Dairyland Auto Insurance Review for 2025 (Rates, Discounts, & Options)

Our Dairyland auto insurance found it focuses on high-risk coverage, with rates from $77 monthly. Specializing in SR-22 filings and comprehensive motorcycle insurance, Dairyland provides essential options for drivers with a spotty driving record.

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Dairyland

Monthly Rates

$77A.M. Best Rating:

A+Complaint Level:

HighPros

- Works with high-risk drivers other companies reject

- Will file SR-22 forms, sometimes for free

- Excellent coverage options for motorcycle drivers

Cons

- Not available in all 50 states

- More complaints than companies similar in size

- Dairyland Insurance specializes in high-risk drivers with DUIs, multiple at-fault accidents, or repeated traffic offenses on their record

- Insurance rates are usually higher than the national average at Dairyland, so drivers with clean records should look elsewhere

- Dairyland offers a decent variety of coverage options for car and motorcycle insurance

Dairyland auto insurance review highlights their specialized offerings for high-risk drivers, including SR-22 filings and a focus on accommodating varied driving histories.

This insurer checks many of your personal details to cover, ranging from simple liability to full coverage. Categorized as one of the more versatile options on this list, Dairyland provides details on coverage options and gives dedicated customer service to drivers who might have a difficult time finding insurance anywhere else.

Dairyland Auto Insurance Rating

| Rating Criteria | Score |

|---|---|

| Insurance Rating | 3.5 |

| Business Reviews | 3 |

| Claim Processing | 3 |

| Company Reputation | 3 |

| Coverage Availability | 4.7 |

| Coverage Value | 3.1 |

| Customer Satisfaction | 4.1 |

| Digital Experience | 3 |

| Discounts Available | 4 |

| Insurance Cost | 3.7 |

| Plan Personalization | 3 |

| Policy Options | 2.8 |

| Savings Potential | 3.8 |

This introduction summarizes the fundamental services and advantages Dairyland provides, focusing on its dedication to providing strong and flexible auto insurance options.

Start saving on your auto insurance by entering your ZIP code and comparing quotes.

- Dairyland auto insurance rates start at $77/month for high-risk drivers

- Covers SR-22 filings and offers both minimum and full coverage options

- Provides motorcycle insurance, roadside assistance, and flexible payments

Dairyland Auto Insurance: Affordable Rates for Mature Drivers

Dairyland auto insurance has competitive pricing notes in its rate structure early on, particularly as drivers age. For 16-year-olds, the outlay is clearly daunting; minimum to full coverage premiums range from $452 to $1,235 — yet for older brackets, that soars down ardently. A 30-year-old man pays less at $101 for minimum coverage and $285 for full coverage.

Dairyland Auto Insurance Monthly Rates by Coverage Level, Age, & Gender

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old Female | $452 | $1,235 |

| 16-Year-Old Male | $494 | $1,291 |

| 18-Year-Old Female | $367 | $910 |

| 18-Year-Old Male | $108 | $1,050 |

| 25-Year-Old Female | $105 | $296 |

| 25-Year-Old Male | $108 | $307 |

| 30-Year-Old Female | $97 | $275 |

| 30-Year-Old Male | $101 | $285 |

| 45-Year-Old Female | $87 | $243 |

| 45-Year-Old Male | $85 | $237 |

| 60-Year-Old Female | $77 | $211 |

| 60-Year-Old Male | $79 | $215 |

| 65-Year-Old Female | $85 | $238 |

| 65-Year-Old Male | $83 | $232 |

This tiered pricing approach makes Dairyland attractive for mature drivers, who can receive all-inclusive coverage at reduced prices. While upstart competitors like Geico and Nationwide auto insurance may provide lower initial rates for younger drivers, Dairyland excels as a long-term, price-conscious option for experienced drivers who want premium insurance coverage without overpaying.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

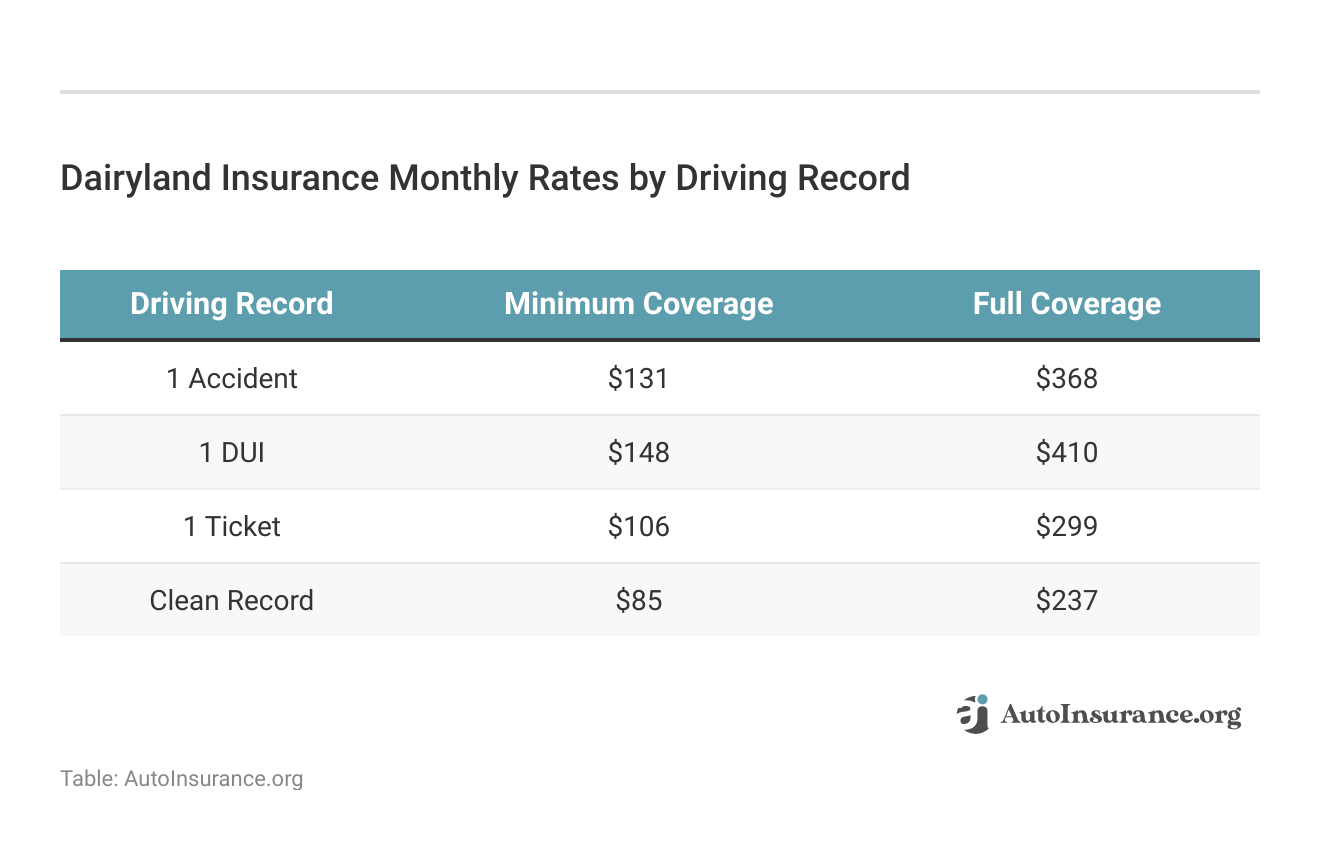

Assessing Dairyland Auto Insurance: Costs for High-Risk Coverage

The company’s rates reflect its classification as a specialist provider for high-risk drivers. Dairyland’s monthly premium starts at $85 for minimum coverage and $165 for full coverage, placing it in the higher cost range compared to mainstream insurers like Geico auto insurance, which will charge $65 and $140 for those same policies, respectively.

Dairyland Auto Insurance Monthly Rates vs. Top Providers

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $78 | $152 | |

| $72 | $145 | |

| $85 | $165 | |

| $80 | $158 | |

| $65 | $140 | |

| $82 | $160 |

| $75 | $148 |

| $70 | $143 | |

| $68 | $138 | |

| $76 | $150 |

However, that pricing model does make Dairyland less competitive for people with cleaner driving records who may be able to find better deals elsewhere. However, Dairyland’s niche of insuring high-risk drivers and those who need SR-22 documentation leaves it serving a vital market that’s largely avoided by larger insurers.

Its premiums, like a steep $368 for full coverage after a DUI, appeal to a demographic for which few other options remain. Dairyland offers a much-needed service for at-risk individuals requesting auto coverage, such as drivers with a history of accidents, DUIs, or multiple tickets.

For high-risk drivers seeking reliable coverage, Dairyland Auto Insurance offers tailored solutions, including essential SR-22 filings and comprehensive motorcycle insurance, ensuring you can navigate claims smoothly with customer-focused support.Daniel Walker Licensed Auto Insurance Agent

This focus on underrepresented drivers helps Dairyland auto insurance fill a crucial gap in the market, albeit at higher rates.

Dairyland Auto Insurance: A Comparison of Rates by Credit Score

Dairyland Auto Insurance tends to be pricier for drivers across all credit levels compared to many of its competitors. With monthly premiums at $140 for bad credit, $110 for fair credit, and $85 for good credit, Dairyland’s rates are higher than those of more budget-friendly options like Geico and USAA auto insurance, which offer rates as low as $65 and $60 for good credit, respectively.

Dairyland Auto Insurance Monthly Rates vs. Top Competitors by Credit Score

| Insurance Company | Bad Credit | Fair Credit | Good Credit |

|---|---|---|---|

| $135 | $105 | $78 | |

| $125 | $100 | $72 | |

| $140 | $110 | $85 | |

| $130 | $108 | $80 | |

| $115 | $90 | $65 | |

| $138 | $112 | $82 |

| $128 | $102 | $75 |

| $120 | $95 | $70 | |

| $118 | $92 | $68 | |

| $127 | $100 | $76 | |

| $105 | $85 | $60 |

However, Dairyland still competes with companies such as Liberty Mutual and Allstate, demonstrating its potential as a provider for consumers potentially seeking particular high-risk niches or unique wants, such as different coverages related to less-than-perfect credit scores.

Dairyland Auto Insurance: A Comparative Review of High-Risk Driver Rates

Dairyland auto insurance tends to be pricier, translating to higher monthly premiums than those of other large carriers, in a bid to offer coverage to high-risk drivers. For instance, people with a clean driving record can expect to pay $339 monthly, significantly above the U.S. average of $165.

Dairyland vs. Competitors: Full Coverage Auto Insurance Monthly Rates by Driving Record

| Insurance Company | Clean Record | One Accident | One DUI | One Ticket |

|---|---|---|---|---|

| $228 | $321 | $385 | $268 | |

| $166 | $251 | $276 | $194 | |

| $339 | $525 | $585 | $427 | |

| $198 | $282 | $275 | $247 | |

| $114 | $189 | $309 | $151 | |

| $248 | $335 | $447 | $302 |

| $164 | $230 | $338 | $196 |

| $150 | $265 | $200 | $199 | |

| $123 | $146 | $160 | $137 | |

| $141 | $199 | $294 | $192 | |

| $84 | $111 | $154 | $96 | |

| U.S. Average | $165 | $244 | $295 | $203 |

Rates rise sharply in the presence of a driving infraction, with a single accident bumping the rate to $525, a DUI to $585, and a speeding ticket to $427.

This pricing structure places Dairyland at the higher end of the spectrum, especially when compared to more economical options like Geico or USAA, which charge significantly lower rates for similar coverage scenarios.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Pros and Cons of Dairyland Auto Insurance

Dairyland auto insurance has established a foothold in coverage for high-risk drivers. With niche offerings, such as SR-22 filings and complete motorcycle insurance coverage, Dairyland shines as an insurance source for those who might struggle to find policies elsewhere. In this review, we’ll look into the pros and cons of Dairyland auto insurance.

Pros

- Specialization in High-Risk Coverage: Dairyland offers flexible payments and low-down options, making insurance accessible for budget-conscious drivers.

- Flexible Payment Options: Dairyland also provides flexible payment plans, low down payments, and coverage options, making insurance more available to those with tight budgets.

- Robust Customer Support: Dairyland is recognized for its customer service quality, service reliability, and extensive support when it comes to resolving insurance matters as well as claims.

While Dairyland offers several advantages, especially for drivers who have limited options, it’s essential to consider the full picture.

Cons

- Higher Premiums for High-Risk Drivers: Dairyland’s focus is on high-risk drivers; it is more expensive than other providers that are more competitive for those with clean records.

- Limited Digital Tools: Dairyland’s online tools are limited compared to larger insurers, which may affect policy management and claims convenience.

Dairyland auto insurance is a strong competitor among high-risk auto insurance companies, with flexible payment options and excellent customer service. However, would-be policyholders must balance these advantages against the higher premiums and lack of digital offerings.

To help you decide if Dairyland is the right insurer for you, let’s dive into specific details about what they offer. This clarity will ensure you’re well-informed when you need to file an auto insurance claim or adjust your coverage.

Dairyland Auto Insurance: Comprehensive Review and Ratings

With diverse ratings among leading agencies, Dairyland Auto Insurance is unique in its value in the industry. J.D. Power gave Dairyland a score of 820 out of 1000, demonstrating a high level of customer satisfaction.

Dairyland Auto Insurance Business Ratings & Consumer Reviews

| Agency | |

|---|---|

| Score: 820 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 73/100 Mixed Customer Feedback |

|

| Score: 1.10 Avg. Complaints |

|

| Score: A+ Superior Financial Strength |

The Better Business Bureau (BBB) gives Dairyland an A+ rating, reflecting excellent business practices despite consumer feedback being mixed, as noted by a score of 73 from Consumer Reports. This mix of feedback suggests some variability in customer experience.

After my accident, I appreciated Dairyland's prompt claim handling and comprehensive coverage options, which notably eased the process during a stressful time, showcasing their commitment to high-risk driver support.Aremu Adams Adebisi Feature Writer

It has a low complaint ratio of 1.10 on the National Association of Insurance Commissioners (NAIC), which means it gets fewer complaints than the average company its size. Dairyland’s AM Best rating of A+ for financial strength gives customers confidence that it can satisfy ongoing insurance obligations.

Comment

byu/ncstatecamp from discussion

inmotorcycles

Consumer reviews also demonstrate the company’s effectiveness, such as a Reddit user’s tip-of-the-hat comment saying Dairyland’s adjusters promptly handled a complex accident with animals. Dairyland’s strong financial base, along with responsive customer service, places it among the best auto insurance companies for those seeking dependable coverage.

How to Buy a Dairyland Auto Insurance Policy

When you decide to get a Dairyland auto insurance policy, the process is both easy to navigate and user-friendly, appealing to both tech-savvy customers and those who prefer the old ways. Here are two main ways to lock in coverage:

- Get a Quote Online or by Phone: Enter your details on Dairyland’s website or call an agent for a personalized quote.

- Provide Driving and Vehicle Information: Share your driving history, car details, and coverage needs to get an accurate rate.

- Choose Your Coverage: Select liability, full coverage, or SR-22 insurance, depending on your situation and state requirements.

- Review Discounts and Payment Options: Check for savings like multi-car discounts and choose a monthly or full-payment plan.

- Buy Your Policy and Get Proof of Insurance: Complete the purchase online or with an agent, then download your ID card for immediate coverage.

Both methods make the process of purchasing insurance easy, efficient, and accessible so customers can manage individuals’ coverage—in other words, hassle-free.

Dairyland makes it easy to decide whether to take the quick and easy online application route or the phone enrollment route, where you actually get to speak with someone and choose the one best for you on how to manage your auto insurance policy, ensuring a smooth experience.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dairyland Insurance Coverage Options

Most states require car insurance before legally driving or registering your vehicle. While it’s never required by state law, you’ll probably need a Dairyland insurance full coverage policy if you have a car loan or lease. Most insurance companies sell at least enough coverage to meet these needs, and Dairyland is no exception. Learn more about auto insurance requirements by state.

To ensure its customers can get the coverage they need, Dairyland offers the following primary policies:

- Liability: Liability auto insurance pays for property damage and injuries you cause in an accident.

- Collision: Collision auto insurance pays for your car repairs after an accident, no matter who causes it. It also covers repairs if you hit a stationary object like a tree.

- Comprehensive: A lot more than collisions can damage your car. Comprehensive auto insurance covers damage from vandalism, theft, weather, fire, and animal contact.

- Uninsured/Underinsured Motorist: Uninsured motorist (UM) coverage protects you from drivers without insurance and covers hit-and-run damages. Most states require insurance, but not all drivers comply.

- Personal Injury Protection or Medical Payments: Medical payments or PIP insurance helps cover health care costs after an accident. Treatment can be expensive, but this coverage eases the burden.

The amount you need for car insurance depends on what type of vehicle you drive and which state you live in. If you’re unsure of what you need, call Dairyland Insurance and ask a representative to help you.

Dairyland Auto Insurance Add-ons

Add-ons for your car insurance are optional coverages that increase the value of your policy. Some car insurance companies have long lists of options, but high-risk companies often lack variety. Dairyland doesn’t have the largest selection, but it offers a few options:

- Special Equipment Coverage: Standard insurance doesn’t cover custom parts or equipment you install. You can add special equipment coverage to replace or repair up to $1,000 worth of custom parts.

- Roadside Assistance: Dairyland will assist you with towing and emergency services when you’re stranded. This add-on typically costs under $100 a year.

- Rental Reimbursement: Rental car reimbursement covers a rental when your vehicle is stuck in the shop. Dairyland offers $25 a day for this coverage, up to a maximum of $750.

While this list isn’t the most comprehensive, you can still add significant value to your Dairyland car insurance with these options. Make sure to purchase only what you need — add-ons enhance the value of your policy but also raise your rates. For more insights, consider checking Dairyland Insurance reviews to see how these add-ons have benefited other customers.

Dairyland Motorcycle Insurance Coverage Options

Motorcycles need insurance just like cars, and Dairyland offers excellent coverage options. You can get the same primary coverages — liability, collision, comprehensive, uninsured motorist, and personal injury protection or medical payments — for your motorcycle. You can also buy extra coverage with the following add-ons:

- Comprehensive Coverage Options: Includes liability, collision, comprehensive, uninsured motorist, and personal injury protection.

- Replacement Cost for New Bikes: Offers full replacement for motorcycles three years old or newer.

- Original Equipment Manufacturer Parts: Ensures use of OEM parts for repairs through Physical Damage-Plus coverage.

- Additional Protection for Passengers: Provides guest passenger coverage for medical expenses.

- Support for Road Trips: Covers rental, trip interruption, and associated travel expenses if your motorcycle breaks down 100 miles away from home.

Dairyland motorcycle policyholders tend to be more satisfied with their coverage compared to those with car insurance, according to a Dairyland Insurance review. Customers appreciate the knowledge Dairyland representatives have about motorcycles and the ease of signing up for a policy.

Of course, not everyone is completely satisfied with Dairyland Insurance. Reviews often point out that, despite offering motorcycle insurance discounts, one of the more frequent criticisms is the slow claims process for motorcycle insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Other Dairyland Insurance Coverage Types

Aside from car and motorcycle coverage, Dairyland also sells insurance for ATVs, dirt bikes, and snowmobiles. You can also get the following specialty types of car insurance:

-

- Lienholder Policy: This coverage pays the remainder of a car loan if your vehicle is totaled before you can pay it off. Similar to GAP coverage, many lenders require drivers to carry this insurance.

-

- Non-Owner Insurance: Non-owner auto insurance covers you when driving borrowed cars. Dairyland SR-22 or non-owner coverage can help reinstate your license if required.

Dairyland Insurance is also willing to file SR-22 forms on your behalf, sometimes without a fee. If you need cheap SR-22 auto insurance, consider requesting a Dairyland Insurance quote when you apply for a policy. Existing customers can call the Dairyland auto insurance phone number to ask a representative to file SR-22 forms.

Dairyland Auto Insurance: Reliable Coverage for High-Risk Drivers

Dairyland auto insurance offers a solid option for high-risk drivers, providing specialized services like SR-22 auto insurance filings and heavy-duty bike insurers. They also back up their commitment to providing coverage for drivers with different histories with competitive rates and tailored policies.

With high ratings from AM Best and the BBB, Dairyland proves reliable in terms of financial stability and business integrity. Individuals facing difficulties in obtaining coverage elsewhere can easily access necessary protections backed by attentive customer service by getting a Dairyland auto insurance quote.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What is the Dairyland Insurance phone number for customer service inquiries?

You can reach Dairyland customer service for auto insurance inquiries by calling 800-334-0090. This number provides access to support for policy questions, payments, claims, and more.

Where is the headquarters of Dairyland Insurance Company located?

The headquarters of Dairyland Insurance Company is located in Stevens Point, Wisconsin.

How can I verify a lienholder with Dairyland Insurance lienholder verification?

To verify a lienholder, you can contact Dairyland’s customer service using the main phone number or view your auto insurance policy online by logging into your account. For verification, you will need to provide the lienholder’s name and address, along with your policy number.

Is there a Dairyland Insurance office in Lincoln, NE?

Specific office locations, such as one in Lincoln, NE, may vary. It’s best to check directly with Dairyland via their website or customer service to find local agent information or office locations.

What features are offered with Dairyland Insurance roadside assistance?

Features of Dairyland Insurance roadside assistance include 24/7 emergency help, towing service, flat tire changes, emergency fuel delivery, battery jump-start, and locksmith services.

What services are included in Dairyland roadside assistance?

Dairyland roadside assistance offers services, including towing, flat tire changes, battery jump-starts, locksmith services, and emergency fuel delivery. These services are designed to help you quickly resolve common roadside issues.

How do I contact Dairyland roadside assistance by phone?

For roadside assistance, call the Dairyland roadside assistance phone number at 877-469-9227. This number is available 24/7 to provide help when you need it most.

What do the Dairyland motorcycle insurance reviews say about their service and coverage?

Dairyland motorcycle insurance reviews often highlight the company’s competitive rates, the inclusiveness of high-risk riders, and responsive customer service, although some reviews may point out higher premiums compared to other insurers.

Does Dairyland offer specific coverage options for motorcyclists through Dairyland cycle insurance?

Yes, Dairyland Cycle Insurance provides specialized motorcycle coverage that includes collision, comprehensive, and liability insurance, as well as optional coverages like roadside assistance and replacement cost coverage.

What are the benefits of choosing motorcycle insurance from Dairyland?

Benefits include coverage for a wide range of motorcycles, including high-risk policies, options for accessories and custom parts, potential discounts, and 24/7 claims service.

Is Dairyland Insurance considered a good choice for auto insurance?

Yes, Dairyland is considered a good choice, particularly for high-risk drivers or those requiring SR-22 certification, as it offers flexible payment options and a range of coverage levels to suit different needs.

How can I get a Dairyland Insurance auto quote for my vehicle?

You can obtain a Dairyland insurance auto quote online by visiting their website and entering your vehicle and driver details. Alternatively, you can call their customer service number for a personalized quote. This process is an essential step in how to evaluate auto insurance quotes effectively.

How legitimate is Dairyland Insurance as an insurance provider?

Dairyland Insurance is a legitimate provider with strong financial backing from its parent company, Sentry Insurance, which holds an A+ rating from A.M. Best, indicating excellent financial health.

Enter your ZIP code into our free quote tool to find the best auto insurance providers for your needs and budget.

Why is Dairyland Insurance known for being so affordable?

Dairyland Insurance is known for being affordable because it specializes in providing coverage for high-risk drivers, often offering competitive rates that consider the unique circumstances and needs of drivers who may face higher premiums elsewhere.

What does Peak Property and Casualty Insurance offer through Dairyland auto policies?

Through Dairyland, Peak Property and Casualty Insurance offers auto insurance policies that cover bodily injury and property damage liability, along with options for comprehensive and collision auto insurance coverage tailored to drivers who may not qualify for standard insurance due to their driving history or other factors.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Jyad

The worst insurance company

Tabatha Denney-Navarro

Dairyland review

Bentboy

A complete mess of an insurance company!

Jaykazeee

Dairyland < any other auto insurers

tylercornelison1

Dairyland are you in good hands?

Llm122313

Love them

MWuerth22

Doesn't Need To Have Cheap Features To Be Cheap

lilialespinoza

Excellent Customer Service

tannaa

Horrible

FosterCare2020

Inexpensive