Erie Auto Insurance Review in 2025 (Monthly Rates Here!)

This Erie auto insurance review delves into how Erie stands out with exceptionally low rates, averaging just $58 per month and offering robust coverage options. Discover the compelling advantages and tailored discounts that make Erie insurance a leading choice for discerning drivers seeking both value and quality.

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Dec 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Erie Auto Insurance

Average Monthly Rate For Good Drivers

$58A.M. Best Rating:

A+Complaint Level:

MedPros

- Offers several great perks with standard coverages, such as pet injury protection

- Lower-than-average national average rates

- Various other coverages besides auto insurance

Cons

- Unavailable in most states

- Various complaints and negative customer reviews

In this comprehensive Erie auto insurance review, we explore the various types of auto insurance provided by Erie, which is recognized for offering some of the most competitive rates in the industry, with attractive average monthly premiums.

Erie combines low-cost policies with high-quality coverage, tailoring discounts and options to fit diverse driver needs. For drivers with a clean driving record, Erie’s rates are particularly attractive at $58/mo, but following an accident, premiums may adjust.

Erie Auto Insurance Rating

Rating Criteria

Overall Score 4.5

Business Reviews 4.5

Claim Processing 4.3

Company Reputation 4.5

Coverage Availability 3.5

Coverage Value 4.6

Customer Satisfaction 4.3

Digital Experience 4

Discounts Available 4.7

Insurance Cost 4.7

Plan Personalization 4.5

Policy Options 5

Savings Potential 4.7

Customer feedback highlights Erie’s relatively stable rates post-incident, distinguishing it from competitors whose rates might spike more significantly.

Explore your auto insurance options by entering your ZIP code into our free comparison tool above today.

Understanding Erie Auto Insurance Rates

Dive into the specifics of Erie Auto Insurance’s monthly rates to see how auto insurance rates by age, gender, and driving history influence coverage costs. This quick overview, enriched with Erie Insurance ratings, helps you gauge what to expect when selecting your policy.

Erie Auto Insurance Monthly Rates by Age, Gender, & Coverage Level

Age & Gender Minimum Coverage Full Coverage

Age: 16 Female $85 $218

Age: 16 Male $95 $233

Age: 18 Female $69 $161

Age: 18 Male $81 $189

Age: 25 Female $26 $68

Age: 25 Male $27 $71

Age: 30 Female $24 $63

Age: 30 Male $25 $66

Age: 45 Female $22 $59

Age: 45 Male $22 $58

Age: 60 Female $21 $53

Age: 60 Male $21 $55

Age: 65 Female $22 $57

Age: 65 Male $22 $57

Erie provides tailored rates influenced by the driver’s age and driving history. Younger drivers and those with incidents like accidents or DUIs may face higher premiums, while those with clean records benefit from lower rates. Check Erie Insurance reviews to gauge how these factors typically affect customer premiums.

With Erie Auto Insurance, understanding your potential monthly expenses is straightforward, enabling you to make informed decisions based on your personal driving profile and coverage needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What You Should Know About Erie Insurance Group

Erie auto insurance offers the state minimum auto insurance requirements necessary to drive legally, alongside various other coverage options and affordable rates. However, if you’re considering a policy with the Erie car insurance company, research to see if an Erie auto insurance policy is the right fit.

The Better Business Bureau gives Erie Insurance an A+ rating. While some Erie customer service reviews were negative, the number of complaints is low compared to how many customers Erie insures. Just over 100 complaints with Erie car insurance closed in the last three years, with 30 complaints in the last year.

Erie Auto Insurance stands out with its exceptionally competitive rates and comprehensive coverage options, making it an excellent choice for cost-conscious consumers seeking reliable insurance.Laura Berry Former Licensed Insurance Producer

Overall, Erie insurance customer service ranked fairly well despite negative reviews. However, it’s not uncommon for companies to have a lot of negative reviews, even with good customer service. To understand an insurer’s ratings, consider the percentage of unhappy customers, as a few disgruntled customers don’t reflect on the company.

Keep reading this Erie auto insurance review to see if Erie is the right fit for you out of all the best auto insurance companies. We’ll also compare the pros and cons of Erie car insurance, explain Erie’s auto insurance ratings, and incorporate insights from Erie car insurance reviews to give you a well-rounded perspective.

Erie Auto Insurance: Balancing Benefits and Limitations

There are several advantages to choosing Erie as your auto insurance provider. Notable benefits include:

- Affordable Rates: Erie offers competitive monthly rates, with average premiums as low as $58, making it an economical choice for many drivers.

- Broad Coverage Options: Beyond the state-required minimums, Erie provides a variety of coverage options, including unique add-ons like pet injury coverage and the Auto Plus package, which enhances your policy for a minimal additional cost.

- Discount Opportunities: Policyholders can benefit from multiple discounts such as safe driver rewards, multi-policy discounts, and reduced rates for monthly payments. Always ask for auto insurance discounts to maximize your savings with Erie.

However, there are also some drawbacks to consider when evaluating Erie for your auto insurance needs:

- Limited Geographic Availability: Erie’s services are not available nationwide, restricting access for potential customers outside of its operating regions, which include certain states like Illinois, Indiana, and Pennsylvania among others.

- Mixed Customer Feedback: While many customers report satisfaction with their rates and coverage, Erie has received mixed reviews regarding its customer service, with some policyholders experiencing less than satisfactory interactions.

When considering auto insurance Erie, it’s crucial to evaluate the advantages and disadvantages to see if it meets your particular needs and expectations. For a more informed decision, compare auto insurance quotes in Erie.

Erie Insurance Group Insurance Coverage Options

Erie offers several auto insurance coverages besides the minimum liability auto insurance all drivers must carry. Most drivers with newer cars carry more than the minimum liability insurance to protect their assets fully, and Erie offers additional coverage for customers’ needs. The main auto insurance coverages that Erie car insurance offers are:

- Bodily Injury Liability and Property Damage Liability: If you’re at fault in an accident, bodily injury liability auto insurance and property damage liability auto insurance pay for the other parties’ medical and car repair bills, respectively.

- Collision: If you collide with another vehicle or an object, such as a fence post, your Erie collision auto insurance covers the repair costs for your vehicle.

- Comprehensive: Comprehensive auto insurance pays for repairs if you crash into an animal or your car gets damaged by weather, vandalism, or theft.

- Personal Injury Protection: Personal injury protection auto insurance will help pay medical bills if you or your passengers suffer injuries.

- Uninsured or Underinsured Motorist: If the driver who hits you doesn’t have enough insurance to cover your bills or has no insurance, uninsured/underinsured motorist coverage pays your bills.

Erie offers all the basic coverages for drivers to purchase full coverage auto insurance or liability insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Erie Add-On Auto Insurance Options

In addition to the standard coverages provided, Erie auto insurance company also offers various add-on coverages for drivers. Please note that these additional options may not be available in every state:

- Erie Auto Plus: This add-on includes multiple perks like a diminishing deductible, transportation expenses, increased coverage limits, waived deductibles, and death benefits.

- Rate Lock: Erie will lock your rates with this feature even if you have a claim.

- Rental Car Insurance: If your car is being repaired, Erie auto insurance rental car coverage ensures you have a vehicle to use until yours is ready to hit the road again.

- Rideshare Insurance: If you drive for Uber or Lyft, you’ll need rideshare protection from Erie.

- Roadside Assistance: Erie’s roadside assistance helps with numerous issues, from locking yourself out of your car to a dead battery.

Erie has many great insurance coverages, with some designed to save drivers money over time. By leveraging these additional options, you can customize your policy to meet your specific needs and ensure that you’re covered in all aspects of your driving life.

This flexibility is one of the reasons Erie stands out as a preferred choice among many drivers looking for comprehensive insurance solutions.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Extra Features Included With Insurance Coverages

Erie has many perks included with basic policies at Erie, such as pet injury coverage and travel expense coverage. Take a look at the full list below:

- Accident Forgiveness: If you’ve been an Erie customer for at least three years and are claim-free, Erie will forgive your first accident.

- Diminishing Deductible: Erie reduces your deductible each month you go claim-free, up to a total reduction of $500.

- Pet Injury Protection: Pet injury coverage covers up to $500 per pet and $1,000 total in vet bills if your pet gets injured in a crash.

- Travel Expenses: Travel expenses help pay for food and hotel costs if your car breaks down.

- Windshield Deductible Waiver: Does car insurance cover windshield damage or replacement? With Erie, your deductible gets waived if you get your window repaired rather than replaced.

Erie’s accident forgiveness policy can help drivers save hundreds of dollars if they’re in an accident. Its comprehensive coverage also carries some perks, including glass repair, locksmith services, and personal items coverage.

Auto Plus Package at Erie

Customers can enhance their standard auto insurance policy with the Erie Auto Plus endorsement. This add-on typically costs under $3 monthly, slightly increasing your daily auto insurance rates. The Auto Plus package includes the following benefits:

- Death Benefit: It provides $10,000 per person killed in a covered accident.

- Diminishing Deductible: Erie will reduce your deductible each month you go claims-free.

- Increased Coverage Limits: Your coverage limits will increase to help cover things like personal items in the car.

- Transportation Expenses: Erie will pay for up to 10 days more of transportation expenses after settlement if your car gets totaled.

- Waived Deductibles: In some cases, Erie will waive your auto insurance deductible for covered claims.

Adding on the Auto Plus package is worth the price for most drivers. This package not only enhances your financial security in case of an accident but also maximizes your savings on out-of-pocket costs over time. It’s an ideal choice for those who seek additional peace of mind while on the road.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Other Erie Insurance Types

Erie offers several other insurance types besides auto insurance. You may want to purchase more than just auto insurance at Erie to earn bundling discounts. Some of the other main types of insurance offered at Erie are:

- Business insurance

- Home insurance

- Life insurance

- Recreational vehicle insurance

- Renter’s insurance

Erie provides a full range of insurance options for customers looking to bundle insurance policies at one company, catering to auto insurance for different types of drivers.

Erie Insurance Group Insurance Rates Breakdown

Price is a critical factor in choosing car insurance policies. Erie is known for being one of the more affordable options, with rates that often fall below the national average. Remember that Erie’s rates depend on the individual driver’s history, vehicle, and more, including the factors that affect auto insurance rates. The best way to determine how much Erie will cost for you is to get Erie insurance quotes.

Erie Insurance: Affordable Rates Unveiled

Erie’s average auto insurance rates are around 50% lower than the national average. Check out the table below to compare Erie car insurance rates to competitors:

Full Coverage Auto Insurance Rates by Provider

| Insurance Company | Rates |

|---|---|

| $160 | |

| $117 | |

| $58 |

| $139 | |

| $80 | |

| $174 |

| $115 |

| $105 | |

| $86 | |

| U.S. Average | $119 |

Erie car insurance typically offers more affordable rates compared to its competitors, positioning it as one of the cheapest car insurance options. Geico auto insurance follows with full coverage averaging $80 monthly. Rates vary based on factors like company, driving profile, and demographics, so comparing your Erie auto insurance quote with others is advisable to secure the best deal.

Erie Auto Insurance Rates by Age

Age is a significant factor in determining auto insurance rates. Here’s a look at Erie’s average monthly full coverage rates for adult drivers:

Full Coverage Auto Insurance Monthly Rates by Provider, Age, & Gender

| Age & Gender | Rates |

|---|---|

| Age: 18 Female | $161 |

| Age: 18 Male | $189 |

| Age: 30 Female | $63 |

| Age: 30 Male | $66 |

| Age: 45 Female | $59 |

| Age: 45 Male | $58 |

| Age: 55 Female | $56 |

| Age: 55 Male | $55 |

| Age: 65 Female | $57 |

| Age: 65 Male | $57 |

Auto insurance for teens costs significantly more than for adults since Erie car insurance, like most companies, considers teenagers high-risk due to their lack of driving experience.

Affordable Full Coverage Options for Teen Drivers

Finding affordable auto insurance for teenage drivers can be challenging, yet Erie Insurance provides competitive rates for full coverage that are notably attractive. Here’s a brief overview of the monthly costs that 16- and 18-year-olds with clean driving records might face when opting for car insurance in Erie.

Teen Erie Full Coverage Auto Insurance Monthly Rates by Gender

| Age & Gender | Rates |

|---|---|

| Age: 16 Female | $218 |

| Age: 16 Male | $233 |

| Age: 18 Female | $161 |

| Age: 18 Male | $189 |

If you examine the rate difference in the two charts above, you’ll notice that rates generally decrease as drivers age. However, as individuals approach their senior years, they might observe an increase in their Erie car insurance rates. For a clearer understanding, consider checking car insurance quotes in Erie.

Although auto insurance for seniors typically costs more than the average, Erie car insurance still offers rates that are reasonably priced. For the best options, look into cheap insurance quotes from Erie.

Unlock Savings With Erie Auto Insurance for Safe Drivers

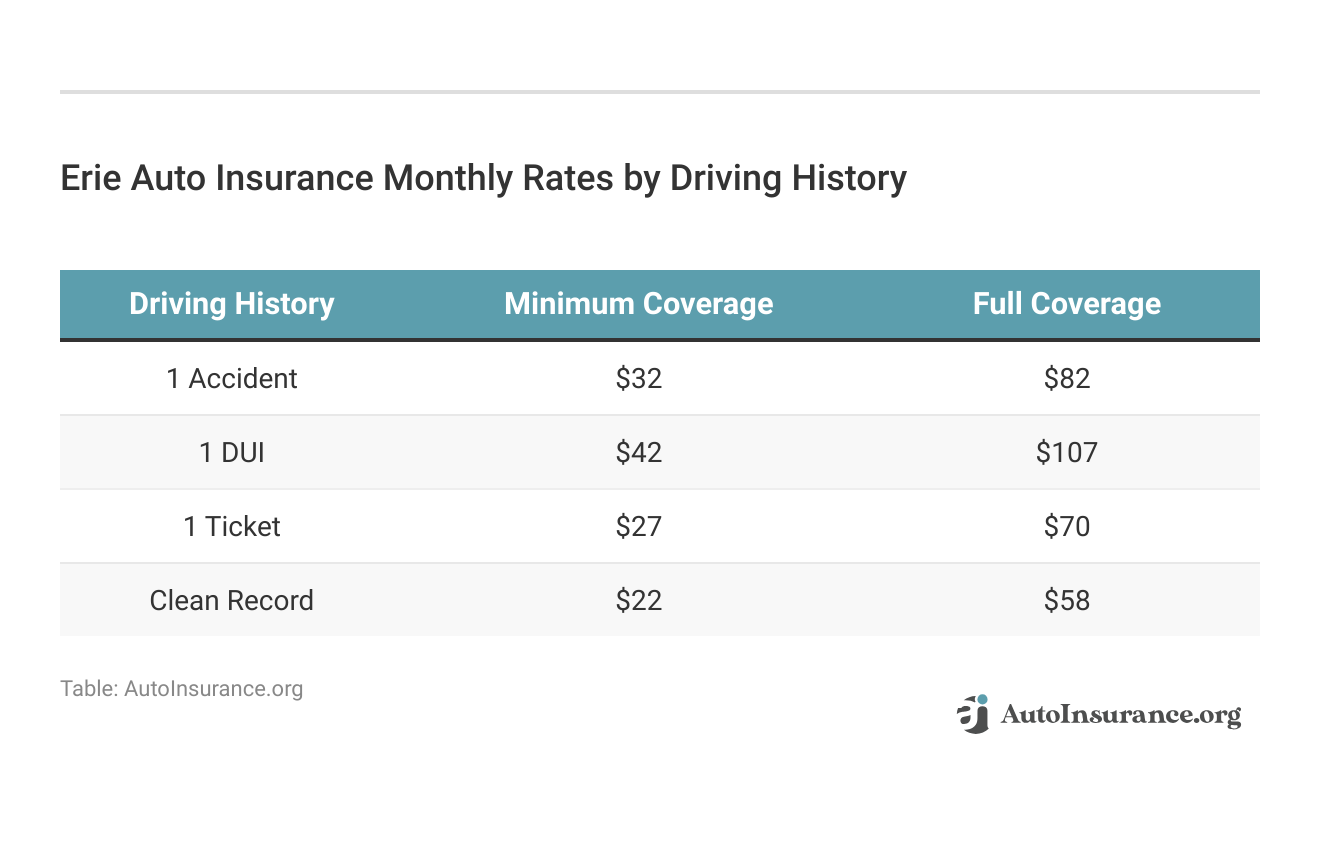

Being a safe driver pays off when looking for auto insurance. You’ll likely pay more for auto insurance for drivers with a bad driving record, like DUIs, speeding tickets, or at-fault accidents.

Erie Auto Insurance Monthly Rates by Driving Record

| Record | Rates |

|---|---|

| Clean Record | $58 |

| One Accident | $82 |

| One DUI | $107 |

| One Ticket | $70 |

Keeping your driving record clean is a great way to avoid higher auto insurance rates. Additionally, Erie may offer incentives and discounts for maintaining a record free of violations and claims, enhancing the savings for conscientious drivers.

Slash Your Erie Premiums: Unlock Big Savings

Dive into savings with Erie Auto Insurance. Whether you’re bundling policies or equipping your car with the latest safety features, Erie rewards your smart choices with hefty discounts. Let’s explore how you can cut costs dramatically:

Erie Auto Insurance Discounts by Savings Potential

| Discount Name | Savings Potential |

|---|---|

| Multi-Policy Discount | 25% |

| ERIE Rate Lock® | 20% |

| Safety Features Discount | 15% |

| Payment Perks | 12% |

| Youthful Driver Discount | 20% |

| Diminishing Deductible | 10% |

| College Student Discount | 10% |

| Vehicle Storage Discount | 9% |

Boost your savings with the variety of discounts offered by Erie, one of the leading auto insurance companies for college students. Whether you’re a student, a safe driver, or somewhere in between, Erie has a discount to suit your needs. Begin refining your policy now and enjoy more cash in your wallet.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Erie Insurance Group Discounts Available

For those wondering how to lower your auto insurance, Erie car insurance discounts can significantly reduce auto insurance costs. Erie auto insurance discounts include:

- Car Safety Equipment Discount: You can earn a discount if your vehicle has safety features like anti-lock brakes.

- Multi-Vehicle Auto Insurance Discount: Adding more than one vehicle to your policy will result in cheaper rates.

- Multi-Policy Discount: Erie will give you a discount if you sign up for more than one type of policy, such as home and auto.

- Safe Driving Discount: You can get discounts on your insurance policy if you keep a clean driving record.

- Young Driver Discount: Young drivers under 21, unmarried, and living with their parents can earn a discount.

Qualifying for as many Erie insurance discounts as possible can help reduce your rates. Erie offers a good selection of discounts, and having a clean driving record will greatly reduce rates.

data-media-max-width=”560″>

Is auto insurance eating up precious dollars in your budget?💰At https://t.co/27f1xf131D, we’ve got a full list of discounts available, so you can stop overpaying and start saving!🙌Find out what discounts you qualify for here👉: https://t.co/JEnTbtVlQv pic.twitter.com/XHkZyAdqwO

— AutoInsurance.org (@AutoInsurance) April 28, 2023

By utilizing these discounts, Erie helps tailor coverage to meet various budget needs, making auto insurance more affordable for diverse groups of drivers. This flexibility in pricing demonstrates Erie’s commitment to providing value and support to its policyholders.

Erie Business Ratings: Top Scores Across the Board

Discover how Erie Insurance stands tall in the business world with stellar ratings from major agencies. From J.D. Power to the Better Business Bureau, Erie consistently earns high marks, showcasing their reliability and customer satisfaction.

Erie Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 880 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices |

|

| Score: 82/100 Positive Customer Feedback |

|

| Score: 0.60 Fewer Complaints |

|

| Score: A+ Superior Financial Strength |

Erie Insurance’s outstanding ratings demonstrate their dedication to excellence and earning customer trust, positioning them among the best auto insurance companies. Whether you’re considering their services or analyzing their performance, these high scores underscore Erie’s status as a premier choice in the insurance sector.

Evaluating Erie Auto Insurance for Your Needs

Erie Auto Insurance stands out with its low average monthly rates and a wide range of coverage options, making it a strong choice for budget-conscious drivers looking for quality insurance. The availability of discounts and add-ons like the Auto Plus package adds value, enhancing coverage at a minimal cost.

However, Erie’s services are limited to certain states, and experiences can vary by location. An auto insurance policyholder is defined as someone who holds an insurance policy. Prospective policyholders should consider local feedback and Erie’s offerings to determine if they meet their insurance needs.

Use our free quote tool below by entering your ZIP code to discover the best car insurance providers in Erie that match your needs and budget.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Are Erie auto insurance policies expensive?

No, most drivers get affordable rates from Erie car insurance compared to the national average. On average, you’ll pay $58 monthly for Erie auto insurance.

Does Erie insurance have additional perks?

Erie has many great perks not typically offered at other insurance companies, such as pet injury protection, locked rates, and diminishing deductibles.

Why is Erie insurance so cheap?

Erie offers some of the lowest auto insurance costs, with rates more than 50% cheaper than the national average. Of course, young drivers and drivers with poor credit will pay higher average rates.

Refer to our comprehensive handbook, “Cheapest Auto Insurance Companies,” to broaden your understanding.

Is Erie auto insurance good?

Yes, Erie has decent rates and coverages for drivers, even though it isn’t available in all states. However, if it’s in your state, it’s worth looking at reviews of Erie car insurance.

How do I contact Erie auto insurance?

You can reach out to the Erie auto insurance claims phone number at 1-800-367-3743.

Protect your vehicle at the best prices by entering your ZIP code into our free auto insurance quote comparison tool below.

What is the credit rating of Erie Insurance?

Erie auto insurance has an A+, or superior, rating from A.M. Best. So, you can rest assured that you’ll get a fair Erie insurance payout after filing a legitimate claim.

Consult our extensive guide titled “How Credit Scores Affect Auto Insurance Rates” for in-depth insights.

Is Erie Insurance a reliable company?

Erie auto insurance is widely regarded as a reputable company. They have been in business for several years and have earned a positive reputation for their customer service and financial stability. However, it’s always a good idea to research and read customer reviews to make an informed decision.

What types of coverage does Erie auto insurance offer?

Erie auto insurance offers a comprehensive range of coverage options, such as liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage. Additionally, the company offers optional coverages like roadside assistance and rental car reimbursement.

Is Erie auto insurance in all 50 states?

You can buy Erie auto insurance in the District of Columbia, Illinois, Indiana, Kentucky, Maryland, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and Wisconsin.

Explore our detailed resource titled “Auto Insurance Rates by State” for a comprehensive overview.

What factors can affect my Erie auto insurance premium?

Several factors can impact your premium with Erie Auto Insurance. These factors include your age, gender, location, driving record, type of vehicle, coverage limits, deductibles, and any applicable discounts. Providing accurate information during the quoting process is important to receive an accurate premium estimate.

Does Erie auto insurance raise rates after a claim?

Whether Erie auto insurance raises rates after a claim depends on the circumstances of the claim, driver’s history, and policy terms. However, you’ll generally see higher rates after filing a claim.

Explore our comprehensive resource titled “How to File an Auto Insurance Claim” to enhance your understanding.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Lee_C

Please don’t hesitate to choose Erie Insurance!

reaglehouse

Erie Insurance

Vinjm_75

Best deals around

holymama

its alright!

Lewis Cooper

Erie Insurance review

Rose327

Handling claims

Glitterz17548

Horrible service

mhake

Great Service and Most Affordable

chrvicars

Good customer service

Kupkake

Great company