Chubb Auto Insurance Review for 2025 (See Ratings & Cost Here!)

This Chubb auto insurance review covers its premium coverage, strong service, and higher costs. Rates start at $42 per month based on the driver profile. Chubb provides luxury vehicle protection, agreed-value coverage, up to $10M in liability, and top-rated claims service with personalized handling.

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Feb 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Chubb Insurance Company

Monthly Rates:

$42A.M. Best Rating:

A++Complaint Level:

LowPros

- Agreed-value coverage ensures full payout without depreciation

- OEM parts replacement guarantees high-quality vehicle repairs

- Personalized claims service offers fast and hassle-free settlements

Cons

- Higher premiums make it less affordable for budget-conscious drivers

- Limited discounts compared to other major insurers

- Chubb car insurance is more expensive than coverage with many other companies

- Customer reviews indicate that Chubb excels at coverage and customer service

- Chubb appeals mainly to high-end customers with expensive vehicles

Chubb auto insurance review shows rates starting at $42 per month, offering high-end coverage for luxury vehicles.

With policies featuring up to $10 million in liability protection, agreed-value coverage, and OEM parts replacement, Chubb prioritizes premium service.

Chubb Auto Insurance Rating

| Rating Criteria | |

|---|---|

| Overall Score | 4.5 |

| Business Reviews | 5.0 |

| Claim Processing | 5.0 |

| Company Reputation | 5.0 |

| Coverage Availability | 5.0 |

| Coverage Value | 4.5 |

| Customer Satisfaction | 4.2 |

| Digital Experience | 4.5 |

| Discounts Available | 5.0 |

| Insurance Cost | 4.1 |

| Plan Personalization | 5.0 |

| Policy Options | 3.8 |

| Savings Potential | 4.4 |

While its rates are higher than those of many competitors, auto insurance policyholders benefit from personalized claims handling.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

- Chubb auto insurance review shows rates from $42 per month for luxury coverage

- Covers up to $10M liability, agreed-value protection, and OEM parts replacement

- Premium service includes personalized claims handling and high-end policy benefits

Chubb Auto Insurance: Rates by Age, Gender & Coverage

Chubb auto insurance provides high-coverage term auto insurance with specialized policies for high-end drivers and premium vehicles. Largely recognized for its high-quality customer service, extensive coverage, and no-fuss claims process. Chubb also offers policyholders broad benefits, such as agreed-value coverage and international rental car coverage.

Chubb Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| Age: 16 Female | $280 | $460 |

| Age: 16 Male | $315 | $490 |

| Age: 18 Female | $240 | $410 |

| Age: 18 Male | $275 | $445 |

| Age: 25 Female | $120 | $200 |

| Age: 25 Male | $135 | $220 |

| Age: 30 Female | $100 | $170 |

| Age: 30 Male | $115 | $185 |

| Age: 45 Female | $42 | $150 |

| Age: 45 Male | $44 | $154 |

| Age: 60 Female | $55 | $130 |

| Age: 60 Male | $60 | $140 |

| Age: 65 Female | $50 | $125 |

| Age: 65 Male | $55 | $135 |

Chubb rates vary based on age, gender, and coverage level. Full coverage auto insurance tends to be more expensive for young drivers, especially males, with 16-year-olds paying up to $490 per month for full coverage.

Younger and male drivers tend to have higher premiums because they are a greater risk, and the level of coverage also makes a difference. For example, choosing a higher deductible or bundling policies together can lower rates.Jeff Root Licensed Insurance Agent

Rates decrease significantly with age, with 45-year-old drivers paying as low as $42 for minimum coverage. Seniors generally enjoy lower premiums, though males have slightly higher rates than females.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chubb Auto Insurance Rates vs. Competitors: Credit Score Impact

Chubb auto insurance tends to have higher monthly rates than competitors, especially for drivers with poor credit. While policyholders with good or fair credit pay around $229 per month, those with poor credit see rates jump to $428.

Chubb Auto Insurance Monthly Rates vs. Top Competitors by Credit Score

| Insurance Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| $126 | $126 | $159 | |

| $229 | $229 | $428 | |

| $235 | $235 | $284 | |

| $113 | $113 | $133 | |

| $233 | $233 | $280 |

| $173 | $173 | $218 |

| $141 | $141 | $178 | |

| $117 | $117 | $181 | |

| $182 | $182 | $230 | |

| $94 | $94 | $117 |

In contrast, insurers like Geico and USAA offer significantly lower rates, with USAA providing the most affordable option at $94 for good credit and $117 for poor credit.

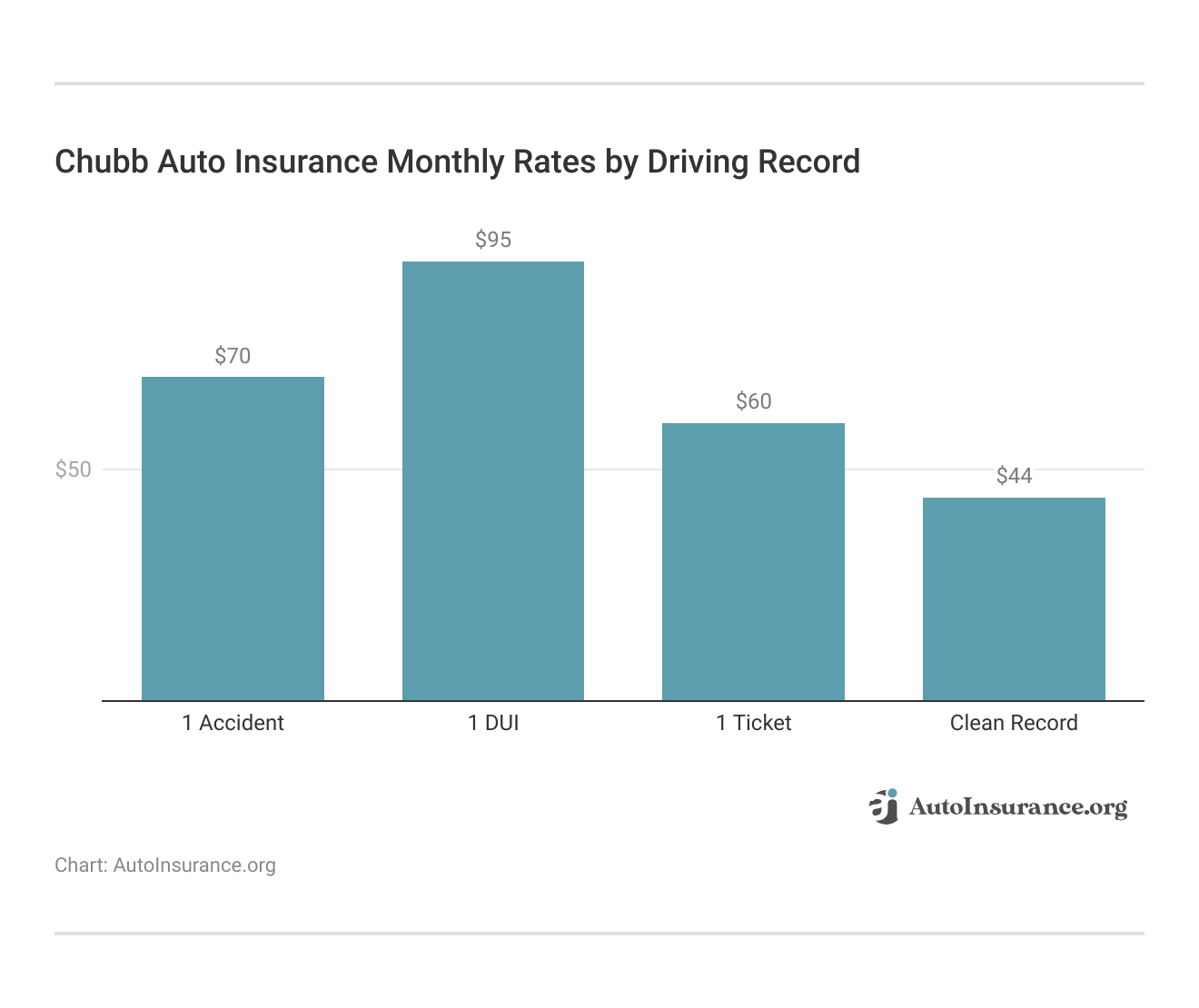

Chubb auto insurance premiums vary based on driving history. Drivers with a clean record enjoy the lowest rates, starting at $44 per month for minimum coverage.

A single accident, DUI, or ticket increases premiums significantly, with full coverage rates rising to $95 per month for drivers with a DUI. Cheap auto insurance after a DUI may be available through discounts or specialized providers. Safe driving helps secure lower premiums over time.

Chubb Auto Insurance Costs Compared to Top Providers

Chubb has higher monthly rates compared to major competitors. Minimum coverage starts at $155 per month, more expensive than USAA at $85 and Geico at $90. Full coverage with Chubb costs around $400 per month, exceeding State Farm at $245 and Progressive at $275.

Chubb Auto Insurance Monthly Rates vs. Top Providers

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $125 | $310 | |

| $155 | $400 | |

| $130 | $320 | |

| $90 | $230 | |

| $140 | $350 |

| $110 | $260 |

| $115 | $275 | |

| $100 | $245 | |

| $120 | $290 | |

| $85 | $210 |

While Chubb provides premium coverage designed for high-value vehicles, drivers looking for affordability may find better rates with insurers like USAA, Geico, and Nationwide.

Comparing multiple providers and understanding the types of auto insurance available can help secure the best coverage at a competitive price.

Chubb Auto Insurance Discounts and Savings Opportunities

Chubb offers various discounts that can help lower your policyholder premium. The best multi-vehicle auto insurance discounts include a 20% multi-vehicle discount, the highest savings available, followed by a 15% bundling discount for combining policies. Safe drivers can save 10% with accident-free records, new car replacements, and safe driving habits.

Chubb Auto Insurance Discounts

| Discount Name | |

|---|---|

| Multi-Vehicle | 20% |

| Bundling | 15% |

| Accident-Free | 10% |

| New Car Replacement | 10% |

| Safe Driver | 10% |

| Anti-Theft Device | 5% |

| Defensive Driving Course | 5% |

| Home Security System | 5% |

| Paid-in-Full | 5% |

| Paperless Billing | 3% |

Additional discounts include 5% for installing anti-theft devices, completing a defensive driving course, using a home security system, or paying in full. Paperless billing offers an extra 3% discount. Utilizing these savings can help make Chubb’s high-quality coverage more affordable.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chubb Auto Insurance: Premium Coverage Options for High-Value Vehicles

Chubb caters to insured consumers seeking high-quality auto insurance protection for a luxury or high-value car. Compare auto insurance rates by vehicle make and model to ensure you’re getting the best coverage for your specific car.

With properties that provide specialized coverage in addition to the normal policies, Chubb helps policyholders get complete protection, excellent repair top services, and hassle-free handling of claims. Below are five key coverages that set Chubb apart.

- Agreed Value Coverage: Chubb offers agreed value coverage, meaning the vehicle’s value is determined and guaranteed before a covered loss. Chubb pays the agreed amount without depreciation if the car is stolen or totaled.

- OEM Parts Guarantee: Chubb ensures that only Original Equipment Manufacturer (OEM) parts are used for repairs after a covered accident, maintaining the vehicle’s integrity, safety, and performance.

- Worldwide Rental Car Coverage: Policyholders receive rental car reimbursement up to $15,000 with no per-day limit, ensuring access to a comparable vehicle while repairs are completed.

- Collision Repair Management: Chubb’s team of Collision Repair Experts oversees repairs to ensure that every detail, from paint color to safety features, is restored to pre-claim condition.

- Liability and Umbrella Protection: Chubb provides high-limit liability coverage to protect policyholders from significant financial loss in the event of bodily injury or property damage claims.

Chubb offers a superior level of protection with coverage options designed to maintain your vehicle’s integrity and value.

Whether you need guaranteed repairs with OEM parts, high-limit liability coverage, or seamless rental car reimbursement, Chubb delivers premium service to keep you covered.

Chubb Auto Insurance Ratings: Strong Financial Stability & Customer Satisfaction

Chubb auto insurance receives high marks from prominent industry rating agencies for its robust financial health and customer satisfaction. It boasts an A++ rating from A.M. Best, signifying superior financial strength.

Chubb Auto Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: A++ Superior Financial Strength |

| Score: A++ Excellent Business Practices |

|

| Score: 82/100 Positive Customer Feedback |

|

| Score: 870 / 1,000 Above Avg. Satisfaction |

|

| Score: 0.60 Fewer Complaints Than Avg. |

Additionally, it holds an A++ rating from the Better Business Bureau, according to Chubb insurance reviews on BBB, reflecting strong business practices, and is well-regarded in Chubb insurance reviews on Consumer Reports. The National Association of Insurance Commissioners (NAIC) also assigns Chubb a 0.60 score, meaning it receives fewer complaints than the industry average.

Comment

byu/Economy_Bug from discussion

infatFIRE

A Chubb policyholder from Reddit praised its quick claims process after hurricane damage, receiving a rental car the next day and full payment within two weeks. While neighbors waited over a year, Chubb settled fast, reinforcing its place among the best companies for cheap rental car insurance.

You can find more experiences like this under the Chubb auto insurance Reddit discussions, where users frequently share their personal stories and interactions with the company. Exploring Chubb auto insurance reviews on Reddit can provide real-world insights and user experiences, helping potential customers make informed decisions.

Chubb Auto Insurance: Key Advantages and Drawbacks

Chubb auto insurance offers high-end coverage and service primarily for luxury car owners.

- Fast and Efficient Claims Process: Chubb provides quick claim resolution, with policyholders reporting same-day response and full payments within weeks.

- Comprehensive Coverage Options: Provides premium coverage options such as stated value coverage, which guarantees that the insured receives an agreed-upon payout in the event of a total loss.

- Superior Customer Service: Compared to other insurers, customers comment on hassle-free experiences, quick response times, and excellent support.

While the company excels in claims handling and comprehensive protection, it may not be the best fit for every driver. Below are the key advantages and drawbacks to consider before choosing Chubb.

QuickPay refers to Chubb’s fast claims payment system. Chubb Trusted Network represents its global network of trusted service providers for high-quality claims handling. Chubb Masterpiece is a high net worth/homeowners insurance product that provides unrivaled coverage for luxury assets.

- Higher Premiums: Chubb’s premium services and high-value coverage options come with higher premiums than you’d find with standard professionals.

- Limited Availability: Chubb is focused on high-net-worth individuals, which may not be accessible for average drivers in search of budget-friendly policies.

Chubb stands out for its superior claims service, extensive coverage options, and customer satisfaction. File an auto insurance claim easily with Chubb’s personalized claims handling and efficient settlement process.

Chubb’s agreed-value coverage means luxury car owners will get the full payout regardless of depreciation. There can be further savings by bundling policies and a clean driving record can help in lowering the premium too.Tonya Sisler Insurance Content Team Lead

However, its higher premiums and exclusive target market may not suit budget-conscious drivers. Weighing these pros and cons can help determine if Chubb is the right fit for your insurance needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Maximize Your Coverage: Navigating Chubb Auto Insurance for Luxury Protection

Chubb auto insurance offers comprehensive auto insurance with premium coverage for high-value and luxury vehicles, with rates starting at $42 per month for minimum coverage. It offers agreed-value coverage with up to $10 million of liability protection and OEM parts replacement for complete protection and personalized claims handling.

Chubb’s higher-end premiums, with minimum coverage starting at $155 per month and full coverage averaging $400 per month, make it less ideal for budget-minded drivers. With fewer discounts and a focus on luxury vehicles, Chubb’s coverage is best for those who want premium protection and unique service.

Explore your auto insurance options by entering your ZIP code into our free comparison tool today.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

How do Chubb car insurance reviews compare to other providers?

Chubb is praised for superior claims service, agreed-value policies, and luxury car protection. However, reviews note higher premiums and fewer discounts compared to standard insurers.

What makes Chubb motor insurance different from standard policies?

Chubb provides agreed-value coverage, OEM parts replacement, and up to $10M in liability protection. It also offers concierge claims service and worldwide rental car reimbursement.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool.

How do Chubb insurance rates compare based on driver profile and vehicle type?

Factors that affect auto insurance rates include age, driving history, location, and vehicle type, all of which impact Chubb insurance rates. Luxury and high-value vehicles have higher premiums, while safe drivers and bundled policies may qualify for discounts. Installing anti-theft devices can also help reduce costs.

Are Chubb collector car insurance reviews positive for classic car owners?

Reviews praise Chubb’s agreed-value coverage, flexible usage, and expert repairs for classic cars. Although premiums are higher, policyholders find the protection worth the cost.

Does Chubb rental car insurance cover international travel?

Chubb rental car insurance provides coverage for damage, liability, and loss of use, with many policies extending internationally. Coverage varies by location, so travelers should confirm details with Chubb before renting abroad.

How does a Chubb review reflect its auto insurance coverage and customer service?

Chubb reviews highlight auto insurance premium coverage, agreed-value policies, and personalized claims handling. While customers appreciate its strong service, higher premiums are a common concern.

Does Chubb vehicle insurance include agreed-value coverage for total loss claims?

Yes, Chubb vehicle insurance includes agreed-value coverage, ensuring policyholders receive a predetermined payout for a total loss without depreciation. This is ideal for luxury and high-value vehicles.

Why do Chubb Group of Insurance Companies reviews mention strong claims support?

Customers praise Chubb’s fast settlements, seamless repairs, and responsive service, making it a top choice for high-value vehicle insurance.

How does Chubb commercial auto insurance protect business vehicles?

Chubb commercial auto insurance, recognized among the best commercial auto insurance companies, covers business-owned vehicles for liability, physical damage, and uninsured motorists. It includes rental reimbursement, roadside assistance, and coverage for employees using personal cars for work. Policies can be tailored based on fleet size and industry needs.

How can I contact Chubb auto insurance for assistance?

The Chubb auto insurance phone number and policy documents are available on their website. Customers can call 24/7 for claims, policy inquiries, or roadside assistance. Having your policy number ready ensures faster service.

Is Chubb the best insurance provider for high-value vehicles?

Chubb is highly rated for luxury and high-value vehicle coverage, offering agreed-value policies and premium claims service. However, its higher rates may not suit all drivers, so it is recommended that you compare quotes.

What services does Chubb roadside assistance provide to policyholders?

Chubb roadside assistance includes towing, battery jump-starts, tire changes, fuel delivery, and lockout services, with higher limits for luxury vehicles. Thus, it is a strong option among the best auto insurance companies for roadside assistance.

Is Chubb a good insurance company for car owners?

Chubb earns top marks for financial strength, outstanding claims service, and high-limit coverage options and is one of the best picks for luxury and classic car owners. Though its premiums exceed budget insurers, policyholders receive tailored coverage and excellent customer service.

Is Chubb a reputable insurance company?

Yes, Chubb is known for its solid financial viability and high customer satisfaction, indicated by its A++ ratings from A.M. Best and the Better Business Bureau.

How does Chubb Insurance Auto compare to standard car insurance providers?

Chubb offers premium coverage with agreed-value settlements, OEM parts, and high liability limits. While more expensive, it’s the best auto insurance for luxury cars, providing superior protection and claims service for high-value vehicles.

How does Chubb Insurance car coverage protect high-value vehicles?

Chubb Insurance car coverage offers agreed-value policies, OEM parts replacement, and up to $10 million in liability protection. It ensures high-value vehicles are restored to pre-claim condition with personalized claims handling and worldwide rental car coverage.

How do Chubb umbrella insurance reviews reflect its coverage quality?

Chubb umbrella insurance reviews highlight strong liability protection, covering legal fees and extended coverage beyond auto and home policies. Policyholders appreciate the high limits and smooth claims process.

How much does Chubb’s car insurance cost?

Chubb’s rates vary based on location, driver profile, and vehicle type. Minimum coverage starts at $42 per month, while complete coverage averages $400 per month. Premiums are higher but include agreed-value coverage and luxury vehicle protection. Drivers seeking cheap full coverage auto insurance may need to compare multiple providers to find more affordable options.

What types of coverage are available under Chubb specialty insurance?

Chubb specialty insurance offers tailored coverage for fine art, collectibles, cyber risks, and professional liability. Businesses also benefit from industry-specific policies and executive protection.

Is Chubb more expensive than State Farm?

Yes, Chubb generally has higher rates than State Farm, especially for full coverage options, reflecting its focus on high-value and luxury vehicles.

Does Chubb insurance pay claims?

Yes, Chubb is recognized for efficient claim processing and has a reputation for quick, reliable payouts, particularly in response to high-value and comprehensive auto insurance claims.

How does Chubb insurance rank in the industry?

Chubb is highly regarded in the industry, often receiving above-average scores for customer satisfaction from agencies like J.D. Power and positive feedback in consumer reviews.

Get the best auto insurance rates possible by entering your ZIP code into our free comparison tool today.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Kapoor

Don’t go with Chubbs do yourself a favor

jsmith2005

High competence and good customer service

bmak

Nice staff, boring stuff.

WorkingClassInsured

STAY AWAY

JobMan

Chubb is Great

Austin Akers

Chubb review

Rijo

Great customer service

Insurance10177342

They do a good job

dancinkarefree

Great !

willygrams

Great review