Erie vs. Farmers Auto Insurance in 2026 (Side-by-Side Review)

When comparing Erie vs. Farmers auto insurance, Erie starts at a lower $32 monthly for minimum coverage, while Farmers begins at $76. Erie offers annual $100 deductible reductions for claim-free years. Meanwhile, Farmers rewards safe drivers with up to 15% off through its Signal app.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance & Finance Analyst

Laura Adams is one of the nation’s leading finance, insurance, and small business authorities. As an award-winning author, spokesperson, and host of the top-rated Money Girl podcast since 2008, millions of readers and listeners benefit from her practical advice. Her mission is to empower consumers to live healthy and rich lives by planning for the future and making smart money decisions. She rec...

Laura D. Adams

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated June 2025

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 3,072 reviews

3,072 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviewsThis Erie vs. Farmers auto insurance review highlights how Erie supports claim-free drivers through long-term policy perks, while Farmers appeals to tech-savvy motorists.

Erie vs. Farmers Auto Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.3 | 4.2 |

| Business Reviews | 4.5 | 4.0 |

| Claims Processing | 4.3 | 3.3 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 3.5 | 5.0 |

| Coverage Value | 4.6 | 4.1 |

| Customer Satisfaction | 2.2 | 2.0 |

| Digital Experience | 4.0 | 4.5 |

| Discounts Available | 4.7 | 5.0 |

| Insurance Cost | 4.7 | 4.3 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 5.0 |

| Savings Potential | 4.7 | 4.5 |

| Erie Review | Farmers Review |

Erie’s Rate Lock program enables eligible customers to maintain stable premiums until they change vehicles, drivers, or addresses. Find out what makes Erie stand out in our complete Erie auto insurance review.

Farmers offers the Signal app, a mobile-based tool that monitors driving habits and rewards safe behavior with policy discounts.

- Erie and Farmers auto insurance offer SR-22 filings for high-risk drivers

- Farmers provides rideshare coverage with up to $1M liability protection

- Erie reimburses up to $75 for locksmith services under roadside coverage

If you want to compare auto insurance companies near you, enter your ZIP code into our tool and review quotes from local providers in your area.

Compare Erie and Farmers Auto Insurance Rates

This table displays how much Erie vs. Farmers auto insurance costs by age and gender. Young drivers have the highest rates, especially 16-year-olds who may pay as much as $452 per month with Farmers.

Erie vs. Farmers Auto Insurance Monthly Rates

| Age & Gender |  | |

|---|---|---|

| 16-Year-Old Female | $121 | $452 |

| 16-Year-Old Male | $136 | $452 |

| 30-Year-Old Female | $34 | $87 |

| 30-Year-Old Male | $35 | $91 |

| 45-Year-Old Female | $32 | $76 |

| 45-Year-Old Male | $32 | $76 |

| 60-Year-Old Female | $30 | $68 |

| 60-Year-Old Male | $31 | $72 |

Erie is consistently lower for all age groups, dropping to around $30 monthly for drivers over 60. The difference between genders decreases with age, but Erie remains the less expensive choice at every age.

This table compares Erie and Farmers’ auto insurance monthly rates based on driving history. For all types of violations, Erie auto insurance is cheaper than Farmers.

Erie vs. Farmers Auto Insurance Monthly Rates by Driving Record

| Driving Record |  | |

|---|---|---|

| Clean Record | $32 | $76 |

| Speeding Ticket | $38 | $95 |

| Not-At-Fault Accident | $45 | $109 |

| DUI/DWI | $60 | $106 |

If you have a DUI, then the monthly charge is $60 by Erie compared to $106 by Farmers. Even small mistakes, such as speeding, can significantly increase rates for both insurers, but Erie is less likely to penalize you.

Read more: DWI vs. DUI Differences Explained

Erie vs. Farmers vs. Top Companies

This table compares the minimum and full coverage rates from the major providers. Erie has the lowest cost for minimum coverage at $32 a month and for full coverage at $83 a month, while Farmers is among the highest, with $76 per month for minimum coverage and $198 a month for full coverage.

Auto Insurance Monthly Rates: Erie and Farmers vs. Top Competitors

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 |

| $32 | $83 |

| $76 | $198 | |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 | |

| $56 | $150 | |

| $47 | $123 | |

| $53 | $141 |

The difference between Erie and others, such as Liberty Mutual at $248 per month for full coverage, shows good value. Farmers is still competitive but tends to be higher on both coverage levels than Erie. Compare more quotes in our Farmers vs. Liberty Mutual auto insurance review.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Erie and Farmers Auto Insurance Coverage Options

Both companies offer the same basic protections, from minimum liability insurance to full coverage. Both also offer accident forgiveness and rental reimbursement. However, each has unique options tailored to various driver requirements.

For example, Erie provides practical protections and exclusive perks designed for long-term policyholders and low-risk drivers:

- Rate Lock: Keeps premium rates the same until the policyholder changes vehicle, driver, or address

- First Accident Forgiveness: Waives the surcharge after your first at-fault accident

- New Vehicle Replacement: If your vehicle is totaled, Erie will replace it with the newest similar model available (within the first 2 years).

- Roadside Assistance: Includes towing, fuel delivery, and up to $75 for locksmith assistance

- Pet Injury Coverage: This pays for veterinary bills if your pet is injured in a covered accident

On the other hand, Farmers focuses on tech-enabled and flexible coverage options, benefiting urban drivers and digital-first customers:

- Signal App Discount: This app gives a discount for good driving. You can get up to 30% off, depending on how you drive, which is tracked on the app

- Customized Equipment Coverage: Protects aftermarket parts and modifications

- Rideshare Insurance: Bridges coverage gaps for Uber/Lyft drivers during off-duty periods

- Accident Forgiveness: Prevents your rate from increasing after one at-fault accident

- Glass Repair Services: Covers chip repair without needing a deductible

Both companies offer a good basic level of regular protections, but their special perks, such as Erie’s Rate Lock and Farmers’ Signal app, are designed for different kinds of driving habits and priorities.

Erie vs. Farmers Auto Insurance Discounts

This table illustrates the differences in discounts among various popular groups. Erie offers a 30% low-mileage auto insurance discount to drivers who don’t drive frequently and a 25% bundling discount when you bundle services, making it a good option for individuals who drive less and own homes.

Erie vs. Farmers Auto Insurance Discounts

| Discount |  | |

|---|---|---|

| Bundling | 25% | 20% |

| Safe Driver | 15% | 20% |

| Defensive Driving | 5% | 10% |

| Good Student | 15% | 15% |

| Multi-Car | 10% | 20% |

| Low Mileage | 30% | 10% |

| Safety Features | 10% | 15% |

| Accident-Free | 25% | 20% |

| Usage-Based | 30% | 30% |

| Anti-Theft | 15% | 10% |

Farmers offers bigger savings for those with multiple cars (20%) and those who take defensive driving courses (10%). Both offer a 30% discount for usage-based programs according to your driving habits.

Erie vs. Farmers Insurance Customer Reviews and Ratings

This table compares ratings from major review platforms for Erie and Farmers. Erie is slightly better, with a 733 J.D. Power score and fewer complaints at 0.60. Use our Farmers car insurance review to see how it ranks on claims handling.

Insurance Business Ratings & Consumer Reviews: Erie vs. Farmers

| Agency |  | |

|---|---|---|

| Score: 733 / 1,000 Avg. Satisfaction | Score: 706 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A Good Business Practices |

|

| Score: 82/100 Positive Customer Feedback | Score: 82/100 High Customer Satisfaction |

|

| Score: 0.60 Fewer Complaints Than Avg. | Score: 1.32 More Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: A Excellent Financial Strength |

Both Erie and Farmers got the same score, 82/100, in Consumer Reports, but Farmers have lower satisfaction with a 706 score, and more complaints. A.M. Best also gives Erie a higher financial score of A+ compared to Farmers, receiving an A.

This Reddit post shares a five-year journey with Erie for both car and home insurance. The user highlights trustworthy claim handling, particularly for homeowners coverage that includes a guaranteed replacement cost. With no claims for the car and an overall easy process, Erie’s good name in personal lines is a significant reason to stay loyal.

Comment

byu/notveryhndyhmnr from discussion

inInsurance

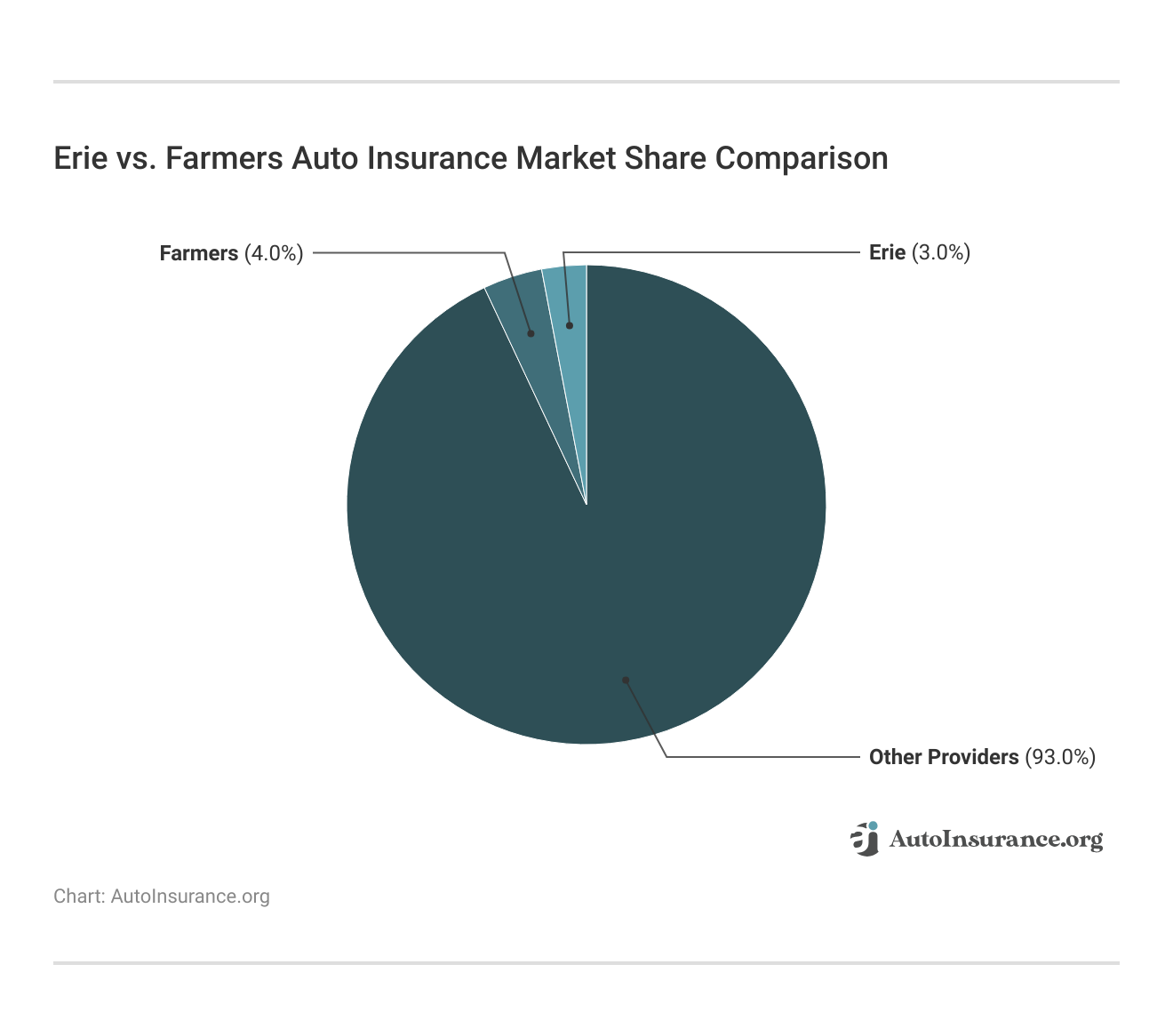

This chart compares the market share of Erie and Farmers. Farmers have a 4.0% share, a bit more than Erie’s 3.0%. Other insurance companies have the remaining 93.0% majority in the market.

The numbers indicate each provider’s national reach and brand recognition. Farmers is slightly ahead of Erie, but both are far behind the bigger market leaders.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Erie vs. Farmers Auto Insurance Stacks Up

Erie and Farmers car insurance have different strong points tailored for the drivers they help. Erie is ideal for those who drive a steady, low number of miles and want long-term benefits through Rate Lock. They also offer significant savings with discounts based on your driving habits and accident-free record.

Farmers is attractive to households with multiple vehicles and drivers who like using apps. It offers benefits from the Signal usage-based app and additional defensive driving rewards.

Farmers covers custom parts like lift kits, Erie offers lockout help up to $75. In particular, both assist with vehicle upgrades and roadside needs.Kristen Gryglik Licensed Insurance Agent

When wondering how to choose an auto insurance company, Erie places more emphasis on stable rates and long-term benefits for the policyholder. On the other hand, Farmers uses technology to engage customers and offer wider options for eligibility.

Knowing how each company aligns with your personal driving habits and family setup is crucial to securing the best savings and coverage. Use our free comparison quote tool to evaluate auto insurance companies in your neighborhood.

Frequently Asked Questions

Is Erie Insurance better than Farmers?

You may find Erie insurance better than Farmers if you value Rate Lock coverage, lower monthly premiums, and strong customer satisfaction for personal lines. Unlock the best Farmers auto insurance discounts to lower your premium.

What does the Erie insurance homeowners policy include?

Erie’s homeowners policy offers guaranteed replacement cost coverage, ensuring your home can be rebuilt to its original state regardless of cost increases. Optional add-ons include water backup and sump overflow protection, identity recovery services, and service line coverage.

What do Erie home insurance reviews say?

Customers often praise Erie for its responsive claims service and customizable coverage options. Notable features include identity theft recovery support and service line protection. Discover discounts with Erie vs Farmers auto insurance by entering your ZIP code now.

What are the current auto loan rates in Erie, PA?

Auto loan rates in Erie, PA, vary depending on the lender and an individual’s creditworthiness. For instance, Erie Federal Credit Union offers rates as low as 5.24% APR, while other local institutions have rates ranging from 5.49% to 6.24%.

What does Farmers Insurance offer in Erie, PA?

Farmers Insurance in Erie, PA, provides a range of products, including auto, home, and life insurance. Policyholders can benefit from discounts through bundling and safe driving programs, such as the Signal app. Explore the best Erie, Pennsylvania auto insurance options for local drivers.

How reliable are Indiana Farmers Mutual Insurance reviews?

Indiana Farmers Mutual Insurance receives positive feedback for its customer service and claims handling. Reviews highlight the company’s commitment to serving rural communities with tailored coverage options.

What should you know about Erie car insurance in Indiana?

Erie car insurance in Indiana offers features like Rate Lock, which prevents premium increases unless specific changes are made to the policy. Additional benefits include accident forgiveness and pet injury coverage, providing comprehensive protection for drivers.

Why is Erie auto insurance so expensive?

You might see Erie car insurance as expensive due to add-ons like guaranteed replacement cost or full coverage features, which increase value but raise monthly costs.

Is Erie a good auto insurance company?

Yes, you’ll find Erie a good car insurance company for claims satisfaction, policy customization, and low monthly rates—especially for safe, low-mileage drivers. Find out how to lower your auto insurance rates with usage-based savings.

How much does Erie auto insurance go up after an accident?

Your Erie insurance premium may not increase after your first accident if you’re enrolled in accident forgiveness through the Auto Plus endorsement.

Is Farmers Insurance an A-rated company?

How well does Erie Insurance pay claims?

Is Farmers auto insurance good?

Does Farmers Insurance pay claims well?

What auto insurance is cheaper than Farmers?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which auto insurance company has the most complaints?

You may find Erie insurance better than Farmers if you value Rate Lock coverage, lower monthly premiums, and strong customer satisfaction for personal lines. Unlock the best Farmers auto insurance discounts to lower your premium.

Erie’s homeowners policy offers guaranteed replacement cost coverage, ensuring your home can be rebuilt to its original state regardless of cost increases. Optional add-ons include water backup and sump overflow protection, identity recovery services, and service line coverage.

What do Erie home insurance reviews say?

Customers often praise Erie for its responsive claims service and customizable coverage options. Notable features include identity theft recovery support and service line protection. Discover discounts with Erie vs Farmers auto insurance by entering your ZIP code now.

What are the current auto loan rates in Erie, PA?

Auto loan rates in Erie, PA, vary depending on the lender and an individual’s creditworthiness. For instance, Erie Federal Credit Union offers rates as low as 5.24% APR, while other local institutions have rates ranging from 5.49% to 6.24%.

What does Farmers Insurance offer in Erie, PA?

Farmers Insurance in Erie, PA, provides a range of products, including auto, home, and life insurance. Policyholders can benefit from discounts through bundling and safe driving programs, such as the Signal app. Explore the best Erie, Pennsylvania auto insurance options for local drivers.

How reliable are Indiana Farmers Mutual Insurance reviews?

Indiana Farmers Mutual Insurance receives positive feedback for its customer service and claims handling. Reviews highlight the company’s commitment to serving rural communities with tailored coverage options.

What should you know about Erie car insurance in Indiana?

Erie car insurance in Indiana offers features like Rate Lock, which prevents premium increases unless specific changes are made to the policy. Additional benefits include accident forgiveness and pet injury coverage, providing comprehensive protection for drivers.

Why is Erie auto insurance so expensive?

You might see Erie car insurance as expensive due to add-ons like guaranteed replacement cost or full coverage features, which increase value but raise monthly costs.

Is Erie a good auto insurance company?

Yes, you’ll find Erie a good car insurance company for claims satisfaction, policy customization, and low monthly rates—especially for safe, low-mileage drivers. Find out how to lower your auto insurance rates with usage-based savings.

How much does Erie auto insurance go up after an accident?

Your Erie insurance premium may not increase after your first accident if you’re enrolled in accident forgiveness through the Auto Plus endorsement.

Is Farmers Insurance an A-rated company?

How well does Erie Insurance pay claims?

Is Farmers auto insurance good?

Does Farmers Insurance pay claims well?

What auto insurance is cheaper than Farmers?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which auto insurance company has the most complaints?

Customers often praise Erie for its responsive claims service and customizable coverage options. Notable features include identity theft recovery support and service line protection. Discover discounts with Erie vs Farmers auto insurance by entering your ZIP code now.

Auto loan rates in Erie, PA, vary depending on the lender and an individual’s creditworthiness. For instance, Erie Federal Credit Union offers rates as low as 5.24% APR, while other local institutions have rates ranging from 5.49% to 6.24%.

What does Farmers Insurance offer in Erie, PA?

Farmers Insurance in Erie, PA, provides a range of products, including auto, home, and life insurance. Policyholders can benefit from discounts through bundling and safe driving programs, such as the Signal app. Explore the best Erie, Pennsylvania auto insurance options for local drivers.

How reliable are Indiana Farmers Mutual Insurance reviews?

Indiana Farmers Mutual Insurance receives positive feedback for its customer service and claims handling. Reviews highlight the company’s commitment to serving rural communities with tailored coverage options.

What should you know about Erie car insurance in Indiana?

Erie car insurance in Indiana offers features like Rate Lock, which prevents premium increases unless specific changes are made to the policy. Additional benefits include accident forgiveness and pet injury coverage, providing comprehensive protection for drivers.

Why is Erie auto insurance so expensive?

You might see Erie car insurance as expensive due to add-ons like guaranteed replacement cost or full coverage features, which increase value but raise monthly costs.

Is Erie a good auto insurance company?

Yes, you’ll find Erie a good car insurance company for claims satisfaction, policy customization, and low monthly rates—especially for safe, low-mileage drivers. Find out how to lower your auto insurance rates with usage-based savings.

How much does Erie auto insurance go up after an accident?

Your Erie insurance premium may not increase after your first accident if you’re enrolled in accident forgiveness through the Auto Plus endorsement.

Is Farmers Insurance an A-rated company?

How well does Erie Insurance pay claims?

Is Farmers auto insurance good?

Does Farmers Insurance pay claims well?

What auto insurance is cheaper than Farmers?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which auto insurance company has the most complaints?

Farmers Insurance in Erie, PA, provides a range of products, including auto, home, and life insurance. Policyholders can benefit from discounts through bundling and safe driving programs, such as the Signal app. Explore the best Erie, Pennsylvania auto insurance options for local drivers.

Indiana Farmers Mutual Insurance receives positive feedback for its customer service and claims handling. Reviews highlight the company’s commitment to serving rural communities with tailored coverage options.

What should you know about Erie car insurance in Indiana?

Erie car insurance in Indiana offers features like Rate Lock, which prevents premium increases unless specific changes are made to the policy. Additional benefits include accident forgiveness and pet injury coverage, providing comprehensive protection for drivers.

Why is Erie auto insurance so expensive?

You might see Erie car insurance as expensive due to add-ons like guaranteed replacement cost or full coverage features, which increase value but raise monthly costs.

Is Erie a good auto insurance company?

Yes, you’ll find Erie a good car insurance company for claims satisfaction, policy customization, and low monthly rates—especially for safe, low-mileage drivers. Find out how to lower your auto insurance rates with usage-based savings.

How much does Erie auto insurance go up after an accident?

Your Erie insurance premium may not increase after your first accident if you’re enrolled in accident forgiveness through the Auto Plus endorsement.

Is Farmers Insurance an A-rated company?

How well does Erie Insurance pay claims?

Is Farmers auto insurance good?

Does Farmers Insurance pay claims well?

What auto insurance is cheaper than Farmers?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which auto insurance company has the most complaints?

Erie car insurance in Indiana offers features like Rate Lock, which prevents premium increases unless specific changes are made to the policy. Additional benefits include accident forgiveness and pet injury coverage, providing comprehensive protection for drivers.

You might see Erie car insurance as expensive due to add-ons like guaranteed replacement cost or full coverage features, which increase value but raise monthly costs.

Is Erie a good auto insurance company?

Yes, you’ll find Erie a good car insurance company for claims satisfaction, policy customization, and low monthly rates—especially for safe, low-mileage drivers. Find out how to lower your auto insurance rates with usage-based savings.

How much does Erie auto insurance go up after an accident?

Your Erie insurance premium may not increase after your first accident if you’re enrolled in accident forgiveness through the Auto Plus endorsement.

Is Farmers Insurance an A-rated company?

How well does Erie Insurance pay claims?

Is Farmers auto insurance good?

Does Farmers Insurance pay claims well?

What auto insurance is cheaper than Farmers?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which auto insurance company has the most complaints?

Yes, you’ll find Erie a good car insurance company for claims satisfaction, policy customization, and low monthly rates—especially for safe, low-mileage drivers. Find out how to lower your auto insurance rates with usage-based savings.

Your Erie insurance premium may not increase after your first accident if you’re enrolled in accident forgiveness through the Auto Plus endorsement.

Is Farmers Insurance an A-rated company?

How well does Erie Insurance pay claims?

Is Farmers auto insurance good?

Does Farmers Insurance pay claims well?

What auto insurance is cheaper than Farmers?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which auto insurance company has the most complaints?

Is Farmers auto insurance good?

Does Farmers Insurance pay claims well?

What auto insurance is cheaper than Farmers?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which auto insurance company has the most complaints?

What auto insurance is cheaper than Farmers?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Which auto insurance company has the most complaints?

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.