First Chicago Auto Insurance Review for 2025 (Find a Top-Rated Policy)

The First Chicago insurance company offers minimum coverage at $85 per month for Illinois drivers. This First Chicago auto insurance review covers its Maverick Auto Program, which provides coverage for high-risk drivers without prior insurance and without using credit scores for cheap First Chicago insurance rates.

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 29, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

First Chicago Auto Insurance

Monthly Rates:

$85A.M. Best Rating:

B++Complaint Level:

HighPros

- Affordable rates compared to similar competitors

- Quick policy issuance with minimal paperwork delays

- Coverage for high-risk drivers with bad credit

Cons

- High complaint volume on denied claims experiences

- Limited availability in only 11 states

Explore the First Chicago auto insurance review featuring the Maverick Auto Program, making it one of the best auto insurance companies for high-risk drivers without prior insurance or bad credit histories.

First Chicago Auto Insurance Rating

| Rating Criteria |  |

|---|---|

| Overall Score | 2.9 |

| Business Reviews | 3.0 |

| Claim Processing | 3.0 |

| Company Reputation | 3.0 |

| Coverage Availability | 1.7 |

| Coverage Value | 3.0 |

| Customer Satisfaction | 3.4 |

| Digital Experience | 3.0 |

| Discounts Available | 3.0 |

| Insurance Cost | 3.0 |

| Plan Personalization | 3.0 |

| Policy Options | 3.0 |

| Savings Potential | 3.0 |

First Chicago auto insurance includes flexible payment plans and discounts to make policies more accessible to high-risk drivers.

While some customers appreciate the affordability, others report concerns about claims processing. Enter your ZIP code to find cheap auto insurance near you today.

- The First Chicago Maverick Program helps insure high-risk drivers

- FCIC partners with agencies across 11 states for wider access

- First Chicago offers 25% multi-policy and multi-vehicle discounts

First Chicago Insurance Company (FCIC) is a member of the Warrior Insurance Network (WIN) and partners with independent agencies across Illinois, Indiana, Iowa, Kansas, Louisiana, Missouri, New Jersey, Ohio, Pennsylvania, Texas, and Wisconsin.

First Chicago Auto Insurance Costs Vary by Age and Gender

This table breaks down First Chicago auto insurance rates by age, gender, and coverage level. Younger drivers face the highest costs, with 16-year-old males paying $290 per month for minimum coverage.

First Chicago Auto Insurance Monthly Rates by Coverage Level

| Age & Gender | Minimum Coverage | Full Coverage |

|---|---|---|

| 16-Year-Old-Female | $260 | $380 |

| 16-Year-Old-Male | $290 | $410 |

| 18-Year-Old-Female | $210 | $320 |

| 18-Year-Old-Male | $240 | $350 |

| 25-Year-Old-Female | $130 | $220 |

| 25-Year-Old-Male | $140 | $230 |

| 30-Year-Old-Female | $100 | $190 |

| 30-Year-Old-Male | $110 | $200 |

| 45-Year-Old-Female | $90 | $160 |

| 45-Year-Old-Male | $95 | $165 |

| 60-Year-Old-Female | $85 | $150 |

| 60-Year-Old-Male | $90 | $155 |

| 65-Year-Old-Female | $95 | $160 |

| 65-Year-Old-Male | $100 | $165 |

Rates decrease with age, with 60-year-old females seeing the lowest at $85 monthly. Full coverage remains pricier across all groups.

This table compares First Chicago’s monthly rates to major competitors. Monthly minimum coverage ranges from $32 with USAA to $107 with Travelers, while full coverage peaks at $248 with Liberty Mutual.

First Chicago Auto Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $87 | $228 | |

| $62 | $166 | |

| $95 | $165 |

| $43 | $114 | |

| $96 | $248 |

| $63 | $164 |

| $56 | $150 | |

| $47 | $123 | |

| $107 | $107 | |

| $32 | $84 |

First Chicago car insurance rates fall mid-range, costing $95 a month for minimum coverage and $165 monthly for full coverage. Geico and USAA offer the lowest rates.

Read more: Minimum Auto Insurance Requirements by State

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

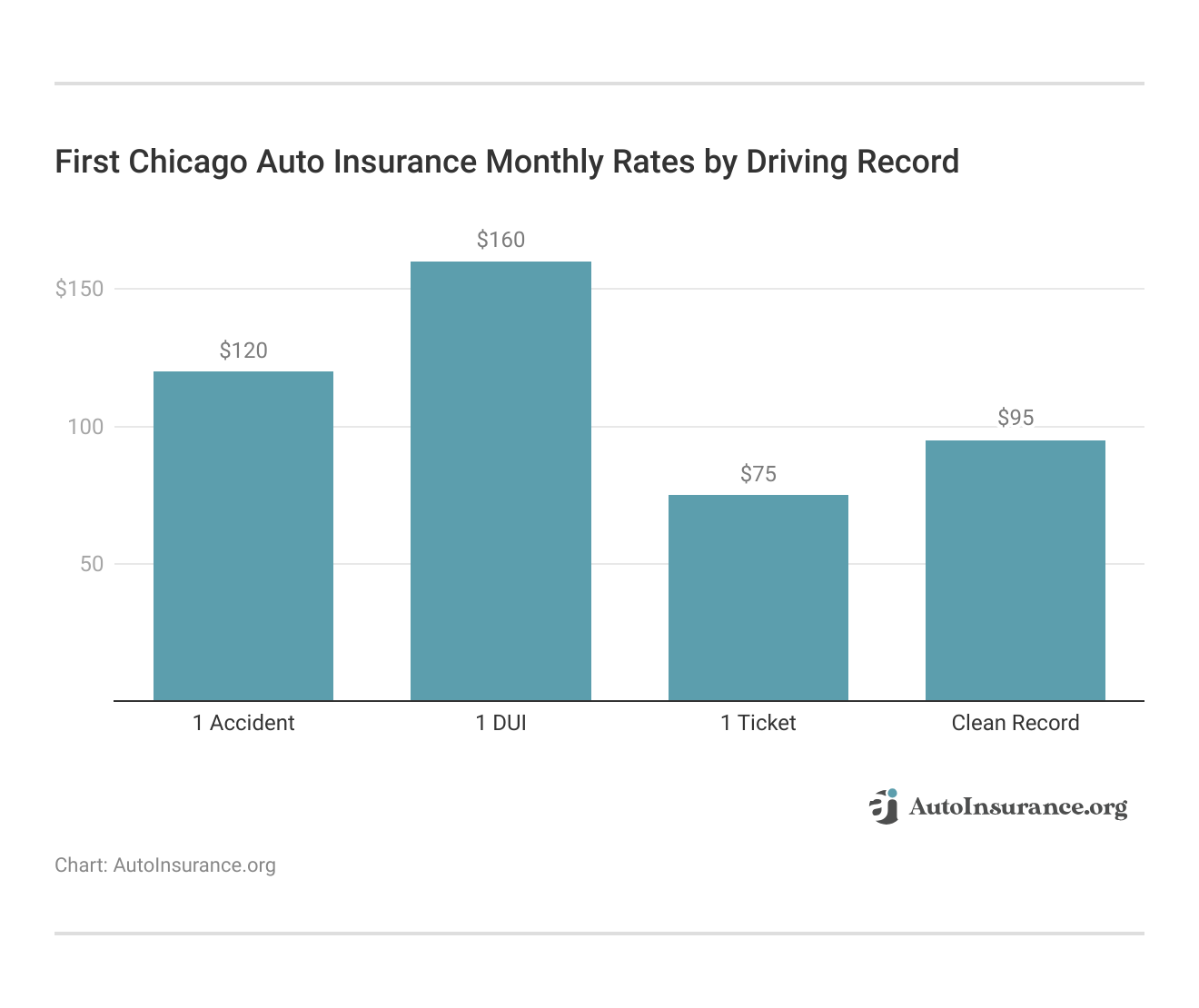

First Chicago Auto Insurance Rates by Driving History

The table outlines how driving records impact First Chicago auto insurance rates. A clean record secures the lowest cost, while a history of accidents, DUIs, or tickets increases premiums.

The table below breaks down monthly premiums across providers, highlighting rate fluctuations based on driving records. First Chicago offers a competitive rate of $165 for clean drivers.

First Chicago Auto Insurance Monthly Rates by Provider & Driving Record

| Insurance Company | Clean Record | One Ticket | One Accident | One DUI |

|---|---|---|---|---|

| $228 | $321 | $385 | $268 | |

| $166 | $251 | $276 | $194 | |

| $165 | $200 | $300 | $155 |

| $114 | $189 | $309 | $151 | |

| $248 | $335 | $447 | $302 |

| $164 | $230 | $338 | $196 |

| $150 | $265 | $200 | $199 | |

| $123 | $146 | $160 | $137 | |

| $141 | $199 | $294 | $192 | |

| $84 | $111 | $154 | $96 |

Prices increase significantly for accidents and DUIs, but First Chicago is still cheaper than most companies after a speeding ticket or DUI. FCIC specializes in high-risk auto insurance, and its Maverick Auto Insurance program ensures drivers with bad credit or driving histories can find affordable coverage.

USAA remains the most affordable option, but it’s only available to military families. FCIC is an affordable option if it’s available where you live.

Learn More: DWI vs. DUI Differences Explained

Coverage Options Available With First Chicago Auto Insurance

Chicago Auto Insurance Company offers different coverage choices, including the most common types of auto insurance policies:

- Liability coverage

- Collision coverage

- Comprehensive coverage

- Medical Payments and personal injury protection

Drivers can also add affordable add-ons, including roadside assistance and rental reimbursement coverage. These policy choices allow drivers to adjust their First Chicago car insurance according to what they need and can afford.

First Chicago coverage options are limited when compared to national providers, but it provides all the policies high-risk drivers need to get covered at an affordable rate.

Savings Opportunities With First Chicago Auto Insurance

The table outlines First Chicago Auto Insurance discounts that can lower monthly costs. Safe drivers, senior motorists, and those with anti-theft devices can save up to 15%.

First Chicago Auto Insurance Discounts by Savings Potential

| Discount Type |  |

|---|---|

| Anti-Theft | 15% |

| Good Student | 10% |

| Low Mileage | 18% |

| Paperless | 5% |

| Safe Driver | 15% |

| Senior Driver | 15% |

| Multi-Vehicle | 25% |

| Multi-Policy | 25% |

| Defensive Driving | 10% |

| Pay-in-Full | 10% |

Bundling policies or insuring multiple vehicles unlocks 25% off. Low-mileage drivers benefit from an 18% reduction, while paperless billing offers a 5% discount.

Read More: How to Save Money by Bundling Insurance Policies

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

First Chicago Auto Insurance Consumer Ratings and Insights

The table below presents First Chicago Auto Insurance’s performance across major rating agencies. J.D. Power scores suggest customer satisfaction falls below the industry average.

First Chicago Auto Insurance Business Ratings & Consumer Reviews

| Agency |  |

|---|---|

| Score: 790 / 1,000 Below Average Satisfaction |

|

| Score: A- Generally Positive Practices |

|

| Score: 65/100 Below Average Satisfaction |

|

| Score: 2.8 Higher Than Average Complaints |

|

| Score: B++ Good Financial Strength |

A.M. Best assigns a B++, reflecting stable financial strength but not the best. Consumer Reports rates the company 65 out of 100, indicating mixed feedback. See how the best auto insurance companies according to Consumer Reports compare.

Need Advice on Dealing with “First Chicago Insurance Company” After Car Accident

byu/Alive-Ad1542 inInsurance

According to NAIC, First Chicago Insurance customer service also receives below-average claims ratings from J.D. Power and double the number of consumer complaints. Most customer reviews of First Chicago insurance take issue with First Chicago auto claims when dealing with an at-fault driver’s coverage.

Weighing the Pros & Cons of First Chicago Auto Insurance

This First Chicago auto insurance review found competitive insurance starting from $95 monthly. The First Chicago Maverick Auto Program is for drivers without previous insurance, DUIs, or poor credit, setting it apart from some of the best auto insurance companies. Other benefits of First Chicago auto insurance are:

- Affordable rates compared to similar competitors

- Quick policy issuance with minimal paperwork delays

- Multiple discounts to save money on car insurance

However, this company’s customer service has room for improvement. It has a high volume of complaints about denied claims experiences. First Chicago is also a smaller company, only available in 11 states, and does not offer as many coverage options or big discounts.

First Chicago auto insurance helps high-risk drivers find coverage. For example, they insure those with lapses and don’t check credit.Daniel Walker Licensed Auto Insurance Agent

Though the attractive pricing is appealing, there are still worries about claim processing and quality of service. Before selecting a policy, it is important to balance cost savings with customer feedback. Compare cheap auto insurance for bad driving records to find companies with better customer service ratings than First Chicago.

Explore local auto insurance deals by entering your ZIP code into our free quote comparison tool.

Your Opinion Matters!

Rate your insurance provider and provide share feedback with shoppers just like you.

Frequently Asked Questions

What is First Chicago Insurance Company?

First Chicago Insurance Company is a Midwest-based insurer specializing in personal and commercial auto coverage. See why drivers choose it as one of the best commercial auto insurance companies.

What is the First Chicago insurance phone number?

The First Chicago insurance phone number is 1-708-552-4400 to contact customer service for claims assistance, policy management, or general inquiries.

Is there an active First Chicago insurance lawsuit?

If you are involved in a First Chicago lawsuit, reviewing your policy terms and consulting legal counsel is important. How does a First Chicago insurance lawsuit payout work? A First Chicago insurance payout depends on policy terms, legal proceedings, and settlement agreements.

How reliable are First Chicago insurance reviews on BBB?

First Chicago insurance reviews with BBB reflect customer experiences with claims, service, and billing. Checking the BBB rating can help you understand common complaints and resolutions. Learn more about how to choose an auto insurance company.

Who owns First Chicago insurance?

First Chicago Insurance is owned by Warrior Invictus Holding Company, Inc., a holding company that manages multiple insurance providers in the U.S.

How do you access the First Chicago auto insurance login?

You can access the First Chicago insurance login on their official website. The portal allows you to manage policies, make payments, and file claims securely.

Where are First Chicago insurance locations available?

First Chicago insurance locations are available in 11 states, including Illinois, Indiana, and Texas. Enter your ZIP code to find cheap auto insurance companies near you.

What is First Chicago’s customer satisfaction rating?

First Chicago’s customer satisfaction rating varies based on reviews from different sources. While some policyholders appreciate affordable rates, others report concerns with claims processing. Find out how to file an auto insurance claim and receive your payout faster.

Does First Chicago Insurance have roadside assistance?

Yes, First Chicago Insurance offers roadside assistance as an optional add-on. It provides policyholders with towing, battery jump-starts, and other emergency services.

Where is First Chicago located?

First Chicago Insurance Company is headquartered in Bedford Park, Illinois.

Which auto insurance company denies the most claims in Chicago?

While claim denials vary, companies like Allstate and Liberty Mutual have faced customer complaints about denied claims.

Who typically has the cheapest auto insurance in Chicago?

State Farm, Progressive, and Geico often provide the best and cheapest car insurance in Chicago, with rates starting as low as $55 per month.

What is the best auto insurance in Chicago?

The best car insurance in Chicago depends on your needs. State Farm offers low rates, Allstate provides strong policy options, and Progressive is great for discounts.

Who has the cheapest full-coverage car insurance in Illinois?

State Farm and Geico typically offer the cheapest full-coverage car insurance in Illinois, with rates starting at around $85 per month. Discover how Geico vs. State Farm auto insurance rates and discounts stack up.

What insurance company has the most complaints in Chicago?

Complaints vary yearly, but companies like Allstate and Liberty Mutual have been reported for customer service and claims issues. See how Allstate vs. Liberty Mutual auto insurance stacks up in cost, coverage, and customer satisfaction.

What is the average cost of car insurance in Chicago?

The average cost of car insurance in Chicago is around $120 per month, depending on coverage, driving history, and other factors.

Why is car insurance so expensive in Chicago?

Car insurance in Chicago is expensive due to high accident rates, traffic congestion, theft, and insurance fraud risks. Find the best First Chicago insurance rates by entering your ZIP code into our free comparison tool.

Scott W. Johnson

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

fffzzz

Horrible Experience

Nickimarie1990

zero

CNolte

"Your car was stolen yes, no we will not cover"- CFI

tuttasir

Scammers

Teigh0315

First Chicago car insurance reviews on customer service!!!!!

Wkeethers

Awesome company

nicktegeler

Affordable, quick and insured

drycleanshorts

best insurance company ever!

yesyesnhn

Yes Yes

darrelpoppino

Lower rates than most.