Farmers vs. Liberty Mutual Auto Insurance in 2026 (Side-by-Side Review)

When comparing Farmers vs. Liberty Mutual auto insurance, Farmers has cheaper rates at $76 monthly and includes the Signal app, which gives up to 15% off for safe driving. Liberty Mutual runs $96 monthly, but its RightTrack program gives safe drivers up to 30% off based on real-time habits.

Read more Secured with SHA-256 Encryption

Find the Lowest Car Insurance Rates Today

Quote’s drivers have found rates as low as $42/month in the last few days!

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Brandon Frady

Updated June 2025

3,072 reviews

3,072 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 3,792 reviews

3,792 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviewsWhen comparing Farmers vs. Liberty Mutual auto insurance, the companies score the same for availability and customer service. The key difference comes down to which has the best cheap usage-based insurance for your lifestyle and driving habits.

Farmers vs. Liberty Mutual Auto Insurance Insurance Rating

| Rating Criteria |  |

|

|---|---|---|

| Overall Score | 4.3 | 4.2 |

| Business Reviews | 4.0 | 4.0 |

| Claims Processing | 3.3 | 3.3 |

| Company Reputation | 4.5 | 4.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.1 | 4.1 |

| Customer Satisfaction | 2.0 | 2.0 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.3 | 4.3 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 5.0 | 5.0 |

| Savings Potential | 4.5 | 4.5 |

| Farmers Review | Liberty Mutual Review |

Both Farmers and Liberty Mutual reward safe driving, but how they track habits — and how much you can save — varies.

Farmers Signal offers up to 15% off for smooth, steady driving. Liberty Mutual’s RightTrack adjusts rates per trip and offers up to 30% off for low-mileage, daytime driving.

- Signal and RightTrack UBI offer mobile trip feedback and discounts

- Farmers offers a bigger multi-vehicle discount of 20%

- Only Liberty Mutual offers better car replacement options

Keep reading to find the best Farmers vs. Liberty Mutual car insurance rates based on how you drive. Save more on coverage when you use our free comparison tool today.

Comparing Farmers vs. Liberty Mutual Auto Insurance Rates

Your age and gender make a big impact on your monthly Farmers Insurance vs. Liberty Mutual insurance rate. When you compare auto insurance rates side-by-side, Farmers usually comes out cheaper, especially if you’re in your 30s or older.

Farmers vs. Liberty Mutual Auto Insurance Monthly Rates

| Age & Gender |  |

|

|---|---|---|

| 16-Year-Old Female | $452 | $404 |

| 16-Year-Old Male | $452 | $464 |

| 30-Year-Old Female | $87 | $96 |

| 30-Year-Old Male | $91 | $110 |

| 45-Year-Old Female | $76 | $95 |

| 45-Year-Old Male | $76 | $96 |

| 60-Year-Old Female | $68 | $85 |

| 60-Year-Old Male | $72 | $91 |

Farmers is cheaper for teen drivers at $452 per month, compared to Liberty Mutual at $464 monthly. By the time you hit 30, men pay $91 a month with Farmers, compared to $110 from Liberty Mutual.

Driving History on Farmers vs. Liberty Mutual Auto Insurance Costs

The price differences between Liberty Mutual vs. Farmers auto insurance really start to show once you have a violation on your record (Learn More: How Auto Insurance Companies Check Driving Records).

Farmers vs. Liberty Mutual Auto Insurance Monthly Rates by Driving Record

| Driving Record |  |

|

|---|---|---|

| Clean Record | $198 | $248 |

| Speeding Ticket | $247 | $302 |

| At-Fault Accident | $295 | $360 |

| Not-At-Fault Accident | $282 | $335 |

| DUI/DWI | $275 | $447 |

With a clean record, Farmers charges $198 a month for full coverage, while Liberty Mutual comes in higher at $248 monthly. One speeding ticket bumps your monthly rate to $247 with Farmers, but Liberty Mutual jumps to $302 a month.

Across the board, Farmers tends to have cheap auto insurance for a bad driving record. Even if the accident wasn’t your fault, Farmers charges $282 per month for full coverage, still noticeably lower than Liberty Mutual’s monthly rate of $335. The biggest gap shows up after a DUI — Farmers is $275 a month, but Liberty shoots all the way up to $447 monthly.

Credit Score on Farmers vs. Liberty Mutual Auto Insurance Costs

If your credit drops from good to fair, you’re looking at around $30 more each month (over $350 annually). For drivers with bad credit, full coverage rates climb past $200 monthly, making it feel like you’re being penalized twice.

Farmers vs. Liberty Mutual Auto Insurance Monthly Rates by Credit Score

| Credit Score |  |

|

|---|---|---|

| Good Credit (670–739) | $150 | $145 |

| Fair Credit (580–669) | $185 | $175 |

| Bad Credit (300–579) | $240 | $225 |

Liberty Mutual Insurance tends to be slightly cheaper than Farmers at each credit level, but both clearly show how much your credit score can affect what you pay. If you’re rebuilding credit, comparing the best companies for credit-based auto insurance could help you find fairer pricing and save more in the long term.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Auto Insurance Discounts: Farmers vs. Liberty Mutual Insurance

When looking at Farmers vs. Liberty Mutual auto insurance, the discounts are structured very differently, which means one might work better for your lifestyle than the other.

Farmers vs. Liberty Mutual Auto Insurance Discounts

| Discount |  |

|

|---|---|---|

| Multi-Policy | 20% | 25% |

| Multi-Car | 20% | 10% |

| Good Driver | 30% | 30% |

| Good Student | 15% | 10% |

| Distant Student | 10% | 10% |

| Homeowner | 5% | 10% |

| Defensive Driving | 10% | 5% |

| Electronic/Auto Pay | 5% | 3% |

| Paperless Billing | 3% | 3% |

| Affinity/Occupation | 10% | 10% |

| Safety Features | 10% | 10% |

| Hybrid/Electric Vehicle | 5% | 10% |

| Anti-Theft Device | 15% | 10% |

| New Car | 10% | 10% |

| Low Mileage | 10% | 20% |

| Telematics Program | 15% | 30% |

| Early Shopping | 10% | 5% |

| Driver's Education | 10% | 5% |

| Senior | 5% | 5% |

If you’ve got more than one car on your policy, Farmers is the better bet with a 20% multi-car discount, twice what Liberty offers. Among the best Farmers auto insurance discounts, this multi-car deal stands out, especially for families or households with multiple vehicles.

However, if you have one car that you don’t drive much, Liberty Mutual gives a 20% discount for low mileage, which could really cut your costs if you work from home or rarely commute. Liberty Mutual Insurance Company also offers up to 30% off through RightTrack if your driving habits are safe and consistent.

Both companies also provide auto insurance discounts for a new car, but that discount might go further with Liberty Mutual, depending on the type of vehicle and added features.

On the flip side, Farmers rewards people who plan ahead with a better early shopping discount, which can help if you’re switching providers in advance. So, instead of just looking at who has more discounts, think about which ones match how you actually use your car.

Farmers vs. Liberty Mutual Usage-Based Insurance Programs

When you’re deciding between Liberty Mutual and Farmers auto insurance, there’s more to look at than just monthly rates. Both companies offer some unique perks that could make a real difference depending on how you drive or where you work.

If you’re a safe driver, Farmers Insurance also offers up to 15% off through Signal, which tracks things like hard braking, speeding over 80 mph, and phone use. Our Farmers Signal review highlights how the app focuses on consistency and safety rather than penalizing occasional errors, making it ideal for steady, low-risk drivers.

Usage-based auto insurance is best for safe drivers with short commutes. People who don’t drive much or have good habits can see significant savings.Jeff Root Licensed Insurance Agent

The Liberty Mutual RightTrack program monitors your mileage, the time of day you drive, and how often you stop, offering up to 30% in savings for good driving habits. If you’re looking for real feedback and savings tied to how you drive every day, our Liberty Mutual RightTrack review speaks to how it personalizes your rate based on actual behavior.

Farmers and Liberty Mutual Auto Insurance Coverage Options

When it comes to coverage, both Farmers and Liberty Mutual offer a solid lineup, but each brings a few extras that might fit your lifestyle better. They both include roadside assistance for things like flat tires or dead batteries and rental car reimbursement, so you’re not stuck without a ride after a claim.

Farmers vs. Liberty Mutual: Auto Insurance Coverage Comparison

| Coverage |  |

|

|---|---|---|

| Roadside Assistance | ✅ | ✅ |

| Rental Car Reimbursement | ✅ | ✅ |

| New Car Replacement | ✅ | ✅ |

| Rideshare Coverage | ✅ | ✅ |

| Custom Equipment | ✅ | ✅ |

| Gap Insurance | ✅ | ✅ |

| OEM Parts | ✅ | ✅ |

| Accident Forgiveness | ✅ | ✅ |

| Deductible Rewards | ✅ | ❌ |

| Pet Injury Coverage | ❌ | ✅ |

| Teacher Perks | ✅ | ✅ |

If you drive a newer vehicle, their new car replacement coverage can come in handy—it’ll cover the cost of a brand-new car if yours gets totaled under certain conditions. Both also offer rideshare coverage, custom parts protection, and OEM parts coverage, which is great if you drive for Uber or Lyft or just want to keep your car in top shape (Read More: Best Auto Insurance Companies That Offer OEM Parts Coverage).

Farmers throws in deductible rewards, knocking $50 off your deductible for each accident-free year. At the same time, Liberty Mutual adds a thoughtful touch with pet injury coverage—ideal if your furry friend rides along often.

Teachers get extra perks with either company, too. These options aren’t just add-ons—they can make a difference when life throws you a curveball.

Farmers vs. Liberty Mutual Financial Ratings

If you’re weighing Farmers Insurance vs. Liberty Mutual auto insurance, looking at customer satisfaction and complaint records can help you get a better feel for what to expect. It’s one of the most important steps when you research auto insurance companies, and the numbers reveal some clear differences in performance.

Farmers vs. Liberty Mutual Insurance Business Ratings & Consumer Reviews

| Agency |  |

|

|---|---|---|

| Score: 706 / 1,000 Avg. Satisfaction | Score: 717 / 1,000 Avg. Satisfaction |

|

| Score: A Good Business Practices | Score: A- Good Business Practices |

|

| Score: 82/100 High Customer Satisfaction | Score: 74/100 Good Customer Satisfaction |

|

| Score: 1.32 More Complaints Than Avg. | Score: 4.28 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A Excellent Financial Strength |

Farmers earned a 717 out of 1,000 in J.D. Power’s satisfaction score, slightly ahead of Liberty Mutual’s 706. Consumer Reports also gave Farmers a higher rating of 82 compared to Liberty’s 74.

The complaint data shows an even bigger difference: Farmers had a complaint ratio of 1.32, while Liberty Mutual’s was 4.28, meaning more customers have filed formal complaints. Still, both companies scored an A from A.M. Best, so they’re on solid financial ground.

On Reddit, a user shared their experience with Liberty Mutual Insurance, saying they really liked being able to handle everything directly—no agents were involved.

Comment

byu/Help_Me_Reddit01 from discussion

inInsurance

They felt the pricing was fair, especially with a group discount, but admitted that without it, other companies might be cheaper.

They also mentioned having one claim after a rear-end accident about a year ago and said the whole process went smoothly. It’s always helpful to see feedback like this on Reddit when you’re trying to figure out what real customers go through.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

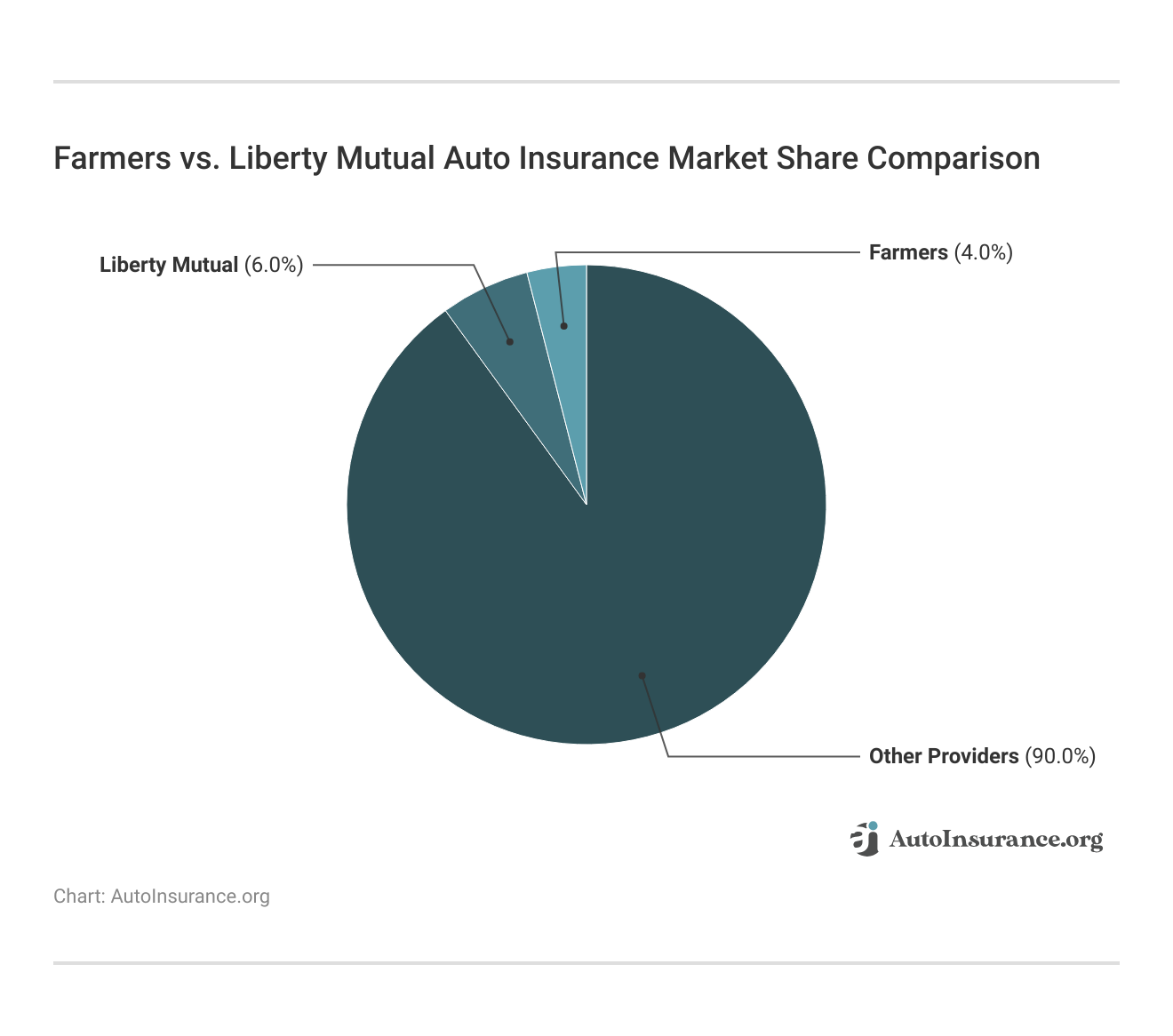

Liberty Mutual vs. Farmers Auto Insurance by Market Share

Market share is one way to see how Farmers and Liberty Mutual auto insurance compare in terms of industry presence. Neither dominates the space, but one holds a slight lead.

Liberty Mutual covers 6% of the market, giving it an edge over Farmers at 4%. That leaves a huge 90% controlled by other providers, predominantly State Farm and Geico, showing how competitive the industry really is. While both companies are familiar names, their overall share is relatively modest.

Read More: Farmers vs. State Farm Auto Insurance

Farmers Insurance Pros and Cons

Farmers Insurance has been around since 1928 and now covers more than 10 million households nationwide. It earned an A rating from A.M. Best and earns strong customer feedback on pricing, service, and claims.

If you’re looking for ways to save and value convenience, here are some of the standout benefits Farmers brings to the table:

- Affordable Clean Record Rates: Drivers with clean records pay $198 per month with Farmers, keeping costs low. Get more quotes in our Farmers auto insurance review.

- Lower DUI Premiums: After a DUI, Farmers charges $275 per month for full coverage—$172 less than Liberty Mutual’s rate of $447.

- Long List of Discounts: Farmers offers more auto insurance discounts than any other national provider, giving drivers even more ways to save.

However, no provider is perfect. While Farmers has competitive pricing in some categories, there are a few things to keep in mind before making your decision:

- No Real-Time Driving Feedback: Signal collects driving data but doesn’t give instant feedback per trip, unlike Liberty Mutual’s RightTrack program.

- Mixed Customer Service: Farmers auto insurance customer service experiences vary depending on the city and state. Compare providers by ZIP code to get local reviews.

While its driving app isn’t the most advanced, Farmers Insurance makes it easy to manage your policy and file claims through its mobile app.

Liberty Mutual Insurance Company Pros and Cons

If you’re considering switching providers or looking to cancel Farmers auto insurance, Liberty Mutual’s offerings may give you a reason to compare. It’s especially appealing for drivers who value usage-based savings or want coverage that adapts to how they drive:

- RightTrack Offers Up to 30% Off: Liberty Mutual’s RightTrack monitors trip-by-trip data like mileage, braking, and time of day, rewarding drivers with savings of up to 30%.

- Responsive Pricing for Low-Mileage Drivers: Drivers who avoid nighttime travel or long commutes may see lower rates with

- Owned by Its Customers: Liberty Mutual is a mutual company, which means it’s owned by its policyholders, and its financial decisions are often designed to benefit the people it insures.

Liberty Mutual Insurance also gives you the option to add roadside assistance, which can cover things like towing, battery jumps, or getting you back in if you’re locked out. If you use one of its approved repair shops, it will back the work with a lifetime guarantee.

You can also add helpful extras like new car replacement or better car replacement, depending on where you live. And if you ask, they’ll use original manufacturer parts for repairs on qualifying vehicles. Still, Liberty Mutual’s rates may not work for every budget, particularly if your driving record has any red flags:

- Most Expensive After a DUI: Liberty Mutual charges $447 a month after a DUI, which is $172 more than Farmers, making it a pricey choice for drivers with serious violations.

- Expensive Starting Point for Clean Drivers: Liberty Mutual charges $248 monthly for full coverage with no violations, which is $50 higher than Farmers. Check our Liberty Mutual insurance review for more quotes.

For many drivers, Liberty Mutual is more expensive than Farmers. The higher price point comes with coverage choices you can’t find with many other companies, making it a smart choice for drivers with new cars.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Choosing the Best Auto Insurance Company for You

If you’re trying to save money by switching companies, Farmers vs. Liberty Mutual auto insurance both offer solid ways to lower your monthly rate. With Farmers Insurance, you can use the Signal app to get up to 15% off by driving safely and avoiding phone use, speeding, and hard braking.

Liberty Mutual Insurance Company rewards good habits even more through RightTrack, offering up to 30% off for low-mileage driving, smooth braking, and avoiding nighttime trips. Drivers who insure multiple vehicles with Farmers or bundle policies with Liberty Mutual can also see extra savings.

To figure out which option gives you the best rate for your driving habits, just enter your ZIP code and get multiple auto insurance quotes from top companies online.

Frequently Asked Questions

Which is better for auto insurance, Farmers or Liberty Mutual?

If you drive multiple vehicles or have custom upgrades, Farmers may suit you better with a 20% multi-car discount and custom equipment coverage. Liberty Mutual works well for low-mileage drivers, offering up to 30% off through RightTrack.

Who is Farmers Insurance’s biggest competitor?

Liberty Mutual is a direct competitor, offering similar base coverage but more aggressive telematics discounts and broader perks like accident forgiveness discounts and new car replacement insurance.

Which insurance company is best at paying claims, Farmers or Liberty Mutual?

Liberty Mutual provides a lifetime repair guarantee when using their approved shops, while Farmers offers OEM parts coverage to ensure factory-quality repairs. Both are rated “A” by A.M. Best for financial strength.

What is cheaper than Liberty Mutual auto insurance?

Geico, Progressive, and State Farm often offer cheaper rates than Liberty Mutual, especially for drivers with clean records and minimal mileage. Find the cheapest company near you by entering your ZIP code today.

Which is better for auto insurance, Farmers or Allstate?

Farmers offers a lower monthly DUI rate for high-risk drivers at $275, while Allstate may appeal to high-risk drivers with Milewise pay-as-you-go insurance. Compare Allstate vs. Farmers auto insurance to see how you qualify for savings.

Who is Liberty Mutual owned by?

Liberty Mutual operates as a mutual company, meaning the people who have policies with it actually own the company rather than shareholders.

Is Liberty Mutual auto insurance more expensive?

Yes, especially after a violation. Liberty Mutual charges $447 per month after a DUI, which is $172 higher than Farmers. However, safe drivers may offset costs through RightTrack.

How does State Farm vs. Liberty Mutual auto insurance compare for safe drivers?

Compare Liberty Mutual vs. State Farm auto insurance head-to-head to see how they stack up. Liberty Mutual offers up to 30% off through RightTrack for consistent safe driving, while State Farm provides up to 30% off with Drive Safe & Save, though Liberty adjusts rates more frequently based on trip data.

What makes Farmers a good insurance company for car customizations?

Farmers includes custom equipment coverage that protects non-factory upgrades, like lift kits, aftermarket rims, and sound systems, which is ideal for drivers who personalize their vehicles.

What does Liberty Mutual full coverage include for newer cars?

On top of the usual coverage, Liberty Mutual full coverage add-ons include better car and new car replacement options. If your car gets totaled in the first year, you could end up with a newer one.

Is Liberty Mutual good auto insurance if you don’t drive often?

Who offers better bundling savings, Farmers, Liberty Mutual, or Travelers?

Which provider offers more flexible coverage in Farmers vs. Liberty Mutual home insurance?

Is Farmers Insurance better than Geico for drivers with violations?

How do consumers rate Farmers Insurance and Liberty Mutual?

What discounts do Farmers Insurance and Liberty Mutual offer?

What additional features do Farmers Insurance and Liberty Mutual offer?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.