Farmers vs. USAA Auto Insurance in 2025 (Side-by-Side Comparison)

When comparing Farmers vs. USAA auto insurance, USAA has cheaper rates, starting at $32 per month for minimum coverage. However, USAA is only available to members of the military, veterans, and their immediate family. Farmers is still a good choice for those who can't get USAA coverage.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 27, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

3,072 reviews

3,072 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 6,589 reviews

6,589 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

6,589 reviews

6,589 reviewsWhen comparing Farmers vs. USAA auto insurance, both are great auto insurance companies, but USAA has the better rates and ratings. However, USAA is available only to military members, veterans, and their immediate family members.

We’ll compare Farmers vs. USAA auto insurance rates to see which one better suits your needs (Read More: How to Choose an Auto Insurance Company).

We also compare available discounts and ratings from agencies with a credible and trustworthy view of Farmers vs. USAA auto insurance companies.

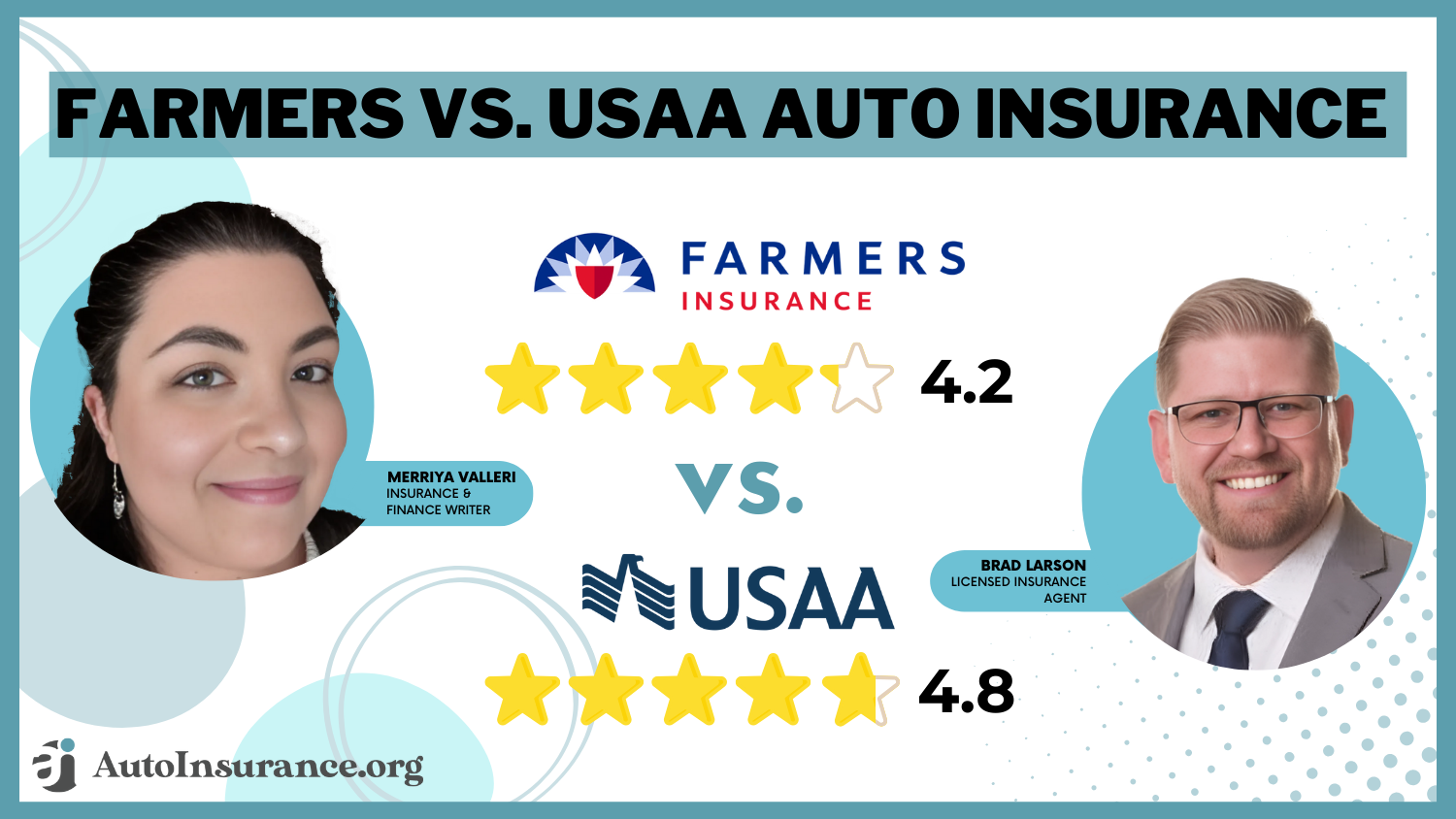

Farmers vs. USAA Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.2 | 4.8 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.3 | 5.0 |

| Company Reputation | 4.5 | 5.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.1 | 4.7 |

| Customer Satisfaction | 2.0 | 2.4 |

| Digital Experience | 4.5 | 5.0 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.3 | 4.6 |

| Plan Personalization | 4.5 | 5.0 |

| Policy Options | 5.0 | 4.7 |

| Savings Potential | 4.5 | 4.8 |

| Farmers Auto Insurance Review | USAA Auto Insurance Review |

Before you find out who has more affordable Farmers vs. USAA auto insurance rates, enter your ZIP code to start comparing free auto insurance quotes from the multiple providers in your area.

- USAA is available only to military, veterans, and their family members

- You can save on car insurance for your teen driver by choosing USAA

- Farmers has more discounts, but USAA has some discounts as high as 50%

Farmers vs. USAA Auto Insurance Rates

The older we get, the more driving experience we have. car insurance companies use age as one of the most influential factors in determining your car insurance rates.

It’s legal to base car insurance rates on marital status and gender in most states; however, some states have outlawed it in their auto insurance laws. Let’s compare Farmers insurance and USAA insurance rates based on age and gender.

Farmers vs. USAA Full Coverage Auto Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $1,156 | $349 |

| 16-Year-Old Male | $1,103 | $356 |

| 30-Year-Old Female | $228 | $106 |

| 30-Year-Old Male | $239 | $113 |

| 45-Year-Old Female | $199 | $84 |

| 45-Year-Old Male | $198 | $84 |

| 60-Year-Old Female | $171 | $75 |

| 60-Year-Old Male | $183 | $75 |

Does USAA have the best insurance rates when compared to Farmers? USAA is a much better option if you have a young driver in your household. You will save significantly by choosing USAA to cover your teen driver. USAA is also cheaper than Farmers for car insurance for drivers 25 and older.

Speeding tickets, accidents, or DUIs on your driving record will raise your car insurance rates no matter what company you pick because you become a high-risk driver.

Farmers vs. USAA Full Coverage Auto Insurance Monthly Rates by Driving Record

| Driving Record | ||

|---|---|---|

| Clean Record | $198 | $84 |

| Not-At-Fault Accident | $282 | $111 |

| Speeding Ticket | $247 | $96 |

| DUI/DWI | $275 | $154 |

Again, USAA will usually have the best rates, but it’s also essential to take a closer look at how punitive each company is if you sign up with a clean driving record but then later get an infraction.

When looking at both companies’ rates, USAA will still be the cheaper option for drivers who have infractions. You can get quotes directly from Farmers or USAA to see which is better for you.

Another thing that will affect your rates is your credit score. A good credit score can drop in a matter of months if you experience some financial trauma such as medical debt or going through a divorce.

In most states, it is legal for car insurance companies to base rates on your credit score; however, some are outlawing this along with basing rates on gender and marital status.

Based on the assumption that those with higher credit scores are more responsible and overall safer drivers less likely to file a claim, car insurance companies justify using your credit score to determine your rates.

Let’s take a look at how Farmers and USAA address rates for drivers with low credit scores.

Farmers vs. USAA Auto Insurance Monthly Rates by Credit Score

| Credit Record | ||

|---|---|---|

| Good Credit | $306 | $152 |

| Fair Credit | $325 | $185 |

| Bad Credit | $405 | $308 |

No matter what your credit score is, your rates will be cheaper with USAA than with Farmers. Once you are with Farmers and your credit score drops, expect your car insurance rates to increase by 32% compared to USAA, which will more than double.

You may live in a state like California, where basing car insurance on credit scores is illegal. So be sure to check your state’s laws before judging Farmers vs. USAA car insurance rates based on credit score alone.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto Insurance Coverages at Farmers vs. USAA

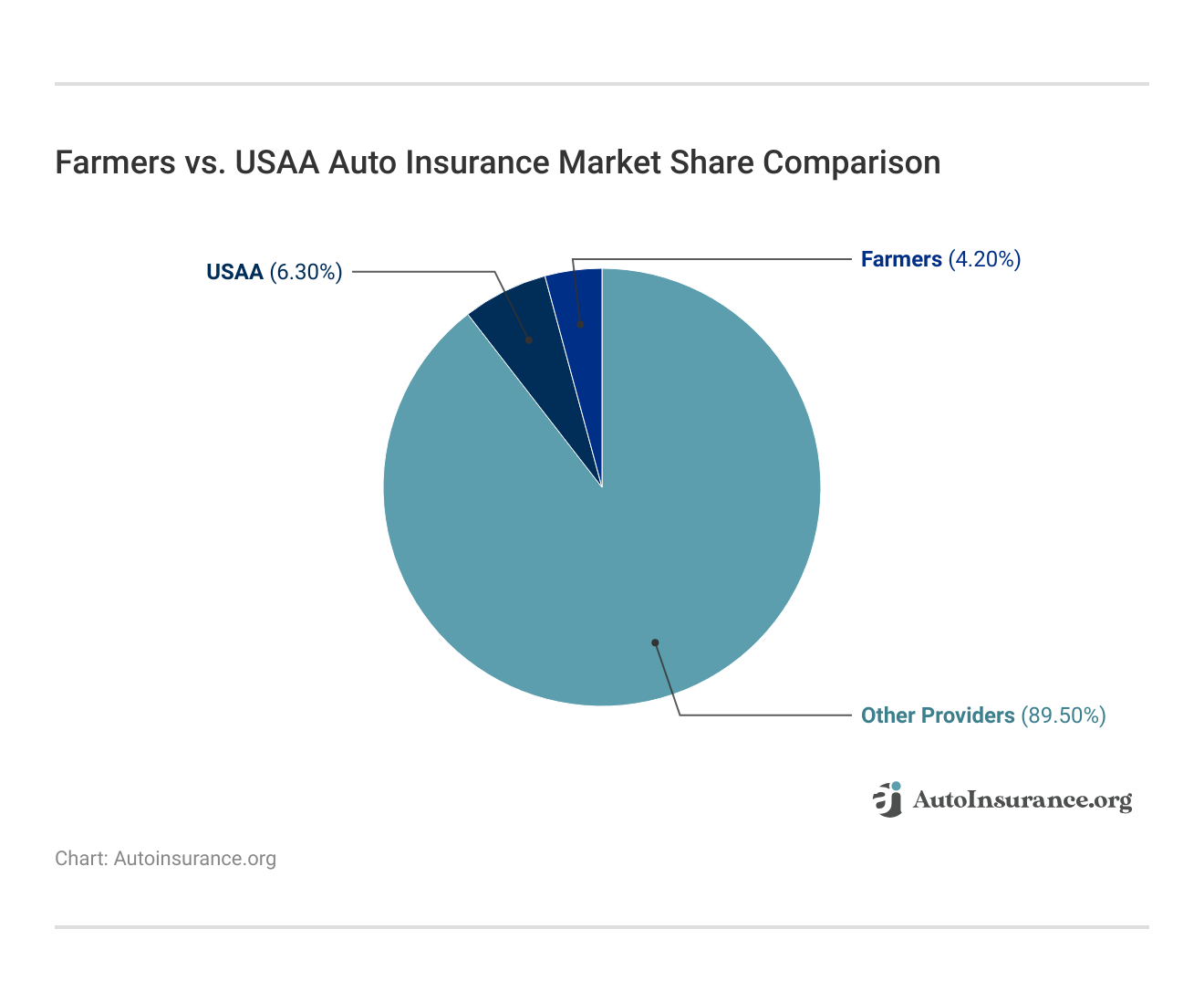

Since Farmers and USAA are two of the ten companies with the most market share, they can offer a wider variety of car insurance coverages beyond the standard coverages. Take a look at their market shares below.

Where does USAA rank in car insurance? USAA has a larger share in the market than Farmers, but both are large, popular companies in the auto insurance world.

Take a look at USAA vs. Farmers auto insurance coverages below. Be sure you understand the various types of auto insurance coverage before purchasing.

Farmers vs. USAA Auto Insurance Available Coverage

| Coverage Option | ||

|---|---|---|

| Collision | ✅ | ✅ |

| Comprehensive | ✅ | ✅ |

| Custom Parts and Equipment | ✅ | ✅ |

| Gap Insurance | ✅ | ✅ |

| Liability | ✅ | ✅ |

| Medical Payments | ✅ | ✅ |

| New Car Replacement | ✅ | ✅ |

| Personal Injury Protection (PIP) | ✅ | ✅ |

| Rental Reimbursement | ✅ | ✅ |

| Rideshare Insurance | ✅ | ✅ |

| Roadside Assistance | ✅ | ✅ |

| Uninsured/Underinsured Motorist | ✅ | ✅ |

Be sure to take a closer look at any specialty coverages such as rental reimbursement, roadside assistance, guaranteed auto protection (GAP), mechanical breakdown, and recreational vehicles such as ATVs or boats.

Auto Insurance Discounts at Farmers vs. USAA

Car insurance company discounts vary widely, and they are usually based on a company’s values and philosophy.

That’s why it pays to shop around, especially if you have a bad driving record or a low credit score. Discounts can help offset high rates.

Farmers vs. USAA Auto Insurance Discounts

| Discount Name | ||

|---|---|---|

| Anti-Theft | 10% | 15% |

| Bundling | 20% | 10% |

| Good Driver | 30% | 30% |

| Good Student | 15% | 10% |

| UBI | 30% | 30% |

| Military | 20% | 15% |

| Multi-Vehicle/Car | 20% | 10% |

| Federal Employee | 7% | 5% |

| Membership | 10% | 25% |

| Pay-in-Full | 10% | 10% |

| Safe Driver | 20% | 20% |

| Loyalty | 12% | 12% |

When comparing discounts offered by either company, Farmers has more discounts. Farmers driving app discount is provided by Signal, where drivers are rewarded for demonstrating safe driving skills. Signal also has perks like crash assistance (Read More: Farmers Signal Review).

However, USAA also offers car insurance discounts between 3% and 50%, and the best bargains are for garaging your vehicle while deployed and teen drivers.

The discounts offered by car insurance companies often target specific types of drivers. When you call Farmers or USAA customer service, be sure to ask if there are any additional discounts.

Customer Reviews of Farmers vs. USAA

Customer reviews of Farmers and USAA can be helpful in determining if a company is worth looking into as a potential provider. You can find customer reviews on Google, Reddit, Yelp, and other rating sites.

All companies will have mixed reviews, but recurring negative reviews about an issue could indicate a problem with a company.Laura Berry Former Licensed Insurance Producer

In order to give you an idea of what customers think of USAA and Farmers, we’ve included some discussions from Reddit. To see what customers think of Farmers, check out the Reddit thread of drivers discussing Farmer’s rates below.

A common complaint about Farmers tends to be its higher rates, with customers labeling Farmers a luxury brand due to paying more for the ease of having agents available for assistance.

USAA also has mixed reviews from customers. While some customers are long-term supporters of USAA and applaud the low rates they continuously receive, others are dissatisfied with USAA’s customer service. Take a look at the Reddit thread discussing USAA below.

Most customers find USAA affordable, which is one of its major selling points. However, other customers complain about unhelpful representatives and state this as a reason for leaving the company (Read More: Auto Insurance Companies With the Best Customer Service).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Business Ratings of Farmers vs. USAA

Buying car insurance is a big financial responsibility, so you want to make sure you choose the right company that will be there for you when you need it. A company’s financial strength, customer satisfaction with USAA vs. Farmers insurance claims process, and customer complaints should be examined before you make your decision.

The following three agencies provide insight into these factors: A.M. Best, Consumer Reports, and the National Association of Insurance Commissioners (NAIC).

A.M. Best scores companies based on their ability to meet their ongoing insurance obligations, such as balancing premiums collected and claims paid.Daniel Walker Licensed Insurance Agent

The highest score A.M. Best awards is Superior A++. Consumer Reports collects annual data from its subscribers regarding customer satisfaction of the Farmers claims process, and the USAA claims process, step by step. In their 2017 survey, 27 insurance companies were rated, and scores ranged between 86 to 96.

Learn More: Best Auto Insurance Companies According to Consumer Reports

And the NAIC calculates a complaint ratio based on the total number of customers against the total number of complaints. In 2017, the national average complaint ratio was 1. The lower the ratio, the better.

Let’s take a closer look at external ratings for Farmers and USAA.

Insurance Business Ratings & Consumer Reviews: Farmers vs. USAA

| Agency | ||

|---|---|---|

| Score: 706 / 1,000 Lower-Than-Average Satisafaction | Score: 726 / 1,000 Above Avg. Satisfaction |

|

| Score: A Good Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 82/100 High Customer Satisfaction | Score: A+ Excellent Business Practices |

|

| Score: 1.70 More Complaints Than Avg. | Score: 1.74 More Complaints Than Avg. |

|

| Score: A Excellent Financial Strength | Score: A++ Superior Financial Strength |

Both Farmers and USAA are highly rated when it comes to customer satisfaction with the claims process. Farmers has earned A from A.M. Best, and USAA has earned an A++, which is the highest possible rating. USAA, however, has a higher customer complaint ratio and a higher number of complaints overall.

Farmers Pros and Cons

Farmers offers a range of coverage options and discounts, making it an attractive option for many drivers. The main pros we found are:

- Agent Assistance: One of Farmer’s selling points is customers’ access to agents for personalized assistance.

- Good Driver Discount: Farmers offers a discount for good drivers through its Signal app (Read More: Best Auto Insurance Apps).

- Coverage Options: Farmers has optional add-ons like gap insurance for new car owners.

The downsides to choosing Farmers as a provider are:

- Higher Rates: Farmers is more expensive on average than USAA for auto insurance.

- Customer Complaints: The NAIC recorded a higher-than-average number of complaints from Farmers customers.

Understanding both the pros and cons and reading reviews from real customers can help guide your decision.

USAA Pros and Cons

Why do people choose USAA? USAA is one of the top providers for military and veteran drivers, due to the following pros:

- A.M. Best Rating: USAA has an A++ rating, which is higher than Farmers.

- Affordable Rates: For most drivers, USAA has more affordable rates than Farmers.

- USAA Perks: USAA customers can use their membership to get discounts on shopping, traveling, and more.

What are the disadvantages of USAA? The main cons of USAA are:

- Limited Eligibility: Customers who qualify for USAA include the military, veterans, and their immediate families.

- Customer Complaints: The NAIC found complaints from USAA customers are higher than average.

If you’re a military member or veteran, USAA is definitely worth considering, but it’s still important to compare options to ensure you’re getting the best deal for your situation (Learn More: How to Get Multiple Auto Insurance Quotes).

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Mobile Apps at Farmers vs. USAA

Usage-based car insurance has become an individualized trend in the last decade or so. All more prominent car insurance companies have a driving app that uses your mobile phone or a device installed into your auto.

Farmers driving app is Signal, and USAA’s is SafePilot (Learn More: USAA SafePilot Review). USAA and Farmers also provide a more general app to enable you to view your policy, make changes, and pay your bill. The USAA Mobile App and Farmers app are well-rated.

Both USAA and Farmers’ mobile apps have a 4.8 out of five-star rating on Apple, with customers mentioning the ease of policy management on the app.

Usually, your Farmers insurance login or USAA insurance login will work with the general app and the driving app.

Deciding Which Company is Right for You

Is USAA better than Farmers? When comparing Farmers vs. USAA auto insurance, USAA will be the most affordable choice (Read More: Cheapest Auto Insurance Companies). USAA also has a better financial standing rating from A.M. Best than Farmers.

However, Farmers is also a good choice for those who don’t qualify for USAA insurance, with strong ratings from A.M. Best and the BBB.

Before you buy Farmers vs. USAA car insurance, enter your ZIP code to start comparing multiple car insurance companies in your local area.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What is the difference between Farmers and USAA?

Farmers and United Services Automobile Association (USAA) are both insurance companies, but there are a few key differences between them when comparing Farmers insurance vs. USAA. USAA Insurance Agency primarily serves military members and their families, offering exclusive benefits and excellent customer service tailored to their needs.

Farmers Insurance Exchange, on the other hand, serves a wider customer base and provides a range of insurance options beyond just auto insurance.

What are the key features of Farmers auto insurance?

Farmers auto insurance offers a range of features, including:

- Customizable Coverage Options: Farmers allows policyholders to tailor their coverage to their specific needs, such as liability, comprehensive, collision, and personal injury protection.

- Additional Coverage Options: Farmers provides various add-on options, including roadside assistance, rental car reimbursement, and rideshare coverage.

- Discounts: Farmers offers various discounts, such as multi-policy, multi-car, good driver, and safe driver discounts.

- Mobile App: Farmers has a user-friendly mobile app that enables policyholders to manage their policies, file claims, and access policy documents conveniently.

Make sure to consider which features are most important to you when researching companies. Get quotes from companies in your area today by entering your ZIP in our free tool.

What are the key features of USAA auto insurance?

Some key features of USAA auto insurance include:

- Coverage Options: USAA offers standard coverage options like liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Military-Focused: USAA primarily serves military members, veterans, and their families, offering unique features such as deployment and garaging discounts.

- Claims Satisfaction: USAA is well-regarded for its prompt and efficient claims process, consistently receiving high customer satisfaction ratings.

- Mobile App and Digital Tools: USAA provides a mobile app and various digital tools to make managing policies, filing claims, and accessing information easier for its customers.

USAA auto insurance is known for its comprehensive auto insurance coverage and excellent customer service.

Can anyone get insurance from USAA?

USAA membership is restricted to active duty military personnel, veterans, and their immediate family members. However, eligibility criteria may vary, and it’s advisable to check with USAA directly or visit their website for the most up-to-date information on membership qualifications.

Why am I not eligible for USAA auto insurance?

If you are not a military member, veteran, or an immediate family member, you will not be able to get USAA.

How can I obtain insurance from Farmers or USAA?

To obtain insurance from Farmers or USAA, you can follow these steps:

- Research: Compare the coverage options, discounts, and customer reviews of both companies.

- Evaluate Quotes: Request quotes from both Farmers and USAA, either through their websites, over the phone, or by contacting local agents. Review the quotes carefully.

- Make a Decision: Based on your research and the quotes received, choose the company that best fits your needs and budget.

- Initiate the Application Process: Contact the chosen insurer to begin the application process and provide any required information or documentation.

- Complete the Process: Follow the instructions provided by the insurer to finalize your policy, make any necessary payments, and obtain your insurance documents.

Read our guide on how to get auto insurance for more information. Make sure to fully consider the pros and cons of each company before making a decision.

Which company has better rates, Farmers or USAA?

Wondering, “Is USAA the best insurance?” Rates for auto insurance can vary depending on various factors, including your location, driving history, vehicle type, and coverage needs, but USAA does have cheaper rates on average than Farmers.

It’s recommended to obtain quotes from both Farmers and USAA to compare the rates specific to your situation. This will help you determine which company offers better rates for your circumstances.

Can I switch from Farmers to USAA or vice versa?

Yes, you can switch your auto insurance from Farmers to USAA or vice versa. However, it’s important to consider any potential penalties or fees associated with canceling your current policy before making the switch. Additionally, ensure that you have a new policy in place before canceling your existing one to avoid any coverage gaps.

Who is USAA’s biggest competitor?

USAA’s biggest competitors include Progressive, Geico, and State Farm. Wondering what auto insurance is better than USAA? Read our guide on the best auto insurance companies.

Are there any notable differences in customer service between Farmers and USAA auto insurance?

Yes, there are differences in customer service between Farmers and USAA auto insurance. USAA is often recognized for its exceptional customer service and satisfaction ratings. They have a reputation for being responsive, efficient, and dedicated to serving military members and their families.

Farmers, on the other hand, may have varying levels of customer service depending on individual experiences and regional factors. It’s advisable to review customer reviews and ratings specific to your location and preferences to assess the customer service reputation of both companies.

Do Farmers and USAA offer any additional types of insurance coverage?

Yes, both Farmers and USAA offer additional types of insurance coverage besides auto insurance. Farmers provides a wide range of insurance options, including homeowners, renters, life, business, motorcycle, and recreational vehicle insurance. USAA offers not only auto insurance but also homeowners, renters, condo, flood, life, health, and umbrella insurance.

If you are considering bundling for a discount, make sure to read reviews of Farmers vs. USAA homeowners insurance to see which is better for your insurance needs.

Can I file an insurance claim online with both Farmers and USAA?

Yes, both Farmers and USAA offer the option to file insurance claims online. Farmers provides an online claims portal and a mobile app where policyholders can report and track their claims. USAA also offers an easy-to-use online claims center and a mobile app for policyholders to file and manage their claims conveniently (Read More: How to File an Auto Insurance Claim).

Which car insurance is cheaper than Farmers?

USAA is cheaper than Farmers on average, with rates that start at $32 per month for minimum coverage.

Why are USAA rates so high?

Your rates may be high due to a number of factors, such as having a poor driving record or living in a high-risk area. If you want to find out what car insurance is better than USAA for your needs, enter your ZIP in our free tool.

Is State Farm or Farmers insurance better?

State Farm has cheaper rates on average than Farmers Insurance. Find out more in our comparison of Farmers vs. State Farm auto insurance.

Why is my Farmers car insurance so high?

If your Farmers Insurance Group car insurance rates are high, it could be due to your driving record, rate hikes at the company, and more.

Is USAA really cheaper for veterans?

Yes, USAA’s rates are some of the lowest available for veterans.

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.