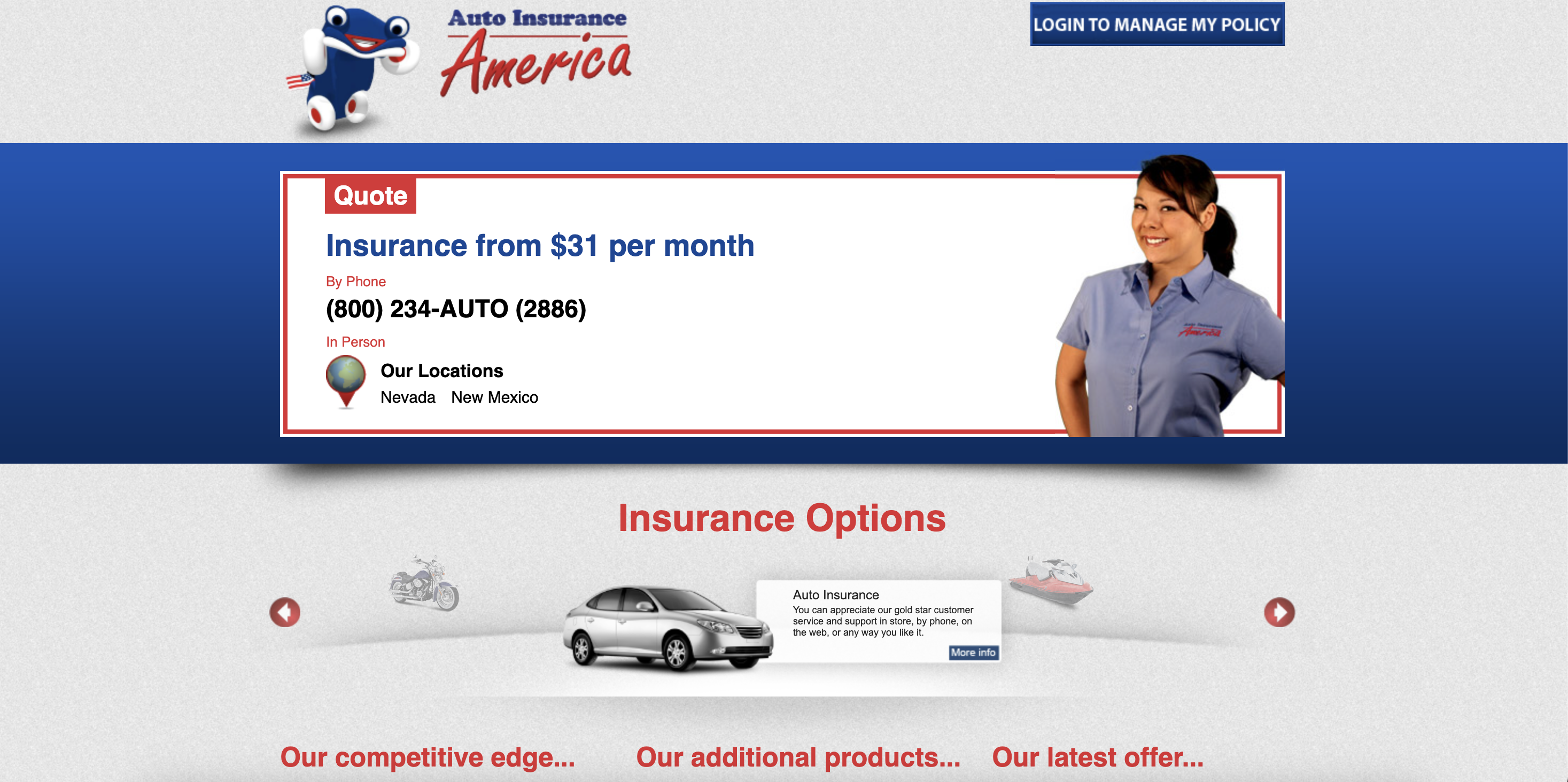

AIA provides various insurance options designed to meet different coverage needs. Overall, AIA offers complete insurance solutions for:

- Auto: You can receive cheap AIA car insurance from $31 per month.

- Motorcycle: Customers can customize their motorcycle insurance to fit their specific needs.

- Home/Condo: AIA offers protection for valuable real estate, owned or rented.

- Watercraft: If you own a water vehicle, AIA can provide you with cheap watercraft insurance to give you peace of mind.

- RV: AIA RV policies protect your belongings while you’re on the road.

- Landlord: Landlords can protect their properties with an Auto Insurance America policy.

AIA isn’t a perfect insurance provider by any means. It’s also not for everyone. Below, we’ll discuss how each of their insurance products stacks up against the nation’s average.

Read More: How to Get Free Online Auto Insurance Quotes

AIA Car Insurance Review

AIA Automobile Insurance claims to be an insurance company that works with all kinds of drivers, whether they’re new to the car insurance process or simply want to lower their rate from another provider.

There is some truth to this statement. When you become a customer, you can make your AIA payment any way you want. That includes cash payments or over the phone by calling the AIA contact number: 1-800-234-AUTO (2886).

State minimums may not be enough with AIA. In fact, uninsured motorist coverage can save thousands after an accident.Tracey L. Wells Licensed Insurance Agent & Agency Owner

This begs the question: Is cheap insurance from AIA really worth it? The answer depends on your motive for buying car insurance. If you own a used car and want to save money on your premium, cheap car insurance is the way to go.

On the other hand, if you’re leasing a valuable car and want more security, you may want to consider a more comprehensive insurance provider and look into auto insurance company reviews. Now, let’s go a bit beyond just an auto insurance company review.

AIA Motorcycle Insurance Review

AIA has offered motorcycle insurance products for several decades. Whether you need a claim or a quote, AIA provides sufficient coverage to help you maintain your required financial responsibility on the road.

AIA motorcycle policies can be customized according to each client’s personal needs. This provides a variety of different AIA motorcycle insurance rates. When you sign up, you can include motorcycle insurance items, such as:

- Accessory Coverage: This form of insurance covers damage to your motorcycle’s critical and optional accessories.

- Comprehensive and Collision Coverage: This all-in-one insurance policy covers all kinds of damage, from natural disasters to vehicular accidents.

- Loss Settlement Options: This coverage provides an alternative for a new vehicle if your existing motorcycle is totaled.

- Bodily Injury Coverage: This form of coverage protects you from liability if your motorcycle causes bodily harm to someone else.

- Property Damage Liability: This coverage absolves you from any culpability if your vehicle causes property damage.

- Medical Payments: This coverage extends to you or a passenger’s medical expenses, even if you’re at fault for the car accident.

In addition, AIA provides customers with the opportunity to combine their motorcycles and cars under one policy, enabling them to make a single monthly payment while enjoying the advantages of multi-vehicle discounts, including significant motorcycle insurance discounts. While AIA may be a cheap insurance option for most drivers, it offers enough perks to be worth your while.

AIA Home/Condo Insurance Review

Customers can purchase affordable insurance to help protect their greatest investments. AIA provides some of the lowest homeowner insurance rates in the industry for owners of:

- Condos

- Townhomes

- Mobile Homes

- Single-Family Homes

Previous customers can lower their already cheap home insurance rates by bundling their auto insurance. This benefit can help you receive home insurance at a lower price than any other provider. AIA also offers an eclectic mix of rental insurance products in one policy, such as:

- Burglary Insurance: This form of coverage protects your home and belongings in the aftermath of a home invasion.

- Theft Insurance: This type of insurance protects your belongings from criminal theft.

- Temporary Living Expense Insurance: If your property is uninhabitable, AIA will provide the funds necessary for you to lodge somewhere else, usually at a hotel.

- Personal Liability Insurance: This form of coverage protects you from liability if someone is injured while on the premises.

Acquiring rental insurance can be a hassle for most people, as it adds an extra cost to rent. Since renters don’t own the property, they may see AIA as a great solution to cut costs.

However, if you just bought a home, you may want to consider other options to protect your investment, especially if your purchase was massive. Compare best home and auto insurance bundling discounts easily.

AIA Watercraft Insurance Review

Depending on where you live, obtaining watercraft insurance can be problematic. Unlike auto and home insurance, watercraft insurance isn’t a saturated market. This means there are a few options to choose from. With that said, AIA is one of the most affordable watercraft insurance providers in the Southwest region.

This product is modeled closely after AIA’s auto insurance offering, meaning you can receive cheap premiums that’ll fit your custom needs. Before choosing AIA, you should assess the pros and cons of purchasing cheap watercraft insurance. If you’re a great driver and want to save money, AIA is an ideal choice.

On the contrary, if you fear paying a high deductible in the event of a water accident and need more protection for your vehicle, you’re better off choosing another option. AIA doesn’t provide a specific cost for their watercraft insurance product.

You’ll need to contact an AIA agent to get a specific quote and customize it according to your needs. Additionally, if you would ever like to change or modify your policy, you should contact an AIA representative to discuss your options.

AIA RV Insurance Review

Before choosing RV insurance, it’s important first to understand what kind of coverage you’ll want in the event of a catastrophe. Every RV insurance policy has two forms of insurance: actual cash value (ACV) and total loss replacement.

The major difference is that ACV insurance will provide you with funds that are commensurate with your vehicle’s worth at the time of the accident. On the other hand, total-loss replacement insurance is more comprehensive.

RV insurance reviews found that AIA offers a full spectrum of RV insurance products to give you complete security of your investment. These products include:

- Vacation Liability: This type of auto insurance coverage extends to damage sustained over the course of travel.

- Full-Time RV Insurance: This is comprehensive RV insurance for all kinds of damage and natural disasters.

- Emergency expenses: This insurance covers every item that falls under an “emergency” on the road.

You can contact the company directly to request AIA RV insurance rates. Total-loss replacement insurance will provide you with a new or similar vehicle after an accident. Making the distinction between both forms of coverage can help you receive a higher payout amount after filing a claim.

Read More: Replacement Cost vs. Actual Cash Value: Car Insurance

Auto Insurance America Discounts Available

One of the best ways to save on auto insurance is to bundle your policies, compare different quotes, and complete a safe driving course. With AIA, you can receive a discount under the “Drive Less Pay Less” feature once you pass a safe driving course.

Auto Insurance America (AIA) Discounts by Savings Potential

| Discount |  |

|---|---|

| Safe Driver | 25% |

| Bundling | 20% |

| Multi-Car Discount | 18% |

| Good Student | 15% |

| Military/Veteran | 15% |

| Defensive Driving | 12% |

| Loyalty Discount | 10% |

| Low Mileage | 10% |

| Anti-Theft | 8% |

| Paperless Billing | 5% |

If you’re going to save money on auto insurance, it’s best to compare different discounts against your current provider.

Doing so will paint a full picture of each of your options so you can make the best buying decisions for auto insurance. Unlock the best auto insurance discounts by bundling coverage.

Read More:

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The AIA Mobile App Review

Every insurance company needs a mobile app to help customers view their policy information on the go. The good news is that the AIA mobile app is a solid platform that gives customers the ability to:

- Make an Auto Insurance America payment

- File an insurance claim

- Provide proof of insurance

- Obtain policy details

- Contact AIA

Customers can download the AIA on both the Android and Apple Stores. This digital convenience makes it easy to provide proof of insurance after a car accident, access Auto Insurance America bill pay options, and contact an AIA representative about any insurance policy questions.

However, it’s important to note that the app is not suitable after a car accident. Accidents must be reported to the AIA claims department directly. Get guidance on how to file an auto insurance claim today.

Important Tips on Choosing the Right Coverage

Choosing the right coverage means something different to every individual. Some people are only concerned about saving money. Others need substantial liability protection because they own a great number of assets.

Do you love shopping 🛒sales? If so, you should shop around for auto insurance to see how much you could save🤑. https://t.co/27f1xf1ARb has all the tips you need to get auto insurance. Check it out here👉: https://t.co/U1DDipUs78 pic.twitter.com/LO4BNc0eTk

— AutoInsurance.org (@AutoInsurance) January 10, 2024

The best way to choose the right coverage is to buy more coverage if you have more assets to protect. Next, buy liability auto insurance coverage according to present asset values, including stocks, bonds, and vehicle values. Lastly, choose the coverage that meets your needs, whether you want to protect your assets or pay your medical bills in case of an accident.

Choose coverage that balances cost and protection. Higher deductibles lower premiums but raise post-claim costs.Tim Bain Licensed Insurance Agent

Don’t let expensive insurance rates hold you back. Now that you’ve read this auto insurance company review, check out a few other auto insurance company reviews and then enter your ZIP code and shop for affordable premiums from the top companies.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What is Auto Insurance America?

Auto Insurance America, sometimes mistakenly referred to as America Auto Insurance, is an insurance company that provides coverage for automobiles in the United States. The AIA company also offers insurance for motorcycles, RVs, boats, watercraft, homeowners, landlords, and renters. Does your auto insurance cover rental cars? Check your policy for details.

What type of insurance does AIA provide?

AIA provides auto, home, motorcycle, and RV insurance, offering affordable monthly rates and bundling options. It caters to drivers needing basic coverage and flexible payment plans.

How do Auto Insurance America customer satisfaction ratings compare?

Auto Insurance America customer satisfaction ratings vary, with positive feedback on affordability and flexible payment options. Some reviews mention issues with claims processing. Compare AIA rates by entering your ZIP code into our free quote tool.

What should you know from an AIA income protection review?

An AIA income protection review highlights coverage for lost wages due to injury or illness. It provides financial security by replacing a portion of your income during recovery.

Is Auto Insurance America legit?

Yes, Auto Insurance America is legit. It offers coverage in Nevada and New Mexico. It specializes in affordable policies for high-risk drivers, including SR-22 filings and flexible payment options. Find cheap SR-22 auto insurance with flexible plans and quick filing today.

Is AIA an American company?

Yes, AIA is an American company that provides various insurance products, including auto, home, and motorcycle coverage. It primarily serves drivers in the Southwestern U.S.

Who is AIA Insurance owned by?

AIA Insurance is an independent company that has been serving policyholders for over 40 years. Although ownership details vary, the company continues to provide coverage in select states.

What should you know from an Assurance America review?

An Assurance America review highlights its non-standard auto insurance for high-risk drivers. Policies are available in select states, offering basic liability and flexible payment options.

Where can you find Auto Insurance America in Las Vegas, NV?

Auto Insurance America Las Vegas, NV, has multiple locations offering affordable car insurance, SR-22 filings, and short-term policies. Visit a local office or check online for quotes. Secure the best Las Vegas, Nevada auto insurance with top providers now.

Is Assurance America a legitimate insurance provider?

Yes, Assurance America is legit. It specializes in non-standard auto insurance for high-risk drivers and operates in several states. It provides basic coverage options.

How do you access MyPolicy Hyundai Insurance in the USA?

You can manage your MyPolicy Hyundai Insurance USA account online by logging in to view policy details, make payments, or file claims. Check the official website for access.

What do RV America Insurance reviews say about coverage?

RV America Insurance reviews indicate that it offers various RV coverage options, including liability and comprehensive policies. Customers appreciate its affordability and flexible plans.

What does FinanceBuzz auto insurance cover?

FinanceBuzz auto insurance provides insights into various coverage options, helping you compare rates and find affordable policies. It features tips on saving money and selecting the best insurer. Know where to compare auto insurance rates for the best savings on auto insurance.

Which company offers America’s best auto insurance?

The best auto insurance in America depends on your needs, but top-rated companies provide competitive monthly rates, strong coverage options, and reliable customer service. Comparing quotes helps find the best fit. Check Auto Insurance America rates now by entering your ZIP code and comparing options.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.